下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

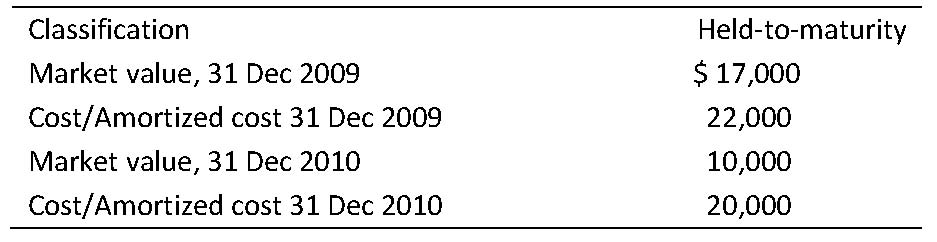

1、The following information is from a company’s investment portfolio:

Investment

If the investment is reclassified as Available-for-sale as of 31 December 2010, the balance sheet carrying value of the company’s investment portfolio would most likely:【单选题】

A.remain the same.

B.decrease by $10,000.

C.decrease by $12,000.

正确答案:B

答案解析:"Understanding The Balance Sheet,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol.3, p. 224

Study Session: 8-33-f

Demonstrate the appropriate classifications and related accounting treatments for marketable and nonmarketable financial instruments held as assets or owed by the company as liabilities.

Held-for-trading and available-for-sale securities are carried at market value, whereas held-to-maturity securities are carried at amortized cost. If the investment is reclassified as available-for-sale in 2010, the carrying amount should be adjusted to its market value, which is $10,000. Compared with the amortized cost of $20,000, it’s a decrease of $10,000.

2、An analyst does research about financial reporting quality.An incentive for acompany's management reporting lower earnings is least likely to:【单选题】

A.remain in compliance with lending covenants.

B.obtain trade relief in the form of quotas or protective tariffs.

C.negotiate favorable terms from creditors.

正确答案:A

答案解析:本题考查的是财务报告质量(financial reporting quality)中管理层操纵盈利的动机。管理层试图提高净利润的动机包括:

·Meet earnings expectations.(实现盈利目标。)

·Remain in compliance with lending covenants.(遵守贷款合约。)

·Receive higher incentive compensation.(获得更高的激励性薪酬。)

管理层试图降低净利润的动机包括:

·Obtain trade relief in the form of quotas or protective tariffs.(获得贸易限额或者保护性关税。)

·Negotiate favorable terms from creditors.(获得债权人给予的优惠性条款。)

·Negotiate favorable labor union contracts.(从工会取得优惠的劳动条款。)

3、All other things being equal, a decrease in expected yield volatility most likely increases the price of:【单选题】

A.a putable bond.

B.a callable bond.

C.an option-free bond.

正确答案:B

答案解析:“Risks Associated with Investing in Bonds” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 53, Section 10

Study Session 15-53-n

Explain how yield volatility affects the price of a bond with an embedded option and how changes in volatility affect the value of a callable bond and a putable bond.

B is correct because the price of a callable bond is equal to the value of an option-free bond minus the value of the embedded call option. A decrease in yield volatility will decrease the value of the call option and, therefore, increase the value of the callable bond.

4、An analyst does research about a bond's indenture.Which of the following isan example of a affirmative covenant?【单选题】

A.Limit additional borrowings unless certainfinancial conditions are met.

B.Prohibit the same assets back several debt issues simultaneously.

C.Maintain of current ratio above 2.5.

正确答案:C

答案解析:债券契约中有肯定性条款和否定性条款,选项A和B都是否定性的,只有选项C保持流动性比率大于2.5,属于肯定性条款。

5、Raymond Ortiz, CFA, provides investment advice to high-net-worth investors. Ortiz has just completed an analysis of Continental Wheat, a manufacturer of wheat-based food products. He rated the company a long-term hold for investors seeking growth and income. Ortiz’s analysis included a review of the company’s management team, financial data, pro forma financial positions, dividends and dividend policy, and a comparison of Continental with its competitors. Although he does not tell anyone, five years ago, Ortiz worked for and managed the commodities derivatives trading unit of Continental. As part of his compensation at Continental, he received stock, which he still owns. Based upon his research, Ortiz recommends Continental to clients who have a moderate risk tolerance. Two weeks later Continental announces its quarterly earnings are 30% less than a year ago. Consequently, shares of Continental drop by 50%. Ortiz most likely violated the CFA Institute Code of Ethics and Standards of Professional Conduct related to his stock:【单选题】

A.research.

B.ownership.

C.recommendation.

正确答案:B

答案解析:CFA Institute Standards

2012 Modular Level I, Vol. 1, pp. 107–108, 123–126

Study Session 1-2-b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

B is correct because there is a violation of Standard VI (A) Disclosure of Conflicts; the analyst worked for Continental and still has ties to the company in the form of his stock ownership.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料