Personal Income & Personal Disposable Income

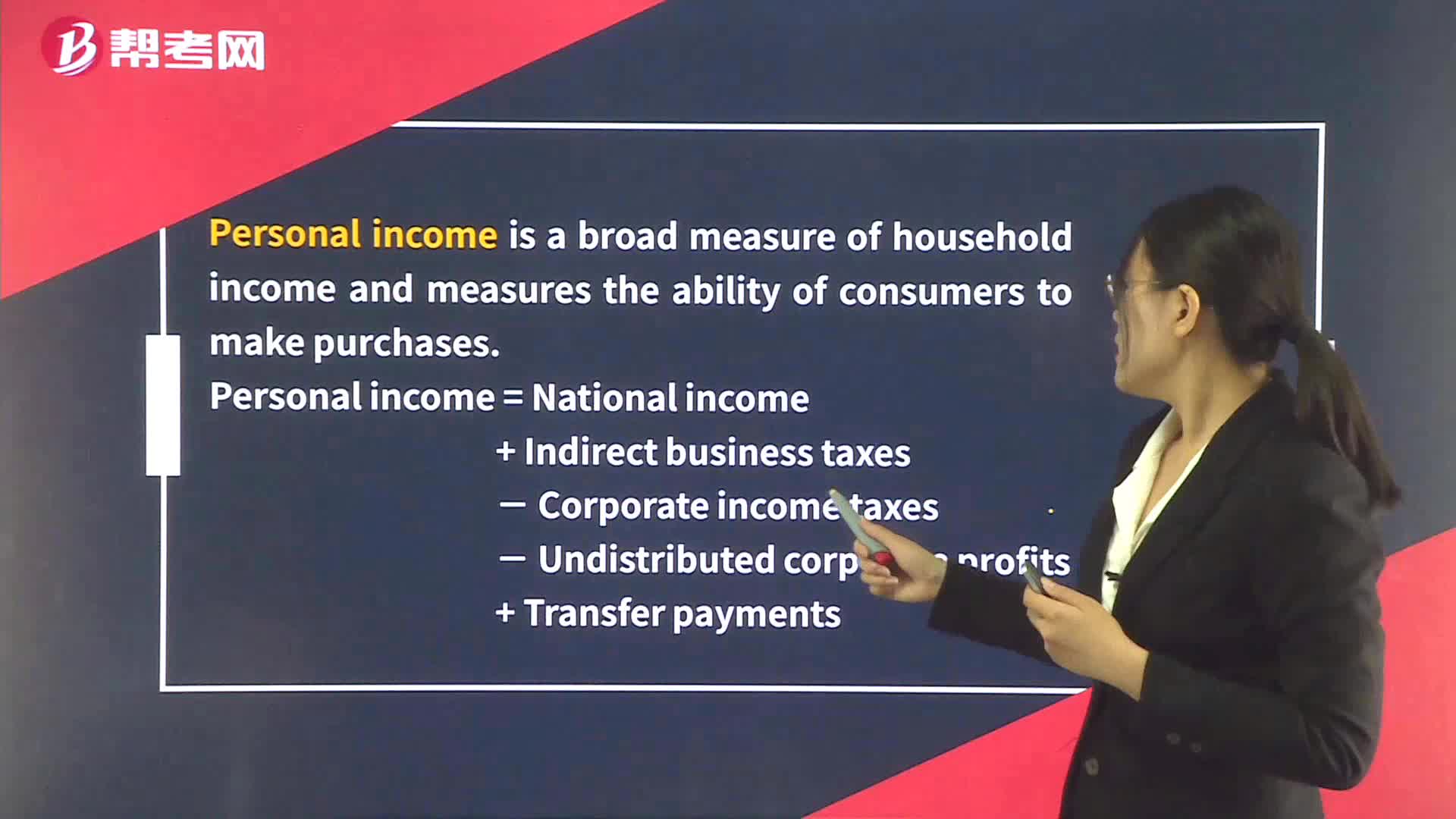

Personal income is the total amount of money earned by an individual from all sources, including wages, salaries, bonuses, tips, rental income, dividends, and interest. It is calculated before taxes and other deductions are taken out.

Personal disposable income, on the other hand, is the amount of income that an individual has left after taxes and other deductions have been taken out. This is the income that an individual has available to spend or save as they choose.

Personal disposable income is calculated by subtracting all taxes, including federal, state, and local income taxes, Social Security taxes, and Medicare taxes, from personal income. Other deductions, such as contributions to retirement accounts or health insurance premiums, may also be subtracted from personal income to arrive at personal disposable income.

Personal disposable income is an important measure of an individual's financial well-being, as it reflects the amount of money that they have available to spend on goods and services, save for the future, or invest in the stock market or other financial vehicles.

帮考网校

帮考网校