下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Which of the following multiples is most useful when comparing companies with significant differences in capital structure?【单选题】

A.EV/EBITDA

B.Price-to-book ratio

C.Price-to-cash flow ratio

正确答案:A

答案解析:“Overview of Equity Securities,” Ryan C. Fuhrmann, CFA and Asjeet S. Lamba, CFA

2013 Modular Level I, Vol. 5, Reading 49, Section 7.1

“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFA

2013 Modular Level I, Vol. 5, Reading 51, Sections 5.2 - 5.4

Study Session 14-49-g, 14-51-h, i

Distinguish between the market value and book value of equity securities.

Calculate and interpret the following multiples: price to earnings, price to an estimate of operating cash flow, price to sales, and price to book value.

Explain the use of enterprise value multiples in equity valuation and demonstrate the use of enterprise value multiples to estimate equity value.

A is correct. The EV/EBITDA approach is most useful when comparing companies with significant differences in capital structure. EBITDA is computed prior to payment to any of the company’s financial stakeholders and is not impacted by the amount of debt leverage.

2、An investor sells a bond at the quoted price of $98.00. In addition he receives accrued interest of $4.40. The clean price of the bond is:【单选题】

A.par value plus accrued interest.

B.accrued interest plus agreed upon bond price.

C.agreed upon bond price excluding accrued interest.

正确答案:C

答案解析:“Features of Debt Securities,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, pp. 330

Study Session 15-53-c

Define accrued interest, full price, and clean price.

C is correct because the agreed upon bond price without accrued interest is simply referred to as the price as well as the clean price.

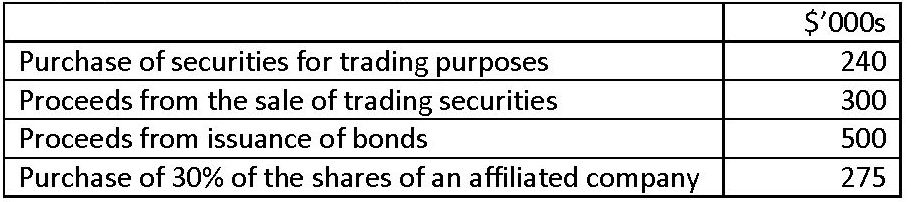

3、A company recorded the following events in 2012:

On the 2012 statement of cash flows, the company’s net cash flow from investing activities (in $‘000s) is closest to:【单选题】

A.-275.

B.-215.

C.285.

正确答案:A

答案解析:A is correct.

“Understanding Cash Flow Statements,” Elaine Henry, CFA, Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, and Michael A. Broihahn, CFA

2013 Modular Level I, Vol. 3, Reading 27, Section 2.1

Study Session 8-27-a

Compare cash flows from operating, investing, and financing activities and classify cash flow items as relating to one of those three categories given a description of the items.

A is correct. Only the cash flows for the purchase of the shares in an affiliated company are cash from investing activities, therefore the net amount is -$275,000. Cash flows from trading securities are operating activities.

4、Which of the following performance measures most likely relies on systematic risk as opposed tototal risk when calculating a risk-adjusted return?【单选题】

A.Treynor ratio

B.M-squared

C.Sharpe ratio

正确答案:A

答案解析:The Treynor ratio measures the return premium of a portfolio versus the risk-free asset relative to theportfolio's beta, which is a measure of systematic risk.

CFA Level I

"Portfolio Risk and Return: Part II," Vijay Singal

Section 4.3.2

5、When calculated for the same data and provided there is variability in the observations, the geometric mean will most likely be:【单选题】

A.equal to the arithmetic mean.

B.less than the arithmetic mean.

C.greater than the arithmetic mean.

正确答案:B

答案解析:“Statistical Concepts and Market Returns,” Richard A. Defusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2011 Modular Level I, Vol. 1, p. 374

Study Session 2-7-e

Define, calculate and interpret measures of central tendency, including the population mean, sample mean, arithmetic mean, weighted average or mean (including a portfolio return viewed as a weighted mean), geometric mean, harmonic mean, median, and mode.

As stated in the reading, “In fact, the geometric mean is always less than or equal to the arithmetic mean. The only time the two means will be equal is when there no variability in the observations.”

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料