How to master Residential Mortgage Loans?

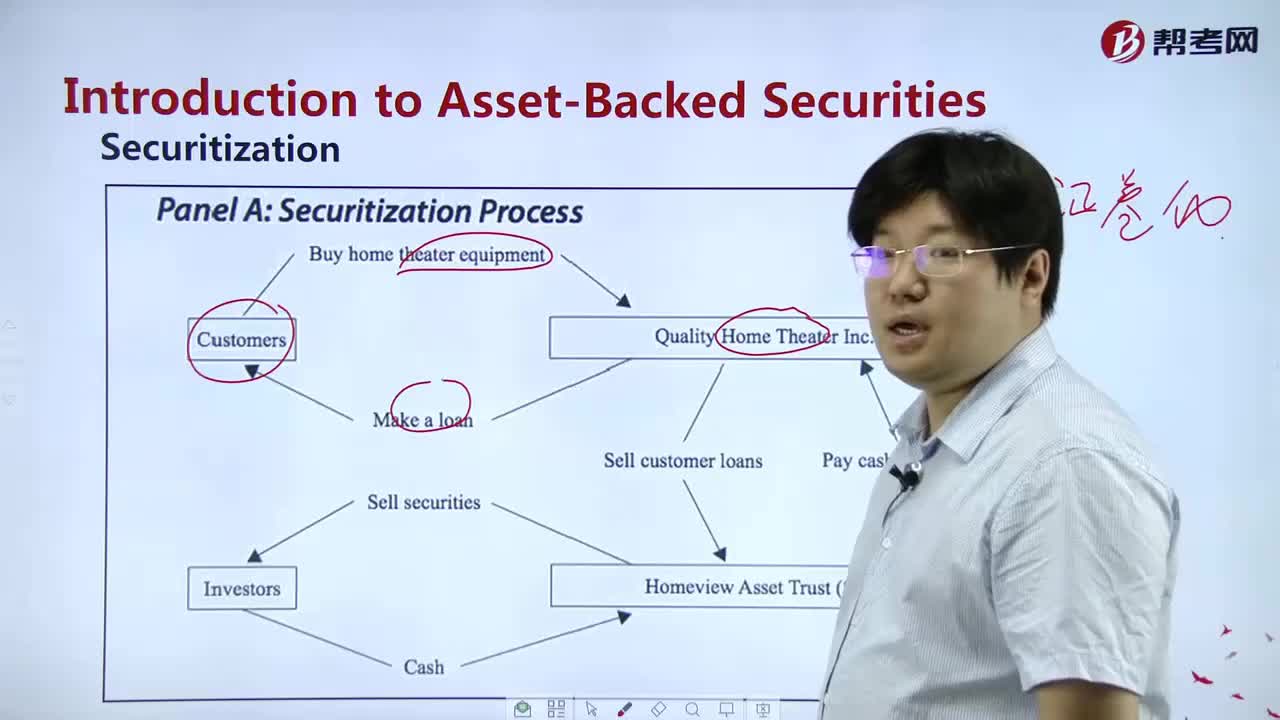

How to master Securitization?

What's that supposed to mean Convertible?

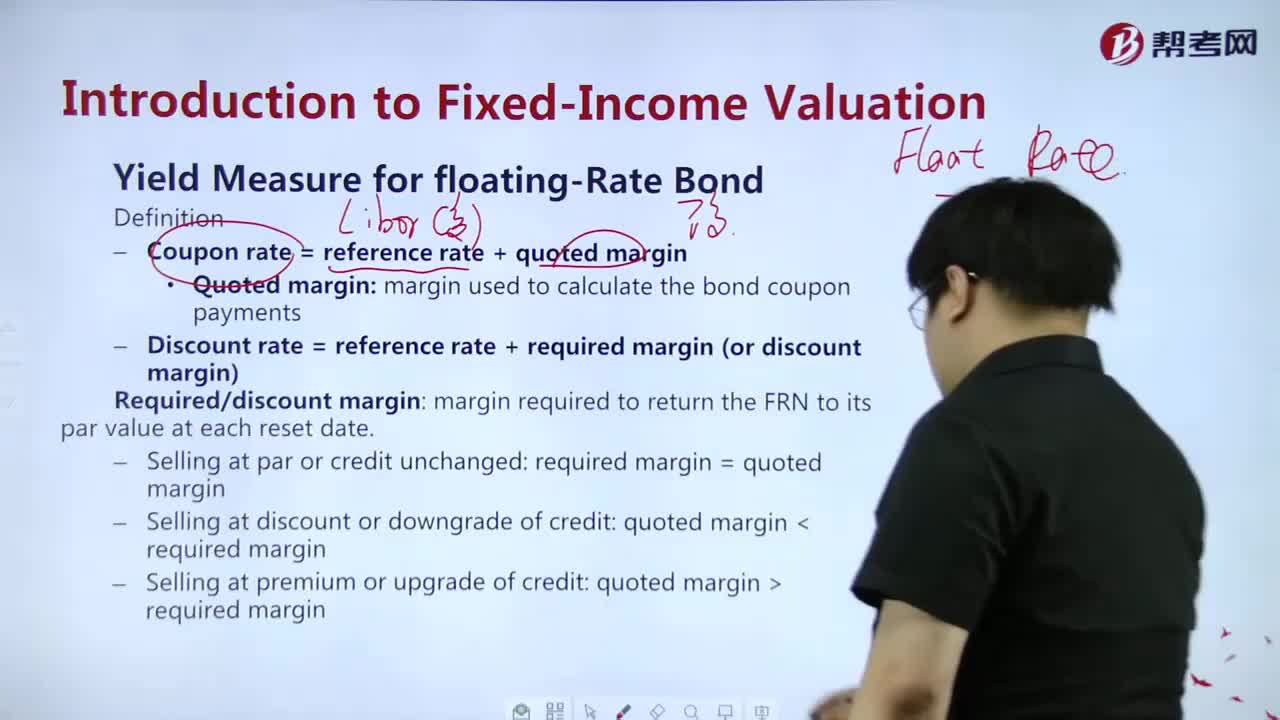

How to understand YTM for fixed rate Bond?

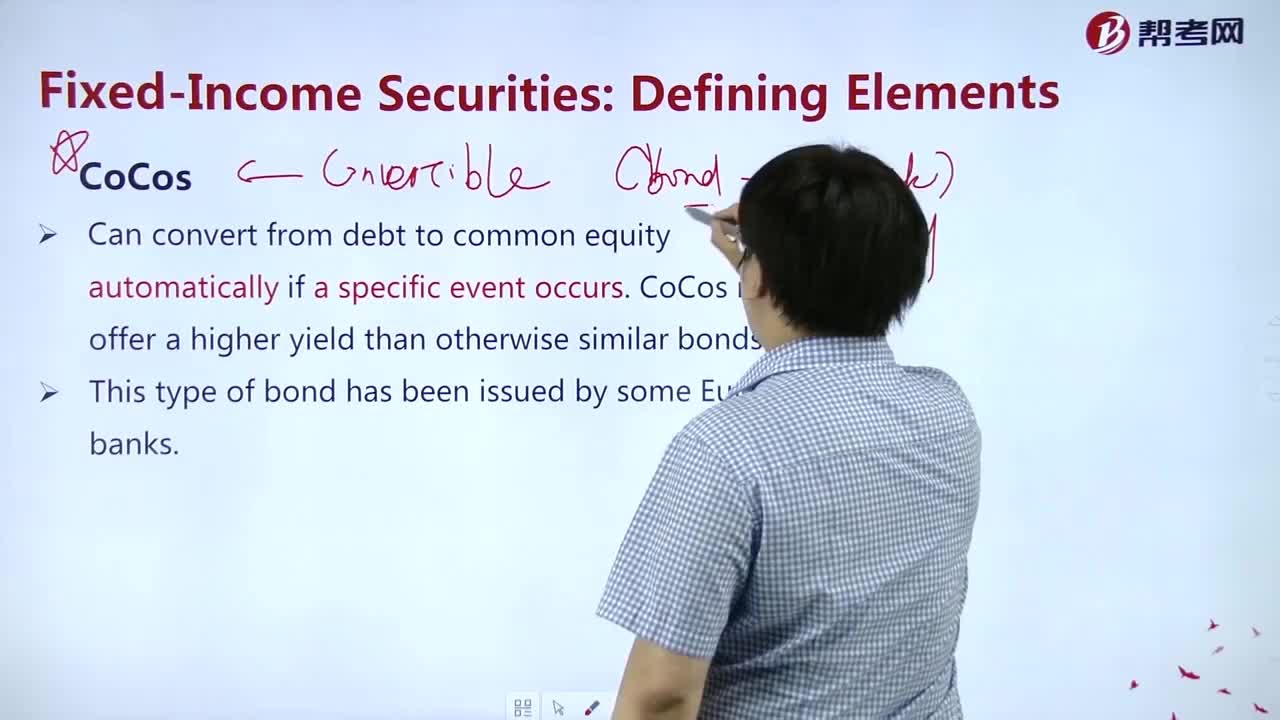

What's that supposed to mean CoCos?

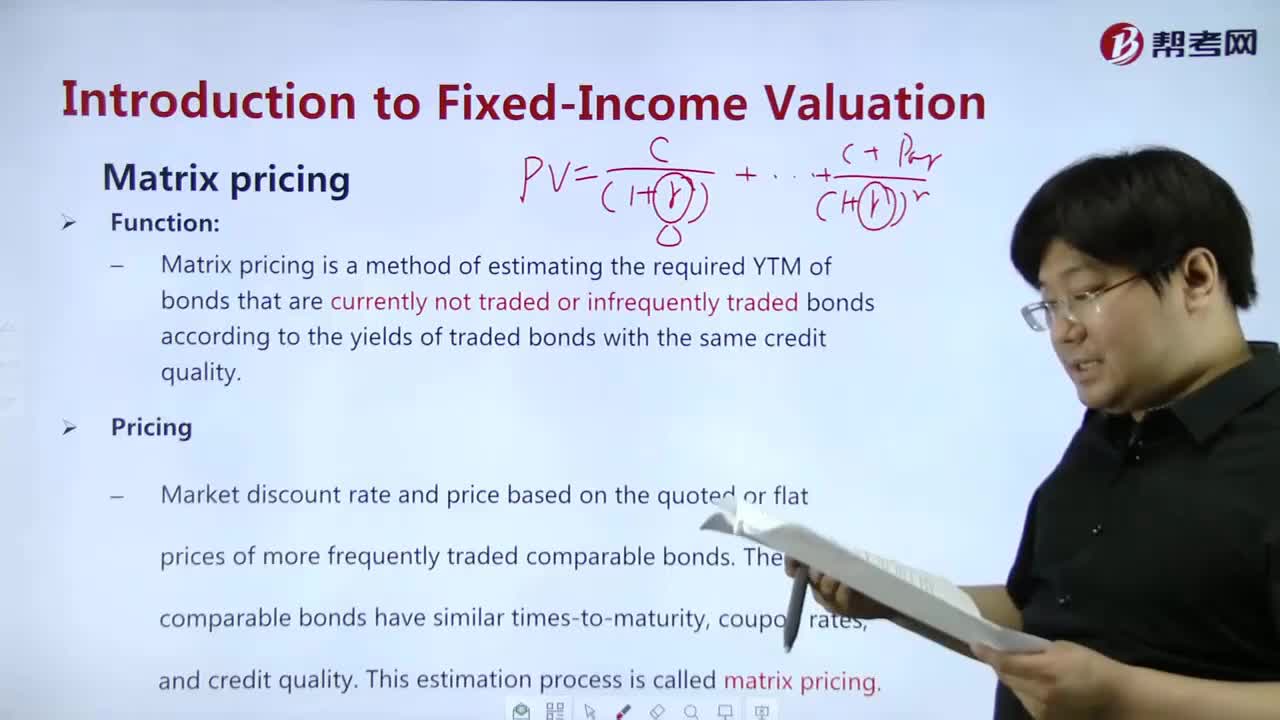

How to explain to you Matrix pricing?

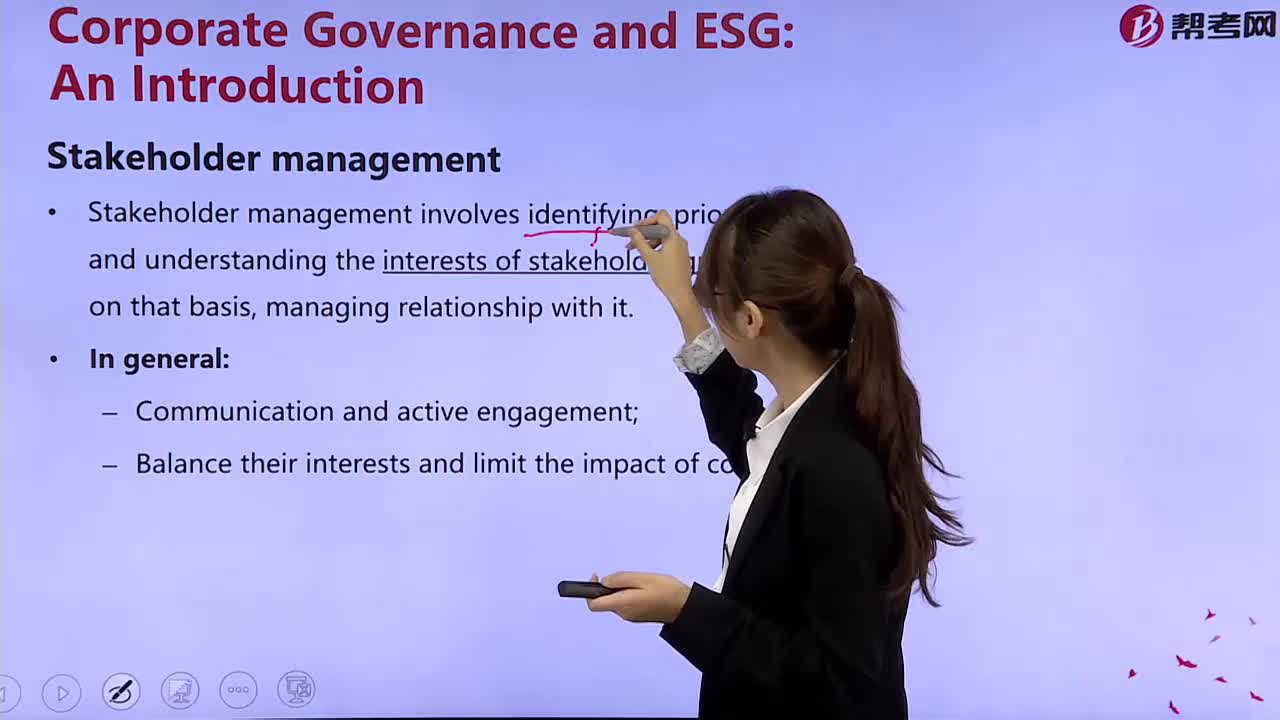

How to manage the claims among stakeholders?

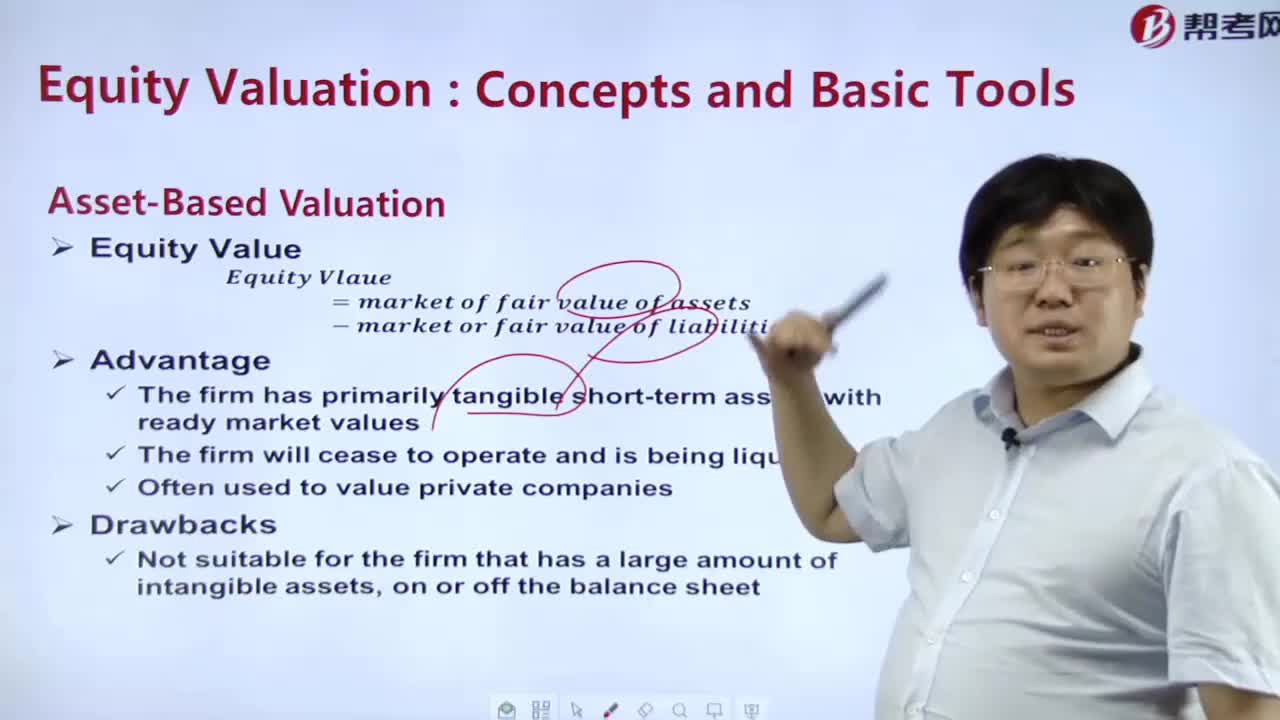

What does asset-based valuation include?

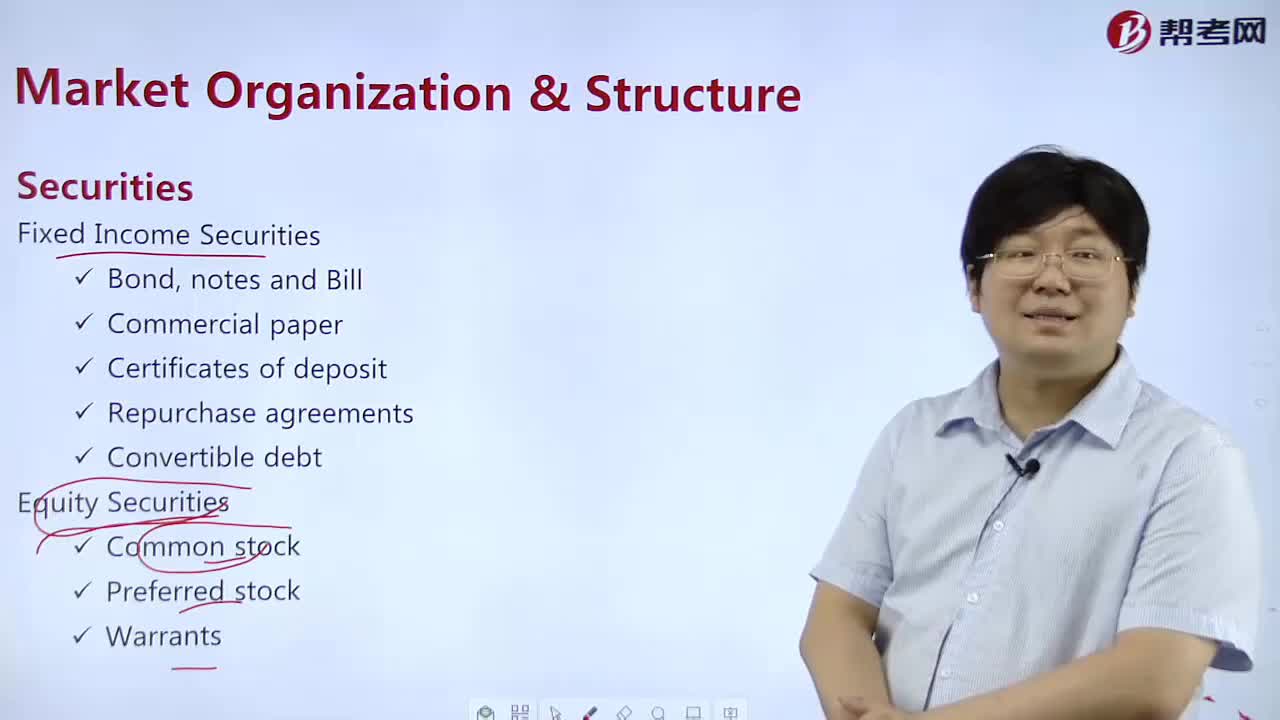

What are the types of securities?

What is the meaning of a Fixed Income Index?

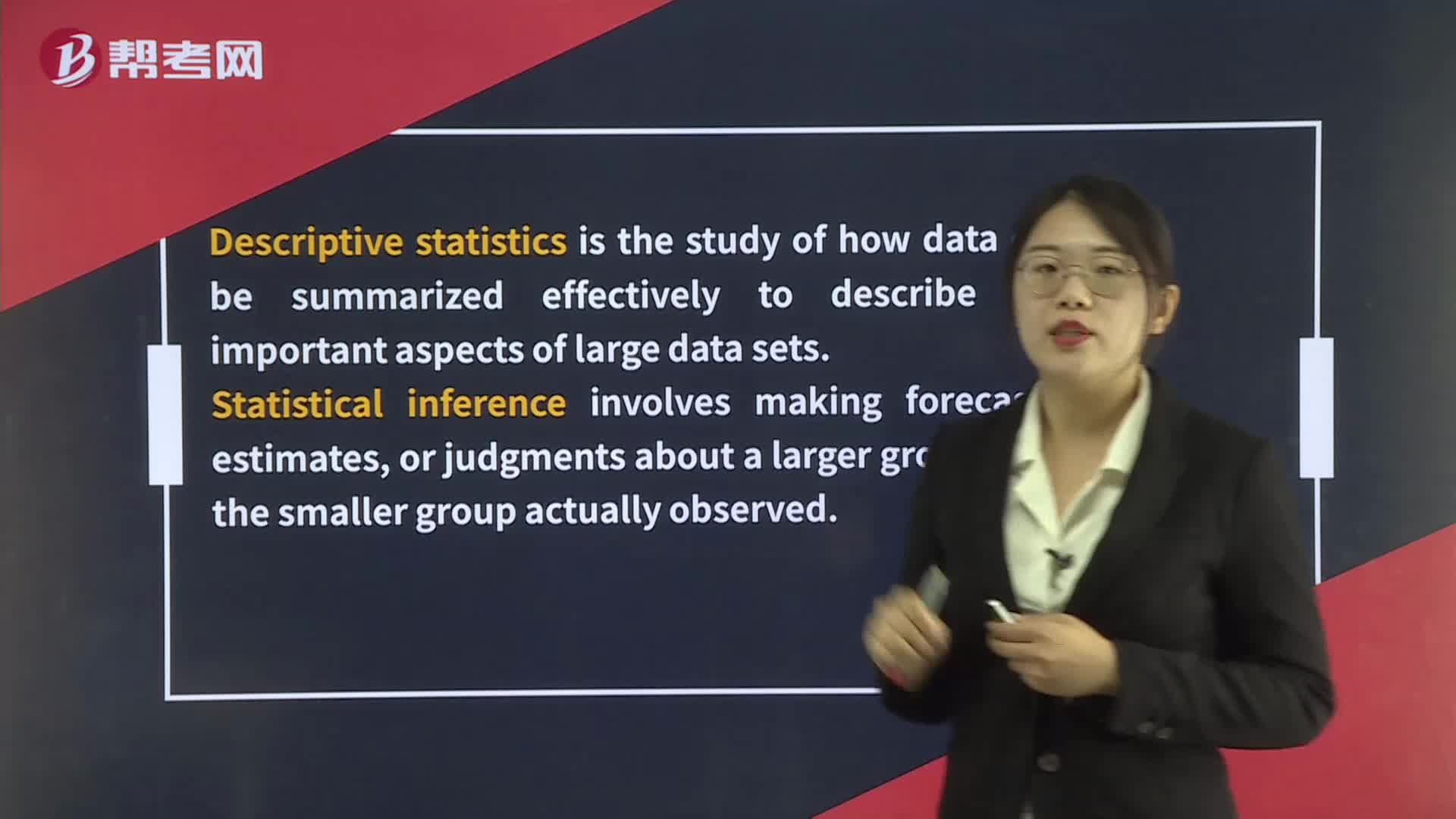

Fundamental Concepts of Statistics

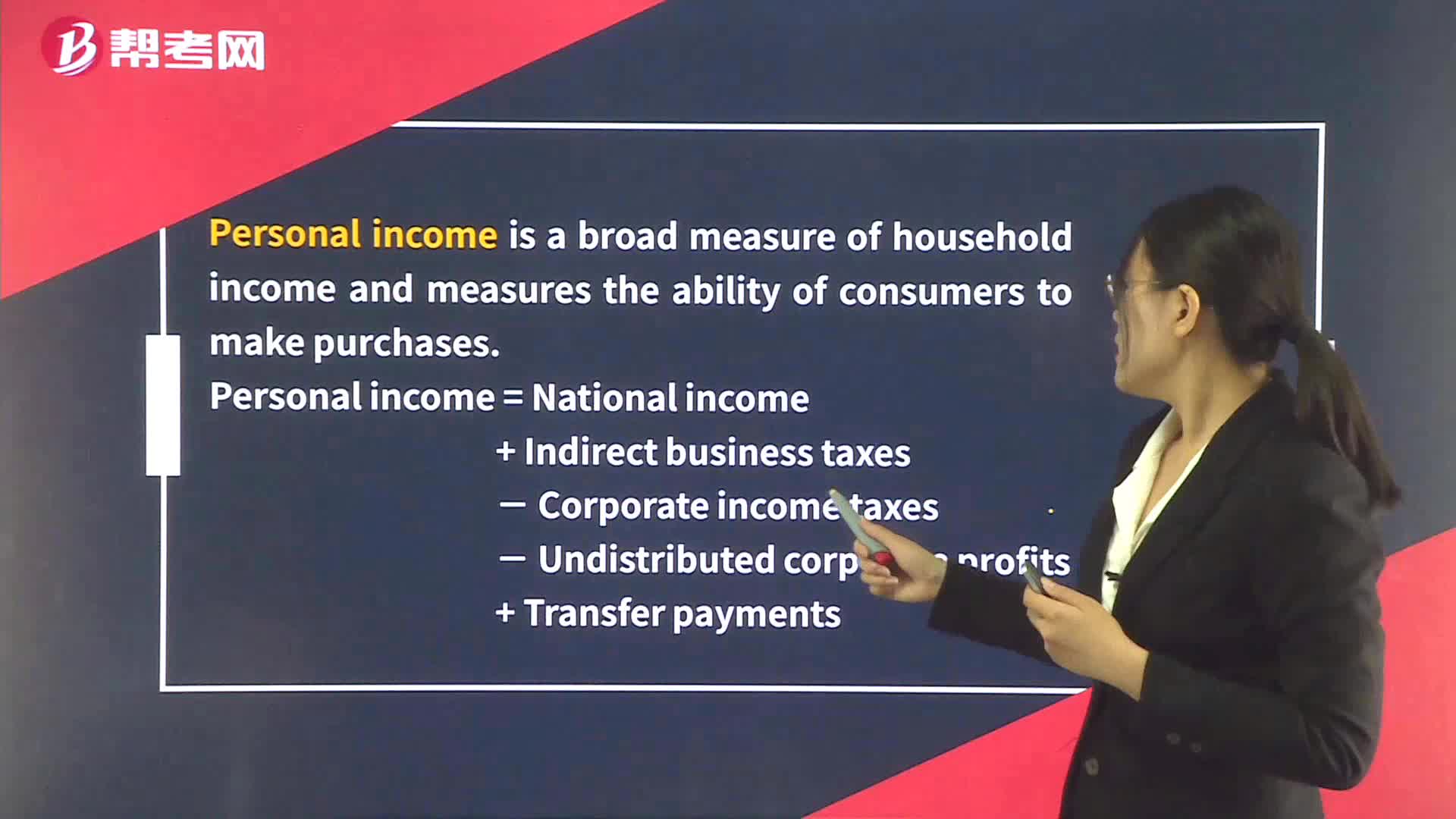

Personal Income & Personal Disposable Income

下载亿题库APP

联系电话:400-660-1360