下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Using a discount rate of 5%, compounded monthly, the present value of $5,000 to be received three years from today is closest to:【单选题】

A.$4,250.

B.$4,305.

C.$4,320.

正确答案:B

答案解析:“The Time Value of Money,” Richard A. Defusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2011 Modular Level I, Vol. 1, pp.272-273

Study Session 2-5-d

Solve time value of money problems when compounding periods are other than annual.

Alternatively, enter into your financial calculator FV=5,000, N=36, I/Y =5/12, PMT=0, and solve for PV.

2、Molly Burnett, CFA, is a portfolio manager for a fund that only invests in environmentally friendly companies. A multinational utility company recently acquired one of the fund’s best performing investments, a wind power company. The wind power company’s shareholders received utility company shares as part of the merger agreement. The utility has one of the worst environmental records in the industry, but its shares have been one of the top performers over the past 12 months. Because the utility pays a high dividend every three months, Burnett holds the utility shares until the remaining two dividends are paid for the year then sells the shares. Burnett most likely violated the CFA Institute Standard of Professional Conduct concerning:【单选题】

A.suitability.

B.disclosure of conflicts.

C.independence and objectivity.

正确答案:A

答案解析:CFA Institute Standards

2012 Modular Level I, Vol. 1, pp. 27–29, 78–81, 123–125

Study Session 1-2-b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

A is correct because the utility is not a suitable investment for a fund that only invests in companies with good environmental records. Continuing to hold this investment, therefore, was a violation of Standard III (C) Suitability.

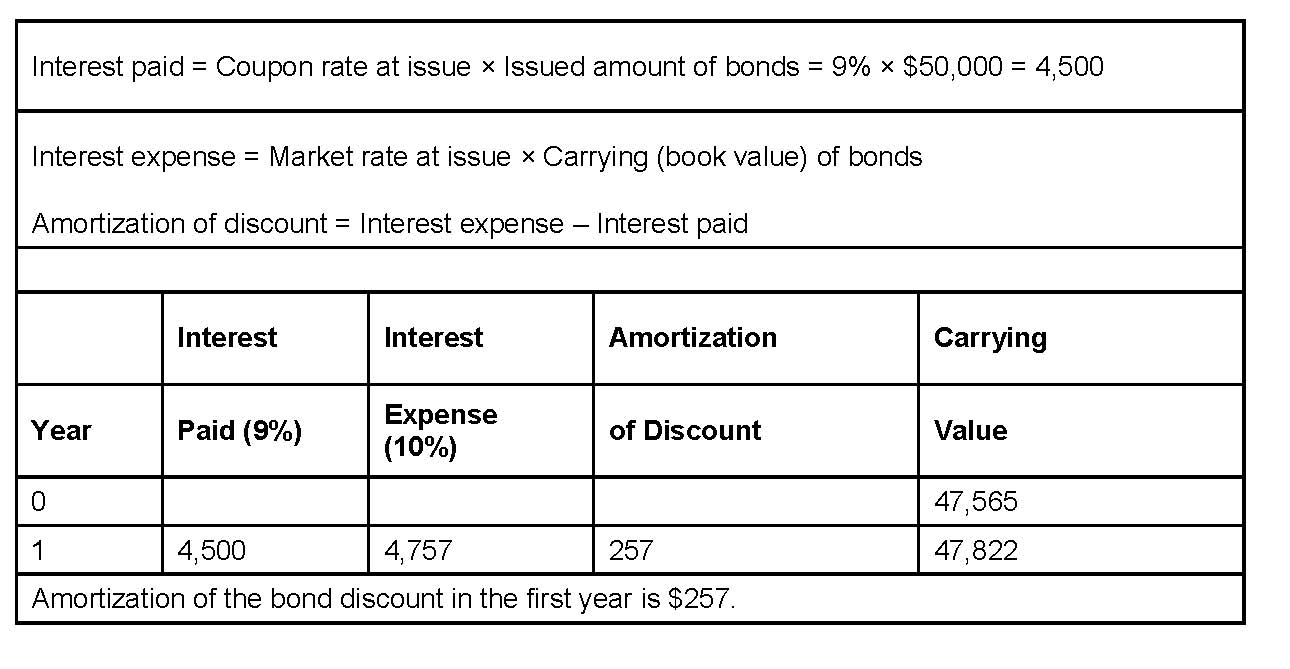

3、A company issued a $50,000 seven-year bond for $47,565. The bonds pay 9% per annum, and the yield to maturity at issue was 10%. The company uses the effective interest rate method to amortize any discounts or premiums on bonds. After the first year, the yield to maturity on bonds equivalent in risk and maturity to these bonds is 9%. The amount of the bond discount amortization recorded in the first year is closest to:【单选题】

A.$0.

B.$348.

C.$257.

正确答案:C

答案解析:

2014 CFA Level I

"Non-Current (Long-Term) Liabilities," by Elizabeth A. Gordon and Elaine Henry

Section 2.2

2014 CFA Level I

"Non-Current (Long-Term) Liabilities," by Elizabeth A. Gordon and Elaine Henry

Section 2.2

4、An analyst does research about yield-to-maturity measure.The yield-to-maturitymeasure for a bond fails to consider the:【单选题】

A.coupon income.

B.reinvestment income.

C.possibility that the bond is sold prior to maturity.

正确答案:C

答案解析:到期收益率(YTM)假设所有本金和利息都能及时给付,同时持有到期,并考虑了利息收入及资本的升值或贬值,也考虑了投资收入(假设利息以等于到期收益率的利率再投资),而到期收益率没有考虑提前出售债券的可能性。

5、Which of the following characteristics of a target company is likely the least attractive for a leveraged buyout?【单选题】

A.High leverage

B.Substantial amount of physical assets

C.Strong and sustainable cash flow

正确答案:A

答案解析:Low leverage is an attractive feature of a target company in a leveraged buyout. This characteristic makes it easier for an acquirer to use debt to finance a large portion of the purchase price.

2014 CFA Level I

"Introduction to Alternative Investments," by Terri Duhon, George Spentzos, and Scott D. Stewart

Section 4.2.1.2

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料