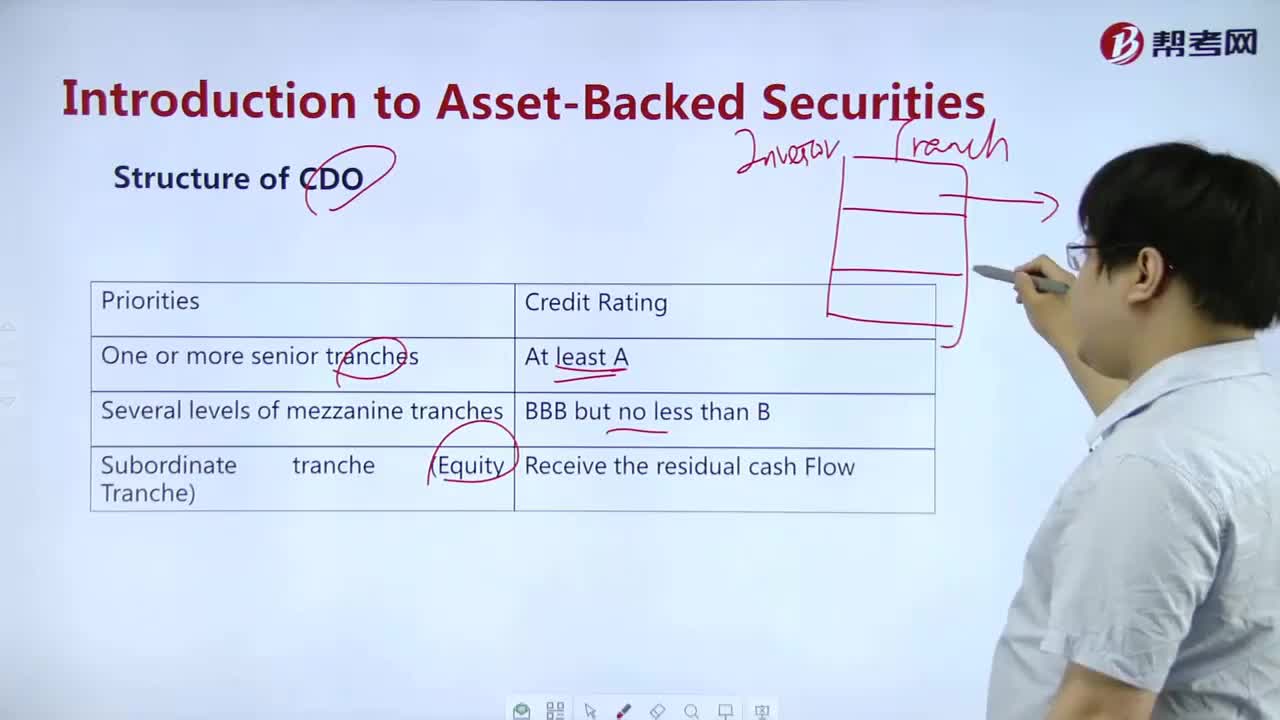

How to understand Structure of CDO?

How to understand YTM for fixed rate Bond?

What's the meaning of Treasury Securities?

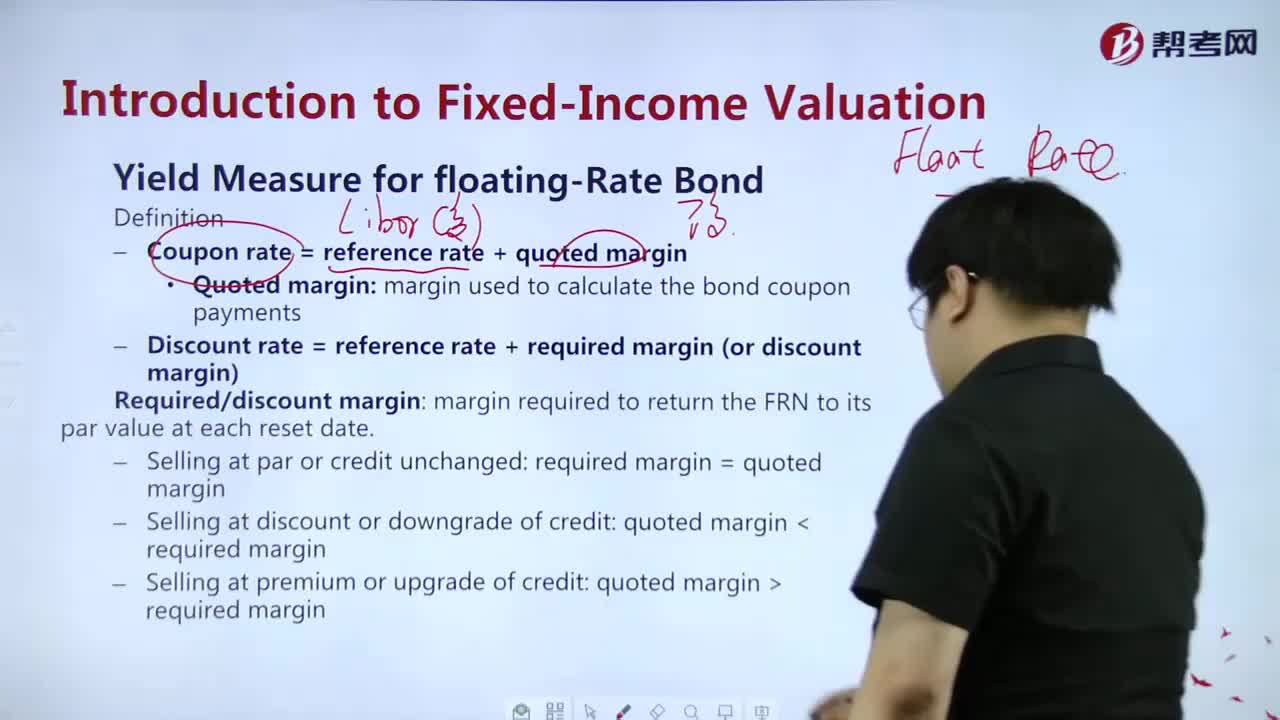

What's the Income Valuation-Yield Measure of Bond?

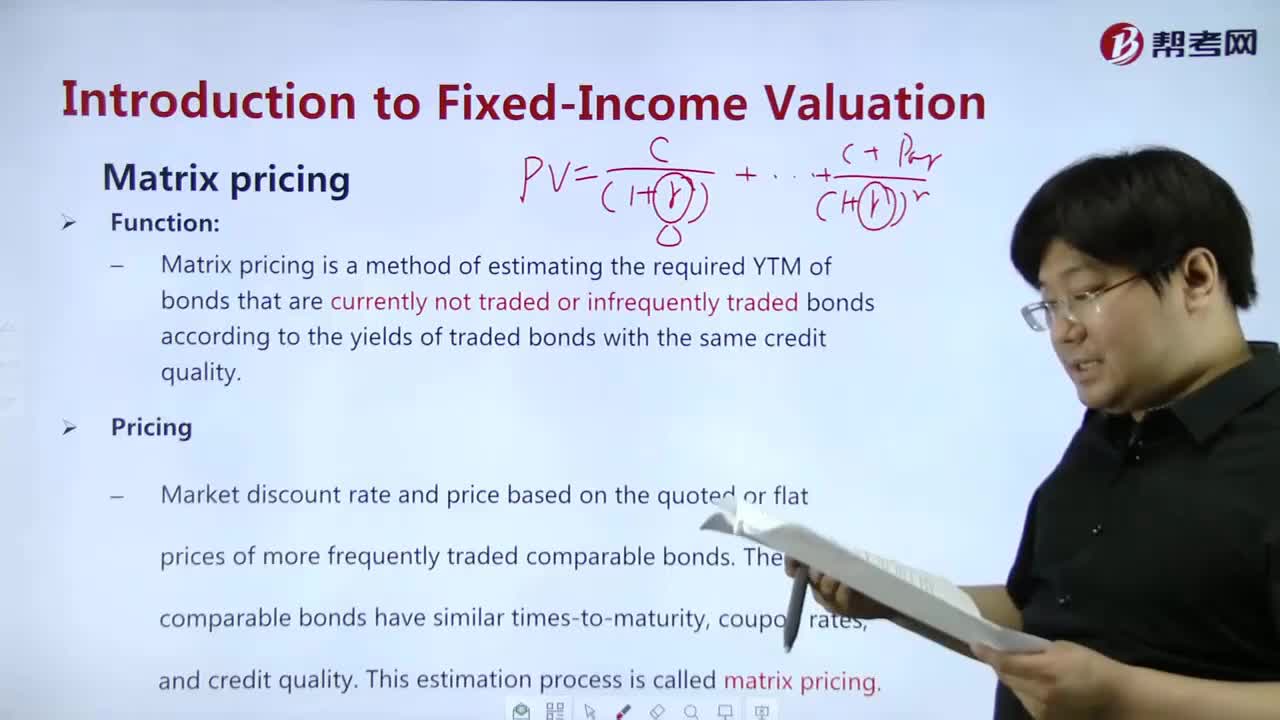

How to explain to you Matrix pricing?

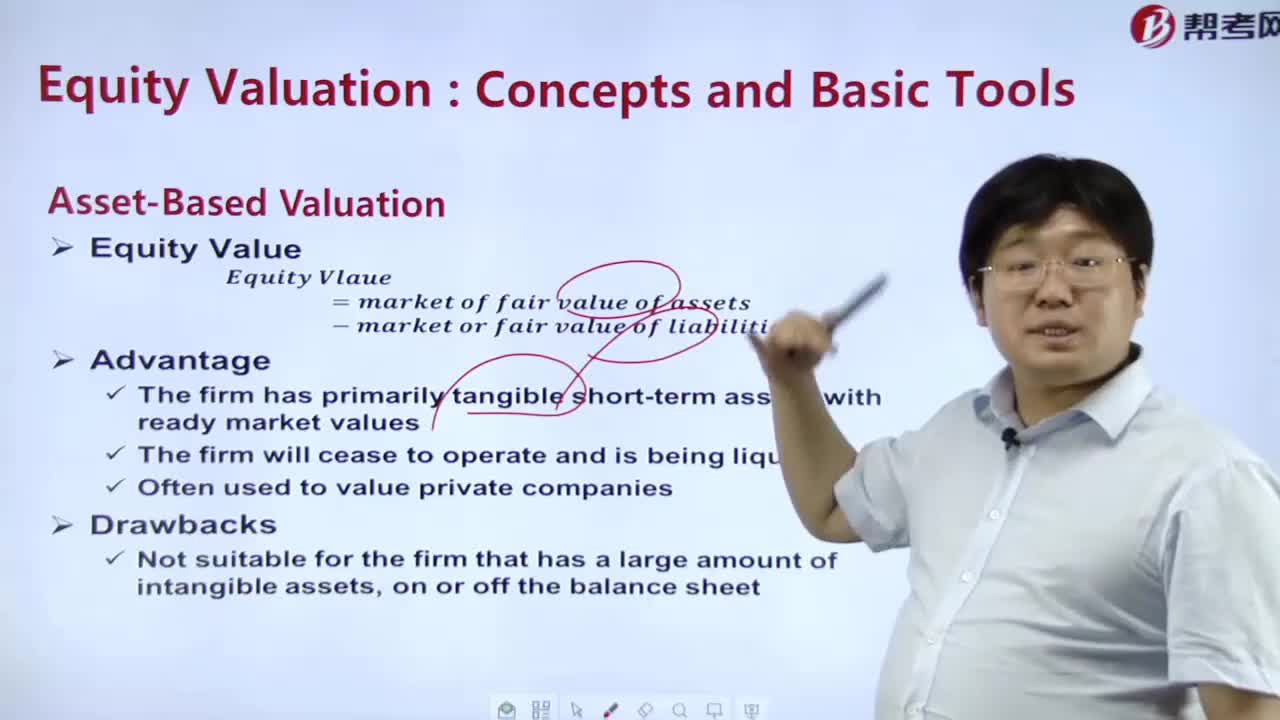

What does asset-based valuation include?

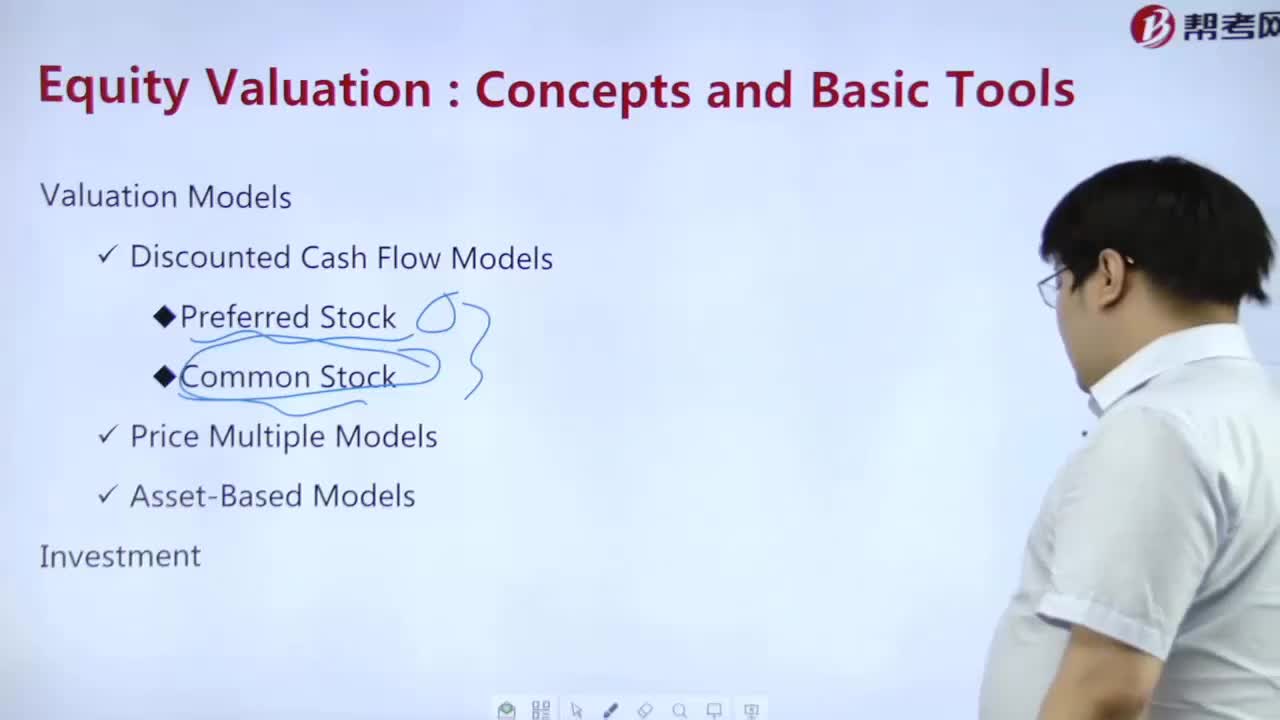

What is the structure of common stock?

How to calculate the value of preferred stock?

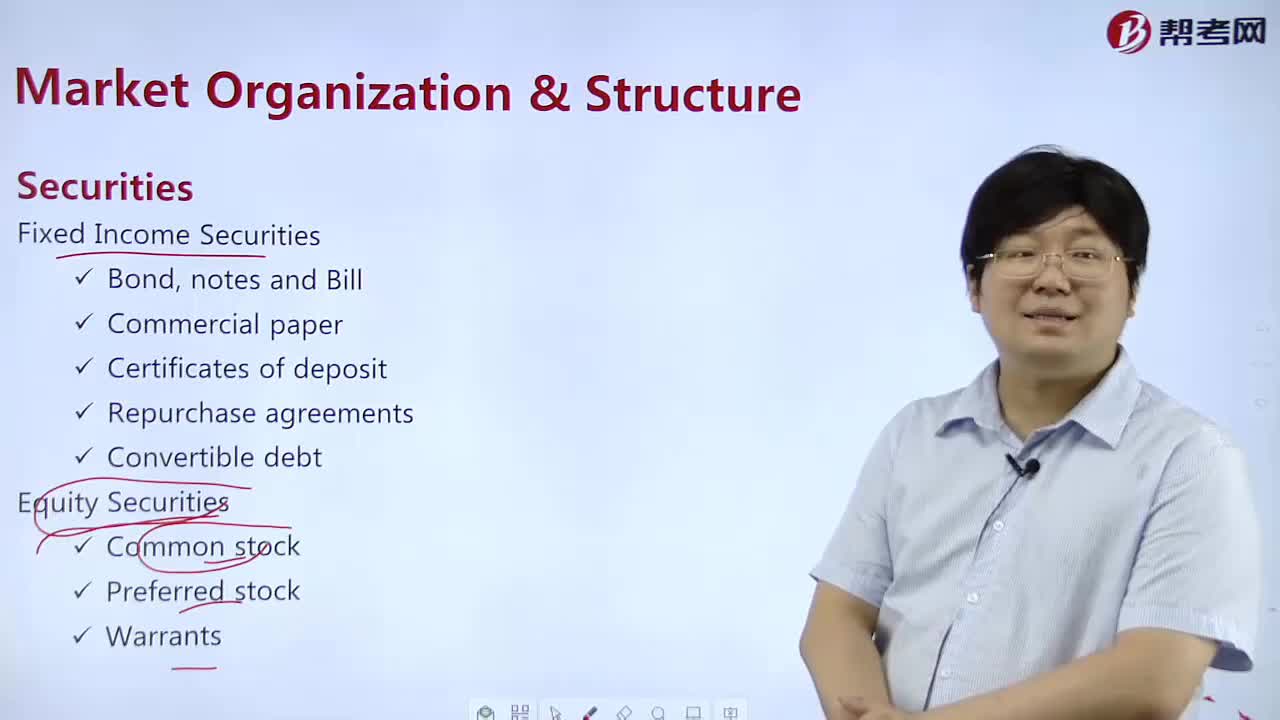

What are the types of securities?

What is the meaning of a Fixed Income Index?

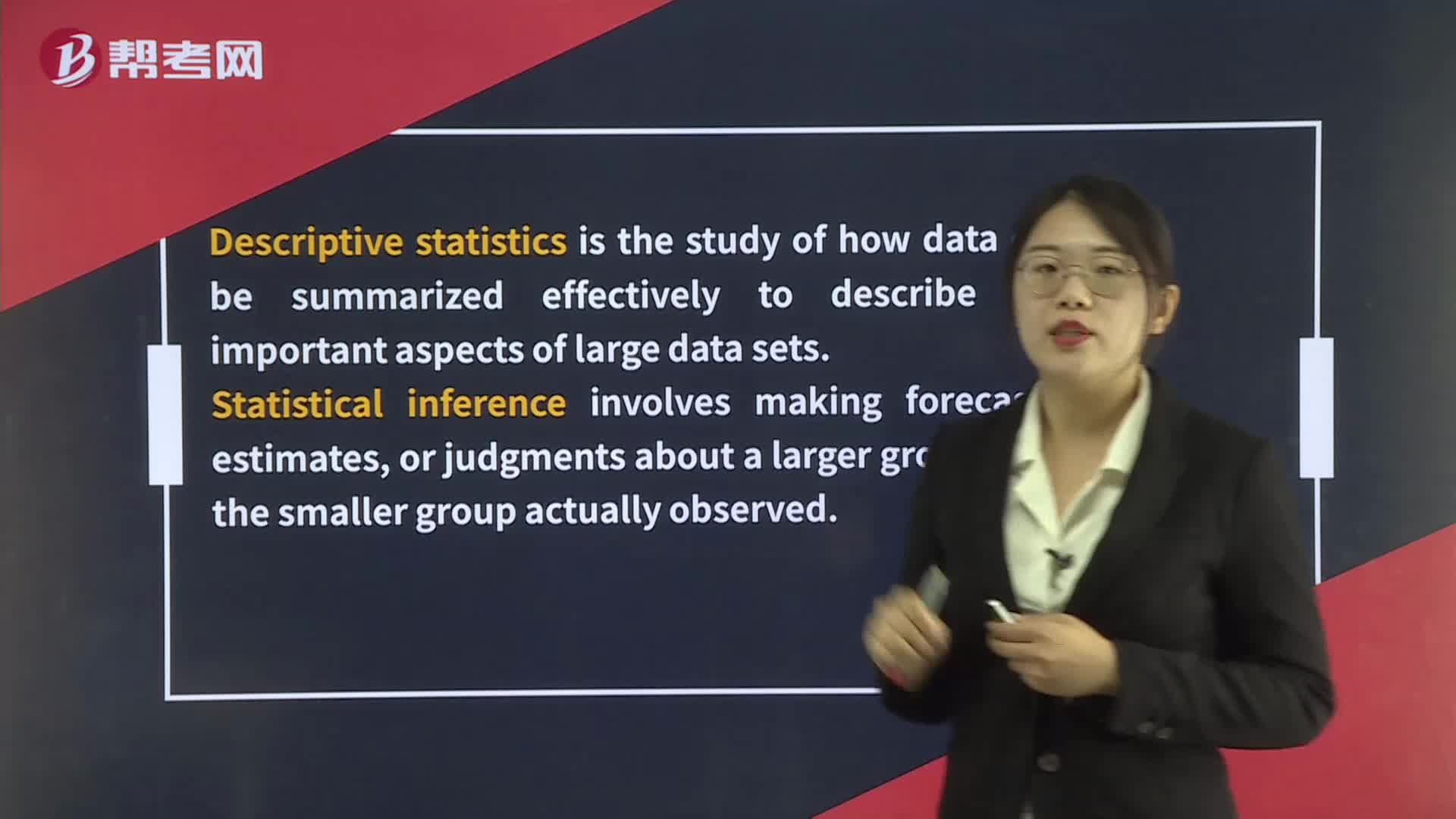

Fundamental Concepts of Statistics

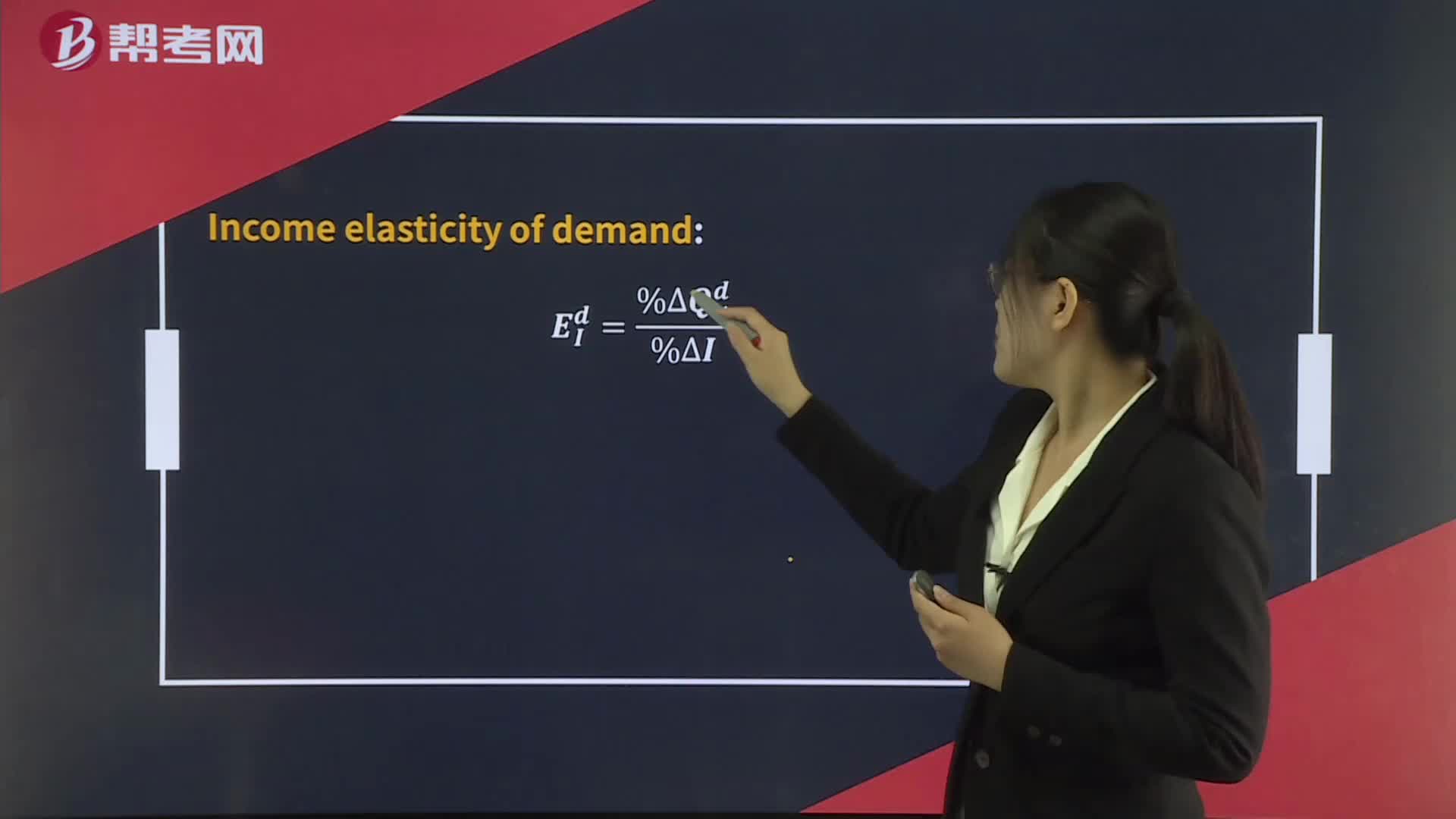

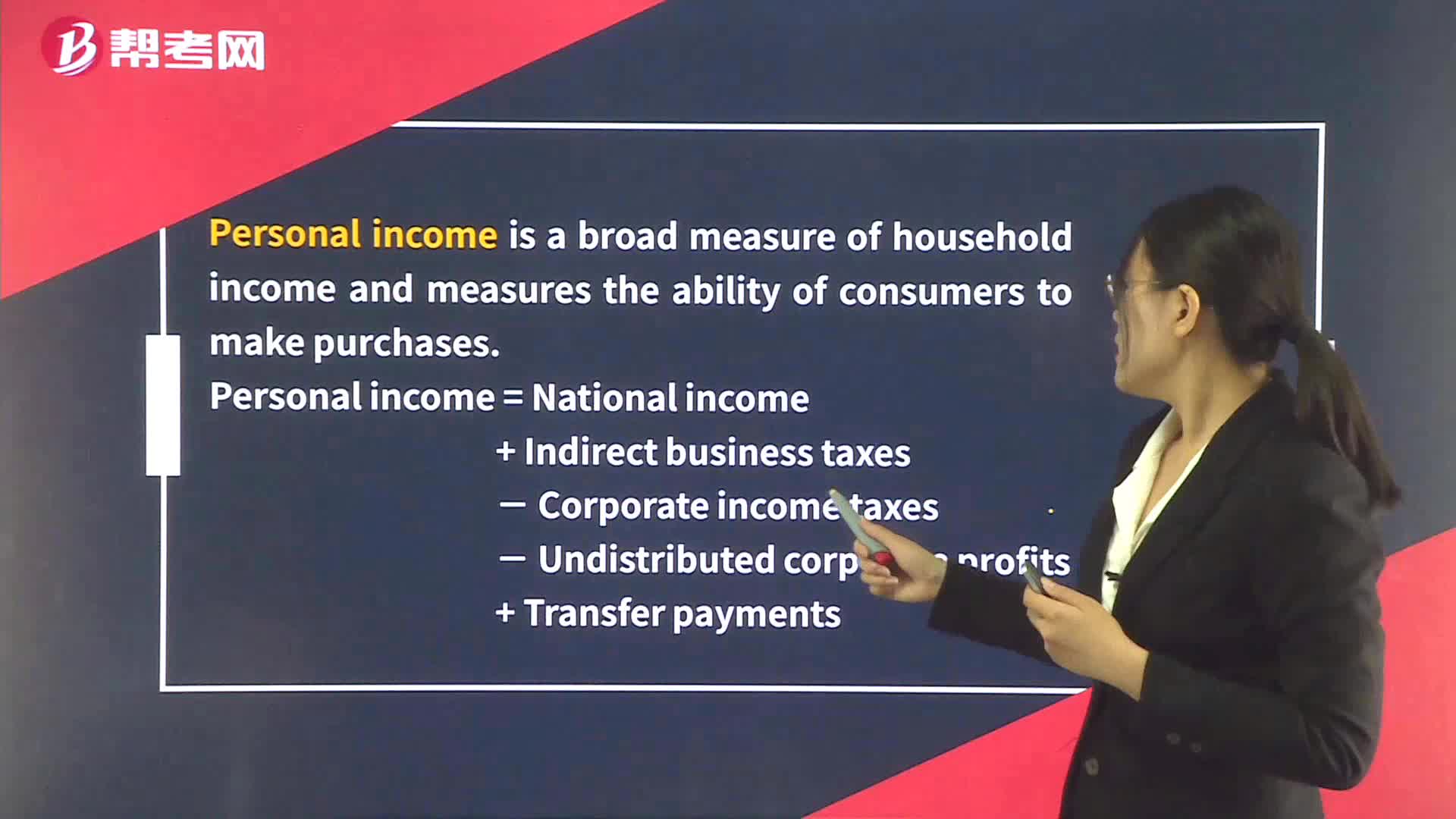

Personal Income & Personal Disposable Income

下载亿题库APP

联系电话:400-660-1360