下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、An analyst does research about equity indices.The beginning value for an indexis 2029 and the ending value is 2132.If the income for the period is 35 points,the price return of the index is closest to:【单选题】

A.4.8%

B.5.1%

C.6.8%

正确答案:B

答案解析:(2 132 - 2 029)/2 029 = 5.1%。题目中要求的是,指数的价格回报而不是总回报,所以不需要考虑该阶段的收入。

2、An analyst does research about kurtosis.Compared to a normal distribution, adistribution with excess kurtosis of zero is best described as:【单选题】

A.less peaked.

B.equally peaked.

C.greater peaked.

正确答案:B

答案解析:正态分布的峰度是3,超峰度(excess kurtosis) = 峰度(kurtosis)- 3,如果超峰度为零的话,说明该分布的峰度和正态分布是一样的。

3、An analyst does research about the difference between International FinancialReporting Standards (IFRS) and U.S.generally accepted accounting principles(GAAP).With respect to the classification of interests received on the statementof cash flows, U.S.GAAP is:【单选题】

A.less flexible than IFRS.

B.equally flexible as IFRS.

C.more flexible than IFRS.

正确答案:A

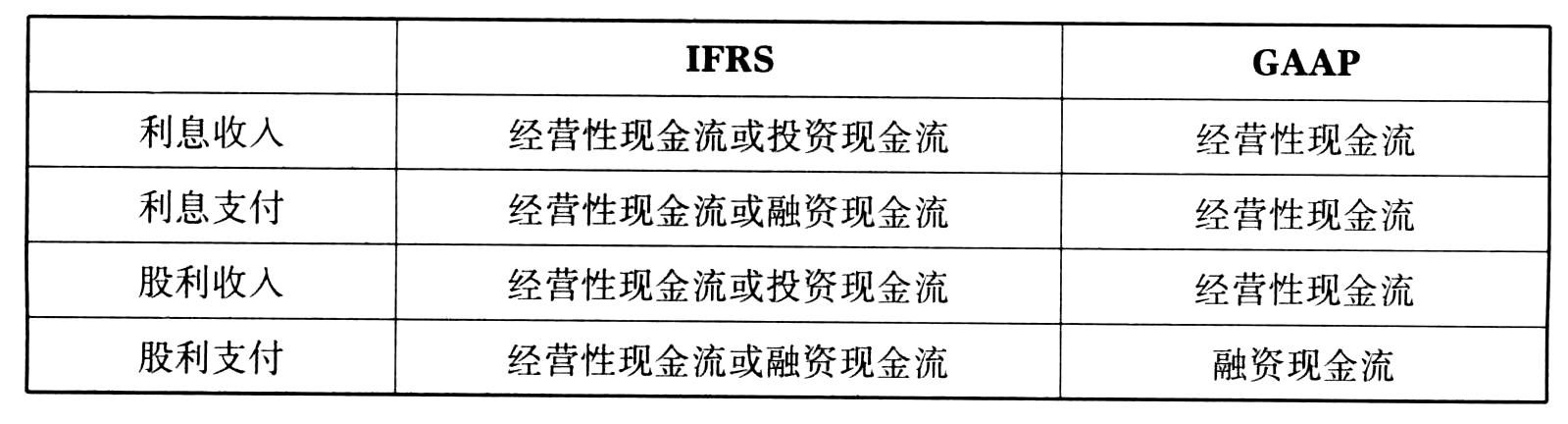

答案解析:IFRS中允许股利分红记在运营现金流或者融资现金流中,而GAAP只允许其分类为融资现金流。

GAAP和IFRS体现在现金流量表中的差异如下:

4、Colin Gifford, CFA is finalizing a monthly newsletter to his clients, who are primarily individual investors. Many of the clients’ accounts hold the common stock of Capricorn Technologies. In the newsletter, Gifford writes, “Based upon the next six months earnings of $1.50 per share and a 10% increase in the dividend, the price of Capricorn's stock will be $22 per share by the end of the year.” Regarding his stock analysis, the least appropriate action Gifford should take to avoid violating any CFA Institute Standards of Professional Conduct would be to:【单选题】

A.separate fact from opinion.

B.include earnings estimates.

C.identify limitations of the analysis.

正确答案:B

答案解析:"Guidance for Standards I-VII CFA Institute"

2011 Modular Level I, Vol. 1, pp. 116-118

Study Session 1-2-c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.

B is correct because while pro forma analysis may be standard industry practice, it is not required by the Standards. Earnings estimates are opinions and must be clearly identified as such.

5、An analyst does research about yield spread.All other factors being equal, willthe yield spread for an option-free corporate bond over the benchmark bond mostlikely decrease :【单选题】

A.

B.

C.

正确答案:C

答案解析:当经济处于衰退期时,人们对于风险更加厌恶,投资者会要求有更高的收益率溢价。当债券的信用评级被调低时,则该债券有更大的风险,投资者会要求有更高的收益率溢价。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料