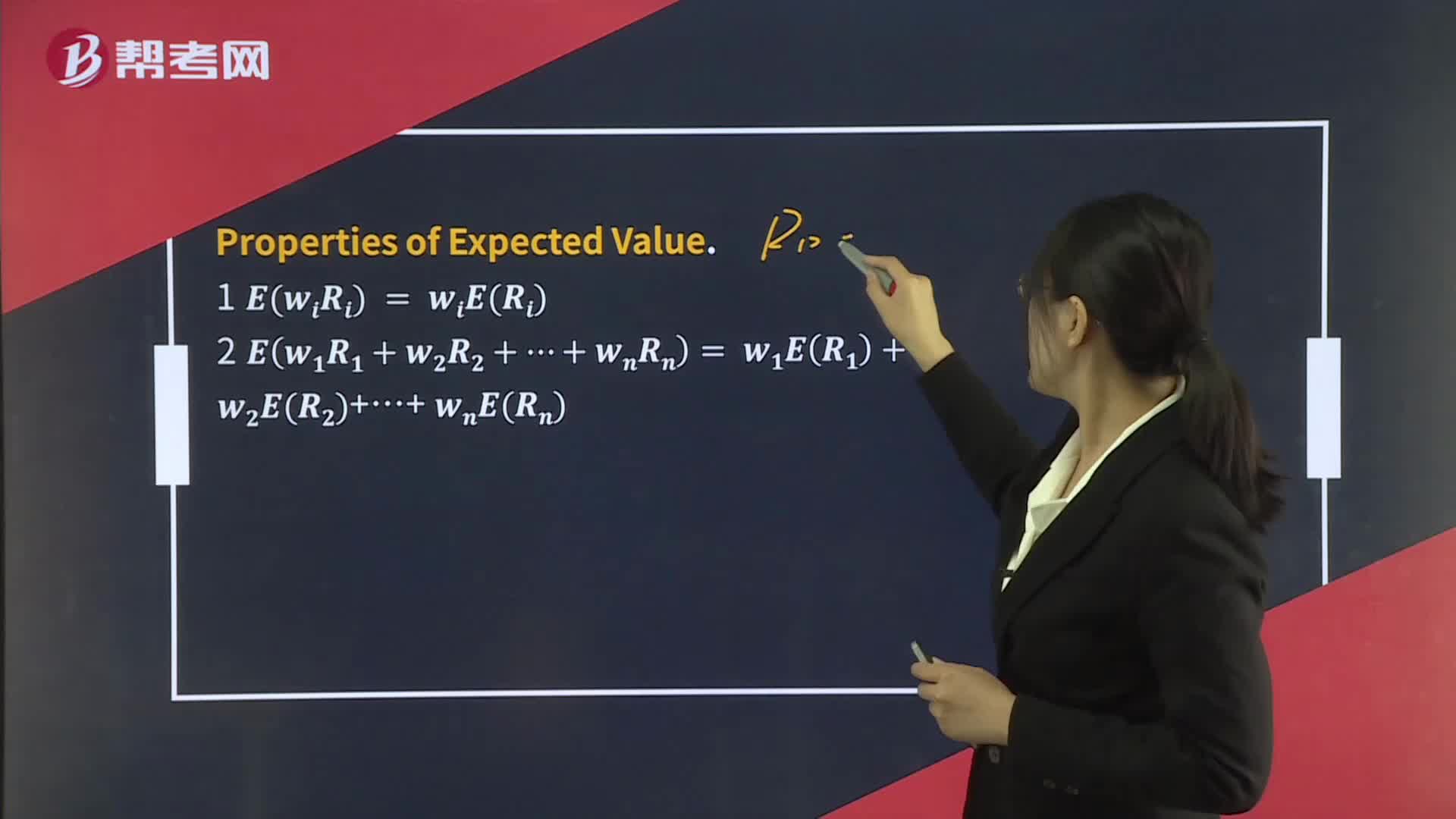

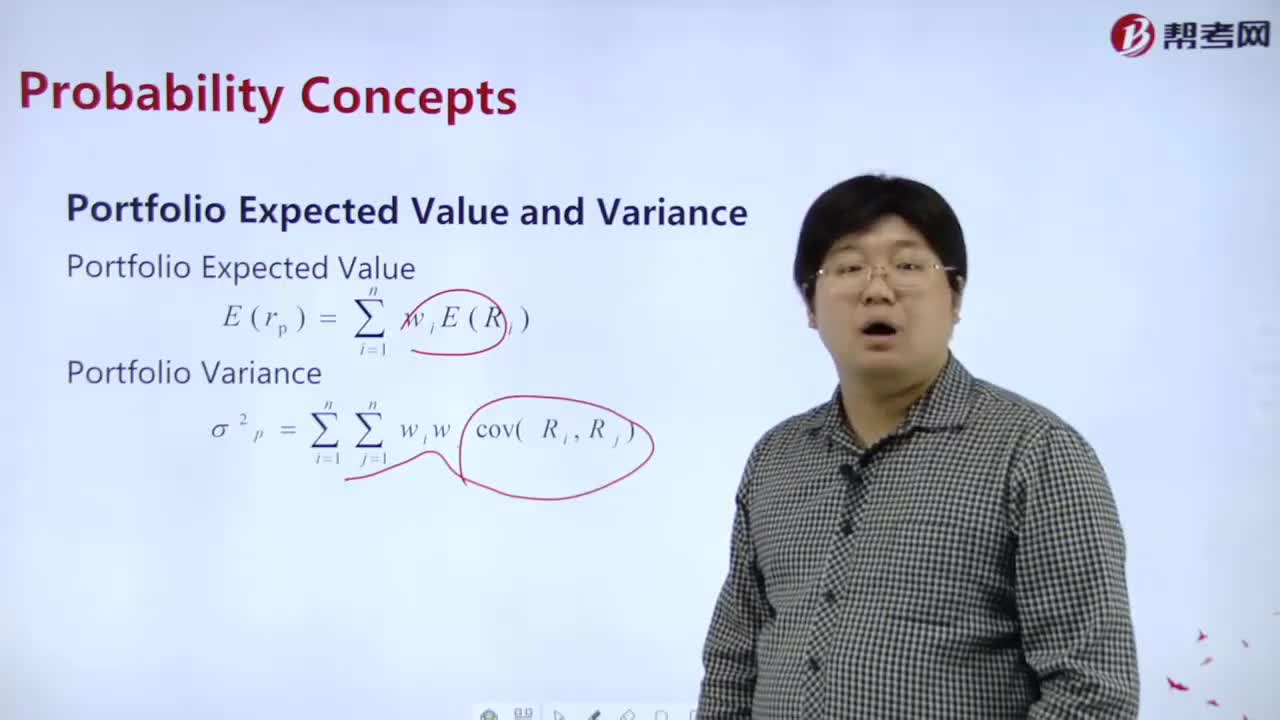

How do you understand the expected value and variance of a portfolio?

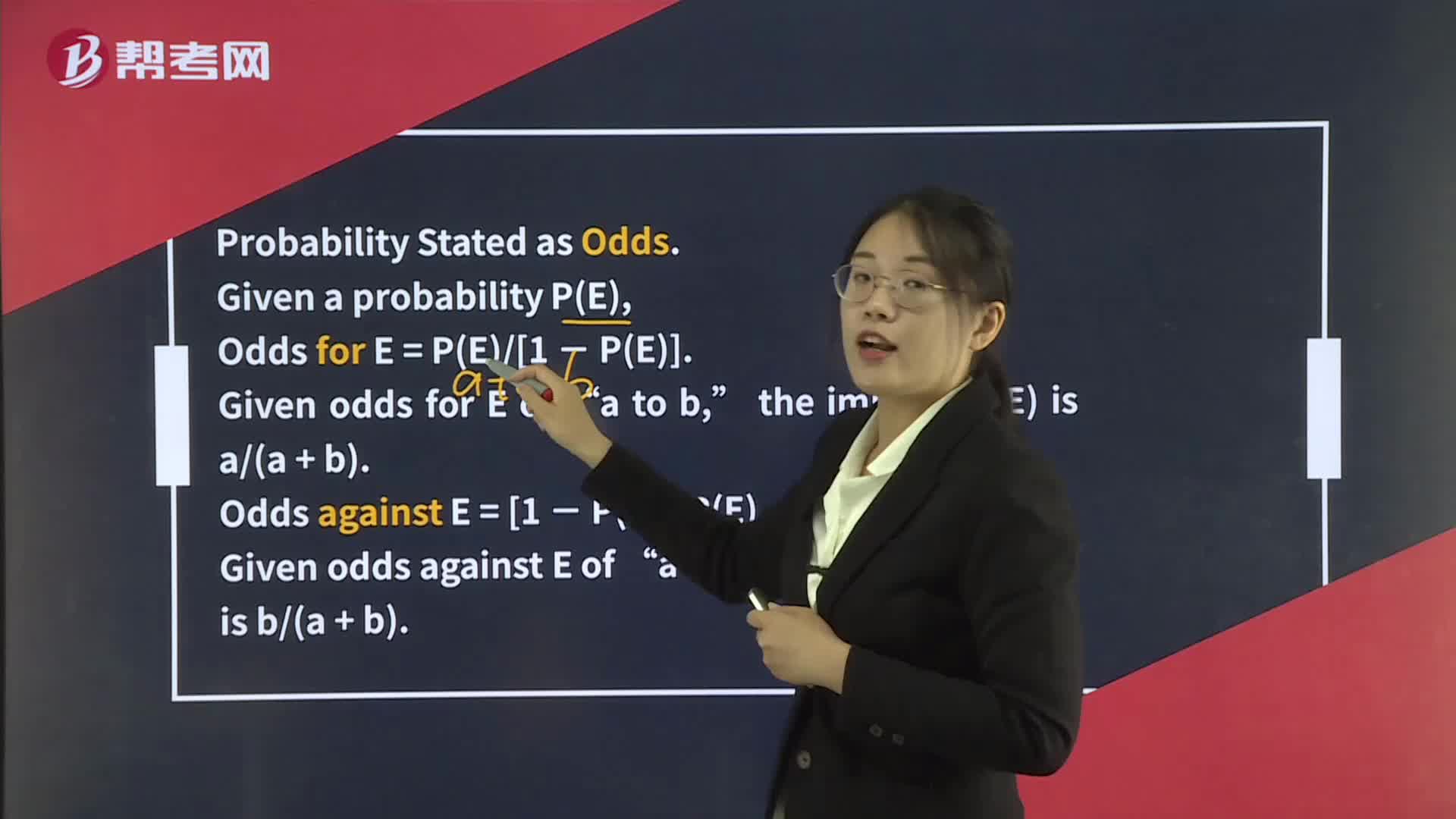

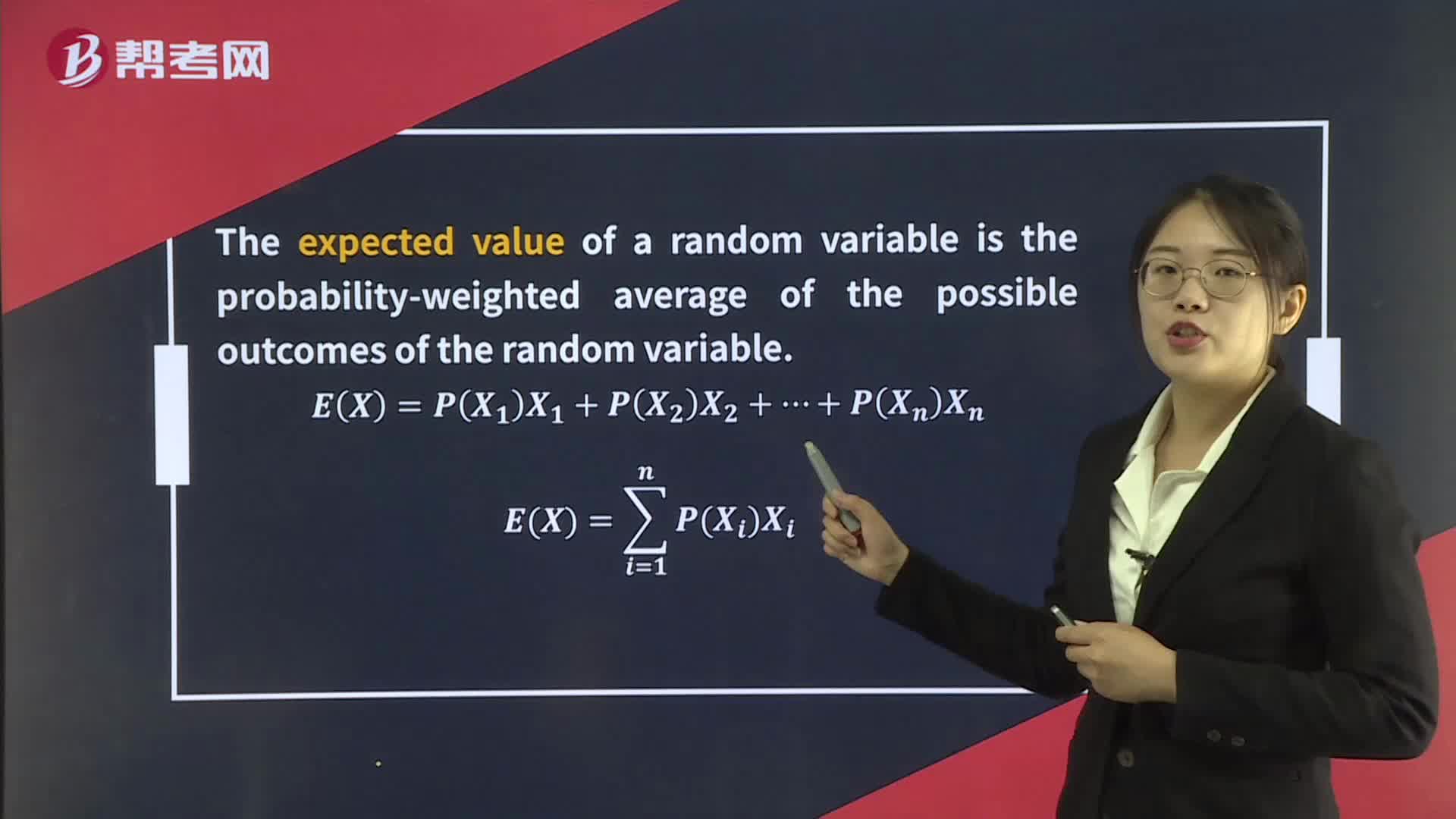

What's the value?

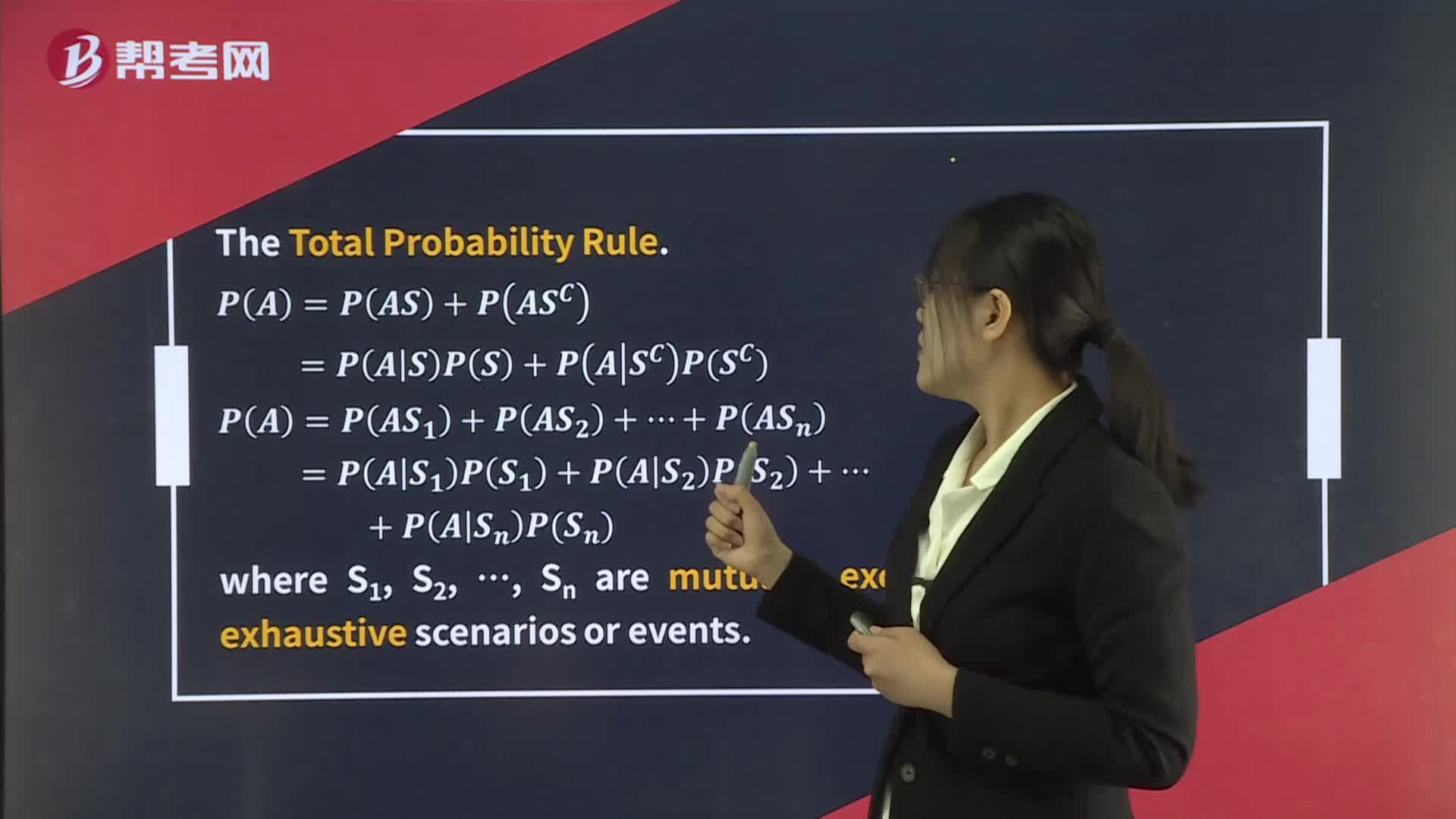

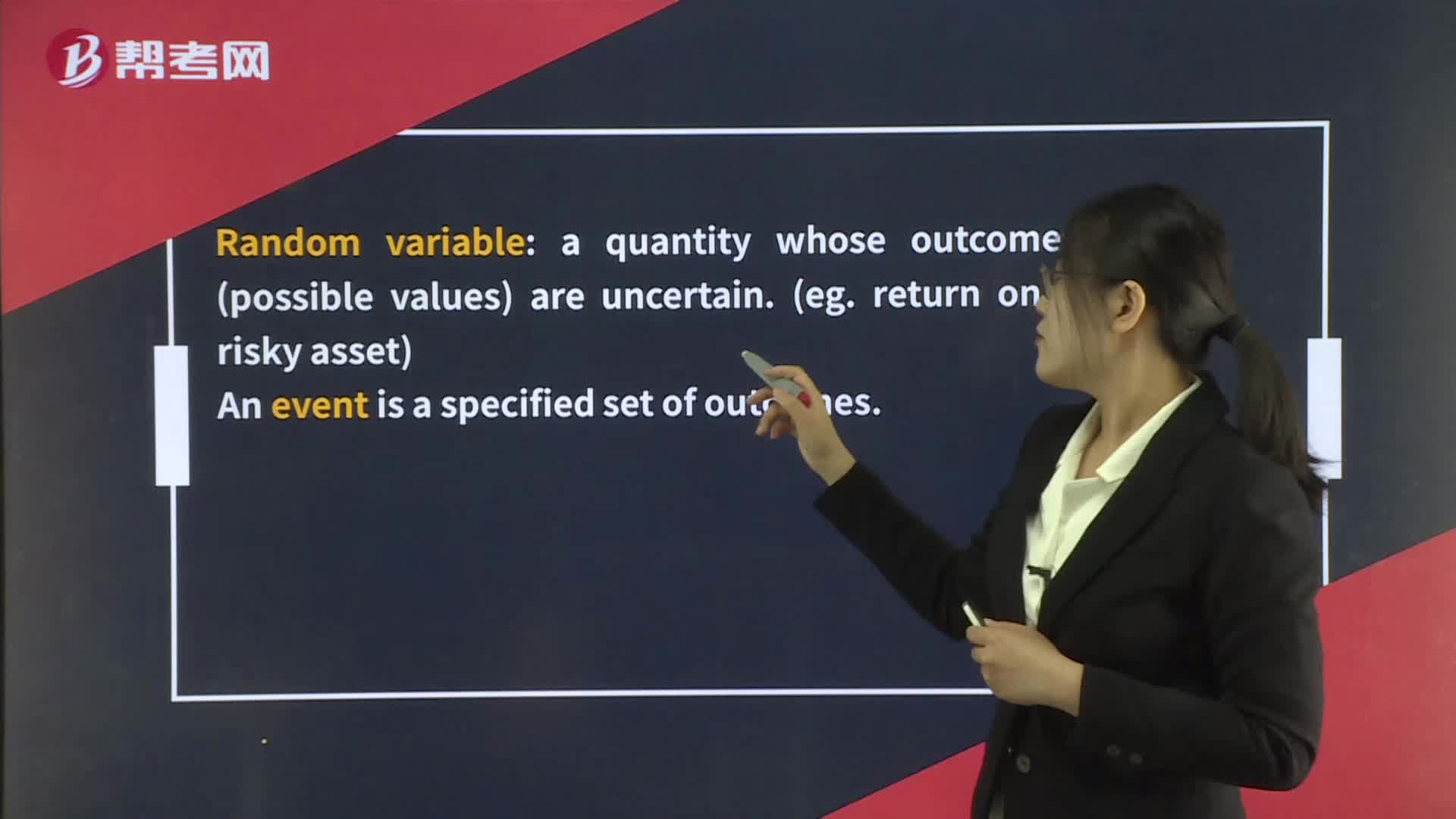

What is probability distribution?

What is portfolio performance

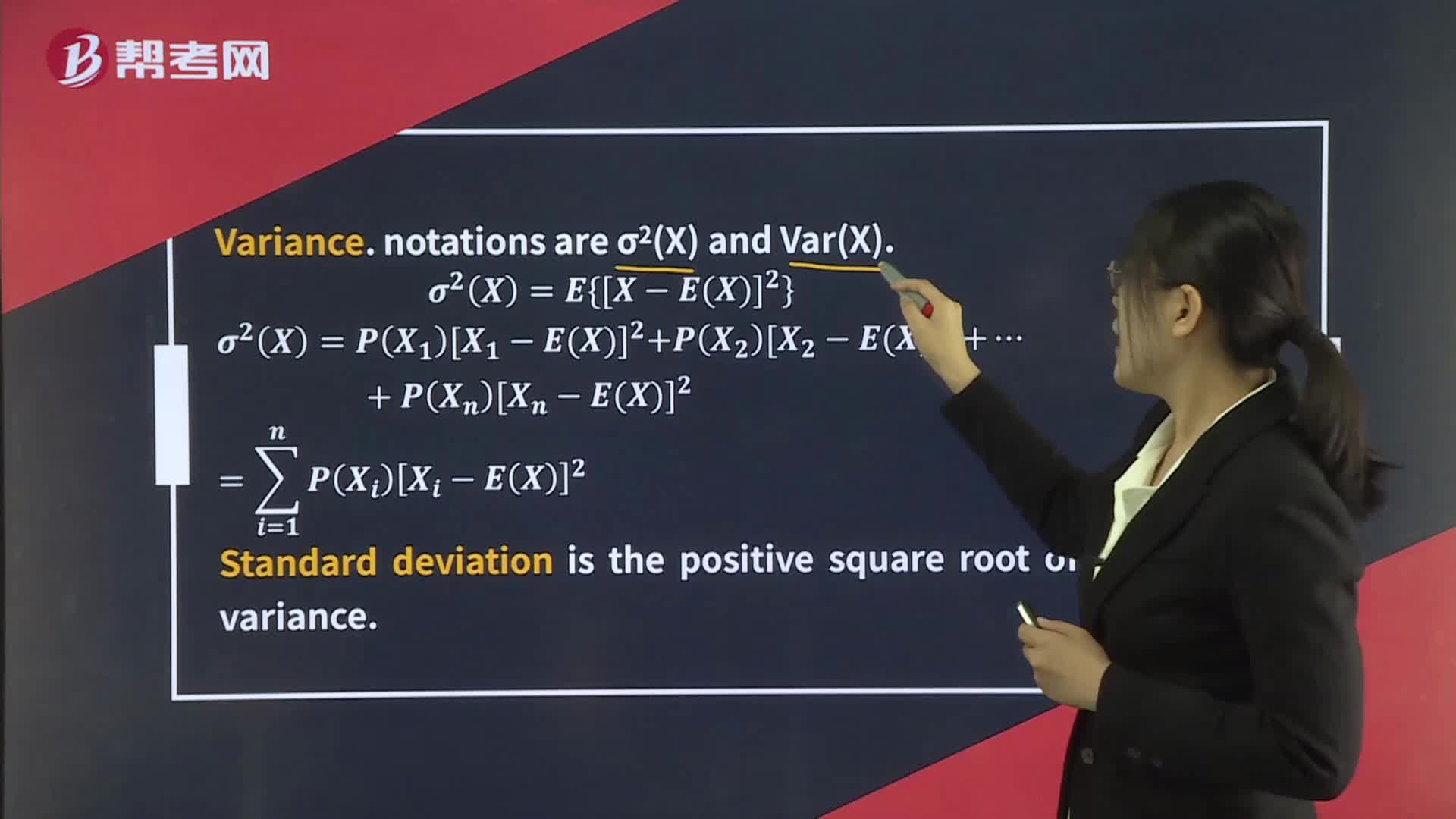

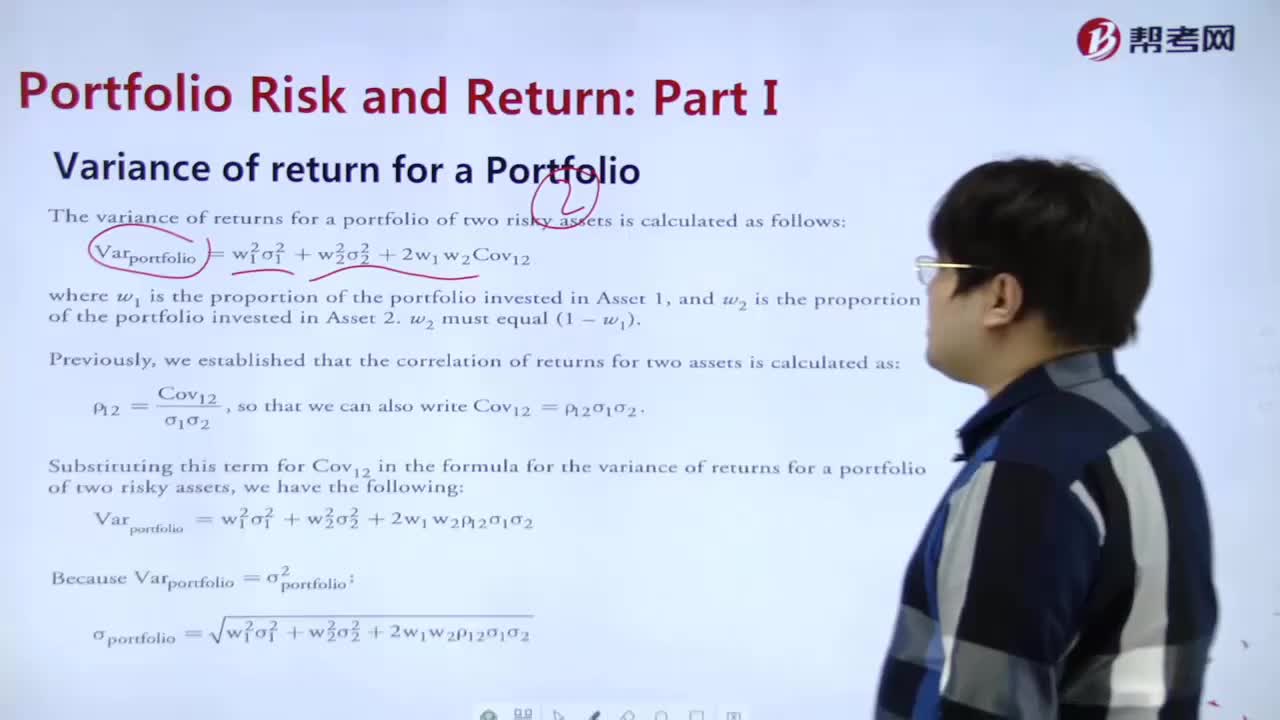

What is variance of return for a portfolio?

What is the purpose of portfolio construction?

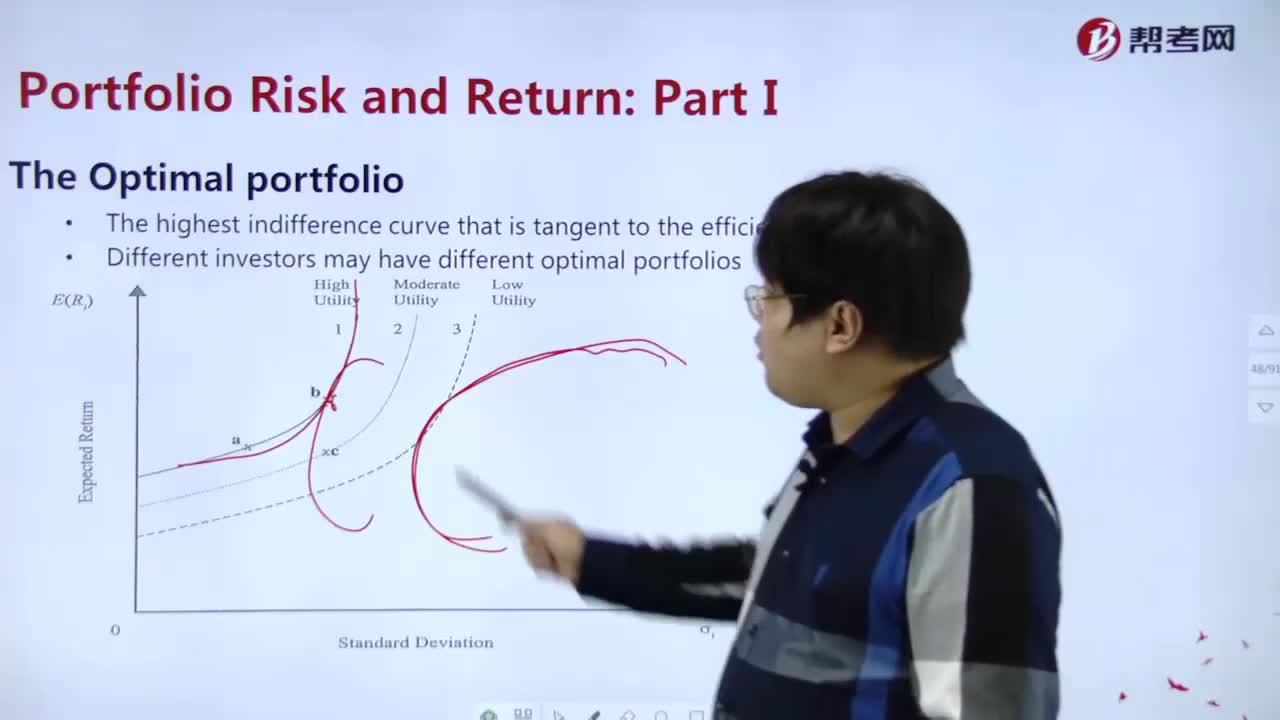

What is the optimal portfolio?

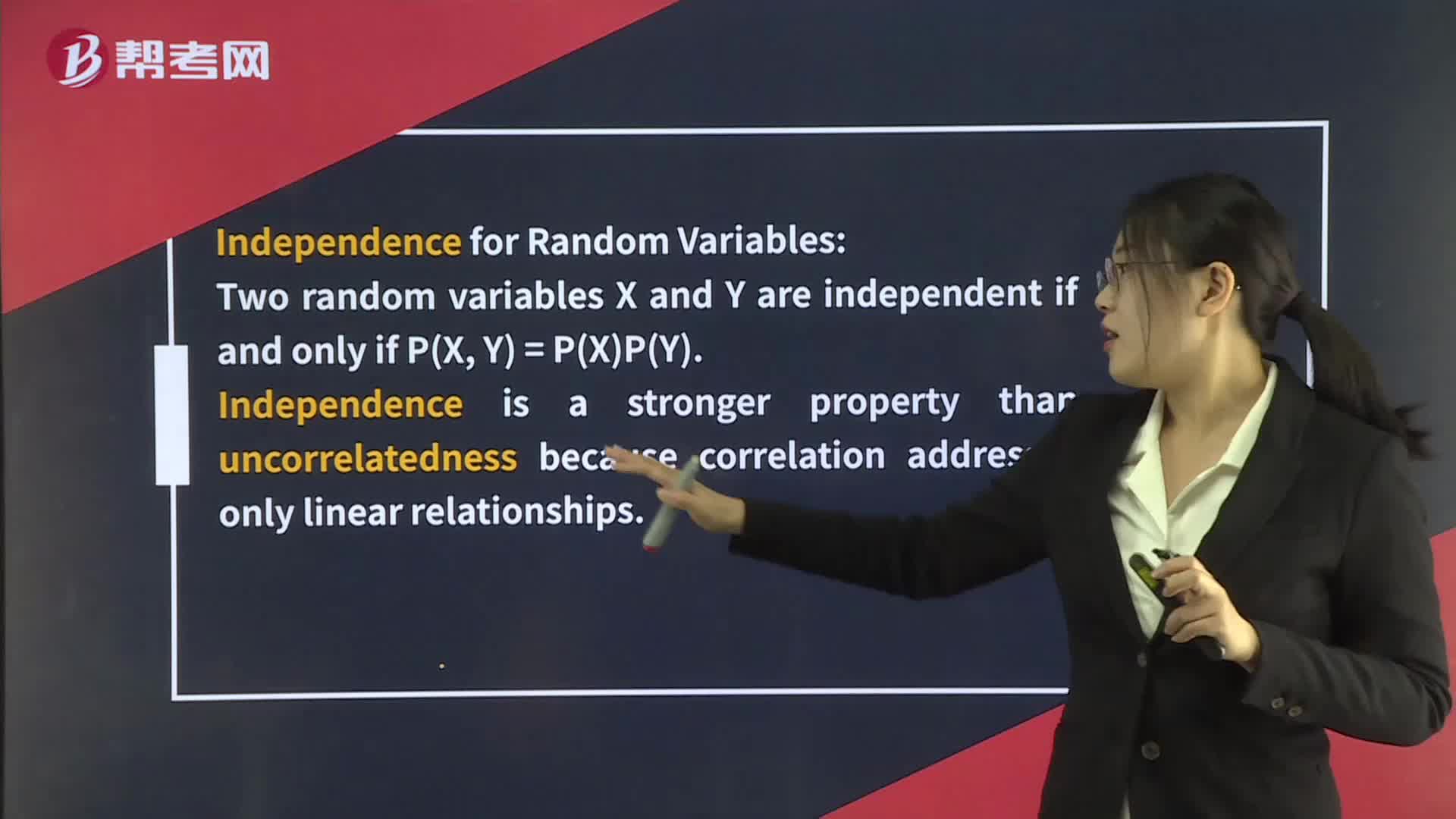

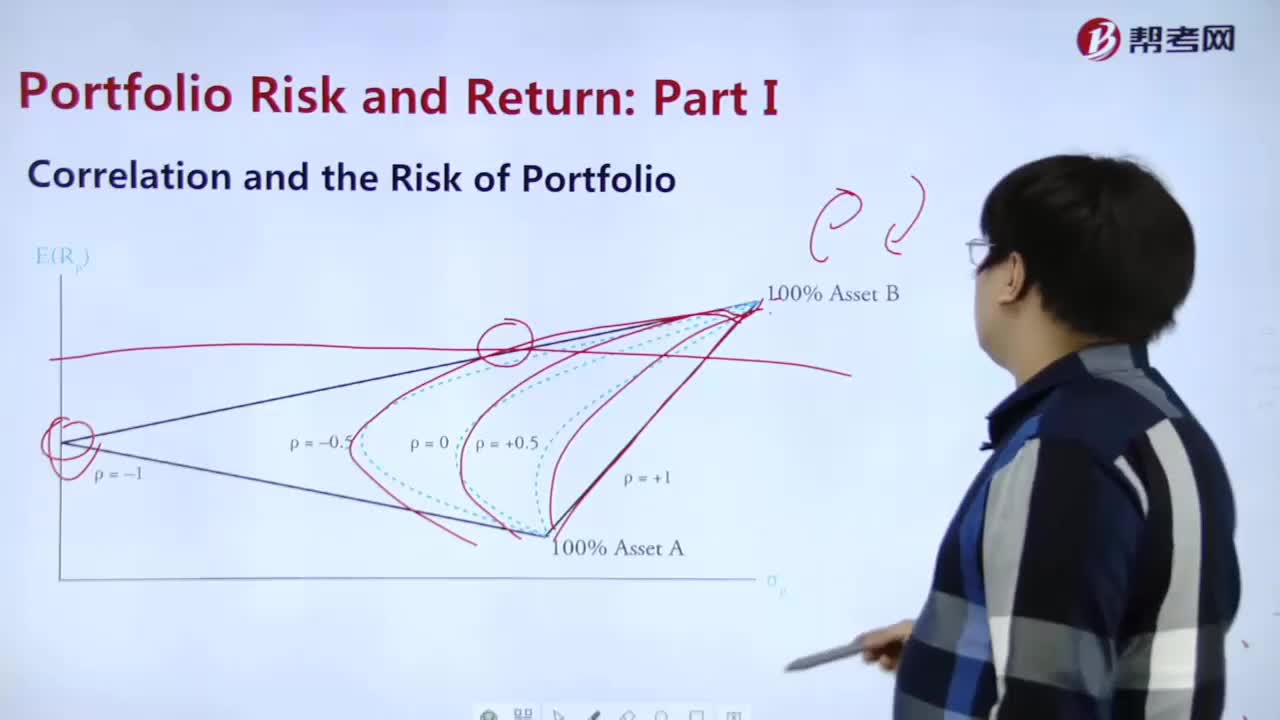

What are the correlations and risks of portfolio?

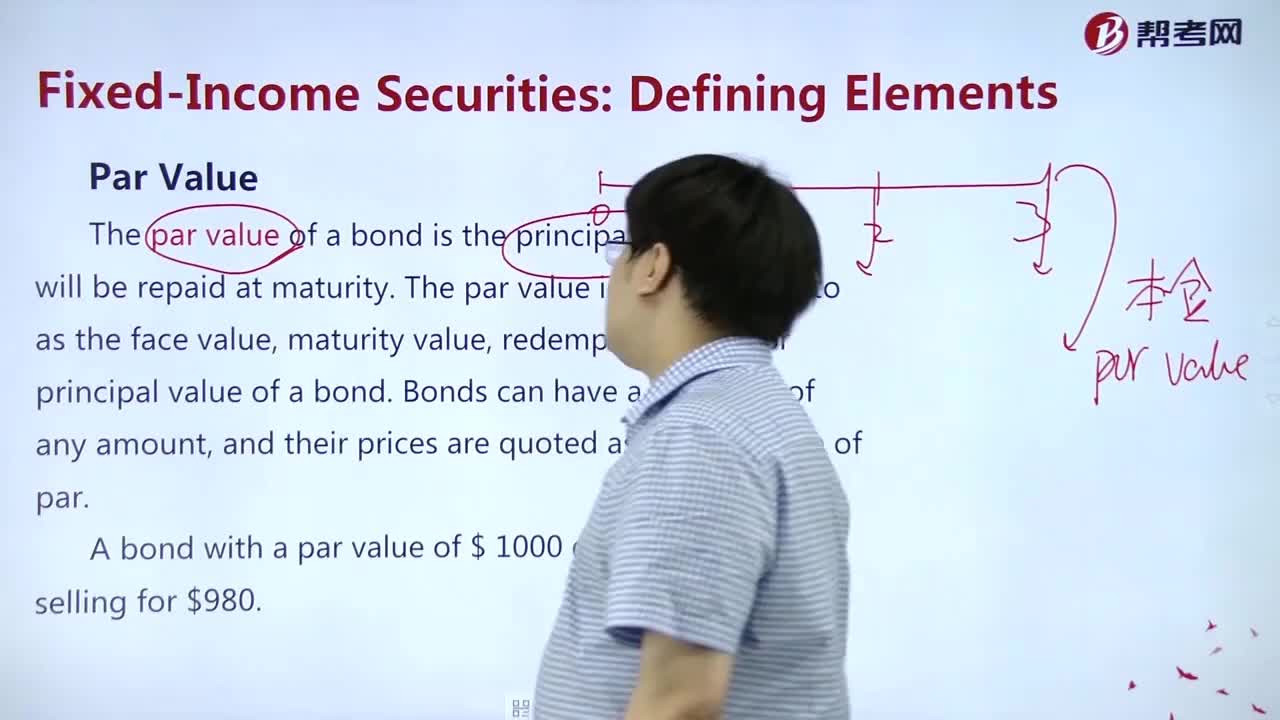

What does Par Value mean?

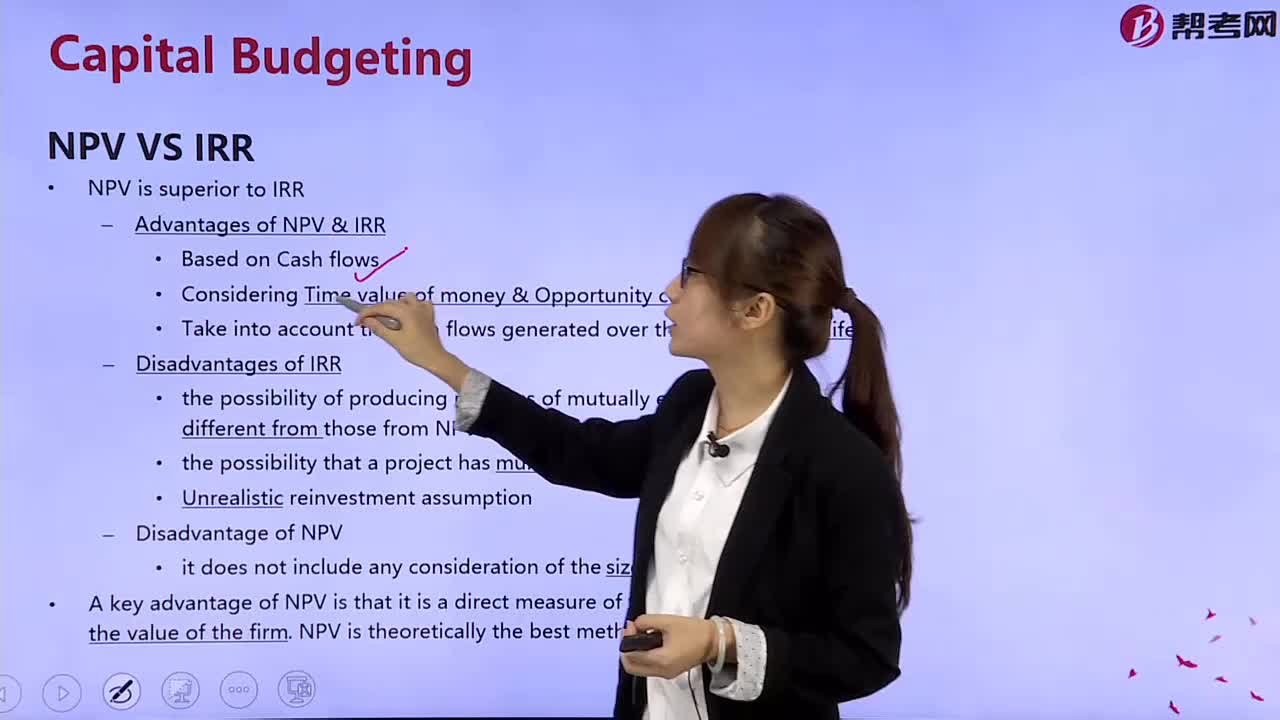

What is the difference between net present value and internal income?

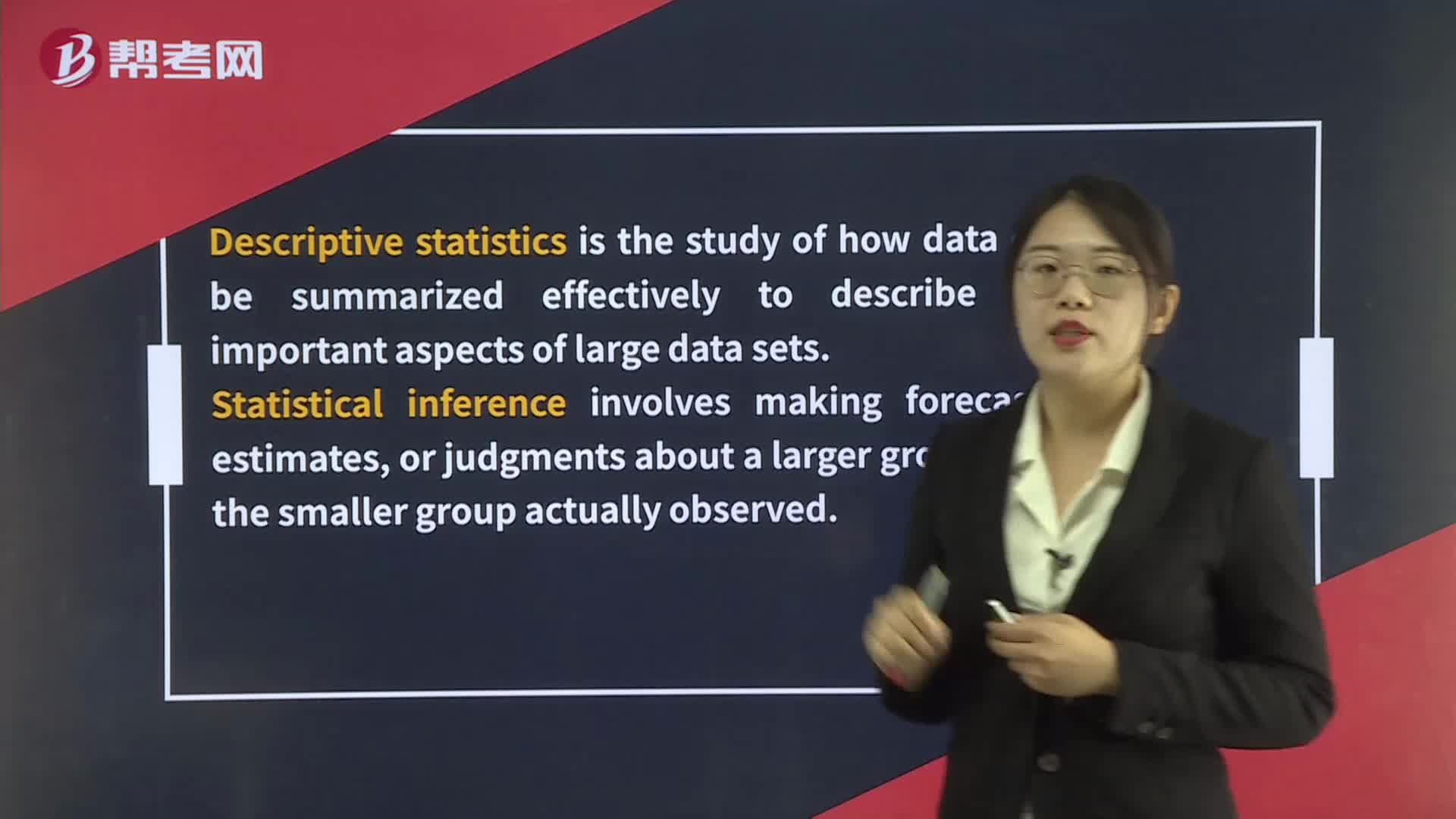

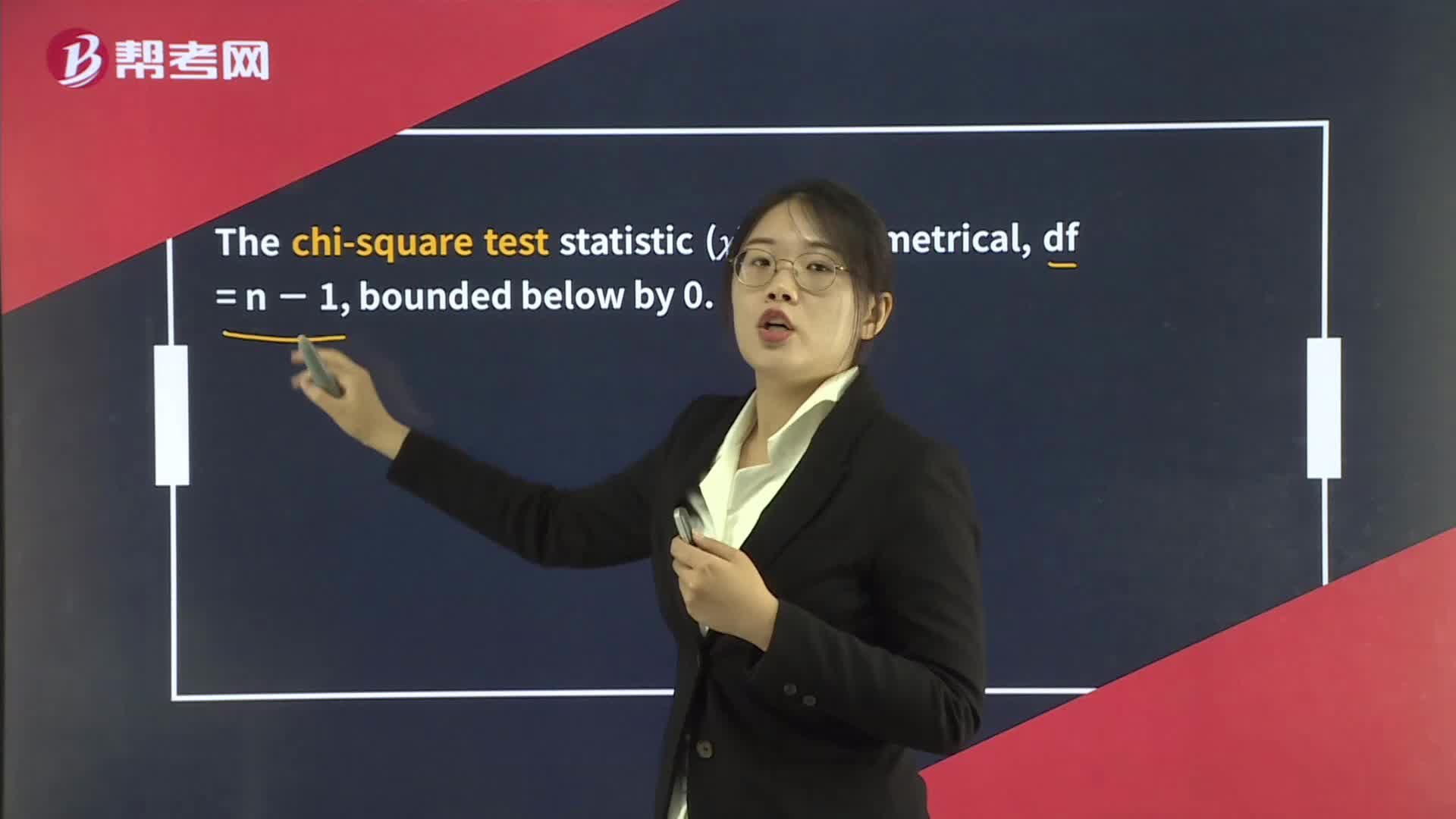

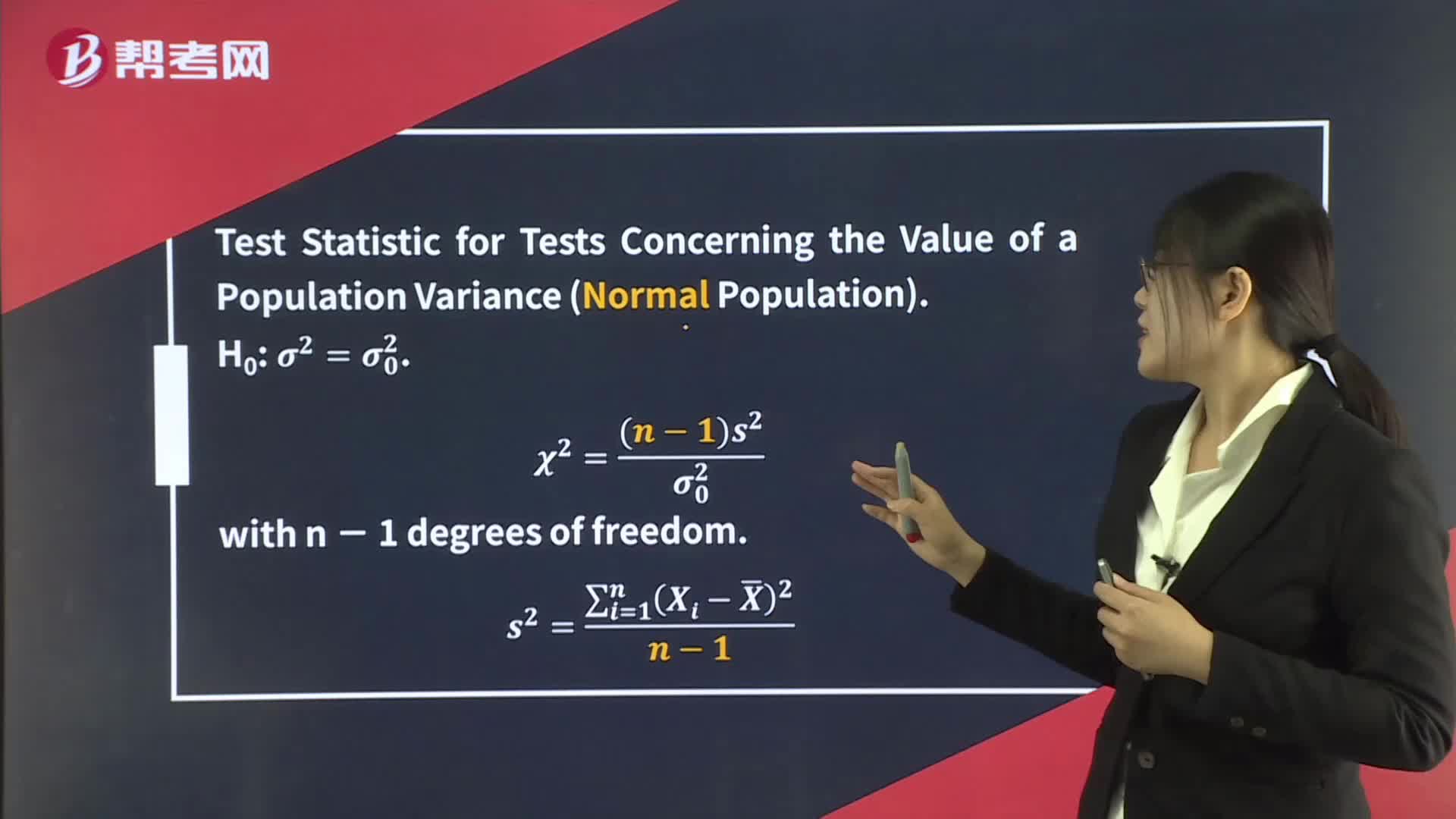

Hypothesis Tests Concerning Variance

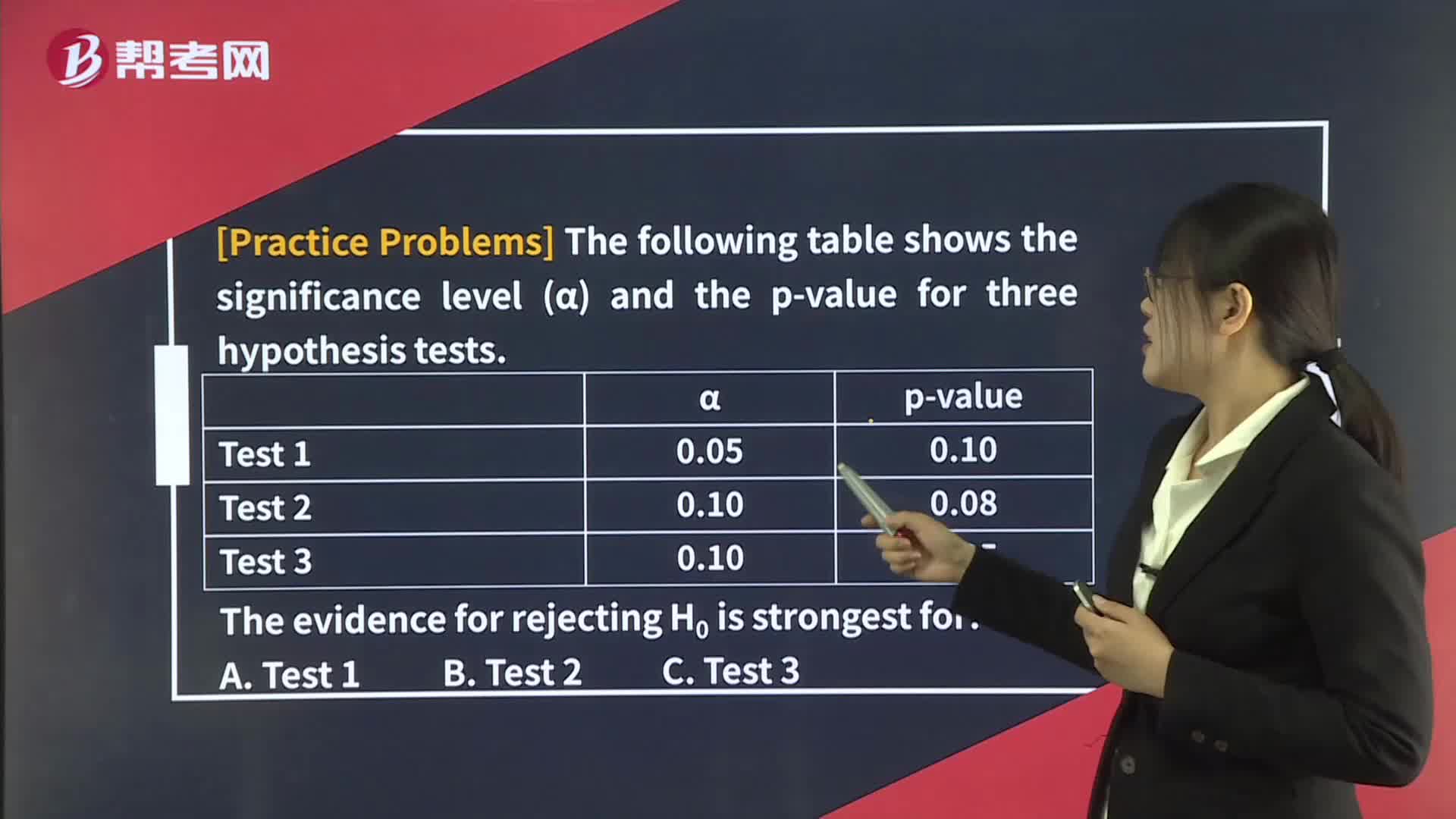

p-Value

下载亿题库APP

联系电话:400-660-1360