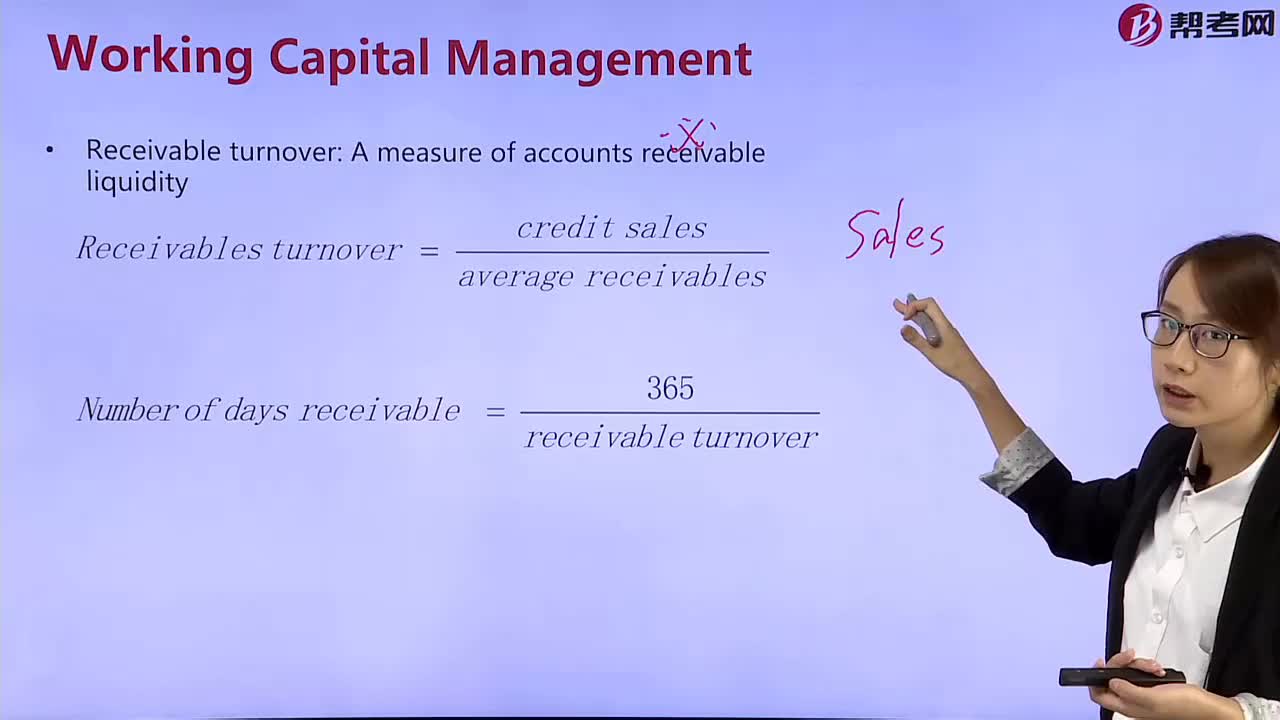

How to calculate the turnover of accounts receivable?

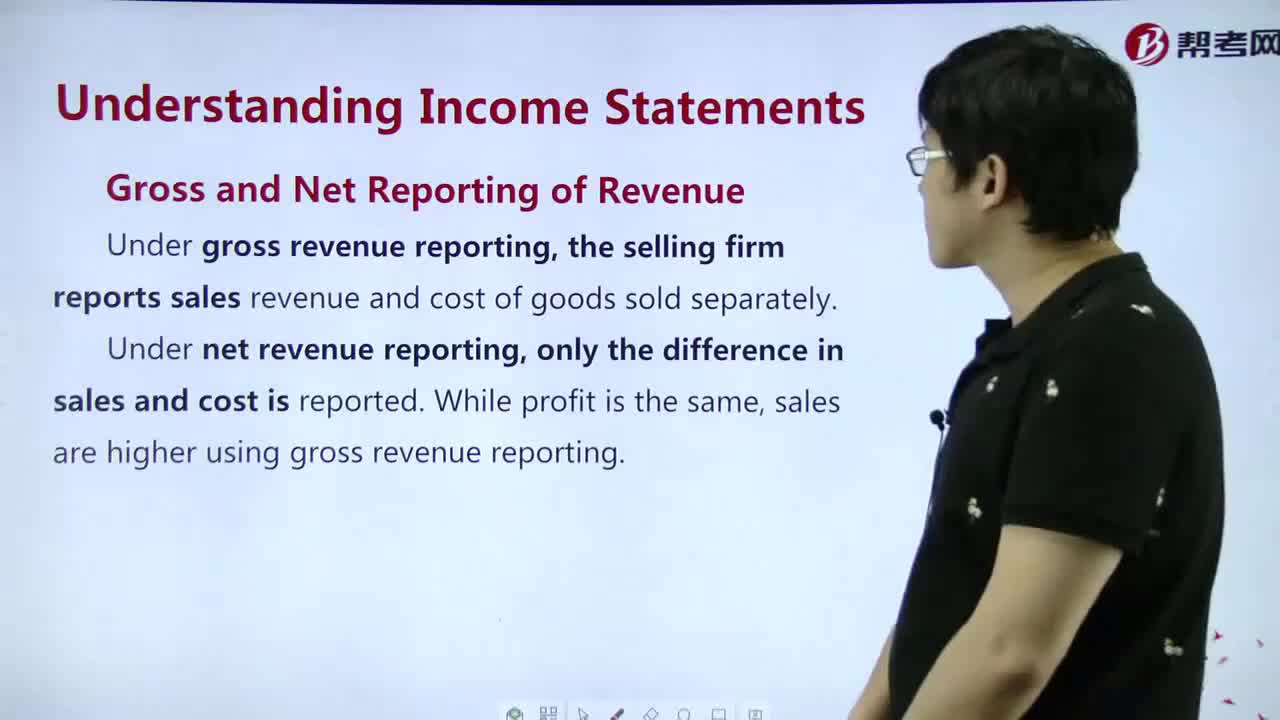

How to master Gross and Net Reporting of Revenue?

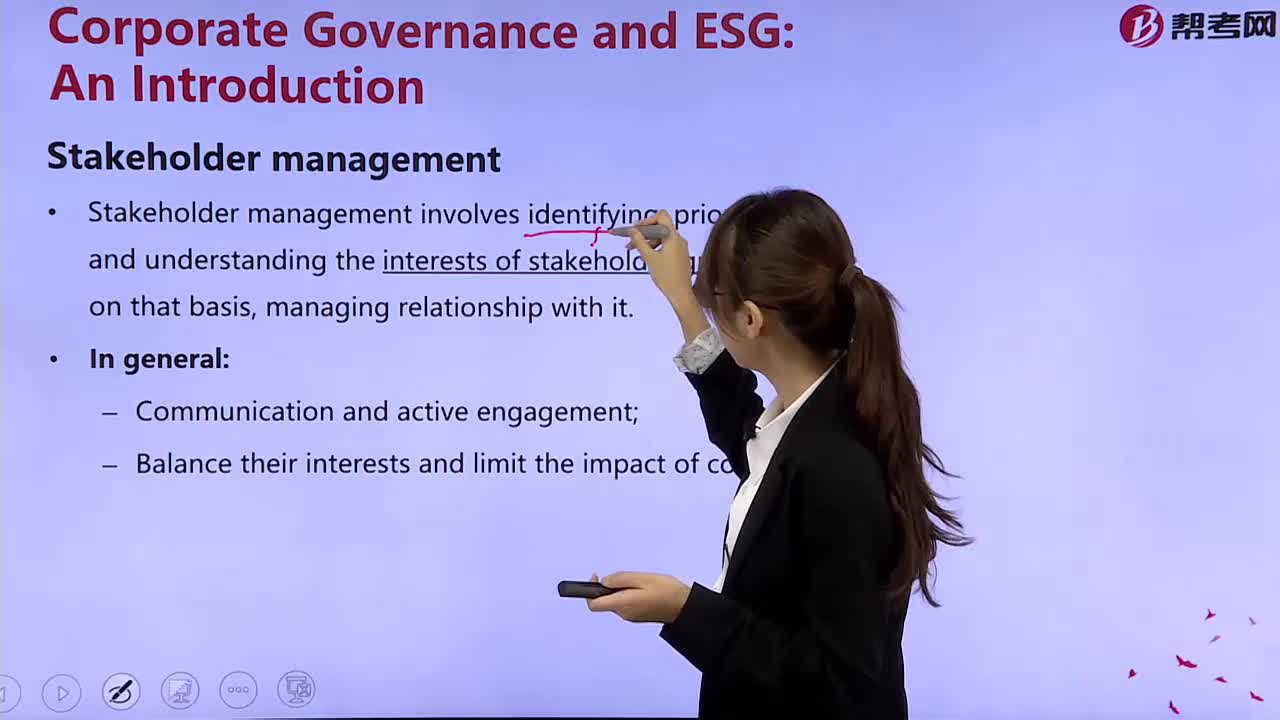

How to manage the client in the project?

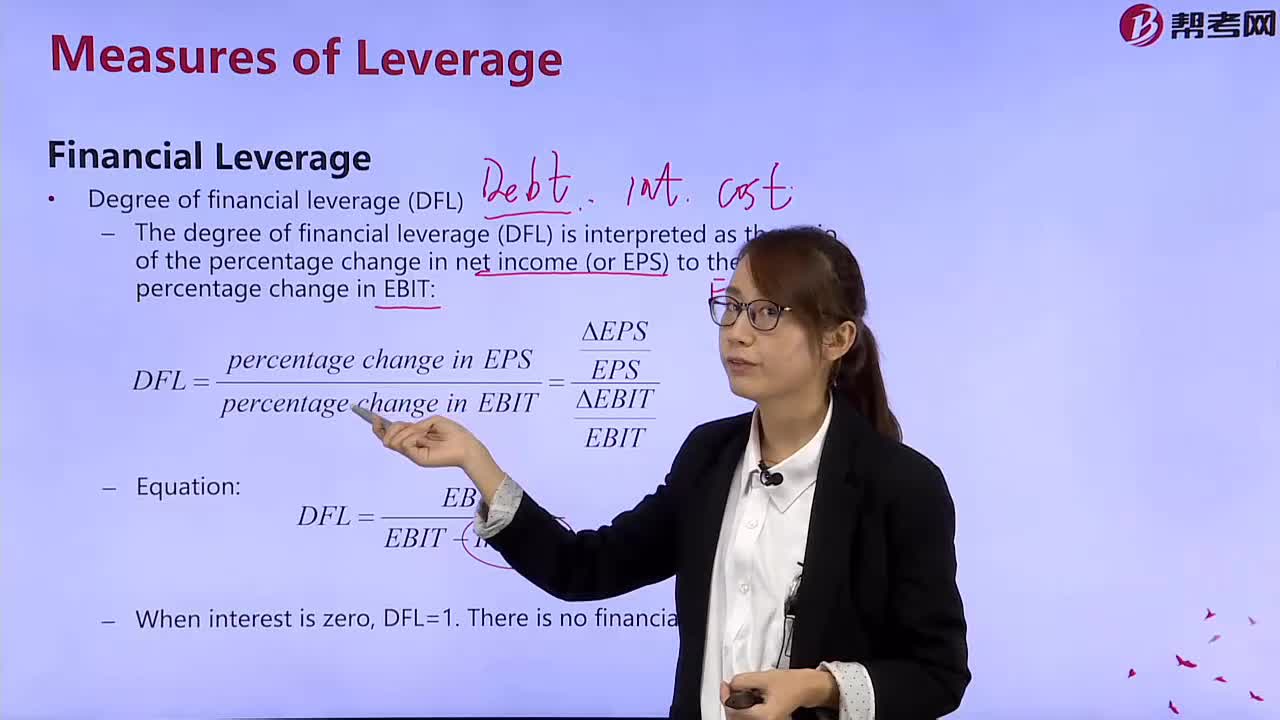

How to calculate the degree of financial leverage?

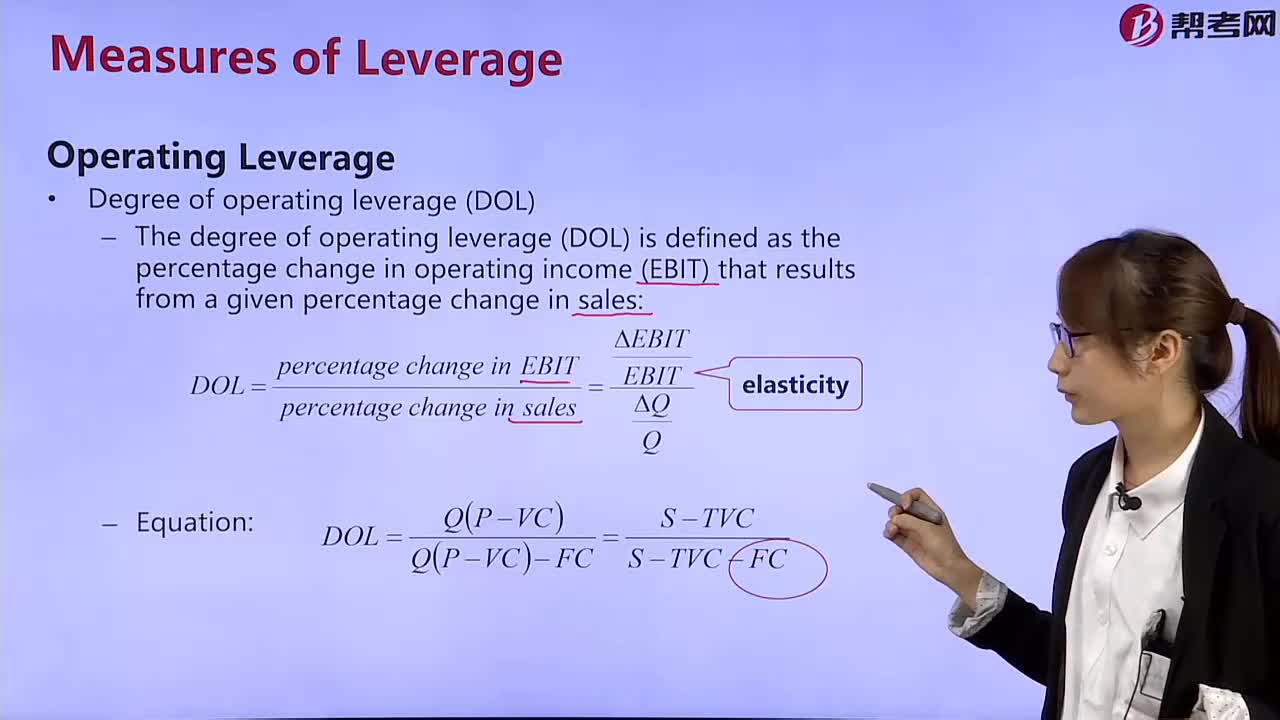

How to calculate the degree of operating leverage?

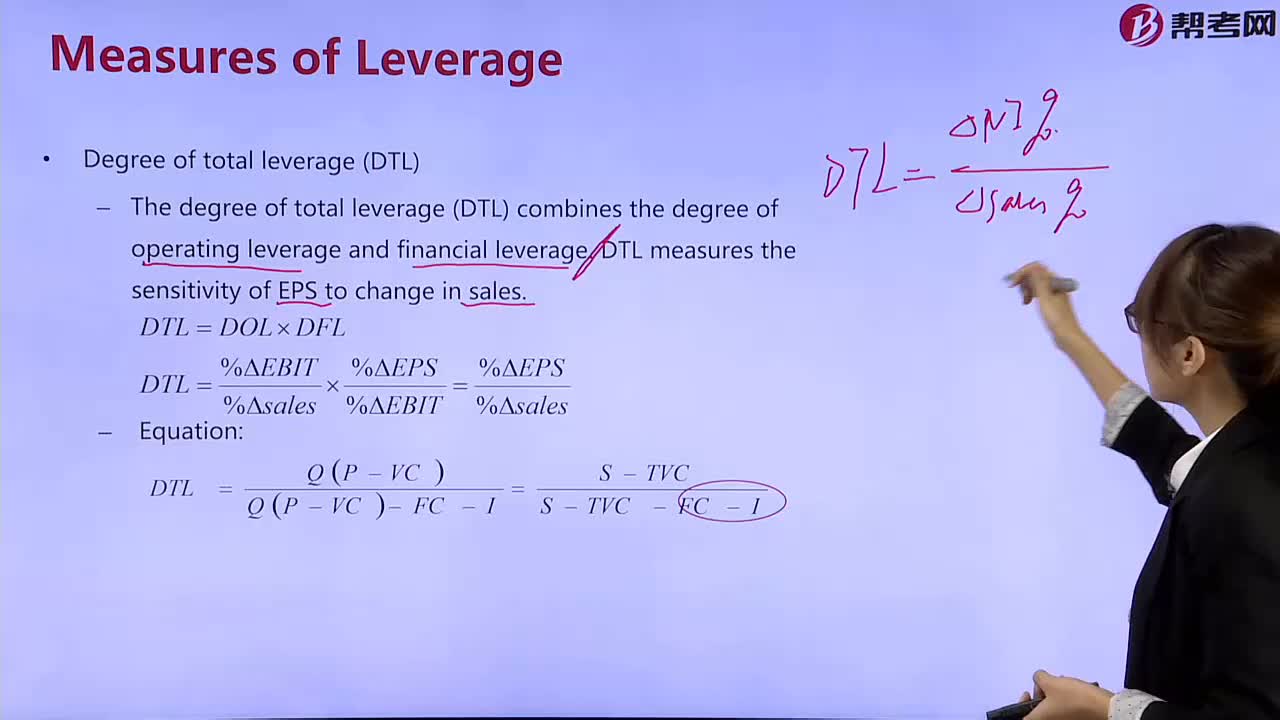

How To calculate total leverage?

How to master Ourline?

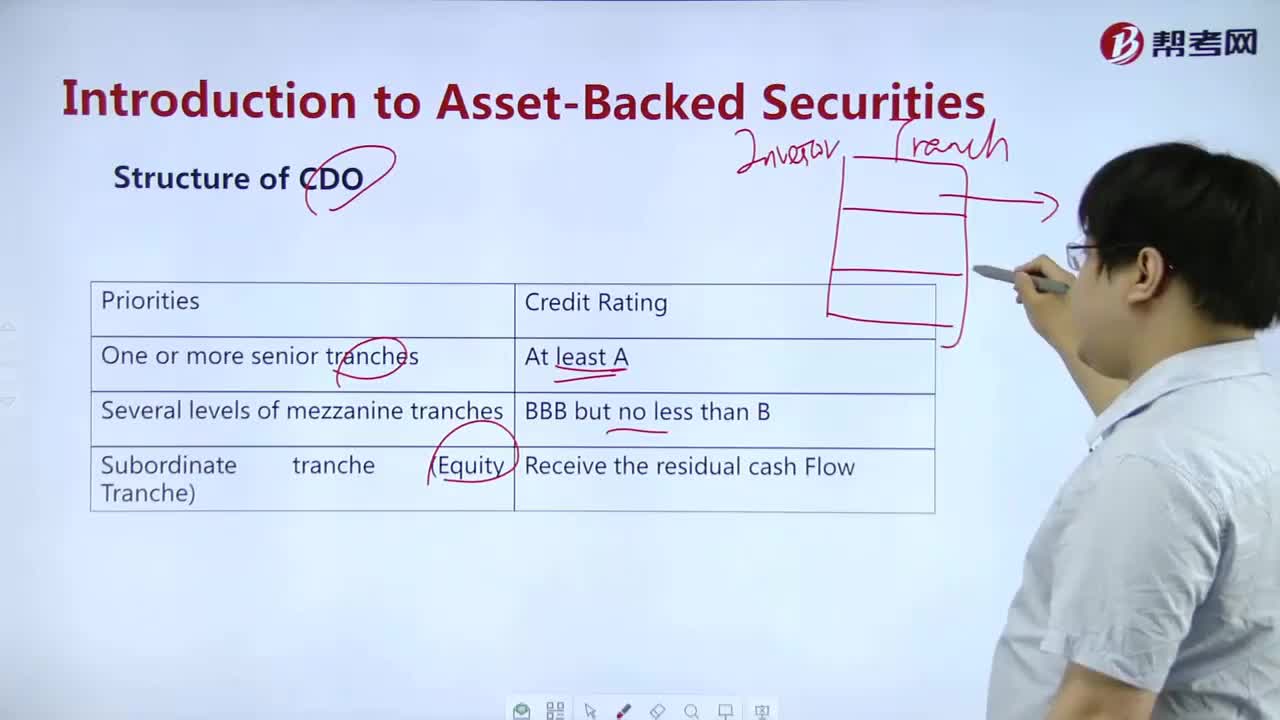

How to understand Structure of CDO?

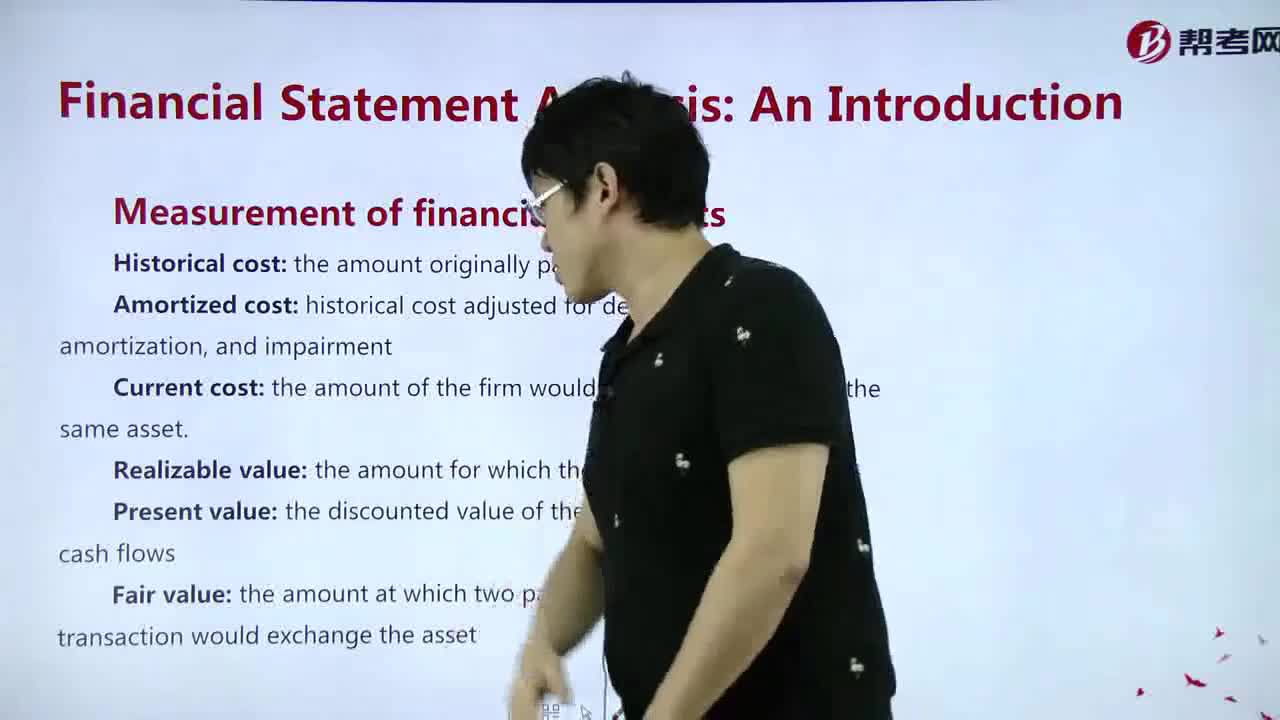

How to master Measurement of financial elements?

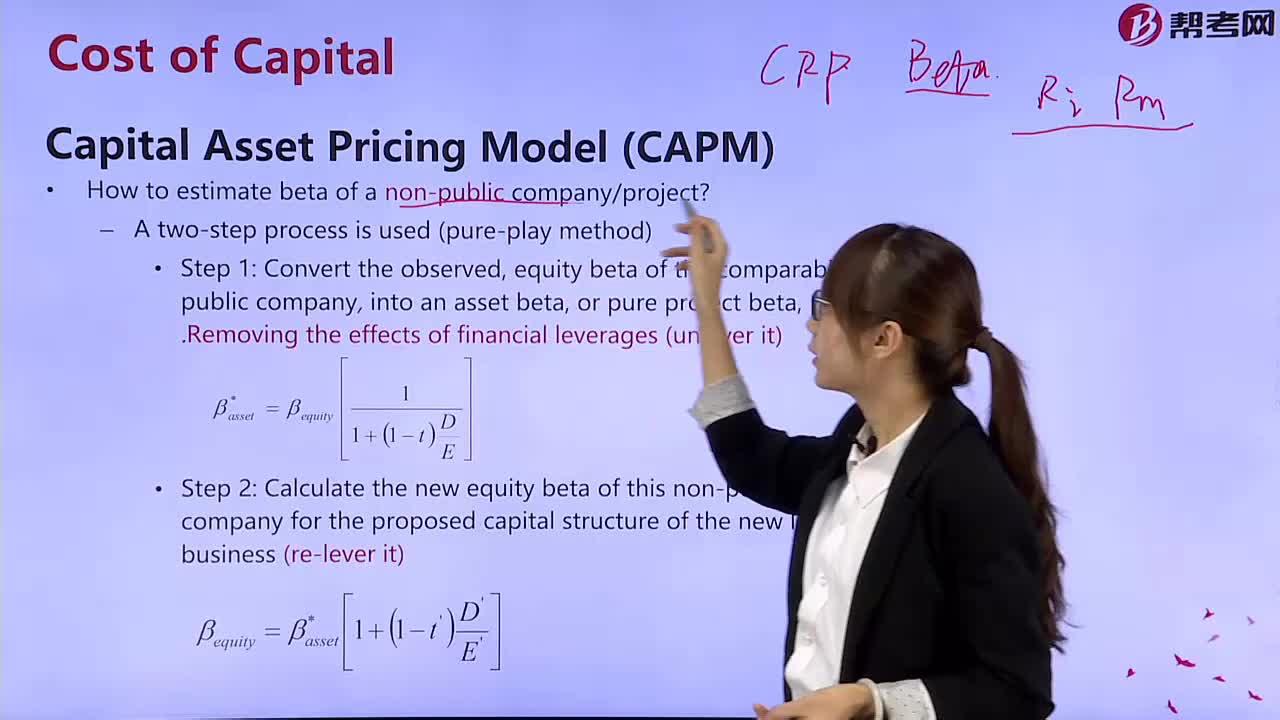

how to estimate beta of a non-public company?

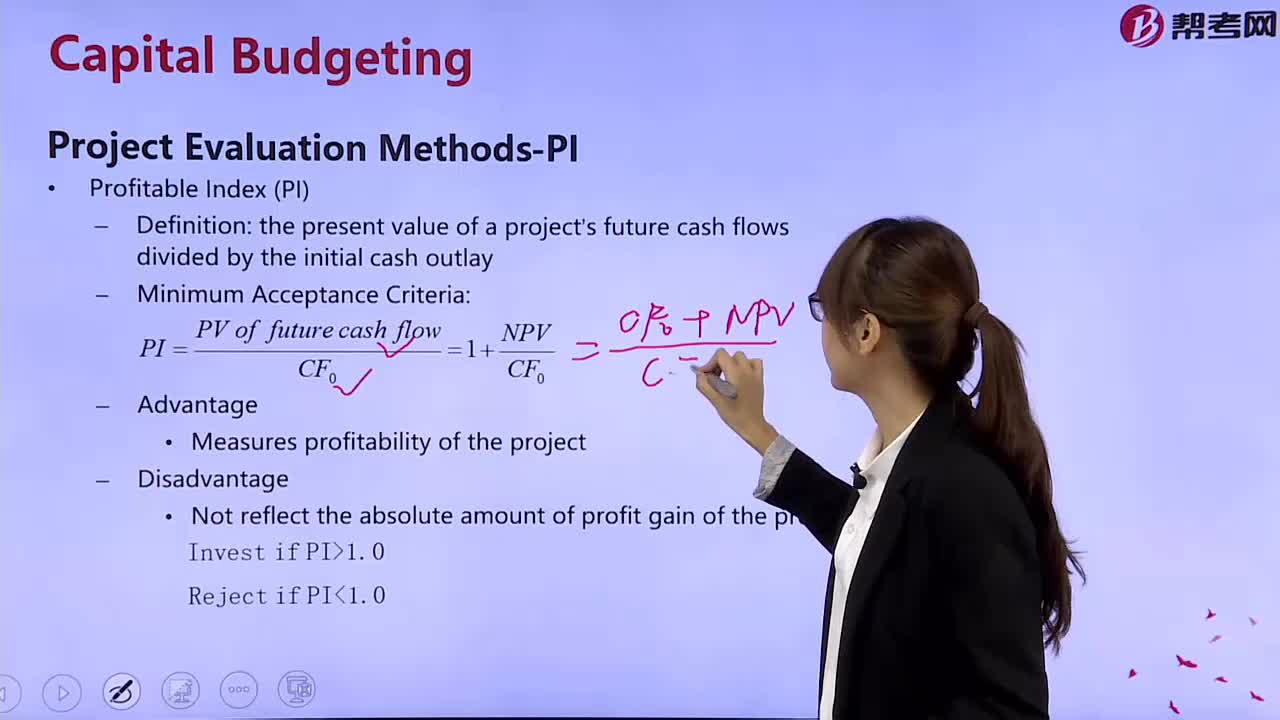

How to calculate a favorable index?

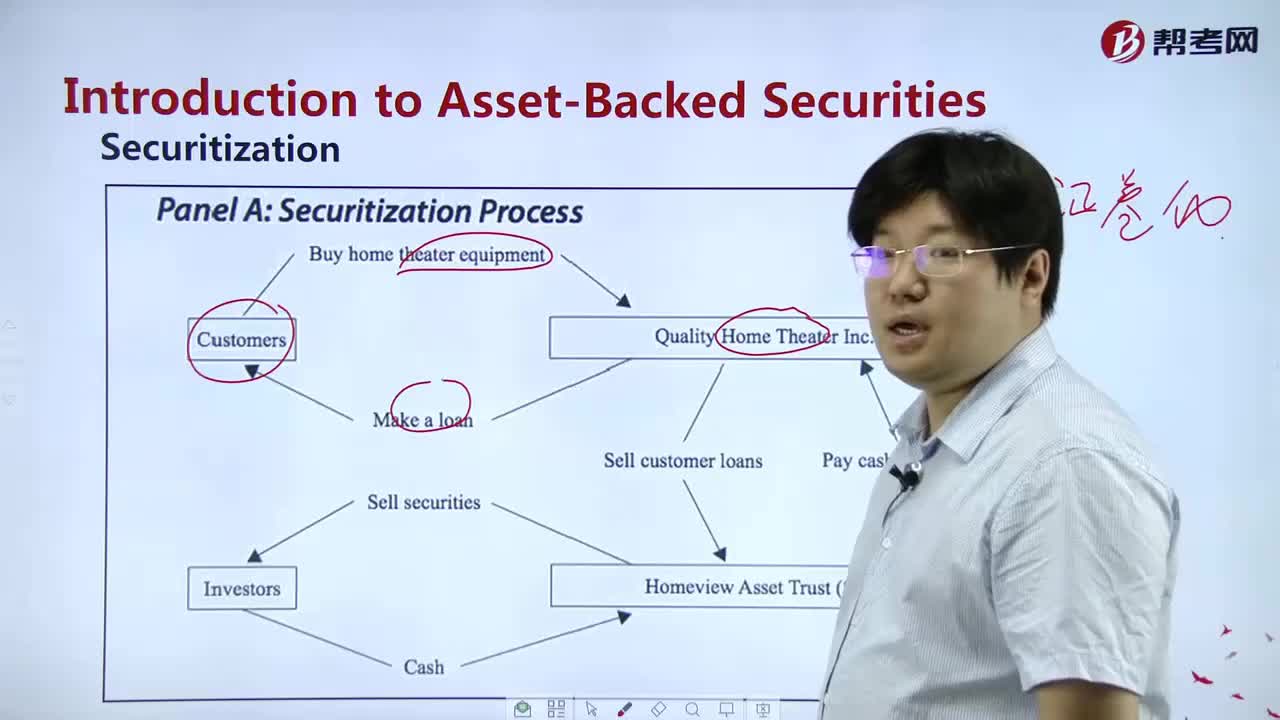

How to master Securitization?

下载亿题库APP

联系电话:400-660-1360