下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

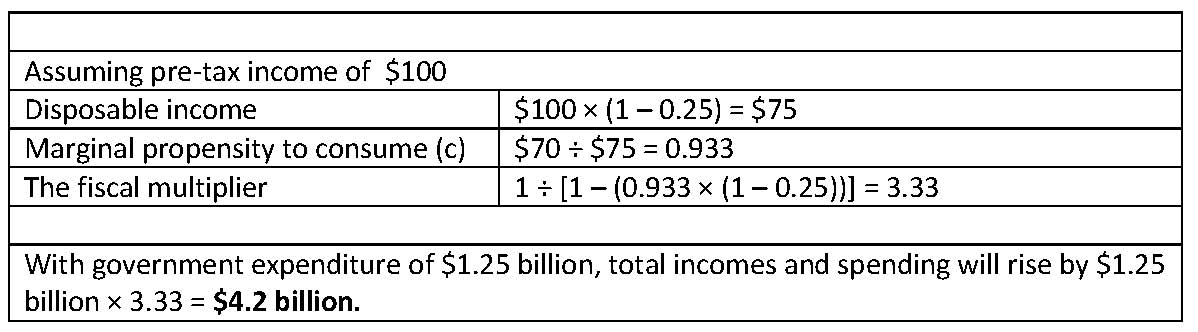

1、In an economy, consumption is 70% of pre-tax income and the average tax rate is 25% of total income. If planned government expenditures are expected to increase by $1.25 billion, the increase in total incomes and spending ($ in billions) is closest to:【单选题】

A.$1.3.

B.$2.6.

C.$4.2.

正确答案:C

答案解析:“Monetary and Fiscal Policy,” Andrew Clare, PhD and Stephen Thomas, PhD

2013 Modular Level I, Vol. 2, Reading 19, Section 3.2.2

Study Session 5-19-o, q

Describe the tools of fiscal policy including their advantages and disadvantages.

Explain the implementation of fiscal policy and the difficulties of implementation.

2、Which of the following government interventions in market forces is most likely to cause overproduction?【单选题】

A.Price floors

B.Price ceilings

C.Imposing an additional per-unit tax of $1 on sellers

正确答案:A

答案解析:“Demand and Supply Analysis: Introduction,” Richard V. Eastin and Gary L. Arbogast

2012 Modular Level I, Vol. 2, pp. 37–44

Study Session 4-13-k

Forecast the effect of the introduction and removal of a market interference (e.g., a price floor or ceiling) on price and quantity.

A is correct. Price floors lead to overproduction.

3、Which of the following is most likely a benefit of debt covenants for the borrower?【单选题】

A.Reduction in the cost of borrowing.

B.Limitations on the company’s ability to pay dividends.

C.Restrictions on how the borrowed money may be invested.

正确答案:A

答案解析:“Long-term Liabilities and Leases,” Elizabeth A. Gordon and R. Elaine Henry, CFA

2010 Modular Level 1, Vol.3, pp. 524-525

Study Session: 9-39-b

Explain the role of debt covenants in protecting creditors by restricting a company’s ability to invest, pay dividends, or make other operating and strategic decisions.

The reduction in the cost of borrowing is a benefit of covenants to the borrower.

4、Which of the following theories suggests that both aggregate demand and aggregatesupply are primarily driven by changes in technology over time?【单选题】

A.Neoclassical school.

B.Keynesian school.

C.Austrian school.

正确答案:A

答案解析:新古典学派认为,总供给和总需求长期来讲主要由科学水平的变化所主导,而凯恩斯学派认为,总需求的变化是由于市场参与者预期的改变进而引起经济周期,奥地利学派认为,经济周期是由于政府对于经济的干预所引起的。

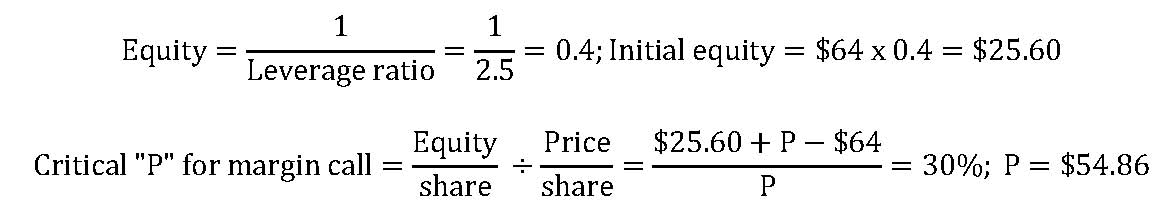

5、A trader who buys a stock priced at $64 on margin with a leverage ratio of 2.5 and a maintenance margin of 30% will most likely receive a margin call when the stock price is at or falls just below:【单选题】

A.$36.57.

B.$44.80.

C.$54.86.

正确答案:C

答案解析:“Market Organization and Structure,” Larry E. Harris

2012 Modular Level I, Vol. 5, pp. 43–46

Study Session 13-47-f

Calculate and interpret the leverage ratio, the rate of return on a margin transaction, and the security price at which the investor would receive a margin call.

C is correct.

Alternate solution:

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料