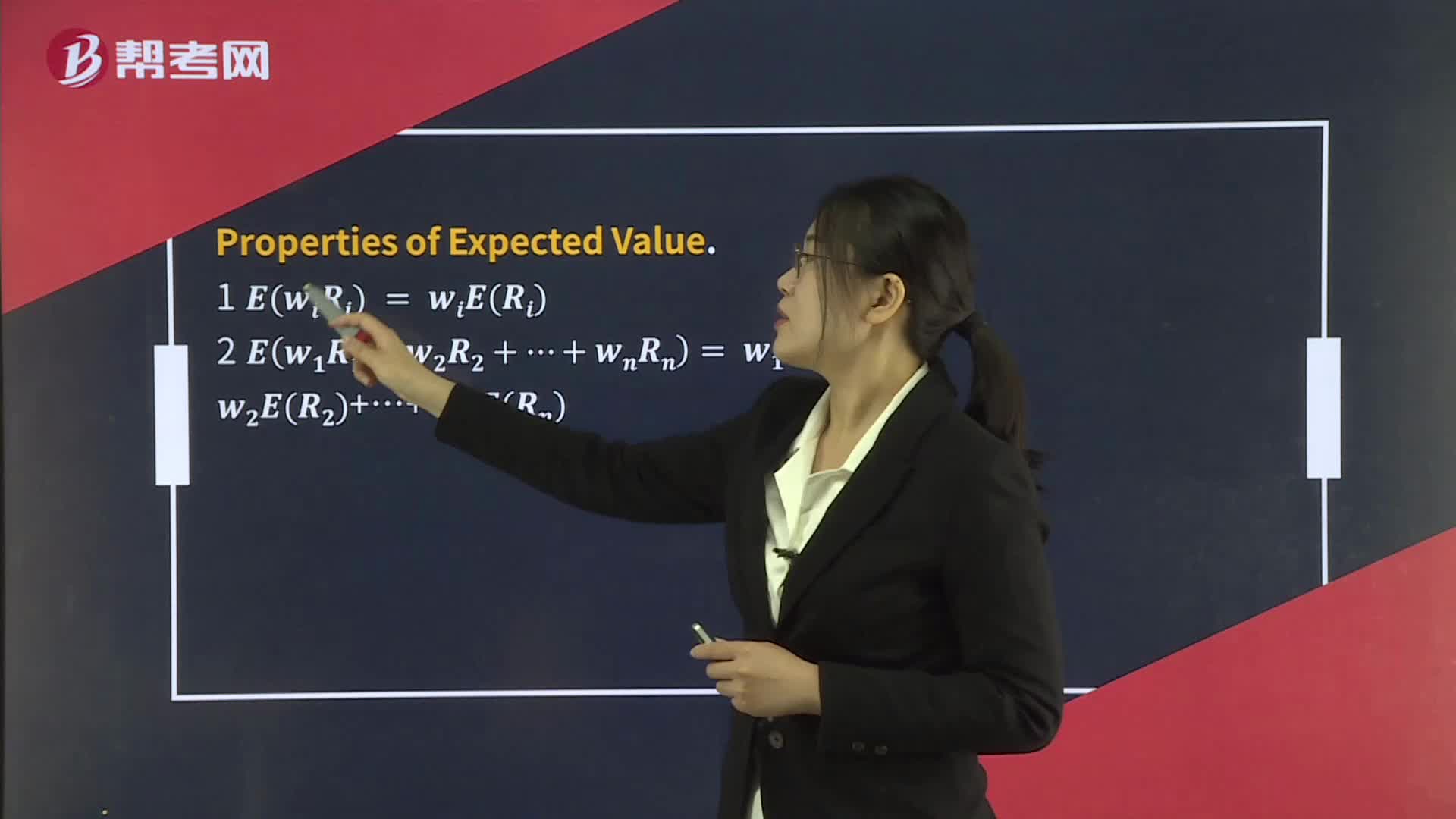

Portfolio Expected Return and Variance of Return

Limitations of Monetary Policy

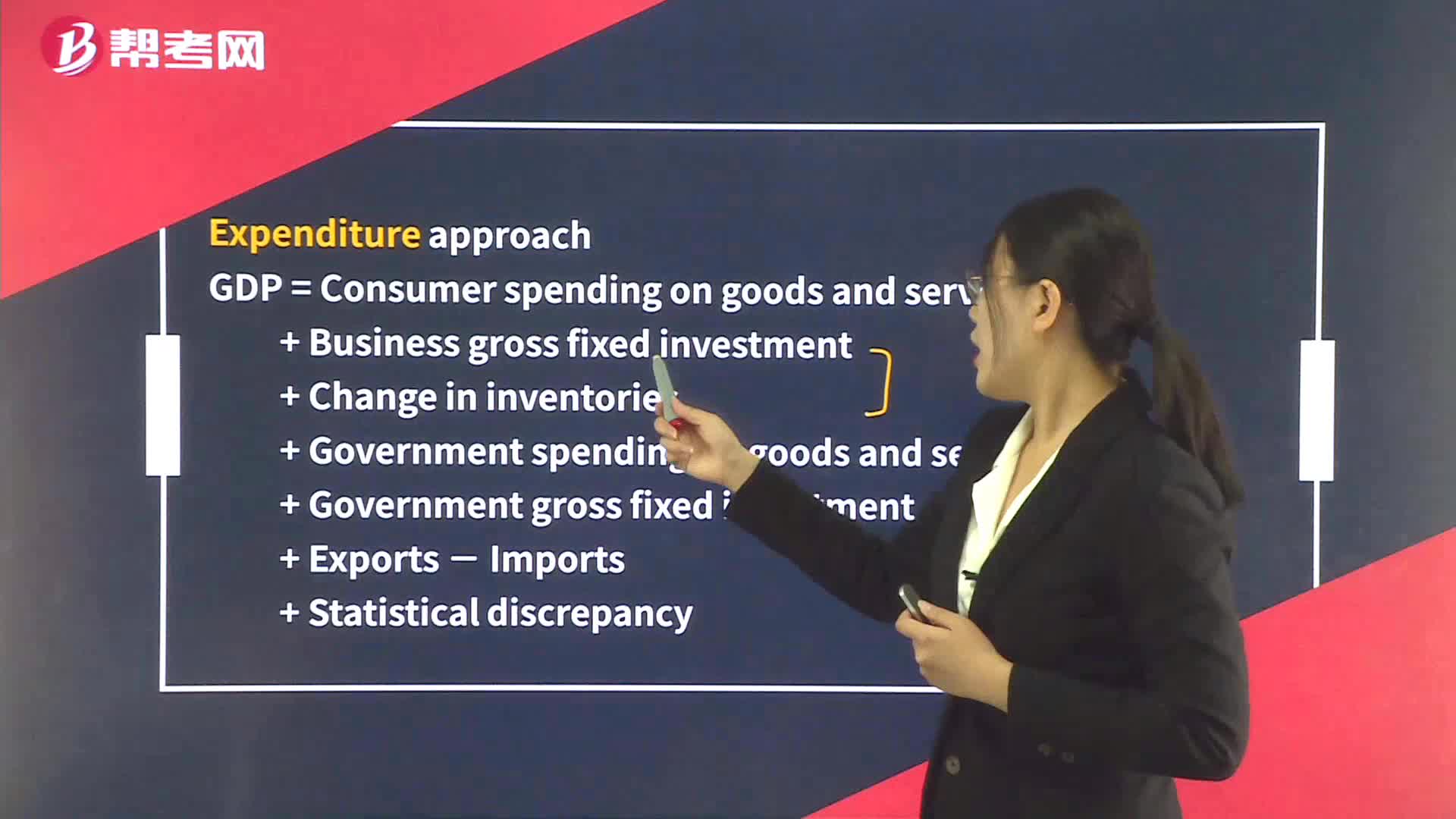

Calculation of GDP – Expenditure Approach

Monetary and Fiscal Policy

Economic Growth and Sustainability

Theories of the Business Cycle - Neoclassical and Austrian Schools

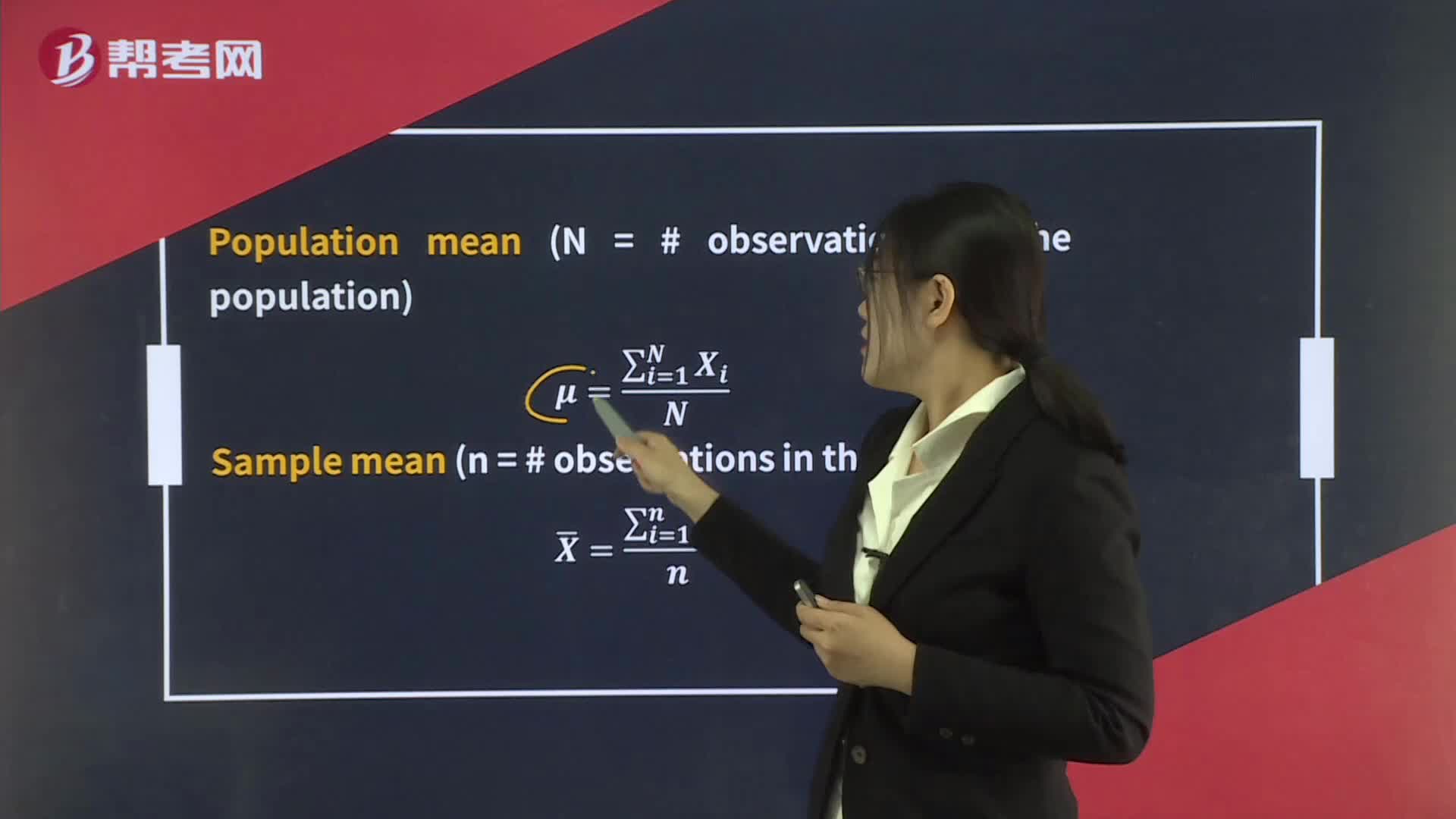

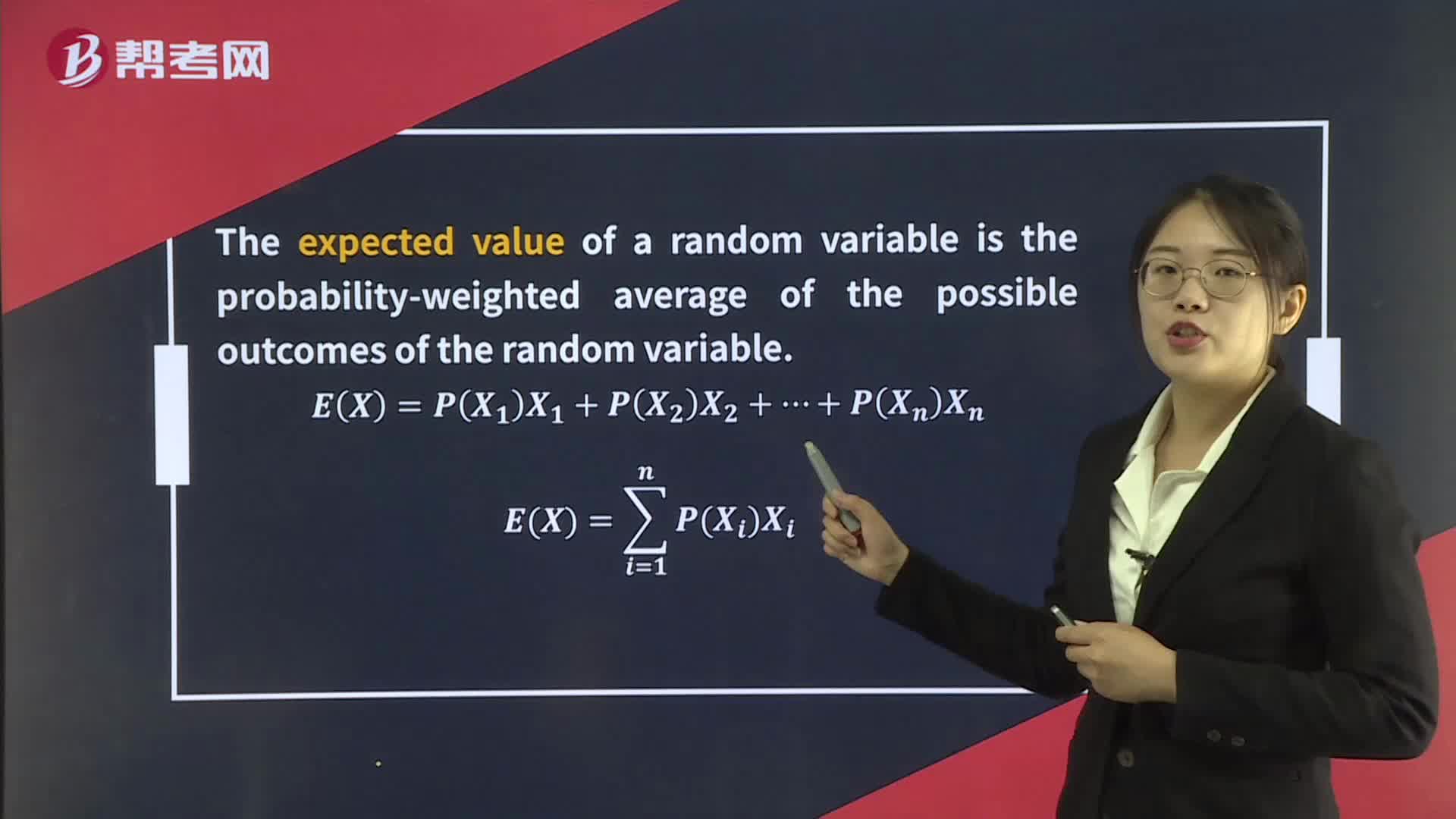

Expected Value & Variance

Theories of the Business Cycle - Keynesian School

Aggregate Output and Income

Fiscal Policy and Aggregate Demand

Phases Of the Business Cycle

Deflation, Hyperinflation, and Disinflation

下载亿题库APP

联系电话:400-660-1360