下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、A stock is declining in price and reaches a price range wherein buying activity is sufficient to stop thedecline. This range is best described as the:【单选题】

A.change in polarity point.

B.resistance level.

C.support level.

正确答案:C

答案解析:The support level is defined to be a low price range in which buying activity is sufficient to stop thedecline in price.

CFA Level I

"Technical Analysis," Barry M. Sine and Robert A. Strong

Section 3.2

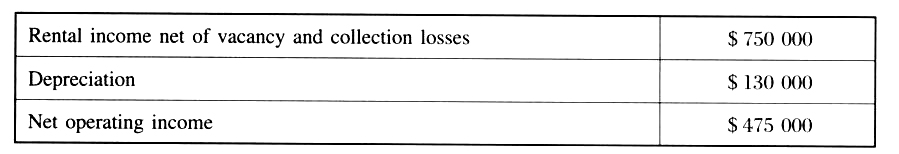

2、An analyst does research about real estate investment and gathered the followingannual information about a real estate investment:

If the property above is valued at $3 925 000 based on the income approach, thecapitalization rate is closest to:【单选题】

A.8.8%

B.12.1%

C.15.8%

正确答案:B

答案解析:在收入法之下,appraisal price = NOI/market cap rate,因而有:

$3 925 000 = $475 000/market cap rate,得出market capitalization rate = 12.1%.

3、Louis Perkowski, CFA, is an investment advisor for institutional clients inSarkozi Securities.To comply with the Standards of Professional Conduct relatingto diligence and reasonable basis, when selecting external advisors,Perkowski must:【单选题】

A.ensure that Sarkozi Securities has standardized criteria for reviewing externaladvisors.

B.ensure that the external advisors have the lowest management fee relativeto others.

C.ensure that the external advisors have the best historical performance relativeto others.

正确答案:A

答案解析:在选择外部咨询时,CFA会员和考生需要保证自己所在的公司有一套对外部投资管理人的评估标准吗,该标准包括但不限于以下几点:(1)审核外部投资管理人的道德准则;(2)了解外部投资管理人的合规性和内部控制流程;(3)评估其对市场所公布信息的质量;(4)审核外部投资管理人是否遵守所制定的策略,并不是仅仅选择一个收取最低管理费或者历史收益表现最好者,CFA会员和考生对此应该综合考虑,寻找性价比最高的外部投资管理人。

4、In early 2011, the British pound (GBP) to New Zealand dollar (NZD) spot exchange rate was 2.0979. LIBOR interest rates, quoted on a 360-day year basis, were 1.6025% for the British pound and 3.2875% for the New Zealand dollar. The 180-day forward points (scaled up by four decimal places) in GBP/NZD would be closest to:【单选题】

A.–343.

B.–173.

C.176.

正确答案:B

答案解析:“Currency Exchange Rates,” William A. Barker, CFA, Paul D. McNelis, and Jerry Nickelsburg

2013 Modular Level I, Vol. 2, Reading 21, Section 3.3, Example 6,

Study Session 6-21-e, g

Convert forward quotations expressed on a points basis or in percentage terms into outright forward quotations.

Calculate and interpret a forward rate consistent with a spot rate and the interest rate in each currency.

B is correct. Covered interest arbitrage will ensure identical terminal values by investing the same initial amounts at the respective country’s domestic interest rates:

GBP investment: 2.0979 × (1 + 0.016025 × 180/360) = 2.1147

NZD investment: 1 × (1 + 0.032875 × 180/360) = 1.0164

The forward rate is determined by equating these two terminal amounts:

GBP/NZD forward Rate = 2.1147/1.0164 = 2.0806

Forward points = (Forward – Spot) × 10,000 = (2.0806 – 2.0979) × 10,000 = –173.0.

5、During 2010, Company A sold a piece of land with a cost of $6 million to Company B for $10 million. Company B made a $2 million down payment with the remaining balance to be paid over the next 5 years. It has been determined that there is significant doubt about the ability and commitment of the buyer to complete all payments. Company A would most likely report a profit in 2010 of:【单选题】

A.$4 million using the accrual method.

B.$0.8 million using the installment method.

C.$2 million using the cost recovery method.

正确答案:B

答案解析:"Understanding The Income Statement,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol.3, pp.150-152

Study Session: 8-32-b

Explain the general principles of revenue recognition and accrual accounting, demonstrate specific revenue recognition applications (including accounting for long-term contracts, installment sales, barter transactions, and gross and net reporting of revenue), and discuss the implications of revenue recognition principles for financial analysis.

Under the installment method, the portion of the total profit that is recognized in each period is determined by the percentage of the total sales price for which the seller has received cash. For Company A 2/10 x 4 = $0.8 million. Note, cost recovery method could be used in this case, but the reported profit would be $0.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料