-

下载亿题库APP

-

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

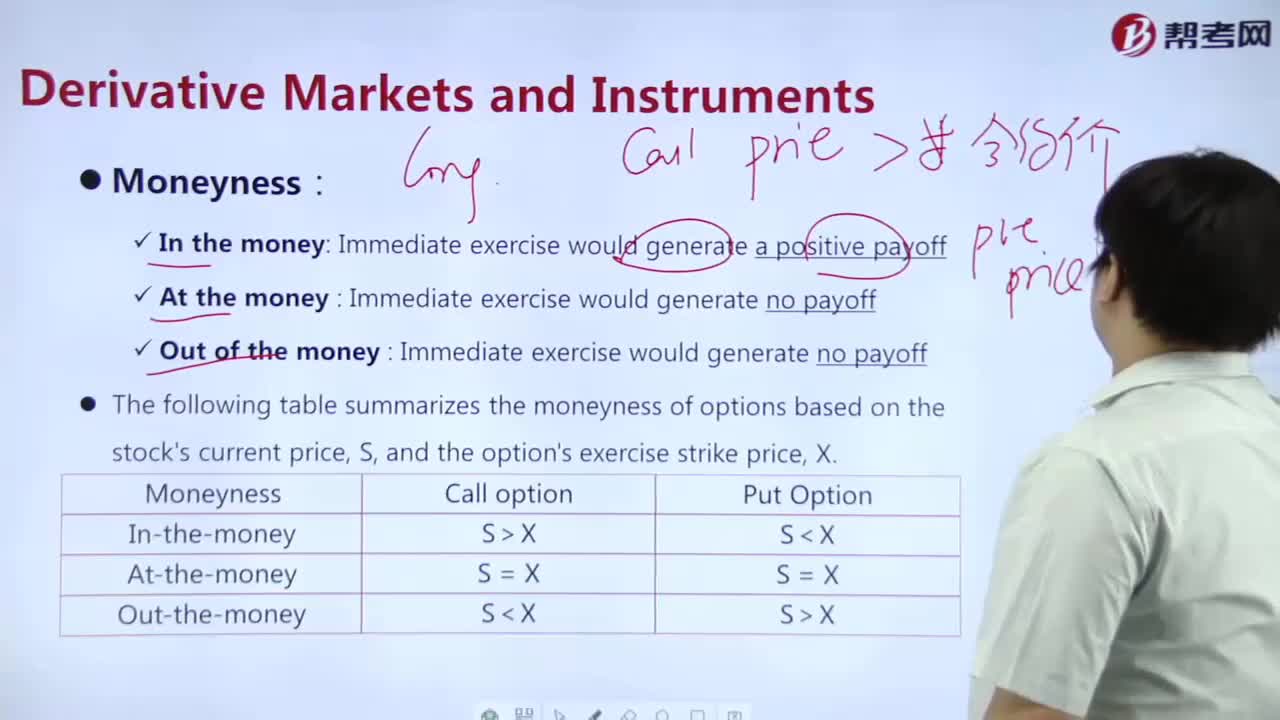

How to determine the value of an option purchased?

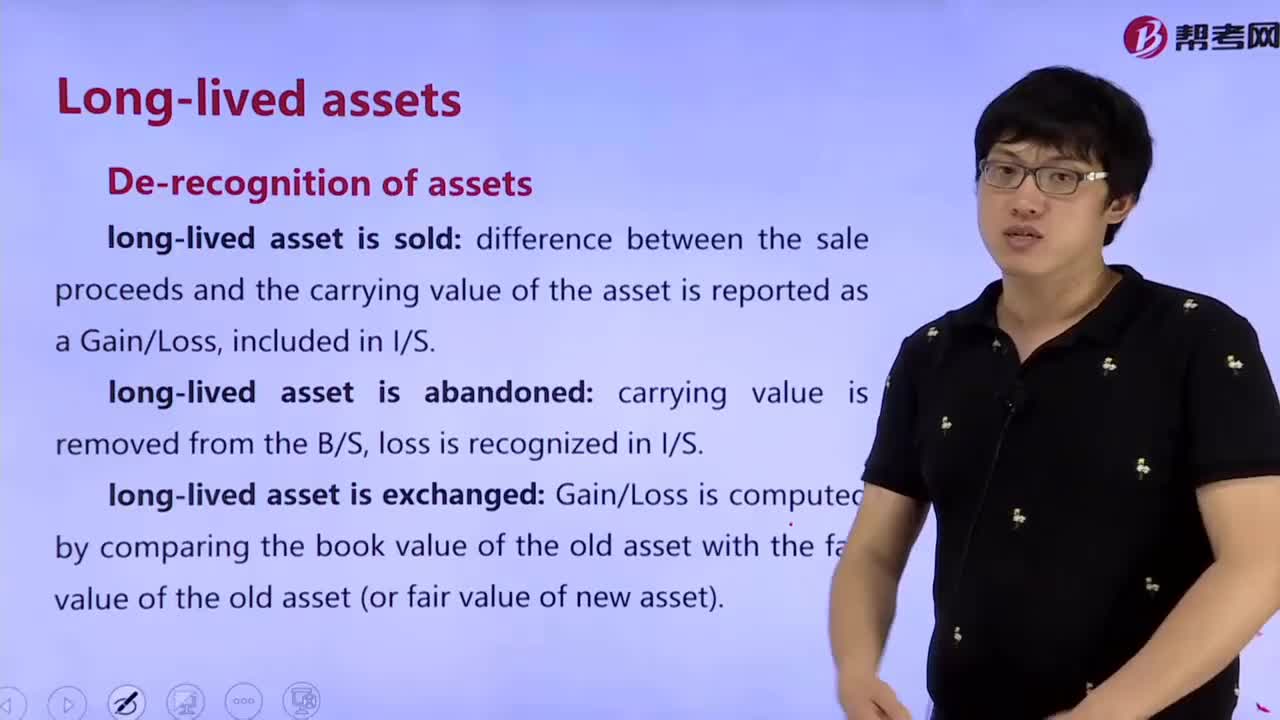

How to understand recognition of assets?

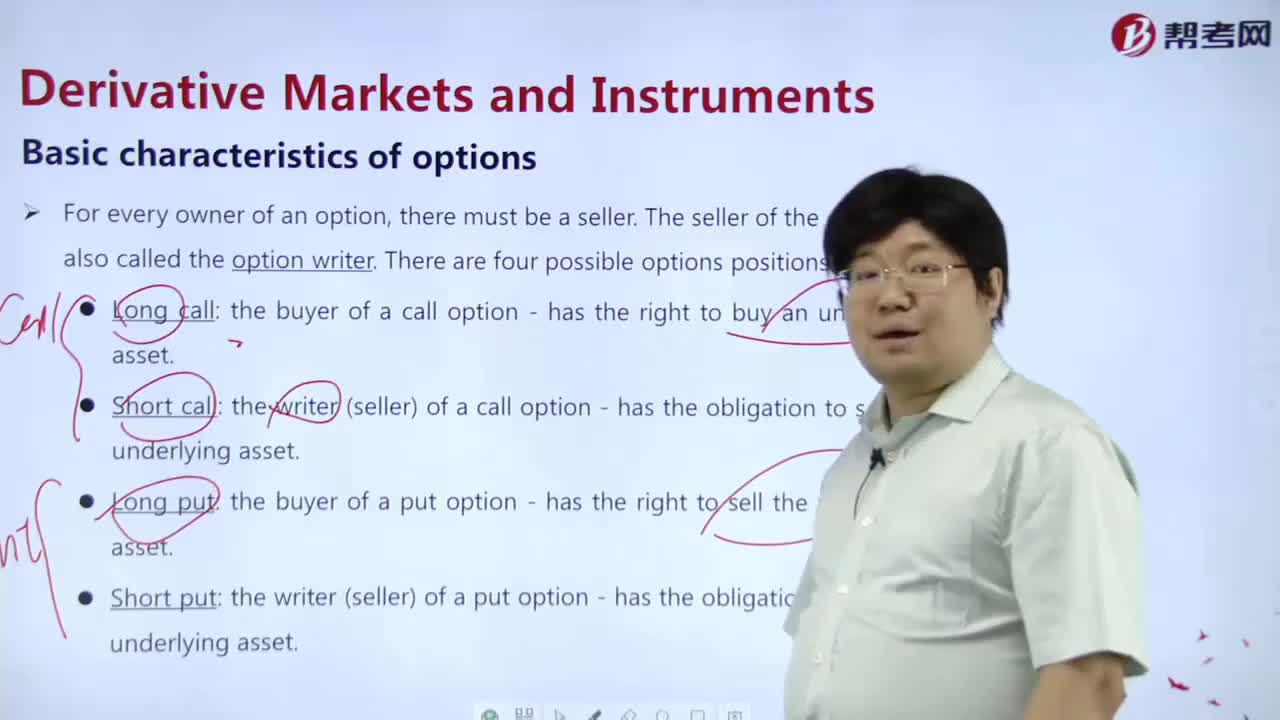

What are the basic characteristics of an option?

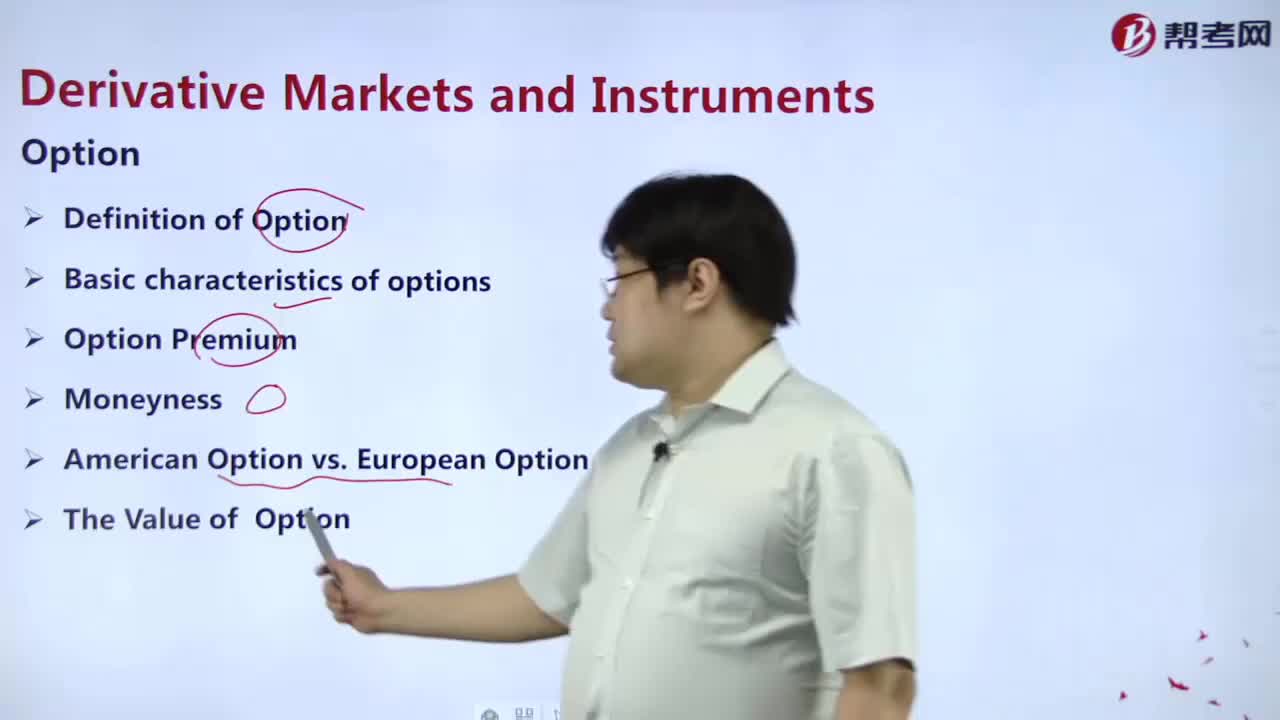

What is the definition of an option?

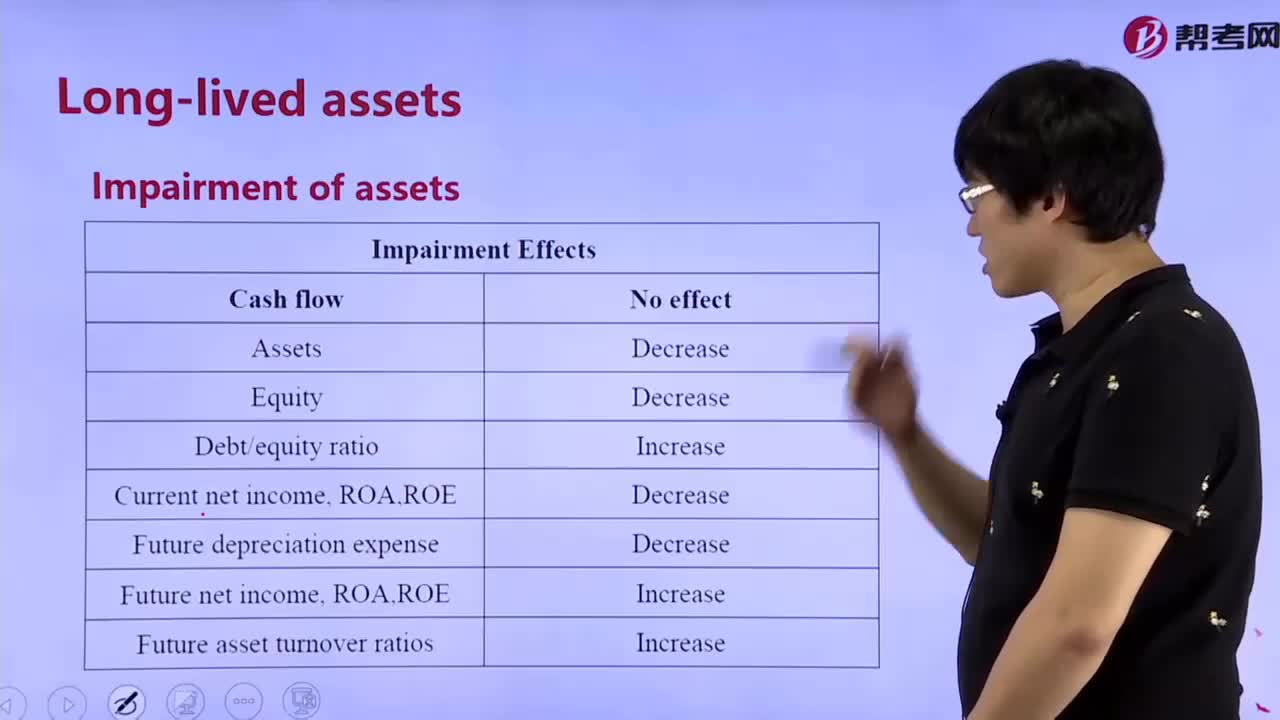

How to explain Impairment of assets:wrote down?

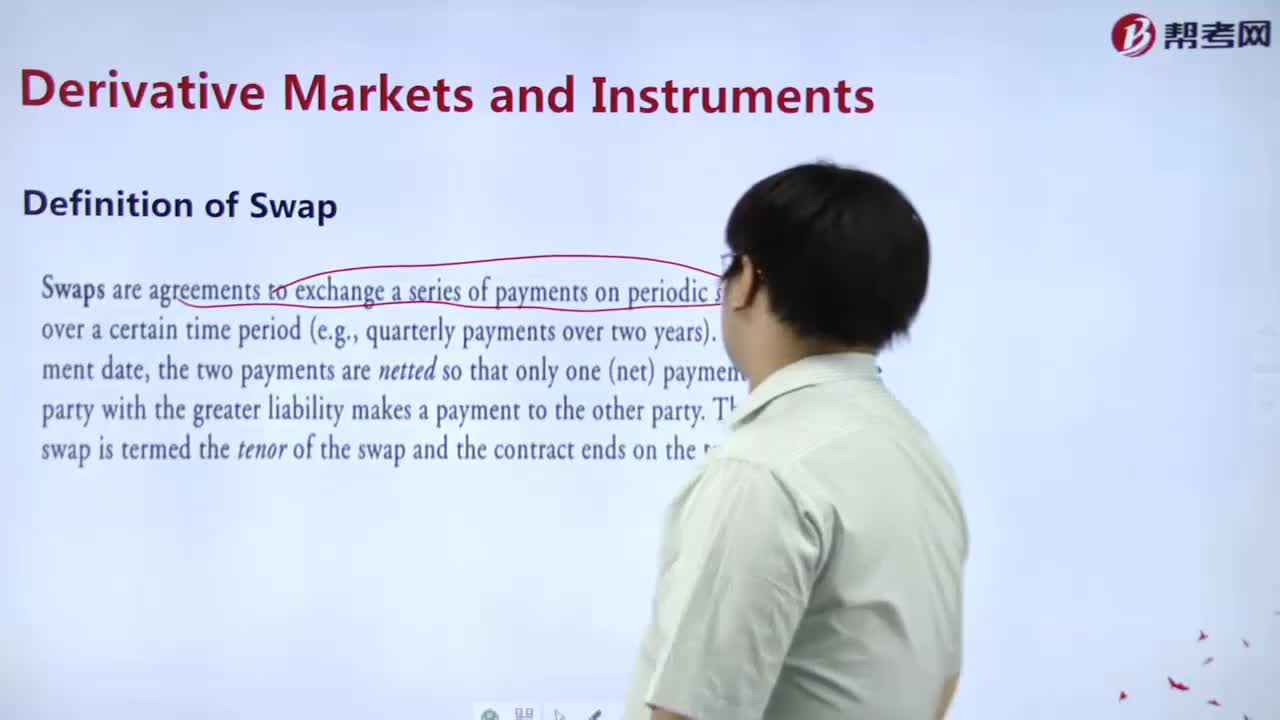

What is the definition of an interchange?

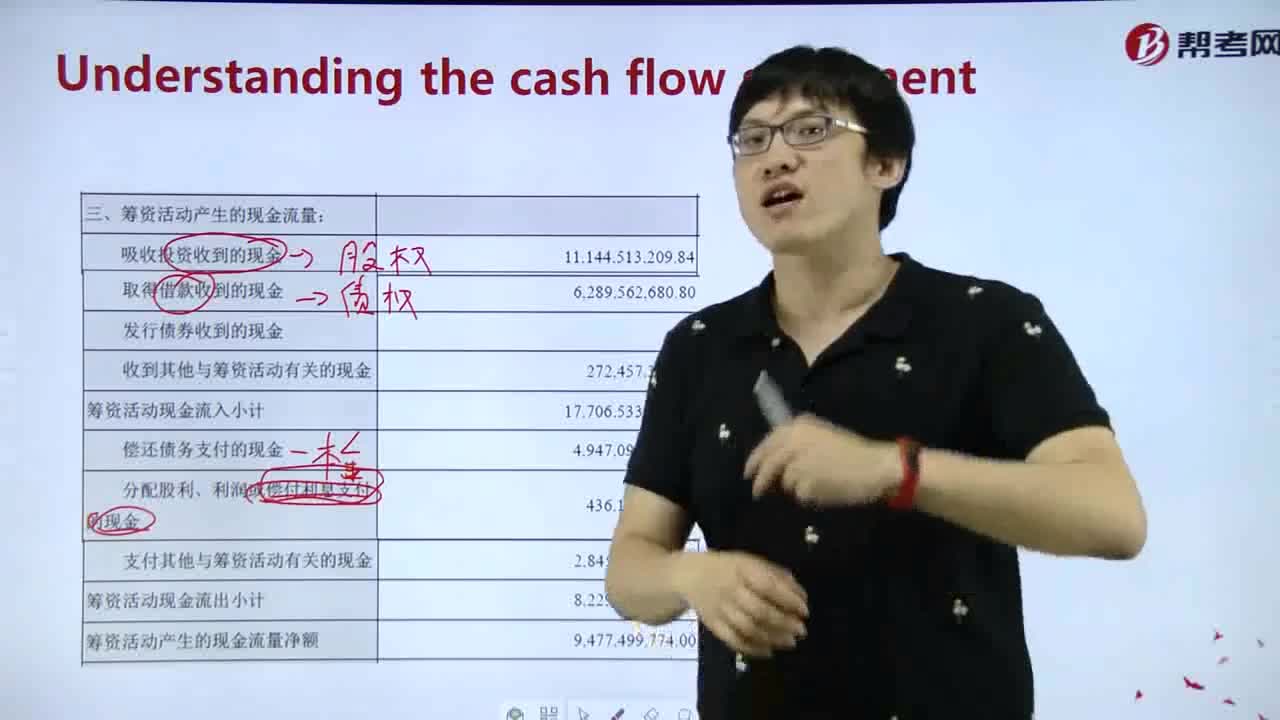

how to explain the CFS information?

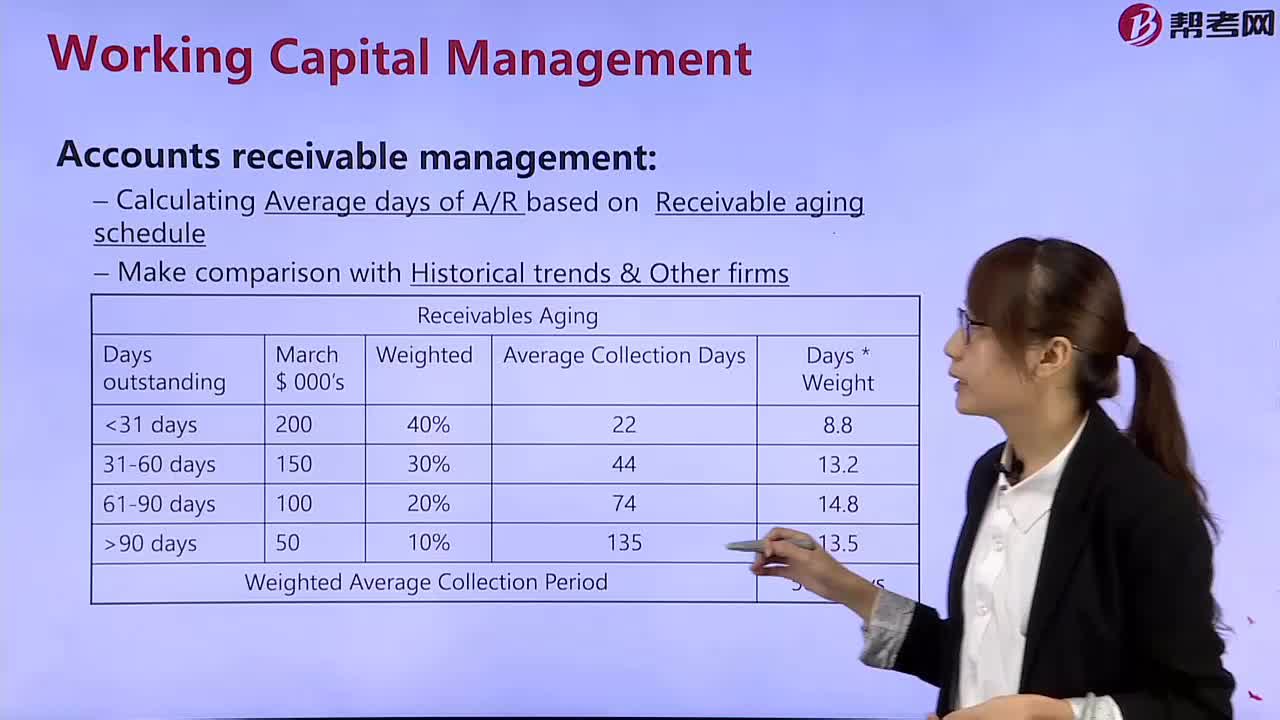

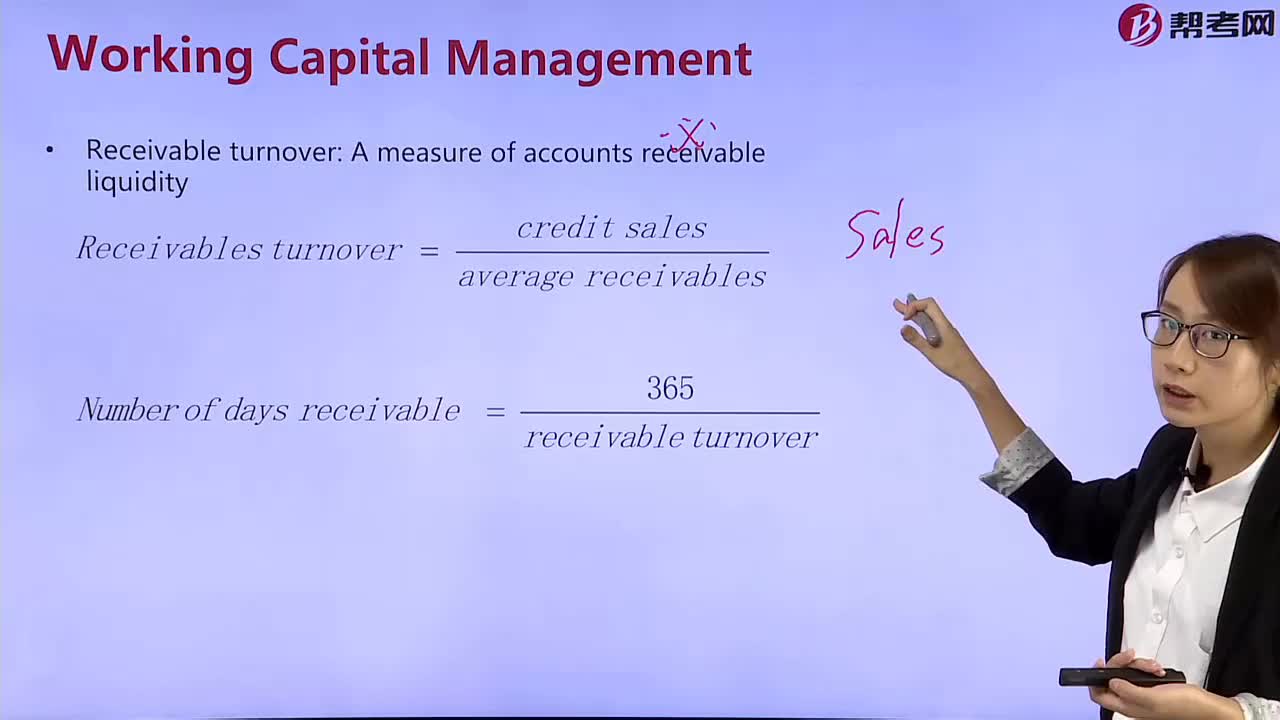

How to manage the accounts receivable?

How to calculate the turnover of accounts receivable?

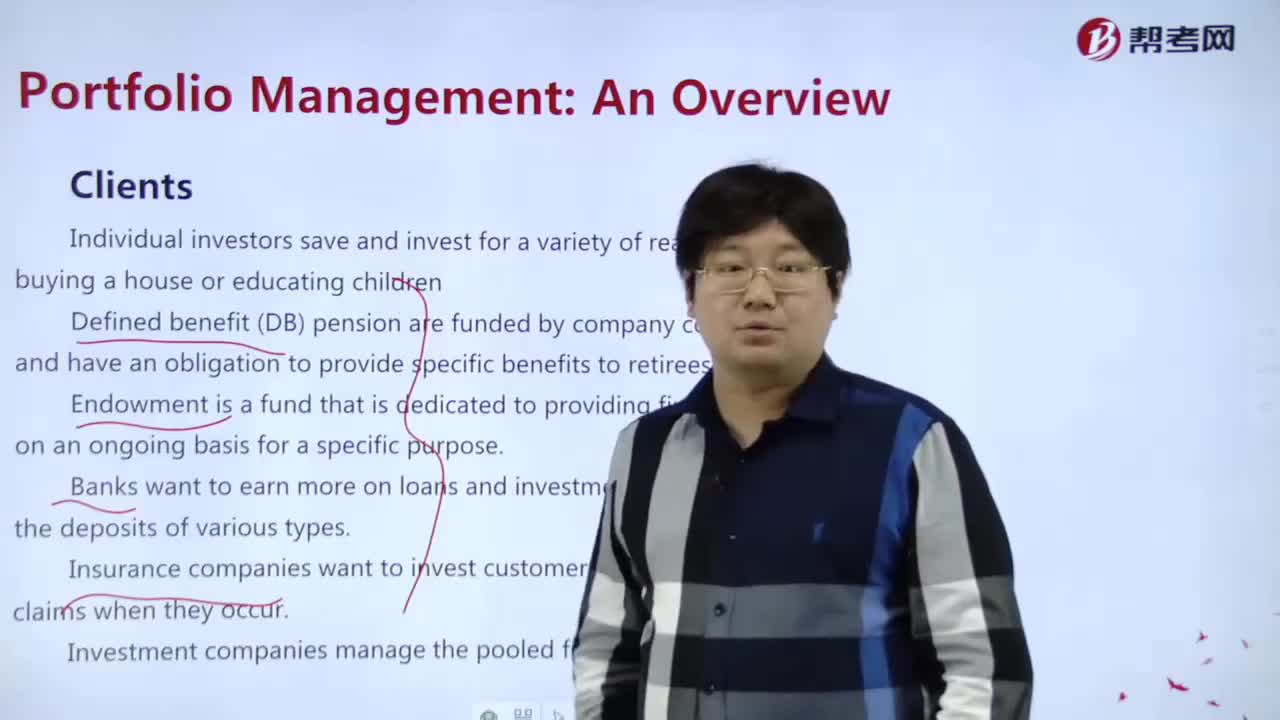

How to manage the client in the project?

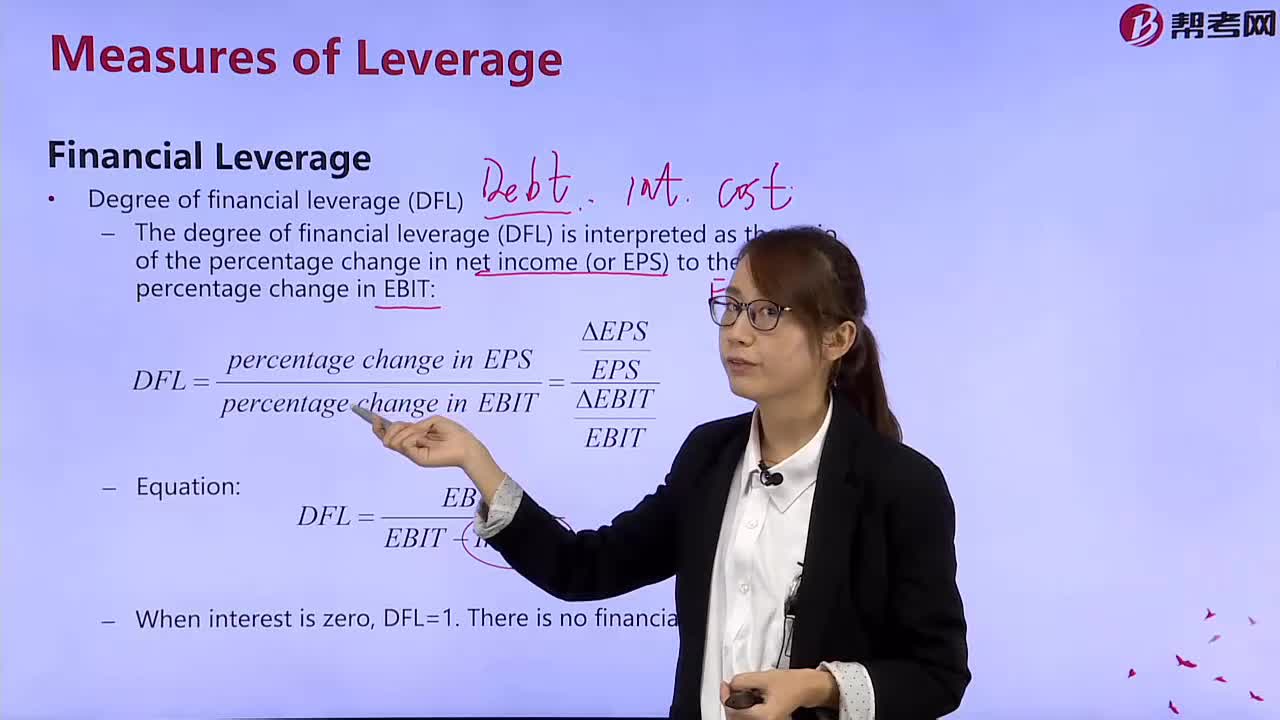

How to calculate the degree of financial leverage?

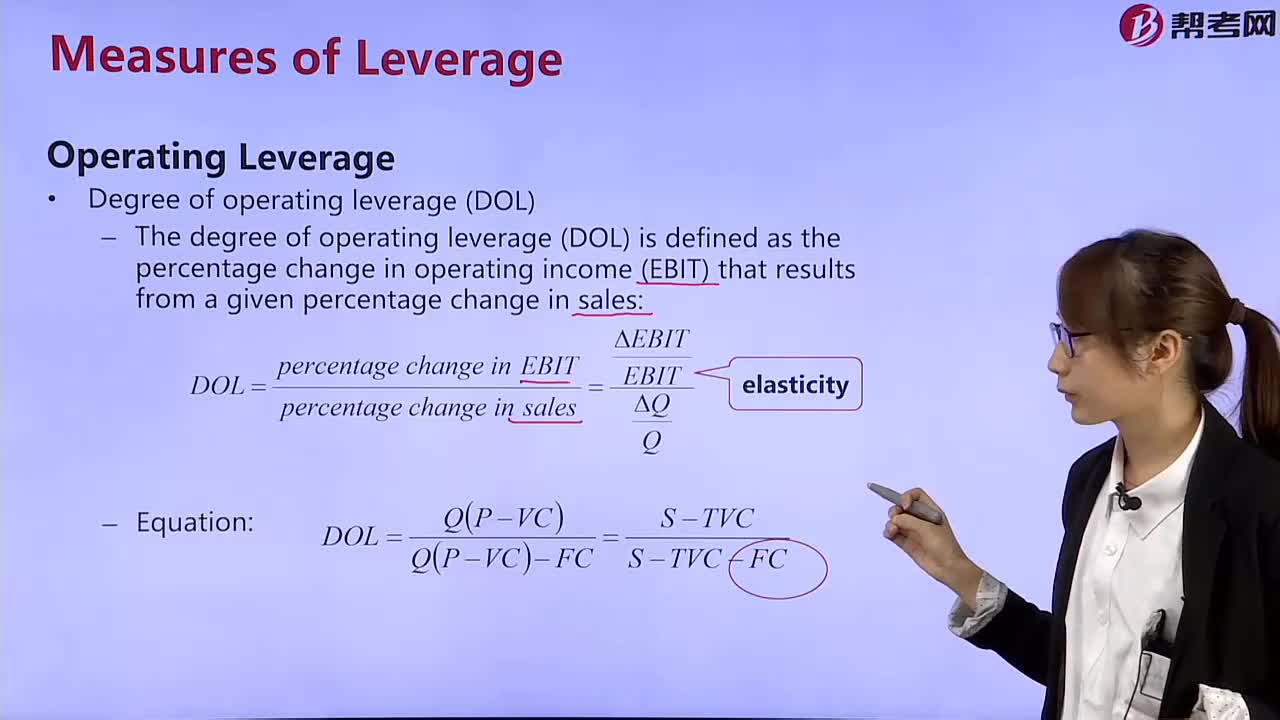

How to calculate the degree of operating leverage?

01:42

01:42

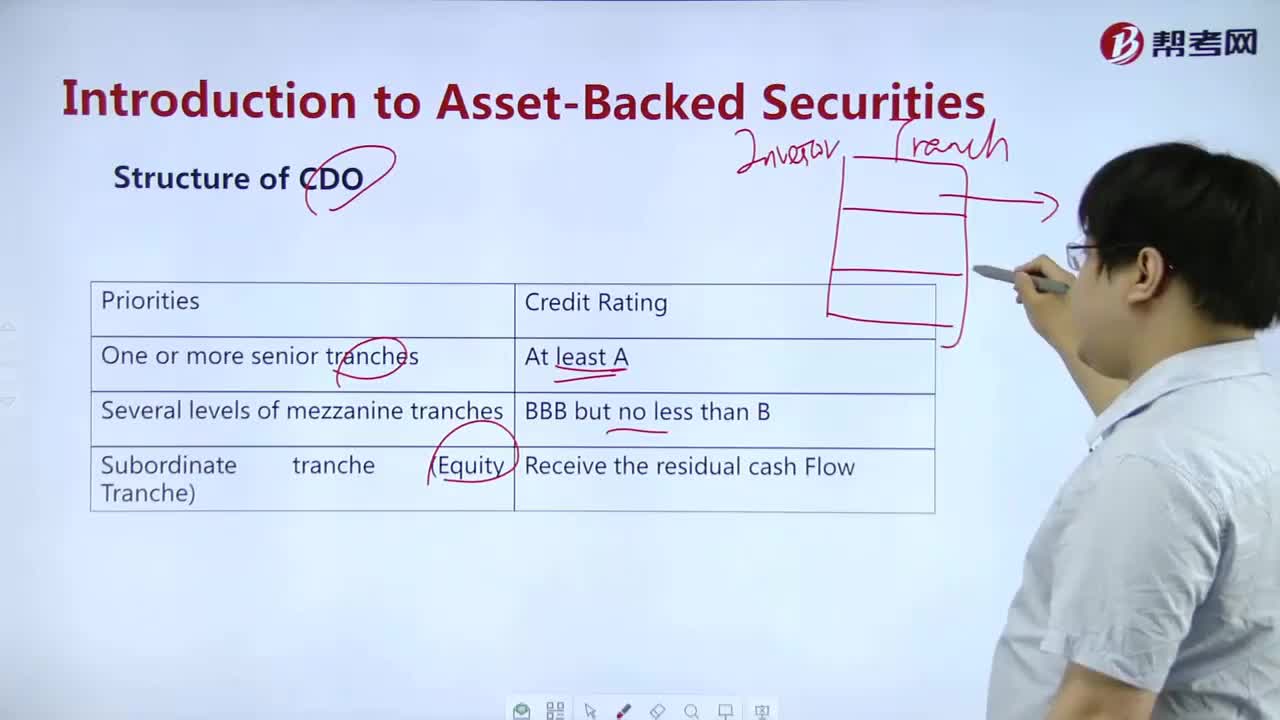

How to understand Structure of CDO?:How to understand Structure of CDO?

05:37

05:37

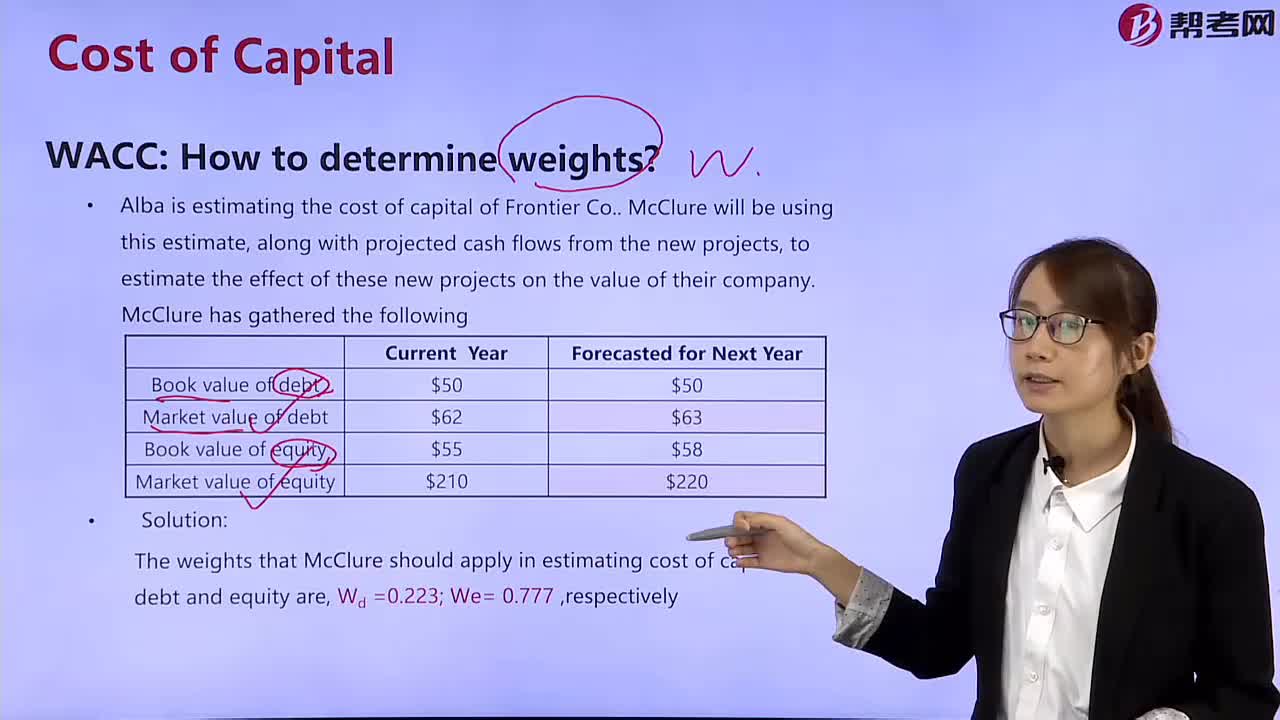

How to determine weights?:How to determine weights?

05:12

05:12

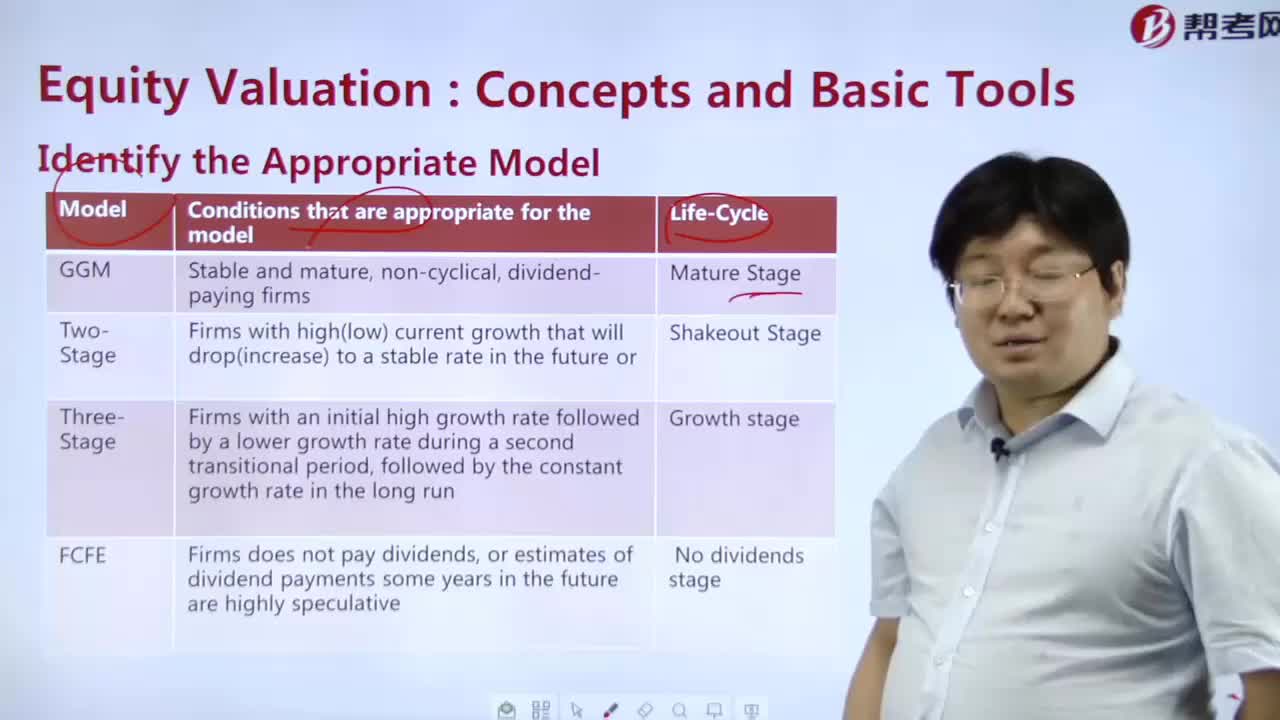

How do determine the right model?:How do determine the right model?

04:58

04:58

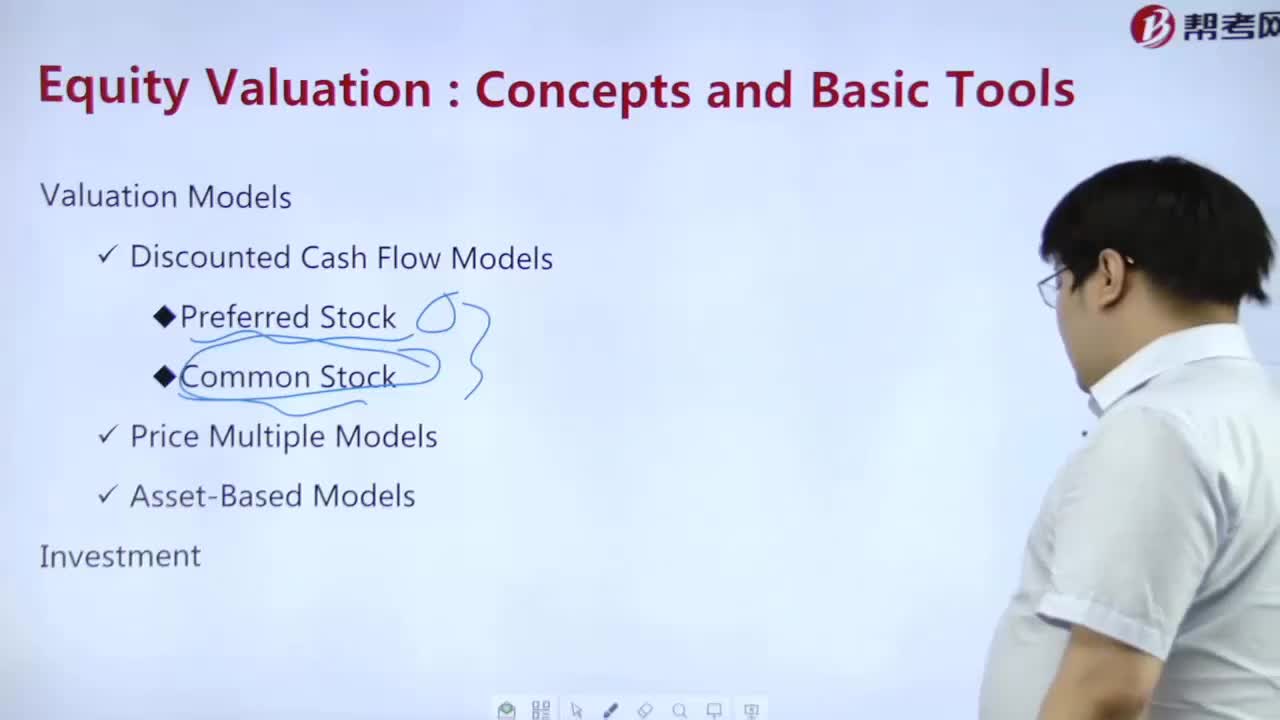

How to calculate the value of preferred stock?:How to calculate the value of preferred stock?

03:36

03:36

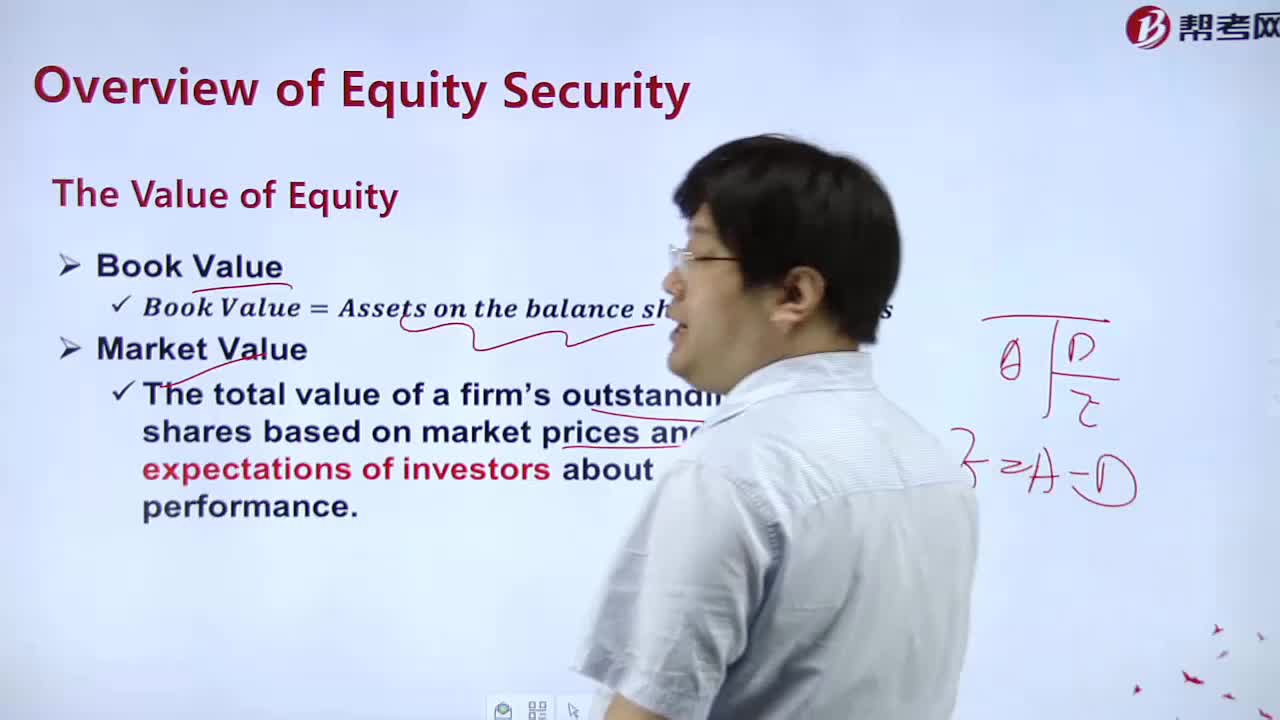

What is the value of the equity?:What is the value of the equity?

03:57

03:57

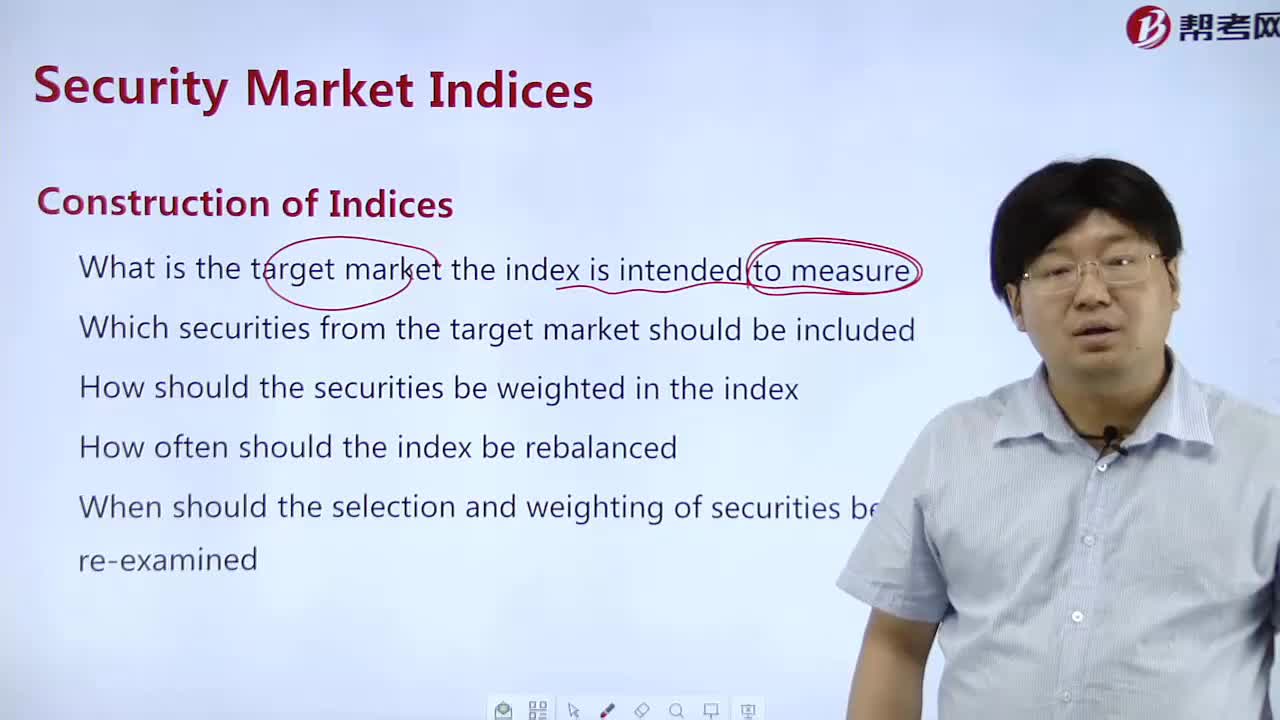

What is the construction of an exponent?:What is the construction of an exponent?

13:02

13:02

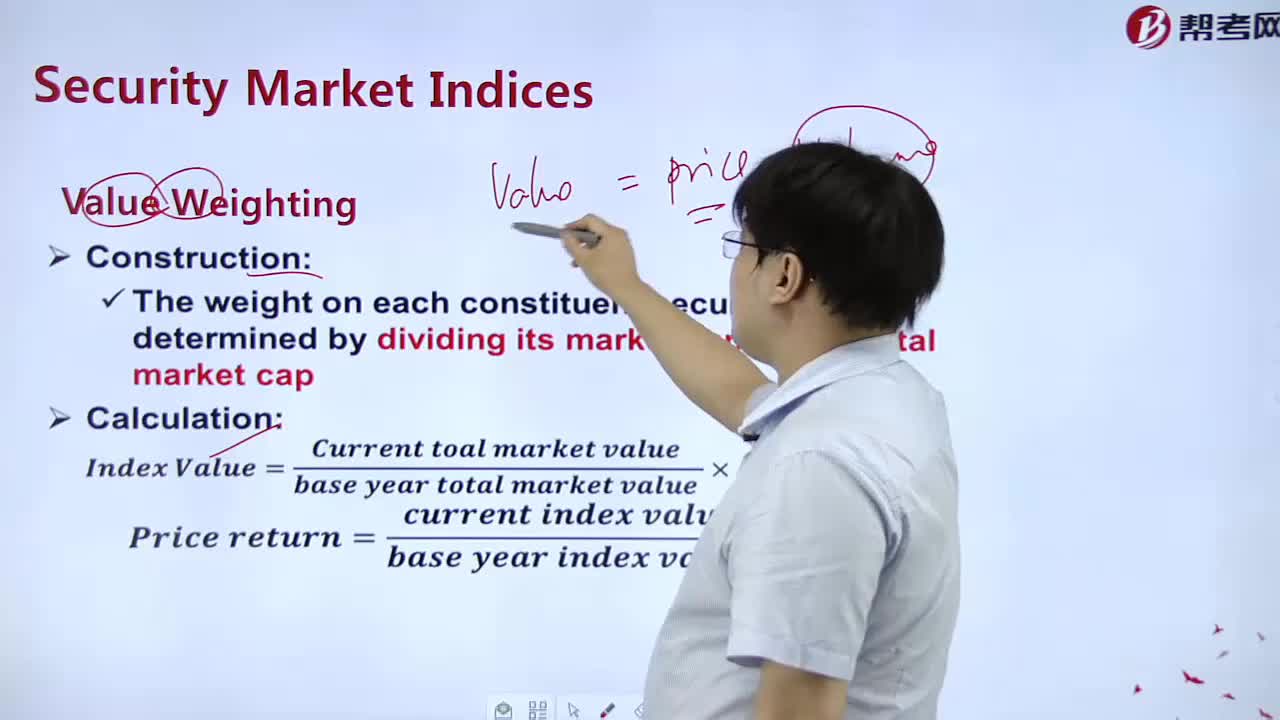

What is the measurement of Value?:What is the measurement of Value?

12:48

12:48

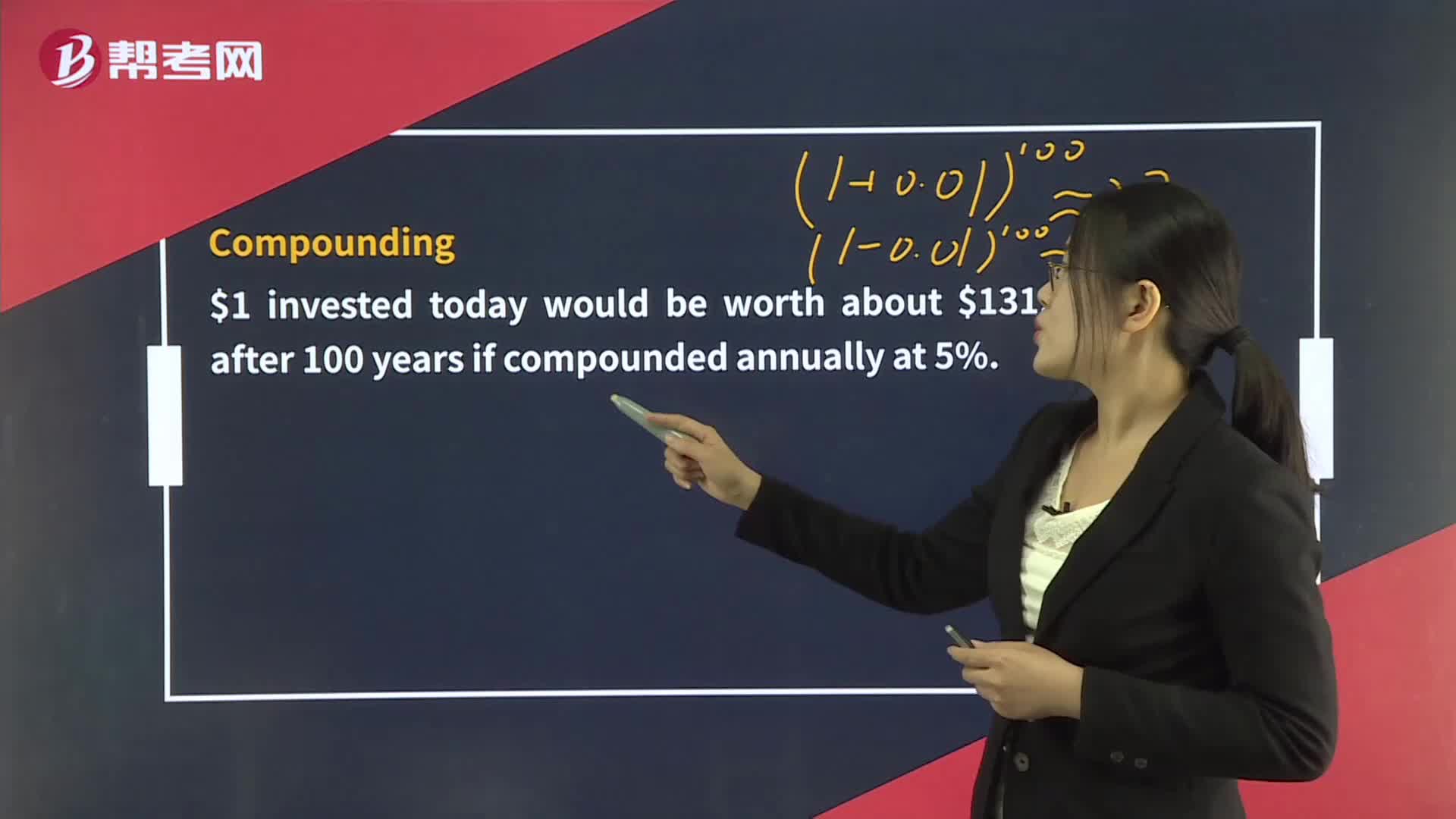

The Time Value of Money:The,Future Value of a Single Cash Flow – Example:B.C.semiannually.

13:18

13:18

How to understand the meaning of misrepresentation?:advertising,书面报告即使没有发布也不行)”tablesstatisticsMay use other people’s work within the same firm without committing a violation. (同一公司的报告不用引用)

05:48

05:48

How to determine if an investment decision or investment proposal is suitable for clients?:作出投资决策或投资建议前,评估整个投资组合是否适合客户。must only make investment recommendations or take investment actions that are consistent with the stated objectives and constraints of the portfolio. (如果投资前对投资目标及限制进行过约定。

06:50

06:50

How to understand the Code of ethics and trust in the investment profession?:I,Professionalism:II:IIIIVVVIVIIResponsibilities as a CFA member or candidate