下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、A moral obligation bond is also known as:【单选题】

A.a prerefunded bond.

B.a general obligation debt.

C.an appropriation-backed obligation

正确答案:C

答案解析:“Overview of Bond Sectors and Instruments,” Frank J. Fabozzi

2010 Modular Level I, Vol. 5, pp. 321-323

Study Session 15-62-g

Describe the types of securities issued by municipalities in the United States and distinguish between tax-backed debt and revenue bonds.

Some municipal bonds include a nonbinding pledge of additional tax revenue to make up any shortfalls; however legislative approval is required for the additional appropriation. These are known as moral obligation bonds. They are a form of general obligation debt, but most general obligation debt does not include such a pledge. In contrast, a prerefunded bond is backed by a trust of riskless securities that provide cash flows sufficient to pay the interest and principal payments of the bond.

2、If an investor uses derivatives to make a long investment in commodities, the return earned on margin is best described as:【单选题】

A.price return.

B.collateral yield.

C.convenience yield.

正确答案:B

答案解析:“Investing in Commodities,” Ronald G. Layard-Liesching

2013 Modular Level I, Vol. 6, Reading 67, Section 1

Study Session 18-67-b

Describe the sources of return and risk for a commodity investment and the effect on a portfolio of adding an allocation to commodities.

B is correct. Collateral yield is the return on cash used as margin on derivatives used to gain commodity exposure.

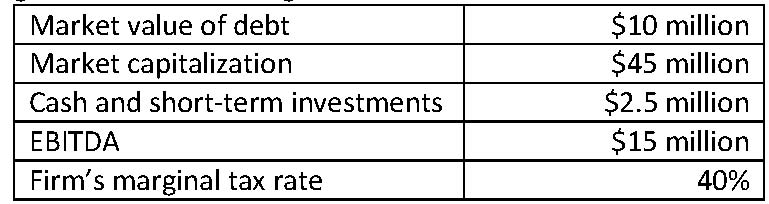

3、An investor who wants to estimate the enterprise value multiple (EV/EBITDA) of a company has gathered the following data:

The company’s EV/EBITDA multiple is closest to:【单选题】

A.2.5.

B.3.5.

C.5.8.

正确答案:B

答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFA

2013 Modular Level I, Vol. 5, Reading 51, Section 5.4

Study Session 14-51-i

Explain the use of enterprise value multiples in equity valuation and demonstrate the use of enterprise value multiples to estimate equity value.

B is correct. Enterprise value (EV) = Market capitalization + MV of debt + MV of preferred stock – Cash and short-term investments.

EV = 45 + 10 – 2.5 = 52.5; EV/EBITDA = 52.5/15 = 3.5

4、An analyst does research about debt covenants.Which of the following leastlikely lowers the risk to creditors? A debt covenant specifying a minimum level ofthe borrower's:【单选题】

A.current ratio.

B.dividend payout ratio.

C.interest coverage ratio.

正确答案:B

答案解析:current ratio = current assets/current liabilities

interest coverage ratio = earnings before interest and taxes/interest payments

设定流动比率(current ratio)和利息保障倍数(interest coverage ratio)的最小值,有利于保持发行人的偿债能力,降低了债权人的风险;而设定最低的派息率,会将更多的股利分配给股东,从而减少了公司现金,增加了债权人的风险。

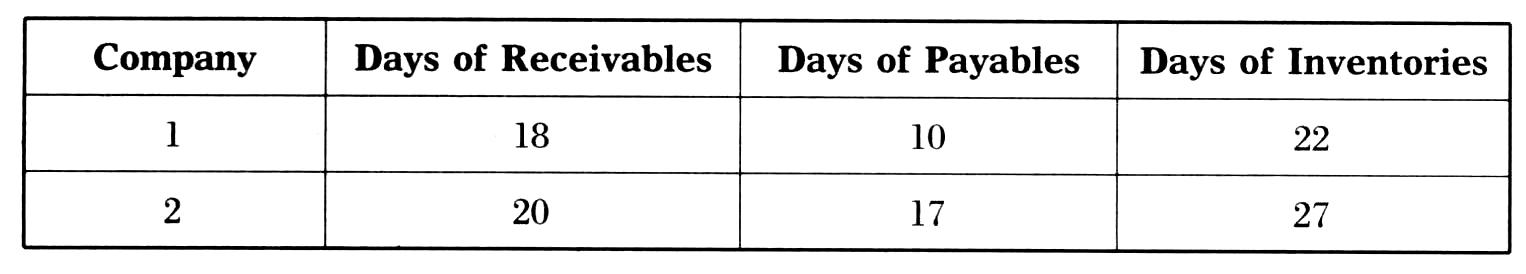

5、An analyst does research about cash conversion cycle and gathers the followinginformation about two companies from the same industry:

All else being equal, the cash conversion cycle of company 1 is most likely:【单选题】

A.less than that of company 2.

B.equal to that of company 2.

C.more than that of company 2.

正确答案:B

答案解析:现金周转期(cash conversion cycle)(Company 1) = 应收账款回收天数(days of receivables)+ 存货周转天数(days of inventory)- 应付账款偿还天数(days of payables) = 18+ 22 - 10 = 30。

现金周转期(cash conversion cycle)(Company 2) = 20 + 27 - 17 = 30。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料