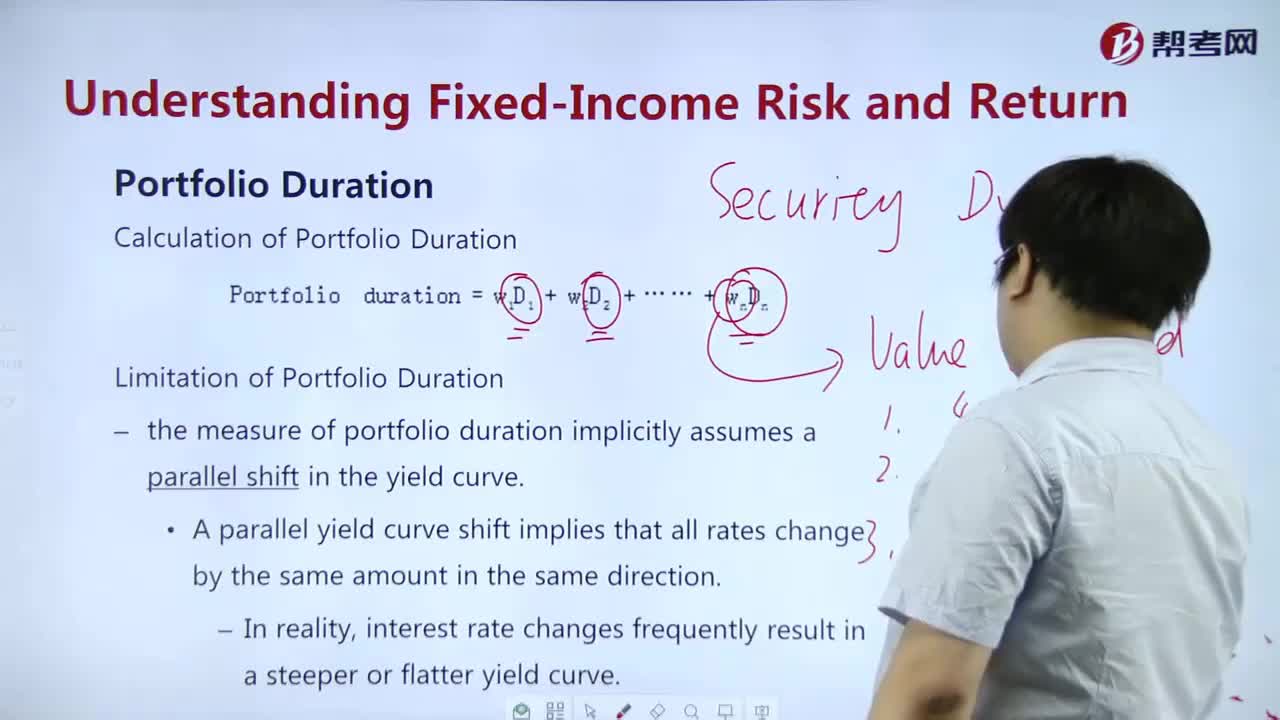

How to understand Portfolio Duration?

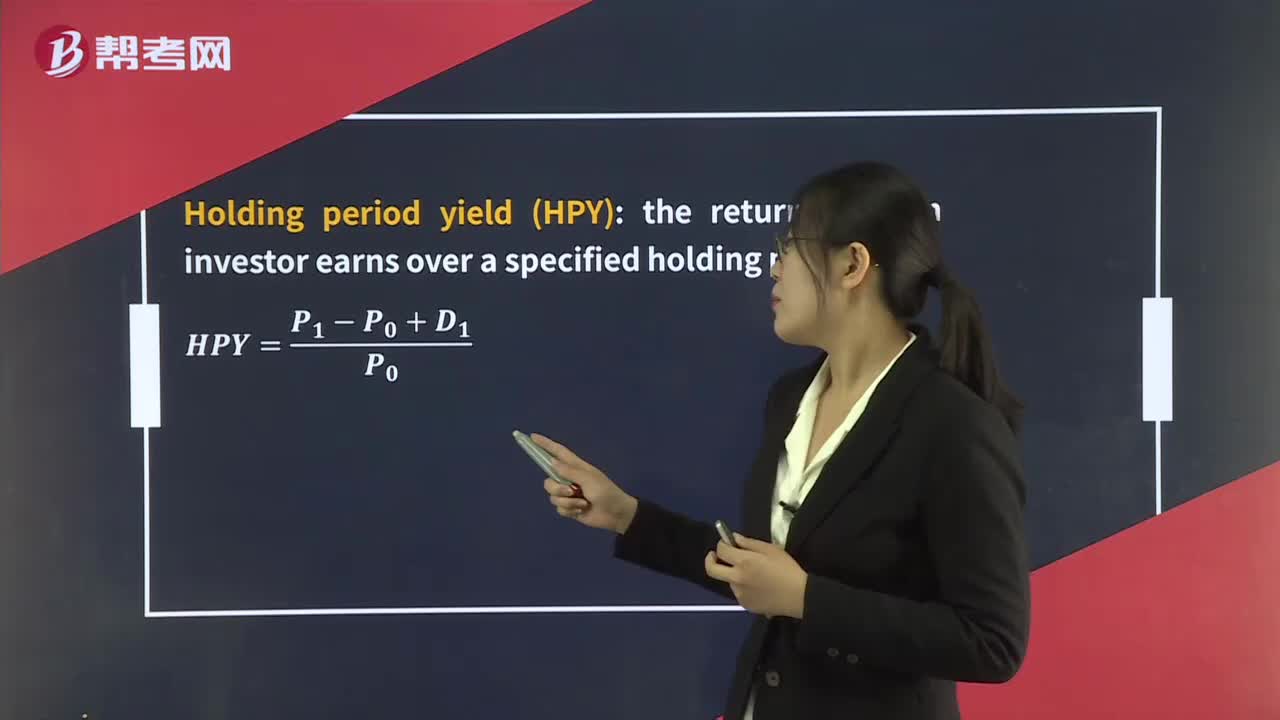

What's the Income Valuation-Yield Measure of Bond?

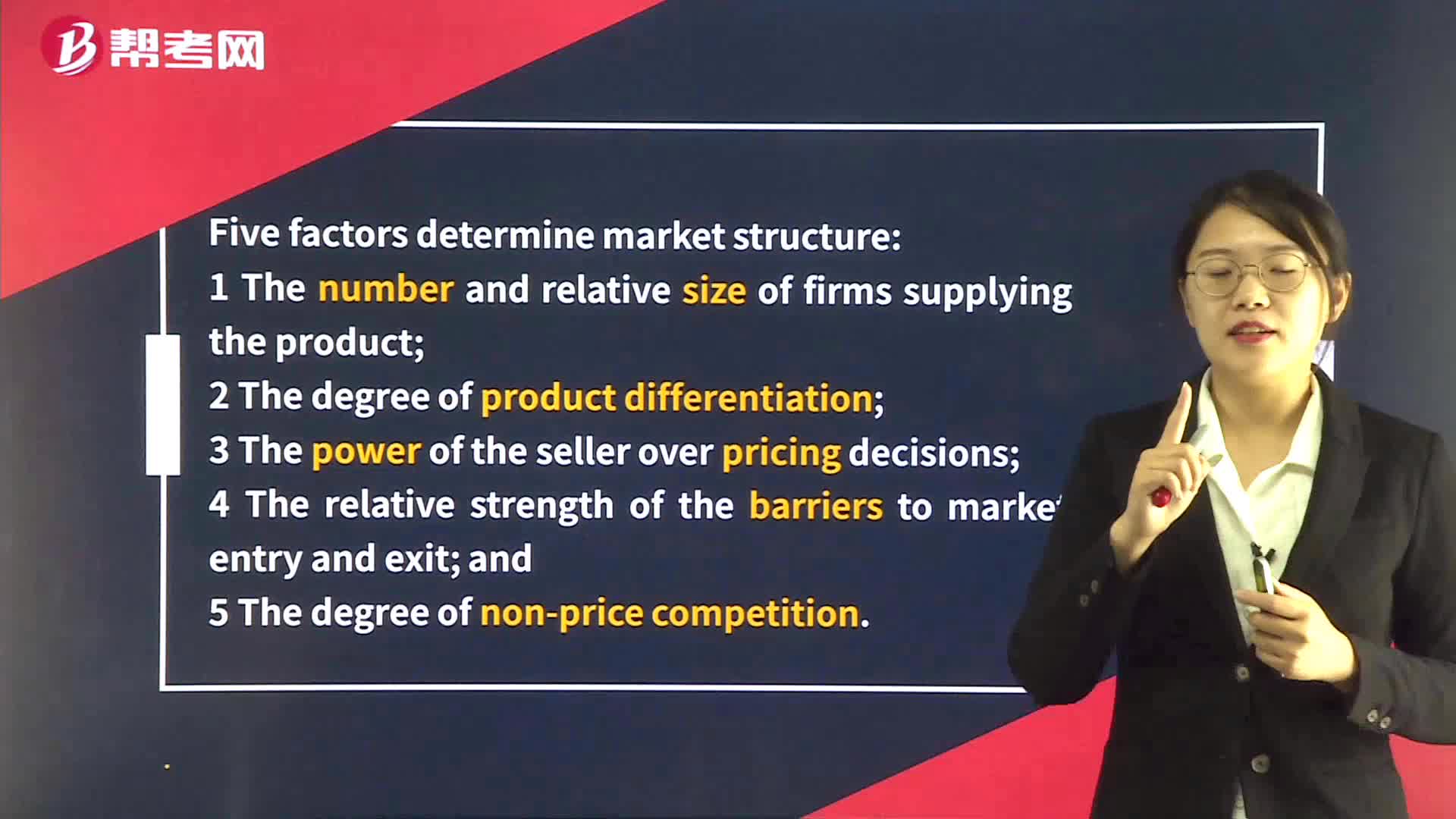

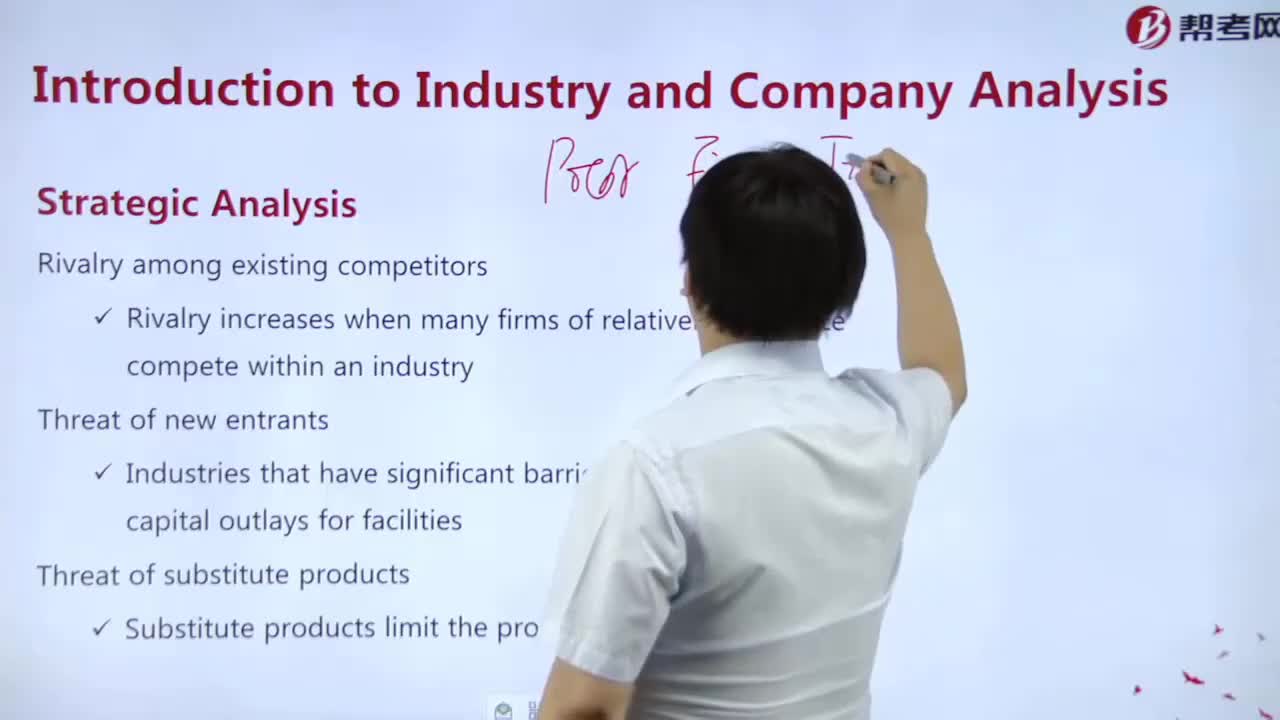

The steps of strategic analysis?

What is the meaning of a Fixed Income Index?

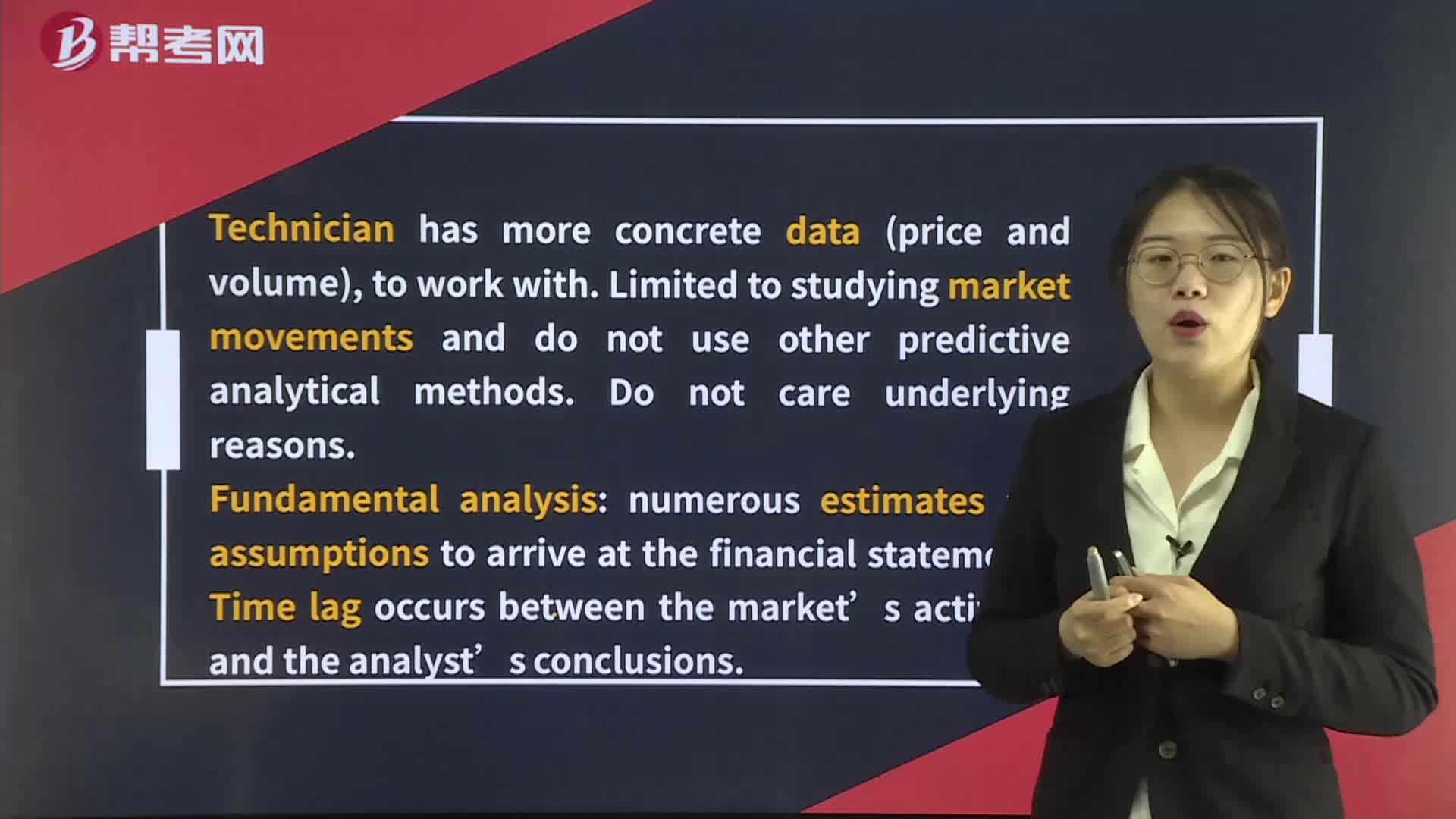

Technical and Fundamental Analysis

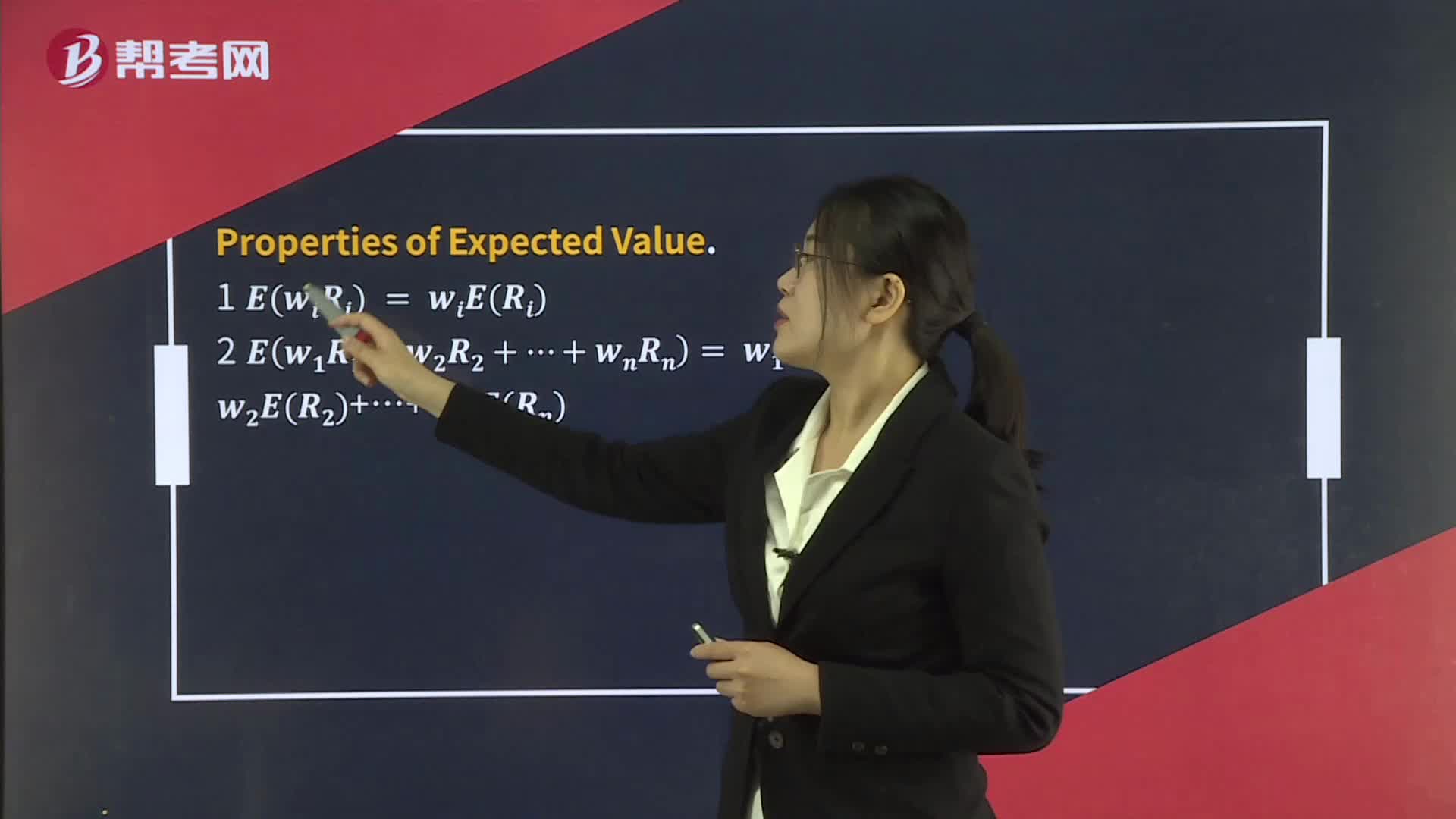

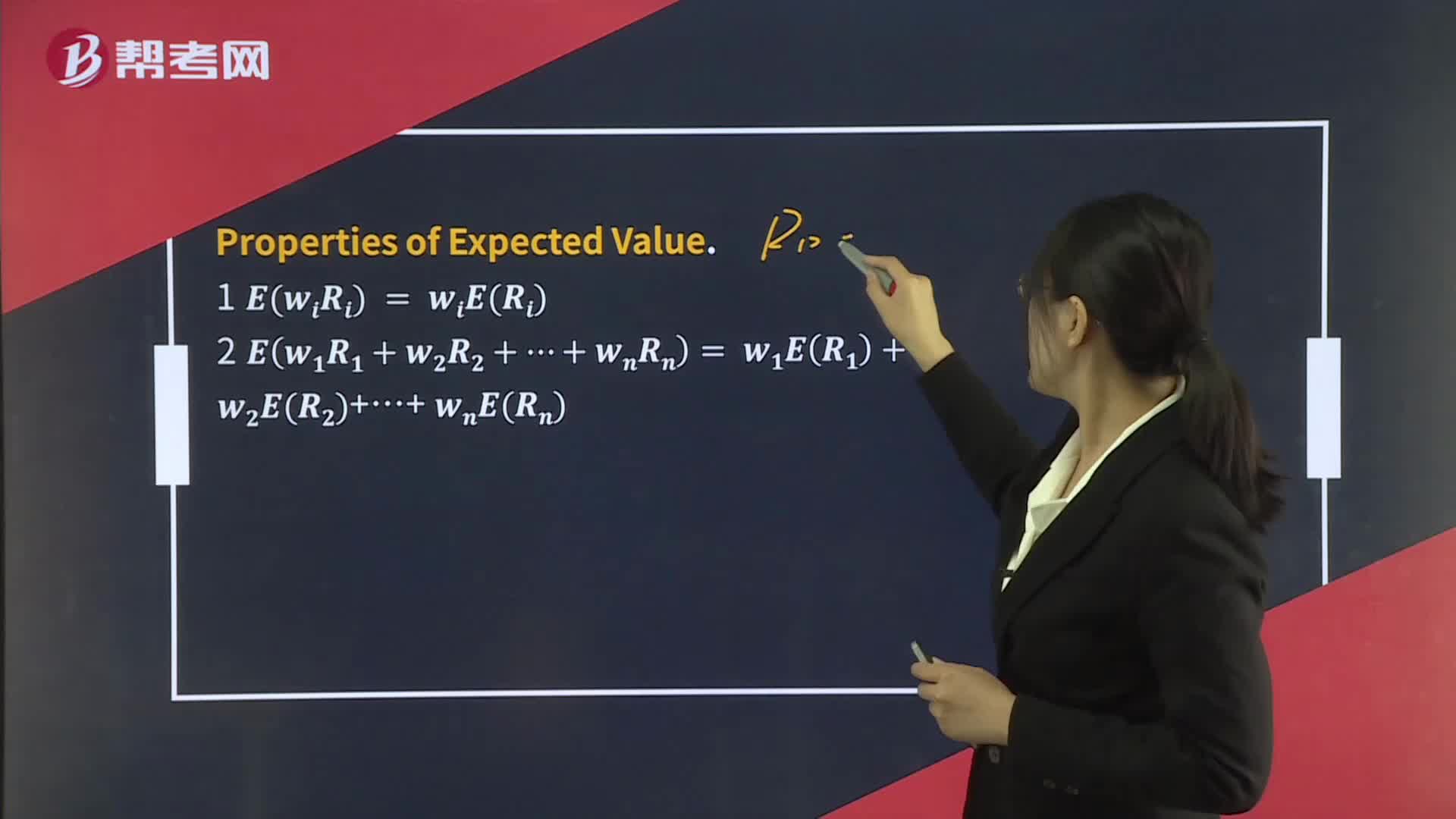

Portfolio Expected Return and Variance of Return

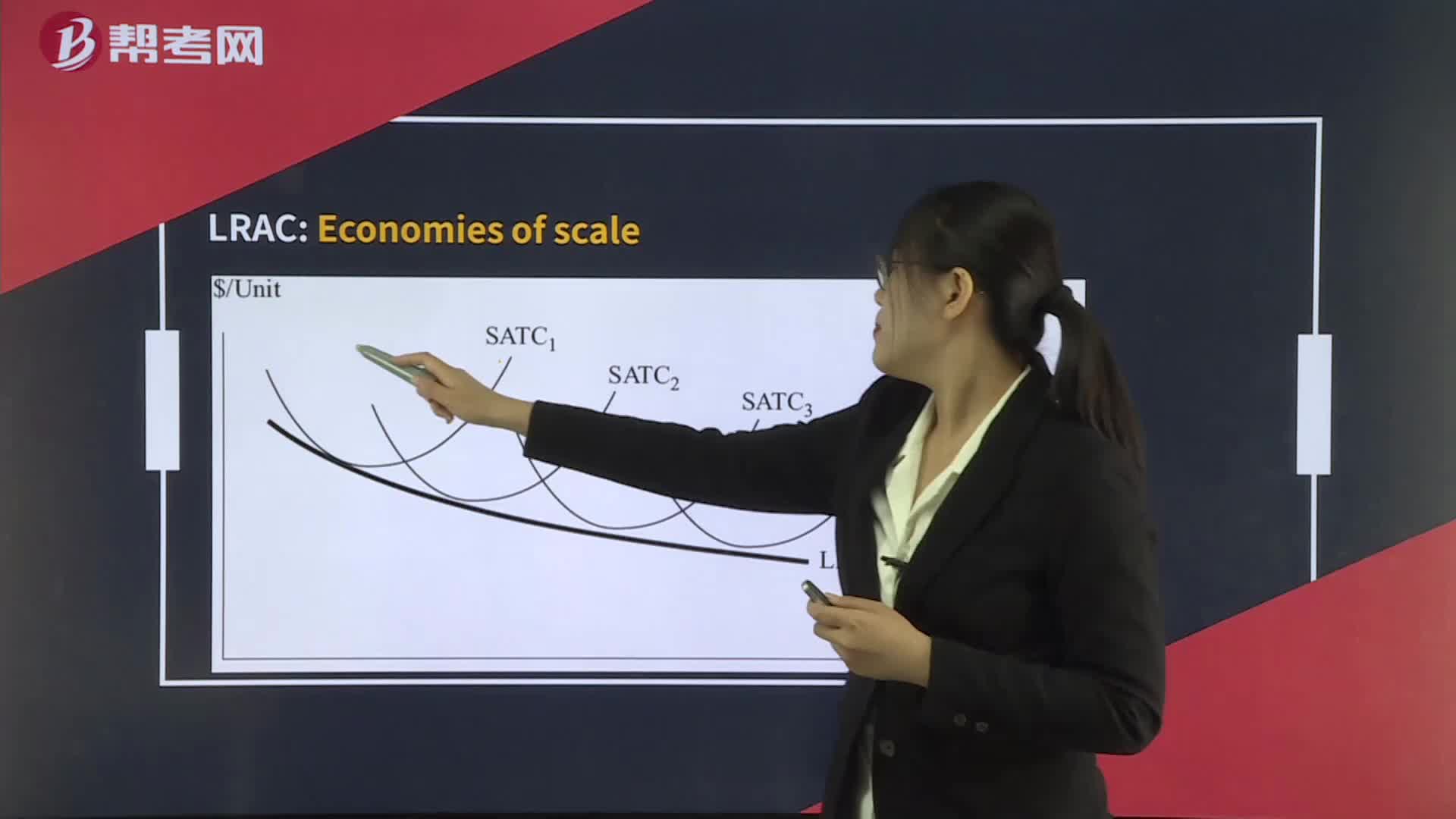

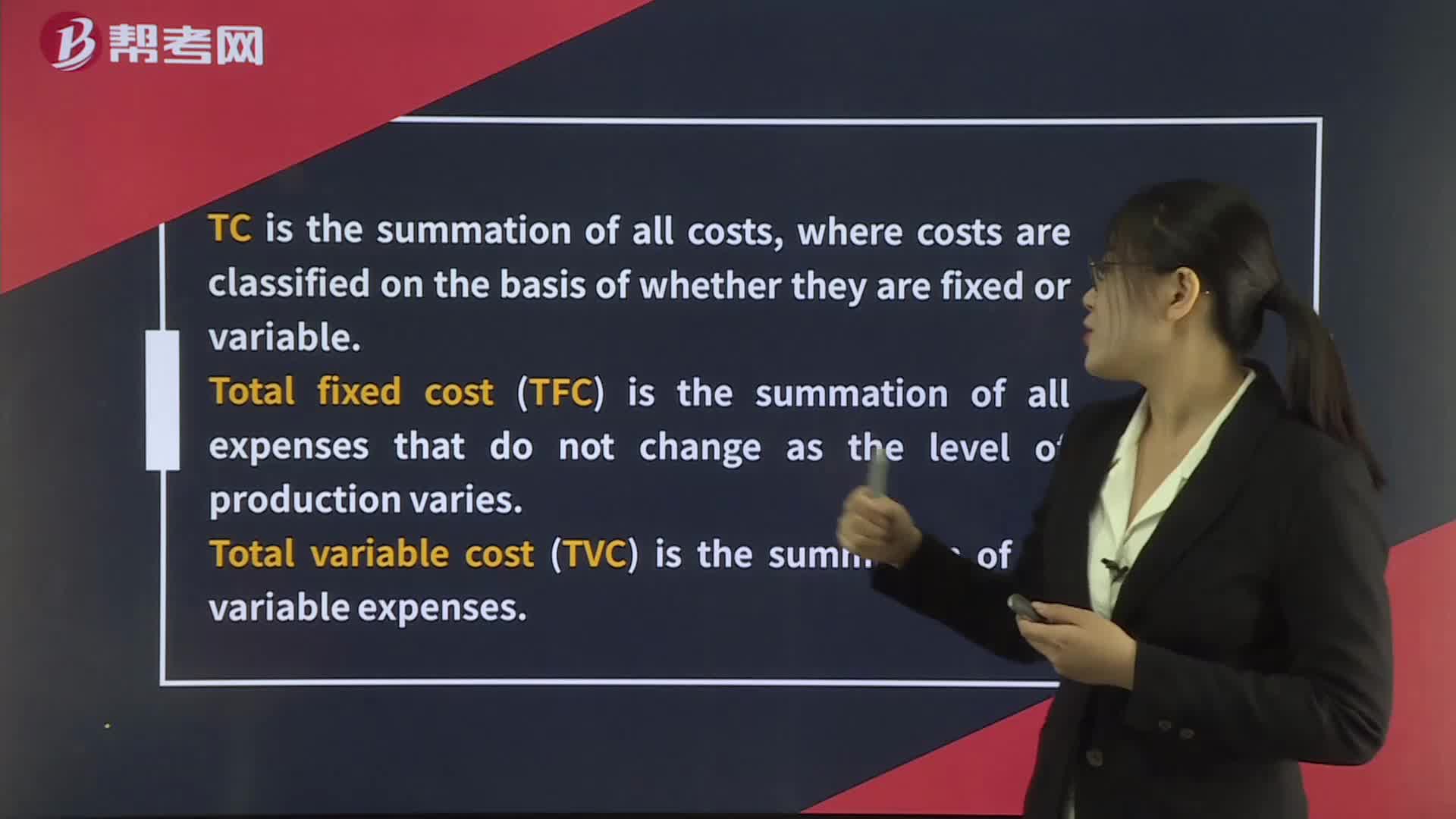

Total, Variable, Fixed, and Marginal Cost and Output

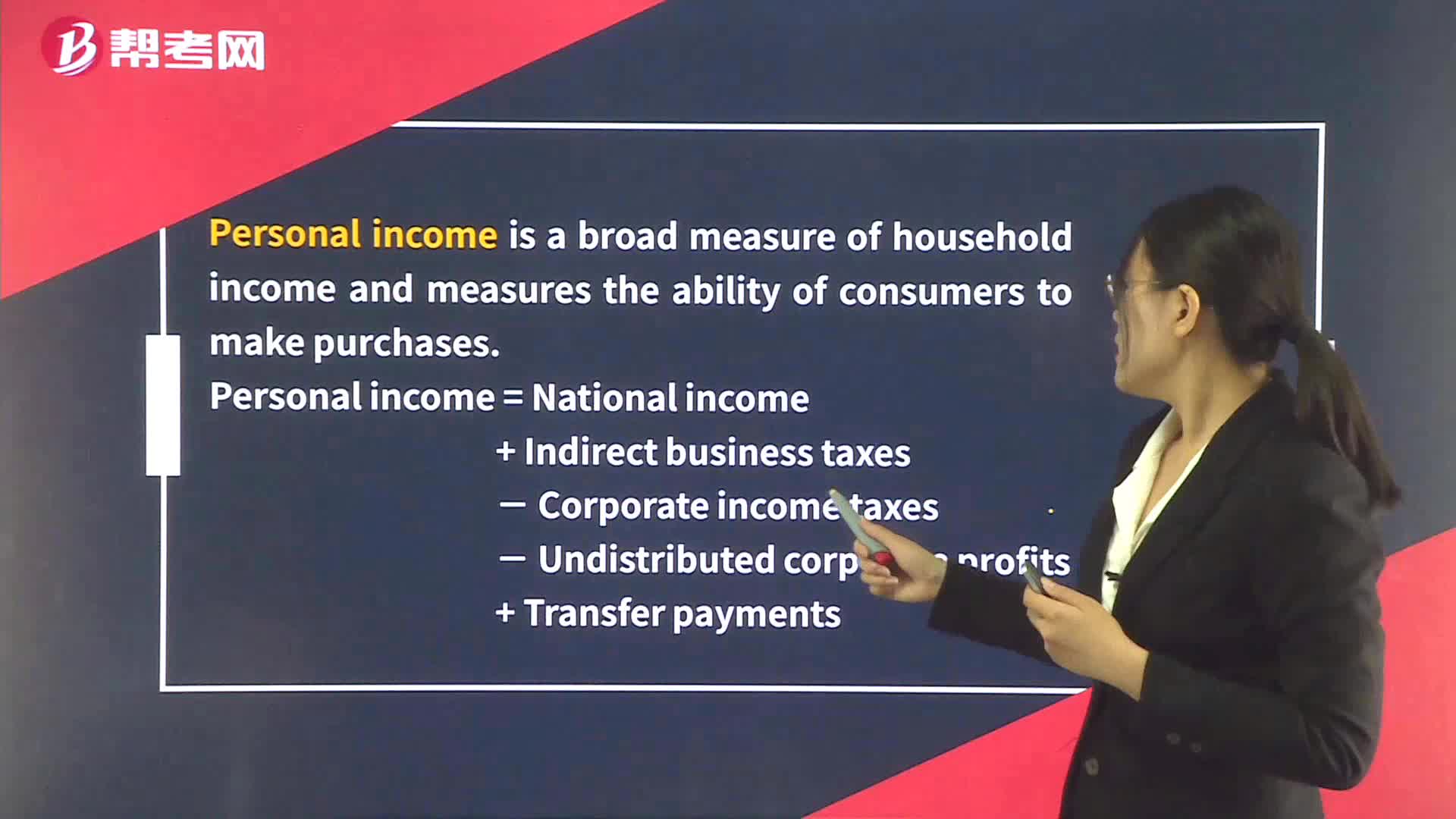

Personal Income & Personal Disposable Income

Substitution and Income Effects

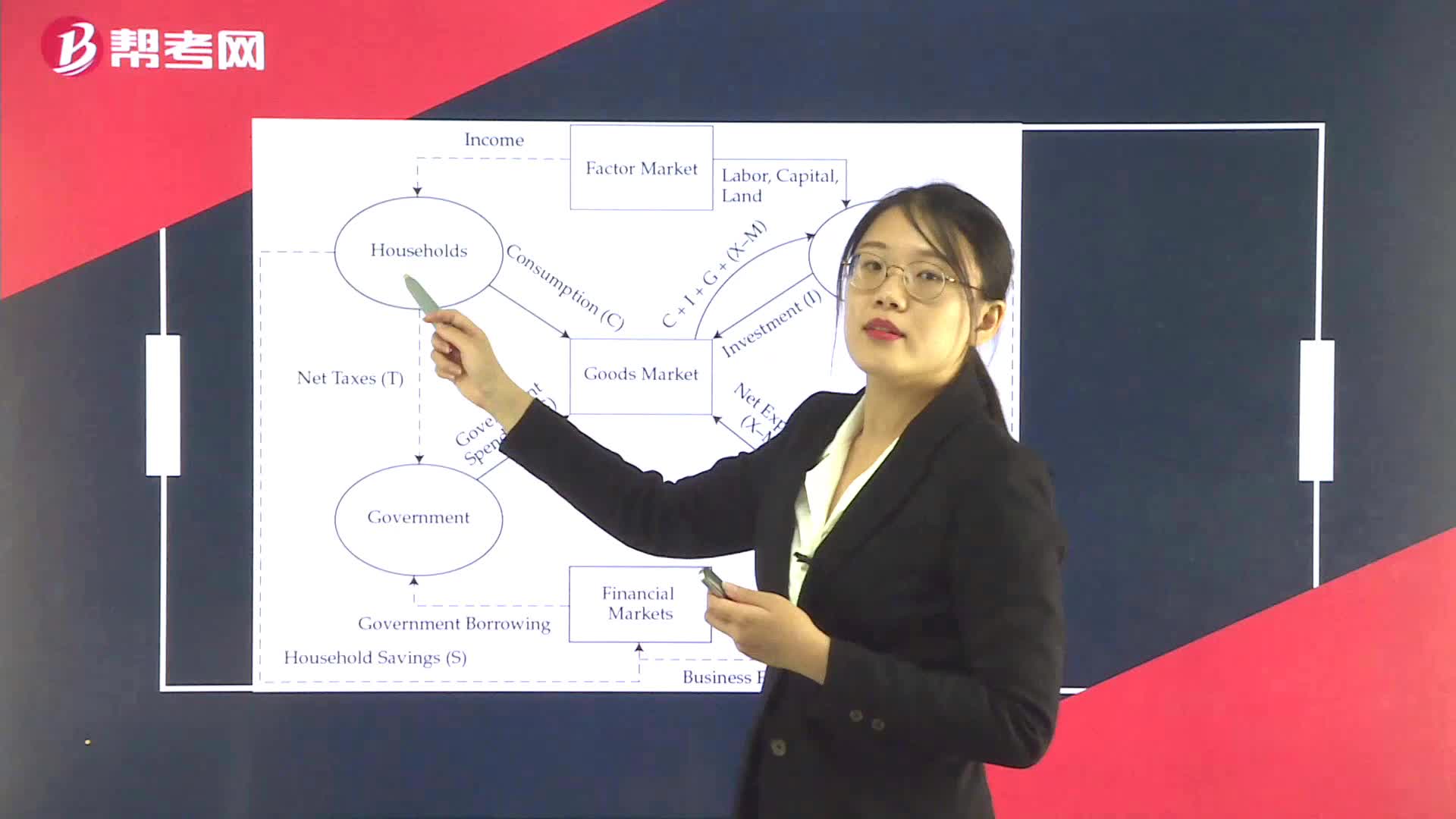

Output, Income, and Expenditure Flows

Money-Weighted Rate of Return & Time-Weighted Rate of Return

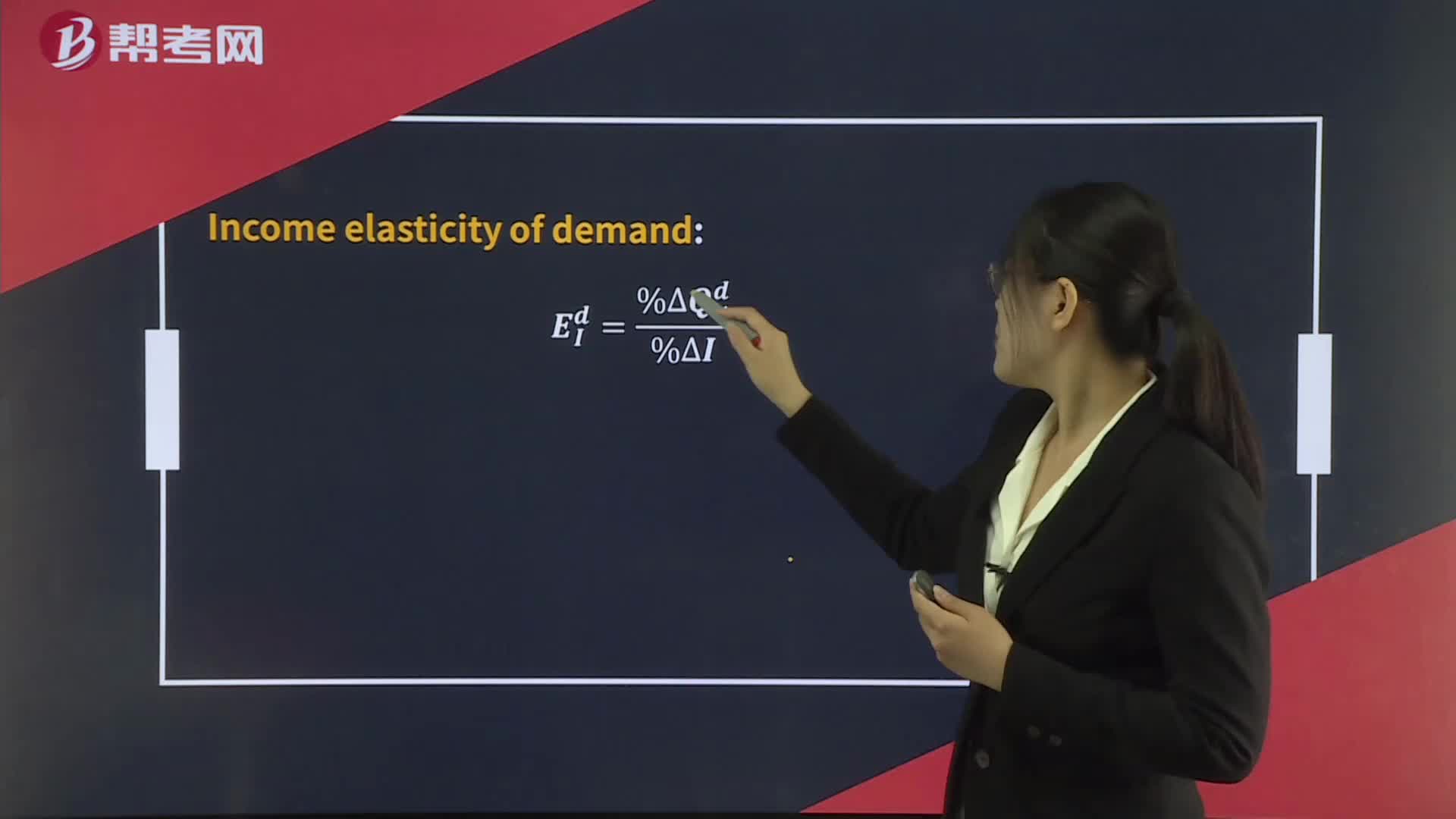

Income Elasticity of Demand

下载亿题库APP

联系电话:400-660-1360