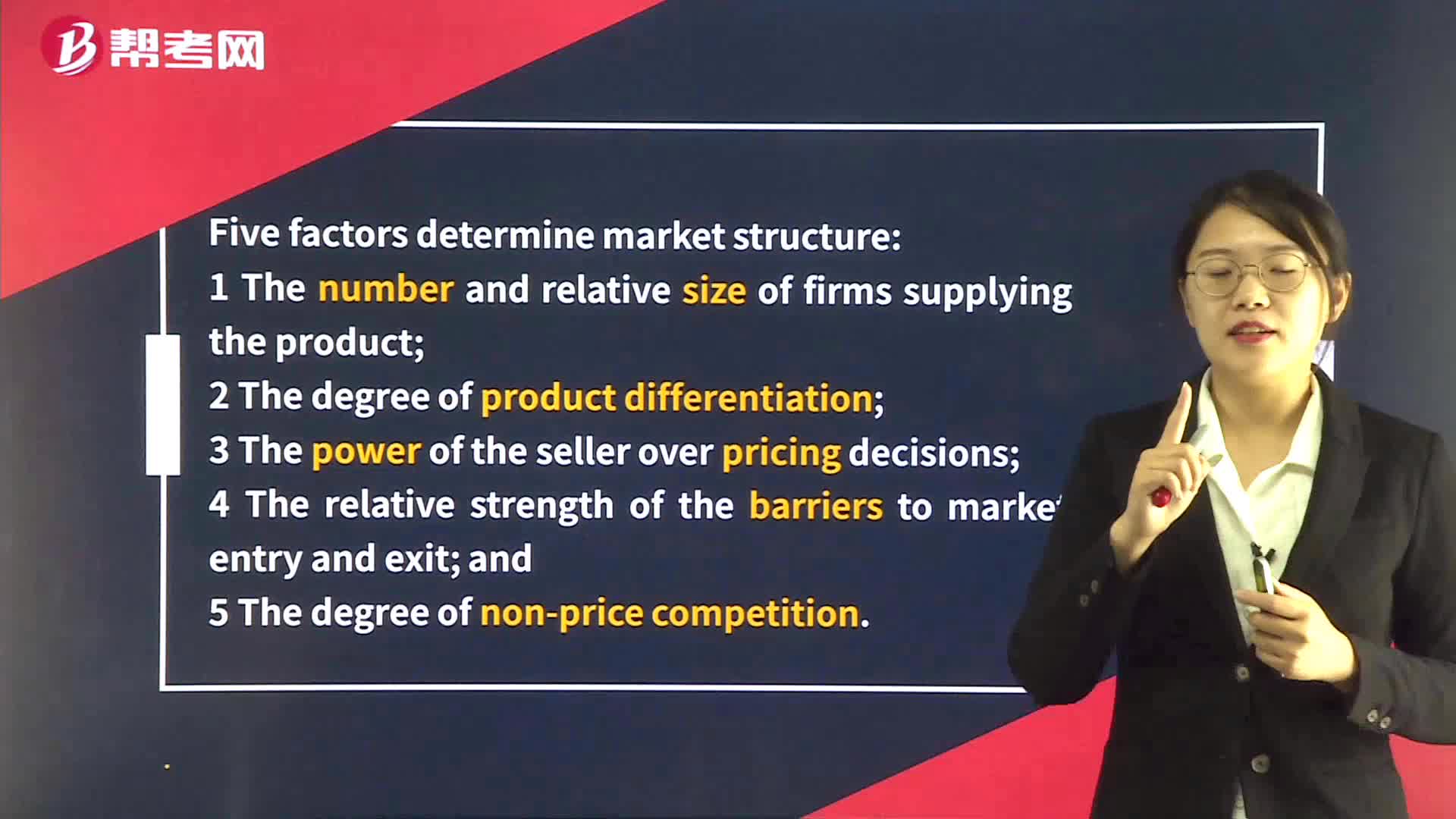

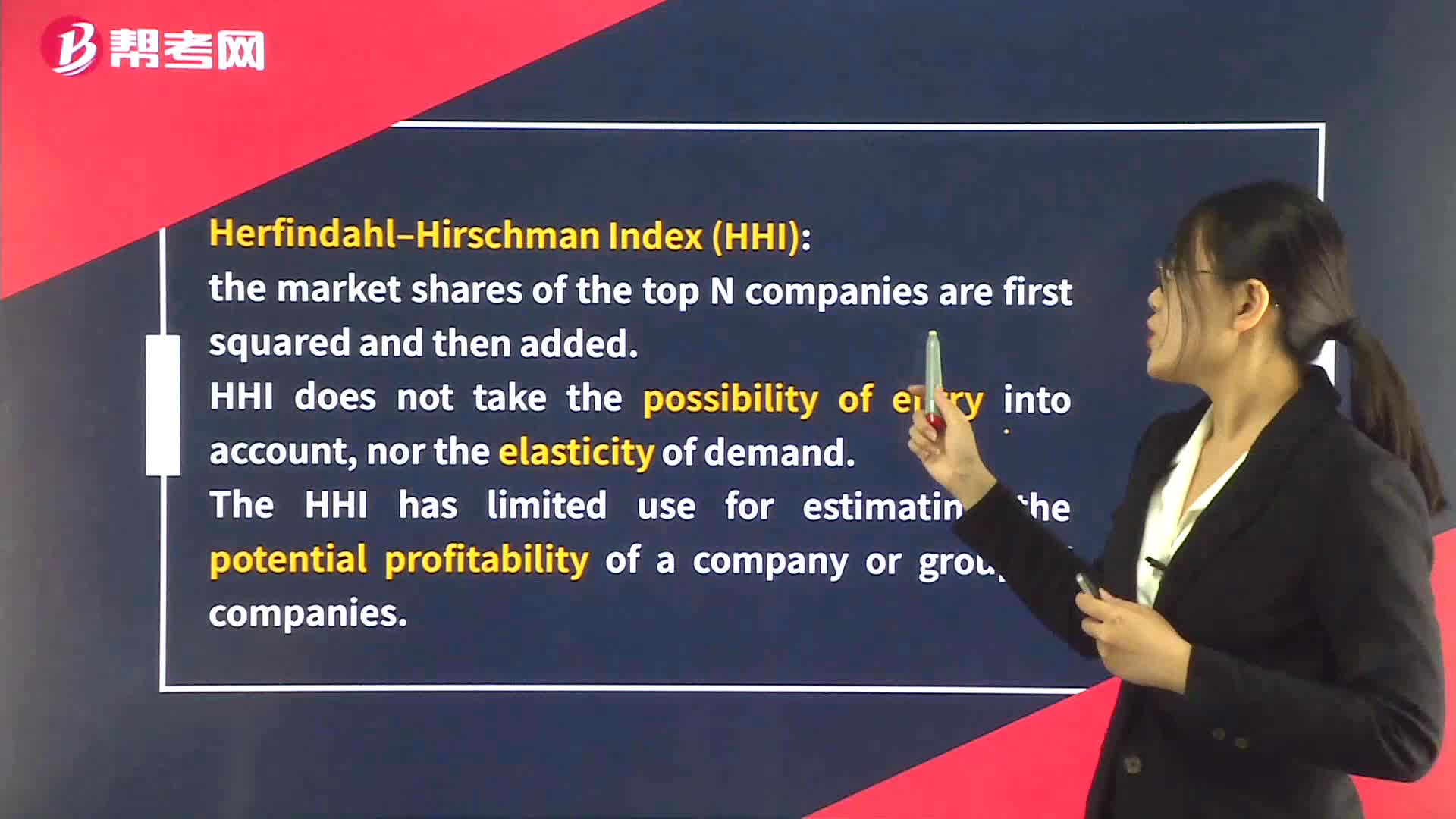

Identification of Market Structure – HHI

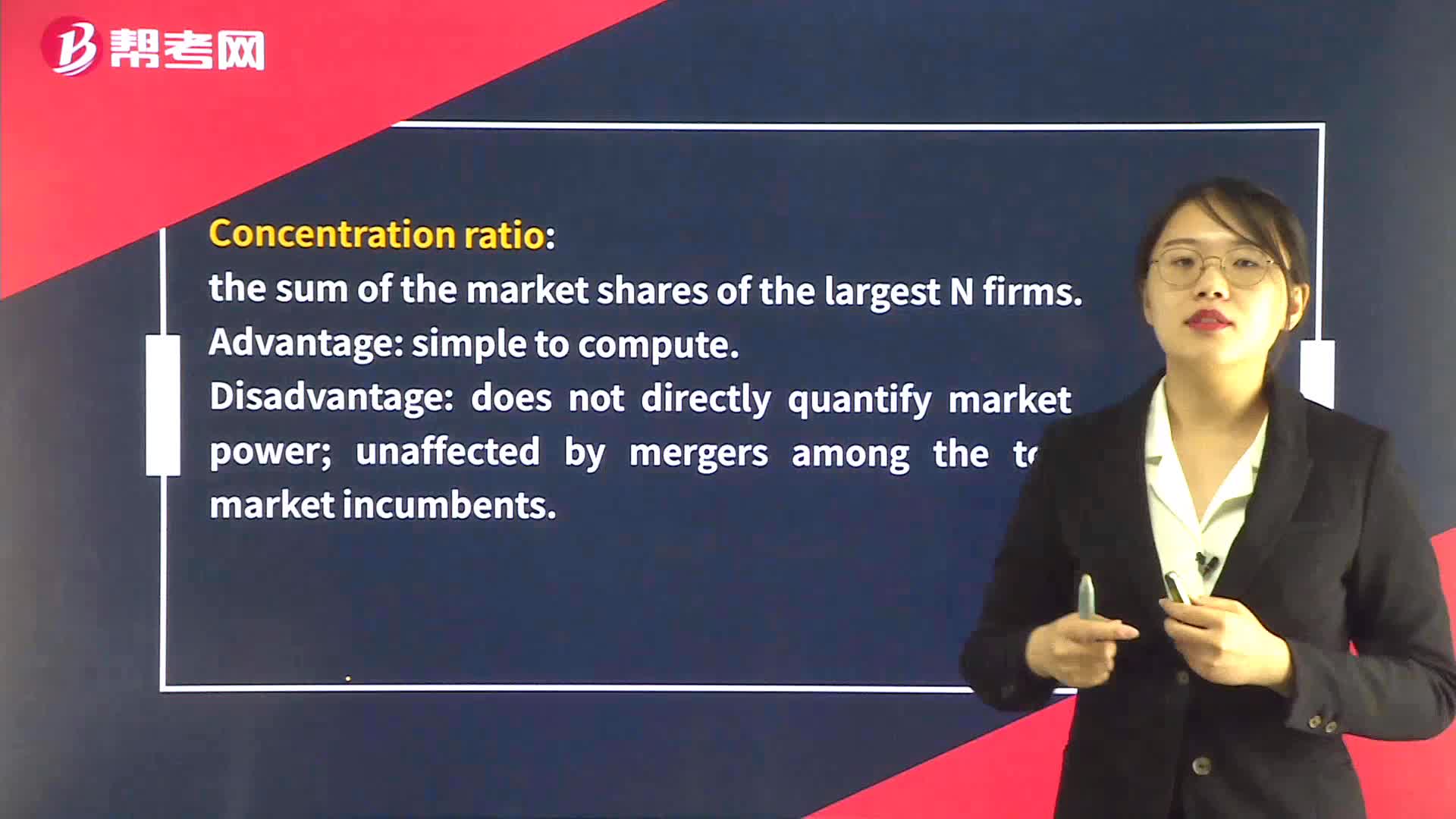

Identification of Market Structure – Concentration Ratio

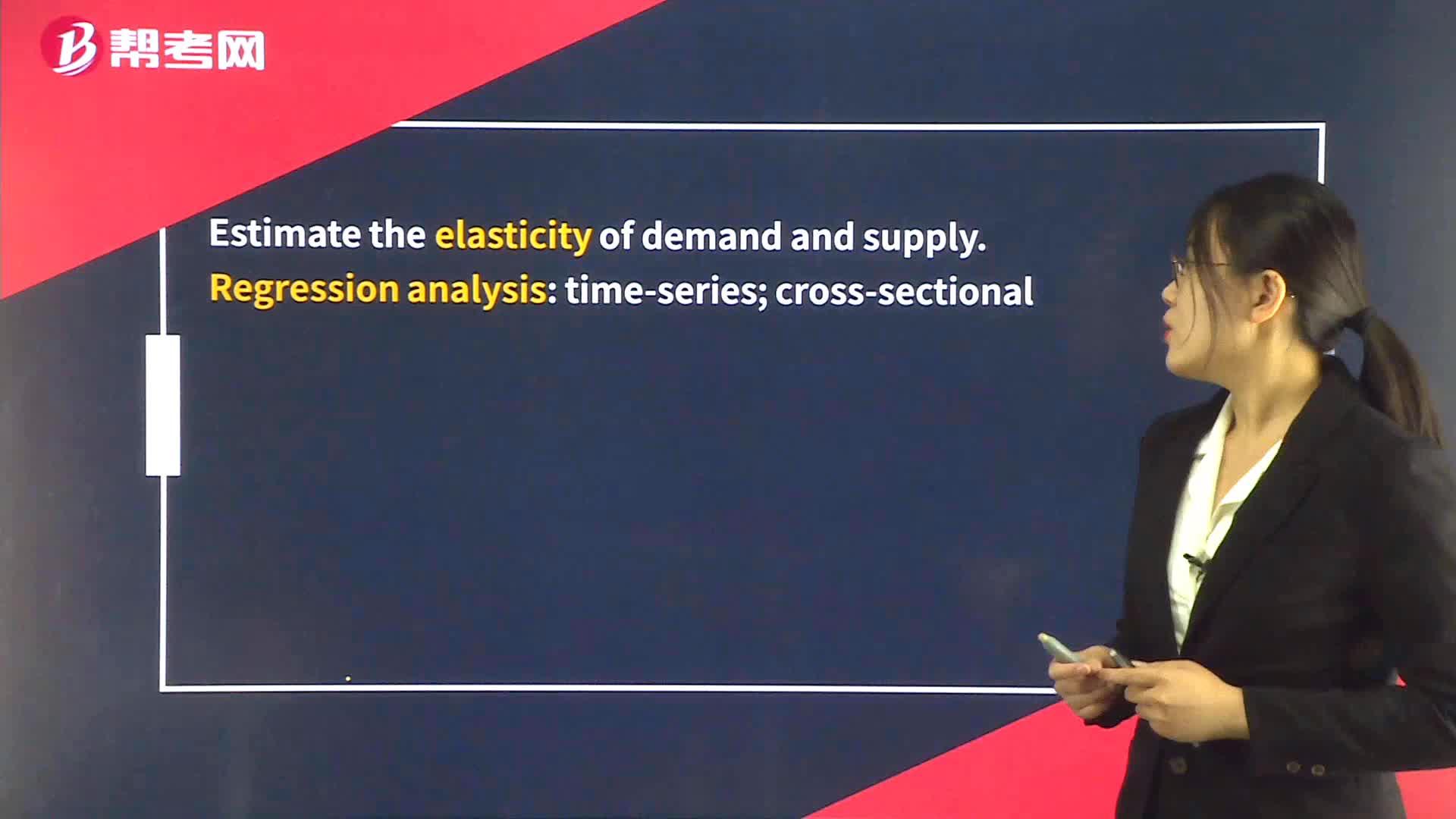

Identification of Market Structure – Econometric Method

The Costs of Inflation

The Construction of Price Indexes

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy

Factors Influencing the Mix of Fiscal and Monetary Policy

Cournot Assumption in Oligopoly Market

Open market operations

Collusion in Oligopoly Market

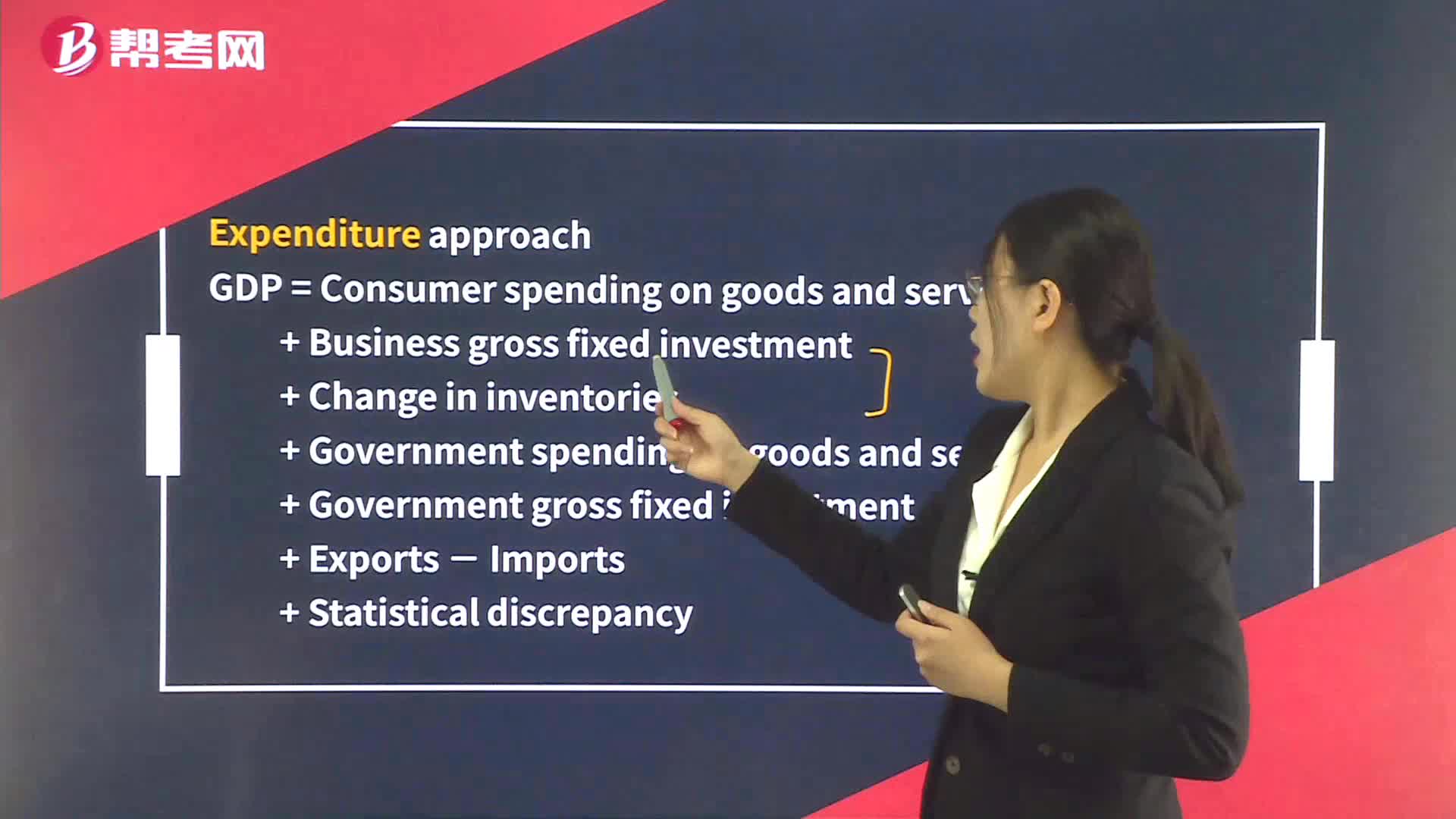

Calculation of GDP – Income Approach

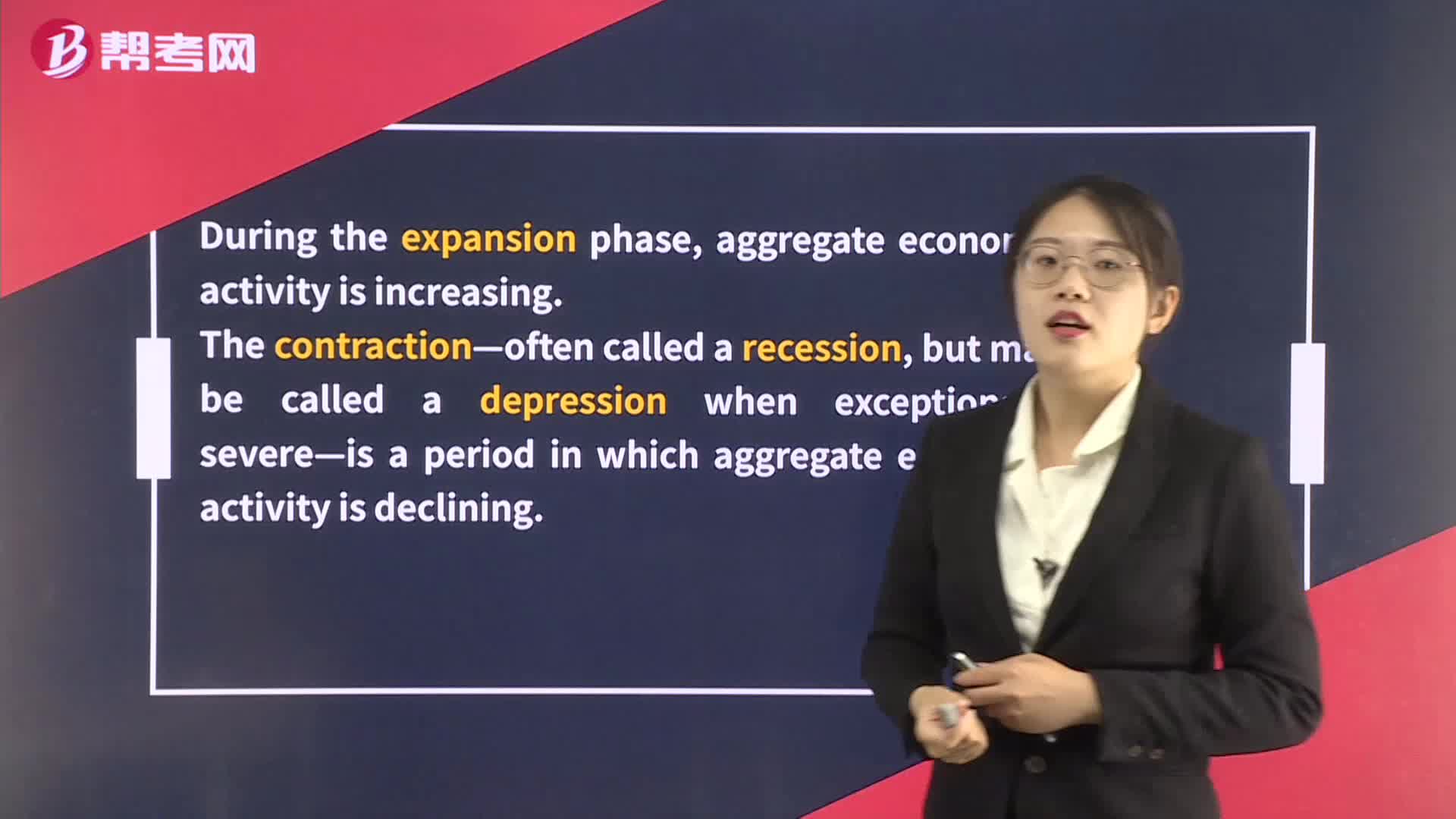

Sources of Economic Growth

下载亿题库APP

联系电话:400-660-1360