下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、In a period of rising prices, when compared with a company that uses weighted average cost forinventory, a company using FIFO will most likely report higher values for its:【单选题】

A.debt-to-equity ratio.

B.return on sales.

C.inventory turnover.

正确答案:B

答案解析:In periods of rising prices, FIFO results in a higher inventory value and a lower cost of goods sold andthus a higher net income. The higher net income increases return on sales. The higher reported netincome also increases retained earnings and thus results in a lower debt-to-equity ratio, not a higherone. The combination of higher inventory and lower cost of goods sold (CGS) decreases inventoryturnover (CGS/Inventory).

CFA Level I

"Inventories, Michael A. Broihahn

Sections 3.2, 3.3, 3.5, 3.7

2、An analyst does research about difference between Generally Accepted AccountingPrinciples (U.S.GAAP) and International Financial Reporting Standards (IFRS).The indirect method of presenting cash flow from operation is NOT allowed under?【单选题】

A.IFRS only.

B.U.S.GAAP only.

C.Neither IFRS nor U.S.GAAP.

正确答案:C

答案解析:无论是IFRS还是U.S.GAAP,都允许用间接法(indirect method)和直接法(direct method)编制现金流量表,但鼓励用直接法。

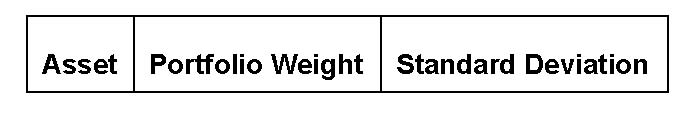

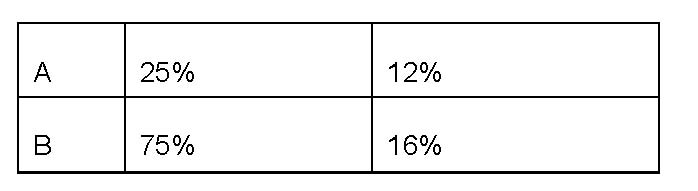

3、Information about a portfolio that consists of two assets is provided below:

If the correlation coefficient between the two assets is 0.75, the standard deviation of the portfolio is closest to:【单选题】

A.12.37%.

B.14.39%.

C.15.00%.

正确答案:B

答案解析:

2014 CFA Level I

"Portfolio Risk and Return: Part I," by Vijay Singal

Sections 4.1.2, 4.1.3

4、Given a large random sample, which of the following types of data are least appropriately analyzed with nonparametric tests?【单选题】

A.Ranked data (e.g., 1st, 3rd)

B.Signed data (e.g., number of +'s and –'s)

C.Numerical values (e.g., 28.43, 79.11)

正确答案:C

答案解析:Nonparametric tests are primarily concerned with ranks, signs, or groups, and they are used when numerical parameters are not known or do not meet assumptions about distributions. Even if the underlying distribution is unknown, parametric tests can be used on numerical data if the sample is large.

2014 CFA Level I

“Hypothesis Testing,” by Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle

Section 5

5、An analyst does research about investment risk.In the context of capital markettheory and the capital asset pricing model, investors should most likely expecthigher returns for accepting increasing amounts of:【单选题】

A.total risk.

B.unique risk.

C.systematic risk.

正确答案:C

答案解析:总风险包括系统性风险和非系统性风险。独特风险(unique risk)就是非系统性风险,且在市场投资组合中能被完全分散化,所以运用资本市场理论和CAPM模型,要获得高收益只有承担更高的系统性风险。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料