Stackelberg Model in Oligopoly Market

Supply Analysis in Monopolistic Competition

Pricing strategies in Oligopoly

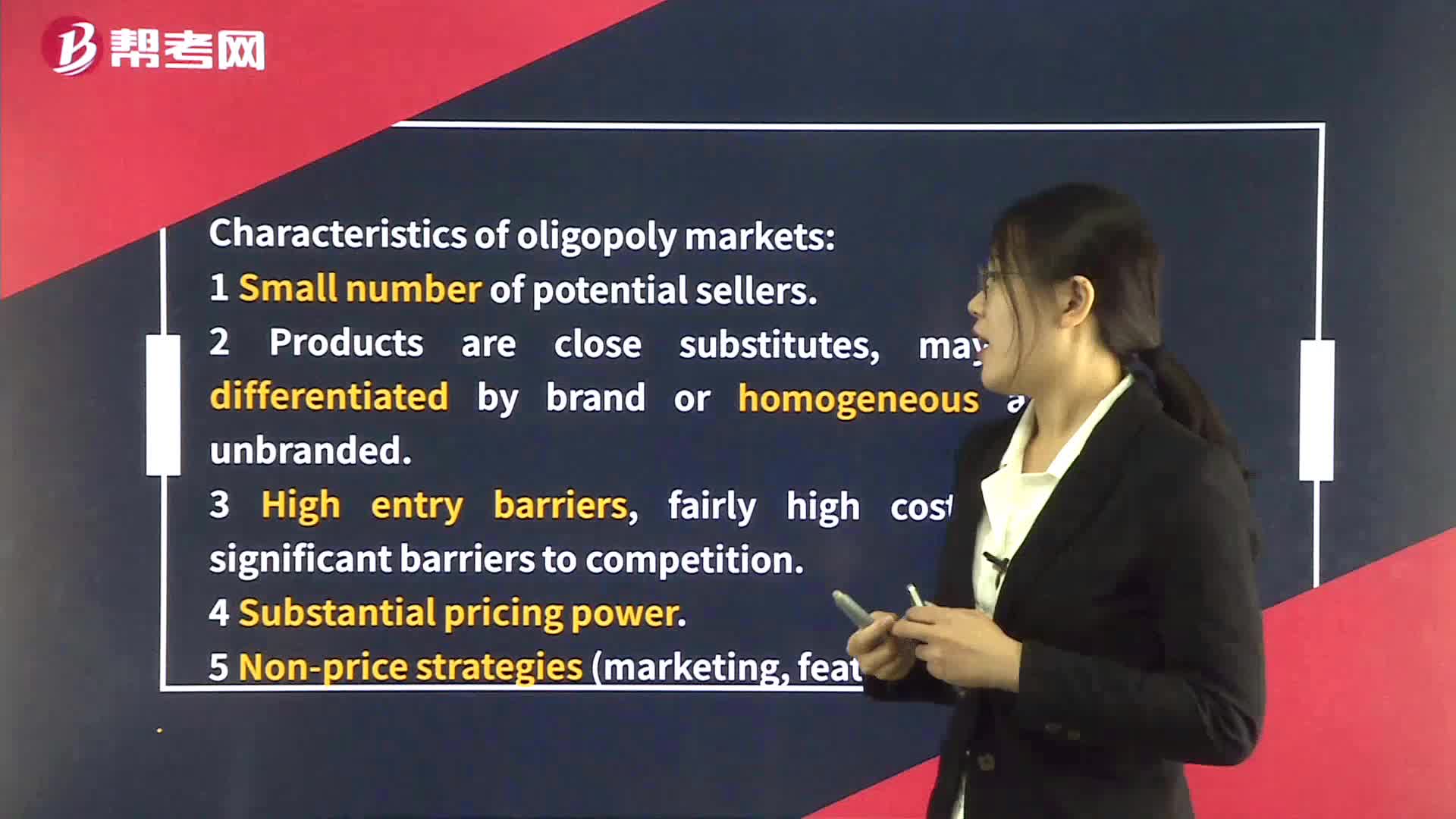

Oligopoly

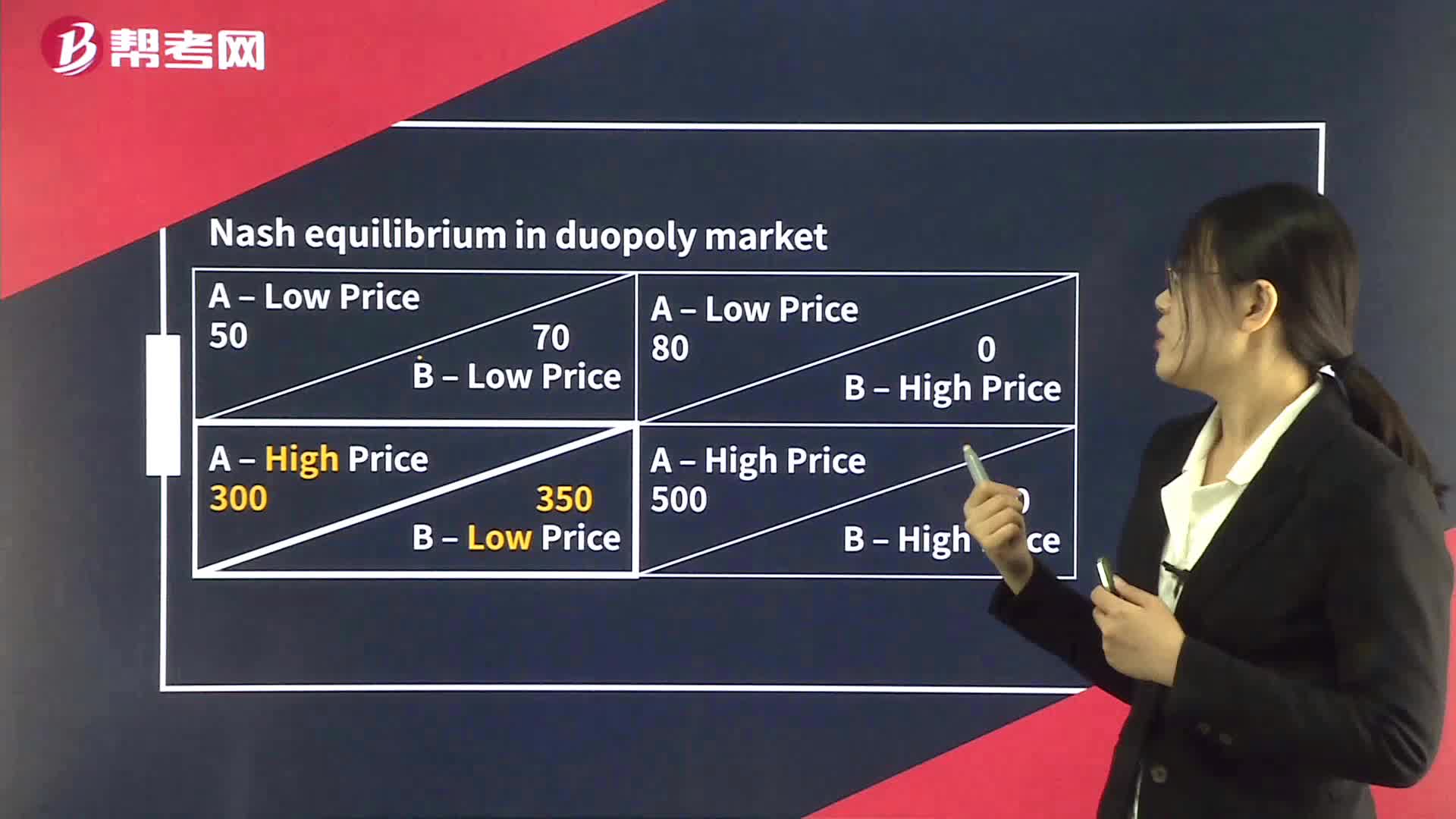

Nash Equilibrium in Oligopoly Market

Long-Run Equilibrium in Perfectly Competitive Markets

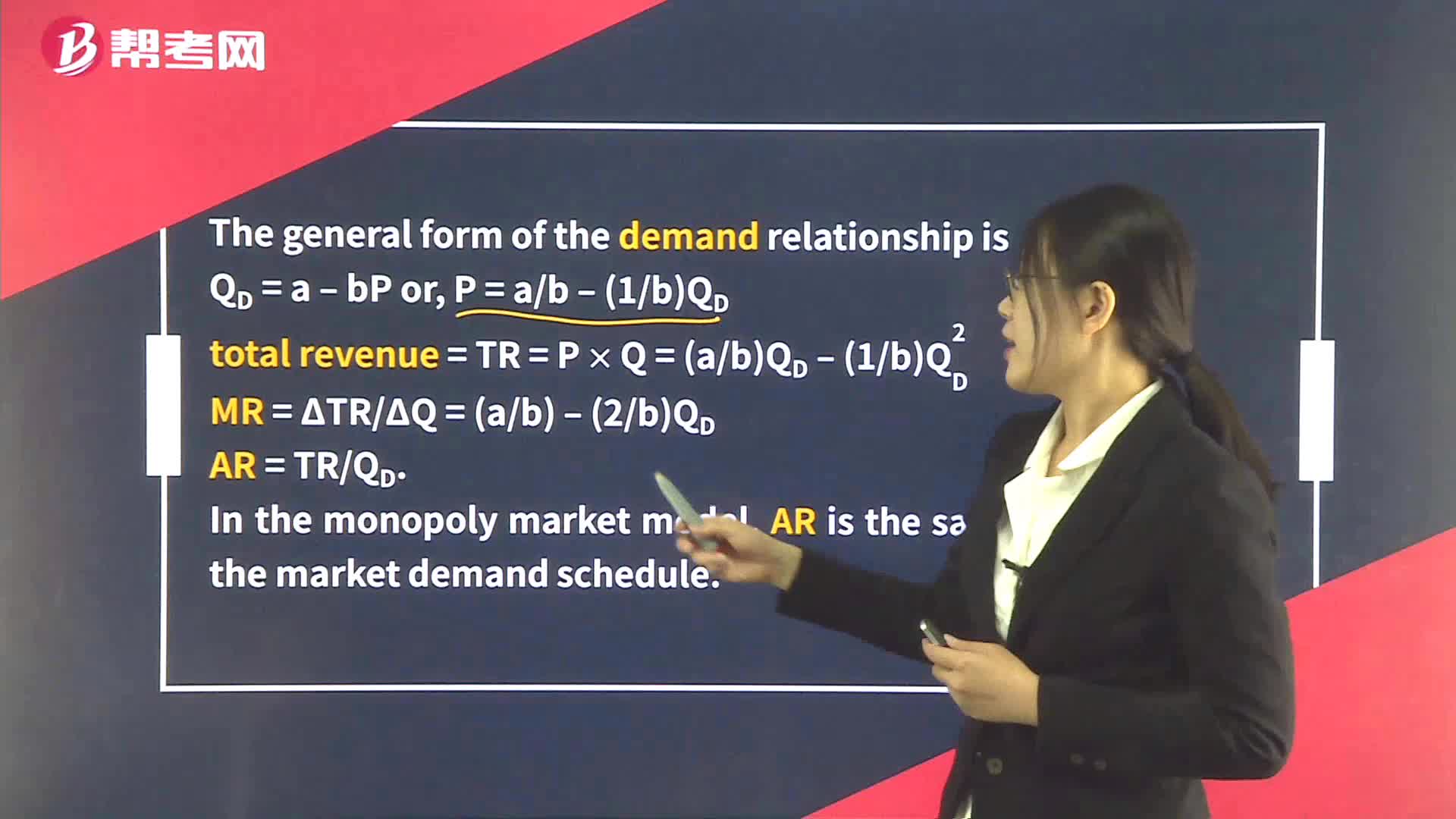

Market Structure

Shifts in Aggregate Supply

Long-Run Equilibrium in Oligopoly Market

Long-Run Equilibrium in Monopolistic Competition

Kinked Demand Curve in Oligopoly Market

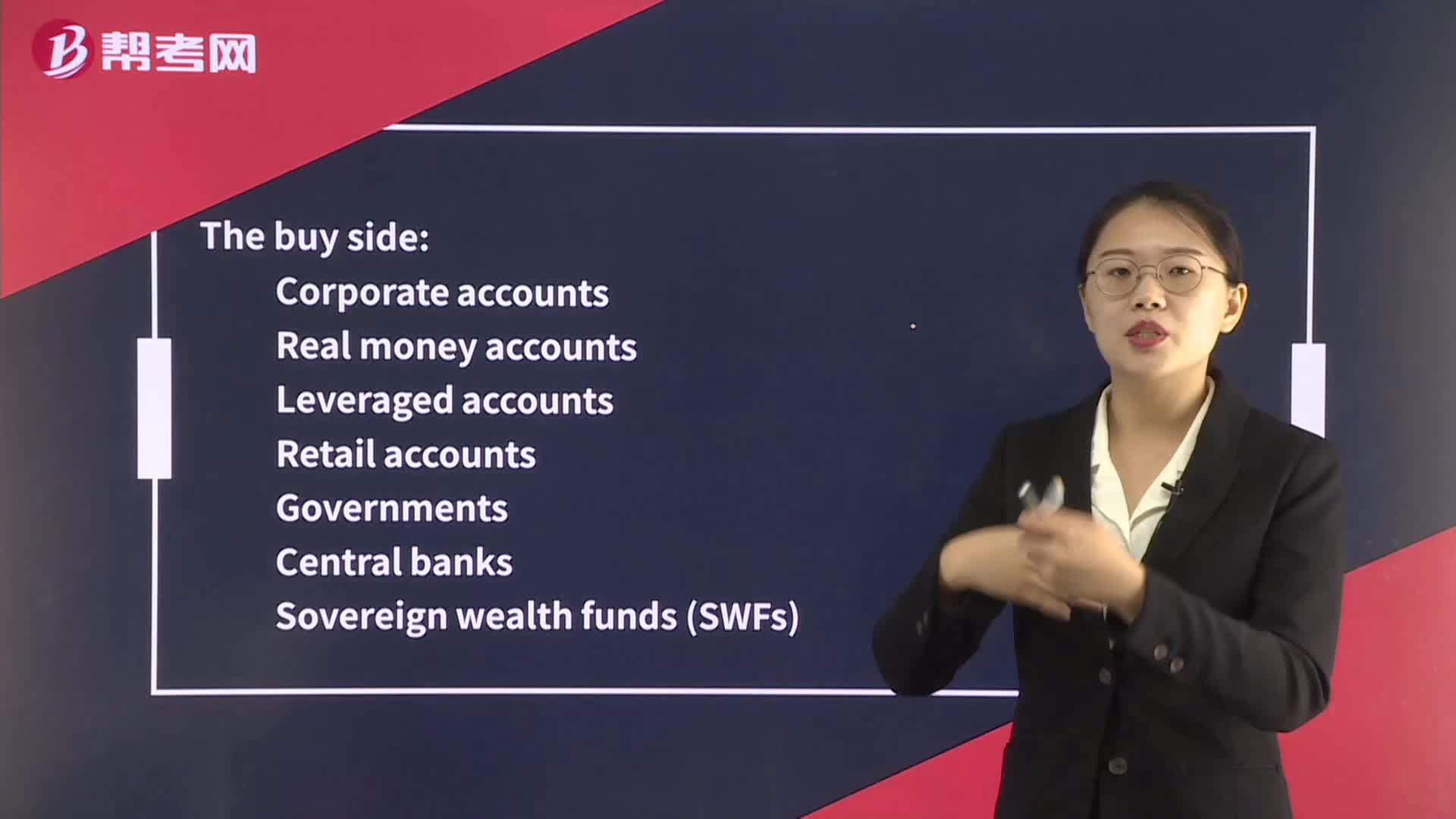

Foreign Exchange Market Participants

下载亿题库APP

联系电话:400-660-1360