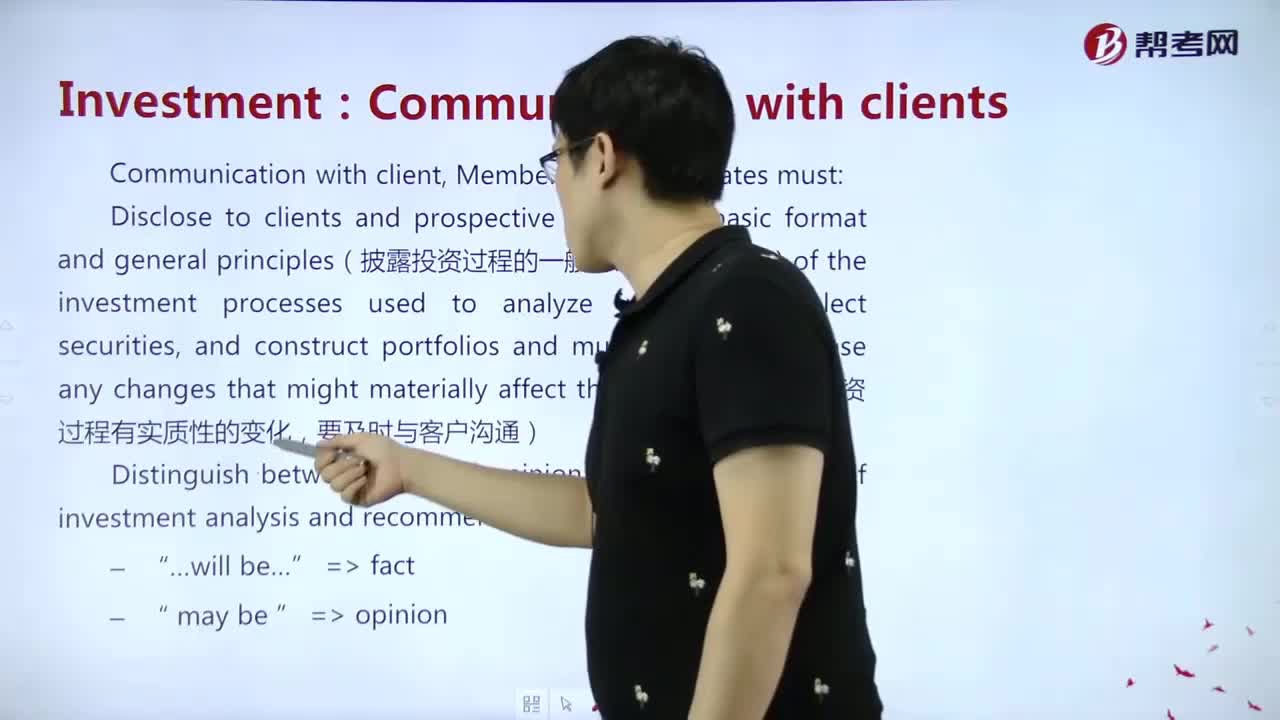

What should members and candidates do when communicating with client?

How to identifying the actual investment client and voting proxy policies?

How to understand loyalty, prudence and care in duty to clients?

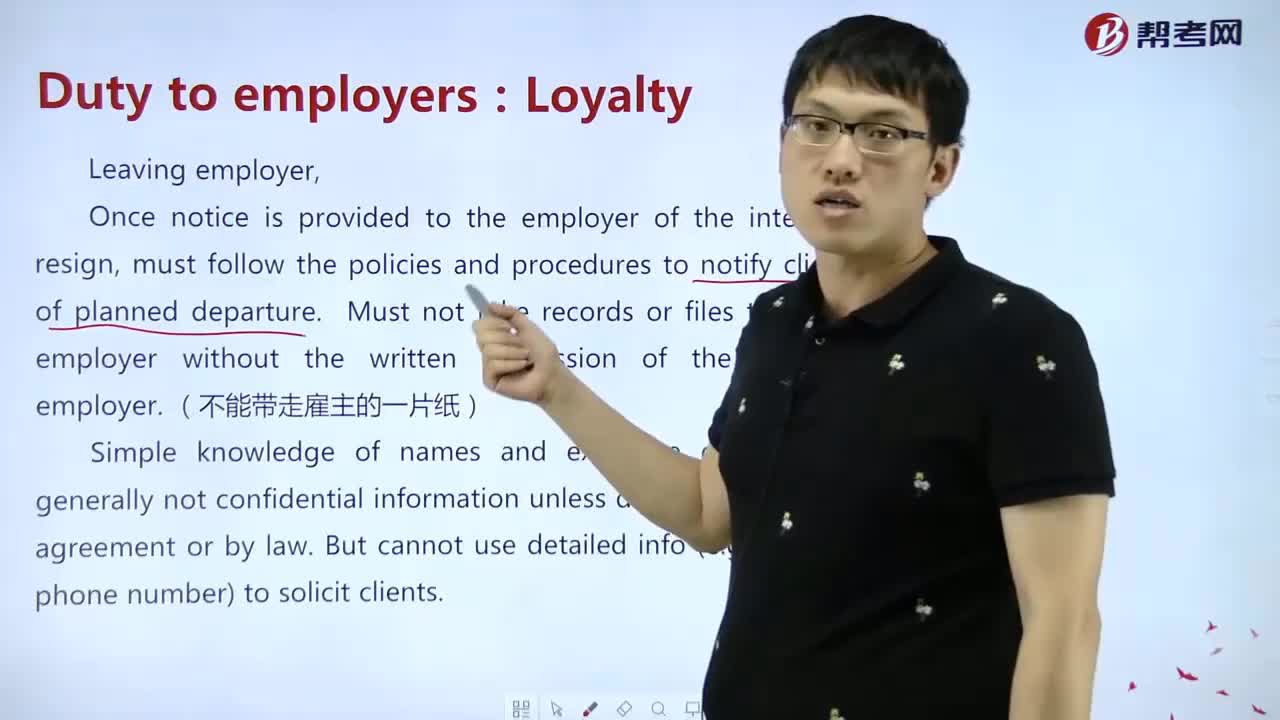

What they should pay attention to,when employees leaving employer?

What aspect is loyalty embodied?

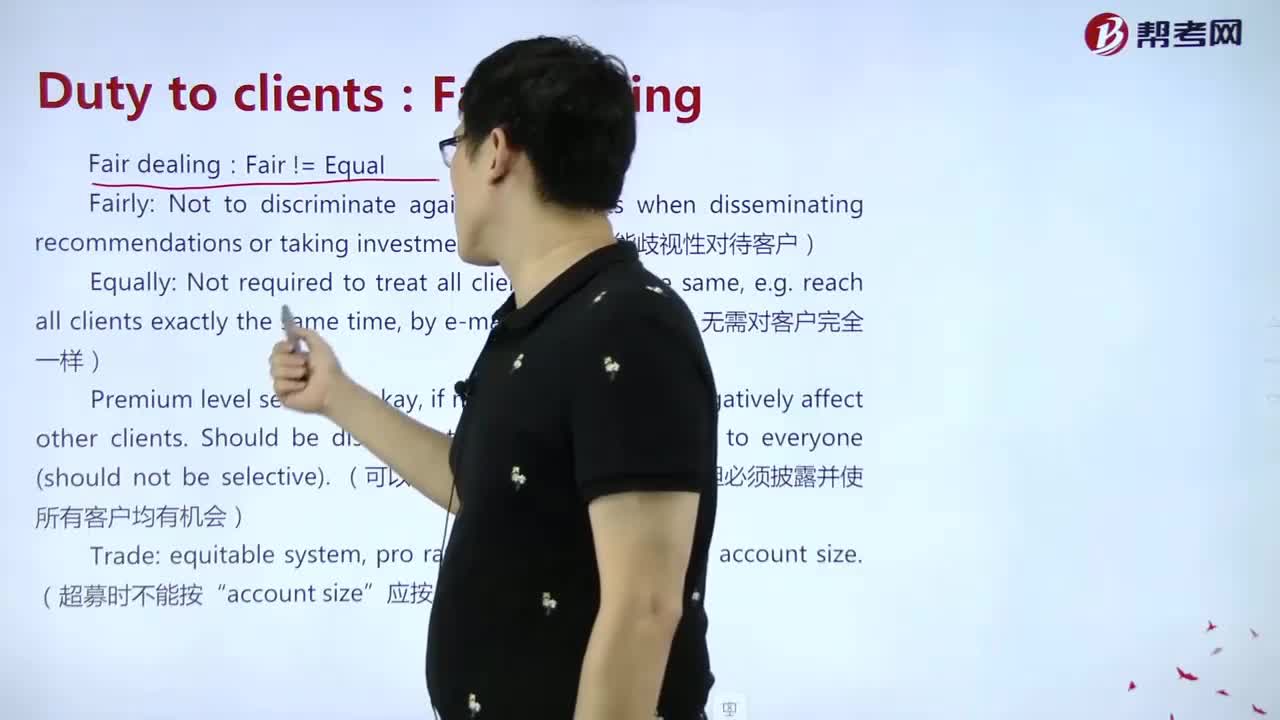

In what ways does fair dealing manifest itself?

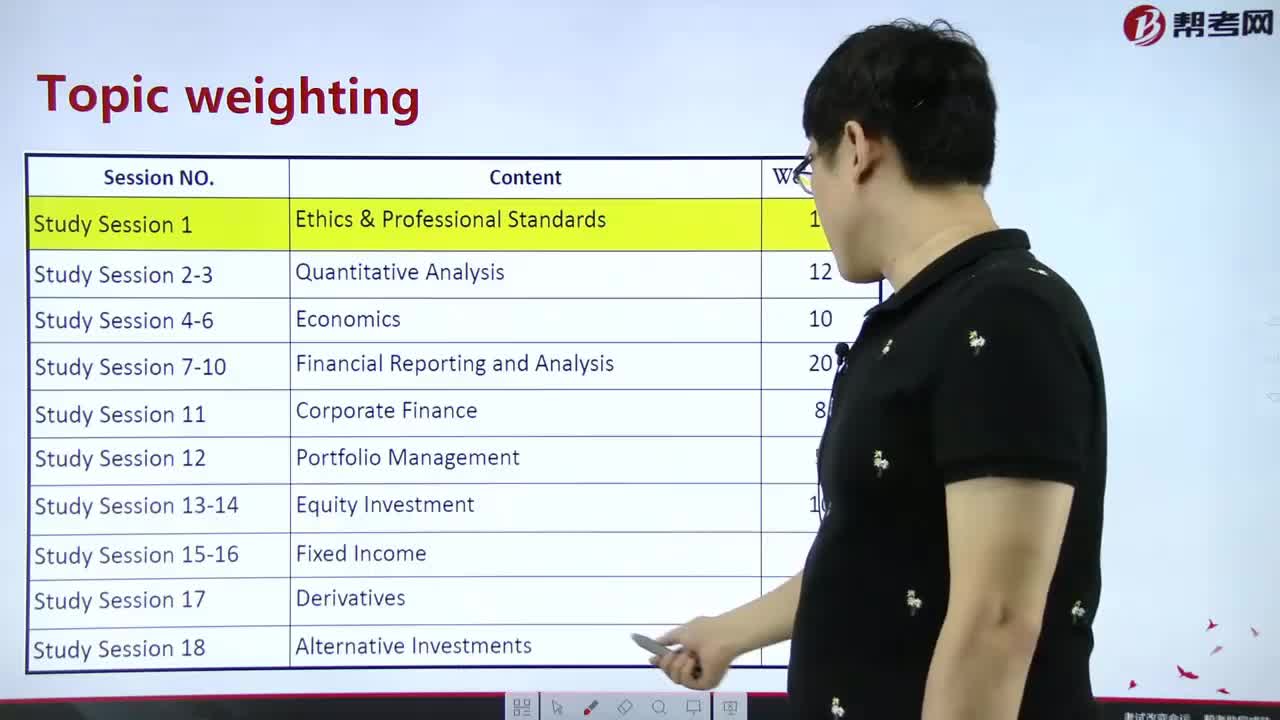

What are the ethics and trust in the investment profession?

In analyzing investment, what should we do to making investment recommendations, and taking investment actions?

How to deal with potential conflict of interest?

What's the meaning of independence and objectivity in professionalism?

What laws,rules, and regulations should be known by members and candidates?

How to understand the Code of ethics and trust in the investment profession?

下载亿题库APP

联系电话:400-660-1360