下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Which of the following most accurately describes the basis for construction of nearly all bond market indices?【单选题】

A.Dealer prices

B.Model prices

C.Market prices

正确答案:A

答案解析:Firms (dealers) are assigned to specific securities and are responsible for creating liquid markets for those securities by purchasing and selling them from their inventory. In addition, many securities do not trade frequently and, as a result, are relatively illiquid. As a result, index providers must contact dealers to obtain current prices on constituent securities to update the index, or they must estimate the prices of constituent securities using the prices of traded fixed-income securities with similar characteristics.

2014 CFA Level I

“Security-Market Indices,” by Paul D. Kaplan and Dorothy C. Kelly

Section 6.1

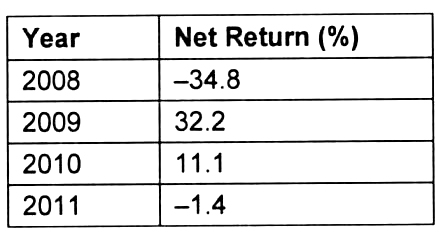

2、An asset management firm generated the following annual returns in their US large-cap equityportfolio:

The 2012 return needed to achieve a trailing five-year geometric mean annualized return of 5% whencalculated at the end of 2012 is closest to:【单选题】

A.27.6%.

B.17.9%.

C.35.2%.

正确答案:C

答案解析:

Holding period total return (cumulative) factor calculation through 2011:

(1-0.348) × (1+0.322) × (1+0.111) × (1-0.014)=0.652 × 1.322 × 1.111 × 0.986=0.9442.

Compound total return (cumulative) factor at 5% per year of 5% for five years: =1.2763.

=1.2763.

Return needed in 2012 to achieve a compound annualized return of 5%:

1.2763/0.9442=1.3517=35.2%.

Check: 0.944 × 1.352= =1.050=5% annualized.

=1.050=5% annualized.

CFA Level I

"Portfolio Risk and Return: Part I," Vijay Singal

Section 2.1.3

3、An analyst does research about income statement and gathers the followinginformation about a company:

● Revenue during this year is $250 000

● Cost of goods sold is $150 000

● Selling, general, and administrative expense is $25 000

● Depreciation expense is $15 000

● Interest expense is 5 000

The company's operating profit is closest to:【单选题】

A.$55 000

B.$60 000

C.$75 000

正确答案:B

答案解析:operating profit = revenue - COGS - selling, general, and administrative expense - depreciationexpense = $250 000 - $150 000 - $25 000 - $15 000 = $60 000。

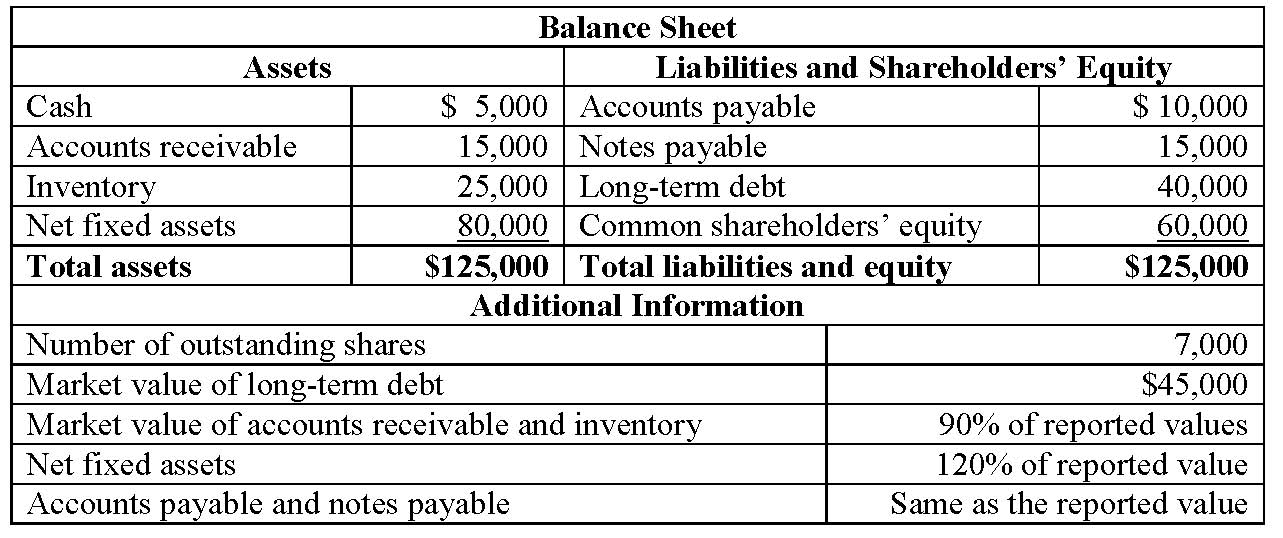

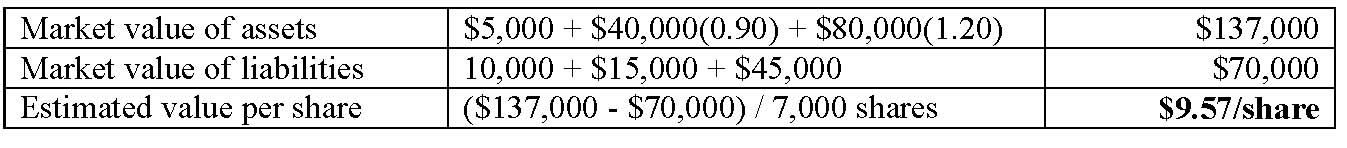

4、An analyst gathers the following information about a company:

Using asset-based valuation approach, the estimated value per share is closest to:【单选题】

A.$ 9.57.

B.$10.29.

C.$11.00.

正确答案:A

答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA, and Stephen E. Wilcox, CFA

2011 Modular Level I, Vol. 5, pp. 300-303

Study Session 14-60-j

Explain asset-based valuation models and demonstrate the use of asset-based models to calculate equity value.

5、Which of the following statements is most accurate about the responsibilities of an auditor for a publicly traded firm in the United States? The auditor:【单选题】

A.assures the reader that the financial statements are free from error, fraud, or illegal acts.

B.must express an opinion about the effectiveness of the company’s internal control systems.

C.must state that he prepared the financial statements according to generally accepted accounting principles.

正确答案:B

答案解析:“Financial Statement Analysis: An Introduction,” Elaine Henry and Thomas R. Robinson

2012 Modular Level I, Vol. 3, pp. 28–31

Study Session 7-22-d

Describe the objective of audits of financial statements, the types of audit reports, and the importance of effective internal controls.

B is correct. For a publicly traded firm in the United States, the auditor must express an opinion as to whether the company’s internal control system is in accordance with the Public Company Accounting Oversight Board, under the Sarbanes–Oxley Act. This is done either as a final paragraph in the auditor’s report or as a separate opinion.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料