下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

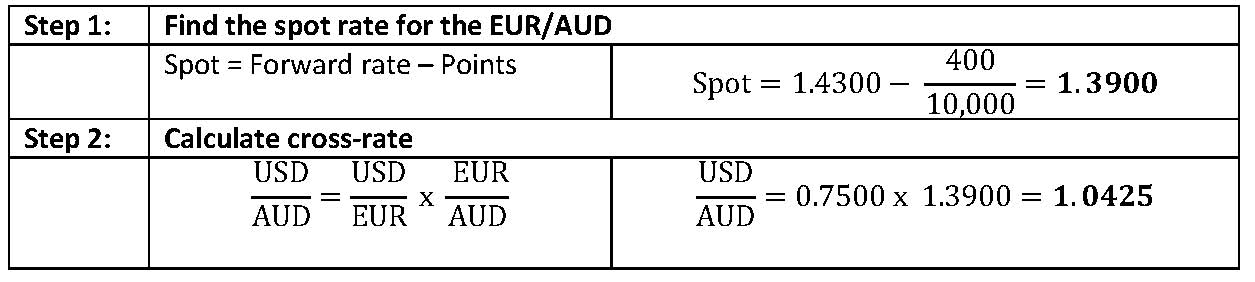

1、The current spot rate for the USD/EUR is 0.7500. The forward rate for the EUR/Australian dollar (AUD) is 1.4300, which represents a 400 point forward premium to the spot rate (scaled up by four decimal places). The USD/AUD spot rate is closest to:【单选题】

A.1.0296.

B.1.0425.

C.1.1154.

正确答案:B

答案解析:“Currency Exchange Rates,” William A. Barker, Paul D. McNelis, and Jerry Nickelsburg

2012 Modular Level I, Vol. 2, pp. 521–523, 525–526

Study Session 6-21-e, f

Calculate and interpret currency cross-rates.

Convert forward quotations expressed on a points basis or in percentage terms into an outright forward quotation.

B is correct.

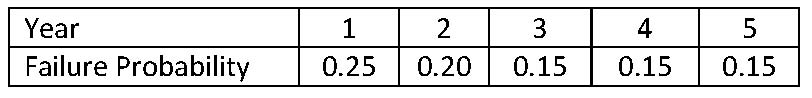

2、A project that requires an initial investment of €5 million is expected to pay €22 million at the end of five years if it is successful. The probabilities of failure for the project are provided below:

Assuming the cost of capital for the project is 16%, the project’s expected net present value is closest to:【单选题】

A.–€3,157,000.

B.–€1,140,000.

C.€2,017,000.

正确答案:B

答案解析:“Alternative Investments,” Bruno Solnik and Dennis McLeavey

2012 Modular Level I, Vol. 6, pp. 216–218

Study Session 18-66-i

Calculate the net present value (NPV) of a venture capital project, given the project’s possible payoff and conditional failure probabilities.

B is correct because you calculate the probability of success as (1 – .25) × (1 – .20) × (1 – .15) × (1 – .15) × (1 – .15) = 0.3685. Then, calculate the NPV from success as [(22,000,000/1.165) – 5,000,000] × 0.3685 = 2,017,000. The NPV of failure is –5,000,000 × (1 – .3685) = –3,157,000. The expected NPV of the project is 2,017,000 – 3,157,000 = –1,140,000.

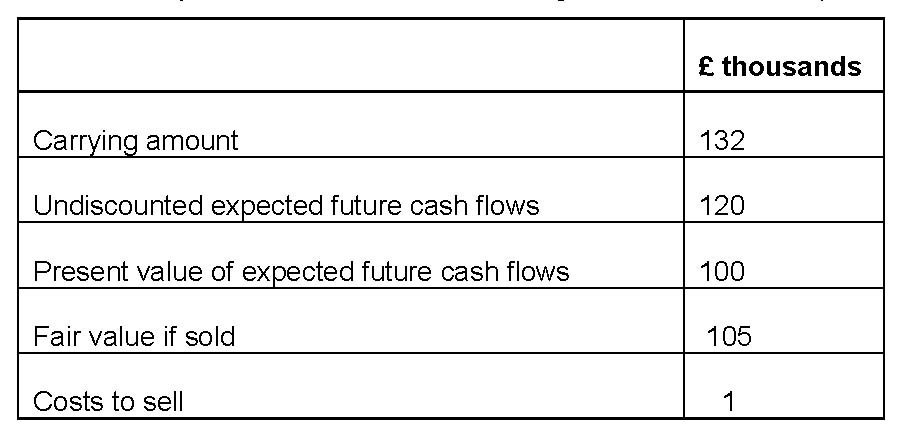

3、An analyst has assembled the following information with respect to a production facility:

Under IFRS, the impairment loss on this production facility (in £ thousands) will be closest to:【单选题】

A.28.

B.27.

C.32.

正确答案:A

答案解析:Under IFRS, the carrying amount (£132 thousand) is compared with the higher of fair value minus costs to sell (£104 thousand = £105 - £1) and present value of expected future cash flows (£100 thousand). The higher of the two amounts, the recoverable amount, is £104 thousand; therefore, the asset is impaired and written down to that amount. The impairment loss is = £132 – £104 = £28 thousand.

2014 CFA Level I

"Long-Lived Assets," by Elaine Henry and Elizabeth A. Gordon

Section 5.1

4、According to the CFA Institute Code of Ethics and Standards of Professional Conduct, trading on material nonpublic information is least likely to be prevented by establishing:【单选题】

A.fire-walls.

B.watch lists.

C.selective disclosure.

正确答案:C

答案解析:CFA Institute Standards

2010 Modular Level I, Vol. 1, pp. 36-42

Study Session 1-2-c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct

C is correct as selective disclosure occurs when companies discriminate in making material nonpublic information public. Corporations that disclose information on a limited basis create the potential for insider-trading violations. Standard II (A).

5、The diagram illustrates a consumer’s allocation of her budget between items X and Y. With an initial budget  she consumes

she consumes  units of item Y. When the price of Y drops, she consumes

units of item Y. When the price of Y drops, she consumes  units of item Y. Lines

units of item Y. Lines  are parallel to one another.

are parallel to one another.

The income effect arising from this change in the price of Y is best described as the distance between:【单选题】

A.

B.

C.

正确答案:B

答案解析:“Demand and Supply Analysis: Consumer Demand,” Richard V. Eastin and Gary L. Arbogast

2012 Modular Level I, Vol. 2, pp. 89–90

Study Session 4-14-b, e, f

Describe the use of indifference curves, opportunity sets, and budget constraints in decision making.

Compare substitution and income effects.

Distinguish between normal goods and inferior goods, and explain Giffen goods and Veblen goods in this context.

B is correct. When the price of Y falls, the budget constraint shifts outward from  indicating an increase in the consumption of Y. Points a and b reflect the change in consumption of Y due solely to a decrease in price because

indicating an increase in the consumption of Y. Points a and b reflect the change in consumption of Y due solely to a decrease in price because  reduces her income by a sufficient amount to return her to her original indifference curve.

reduces her income by a sufficient amount to return her to her original indifference curve.  is the income effect (which is negative here) because this is an inferior good.

is the income effect (which is negative here) because this is an inferior good.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料