-

下载亿题库APP

-

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

Technical Analysis Tools— Technical Indicators

Technical Analysis Tools— Cycles

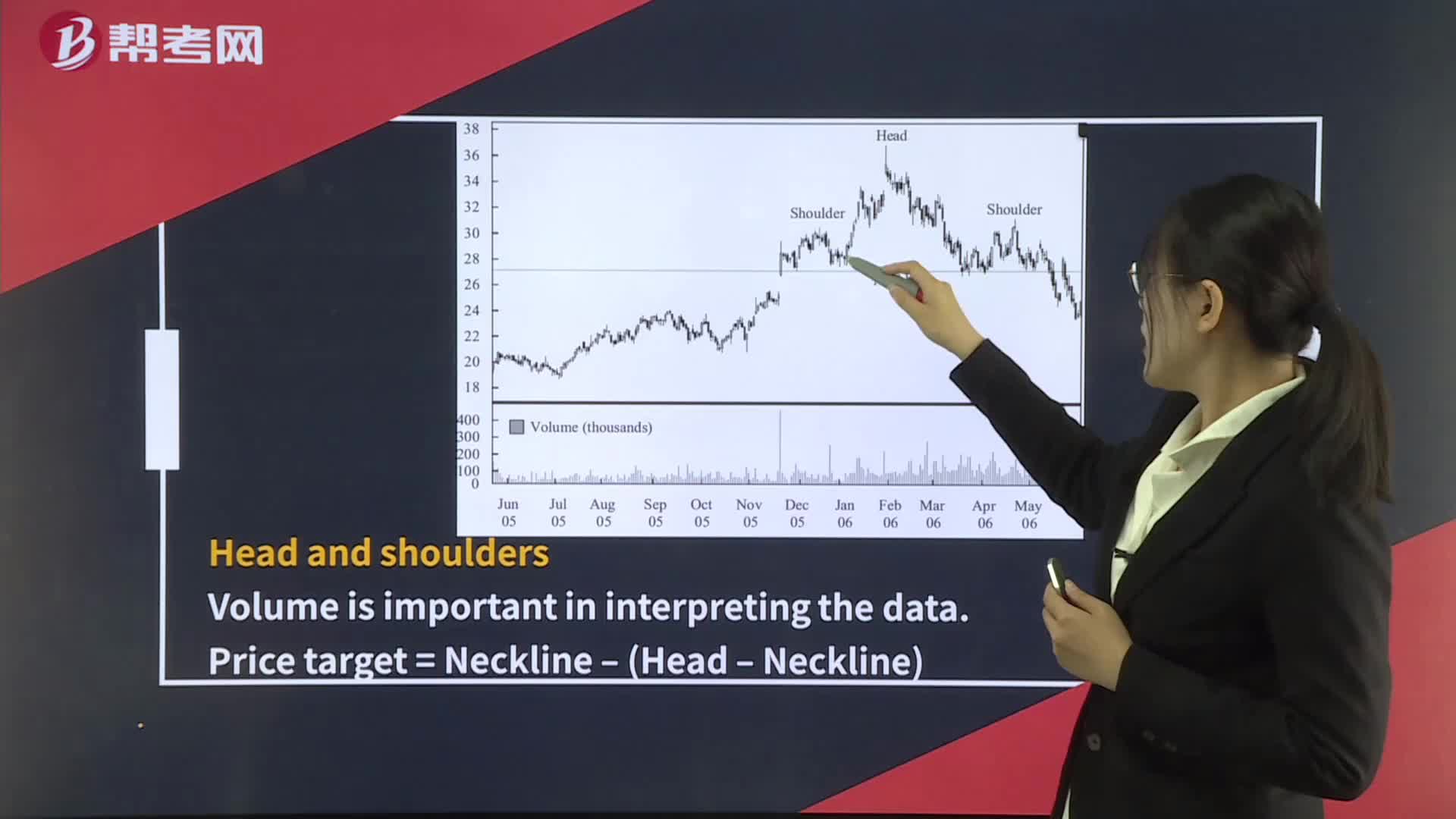

Technical Analysis Tools— Reversal Patterns

Technical Analysis Tools— Continuation Patterns

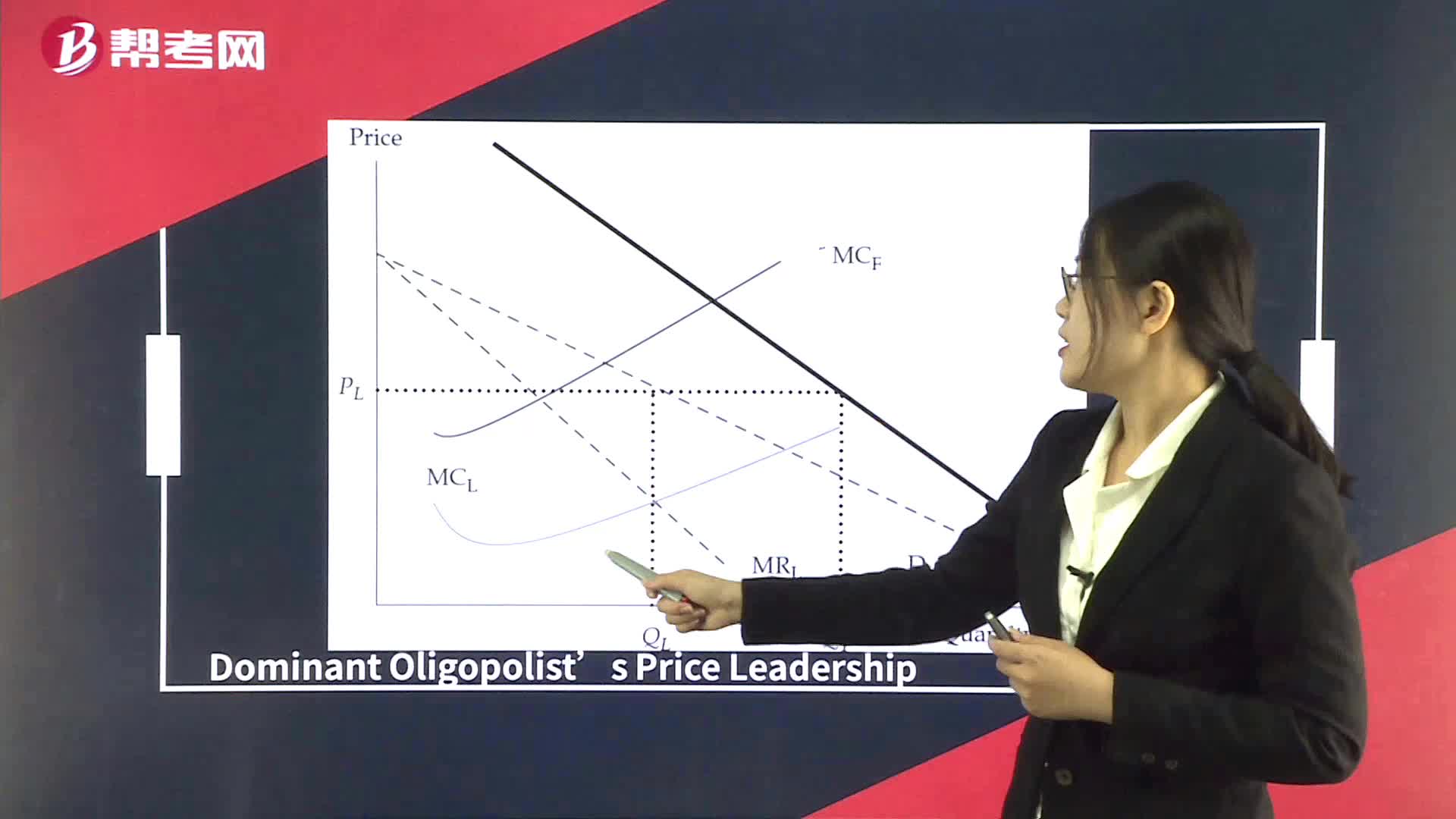

Supply Analysis in Oligopoly Market

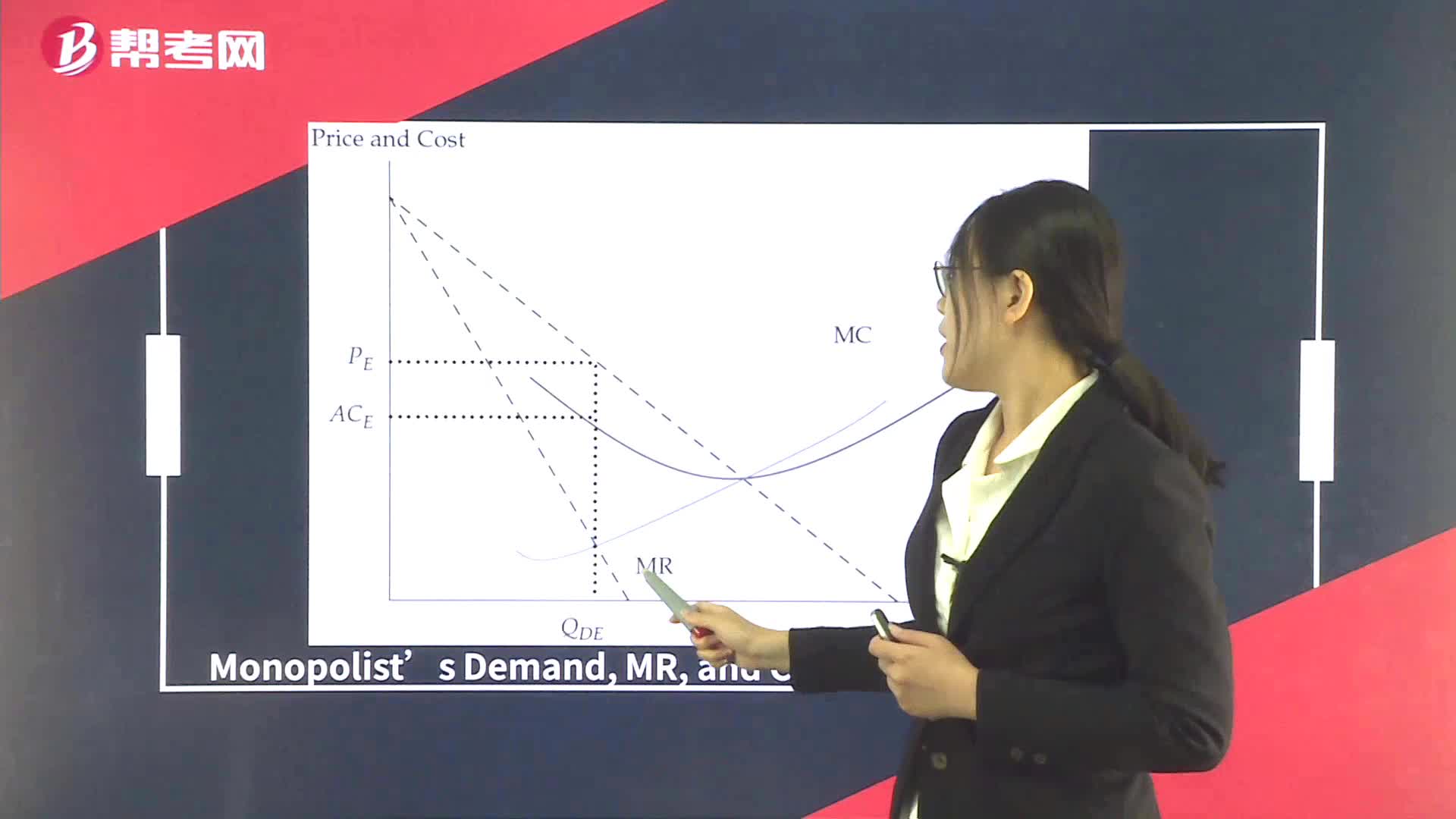

Supply Analysis in Monopoly

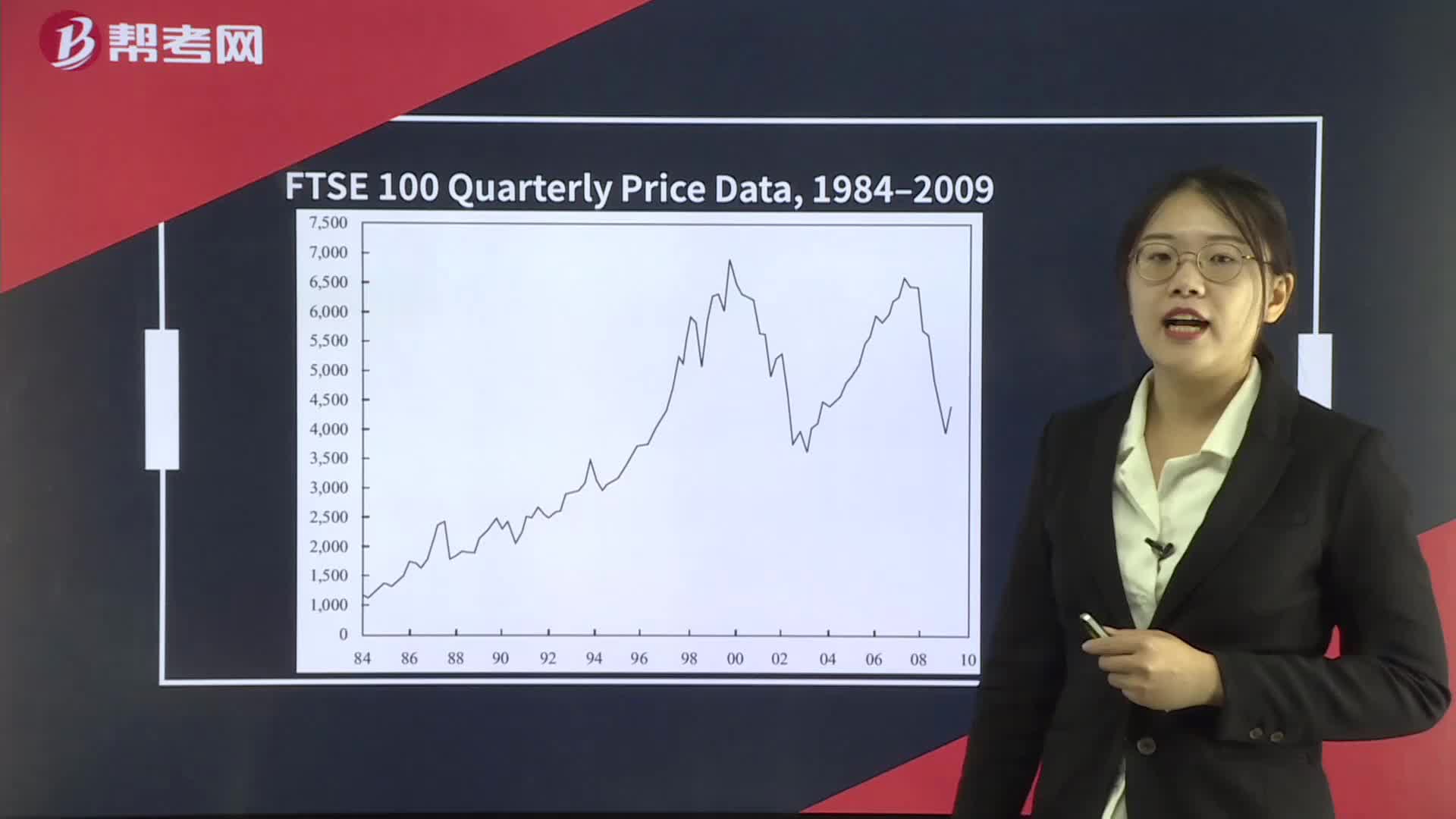

Technical Analysis Tools— Charts

Supply Analysis in Monopolistic Competition

Technical Analysis Tools— Chart Patterns

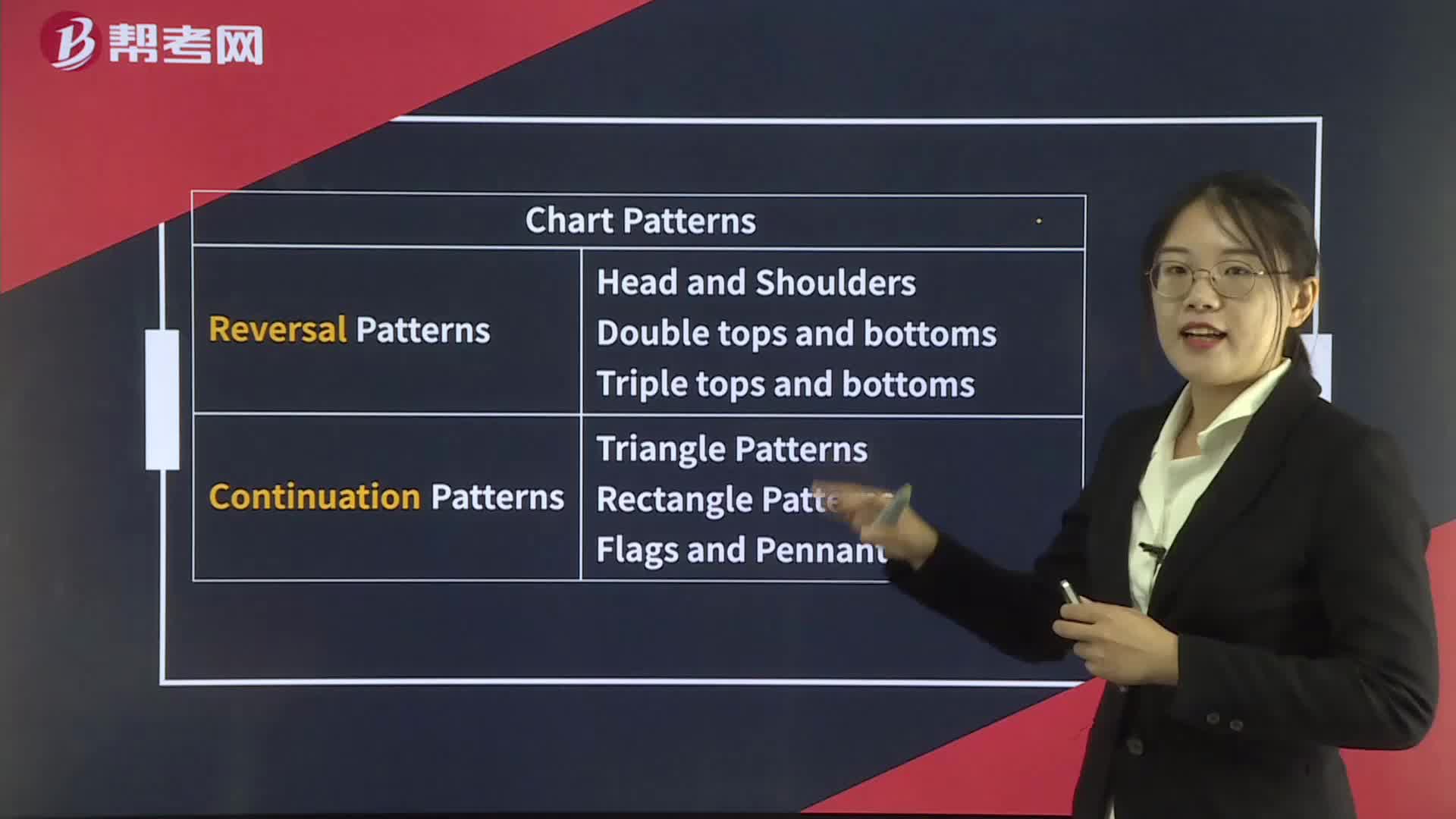

Technical Analysis Tools— Chart Patterns Summary

Intermarket analysis

Breakeven Analysis

30:10

30:10

Technical Analysis Tools— Technical Indicators:average is the average of the closing price of a security over a specified:Once price begins to move back up toward its moving-average linestrategyLong-term investors might buy on a significant

01:44

01:44

Intermarket analysis:analysisby the price of another.

03:08

03:08

Popular Economic Indicators – Lagging:especially the more stable services area.

04:12

04:12

Technical Analysis Tools— Cycles:Kondratieff WaveK Wave:Post-election years and the midterm year have the worst performance.[Solutions]Aa zero will have the worst.

01:27

01:27

Overall Payroll Employment and Productivity Indicators:productivity

00:50

00:50

Monetary Policy Tools:Monetary Policy Tools:one of three ways;openmanipulation of official reserve requirements.

15:59

15:59

Technical Analysis Tools— Chart Patterns:Chart,Categories,Double:tops:FlagsFlag[Practice

04:30

04:30

Fiscal Policy Tools:Transfer,tax,education:GovernmentwealthalcoholSimplicityEfficiency

04:14

04:14

Technical Analysis Tools— Trend:line,draw a line connecting the highs of the price chart.:price.[PracticeLtd.price.Change

10:09

10:09

Technical Analysis Tools— Charts:First,size.,Box,meaning.?scale[Practicemonth.

01:20

01:20

Economic Indicators:value in identifying the economy’s past condition.

11:31

11:31

Technical Analysis:Technical:selling activity in a particular security.:appearsanalysisTechnicalanalysis