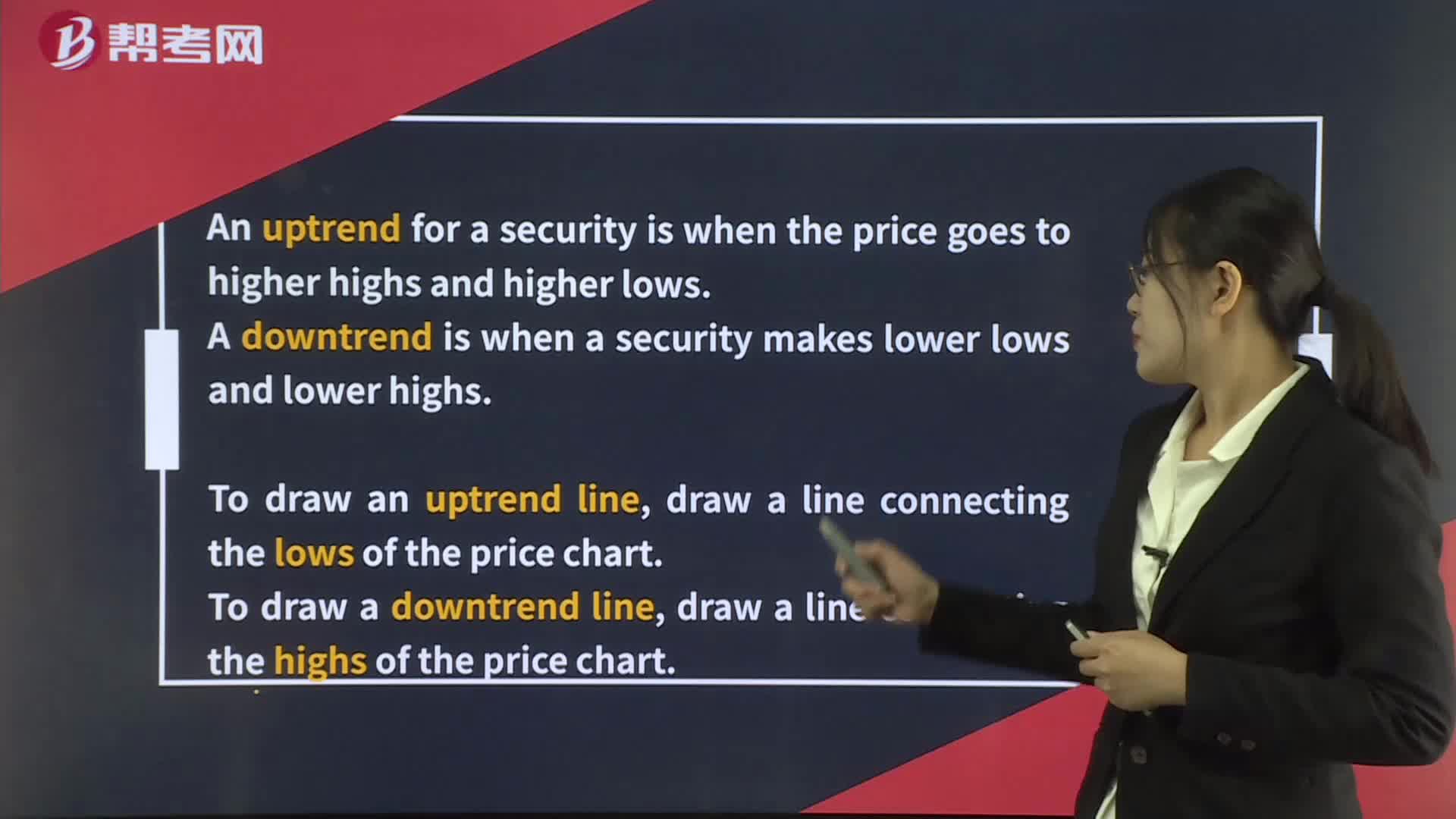

Technical Analysis Tools— Technical Indicators

Demand Analysis in Perfect Competition

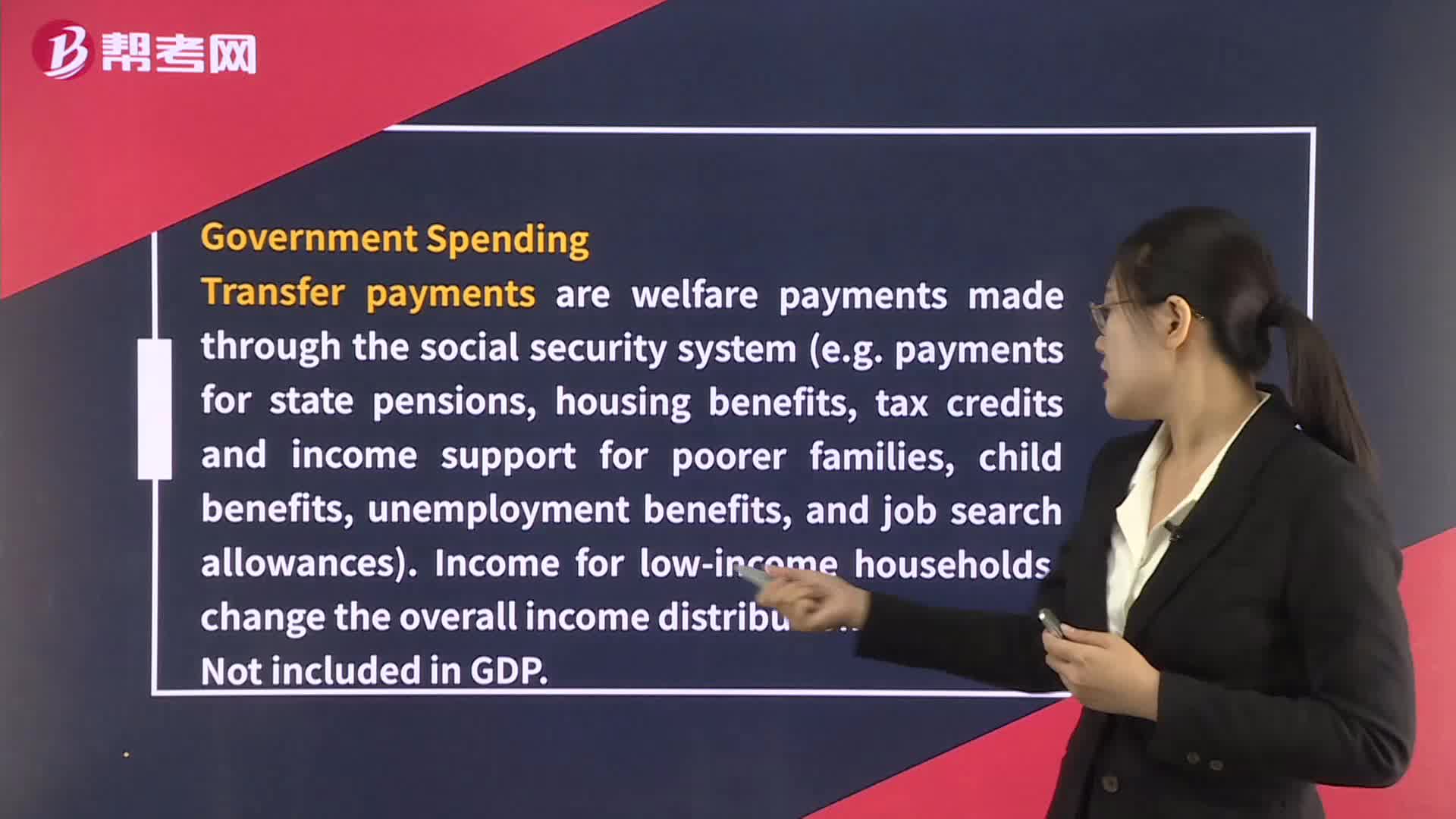

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy

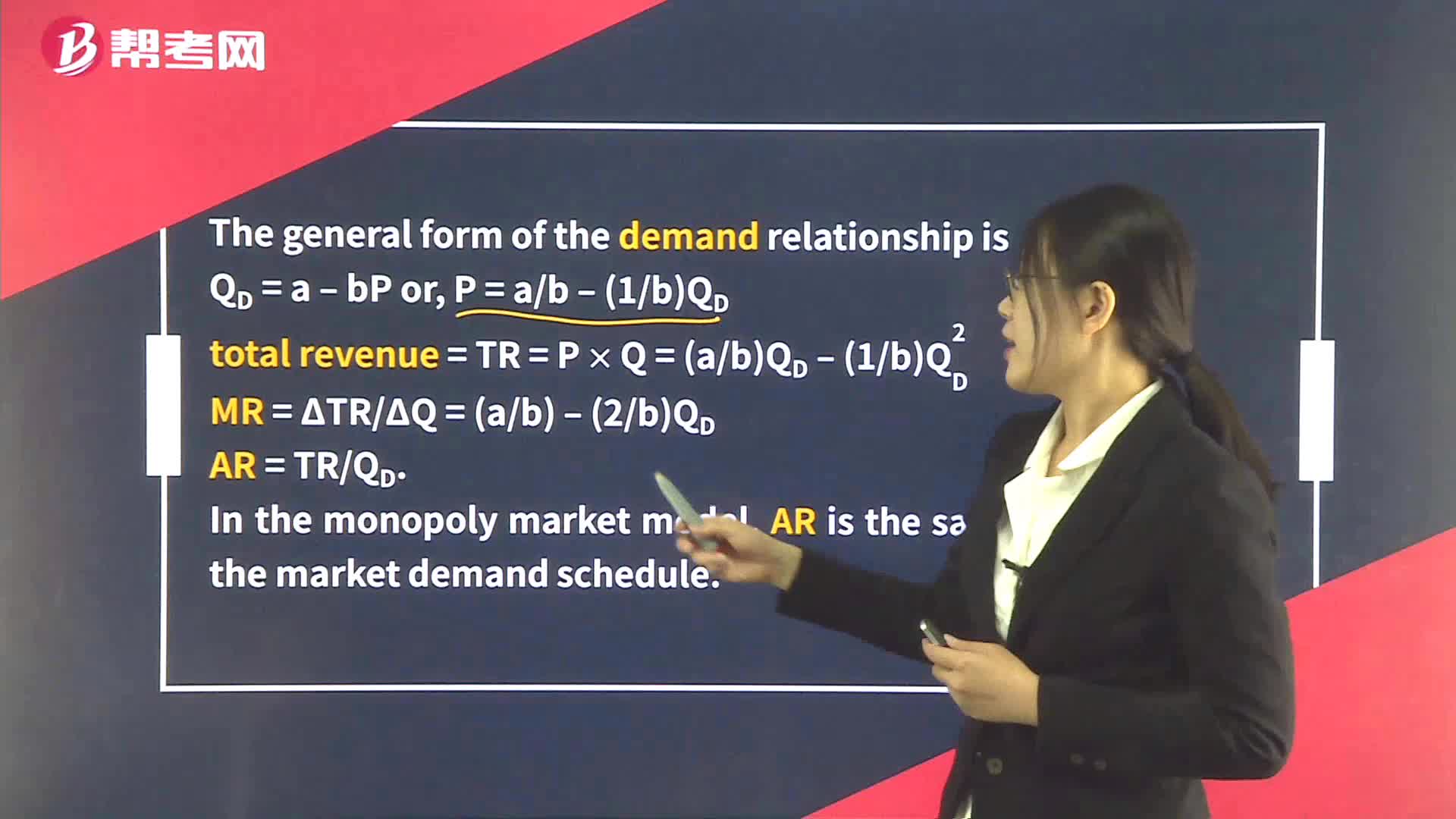

Demand Analysis in Monopoly

Popular Economic Indicators – Coincident

Intermarket analysis

Popular Economic Indicators – Lagging

Popular Economic Indicators – Leading

Technical Analysis Tools— Cycles

Other Variables Used as Economic Indicators

Overall Payroll Employment and Productivity Indicators

Monetary Policy Tools

下载亿题库APP

联系电话:400-660-1360