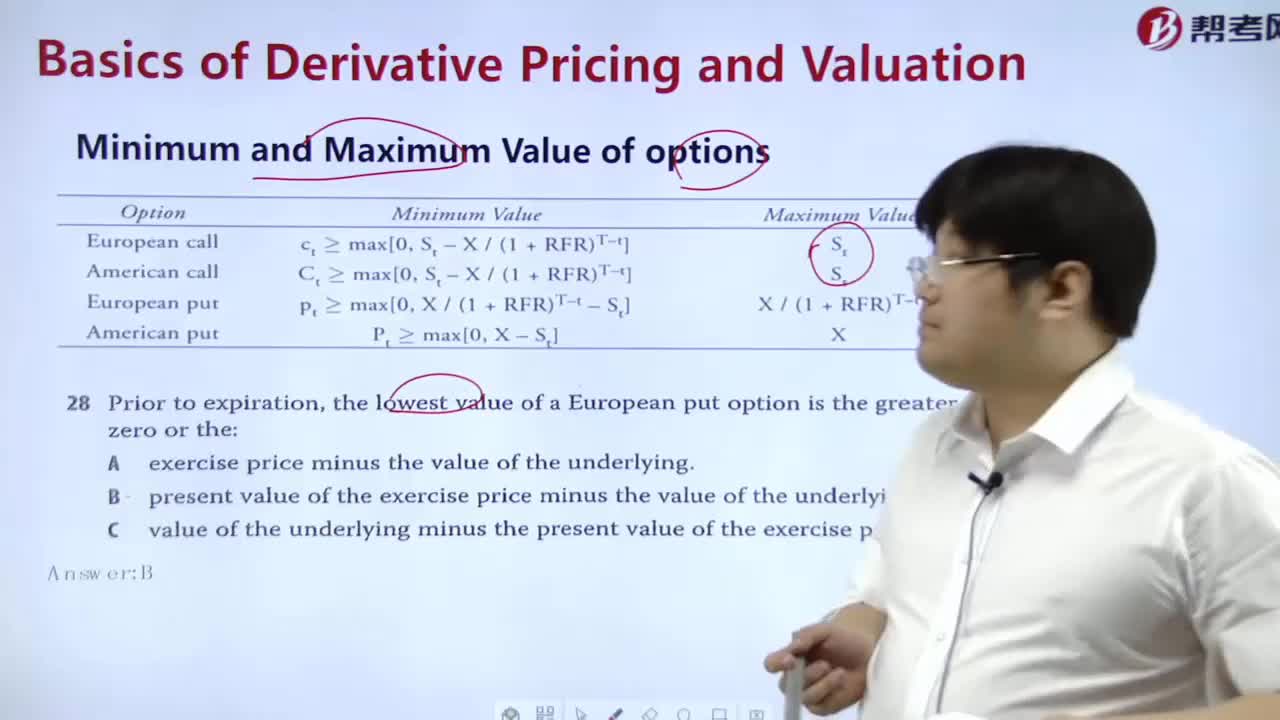

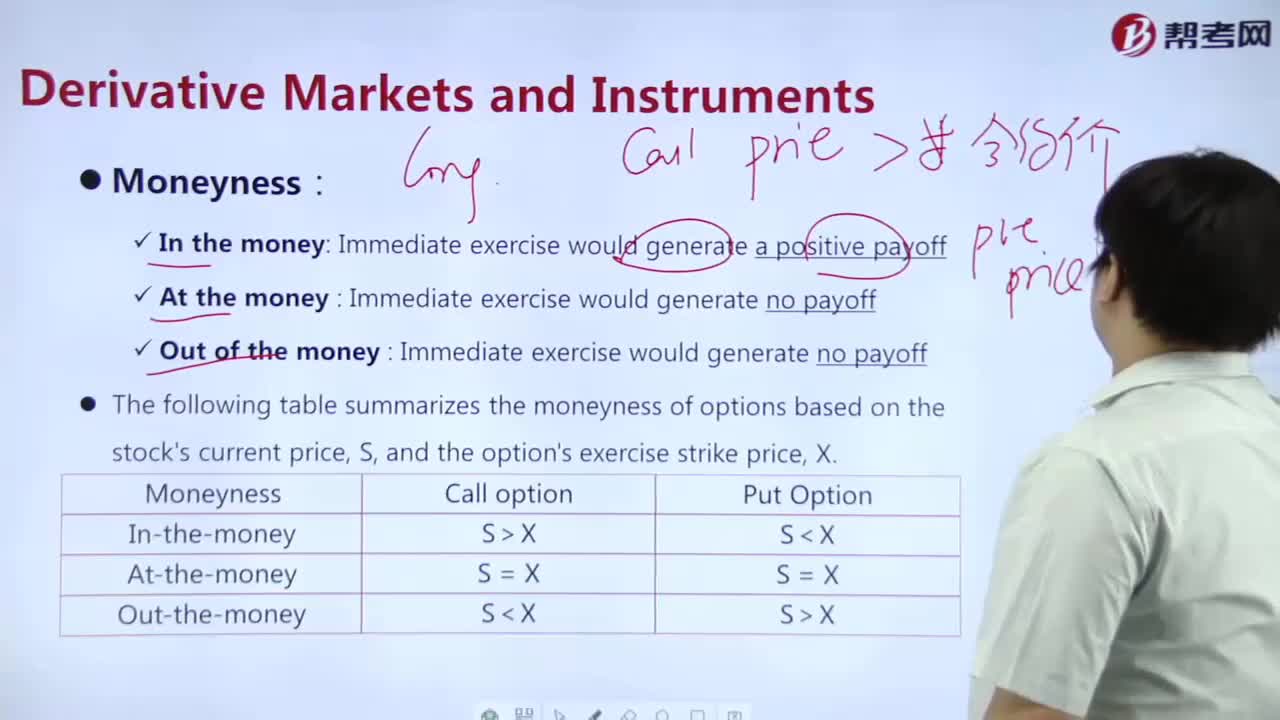

How to calculate the minimum and maximum value of the option?

How to determine the value of an option purchased?

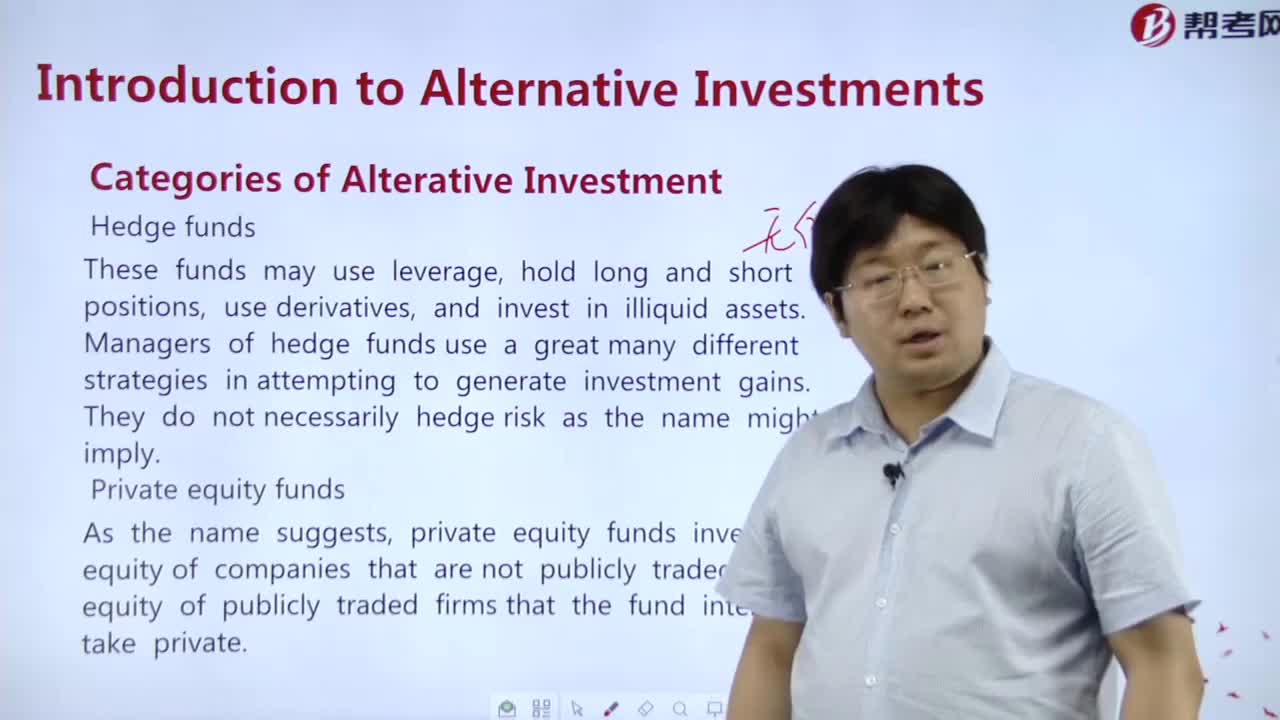

What are the types of alternative investments?

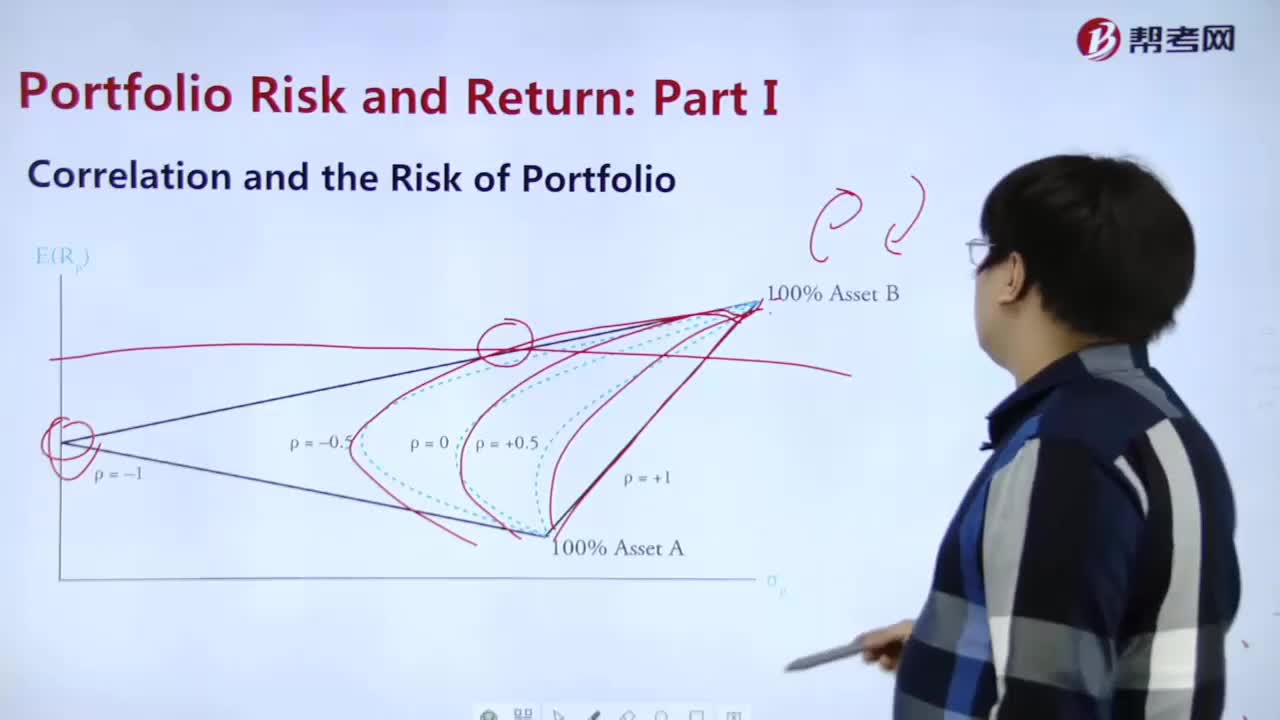

What are the correlations and risks of portfolio?

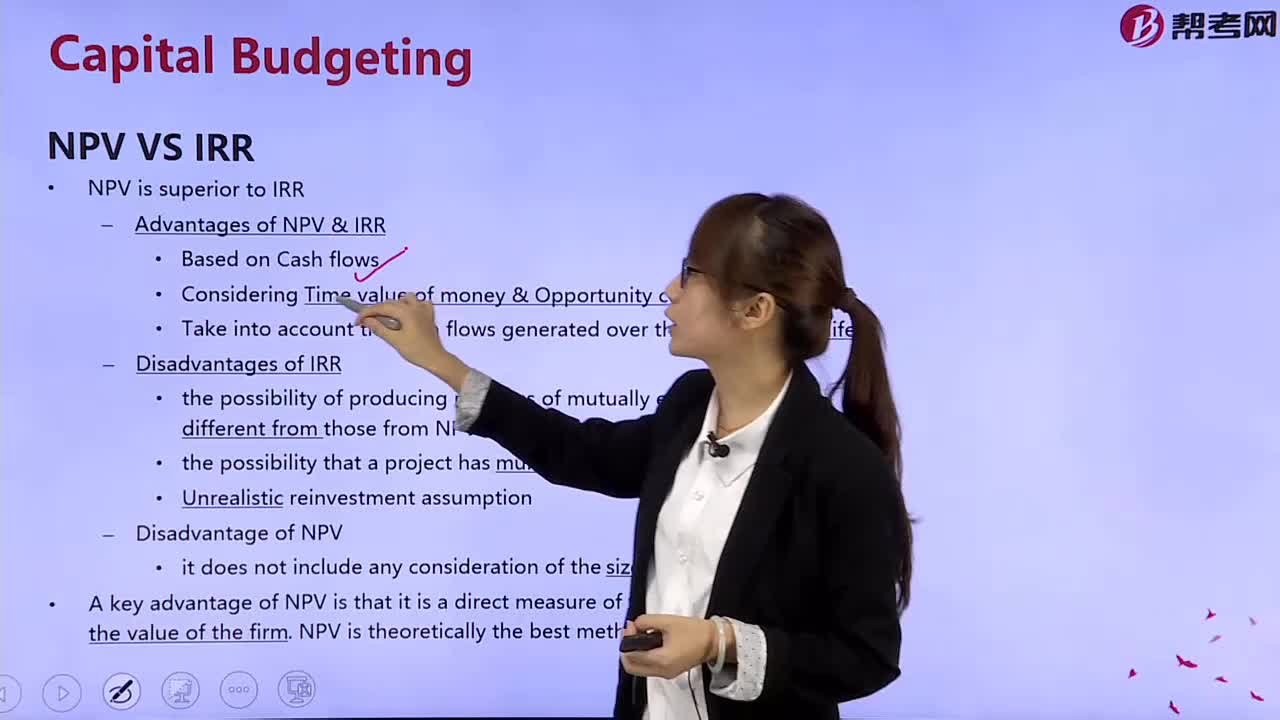

What is the difference between net present value and internal income?

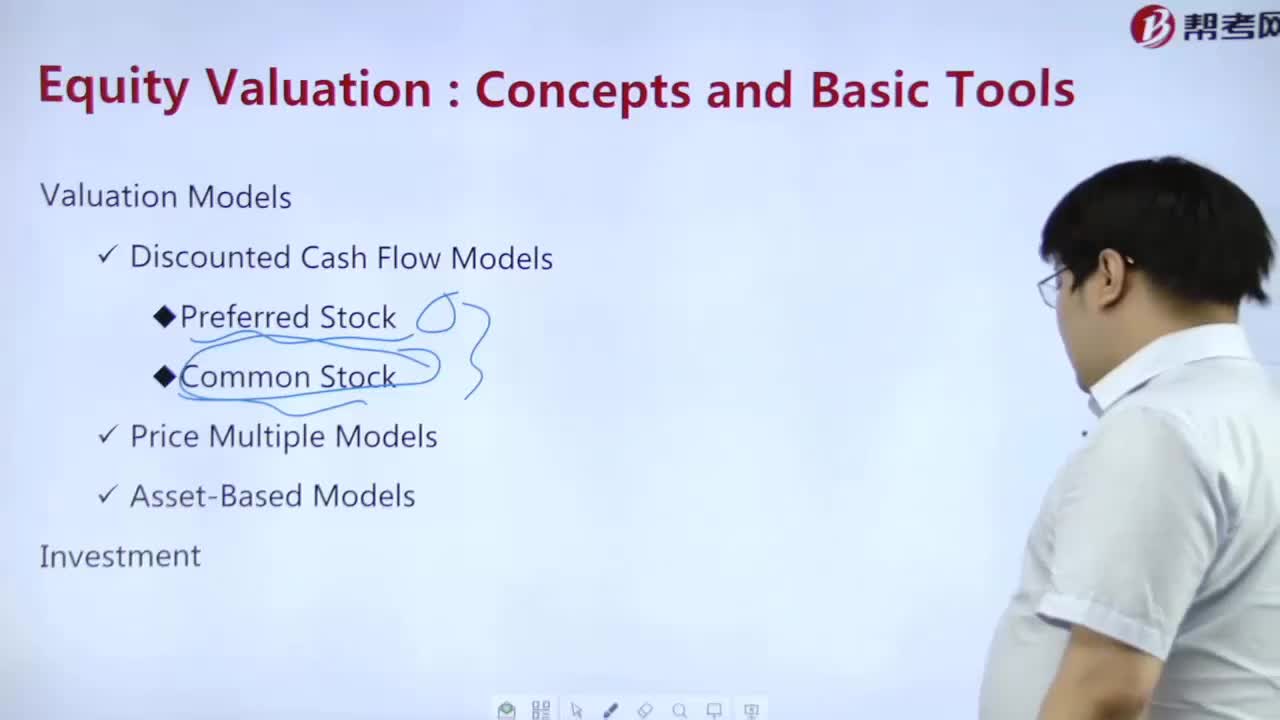

How to calculate the value of preferred stock?

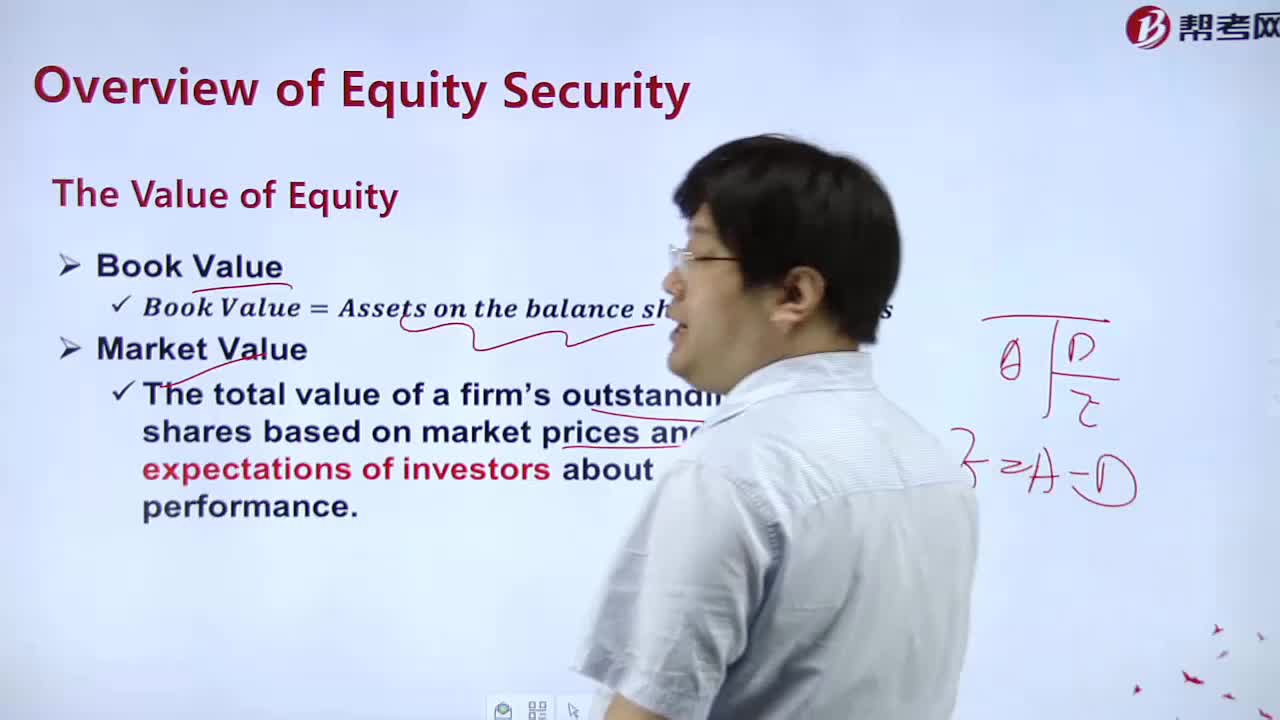

What is the value of the equity?

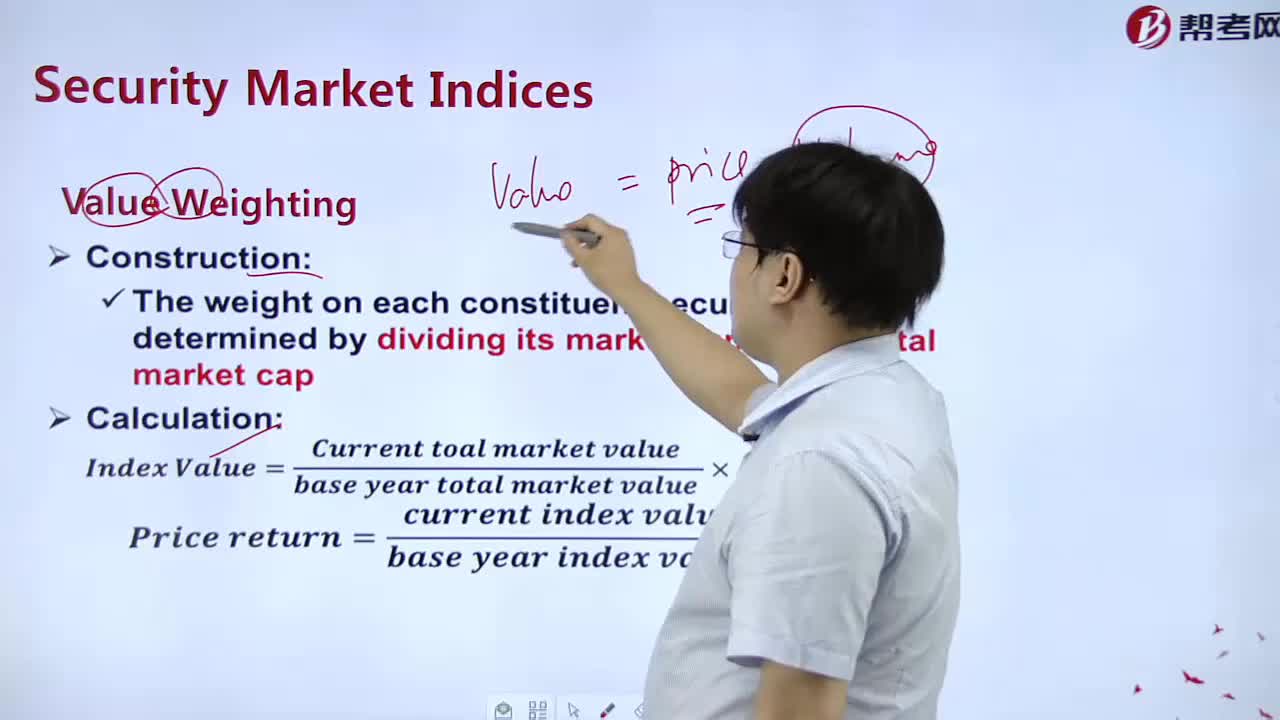

What is the measurement of Value?

Point and Interval Estimates of the Population Mean

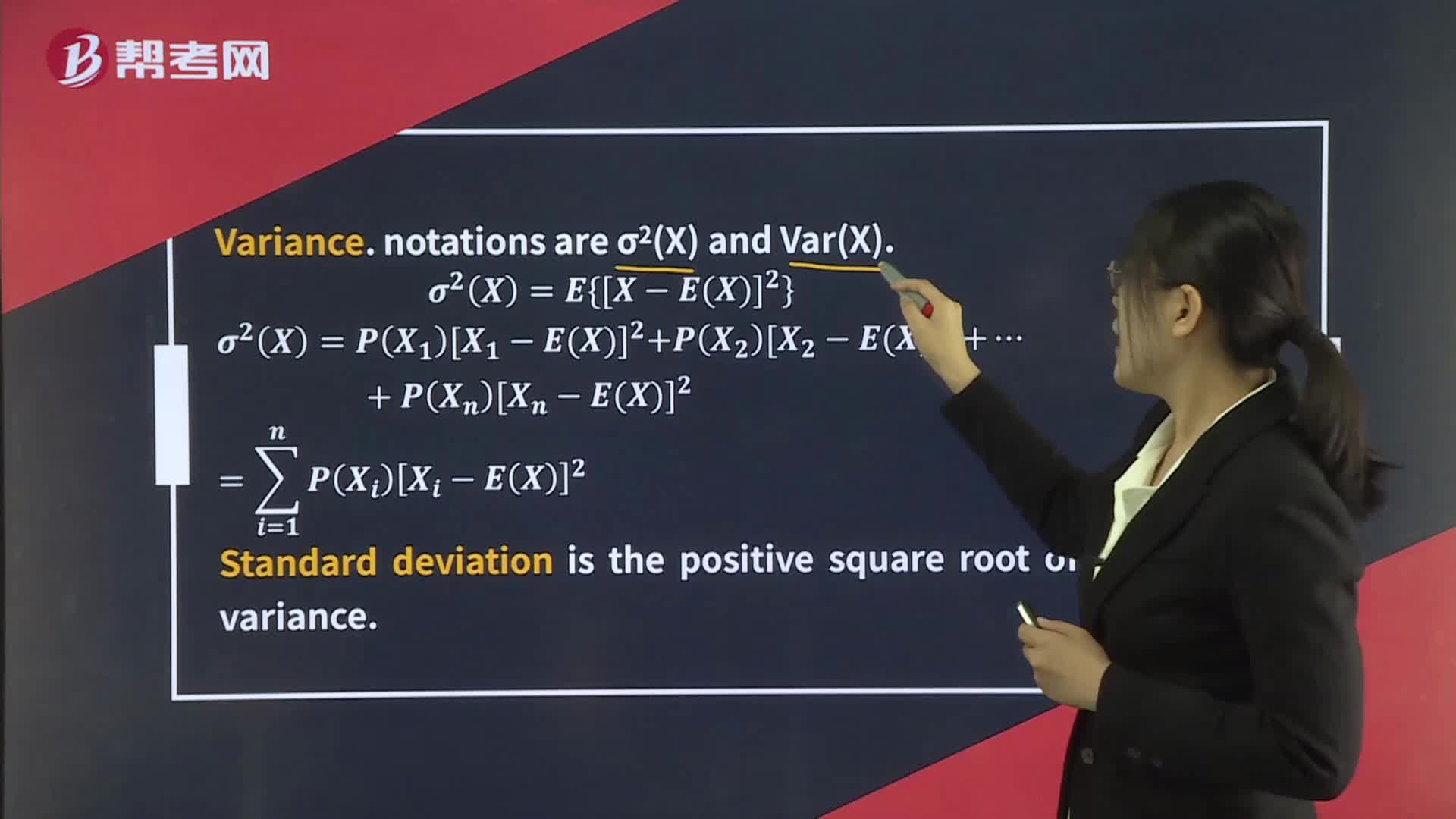

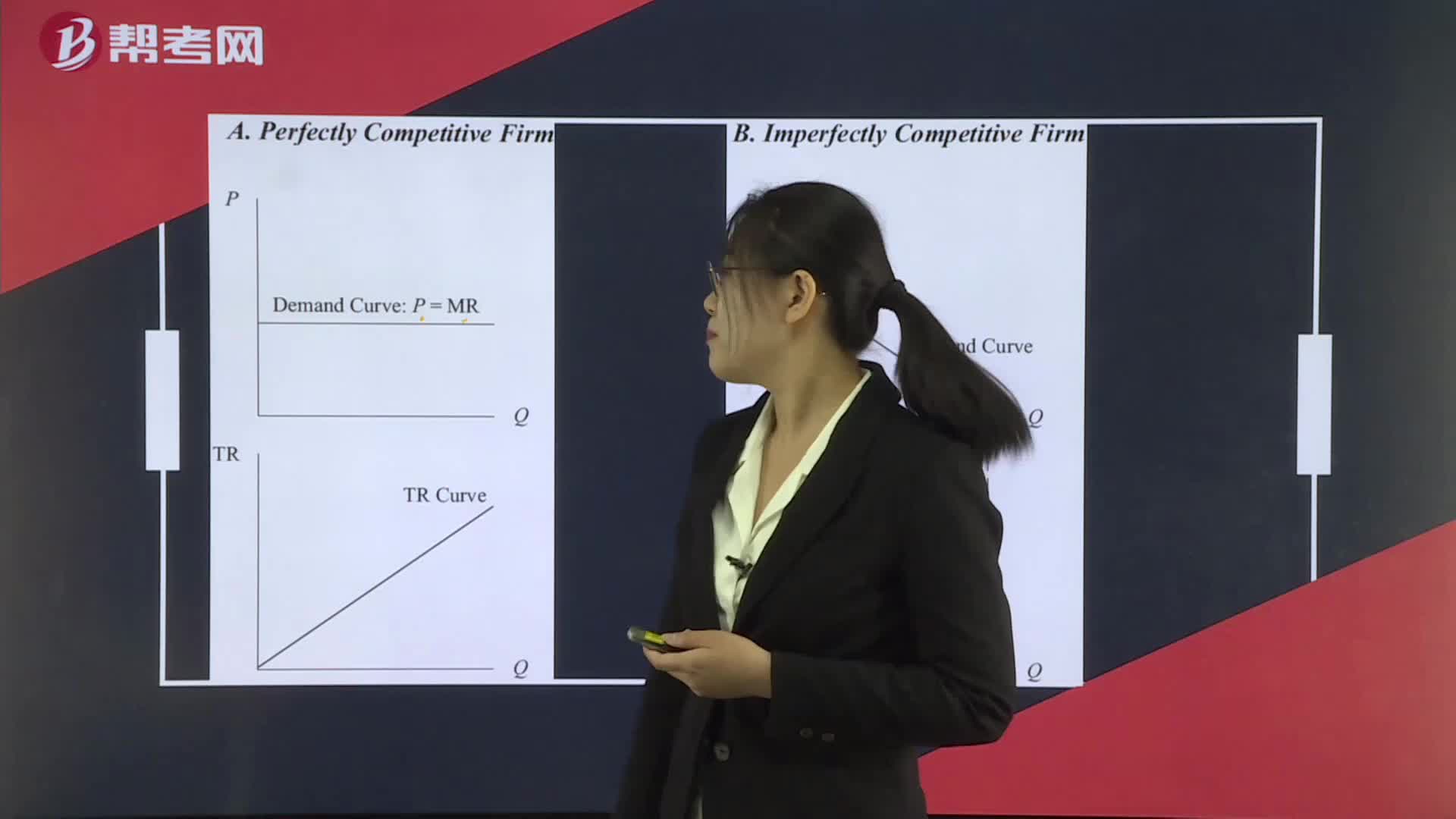

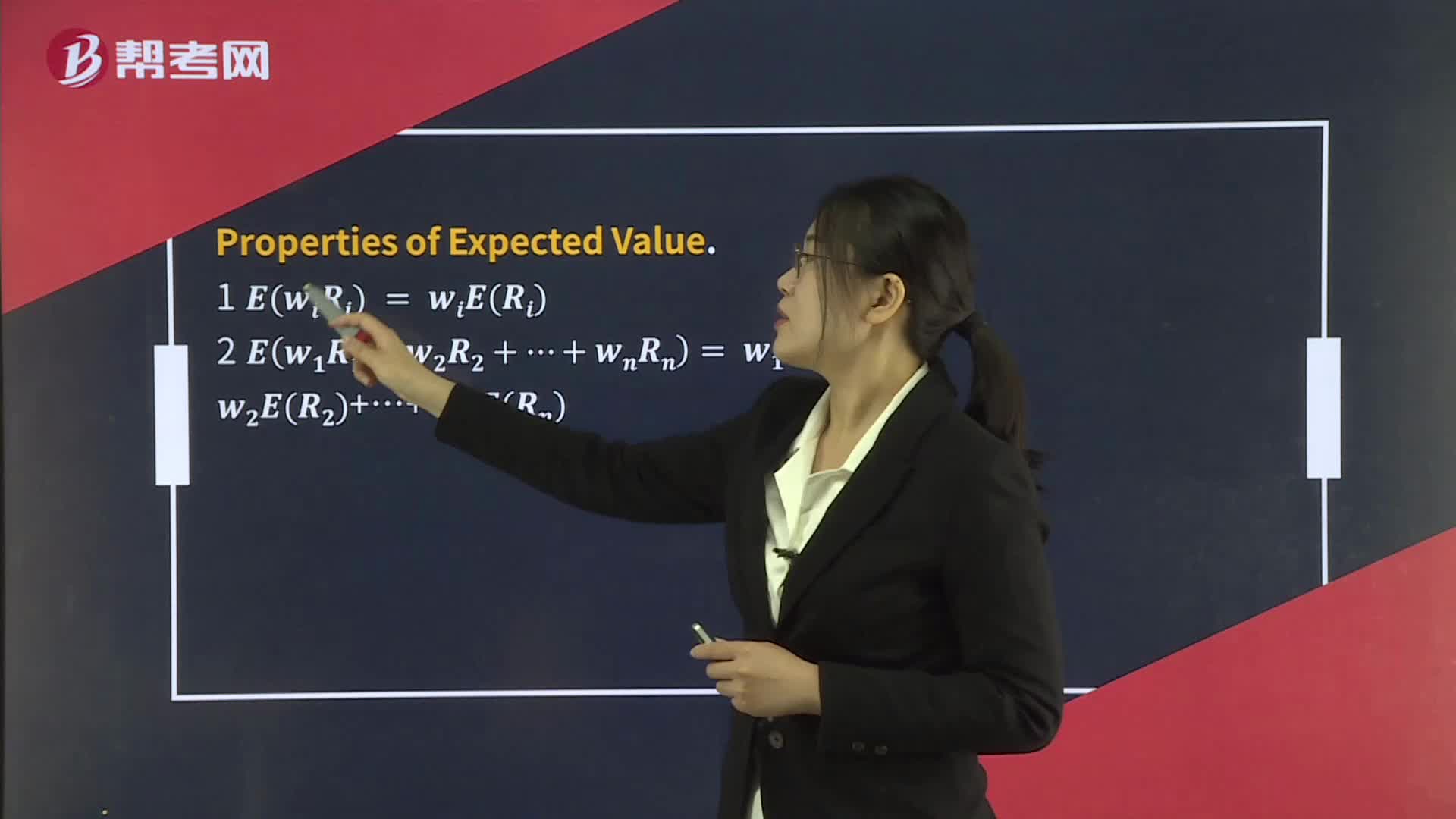

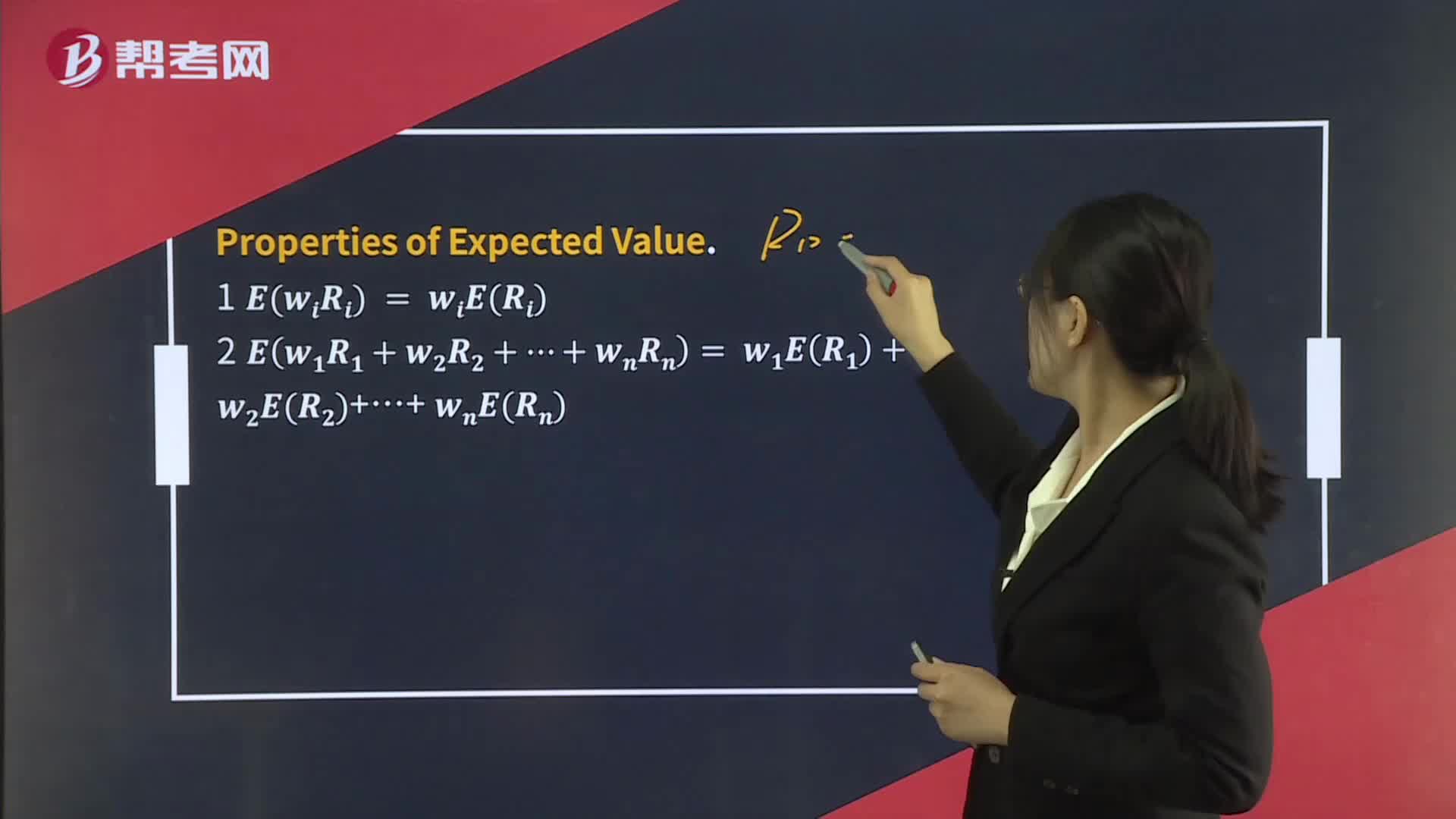

Portfolio Expected Return and Variance of Return

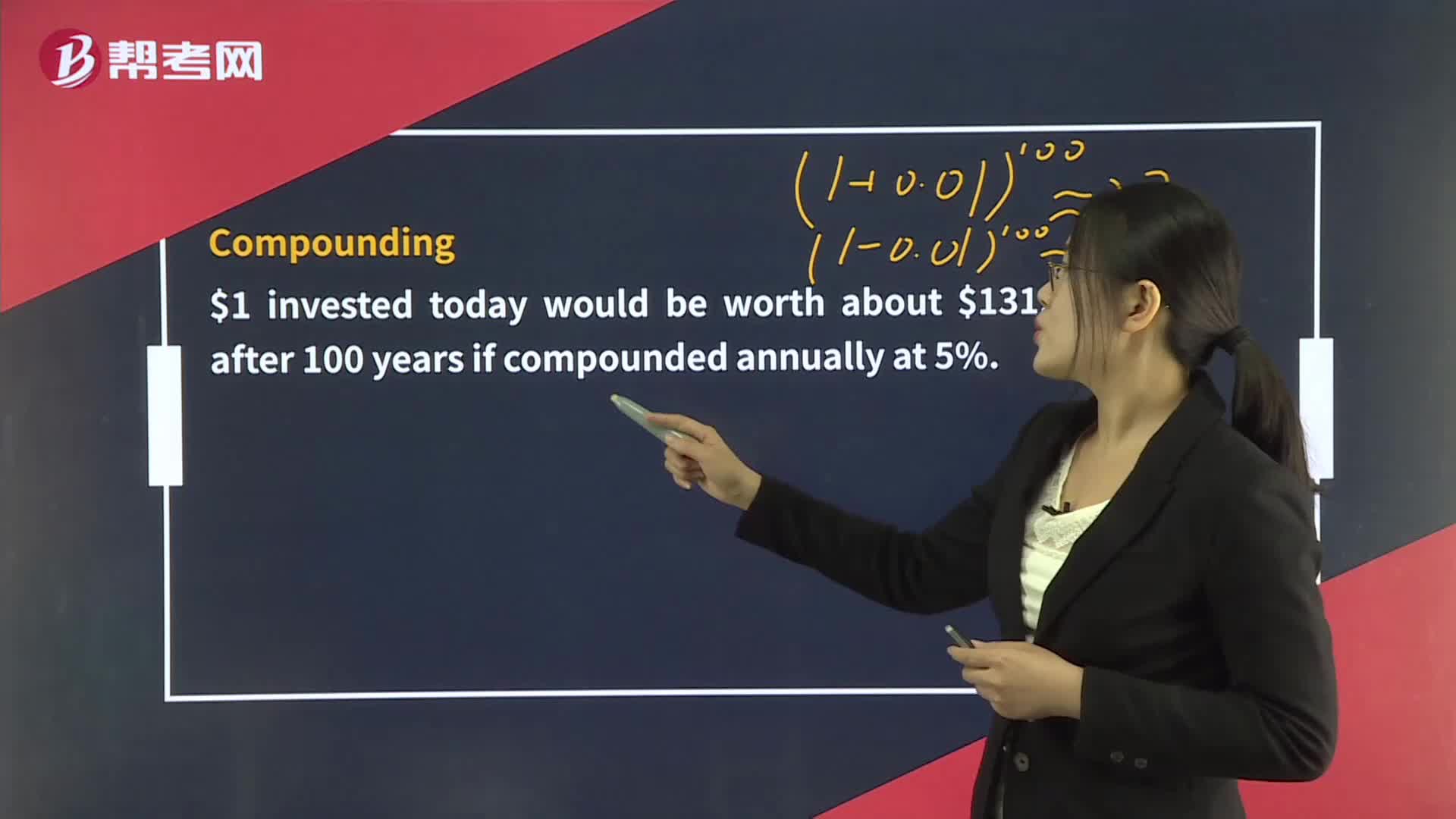

The Time Value of Money

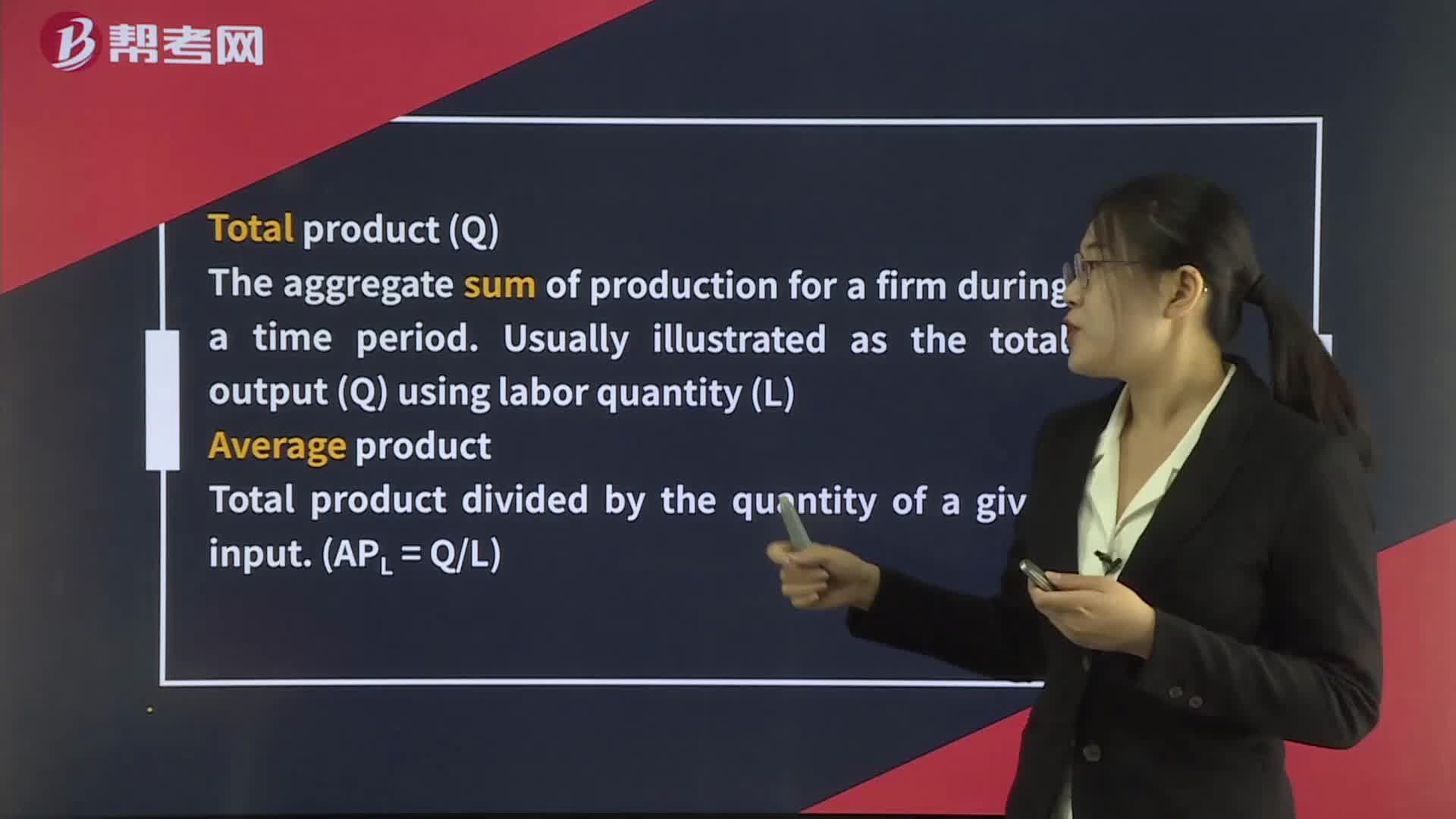

Total, Average, and Marginal Product of Labor

下载亿题库APP

联系电话:400-660-1360