Portfolio Expected Return and Variance of Return

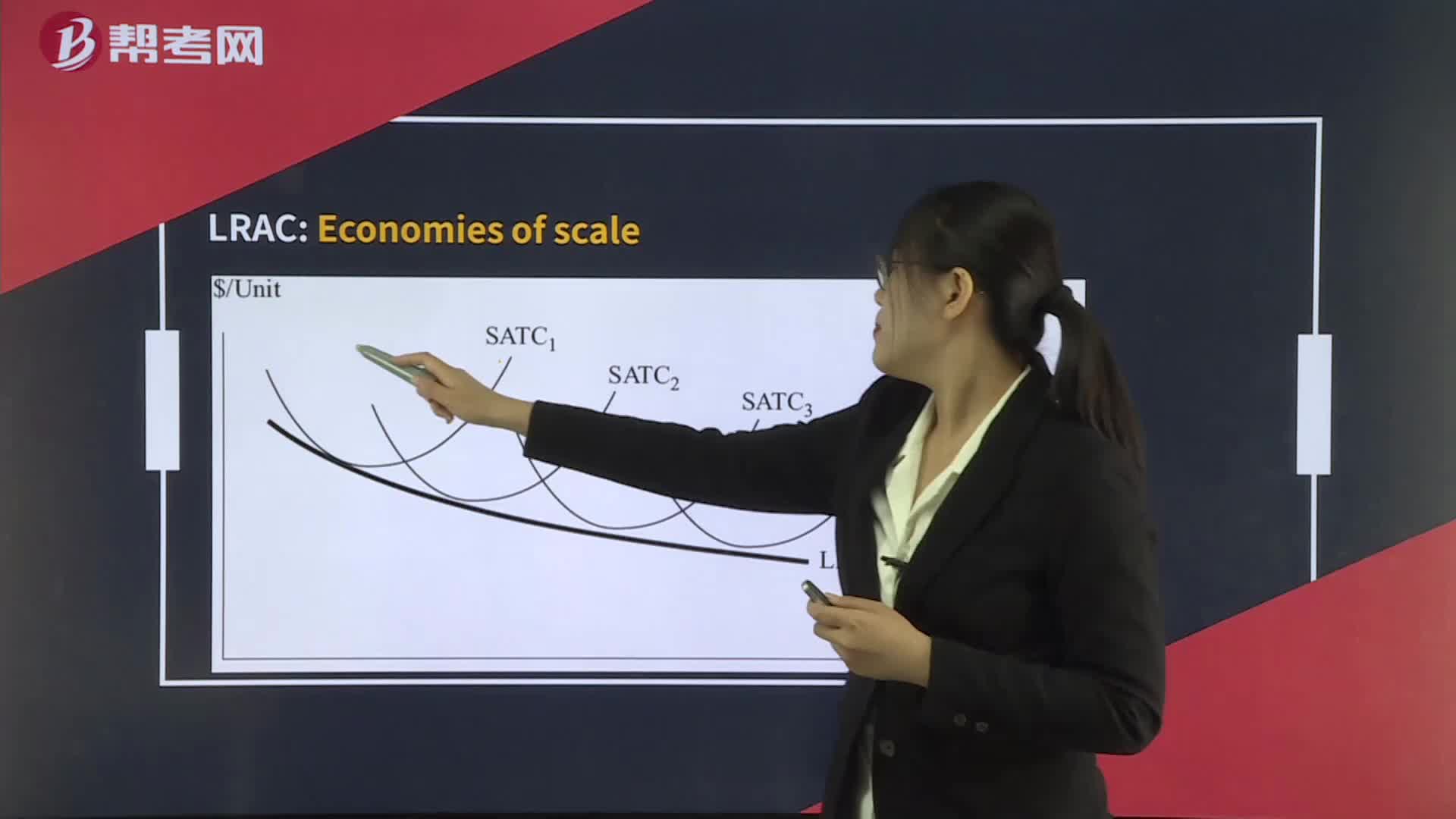

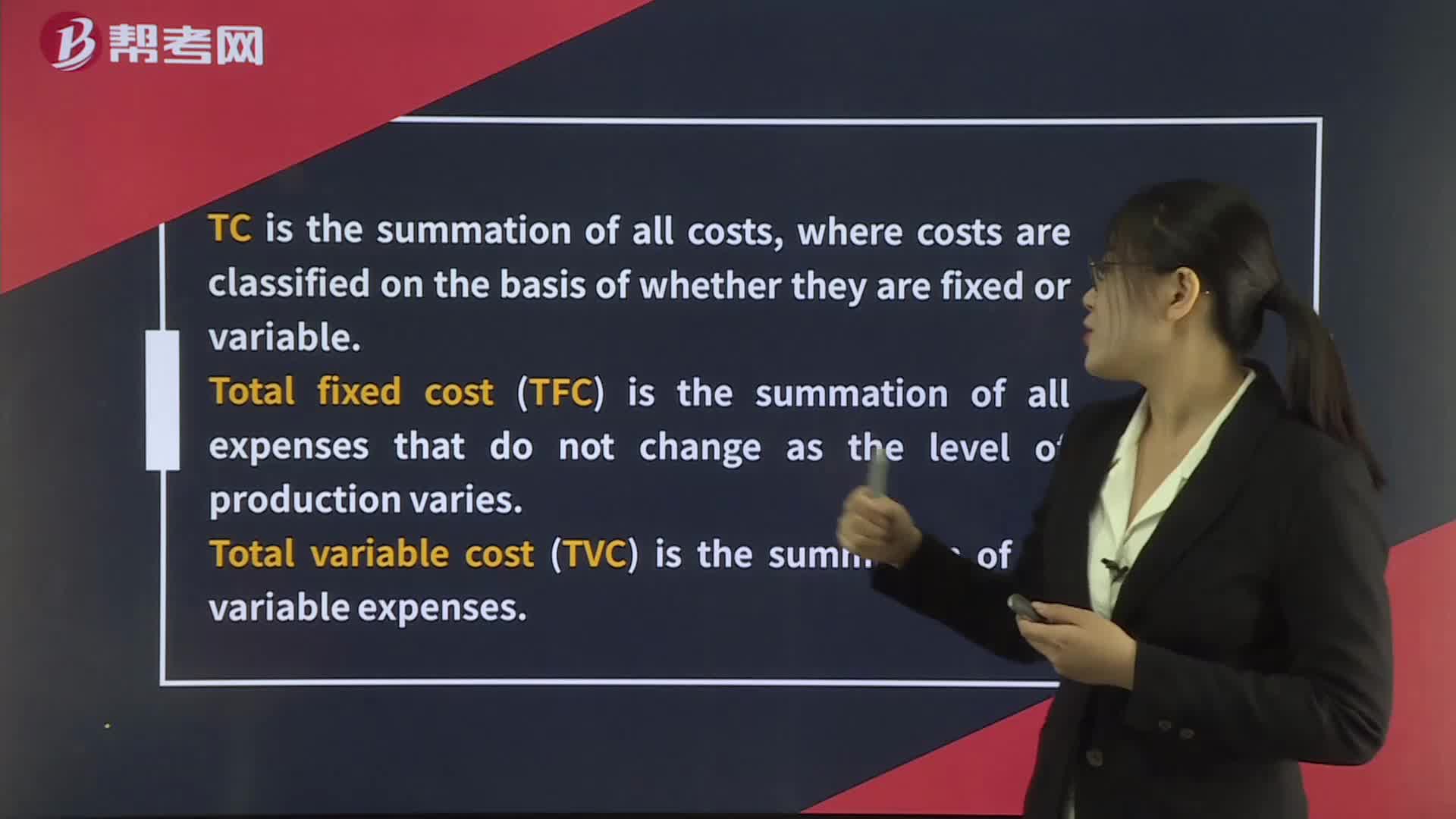

Total, Variable, Fixed, and Marginal Cost and Output

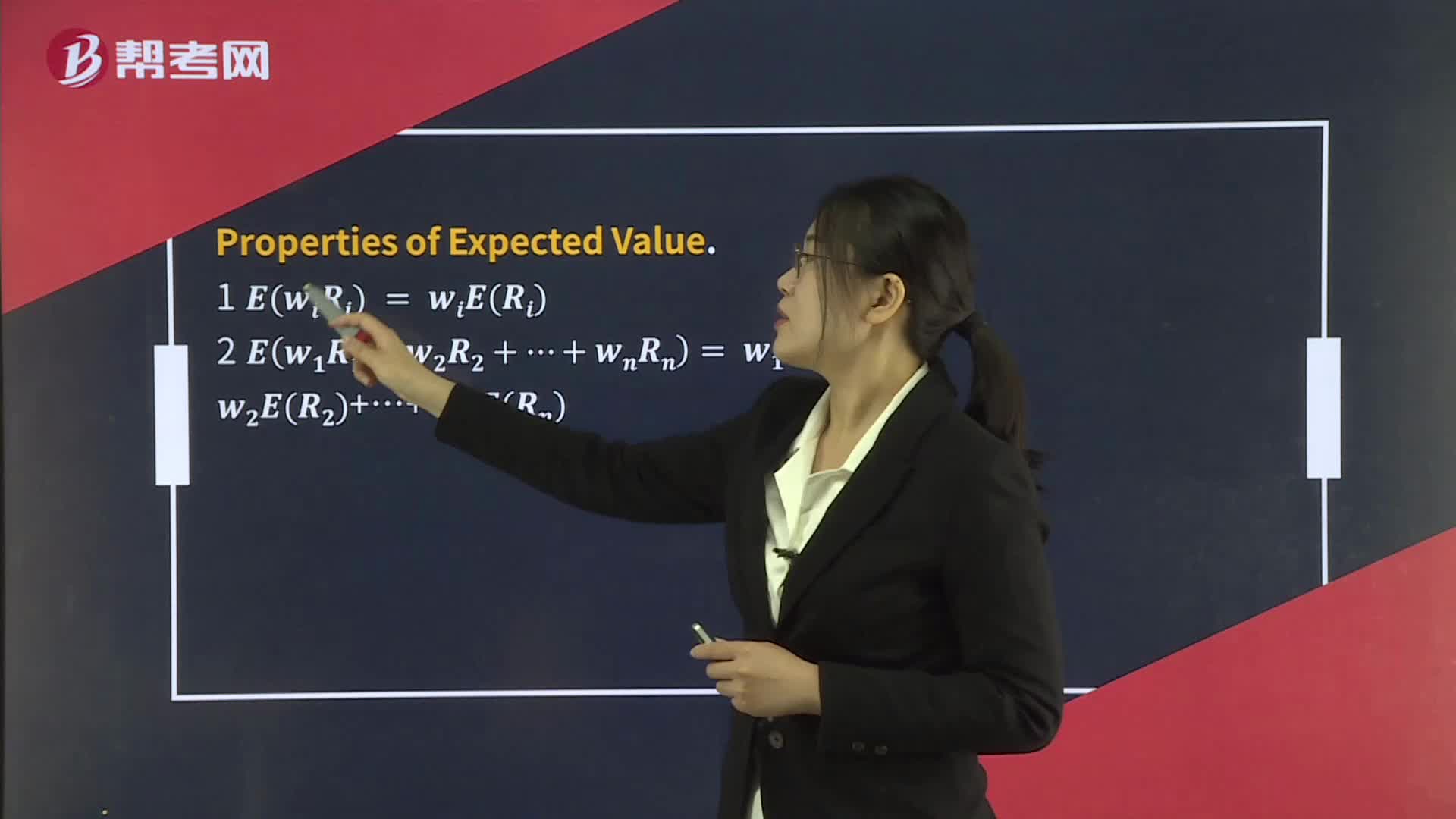

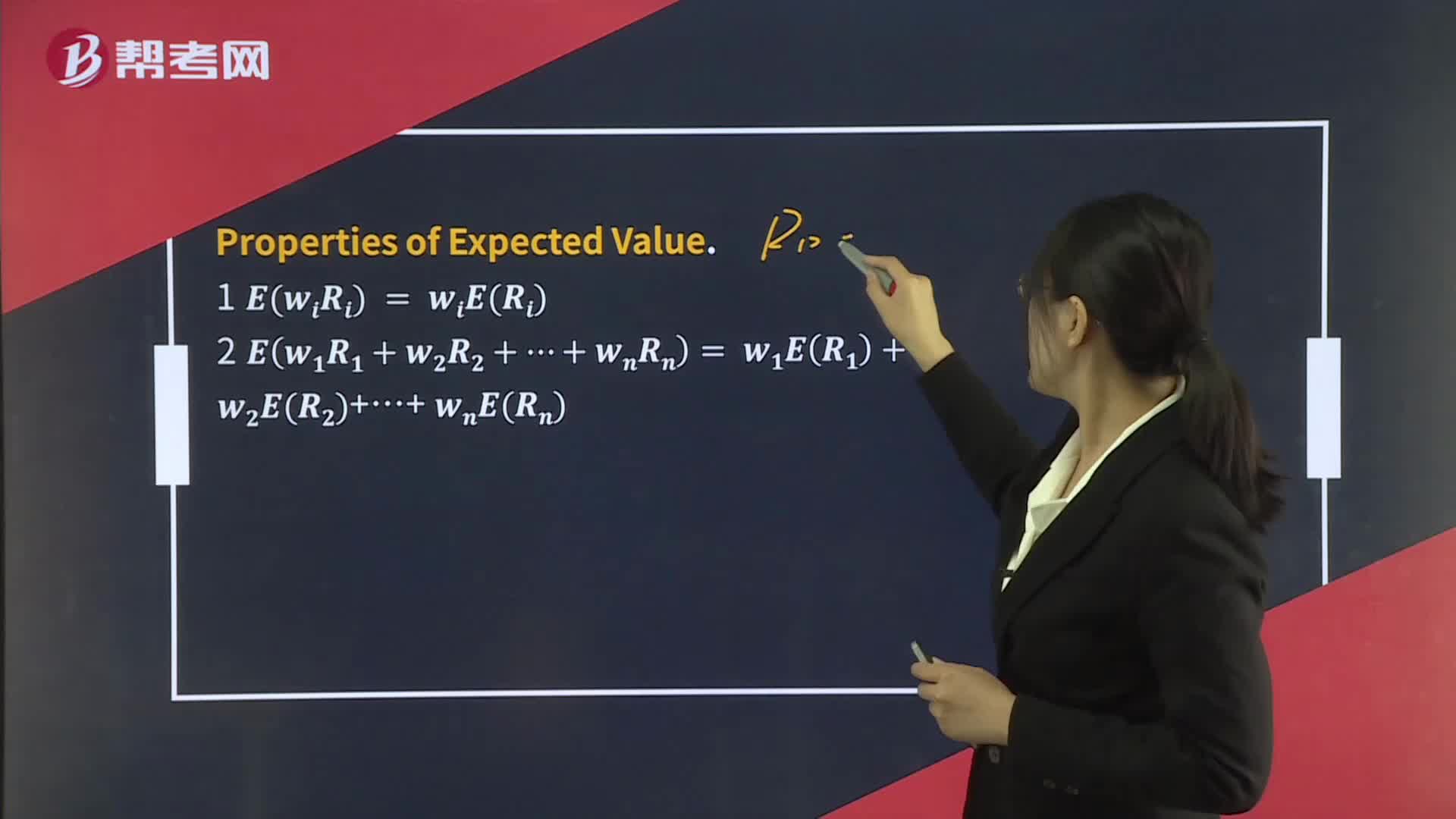

Multiplication Rule For Expected Value

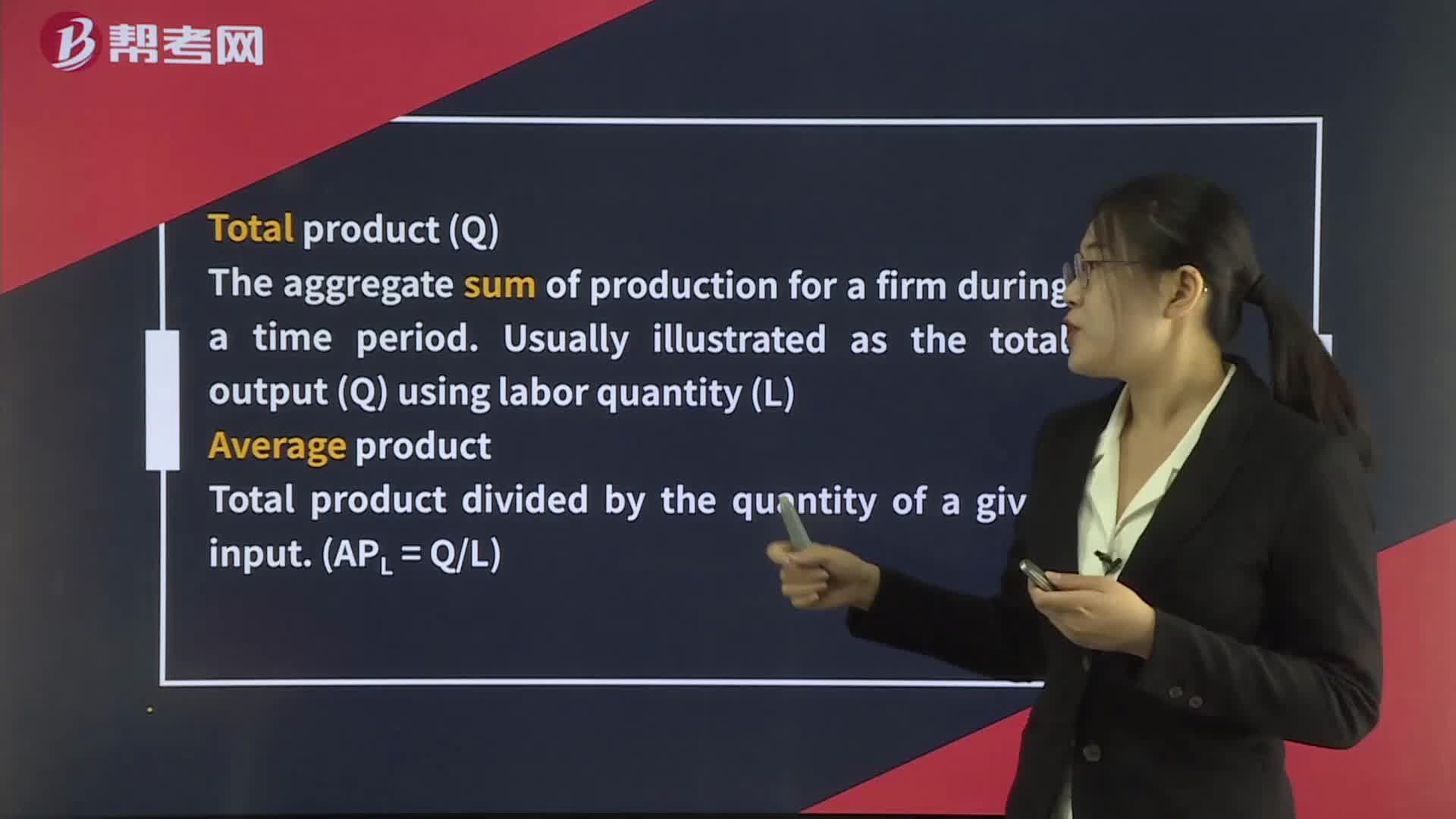

Total, Average, and Marginal Product of Labor

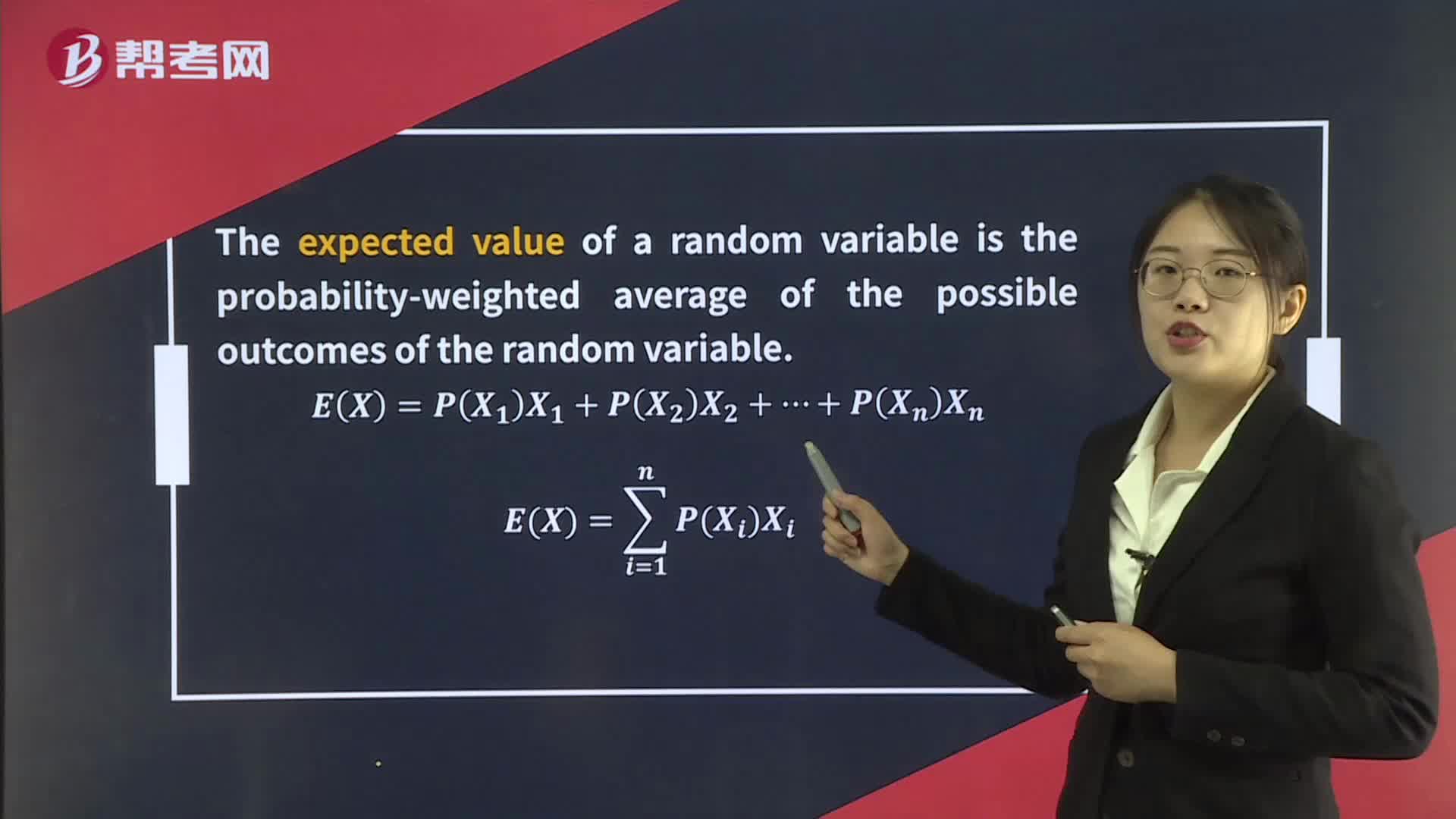

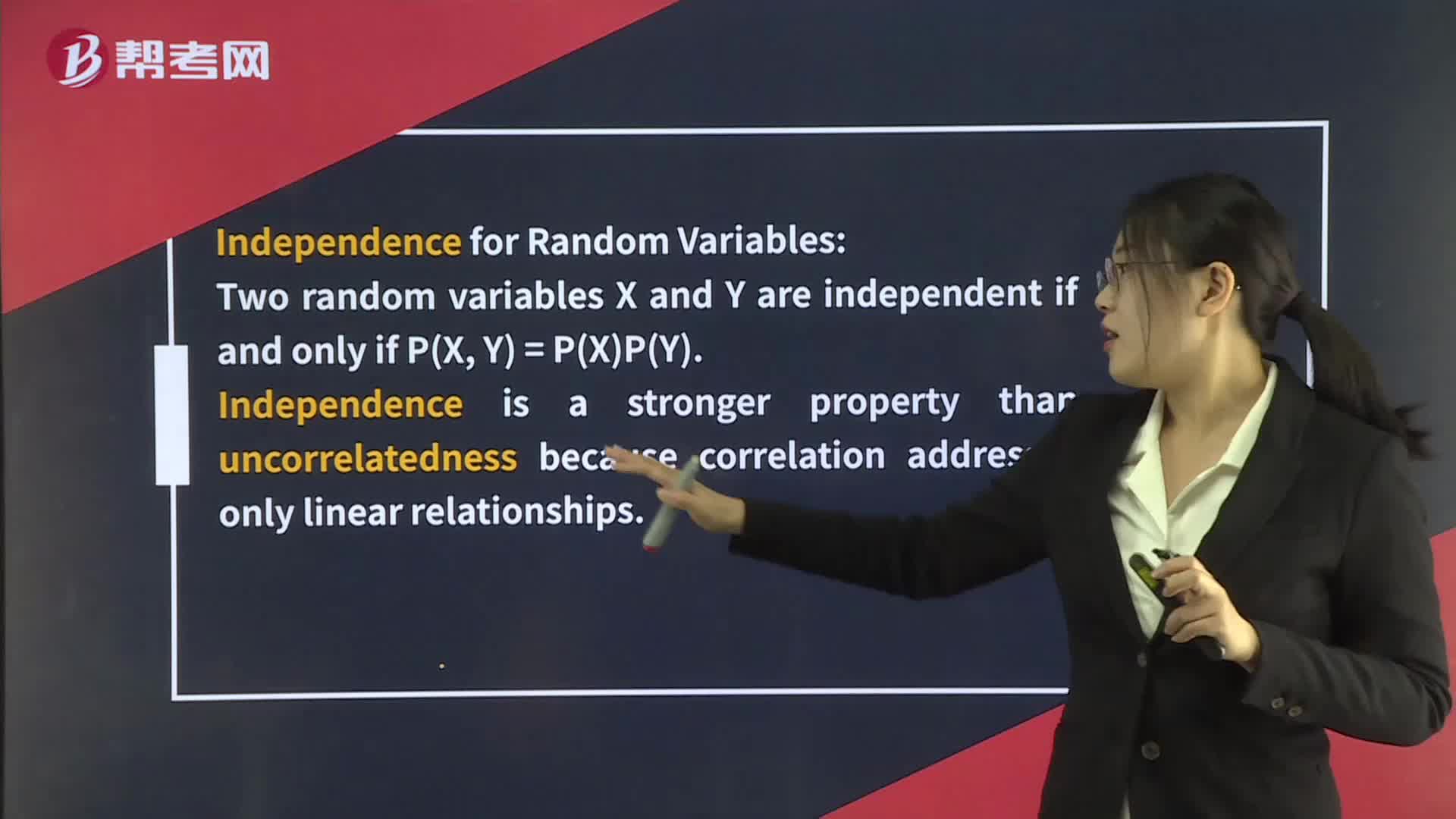

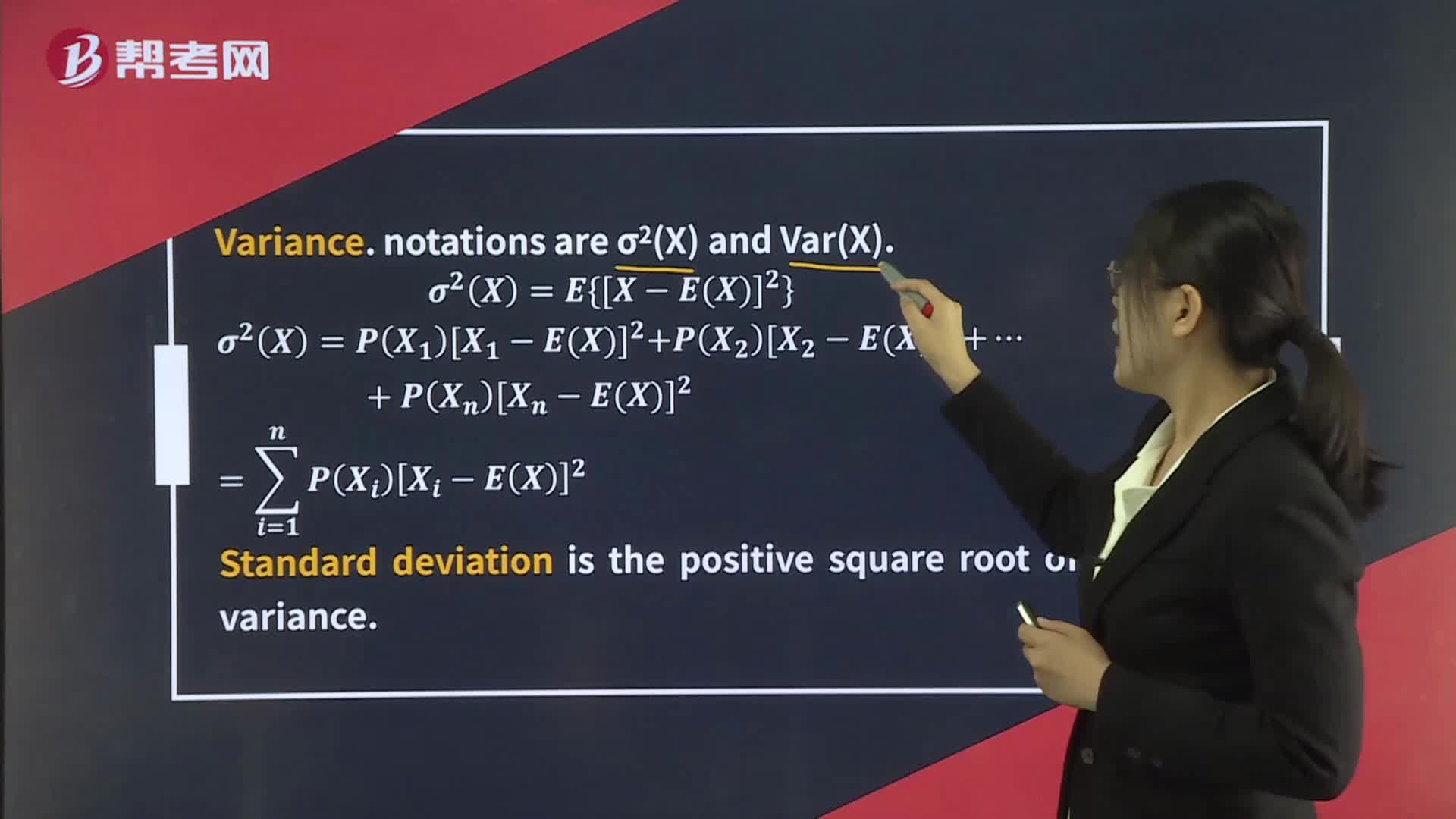

Expected Value and Variance

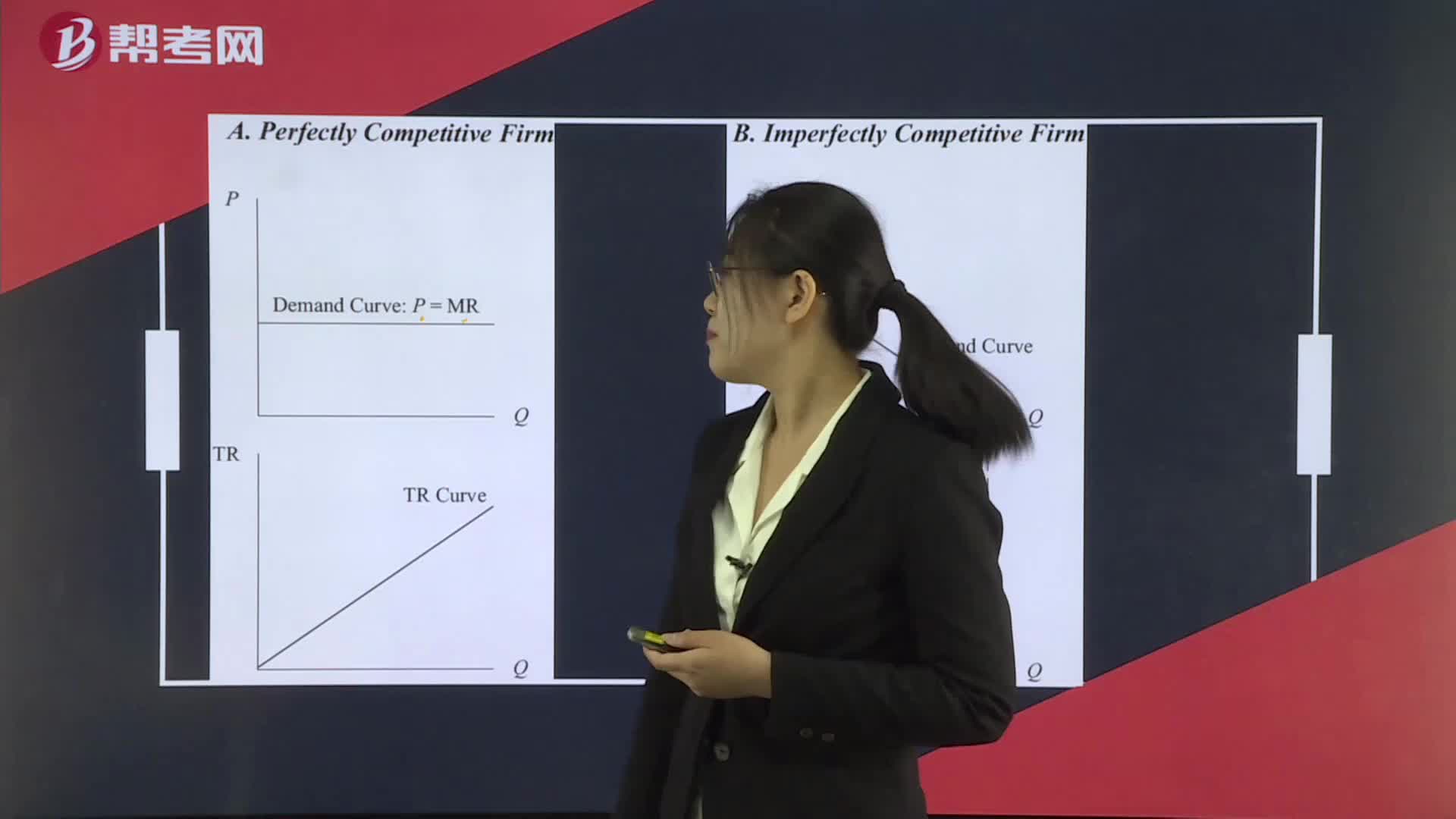

Revenue under Conditions of Perfect and Imperfect Competition

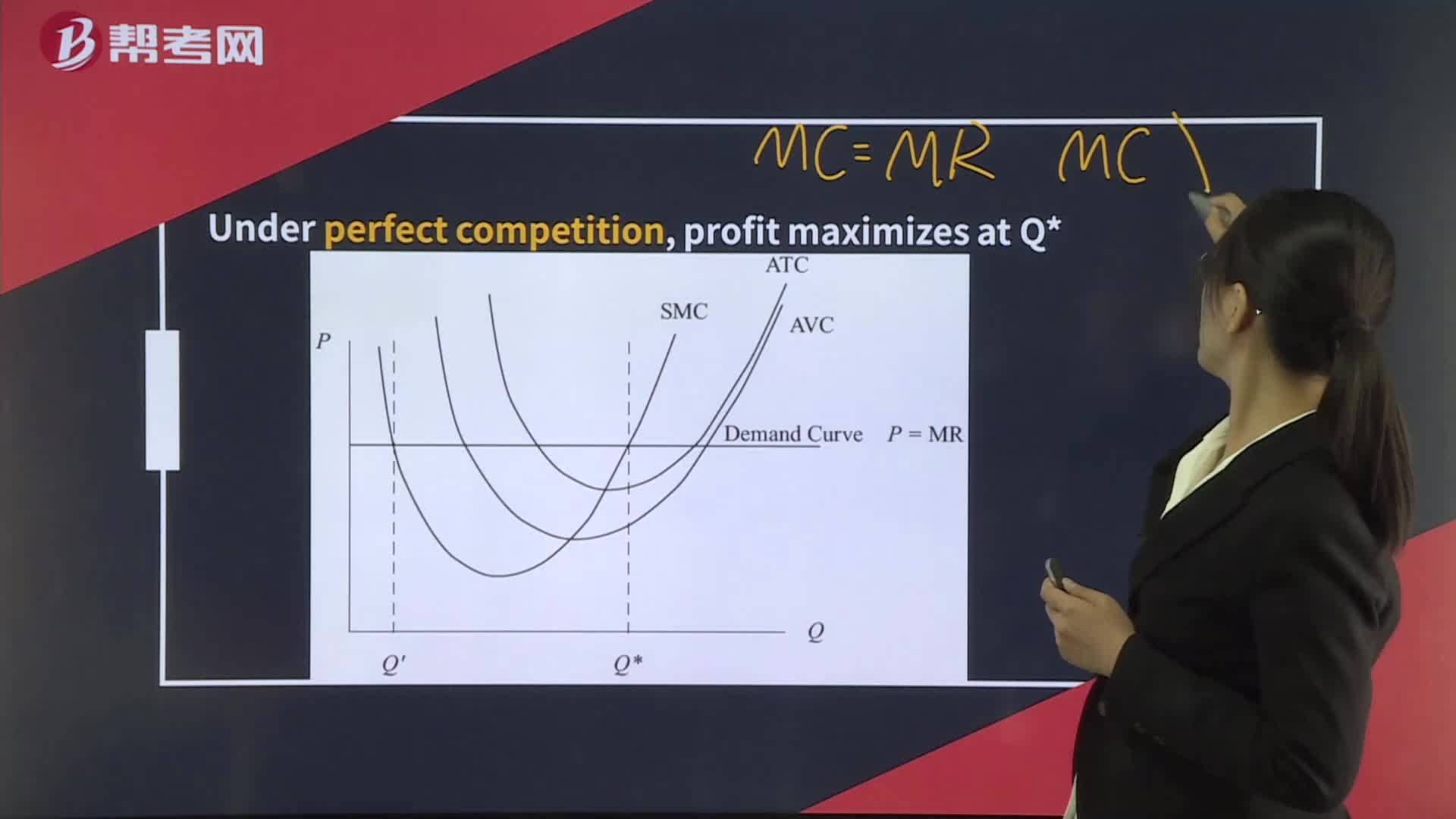

Profit-Maximization, Breakeven, and Shutdown Points of Production

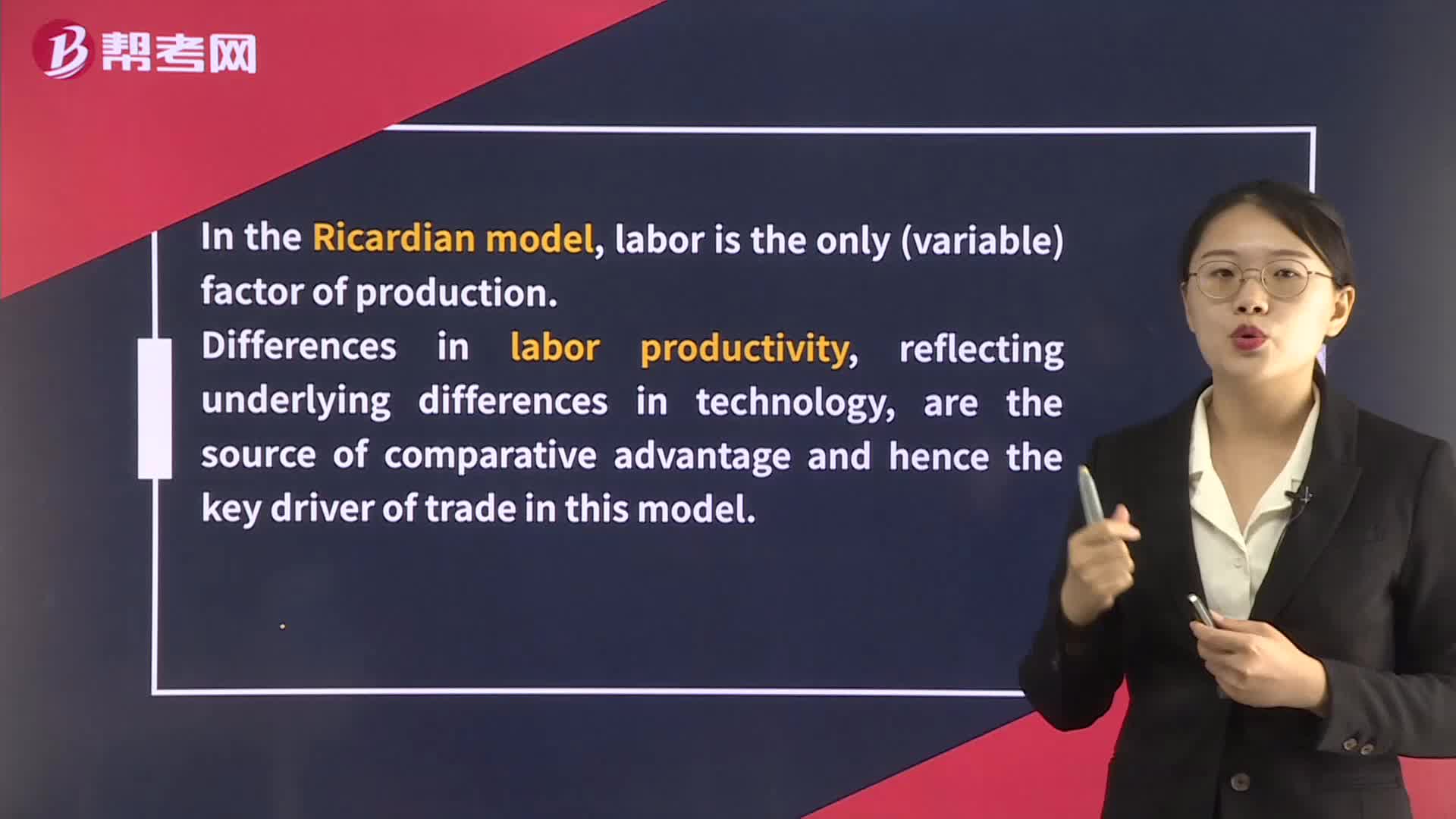

Ricardian and Heckscher–Ohlin Models of Comparative Advantage

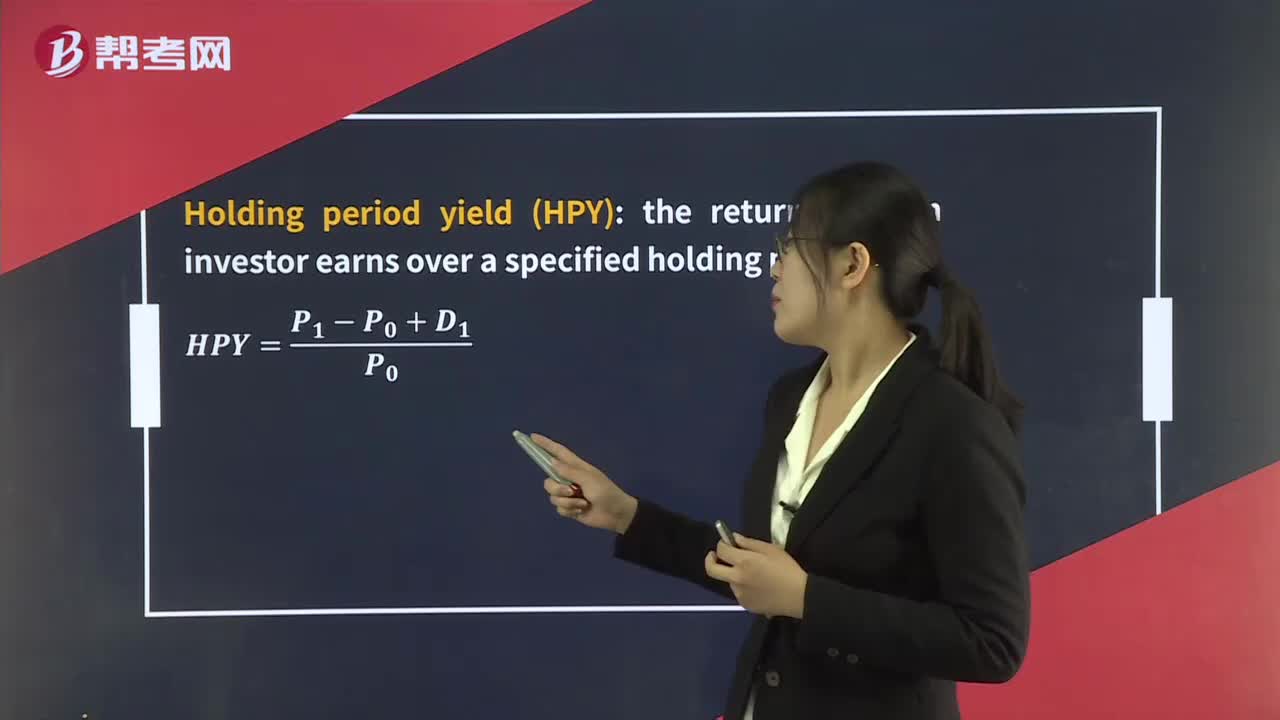

Money-Weighted Rate of Return & Time-Weighted Rate of Return

Point and Interval Estimates of the Population Mean

Hypothesis Tests Concerning Variance

Benefits and Costs of Regional Trading Areas

下载亿题库APP

联系电话:400-660-1360