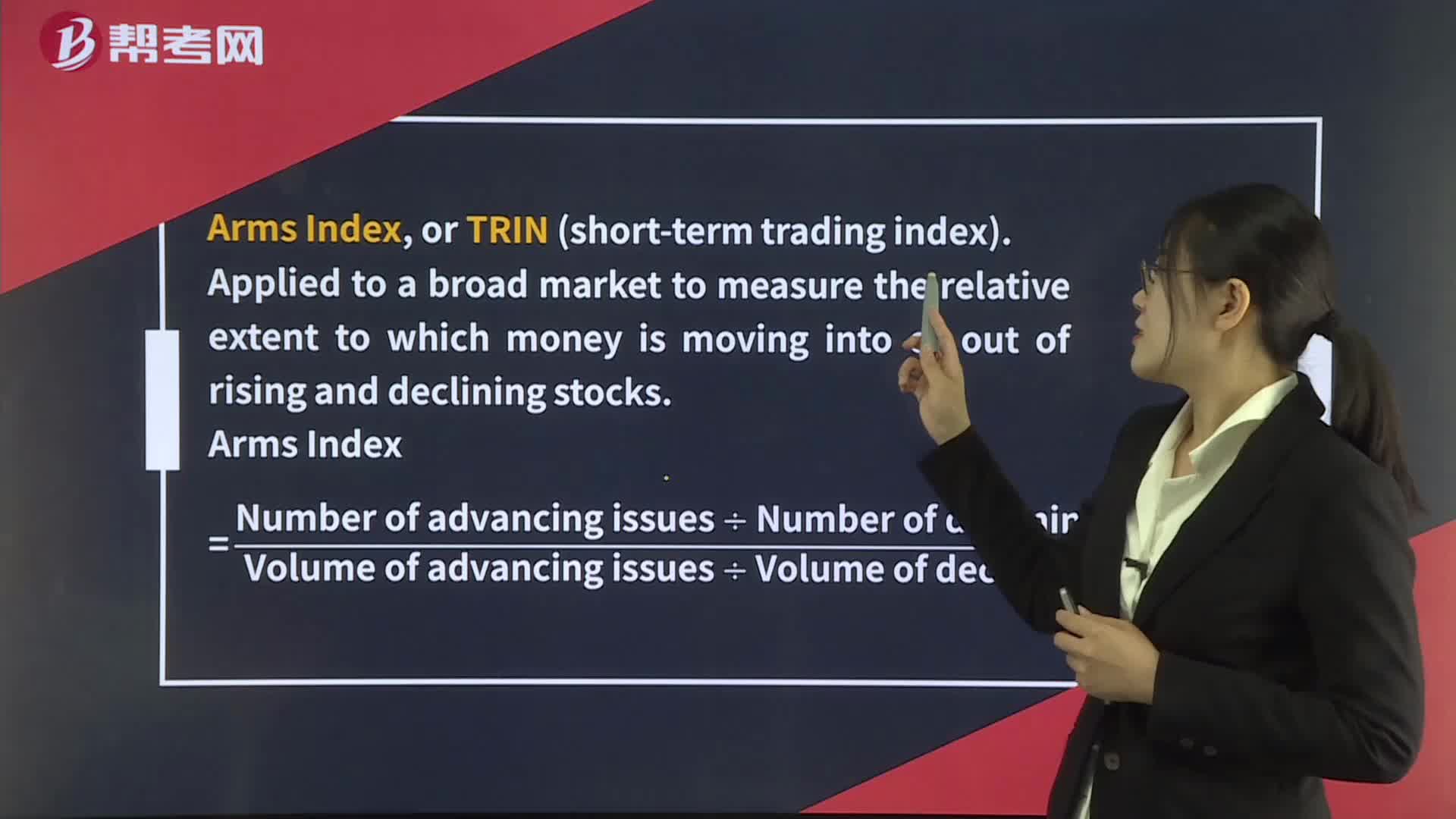

Technical Indicators— Flow-of-Funds Indicators

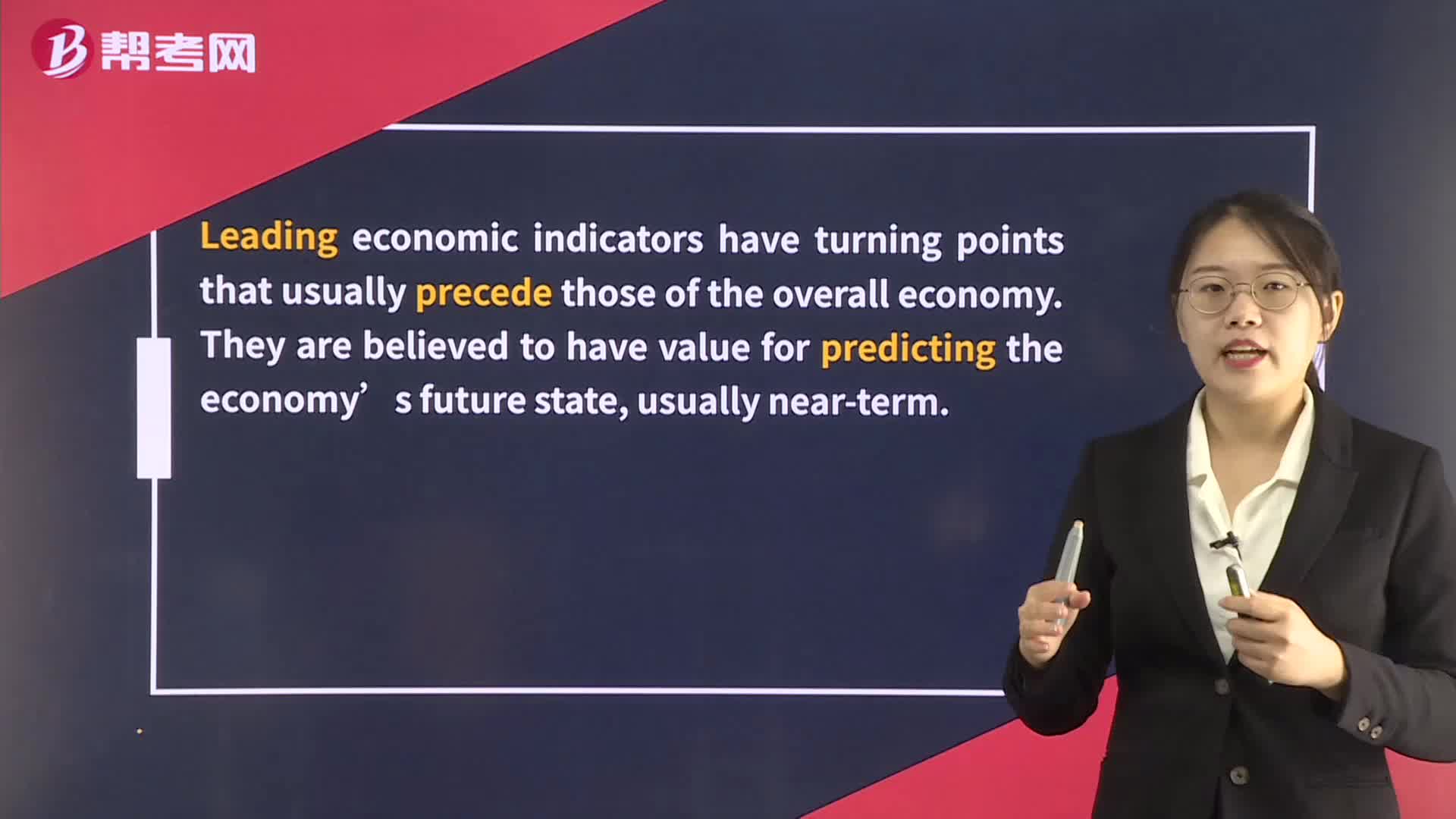

Technical and Fundamental Analysis

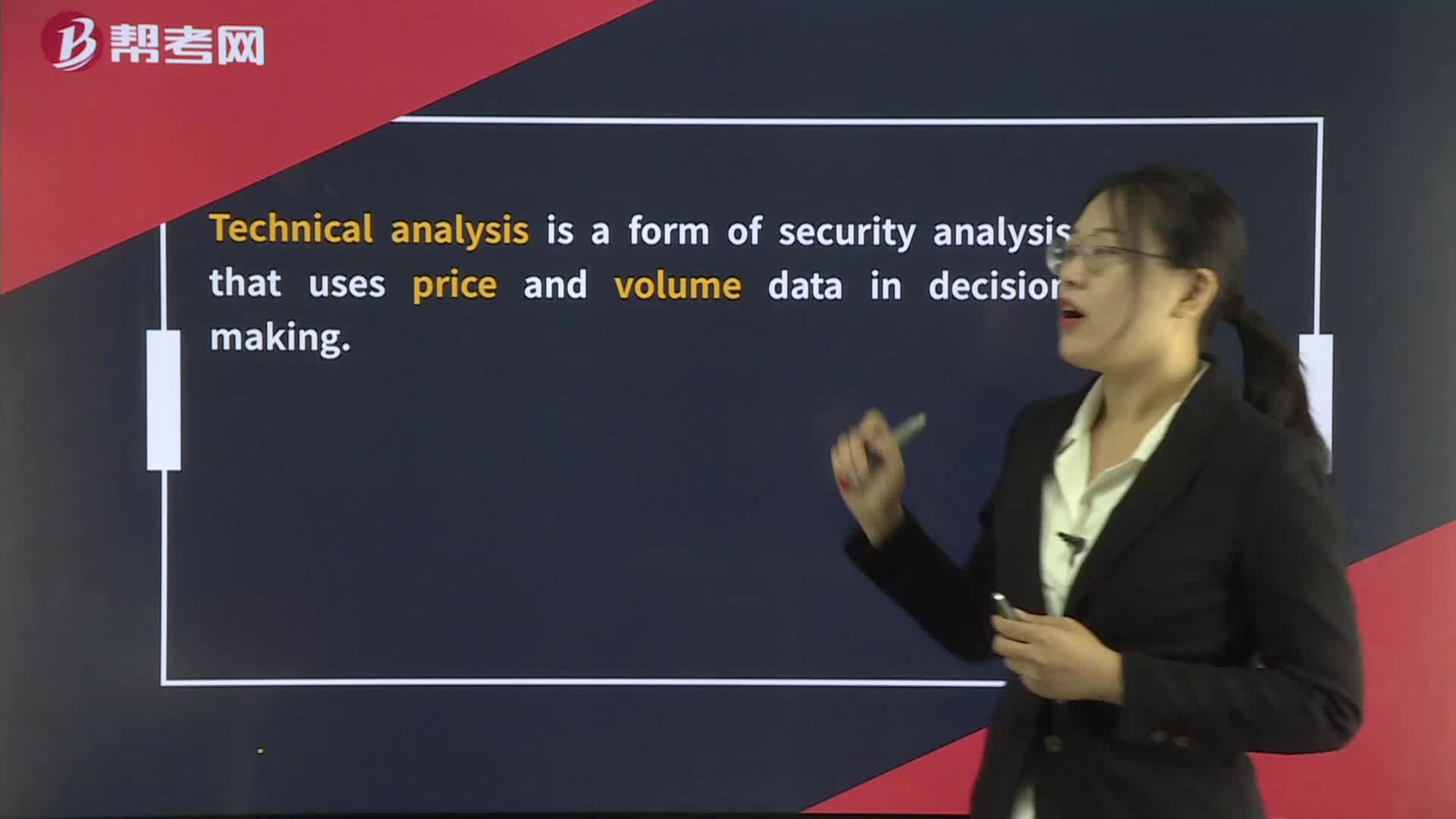

Technical Analysis

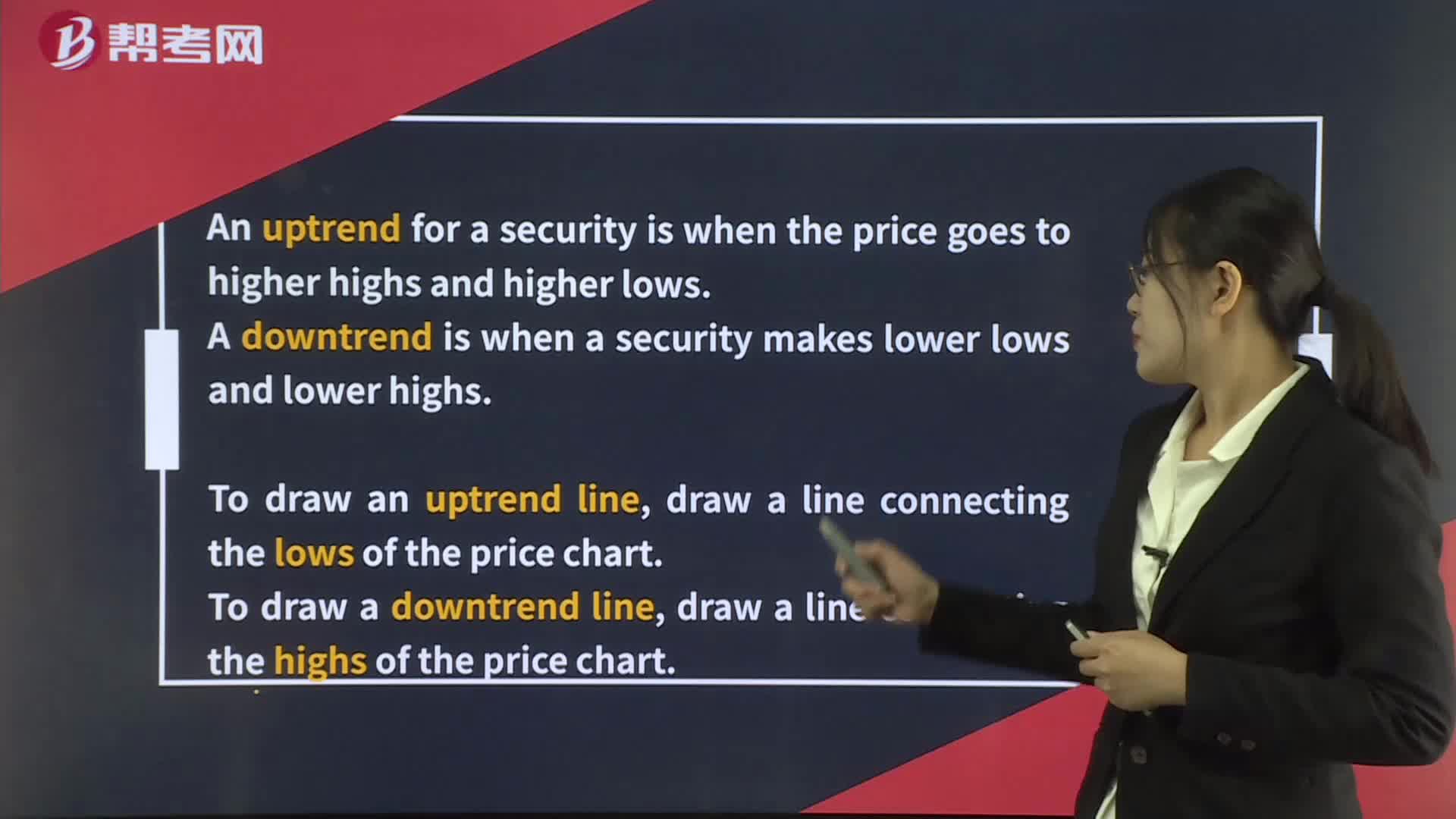

Technical Analysis Tools— Trend

Technical Analysis Tools— Cycles

Technical Analysis Tools— Technical Indicators

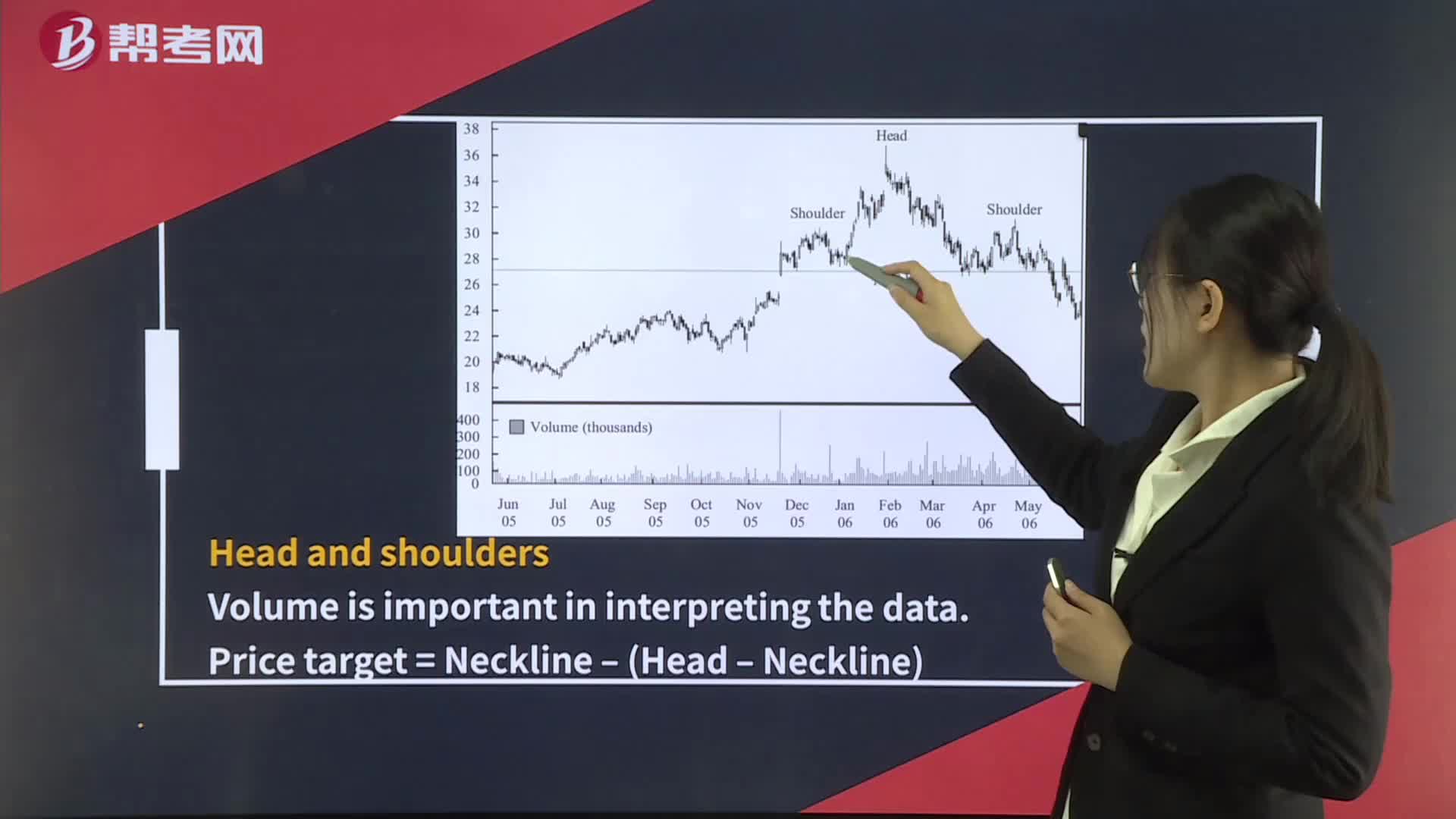

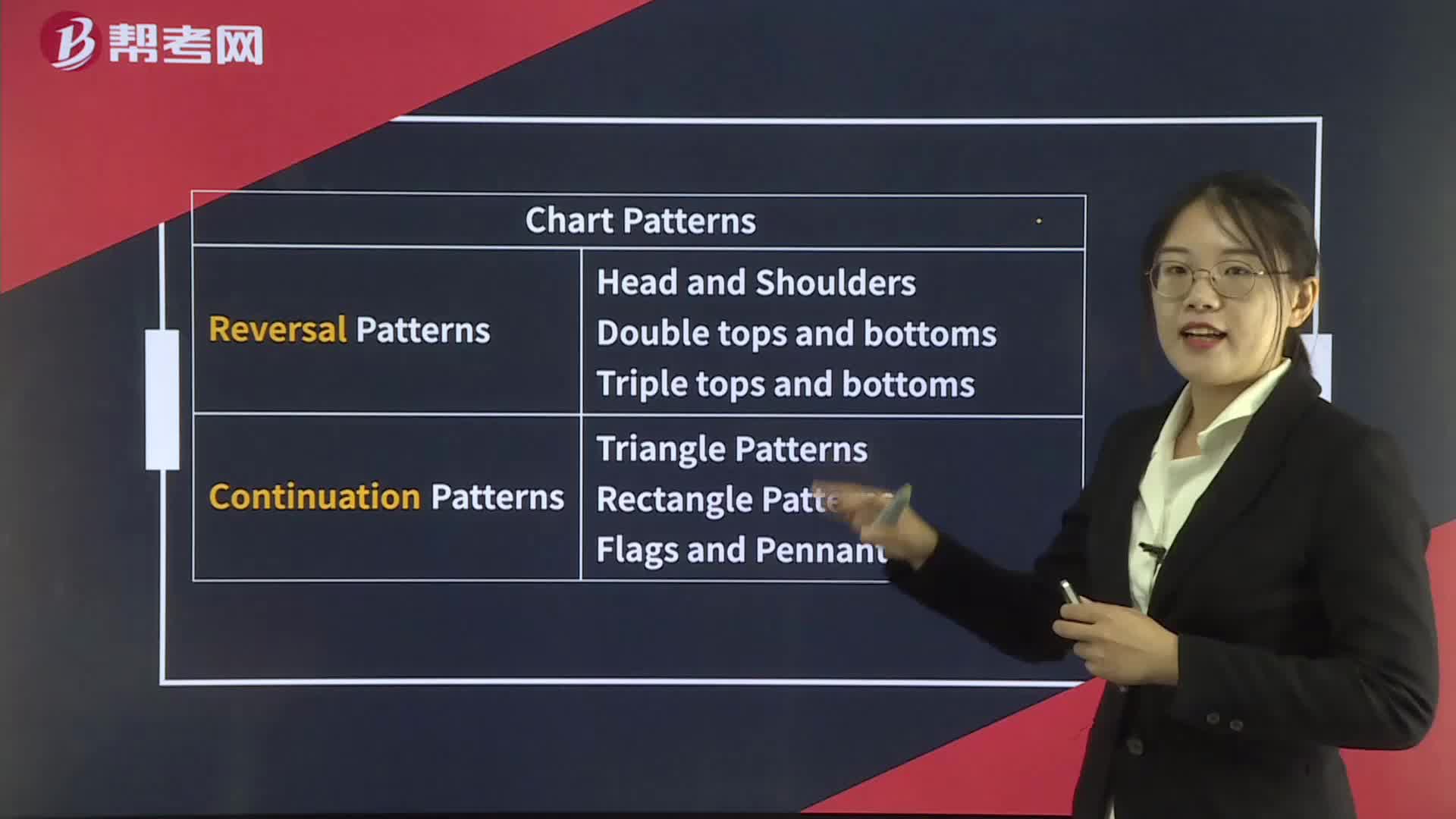

Technical Analysis Tools— Reversal Patterns

Technical Analysis Tools— Continuation Patterns

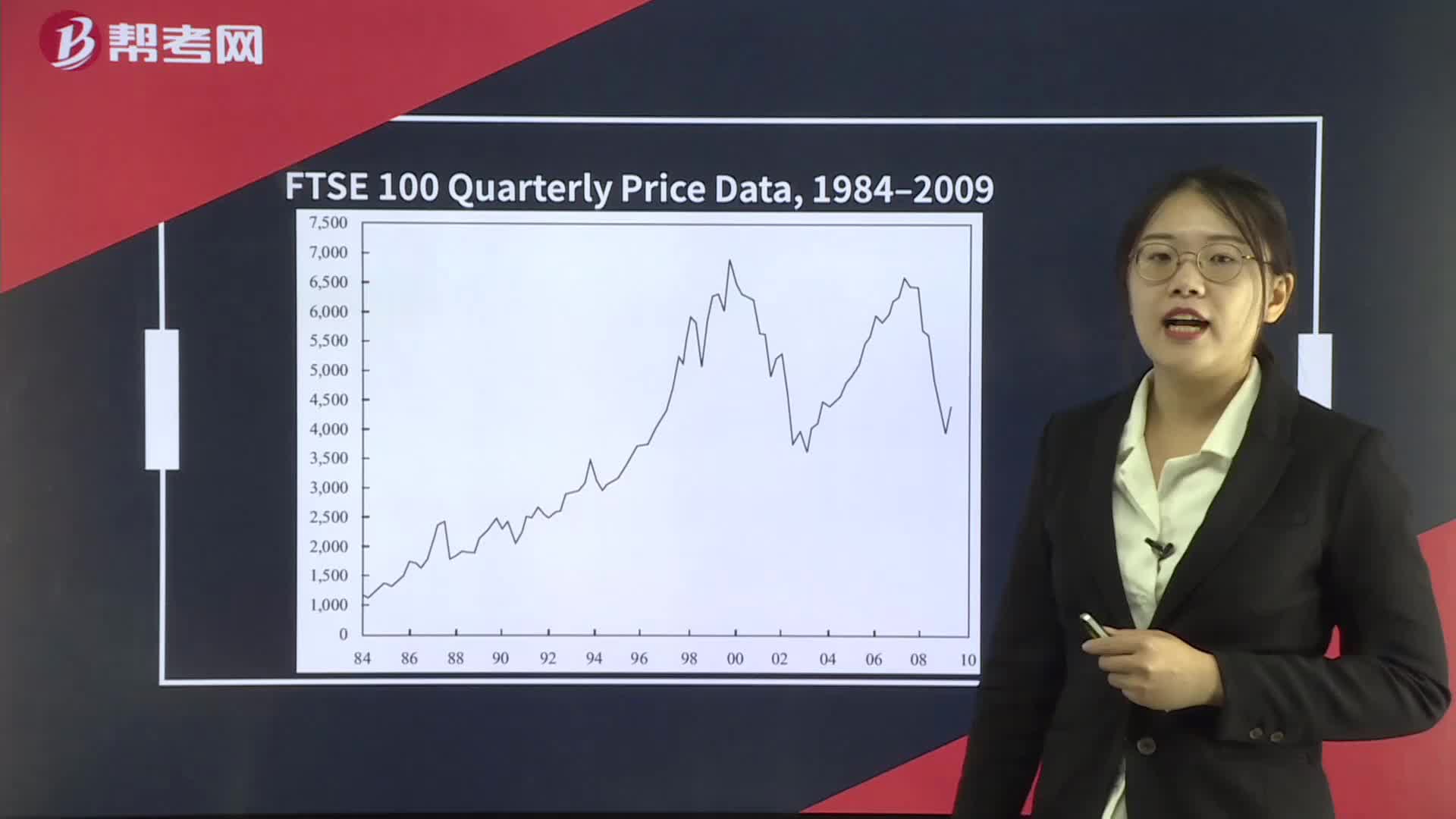

Technical Analysis Tools— Charts

Technical Analysis Tools— Chart Patterns

Technical Analysis Tools— Chart Patterns Summary

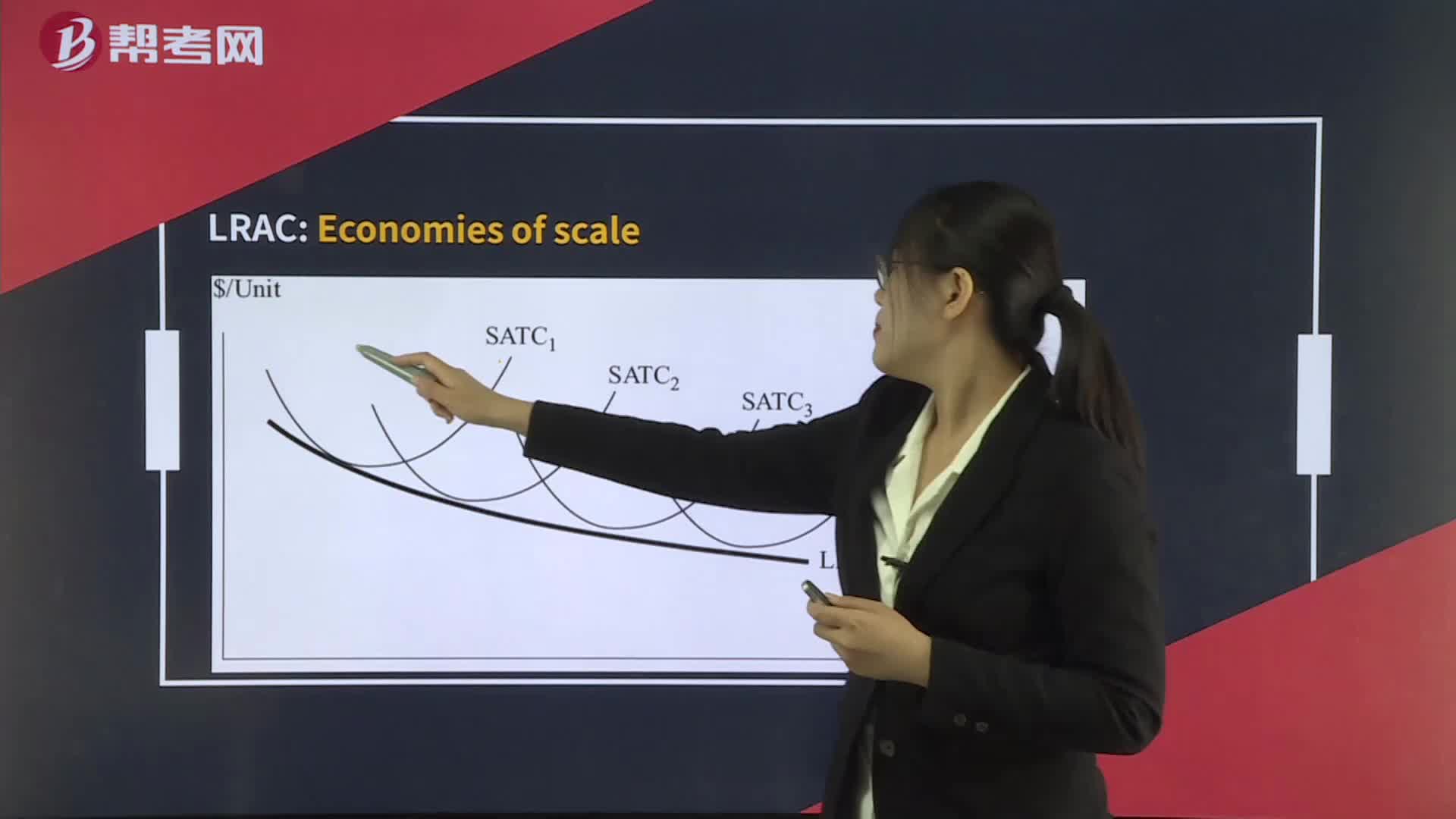

Economies of Scale and Diseconomies of Scale

下载亿题库APP

联系电话:400-660-1360