How to understand Ohlin Model?

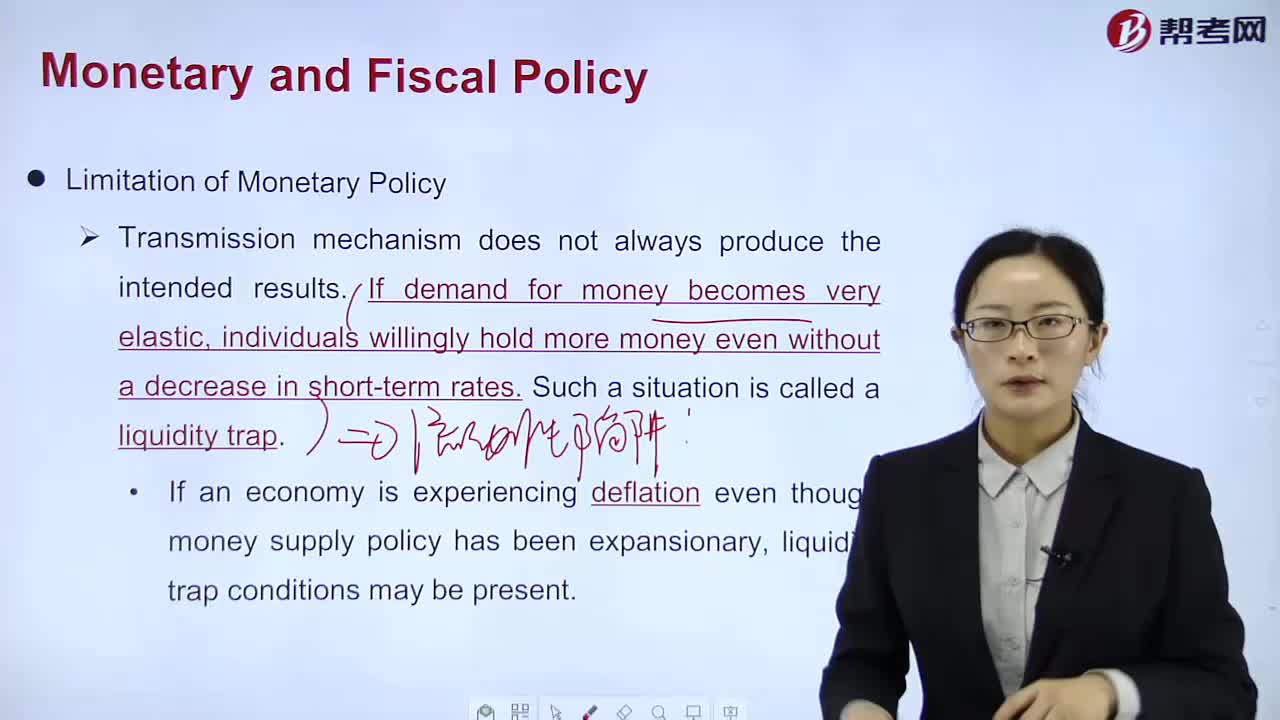

How to understand Economics-Limitation of Monetary Policy?

How to master Economics-Supply of Money?

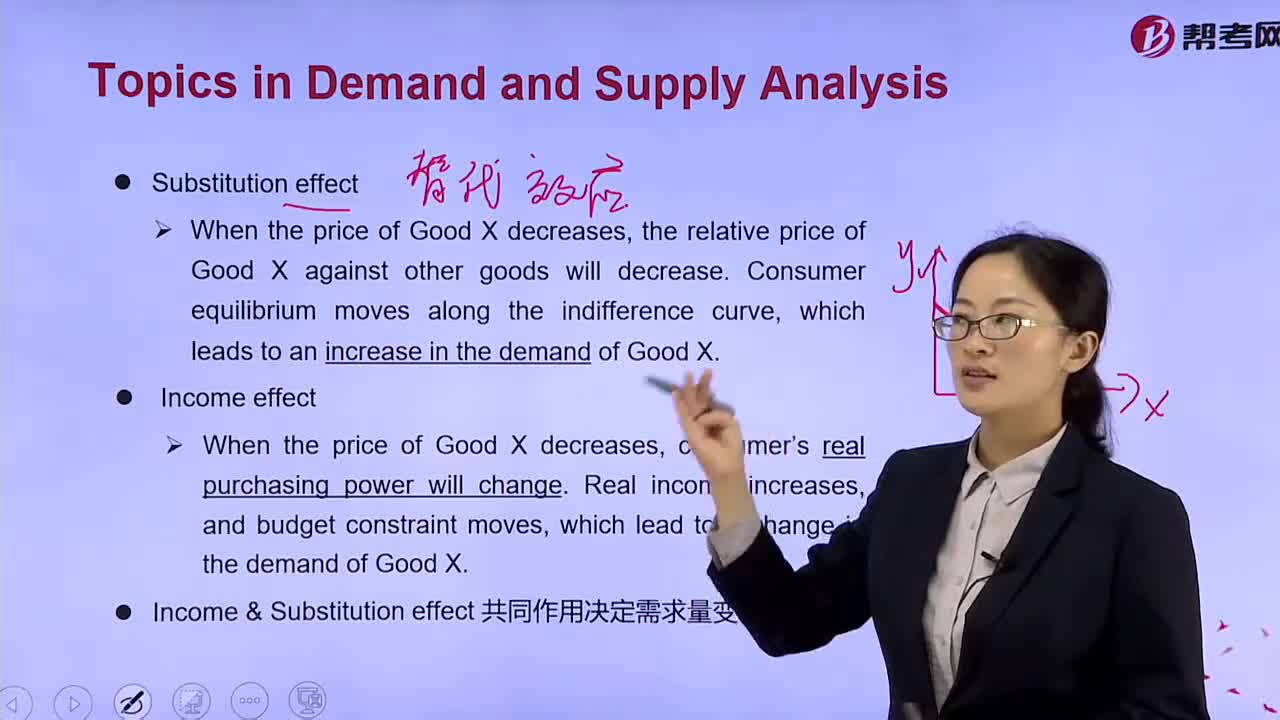

What's the meaning of Economics-Substitution effect?

Monopolistic competition?

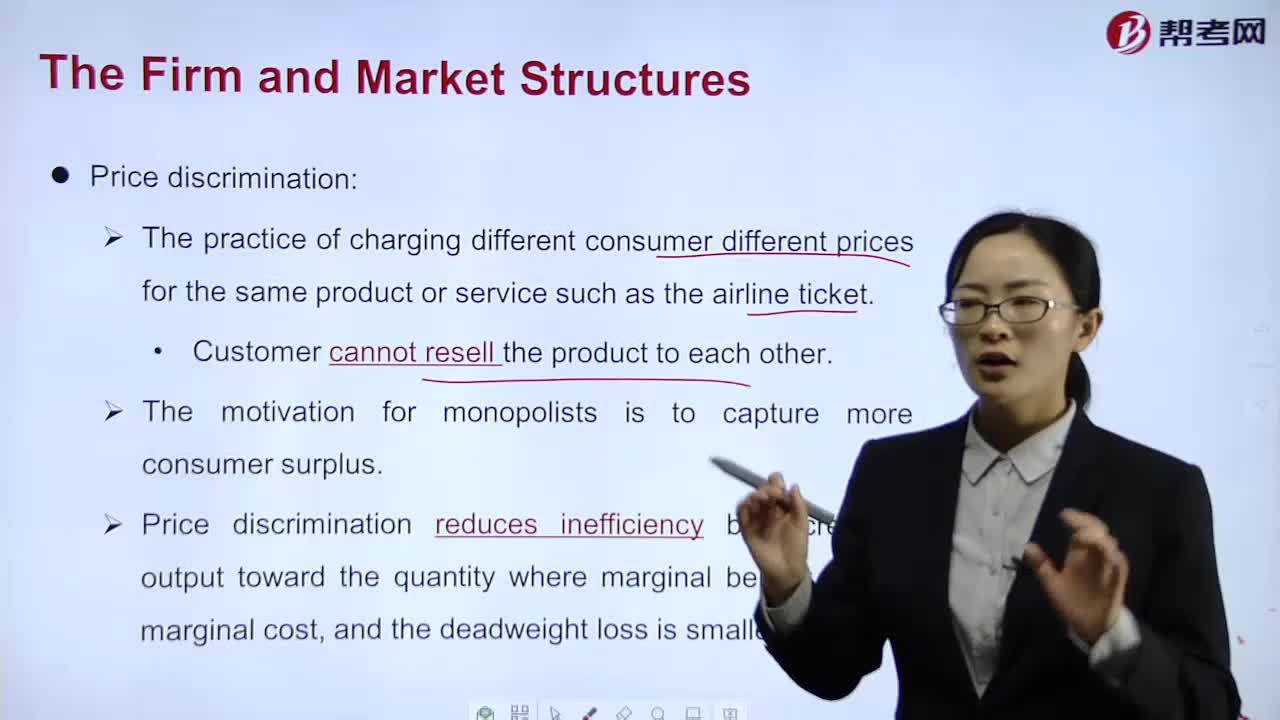

How to master Economics-Price discrimination?

What does Altman' s z-score model mean?

What is mean variance model?

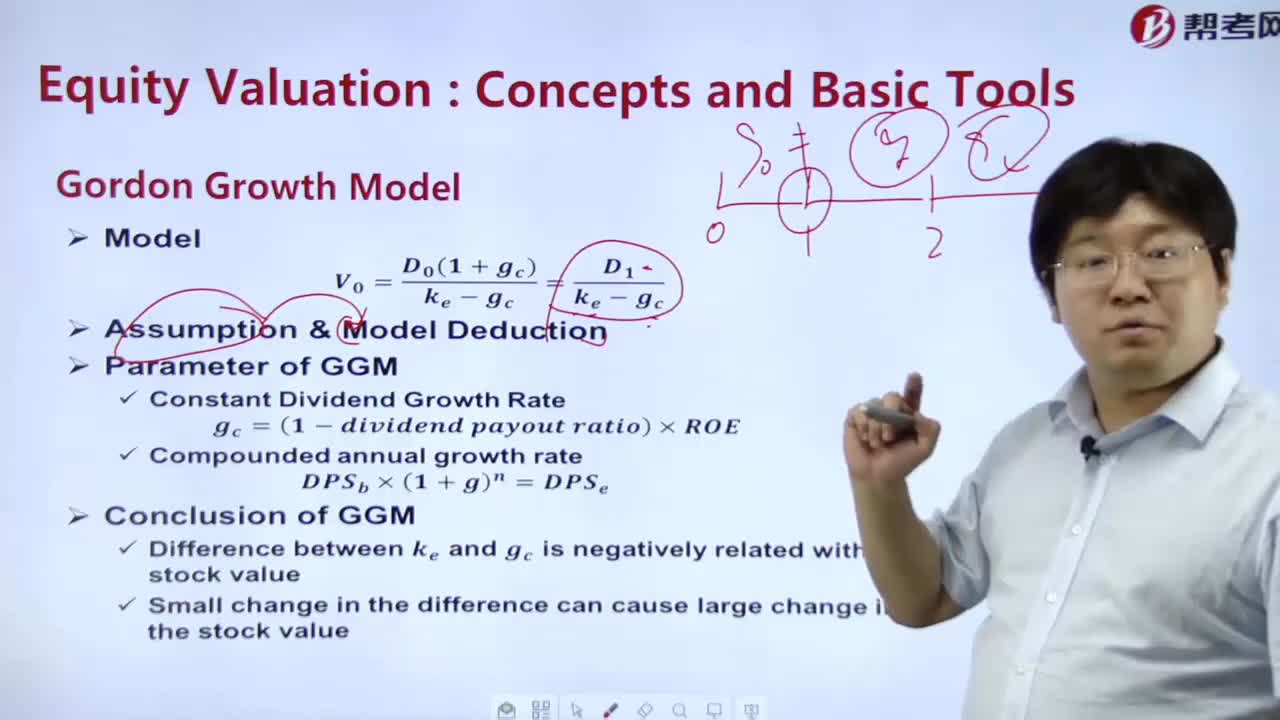

What are the methods of dividend discount model?

What is the formula of dividend discount model?

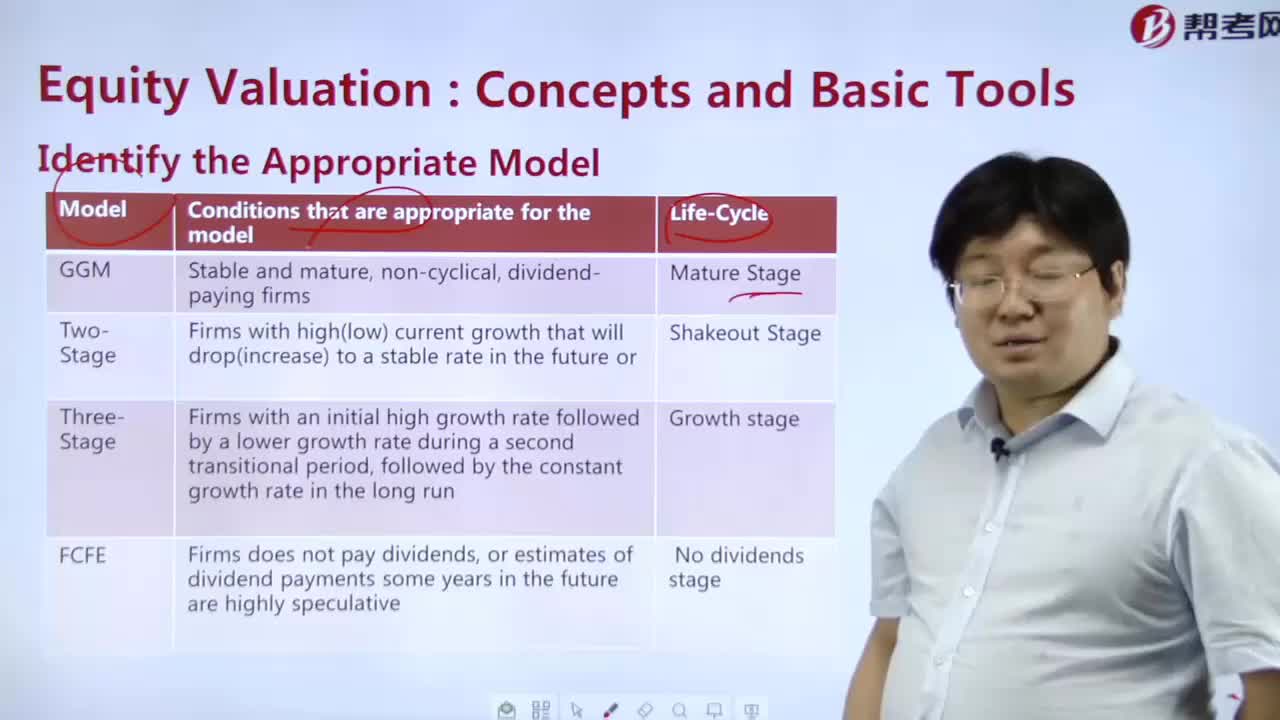

How do determine the right model?

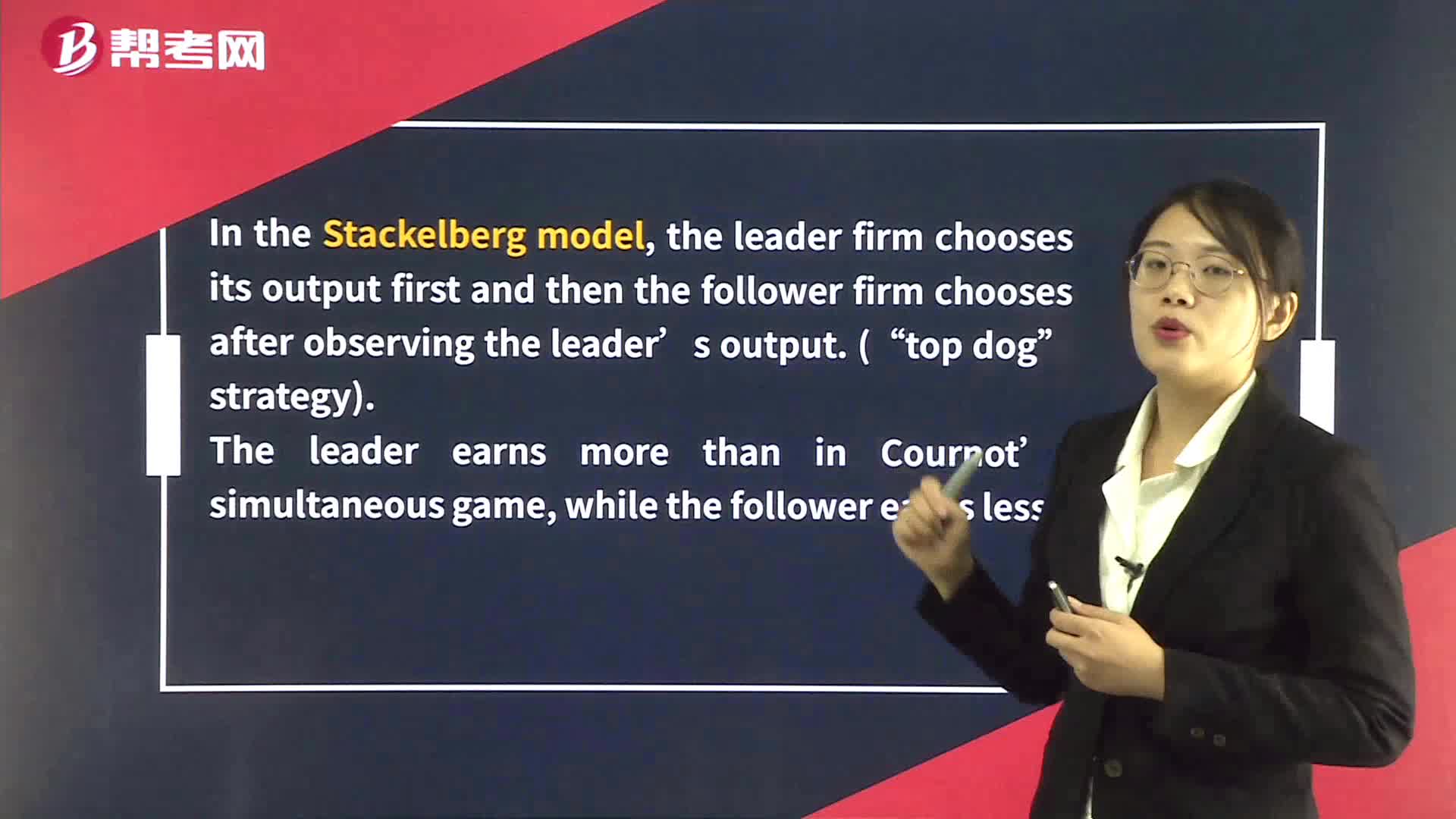

Stackelberg Model in Oligopoly Market

下载亿题库APP

联系电话:400-660-1360