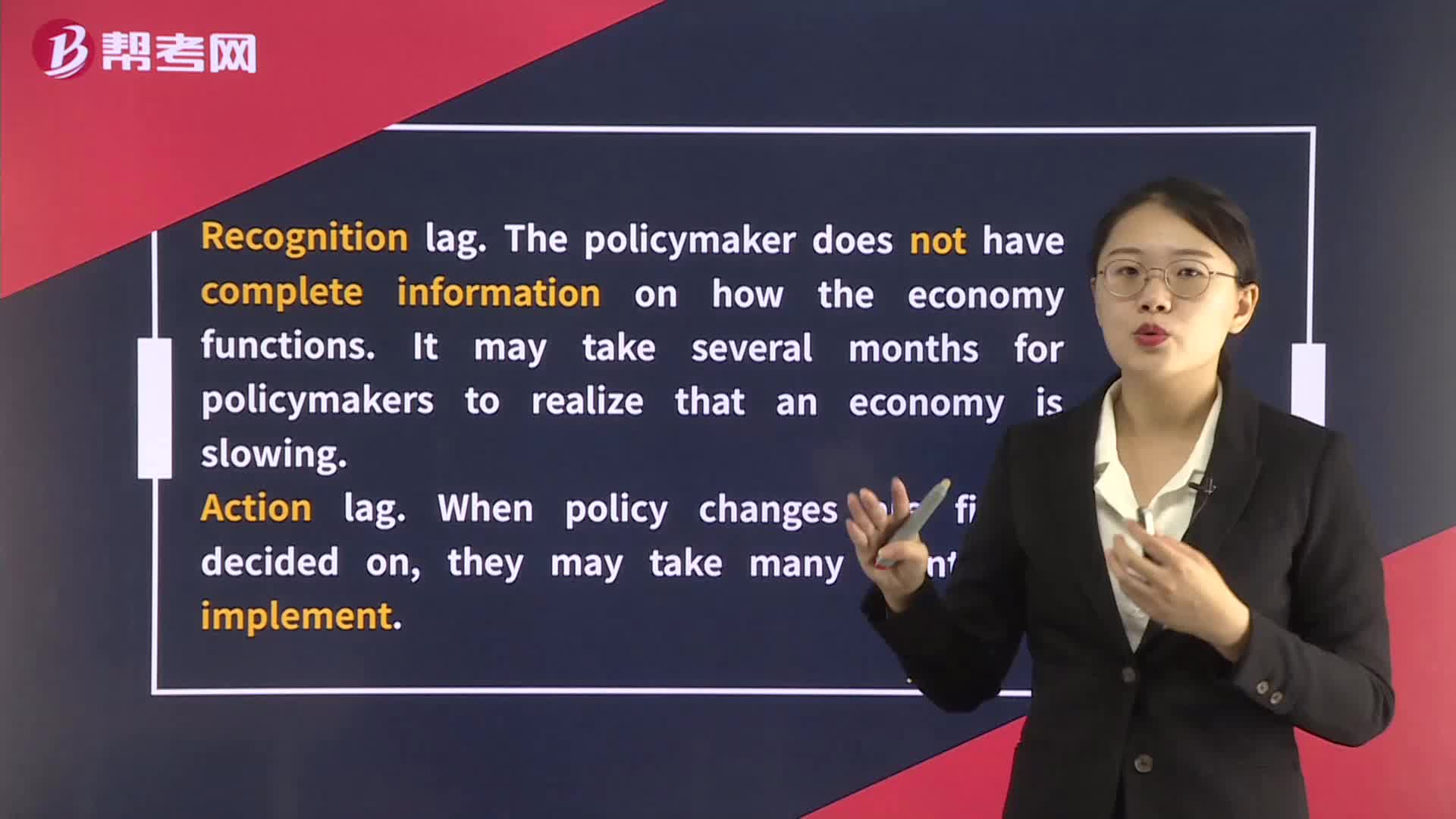

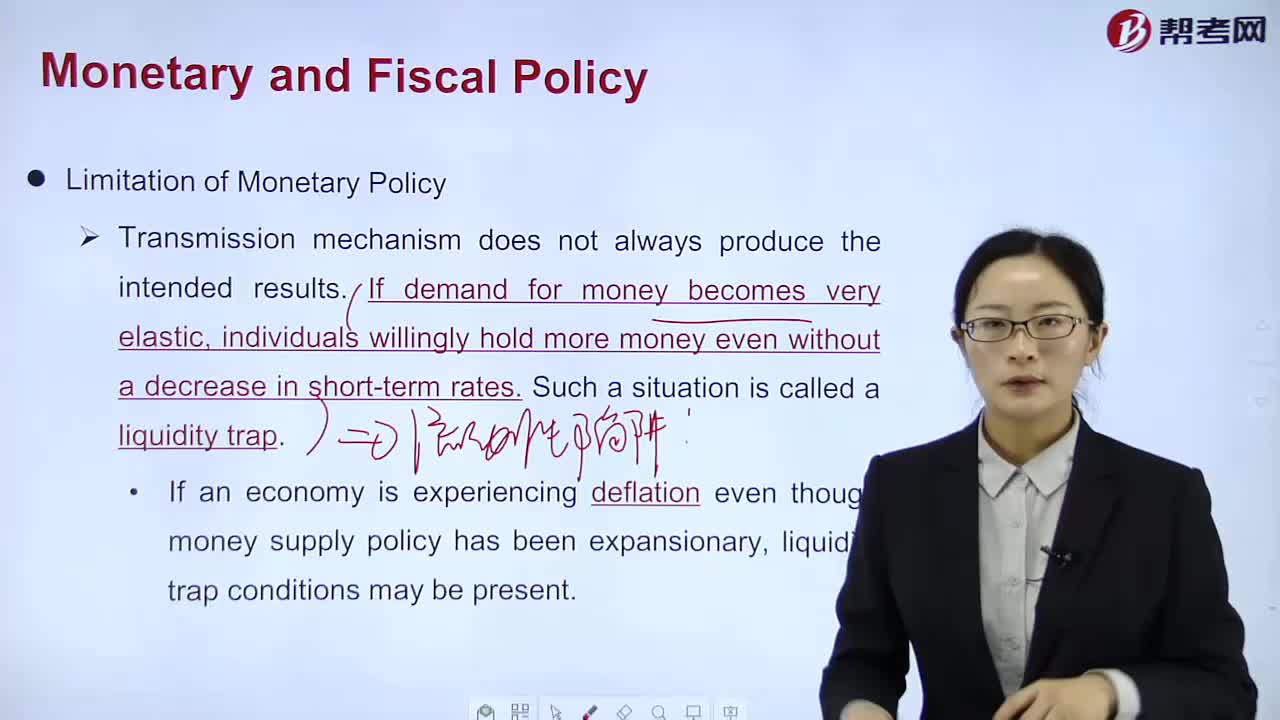

How to understand Economics-Limitation of Monetary Policy?

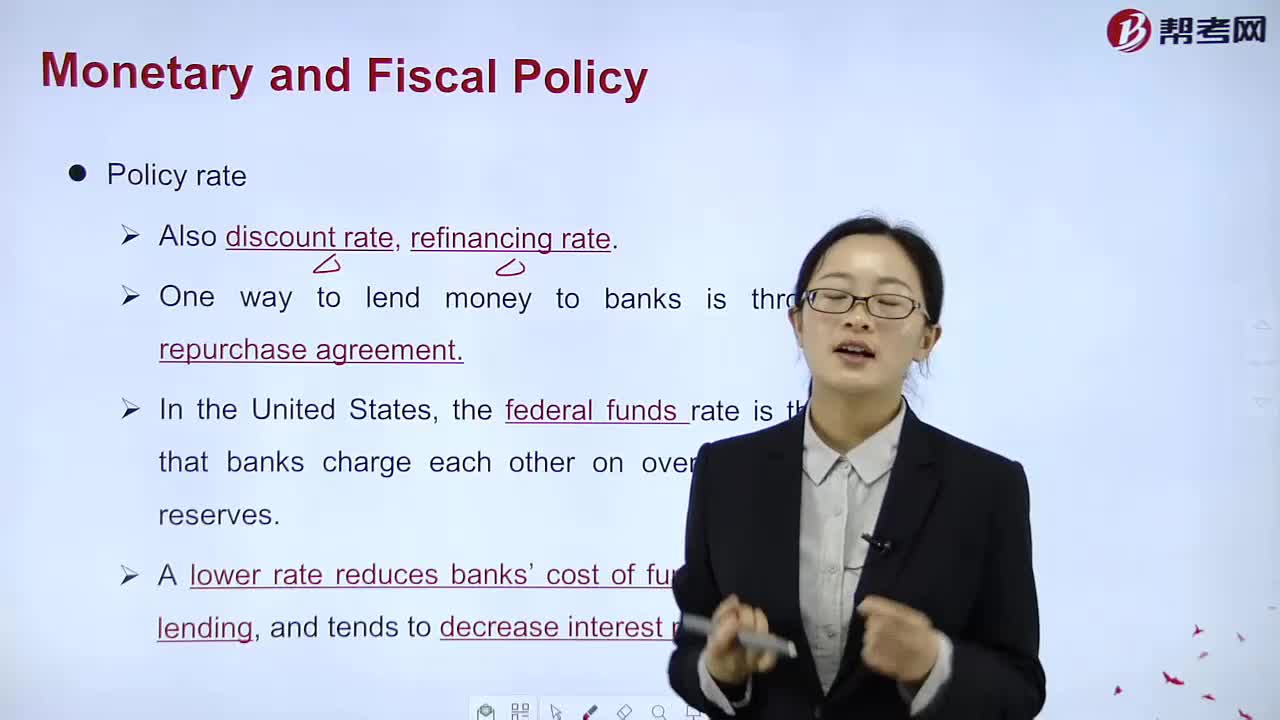

What's the meaning of Policy rate?

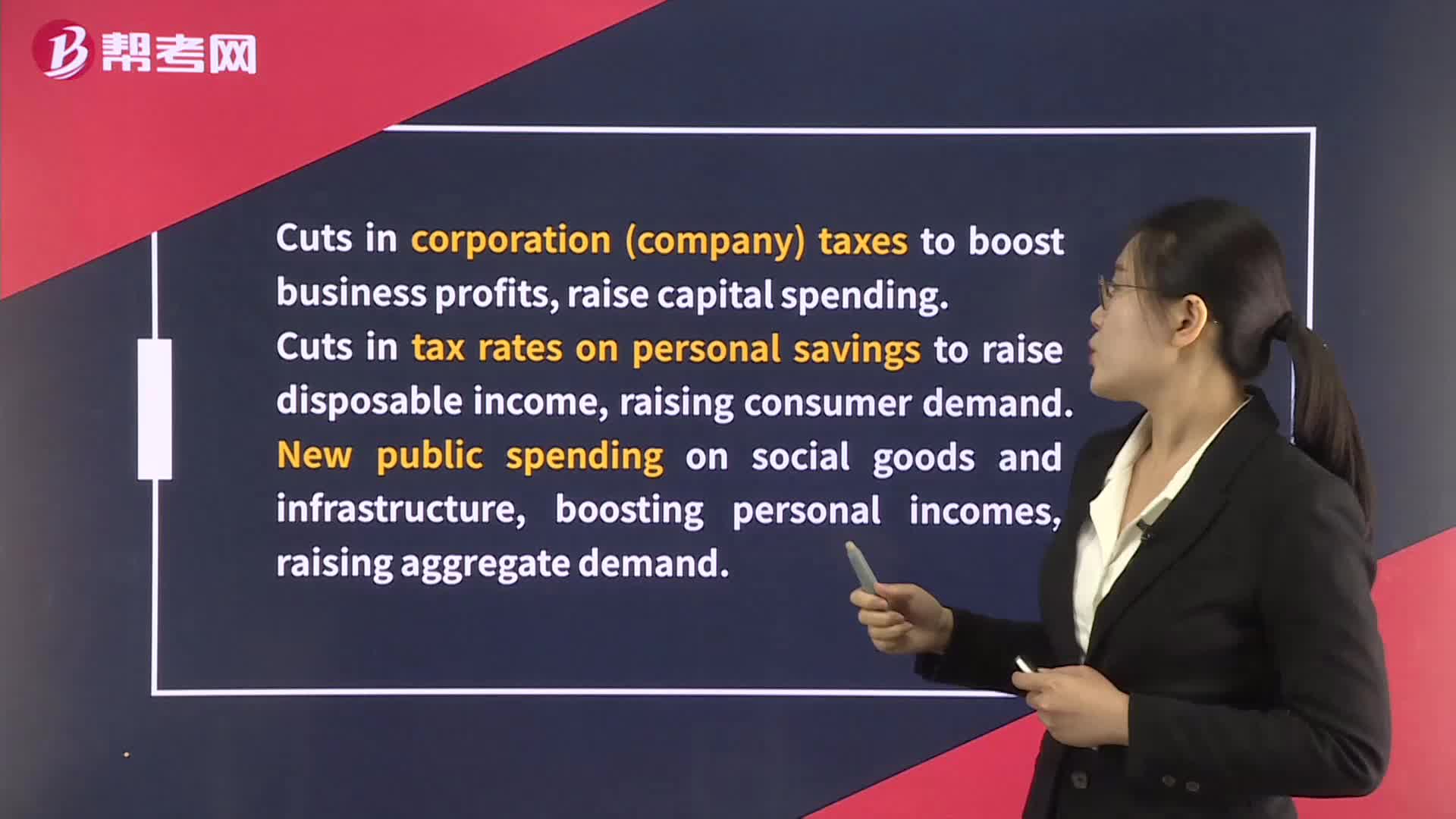

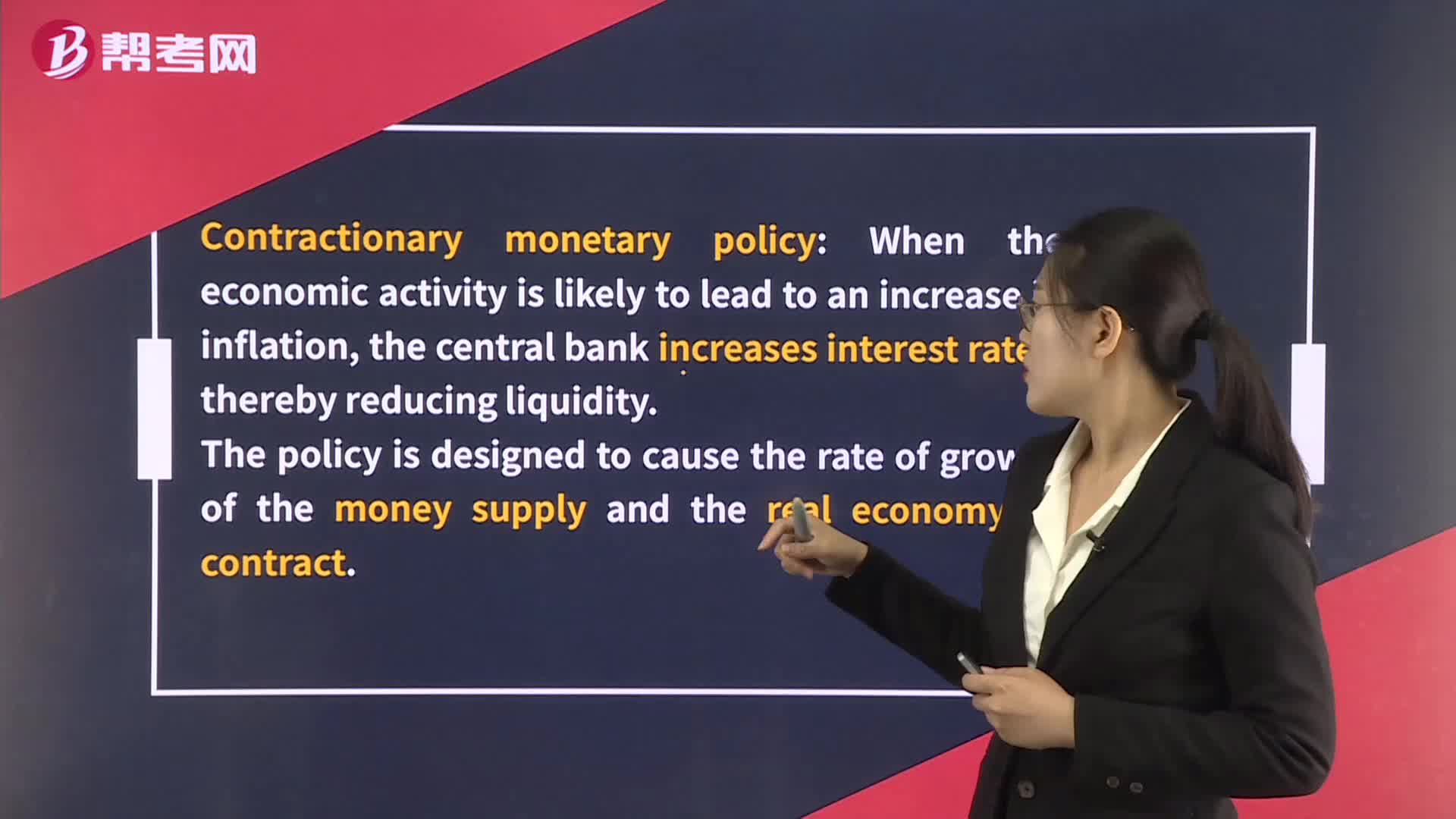

What's the Contractionary and expansionary monetary policies?

How to master Economics-Supply of Money?

What's the meaning of Economics-Substitution effect?

Monopolistic competition?

How to master Economics-Price discrimination?

International Monetary Fund

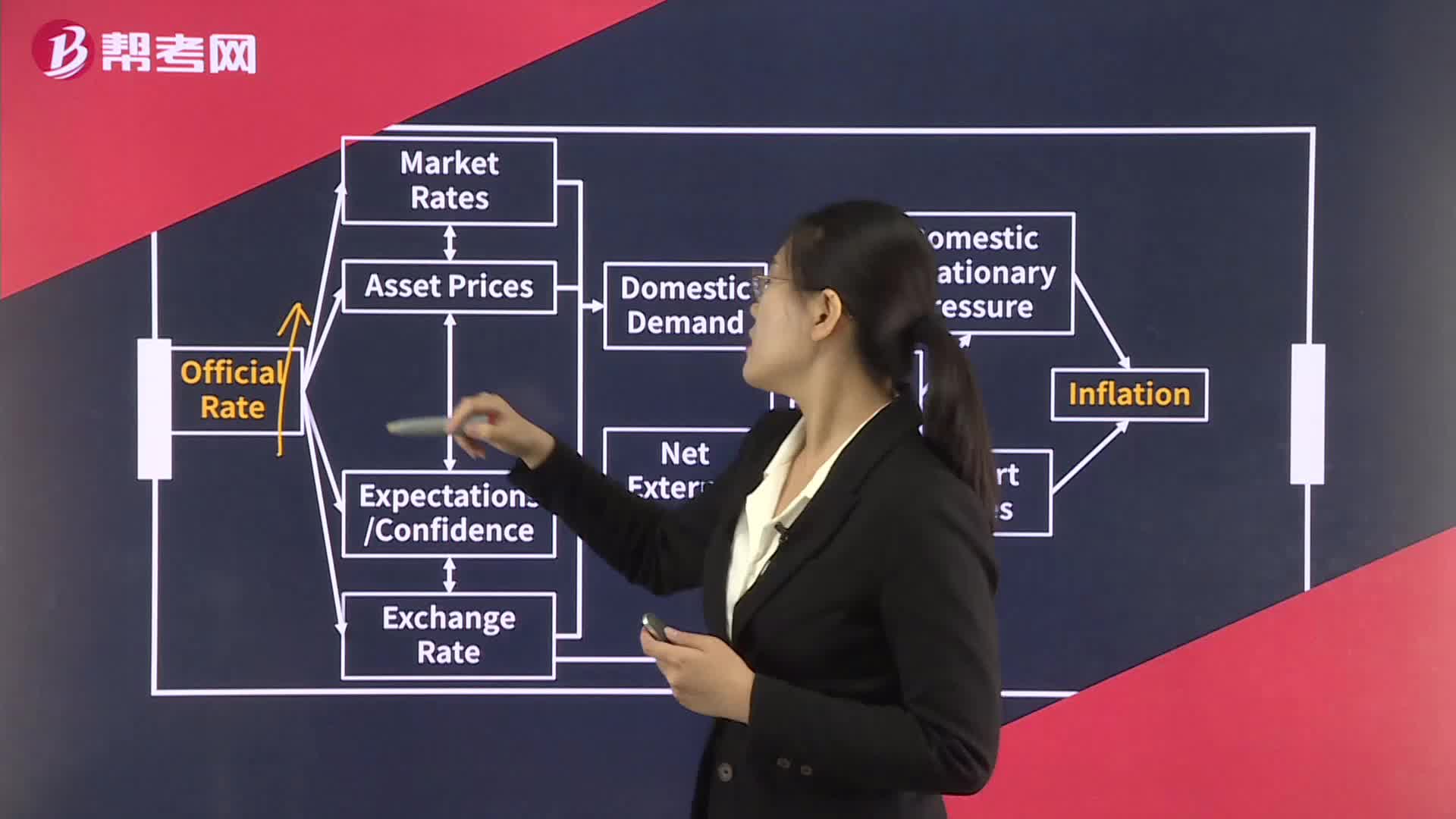

The Objectives of Monetary Policy

Currency Regimes - Dollarization and Monetary Union

The Central Bank’s Policy Rate

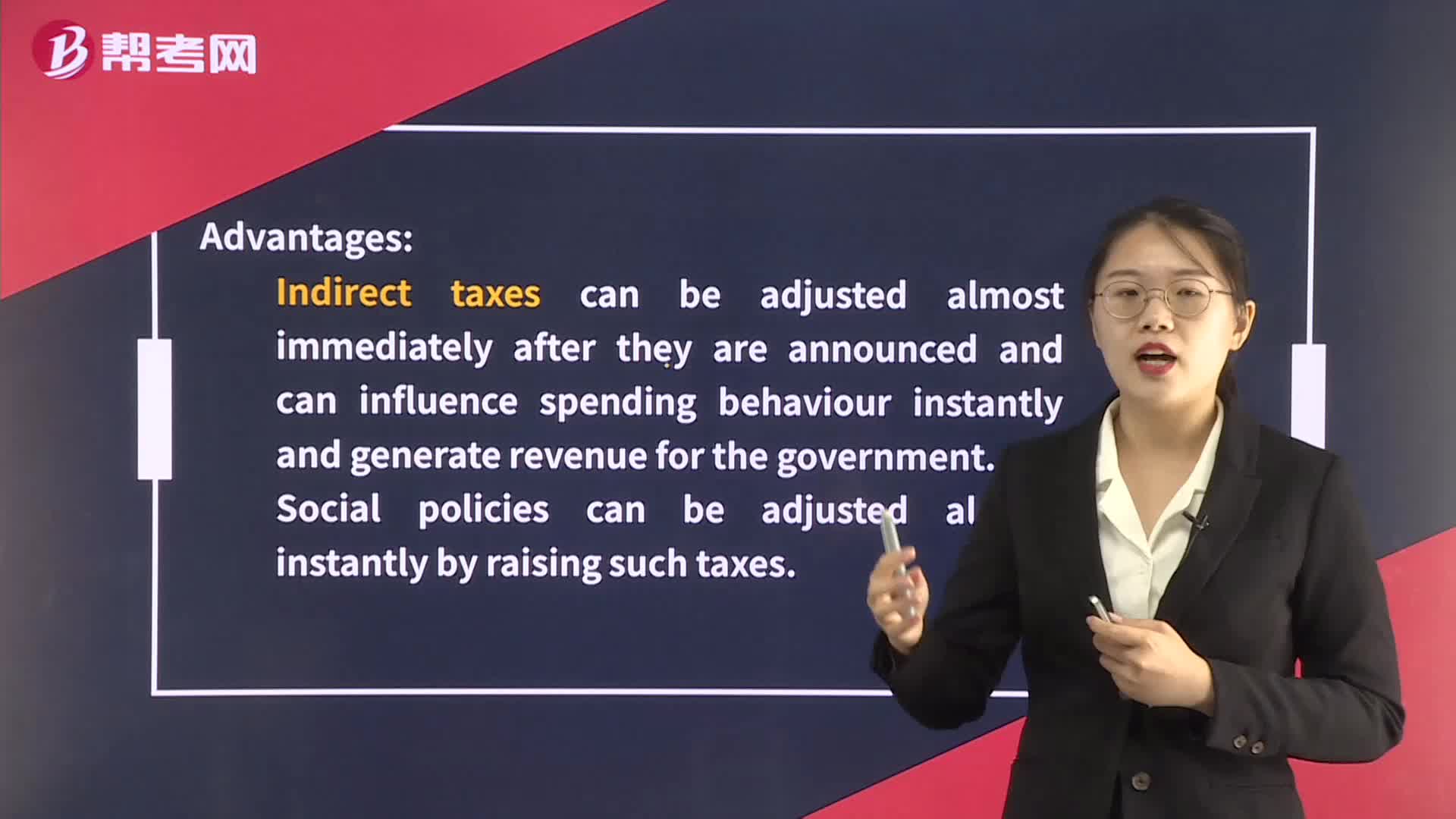

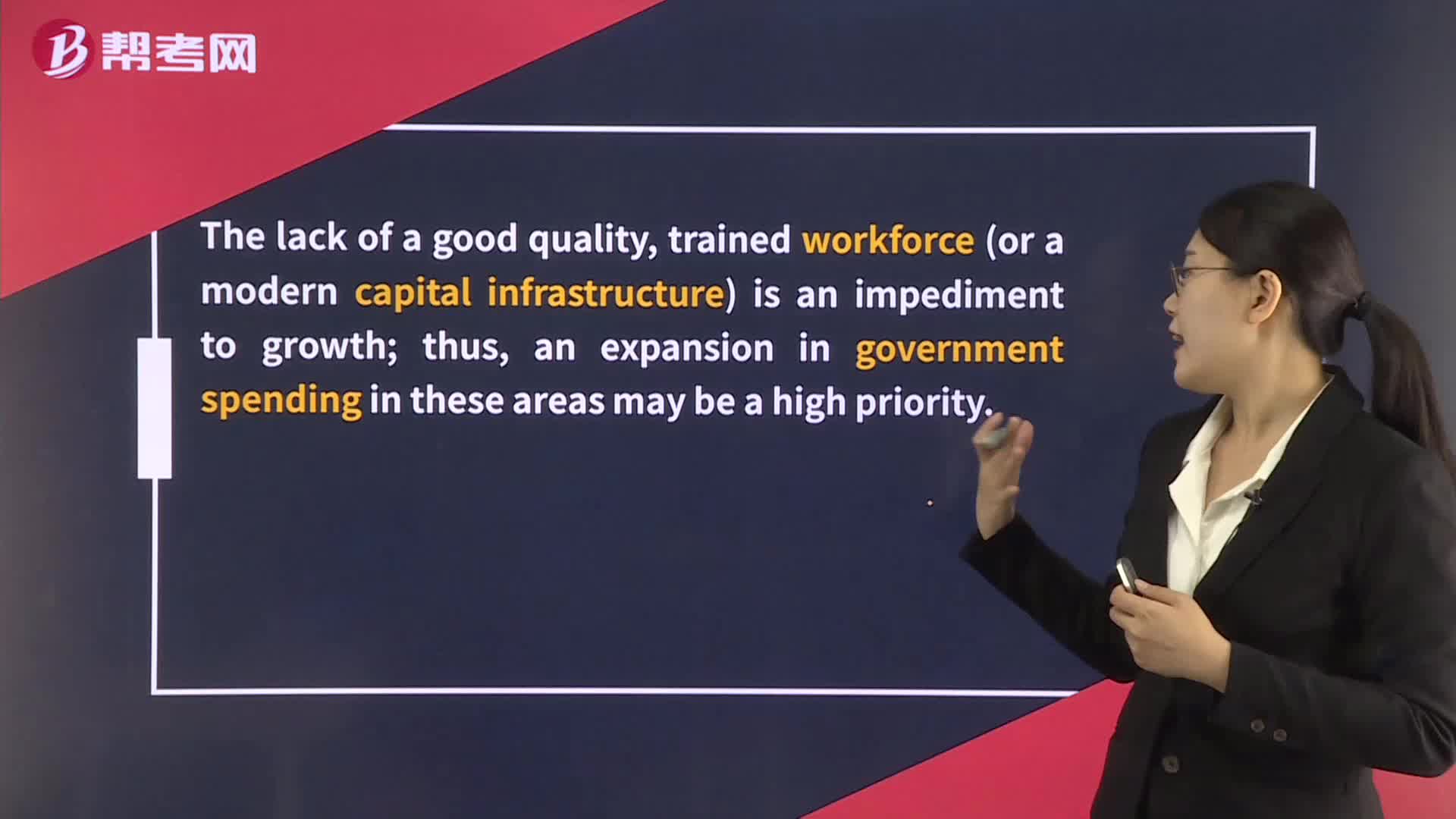

The Relationship Between Fiscal and Monetary Policy

下载亿题库APP

联系电话:400-660-1360