下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、An investor gathers the following information for an index:

The value of the index as of January 1, 2012 is closest to:【单选题】

A.1,047.

B.1,070.

C.1,094.

正确答案:C

答案解析:“Security Market Indices,” Paul D. Kaplan, CFA, and Dorothy C. Kelly, CFA.

2013 Modular Level I, Vol. 5, Reading 47, Section 2

Study Session 13-47-b

Calculate and interpret the value, price return, and total return of an index.

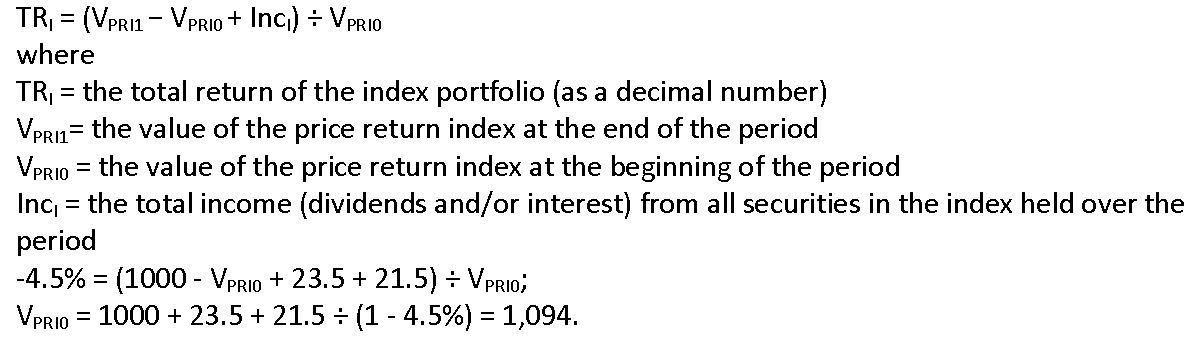

C is correct. The total return of an index is the price appreciation, or change in the value of the price return index, plus income (dividends and/or interest) over the period, expressed as a percentage of the beginning value of the price return index.

2、In a period of rising prices, when compared to a company that uses weighted average cost for inventory, a company using FIFO will most likely report higher values for its:【单选题】

A.return on sales.

B.inventory turnover.

C.debt-to-equity ratio.

正确答案:A

答案解析:“Inventories,” Michael A. Broihahn, CFA

2011 Modular Level I, Vol. 3, pp. 381-384, 390, 394-395

Study Session 9-36-e, h

Compare and contrast cost of sales, ending inventory, and gross profit using different inventory valuation methods.

Calculate and interpret ratios used to evaluate inventory management.

In periods of rising prices FIFO results in a higher inventory value and a lower cost of goods sold and therefore a higher net income. The higher net income increases return on sales. The higher reported net income also increases retained earnings, and therefore results in a lower debt-to-equity ratio not a higher one. The combination of higher inventory and lower cost of goods sold decreases inventory turnover (CGS/inventory).

3、Kelly Amadon, CFA, an investment adviser, has two clients: Ryan Randolf, 65 years old, and Keiko Kitagawa, 45 years old. Both clients earn the same amount in salary. Randolf, however, has a large amount of assets, whereas Kitagawa has few assets outside her investment portfolio. Randolf is single and willing to invest a portion of his assets very aggressively; Kitagawa wants to achieve a steady rate of return with low volatility so she can pay for her child’s current college expenses. Amadon recommends investing 20% of both clients’ portfolios in the stock of very low yielding small-cap companies. Amadon least likely violated the CFA Institute Code of Ethics and Standards of Professional Conduct in regard to his investment recommendations for:【单选题】

A.both clients’ portfolio.

B.only Randolf’s portfolio.

C.only Kitagawa’s portfolio.

正确答案:B

答案解析:“Guidance for Standards I-VII”, CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard III (C) Suitability, Guidance

Study Session 1-2-b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

B is correct because in Randolf’s case, the investment may be appropriate given this client’s financial circumstances and aggressive investment position. This investment would not be suitable for Kitagawa because of her need for a steady rate of return and her low risk profile.

4、If the yield on a 5-year U.S. corporate bond is 7.39% and the yield on a 5-year U.S. Treasury note is 4.26%, the relative yield spread of the bond is closest to:【单选题】

A.3.13%.

B.42.40%

C.73.50%.

正确答案:C

答案解析:“Understanding Yield Spreads,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, pp. 456–457

Study Session 15-56-e

Calculate and compare yield spread measures.

C is correct because the Relative yield spread = (Bond yield – Reference yield)/Reference yield = (7.39% – 4.26%)/4.26% = 73.50%.

5、Which of the following statements is most accurate? For a country to gain from trade it must have:【单选题】

A.an absolute advantage.

B.a comparative advantage.

C.economies of scale or lower labor costs.

正确答案:B

答案解析:“International Trade and Capital Flows,” Usha Nair-Reichert and Daniel Robert Witschi

2012 Modular Level I, Vol. 2, pp. 444–450

Study Session 6-20-b

Distinguish between comparative advantage and absolute advantage.

B is correct. A comparative advantage arises if one entity can produce an item at a lower opportunity cost than another. An absolute advantage in producing a good (or service) arises if one entity can produce that good at a lower cost or use fewer resources in its production than its trading partner. Even if a country does not have an absolute advantage in producing any of its goods, it can still gain from trade by exporting the goods in which it has a comparative advantage. The country with the lower opportunity cost (with the comparative advantage) should specialize and produce its low opportunity cost item, and the other country should produce the high opportunity cost item, trading the goods between each other to make both better off.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料