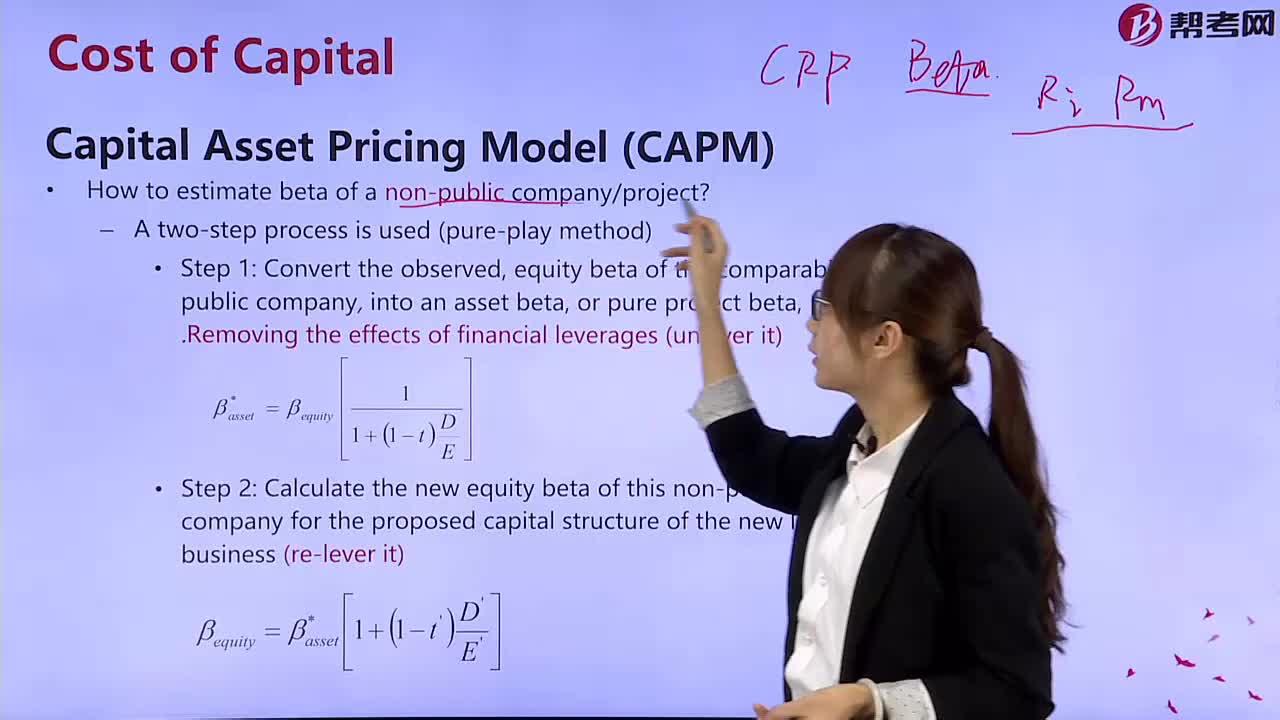

how to estimate beta of a non-public company?

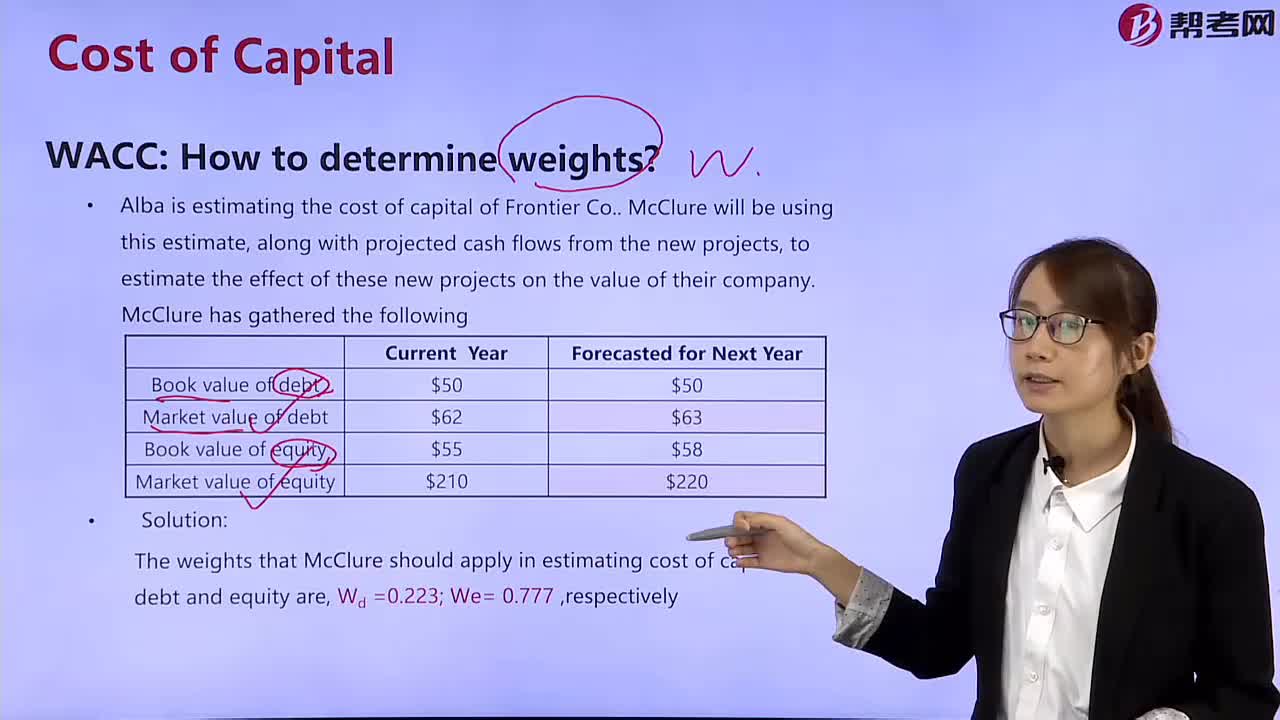

How to determine weights?

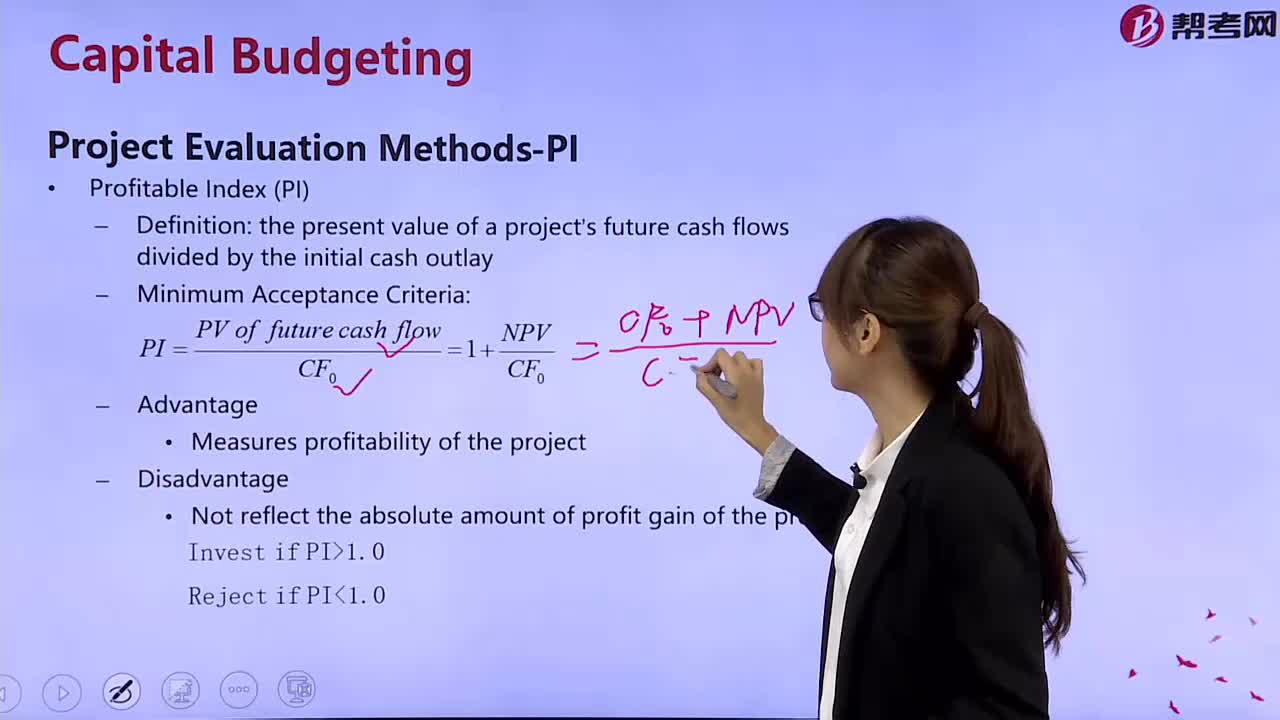

How to calculate a favorable index?

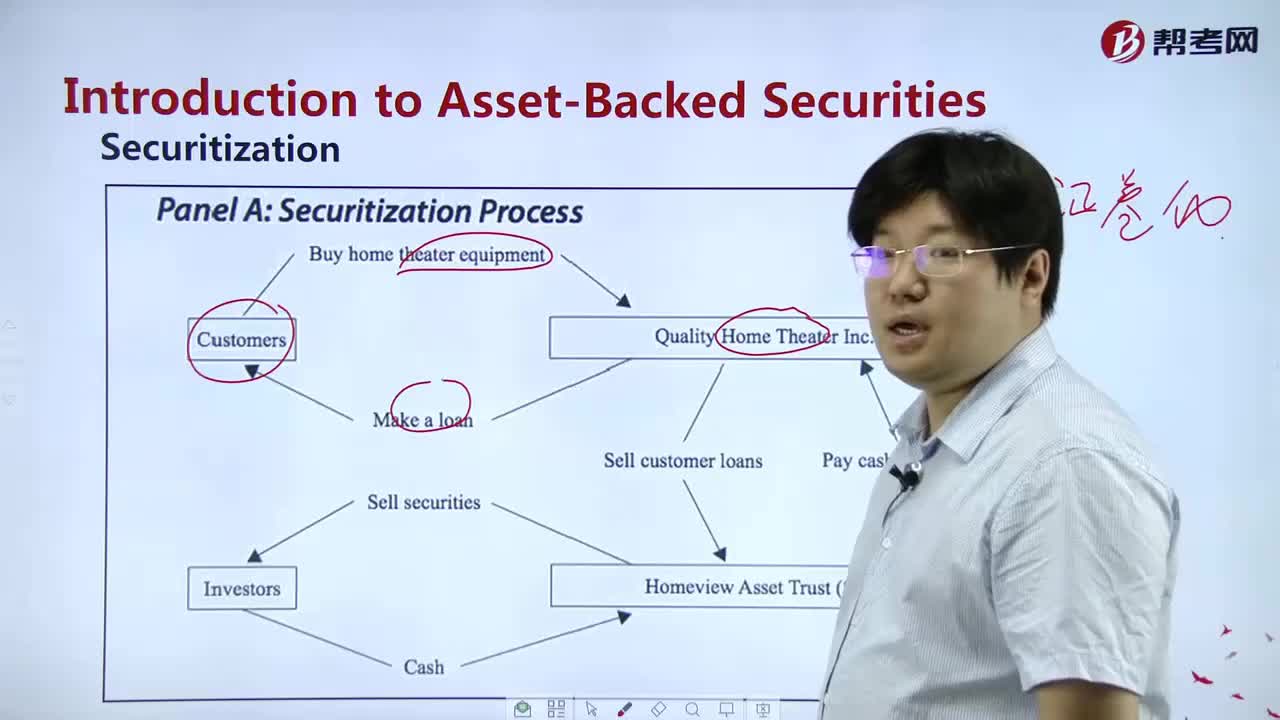

How to master Securitization?

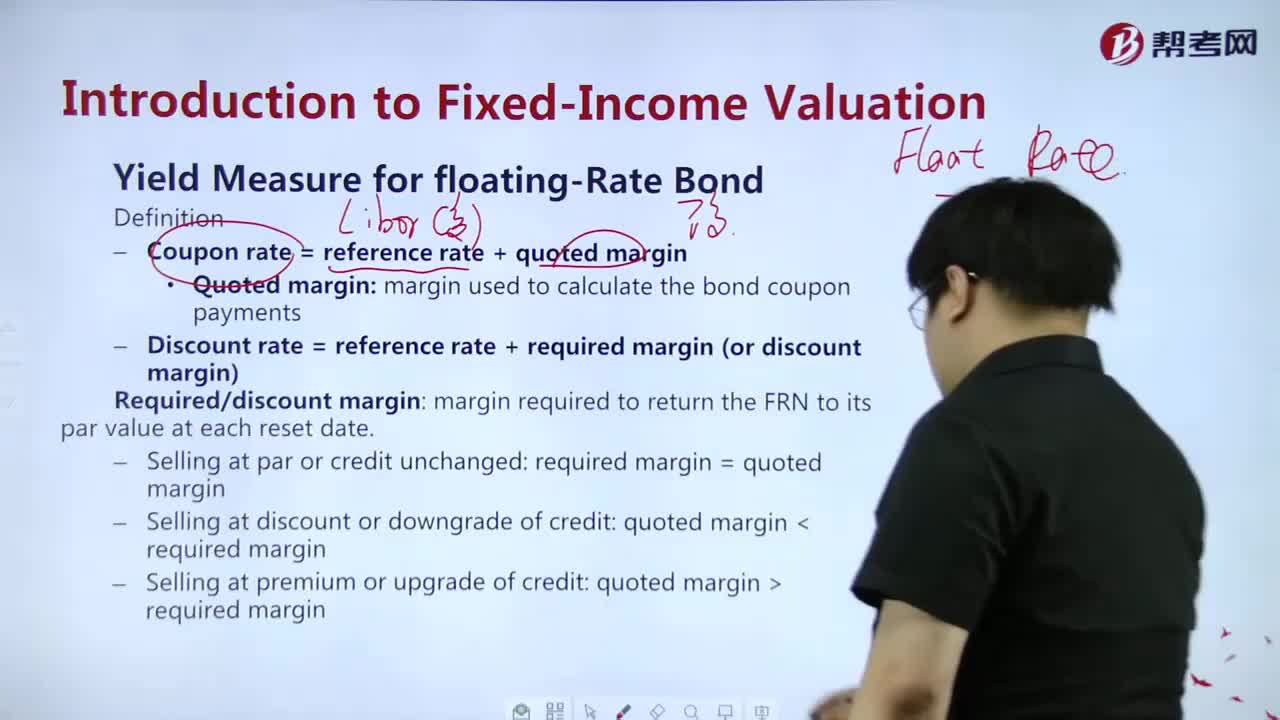

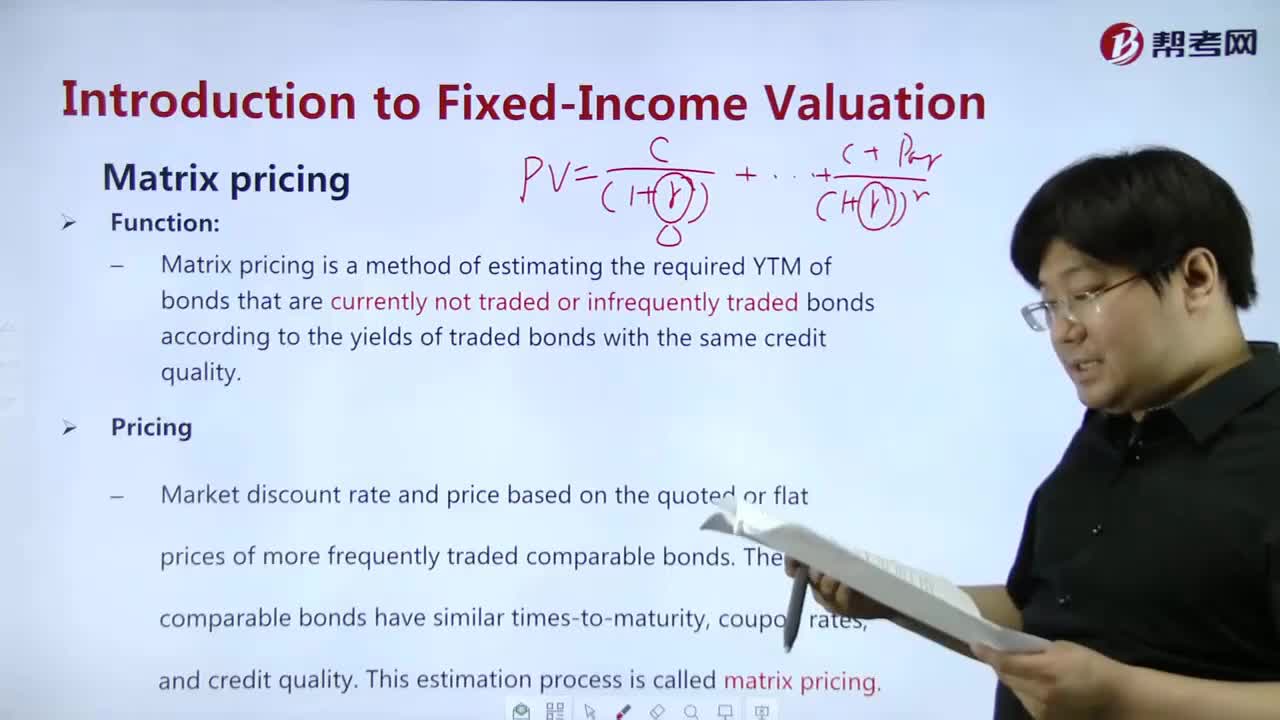

How to understand YTM for fixed rate Bond?

How to explain to you Matrix pricing?

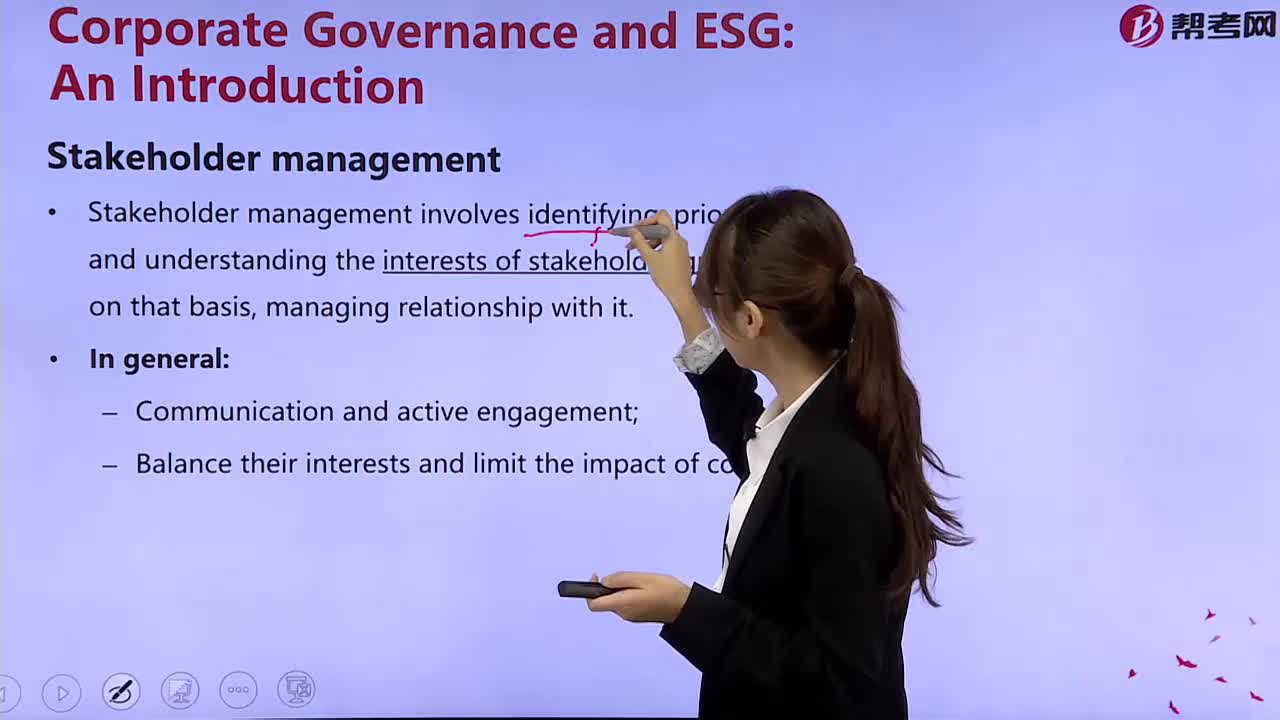

How to manage the claims among stakeholders?

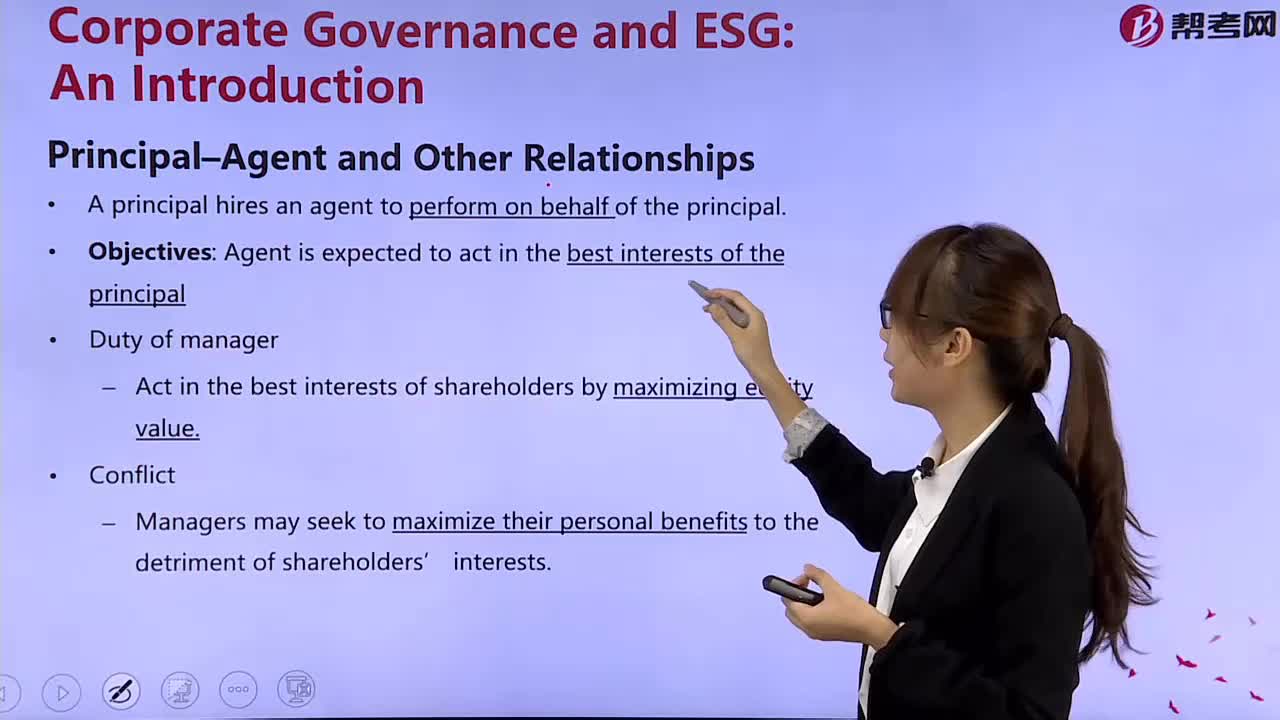

What does a controlling shareholder have to do with a minority shareholder?

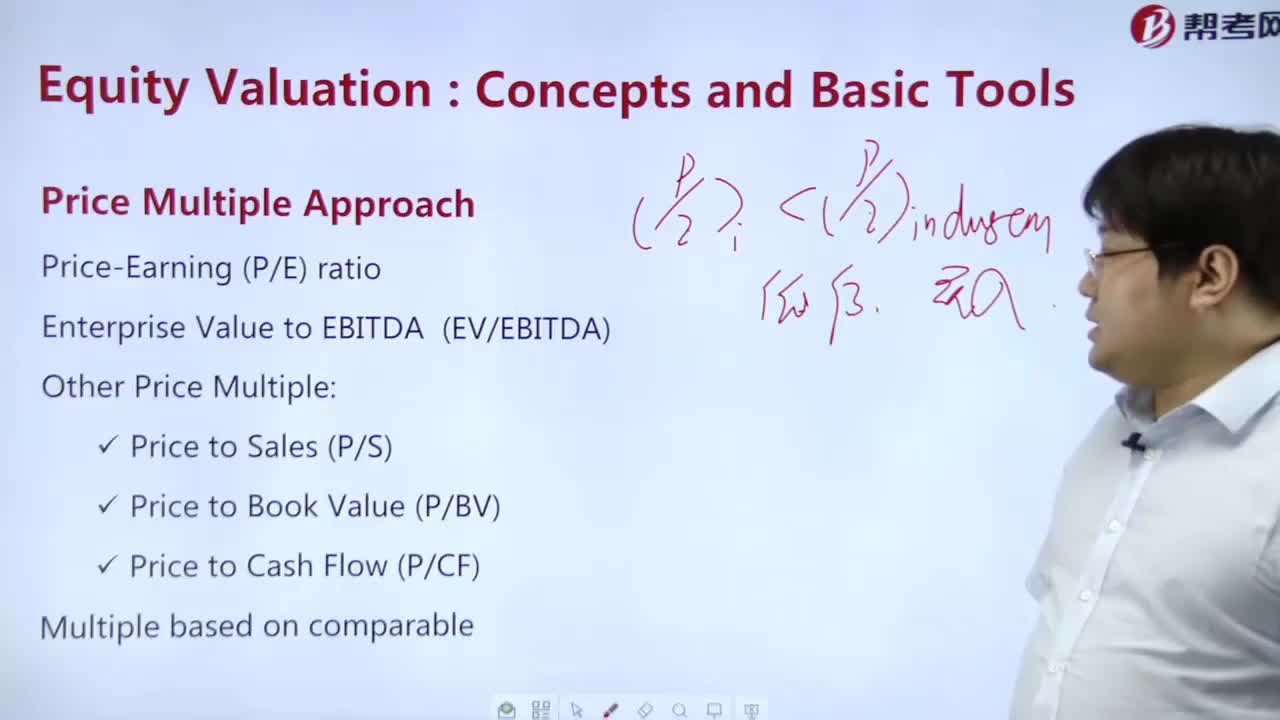

What are the elements of a multi-price strategy?

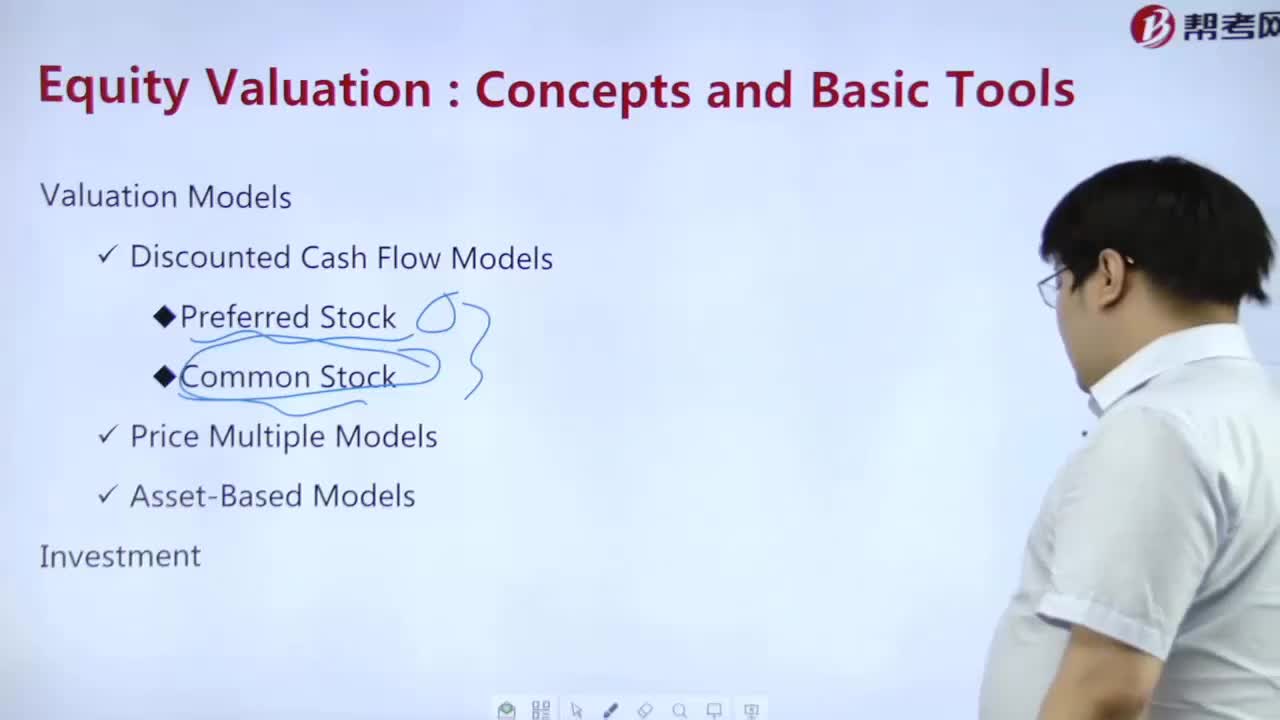

How to calculate the value of preferred stock?

What is the meaning of a Fixed Income Index?

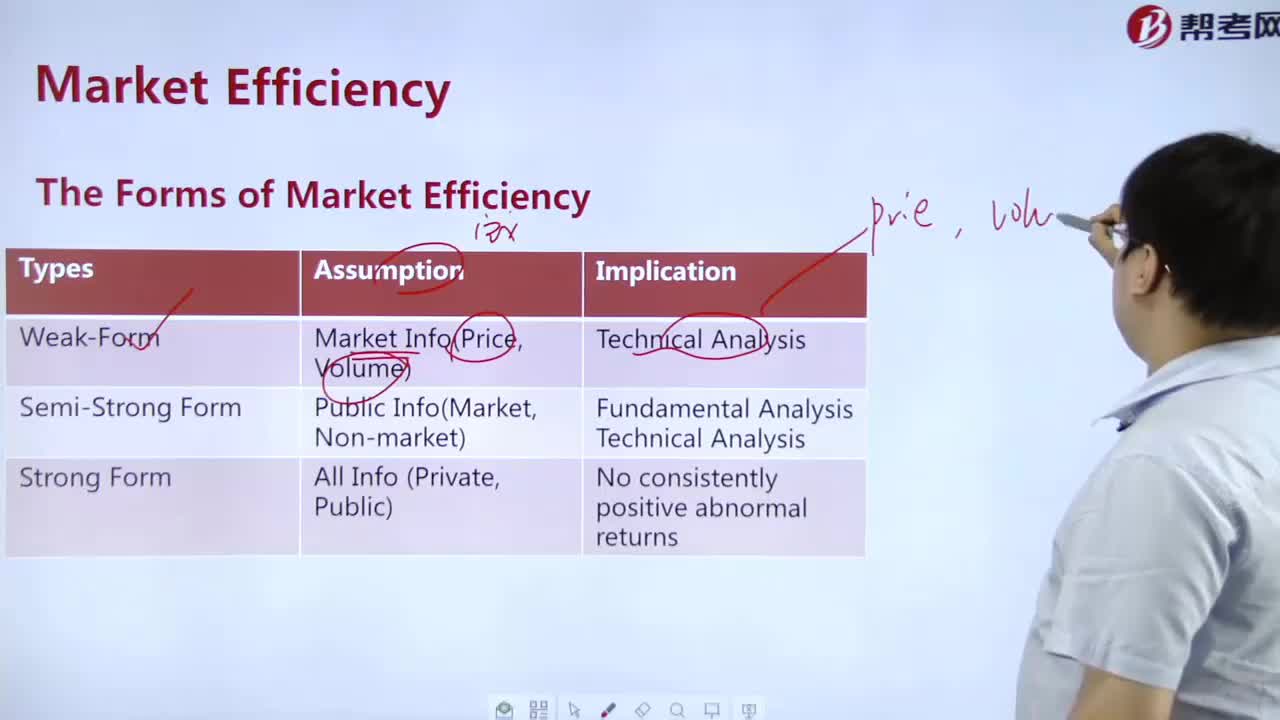

How many are there The Forms of Market Efficiency?

下载亿题库APP

联系电话:400-660-1360