Foreign Exchange Market - Spot Rates and Forward Rates

Exchange Rate Quotations

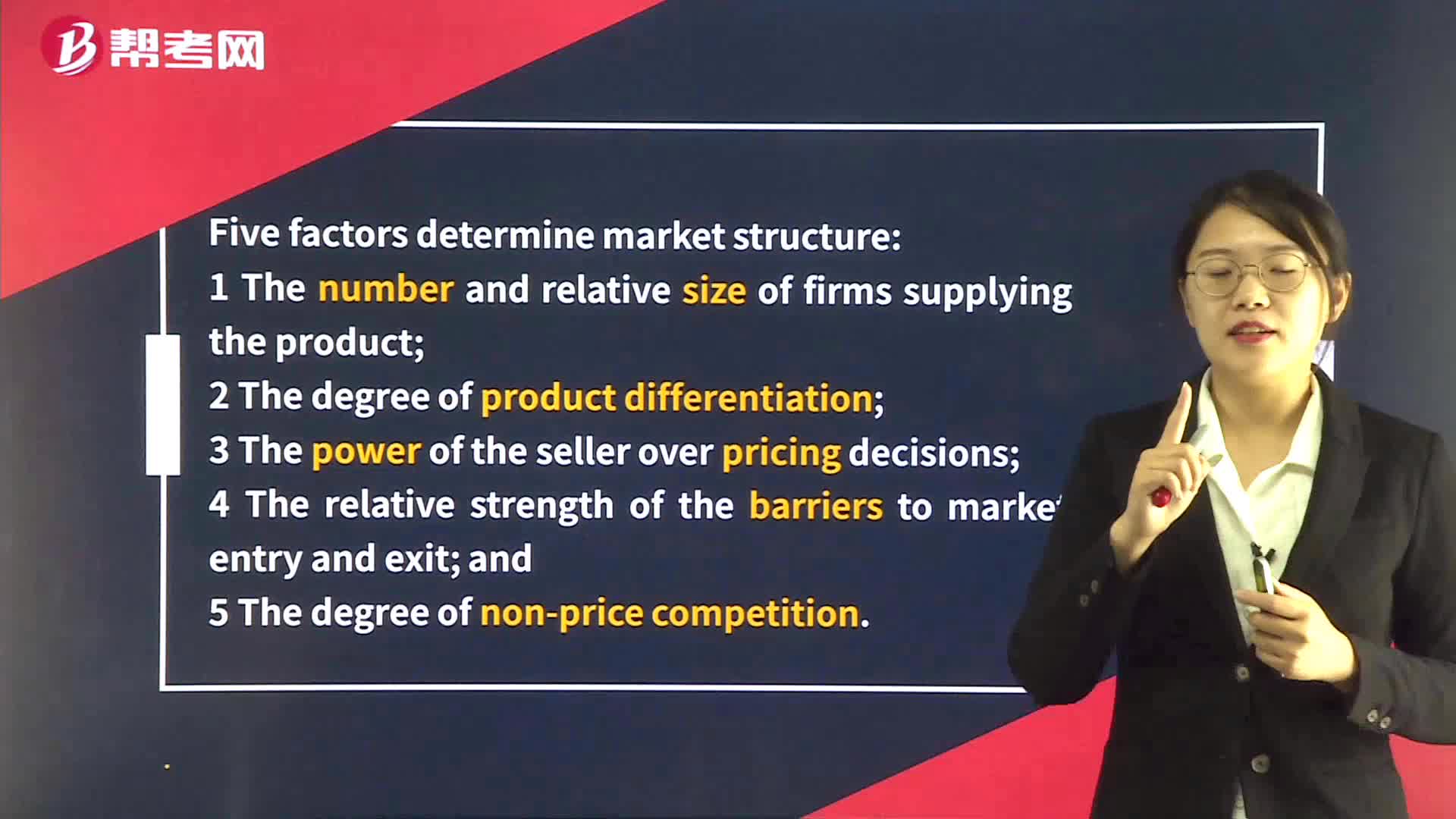

Identification of Market Structure – HHI

Currency Regimes - Dollarization and Monetary Union

Identification of Market Structure – Concentration Ratio

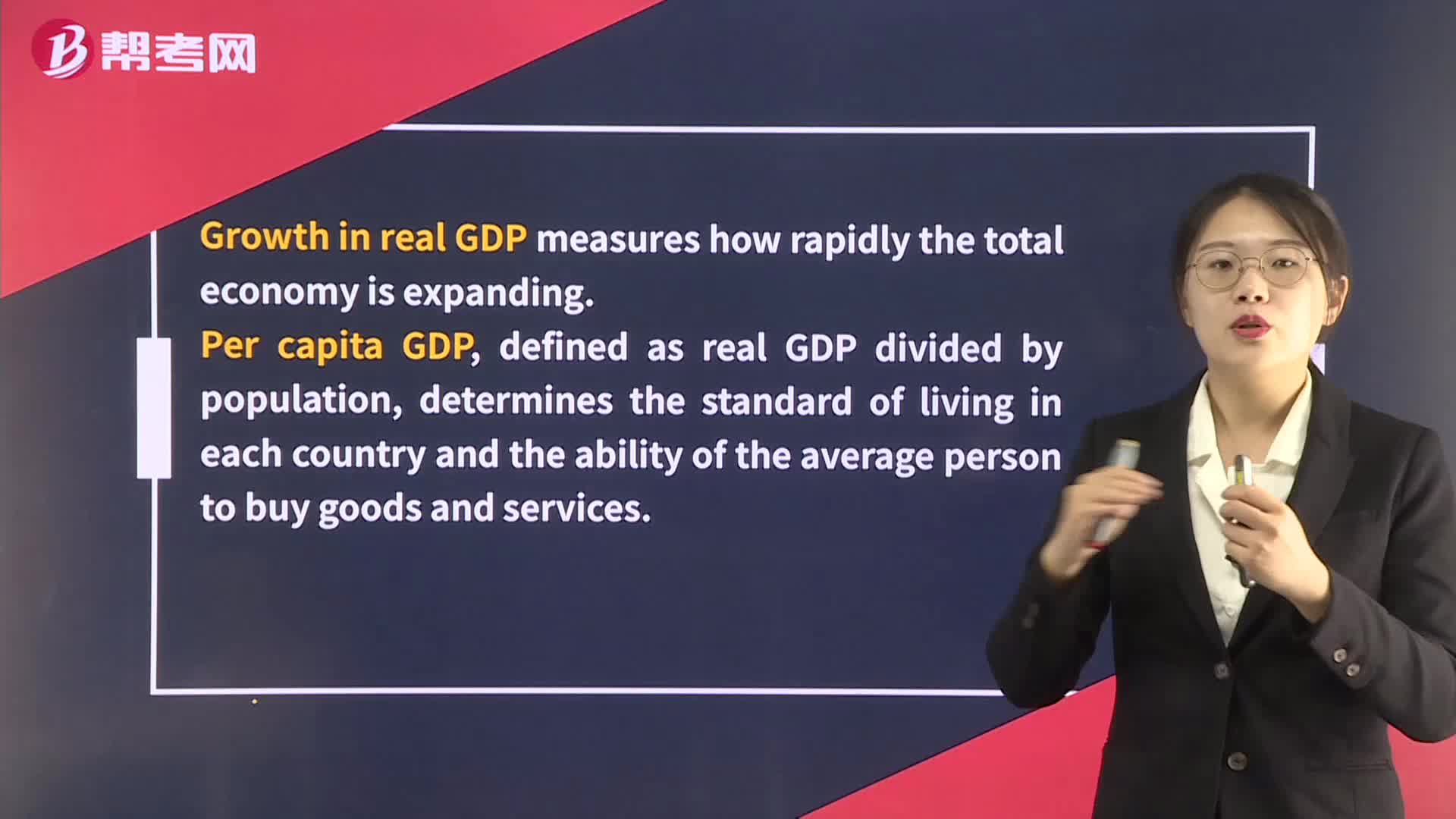

Equilibrium GDP and Prices – Stagflation

Identification of Market Structure – Econometric Method

Equilibrium GDP and Prices

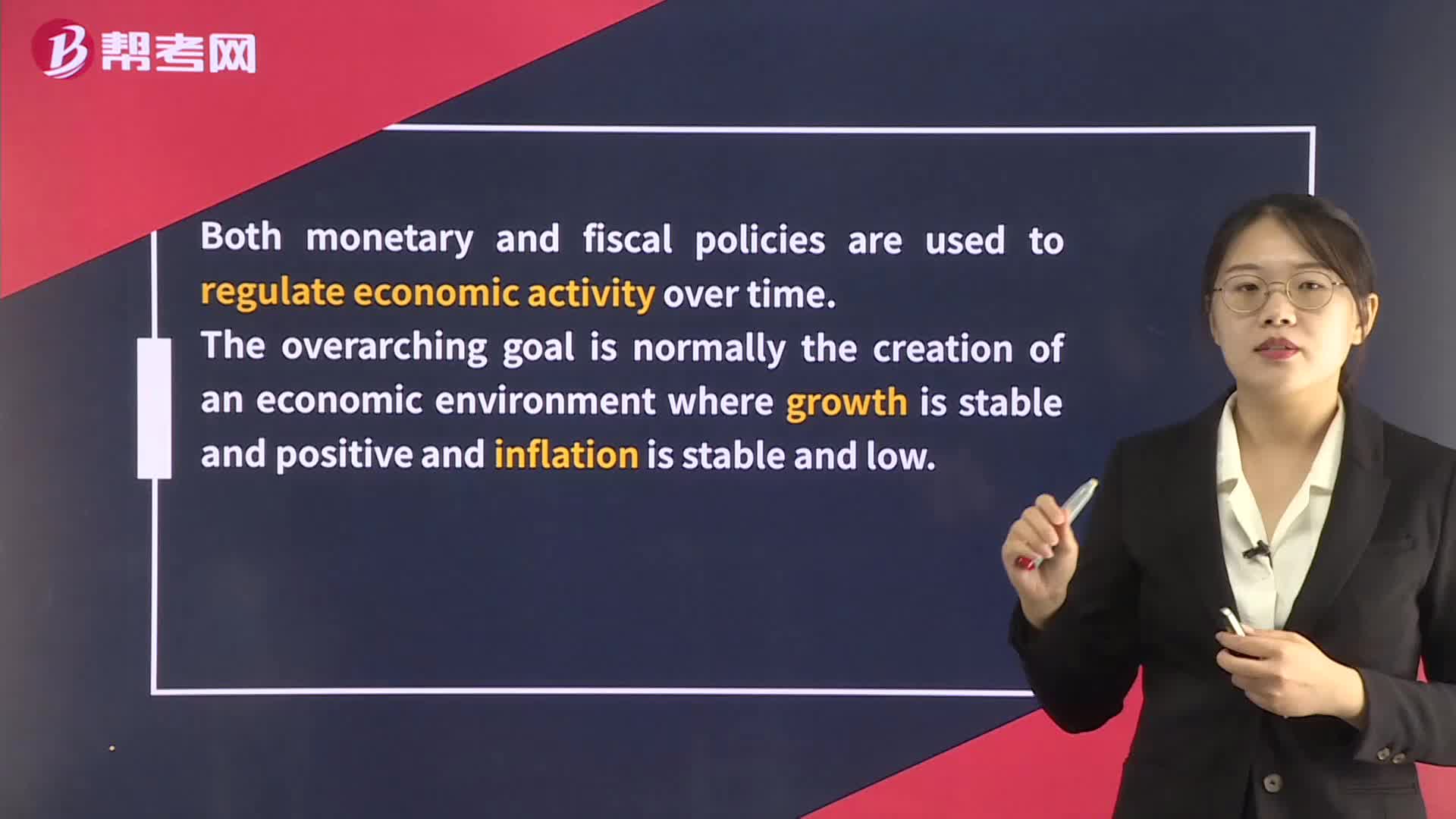

The Relationship Between Fiscal and Monetary Policy

Price Indexes and Their Usage

Cournot Assumption in Oligopoly Market

Deficits and the Fiscal Stance

下载亿题库APP

联系电话:400-660-1360