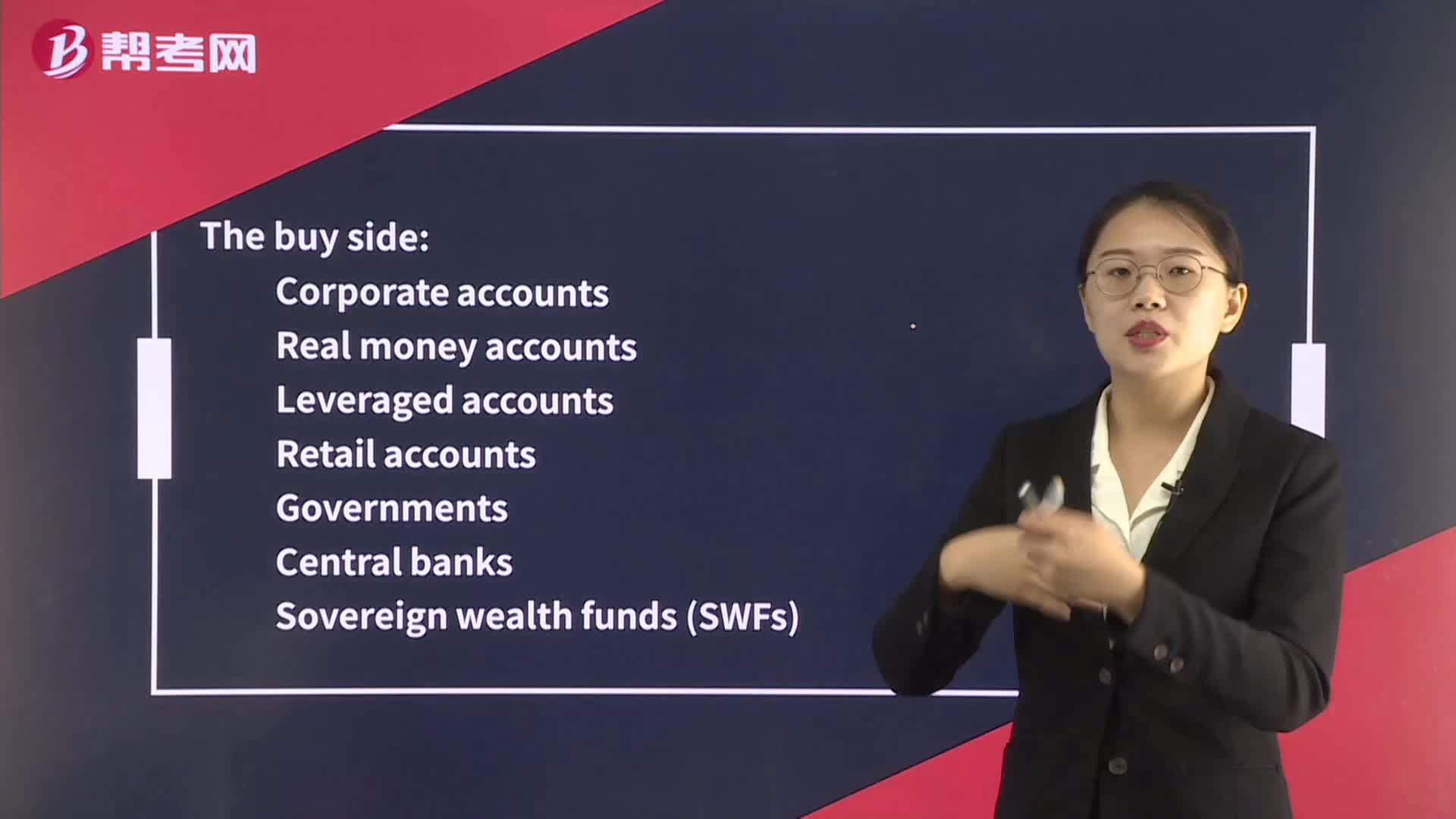

Foreign Exchange Market Participants

1. Commercial banks: Commercial banks are the largest participants in the foreign exchange market. They act as intermediaries between buyers and sellers of foreign currency and provide liquidity to the market.

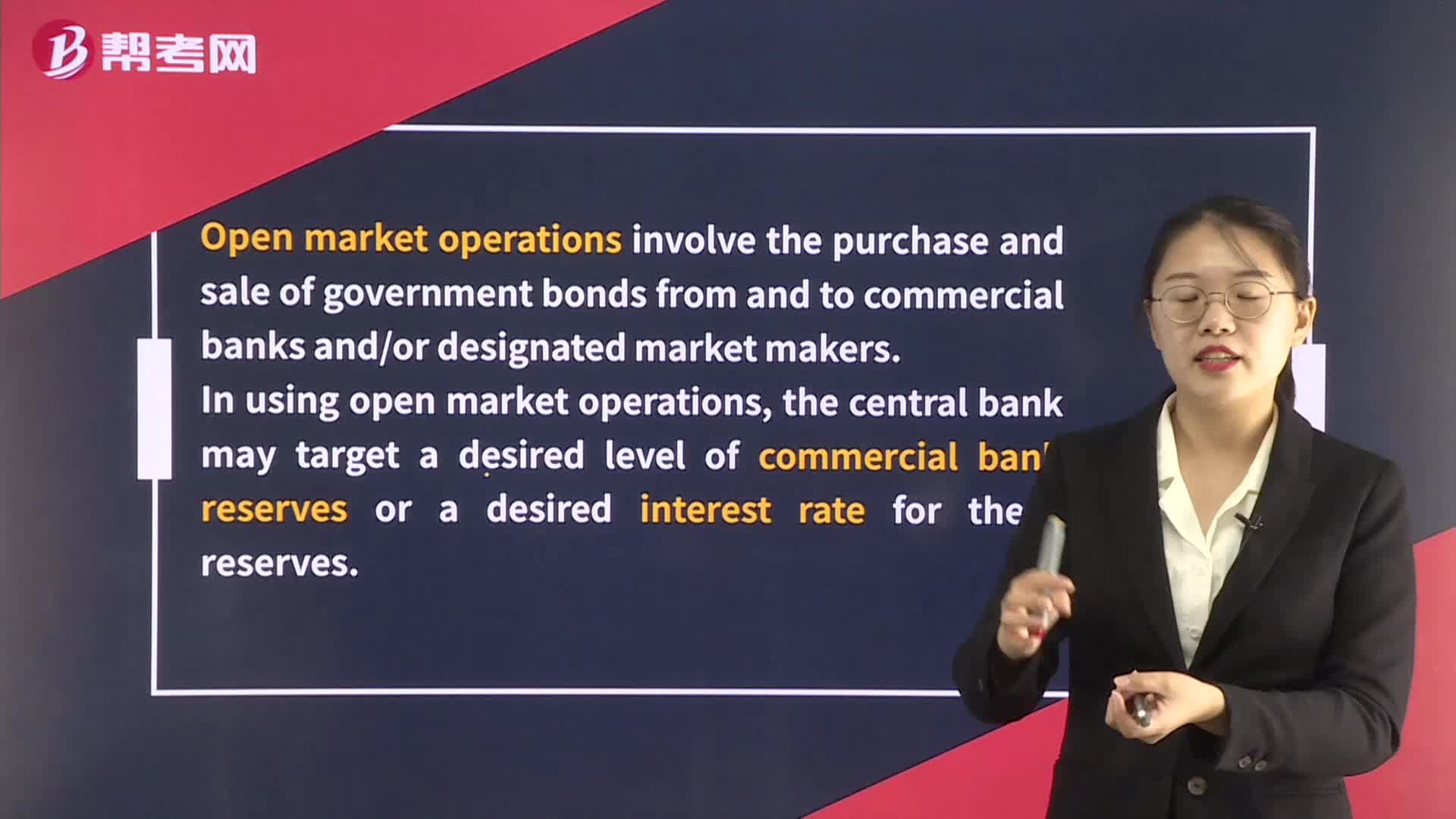

2. Central banks: Central banks are responsible for implementing monetary policy and maintaining stability in the foreign exchange market. They intervene in the market by buying or selling currencies to influence their value.

3. Hedge funds: Hedge funds are large investors who use various trading strategies to profit from fluctuations in the foreign exchange market. They may engage in currency speculation or hedging to manage their risk exposure.

4. Corporations: Multinational corporations engage in foreign exchange transactions to manage their exposure to currency risk. They may use currency hedging strategies to protect against adverse movements in exchange rates.

5. Retail traders: Retail traders are small investors who trade currencies through online platforms. They may engage in currency speculation or use forex trading as a means of diversifying their investment portfolio.

6. Governments: Governments may participate in the foreign exchange market to manage their foreign currency reserves or to influence their country's exchange rate. They may also intervene in the market to prevent excessive volatility or to support their domestic currency.

7. Investment banks: Investment banks provide a range of services to clients in the foreign exchange market, including trading, hedging, and advisory services. They may also engage in proprietary trading to generate profits for their own account.

帮考网校

帮考网校