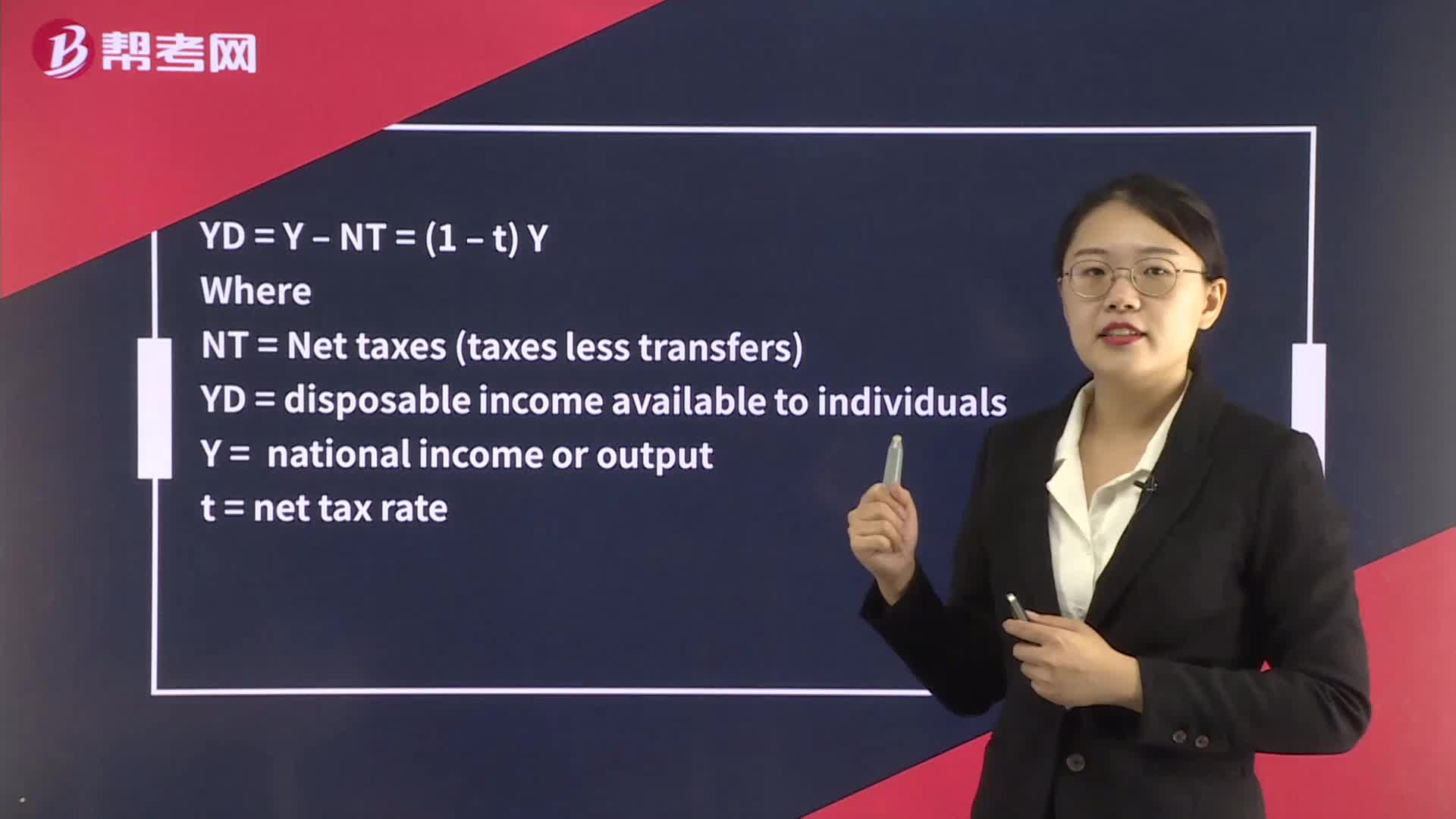

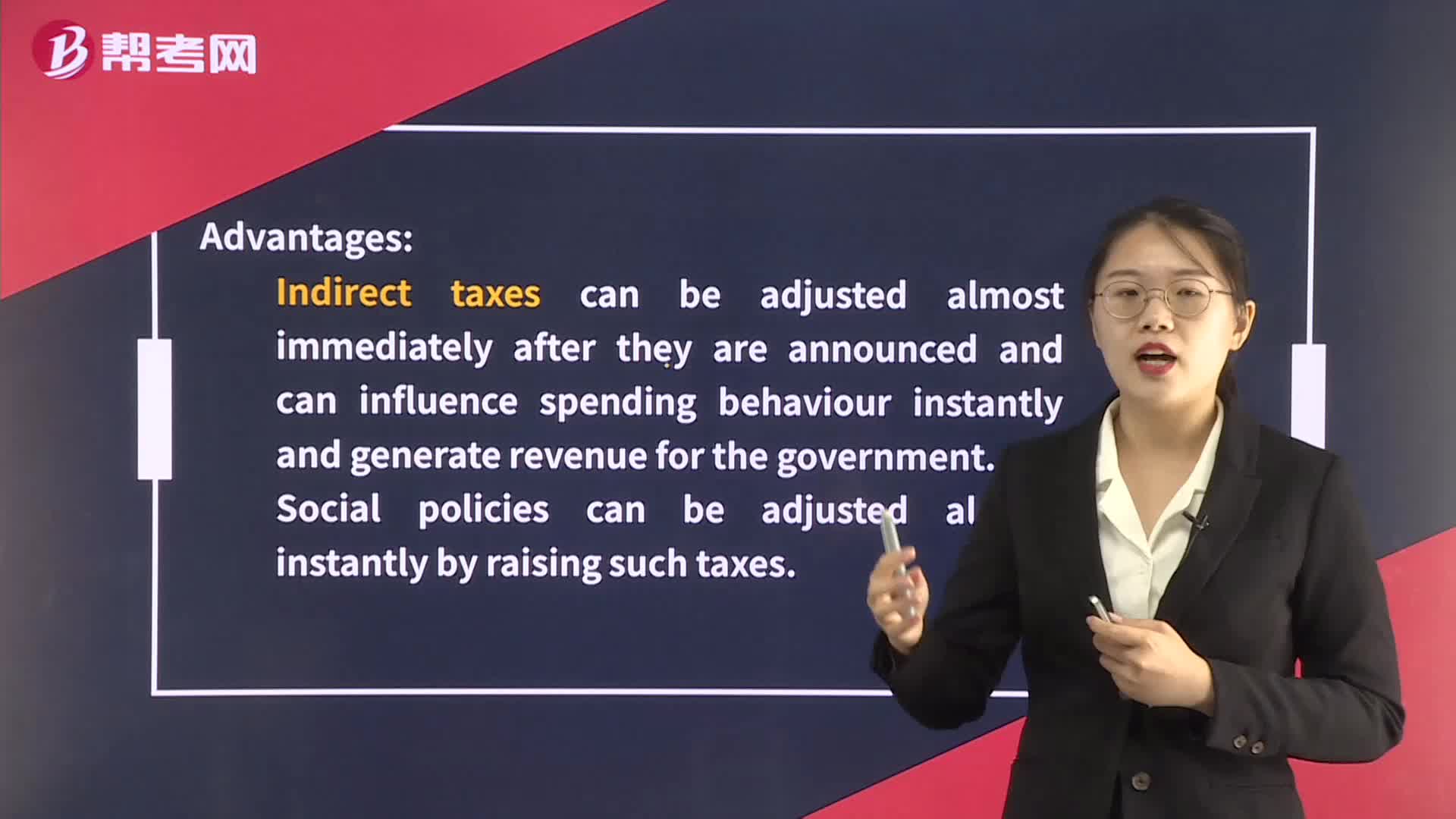

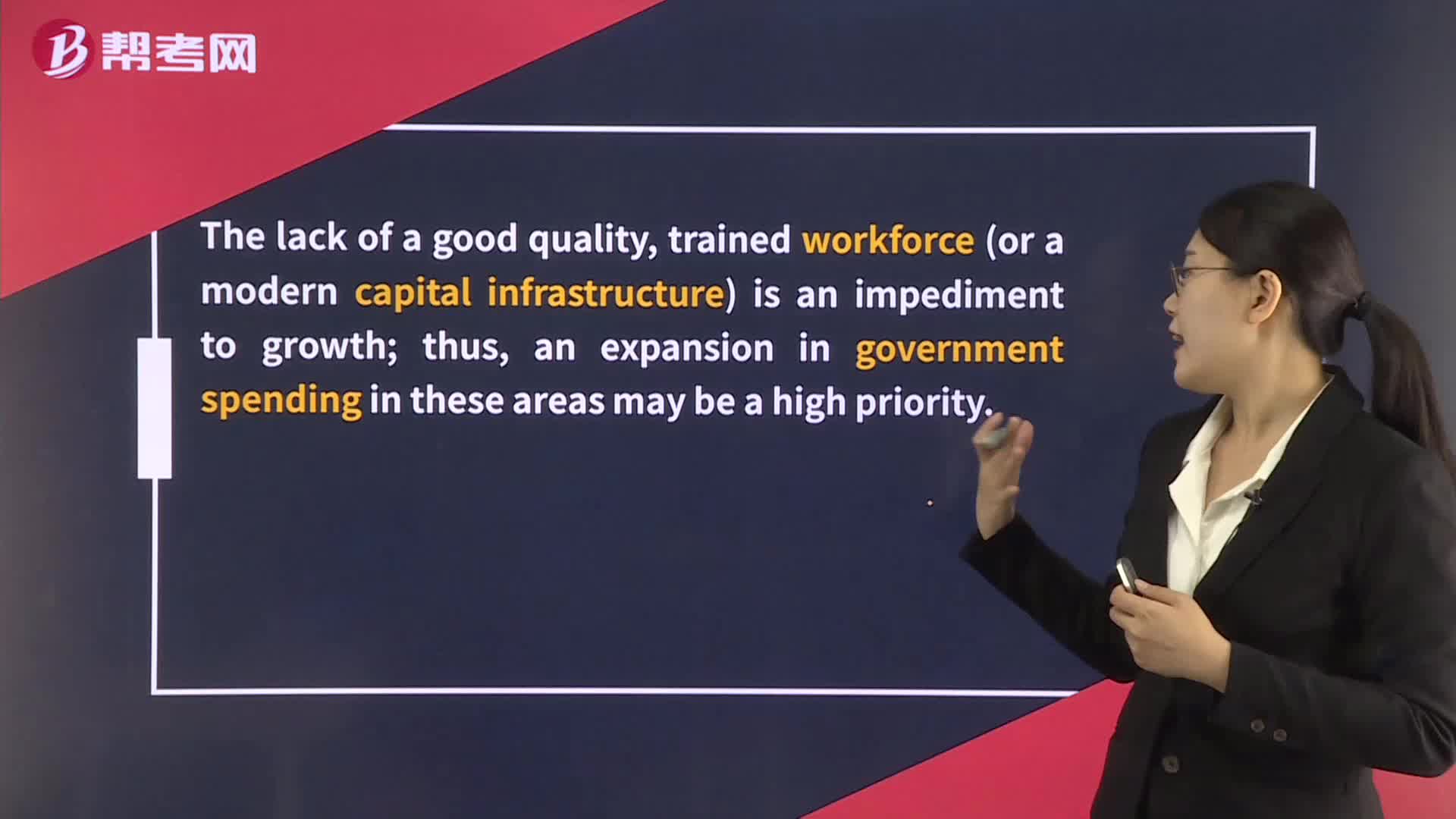

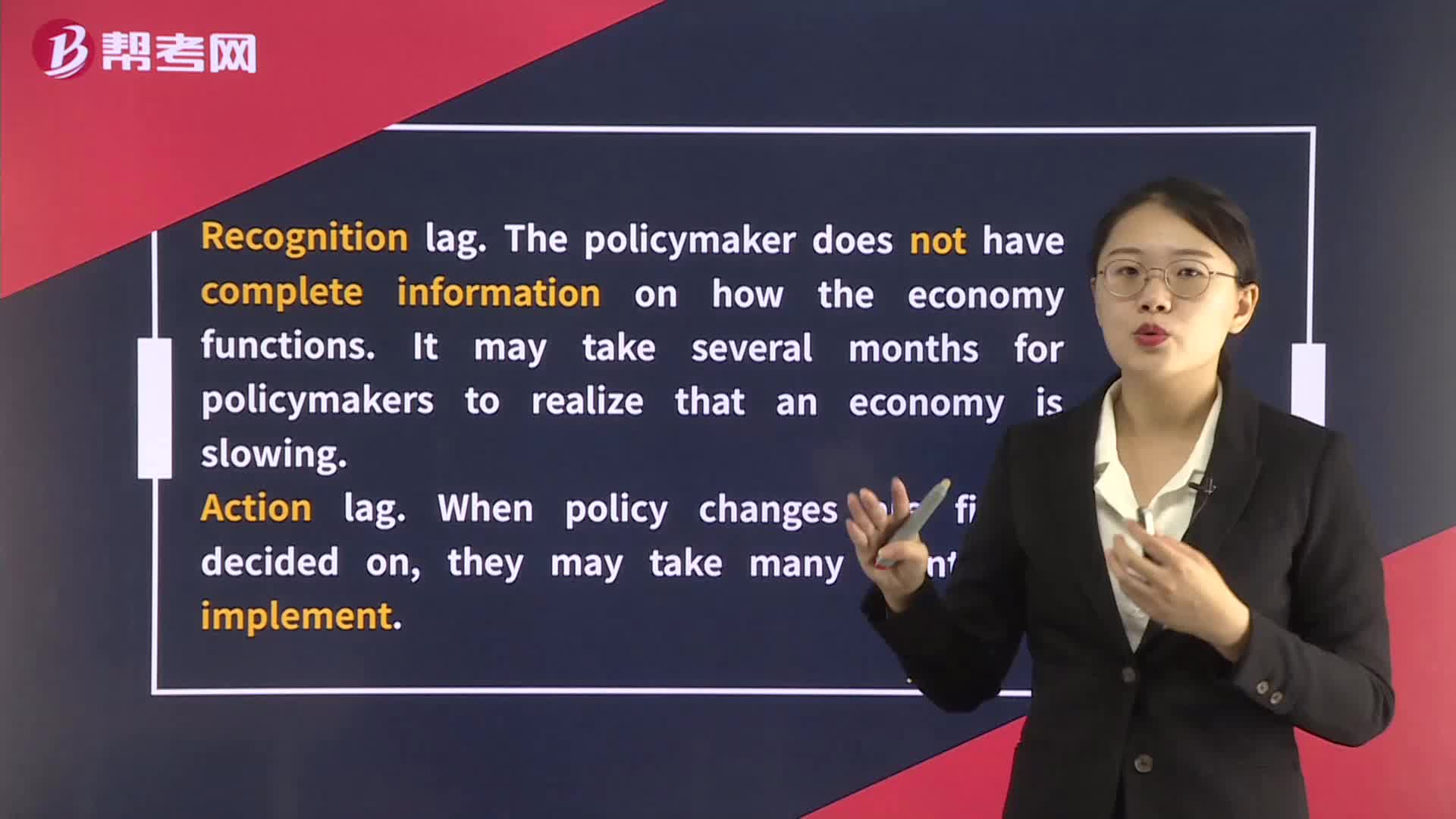

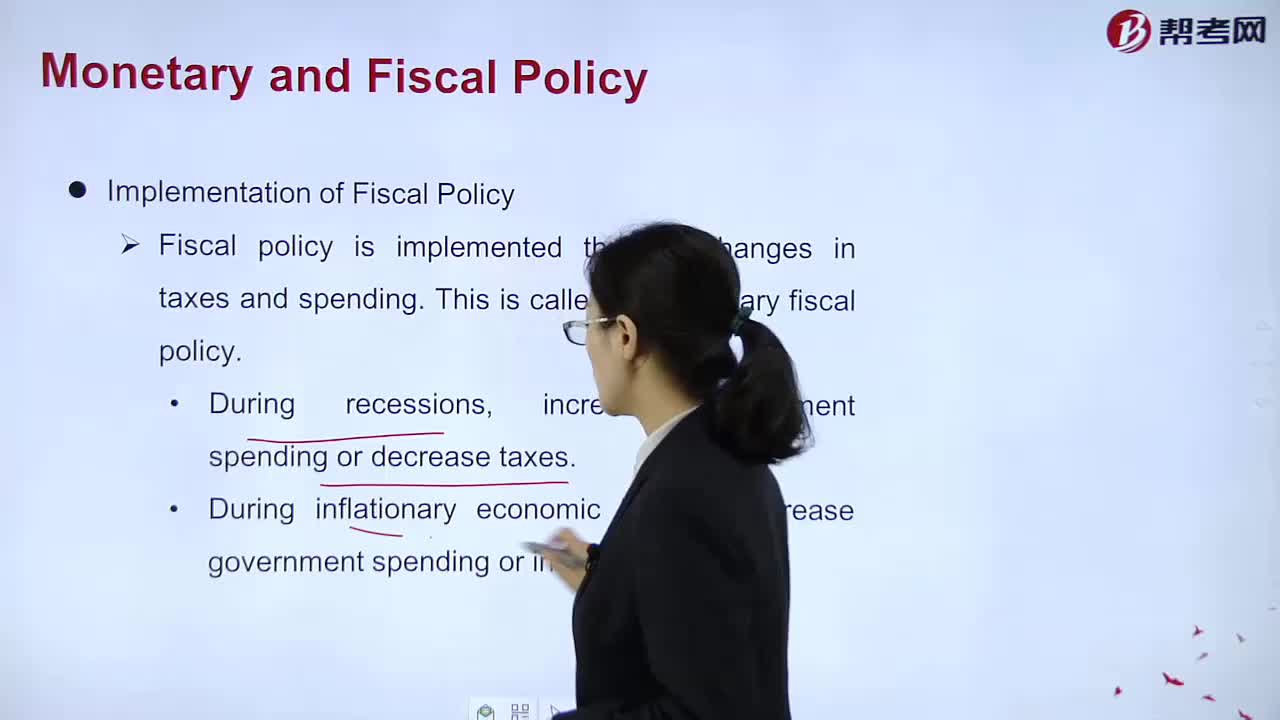

What's the Implementation of Fiscal Policy?

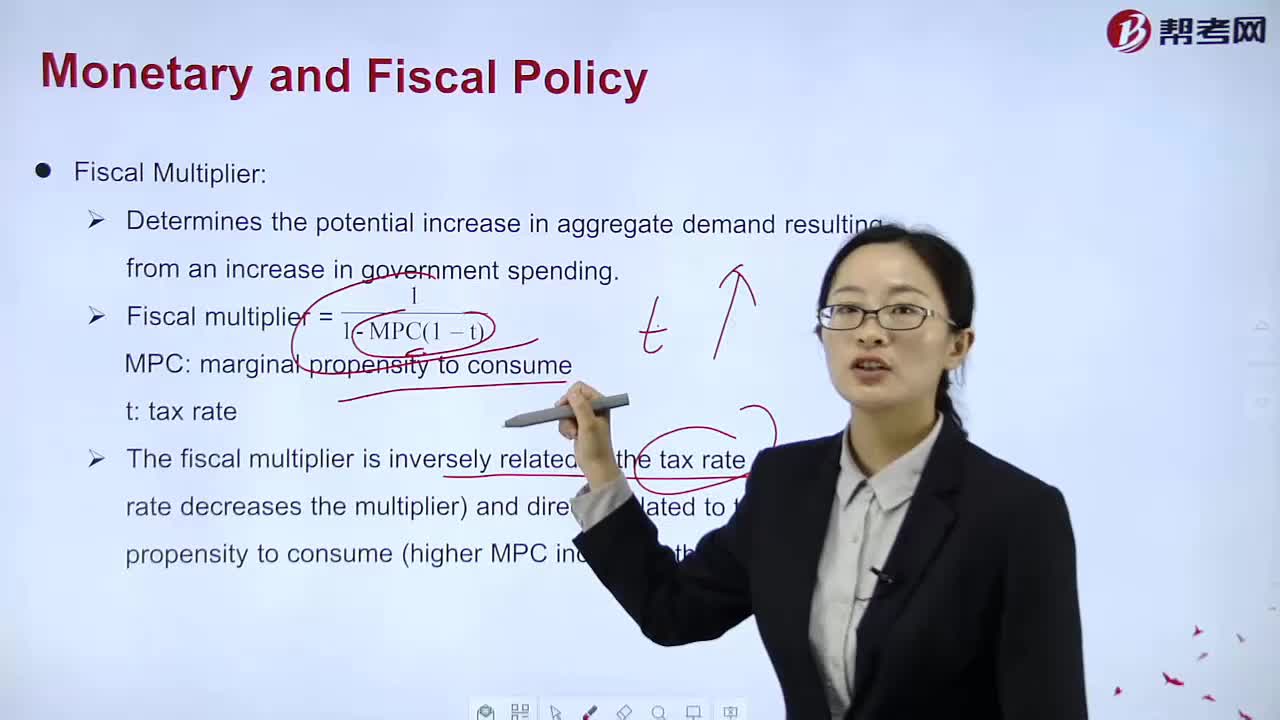

What's the meaning of Fiscal Multiplier?

How to understand Economics-Limitation of Monetary Policy?

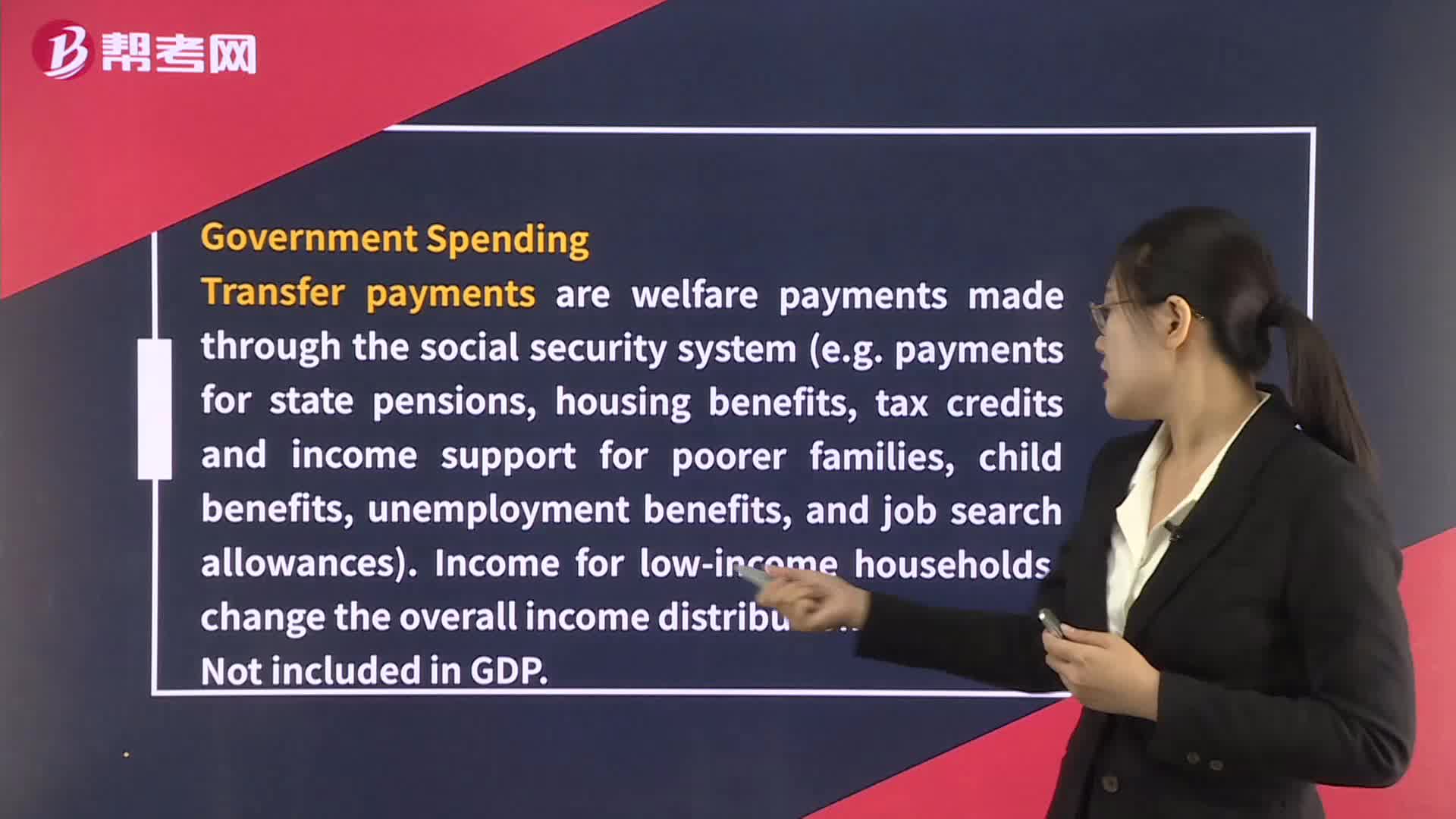

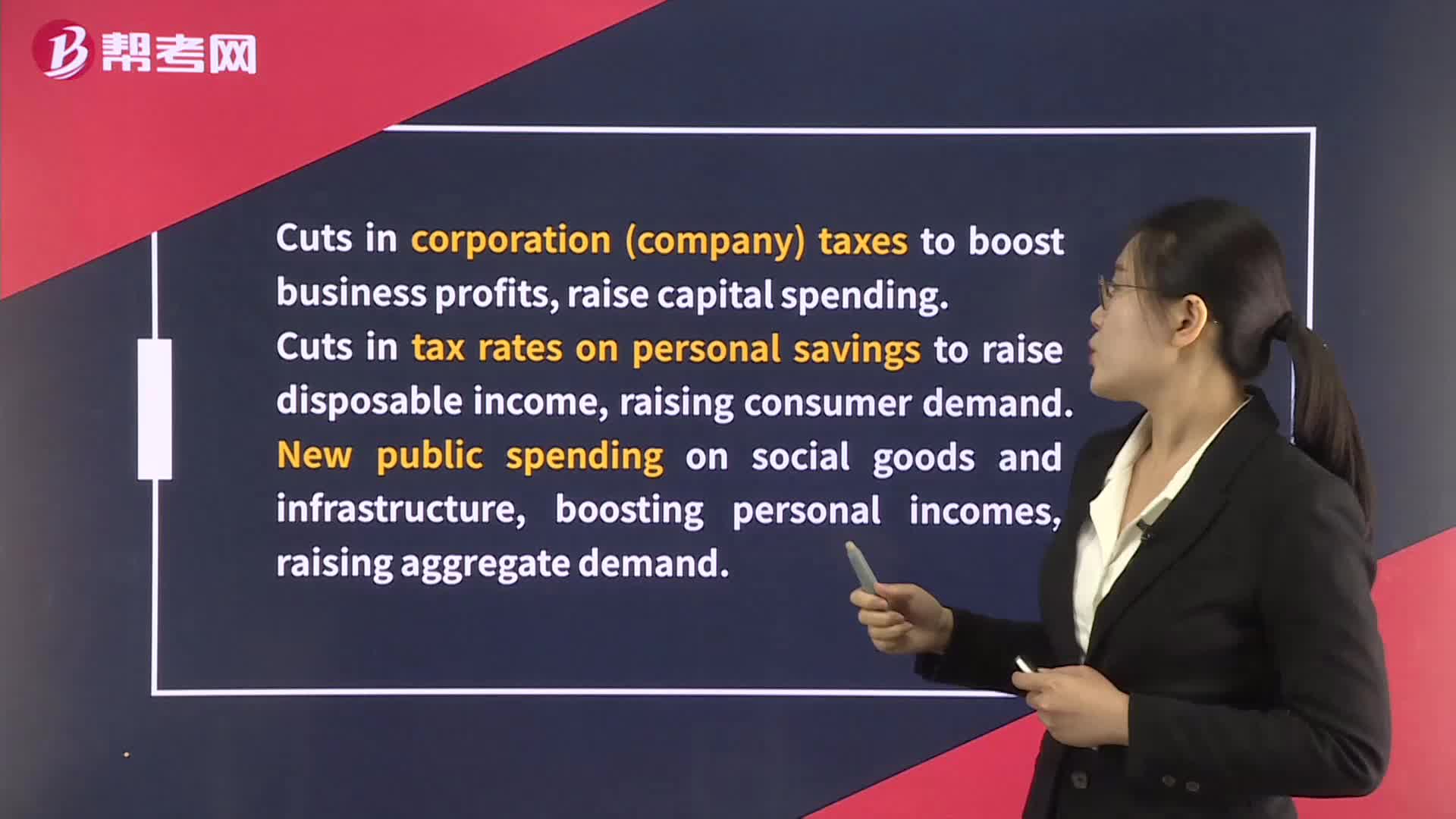

How to master Objectives of Fiscal Policy Includes?

What's the meaning of Policy rate?

How to master Economics-Supply of Money?

What's the meaning of Economics-Substitution effect?

Monopolistic competition?

How to master Economics-Price discrimination?

The Objectives of Monetary Policy

The Central Bank’s Policy Rate

The Relationship Between Fiscal and Monetary Policy

下载亿题库APP

联系电话:400-660-1360