下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、In general, which of the following institutions will most likely have a high need for liquidity and a short investment time horizon?【单选题】

A.Banks

B.Endowments

C.Defined benefit pension plans

正确答案:A

答案解析:“Portfolio Management: An Overview”, by Robert M. Conroy and Alistair Byrne.

2011 Modular Level I, Vol. 4, pp. 286-292

Study Session 12-51-b

Discuss the types of investment management clients and the distinctive characteristics and needs of each.

A is correct. Banks have a short term horizon and high liquidity needs. See Exhibit 14, page 291.

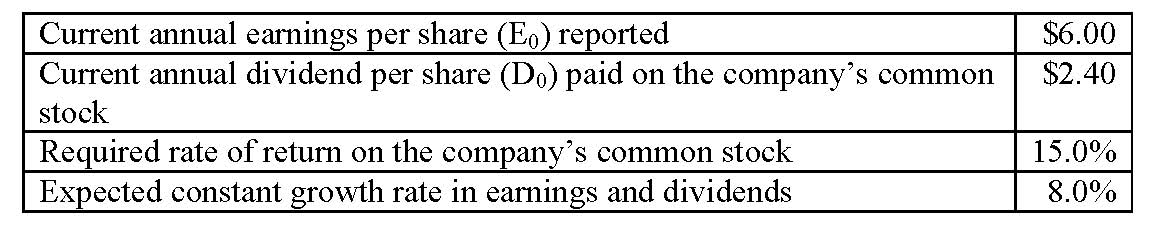

2、An analyst gathered the following information about a company:

If markets are in equilibrium, which of the following statements best describes the company’s price-to- earnings (P/E) ratio? The company’s P/E ratio based on the infinite period dividend discount model (DDM) is:【单选题】

A.less than the company’s trailing P/E ratio.

B.the same as the company’s trailing P/E ratio.

C.greater than the company’s trailing P/E ratio.

正确答案:A

答案解析:“An Introduction to Security Valuation,” Frank K. Reilly, CFA and Keith C. Brown, CFA

2010 Modular Level I, Vol. 5, pp. 142-143, 148-150

“Introduction to Price Multiples,” John D. Stowe, CFA, Thomas R. Robinson, CFA, Jerald E. Pinto, CFA, and Dennis W. McLeavey, CFA

2010 Modular Level I, Vol. 5, p. 198-200

Study Session 14-56-d; 14-59-b

Show how to use the DDM to develop an earnings multiplier model and explain the factors in the DDM that affect a stock’s price-to-earnings (P/E) ratio.

Calculate and interpret P/E, P/BV, P/S, and P/CF.

The trailing P/E ratio is computed as the current stock price divided by the current or trailing 12-months’ EPS. On the other hand, the P/E ratio based on the infinite period dividend discount model is computed as (D/E) / (k – g).

If markets are in equilibrium, the price per share reflects the value determined by the constant growth dividend. Using the constant growth model the stock's value is ($2.40)(1.08) / 0.07 = $37.03;

The trailing P/E = 37.03 / 6 = 6.17. The DDM P/E is the dividend payout ratio divided by k-g = 0.4 / 0.07 = 5.71. Another way of computing DDM P/E is: Current Market Price/Expected 12-month earnings: 37.03/(6.00 x 1.08) = 5.71. (see p. 148)

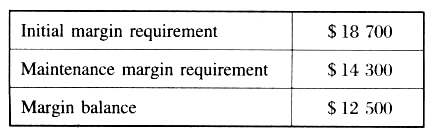

3、An analyst does research about future contracts.A commodity futures accounthas the following margin balances:

The variation margin is closest to:【单选题】

A.$1 800

B.$4 400

C.$6 200

正确答案:C

答案解析:$18 700 - $12 500 = $6 200,当保证金余额低于维持保证金时,要增加保证金到初始保证金的额度,增加的部分被称为变动保证金。

4、An analyst does research about yield spread.All other factors being equal, willthe yield spread for an option-free corporate bond over the benchmark bond mostlikely decrease :【单选题】

A.

B.

C.

正确答案:C

答案解析:当经济处于衰退期时,人们对于风险更加厌恶,投资者会要求有更高的收益率溢价。当债券的信用评级被调低时,则该债券有更大的风险,投资者会要求有更高的收益率溢价。

5、An analyst does research about a floating-rate security.All else being equal, thecap on a floating-rate security is most likely to benefit the:【单选题】

A.issuer if interest rates fall.

B.issuer if interest rates rise.

C.bondholder if interest rates rise.

正确答案:B

答案解析:浮动利率的利率顶对于债券的发行人有利,它限制了票面利率上涨的最高幅度,锁定了发行人的利息支出。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料