下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、In a monopoly industry, a firm is most likely to earn an economic profit in:【单选题】

A.short-run equilibrium only.

B.long-run equilibrium only.

C.both short-run and long-run equilibrium.

正确答案:C

答案解析:完全垄断行业中只有一个企业,产品没有很好的替代品,而且行业的进入门槛非常高,企业可以在短期或者长期内都获得经济利润。相对来说,完全竞争行业由于进出壁垒很低,市场价格超过其平均总成本则产生经济利润,但一旦有经济利润(超额利润)产生,就会有企业进入该行业,这样导致经济利润只可能在短期内发生,长期的经济利润则为零。

2、An analyst uses a stock screener and selects the following metrics: a global equity index, P/E ratio lower than the median P/E ratio, and a price-book value ratio lower than the median price-book value ratio. The stocks so selected would be most appropriate for portfolios of which type of investors?【单选题】

A.Value investors.

B.Growth investors.

C.Market-oriented investors.

正确答案:A

答案解析:“Financial Statement Analysis: Applications,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol. 3, pp. 608-611

“Security Market Indices,” Paul D. Kaplan, CFA, and Dorothy C. Kelly, CFA

2011 Modular Level I, Vol. 5, pp. 105

Study Session: 10-42-d; 13-56-k

Discuss the use of financial statement analysis in screening for potential equity investments.

Compare and contrast the types of security market indices

Metrics such as low P/E and low price-book are aimed at selecting value companies; therefore the portfolio is most appropriate for value investors.

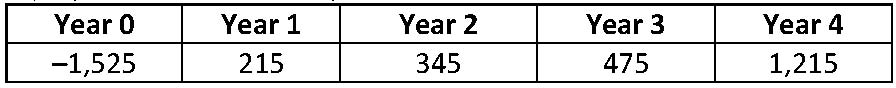

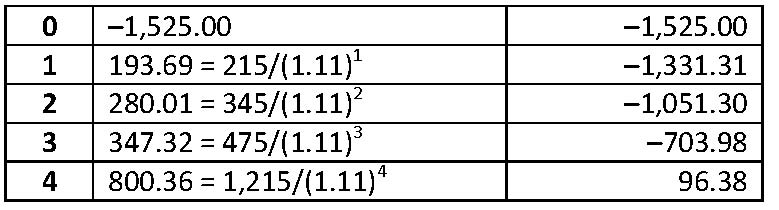

3、A project has the following cash flows (£):

Assuming a discount rate of 11% annually, the discounted payback period (in years) is closest to:【单选题】

A.3.4.

B.3.9.

C.4.0.

正确答案:B

答案解析:“Capital Budgeting,” John D. Stowe, CFA and Jacques R. Gagne, CFA

2013 Modular Level I, Vol.4, Reading 36, Section 4.4.

Study Session 11-36-d

Calculate and interpret the results using each of the following methods to evaluate a single capital project: net present value (NPV), internal rate of return (IRR), payback period, discounted payback period, and profitability index (PI).

B is correct. The discounted cash flows and their cumulative sum are:

After three years, $821.02 of the $1,525 investment is recovered, leaving $703.98 left to recover in the fourth year. Proportionately, only 0.88 (= $703.98/$800.36) of the cash flow in the fourth year is necessary to recover all of the investment. This makes the discounted payback equal to 3.9 years (rounded up from 3.88).

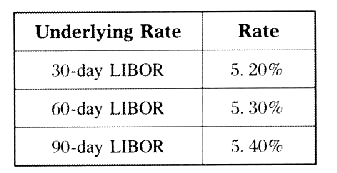

4、An investor does research about forward rate agreement and takes a $1 millionshort position in a forward rate agreement 3 × 9 quoted at 5% according to LIBOR.At expiration, the investor gathers the following rates:

The payoff for this investor is closest to:【单选题】

A.$495.62

B.$500.00

C.$660.83

正确答案:A

答案解析:FRA 3 × 9说明该远期利率协议是3个月的期限,针对6个月的LIBOR,所以取5.3%作为到期结算的LIBOR。

[1 000 000 × (5.30% - 5%) × 60/360]/(1 + 5.30% × 60/360) = 500/1.00883 = 495.62。

5、An analyst does research about earnings quality.With respect to U.S.GAAP,which of the following is least likely an accounting warning sign for a company?【单选题】

A.the use of short useful lives for amortization.

B.a decrease in the last-in, first-out (LIFO) reserve.

C.the use of high discount rates for pension plan liabilities.

正确答案:A

答案解析:对摊销使用更短的使用年限会使得摊销费用变大,净利润变小,这是一种保守的做法,并不是警示信号。LIFO准备(reserve)下降,有可能是由于LIFO清算(liquidation)引起的,造成销货成本(COGS)虚假下降,净利润虚假上升,是警示信号。对于养老金用更高的折现率,使得预计给付义务(projected benefit obligation)变小,能够使负债虚假变小,也是警示信号。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料