下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Assume a 365-day year and the following information for a company:

The firm’s days in payables for the current year is closest to:【单选题】

A.18.3.

B.23.8.

C.24.9.

正确答案:B

答案解析:“Financial Analysis Techniques,” Elaine Henry, CFA, Thomas R. Robinson, CFA, and Jan Hendrik van Greuning, CFA

2013 Modular Level I, Vol. 2, Reading 28, Section 4.2.2

“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFA

2013 Modular Level I, Vol.4, Reading 40, Section 7.3.

Study Session 8-28-b; 11-40-c, f

Classify, calculate, and interpret activity, liquidity, solvency, profitability, and valuation ratios.

Evaluate working capital effectiveness of a company based on its operating and cash conversion cycles, and compare the company’s effectiveness with that of peer companies.

Evaluate a company’s management of accounts receivable, inventory, and accounts payable over time and compared to peer companies.

B is correct.

2、When considering capital projects, which of the following statements is most accurate? Compared to the NPV method, the IRR method:【单选题】

A.can result in multiple values.

B.has the more appropriate reinvestment rate assumption.

C.uses more accurate estimates of the project’s cash flows.

正确答案:A

答案解析:“Capital Budgeting,” John D. Stowe, CFA and Jacques R. Gagné, CFA

2010 Modular Level I, Vol. 4, pp. 19-25

Study Session 11-44-e

Explain the NPV profile, compare and contrast the NPV and IRR methods when evaluating independent and mutually-exclusive projects, and describe the problems associated with each of the evaluation methods.

If the cash flows of the project are nonconventional, the IRR method can result in multiple IRRs.

3、Hezi Cohen, a CFA candidate, is a heavy user of social networking sites on the Internet. His favorite site only allows a limited number of characters for each entry so he has learned to abbreviate everything, including CFA trademarks. Cohen also enjoys professional networking sites and contributes regularly to blogs that discuss the broad topical areas covered within the CFA Exam Program. In addition, he posts to these blogs pieces he has written in his area of expertise: retirement planning. By claiming to be an expert on retirement planning, he believes his stature within the investment community increases and he can gain more clients. Which Internet activity can Cohen most likely continue to be in compliance with the CFA Standards of Professional Conduct?【单选题】

A.Use of abbreviations.

B.Claiming retirement planning expertise.

C.Blogging about broad topical areas within the CFA Exam Program.

正确答案:B

答案解析:“Guidance for Standards I-VII,” CFA Institute

2011 Modular Level I, Vol. 1, pp. 139-148

Study Session 1–2–c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct.

B is correct because the CFA Standards do not prevent a person from claiming to be an expert in their area of specialty as long it is not a misrepresentation and/or an exaggeration of their skill and expertise.

4、Participating preference shares are least likely to entitle the shareholders to participate in:【单选题】

A.additional distribution of the company's assets upon liquidation.

B.corporate decisions through voting rights.

C.additional dividends if the company's profits exceed a predetermined level.

正确答案:B

答案解析:Participating preference shares do not entitle the shareholders to participate in corporate decisionsthrough voting rights. But they do entitle them to (1) an additional dividend if the company's profitsexceed a prespecified level and (2) additional distribution of the company's assets upon liquidation,above the par.

CFA Level I

"Overview of Equity Securities," by Ryan C. Fuhrmann and Asjeet S. Lamba

Section 3.2

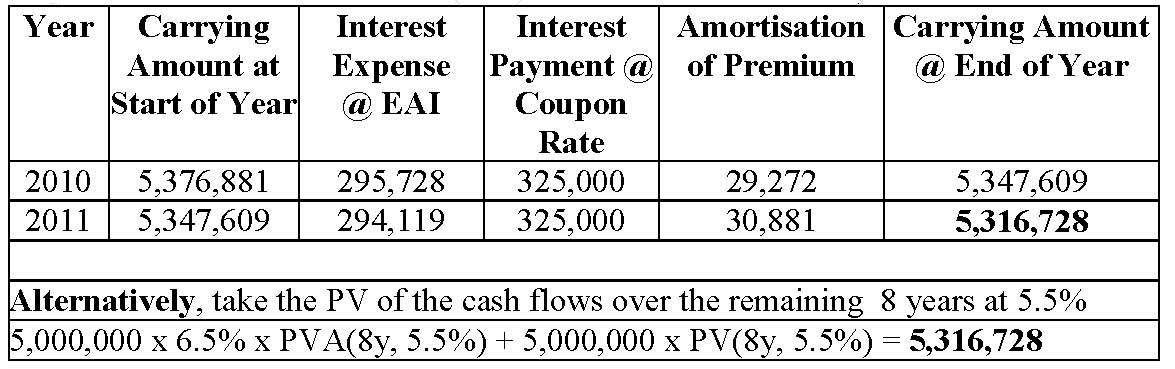

5、A company, which prepares its financial statements in accordance with IFRS issues £5,000,000 face value ten year bonds on January 1, 2010 when interest rates are 5.50%. The bonds carry a coupon of 6.50%, with interest paid annually on December 31. The carrying value of the bonds as of December 31, 2011 will be closest to:【单选题】

A.£4,695,562.

B.£5,301,000.

C.£5,316,000.

正确答案:C

答案解析:“Non-Current (Long-term) Liabilities,” Elizabeth A. Gordon and Elaine Henry, CFA

2011 Modular Level 1, Vol. 3, pp. 504-509

“Introduction to the Valuation of Debt Securities,” Frank J. Fabozzi, CFA

2011 Modular Level 1, Vol. 5, pp. 492-495

Study Session: 9-39-a, b; 16-65-d

Determine the initial recognition and measurement and subsequent measurement of bonds.

Discuss the effective interest method and calculate interest expense, amortisation of bond discounts/premiums, and interest payments.

Explain how the price of a bond changes as the bond approached its maturity date, and calculate the change in value that is attributable to the passage of time.

The bond proceeds are determined by taking the present value of the coupon stream and terminal payment at the interest rate of 5.5%:

Proceeds = 5,000,000 x 6.5% x PVA(10y, 5.5%) + 5,000,000 x PV(10y, 5.5%)

= 325,000 x PVA(10y, 5.5%) + 5,000,000 x PV(10y, 5.5%)

= 5,376,881

Where PVA(10y, 5.5%) is the present value interest factor for an annuity of $1 for 10years at 5.5%, and PV(10y, 5.5%) is the present value interest factor for $1 to be received in 10years when rates are 5.5%

Using the effective annual interest (EAI) rate method which is required under IFRS

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料