下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

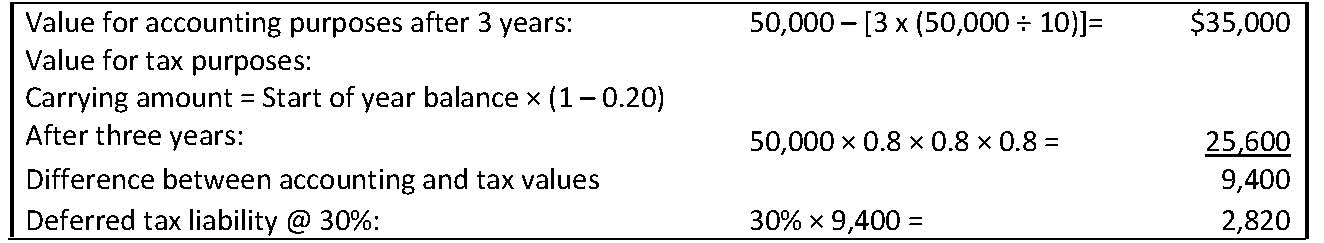

1、A company purchased equipment for $50,000 on 1 January 2009. It is depreciating the equipment over a period of 10 years on a straight-line basis for accounting purposes, but for tax purposes, it is using the declining balance method at a rate of 20%. Given a tax rate of 30%, the deferred tax liability as at the end of 2011 is closest to:【单选题】

A.$420.

B.$2,820.

C.$6,720.

正确答案:B

答案解析:“Income Taxes,” Elbie Antonites and Michael A. Broihahn

2012 Modular Level I, Vol. 3, pp. 493–495

Study Session: 9-31-c, d

Determine the tax base of a company’s assets and liabilities.

Calculate income tax expense, income taxes payable, deferred tax assets, and deferred tax liabilities, and calculate and interpret the adjustment to the financial statements related to a change in the income tax rate.

B is correct. The deferred tax liability is equal to the tax rate times the difference between the carrying amount of the asset and the tax base.

2、Under IFRS, the costs incurred in the issuance of bonds are most likely:【单选题】

A.expensed when incurred.

B.included in the measurement of the bond liability.

C.deferred as an asset and amortized on a straight-line basis.

正确答案:B

答案解析:Under IFRS, debt issuance costs are included in the measurement of the bond liability.

2014 CFA Level I

"Non-Current (Long-Term) Liabilities," by Elizabeth A. Gordon and Elaine Henry

Section 2.1

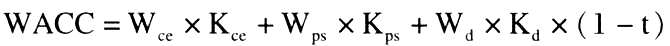

3、An analyst does research about cost of capital.All else being equal, if a U.S.company's marginal tax rate decreases, the company's weighted average cost ofcapital will most likely:【单选题】

A.decrease.

B.remain unchanged.

C.increase.

正确答案:C

答案解析:加权平均资本成本 。其中,

。其中, 是普通股股东的必要回报率,

是普通股股东的必要回报率, 是优先股股东的必要回报率,

是优先股股东的必要回报率, 是公司发行新债券的必要收益率,所以税率t减小,WACC会增大。

是公司发行新债券的必要收益率,所以税率t减小,WACC会增大。

4、A firm’s estimated costs of debt, preferred stock, and common stock are 12%, 17%, and 20%, respectively. Assuming equal funding from each source and a 40% tax rate, the weighted average cost of capital is closest to:【单选题】

A.13.9%.

B.14.7%.

C.16.3%.

正确答案:B

答案解析:“Cost of Capital,” Yves Courtois, Gene C. Lai, and Pamela Peterson Drake

2012 Modular Level I, Vol. 4, pp. 41–42

Study Session 11-37-a, b

Calculate and interpret the weighted average cost of capital (WACC) of a company.

Describe how taxes affect the cost of capital from different capital sources.

B is correct:

5、Which of the following statements is most accurate with respect to the jurisdiction underlyingfinancial reporting?【单选题】

A.The requirement to prepare financial reports in accordance with specified accounting standards isthe responsibility of standard-setting bodies.

B.Standard-setting bodies have authority because they are recognized by regulatory authorities.

C.Regulatory authorities are typically private sector, self-regulated organizations.

正确答案:B

答案解析:Without the recognition of the standards by the regulatory authorities, such as the US SEC, theprivate sector standard-setting bodies, such as US Financial Accounting Standards Board, wouldhave no authority.

CFA Level I

"Financial Reporting Standards," Elaine Henry, Jan Hendrik van Greuning, and Thomas R. Robinson

Section 3

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料