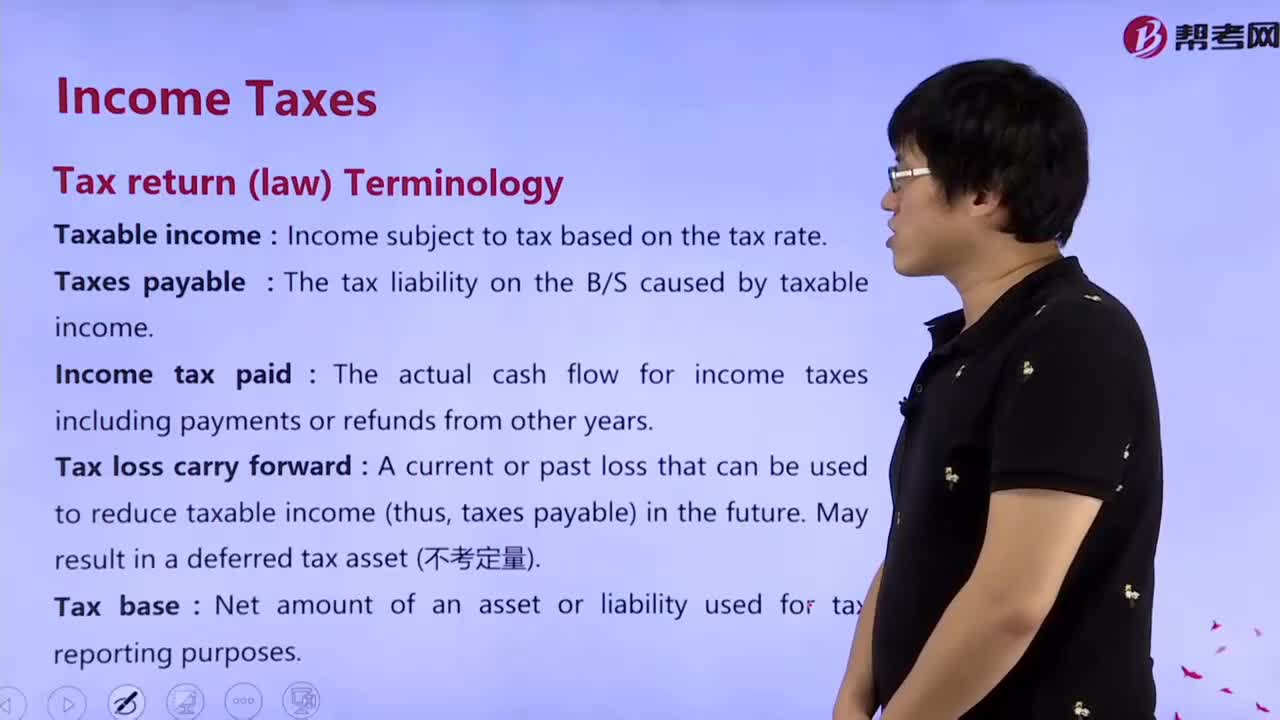

How to understand Tax return (law) Terminology?

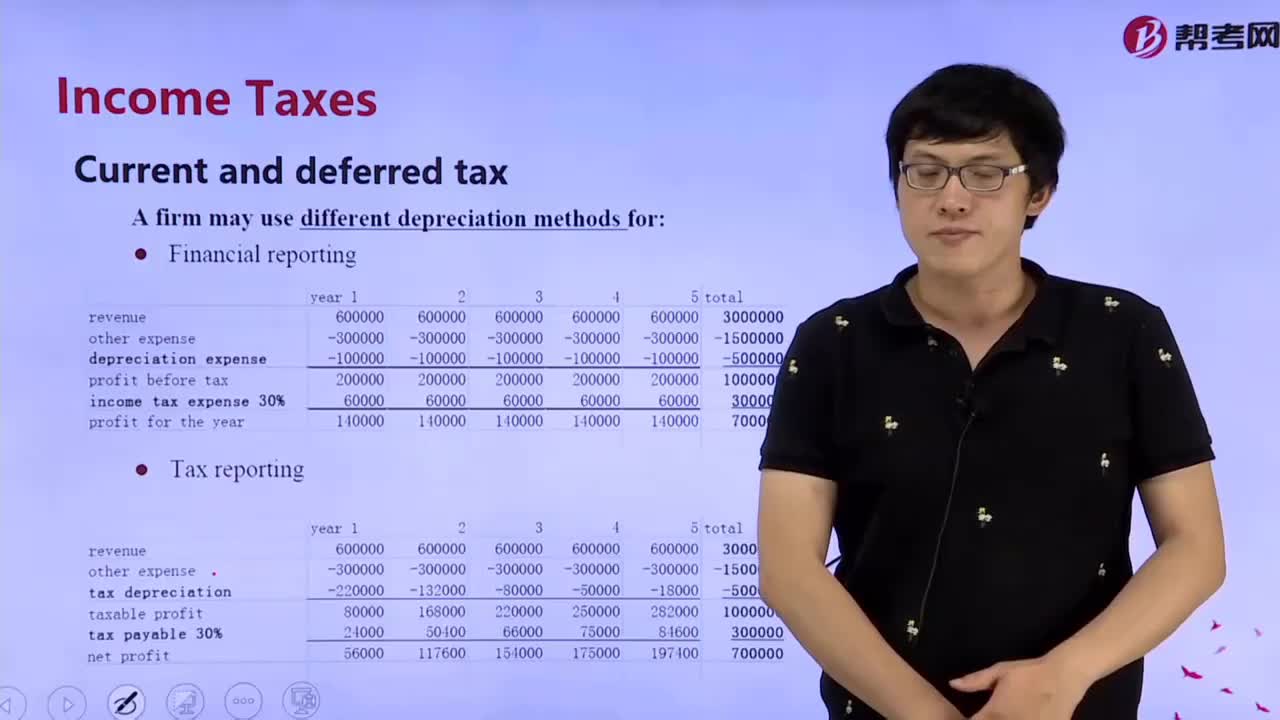

How to master Current and deferred tax?

How to master Disclosure analysis?

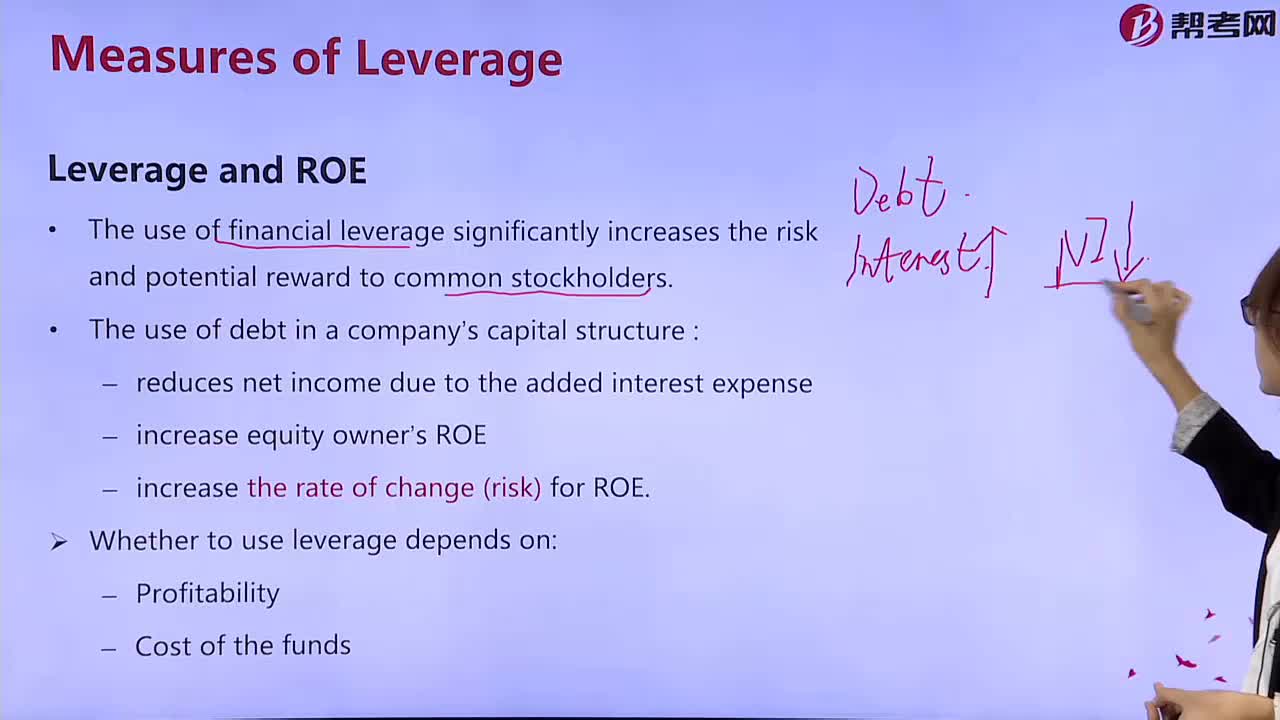

What does financial leverage have to do with return on assets?

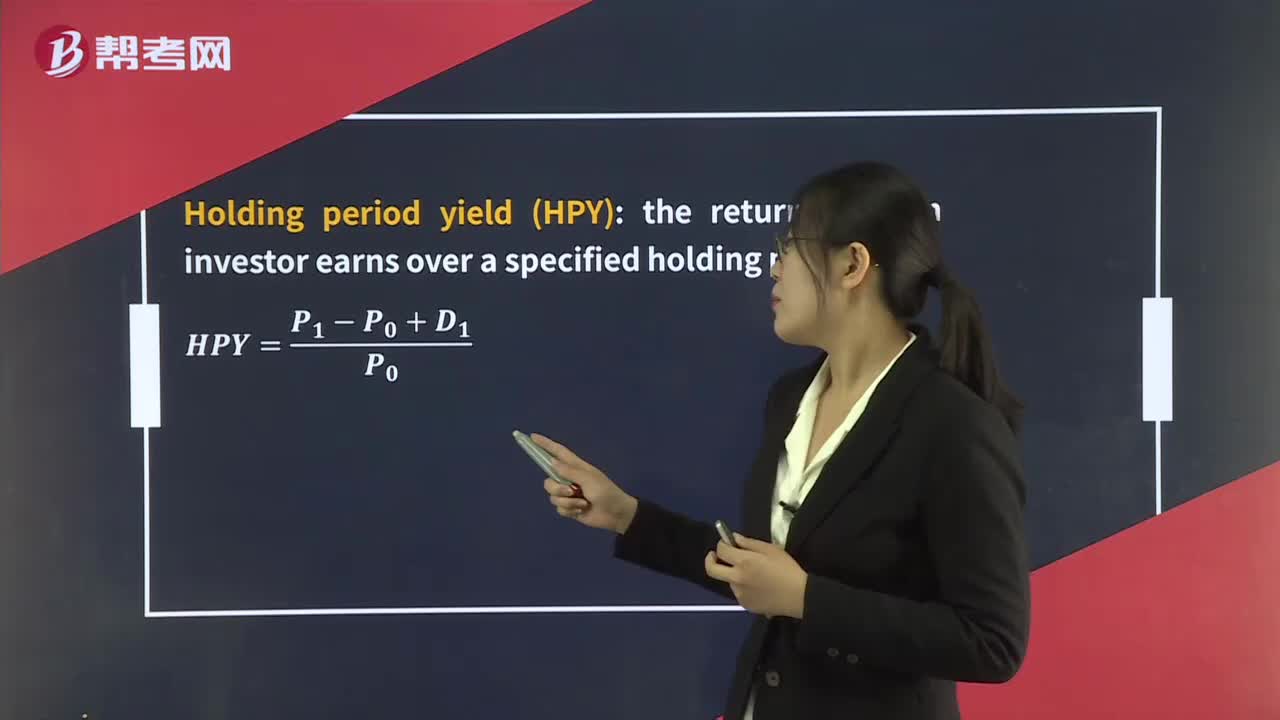

How to control risk and return?

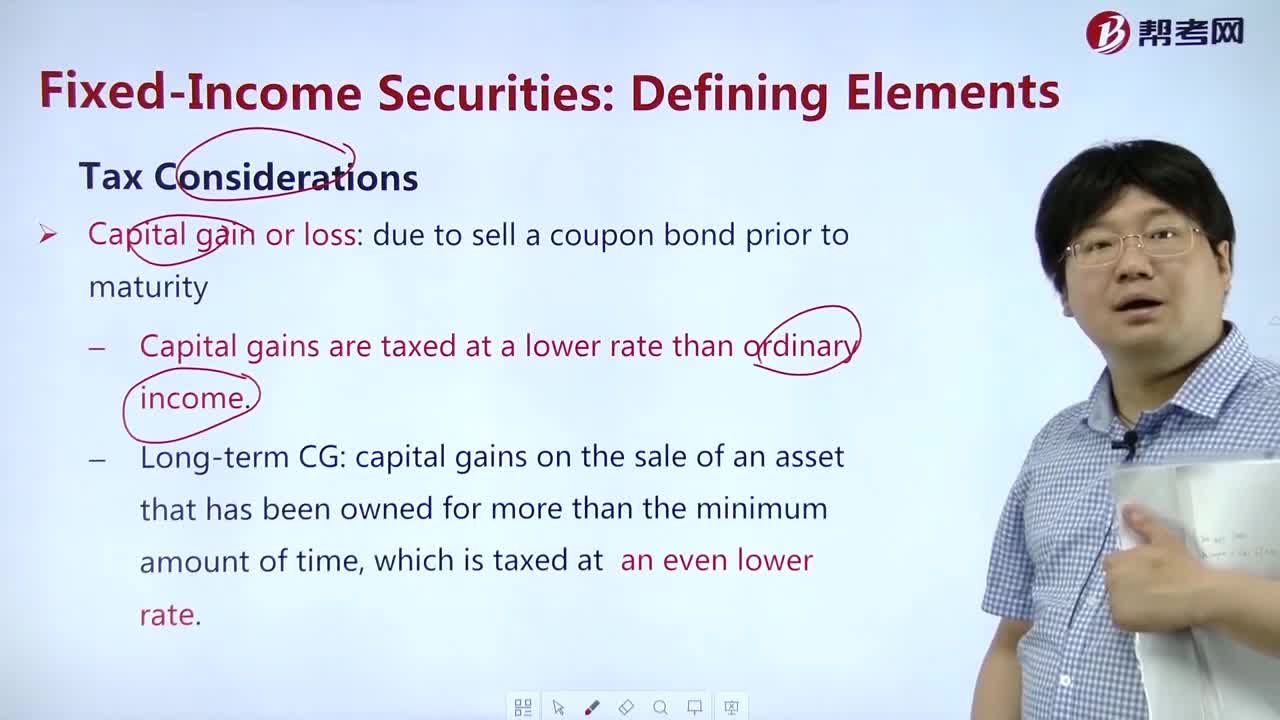

What does Tax Considerations mean?

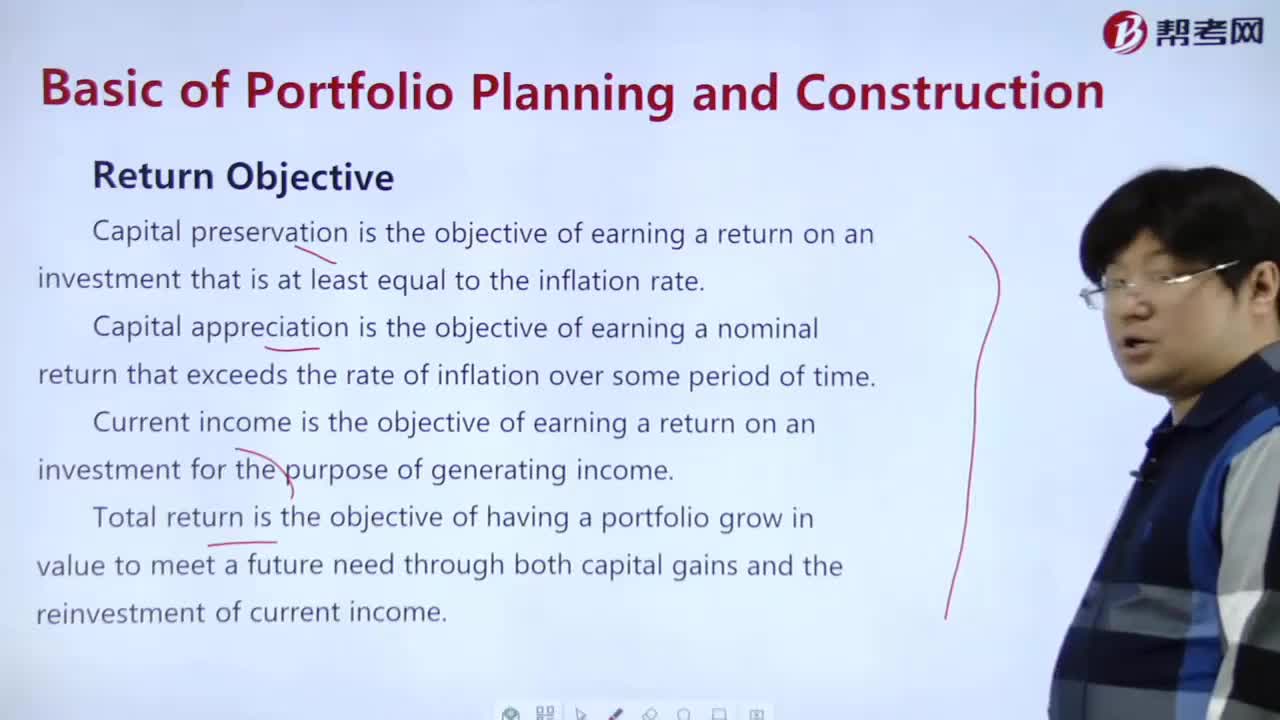

What does it mean Return Objective?

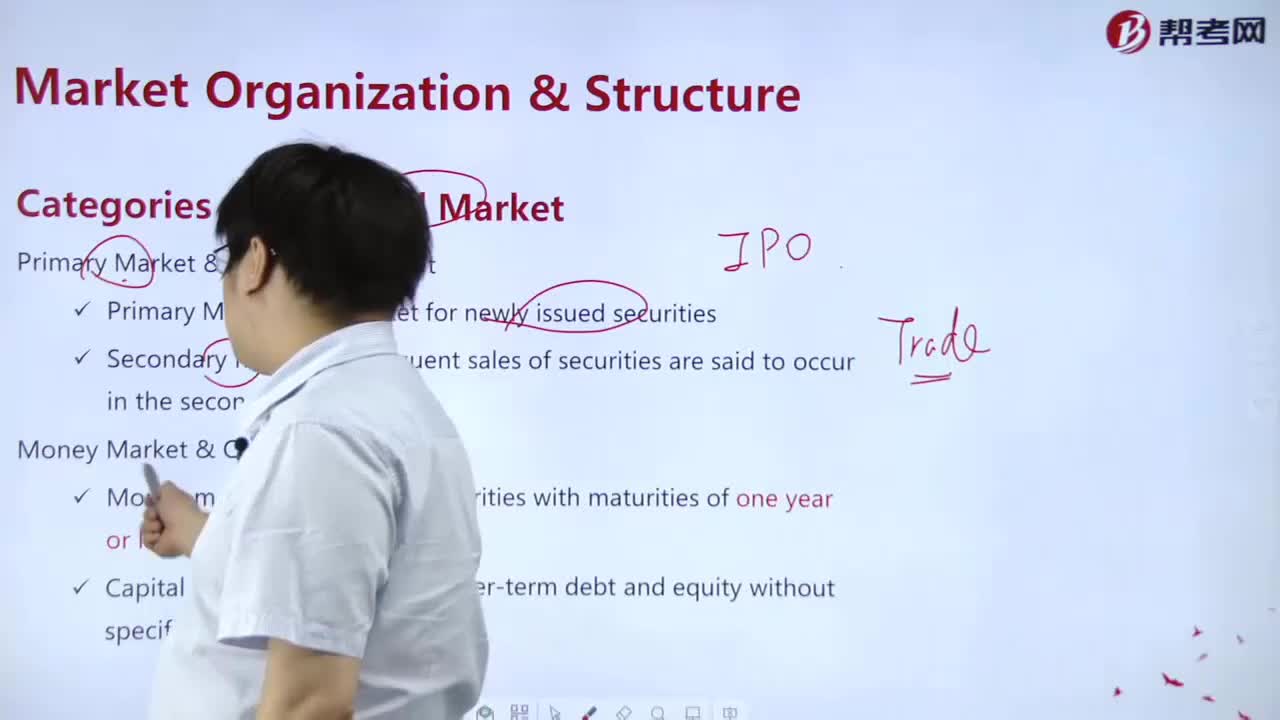

What are the classifications of Financial Market?

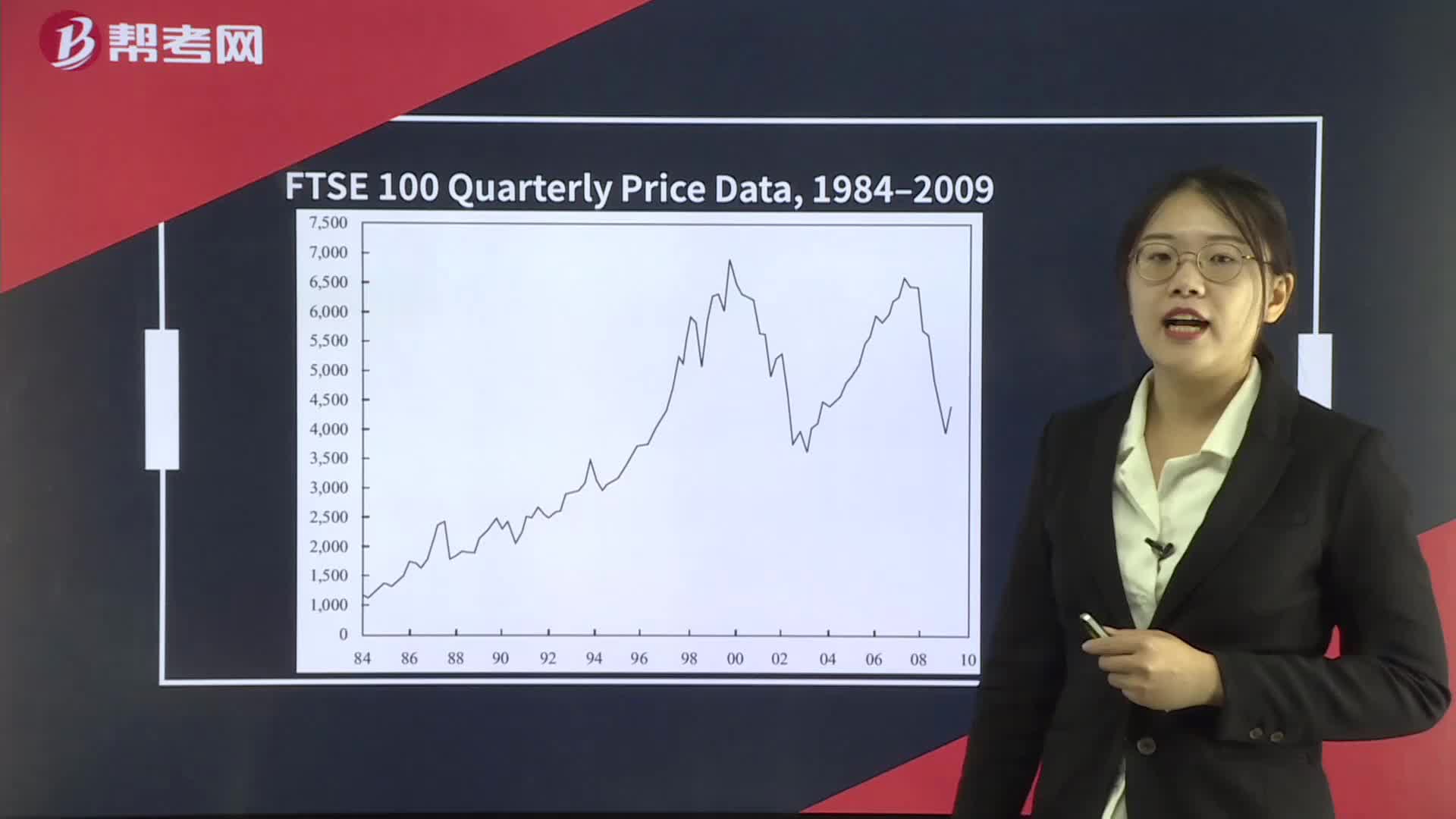

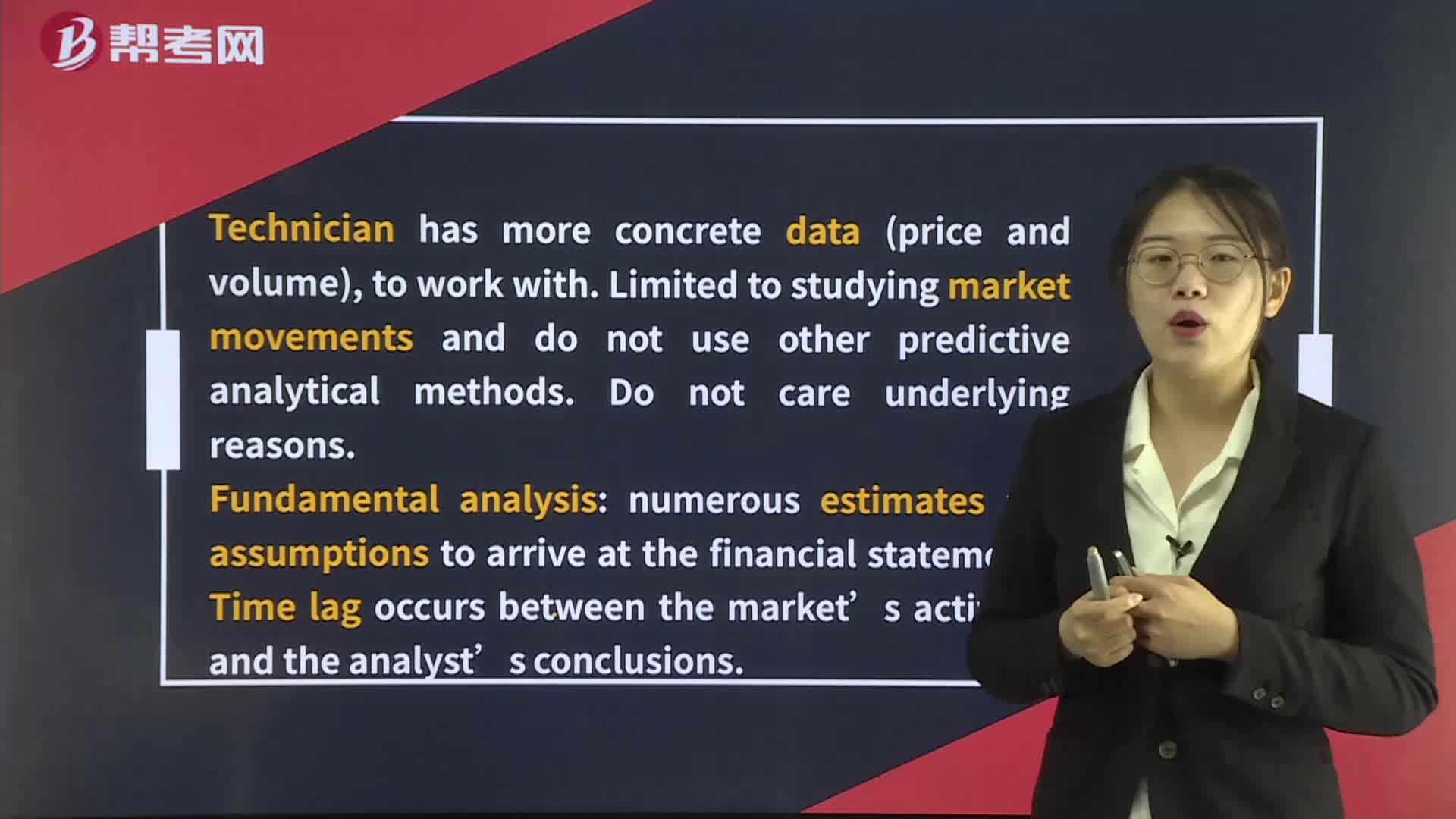

Technical and Fundamental Analysis

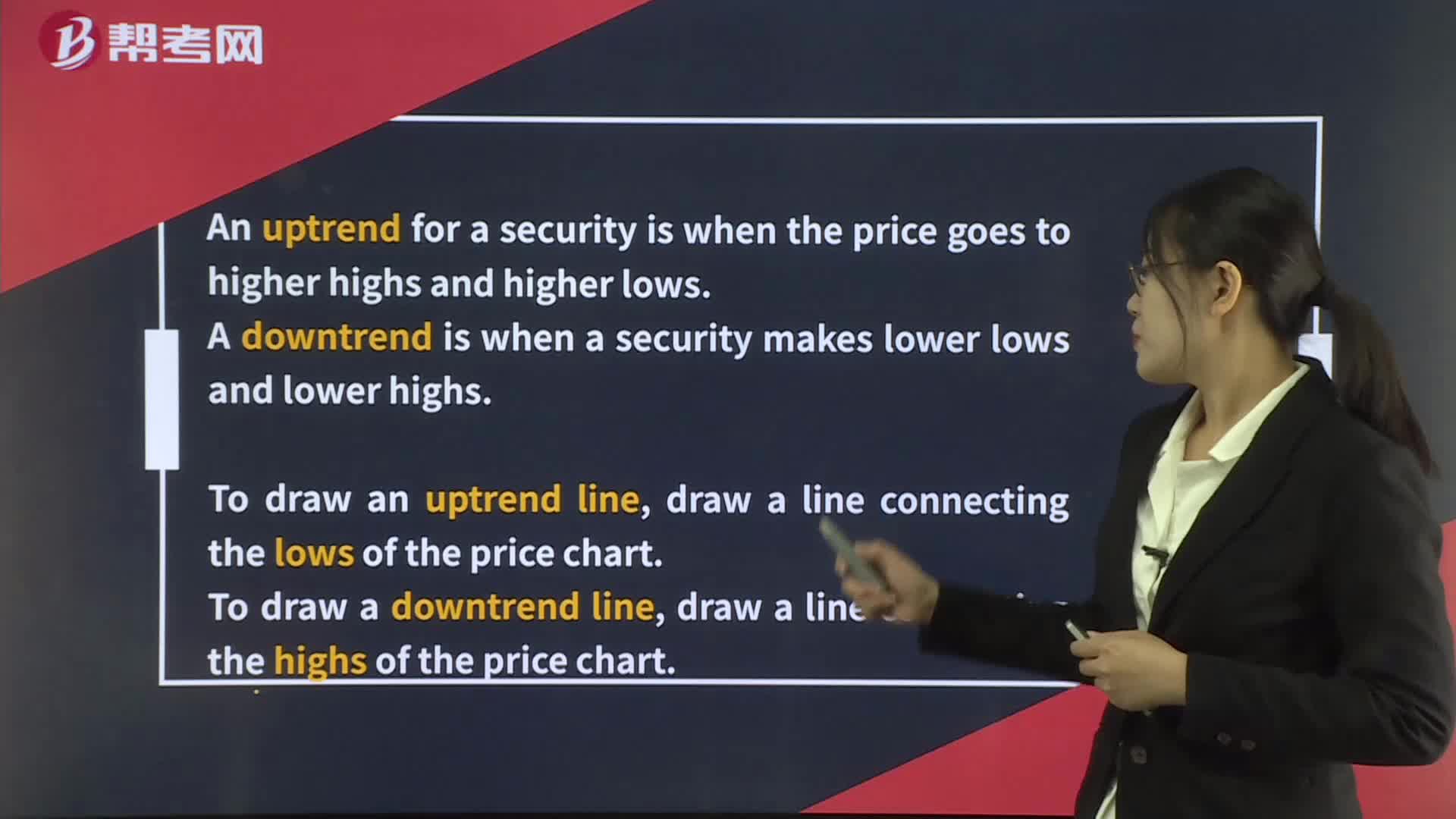

Technical Analysis Tools— Trend

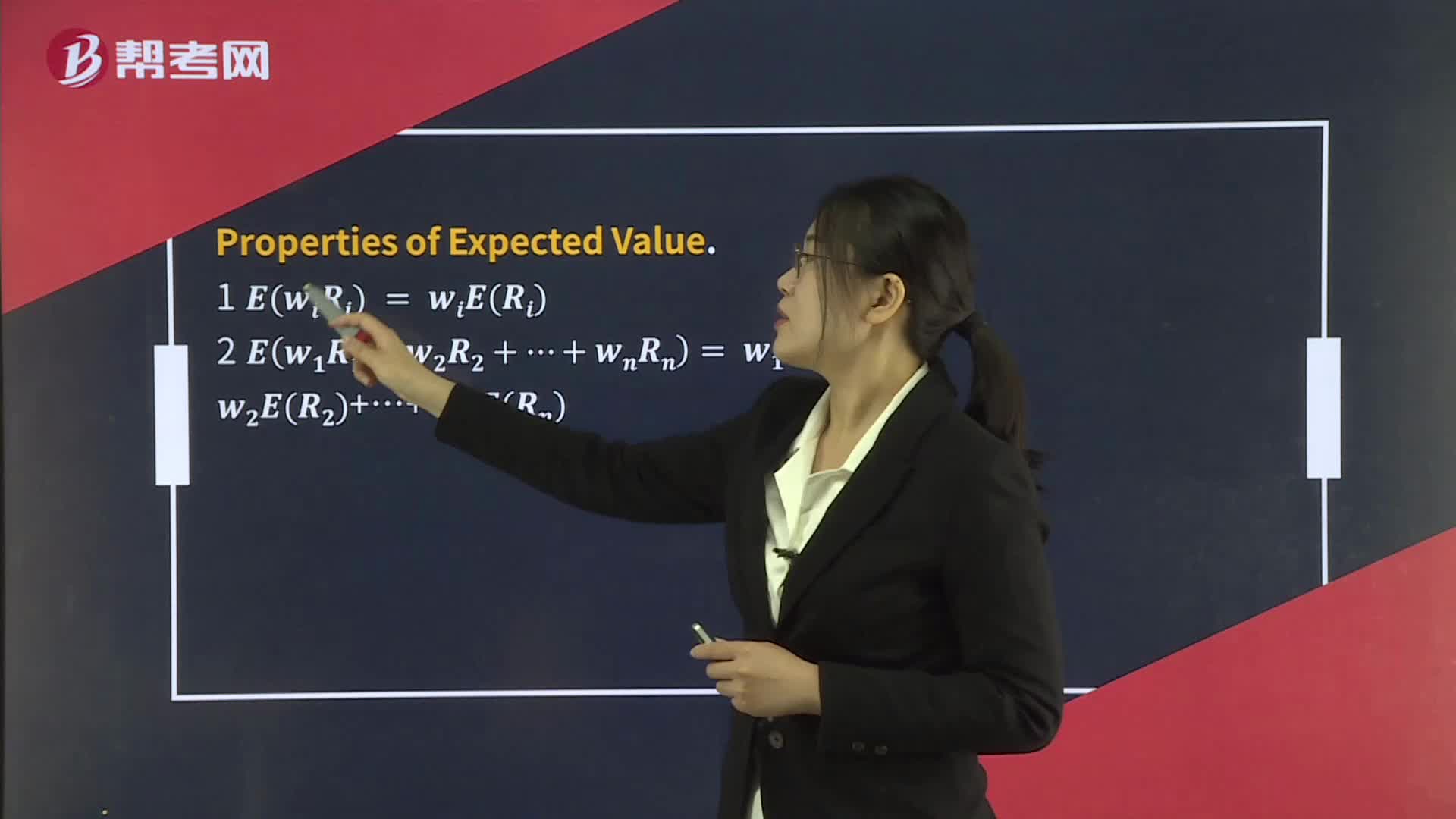

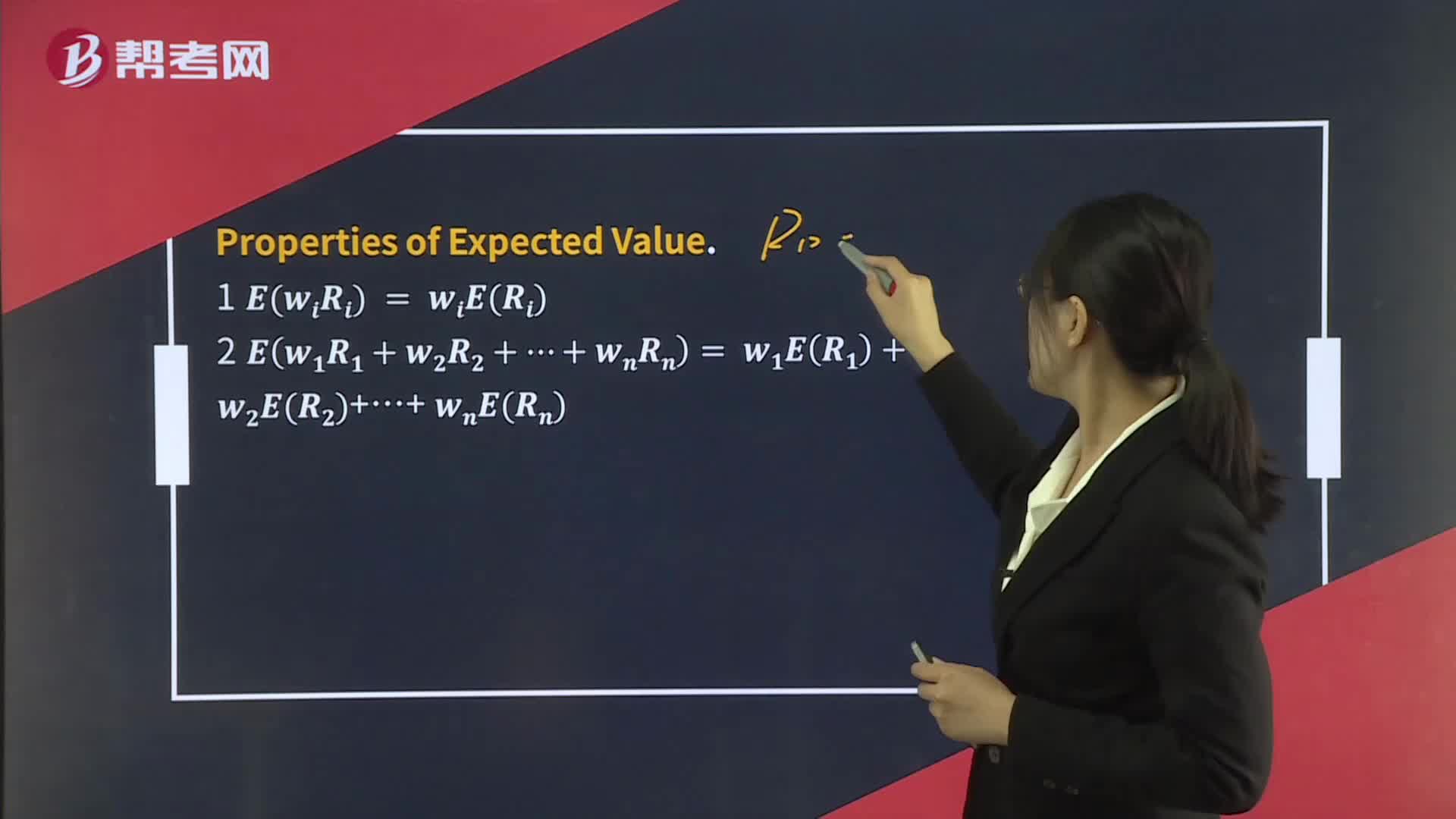

Portfolio Expected Return and Variance of Return

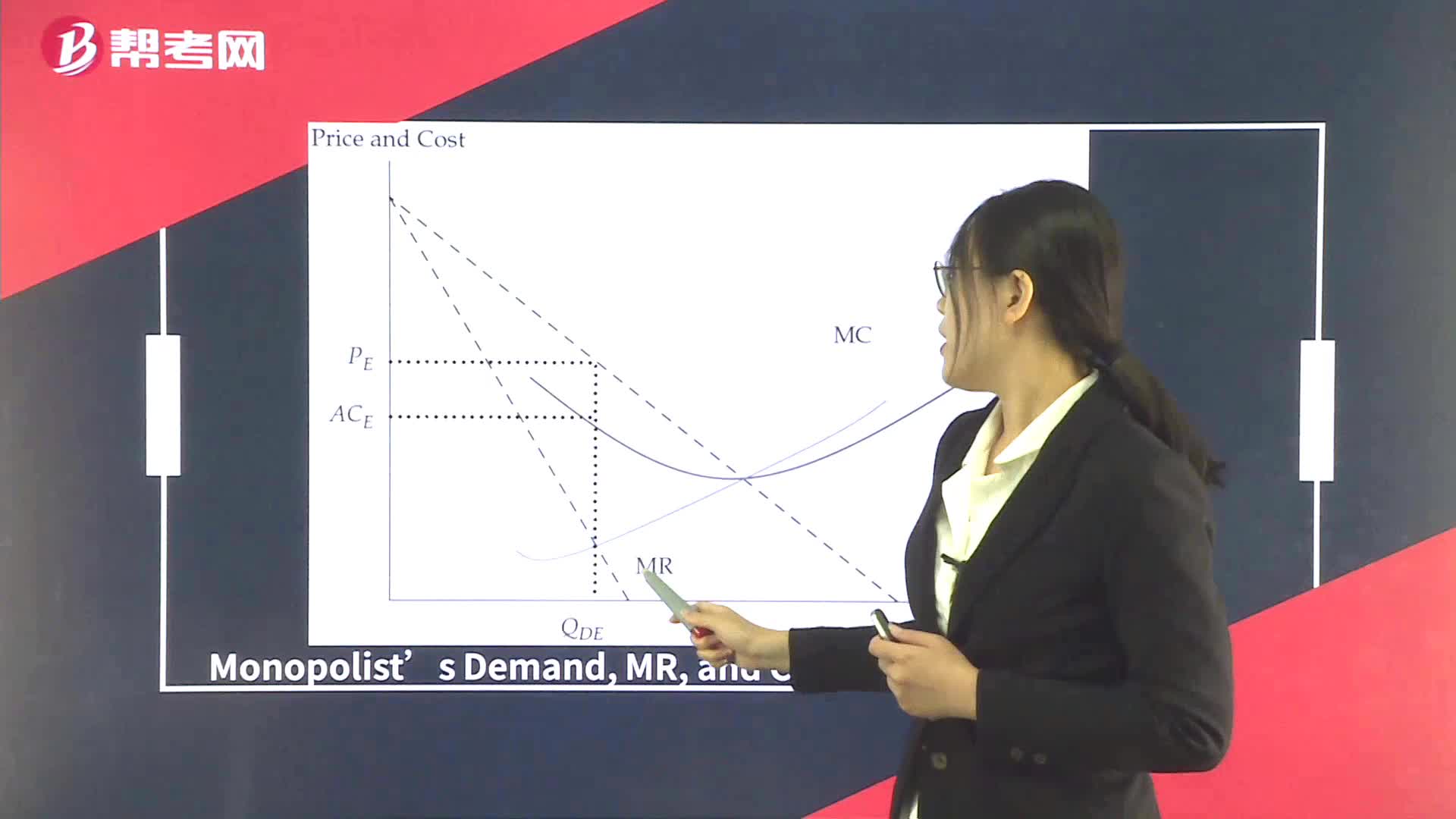

Supply Analysis in Monopoly

下载亿题库APP

联系电话:400-660-1360