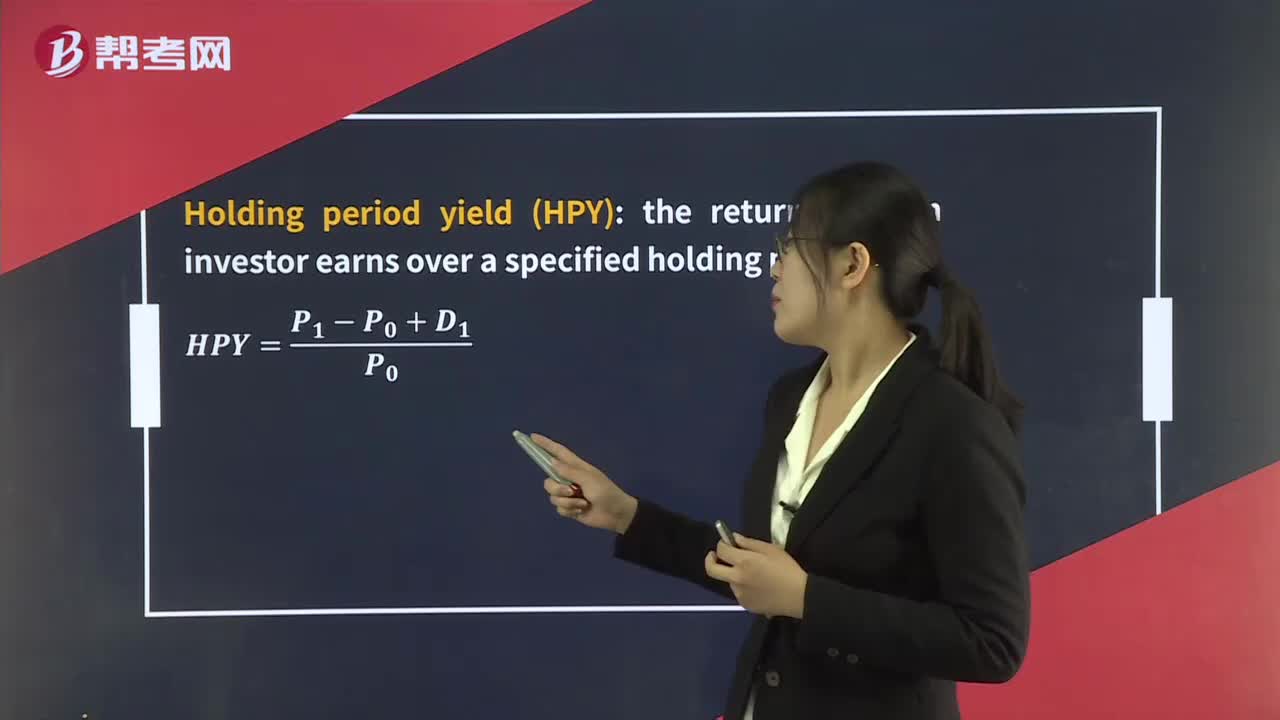

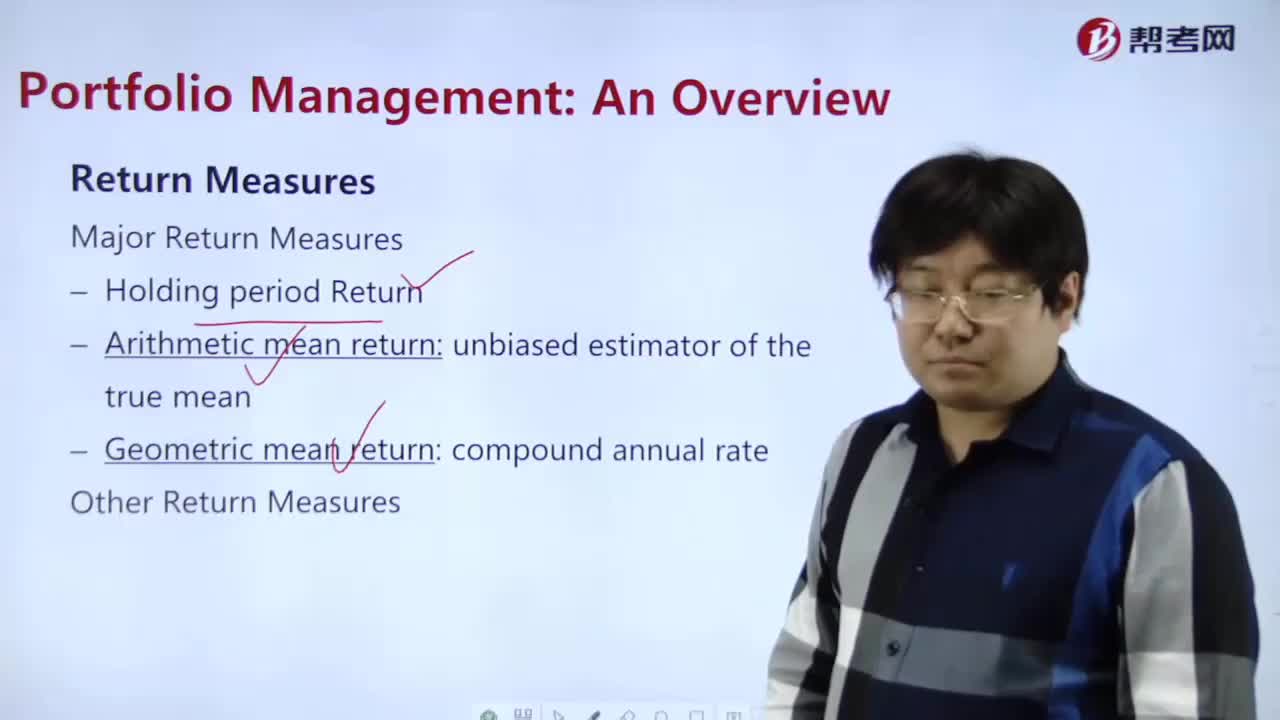

What are the return measures in portfolio management?

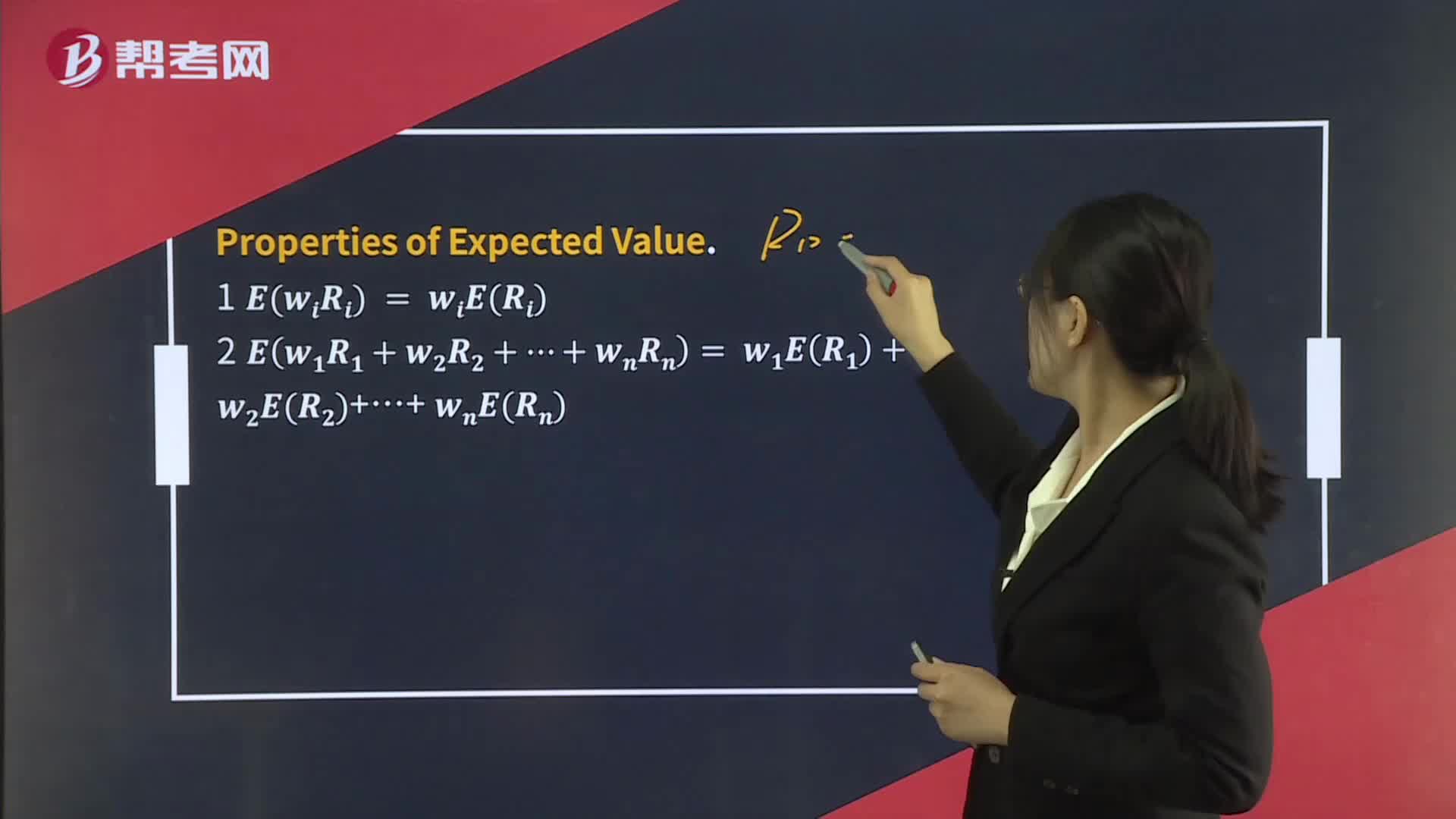

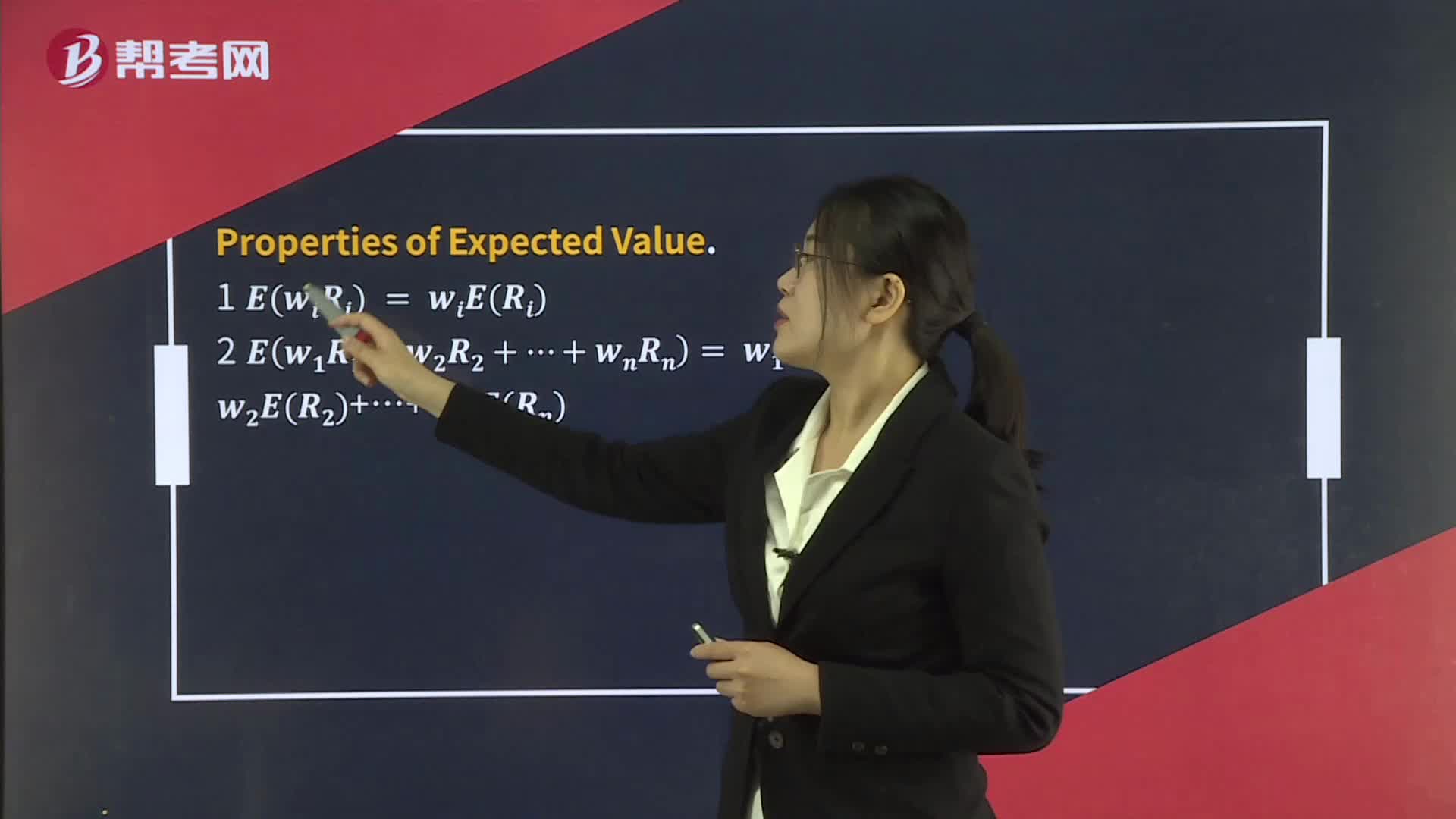

How to control risk and return?

What is the definition of risk management?

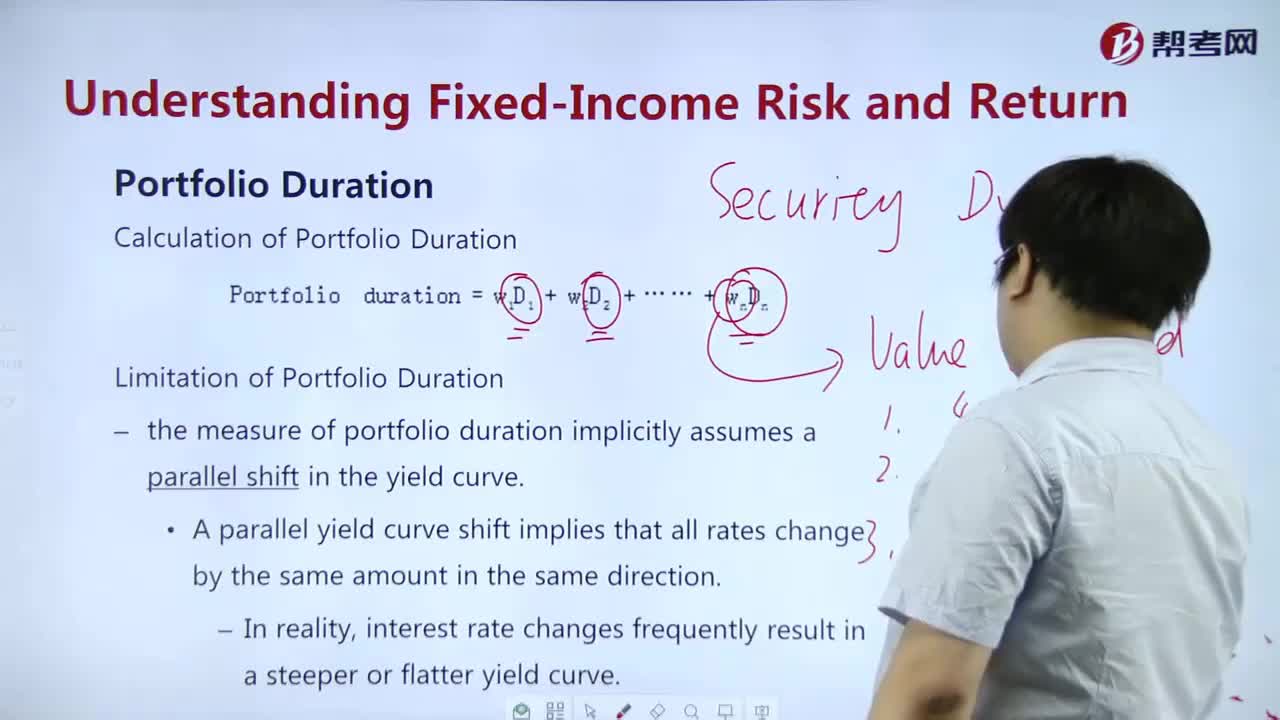

How to understand Portfolio Duration?

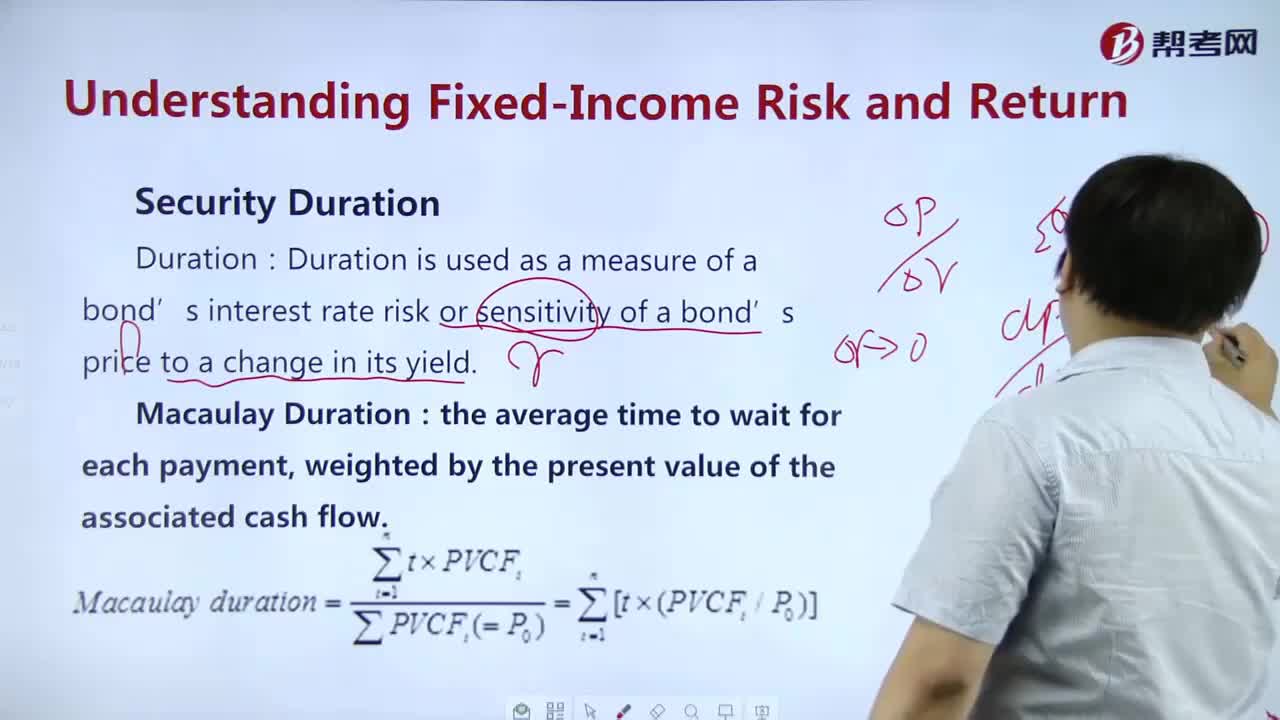

How to master Income Risk and Return-Security Duration?

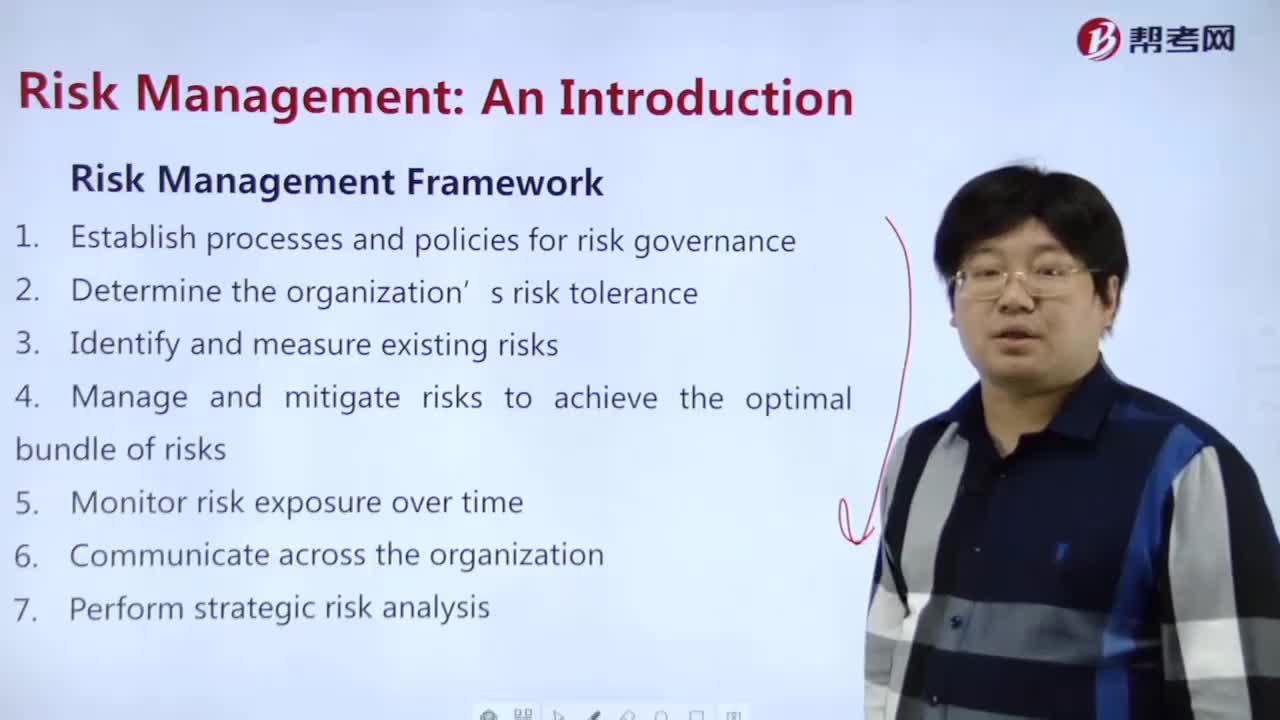

How to understand Risk Management Framework?

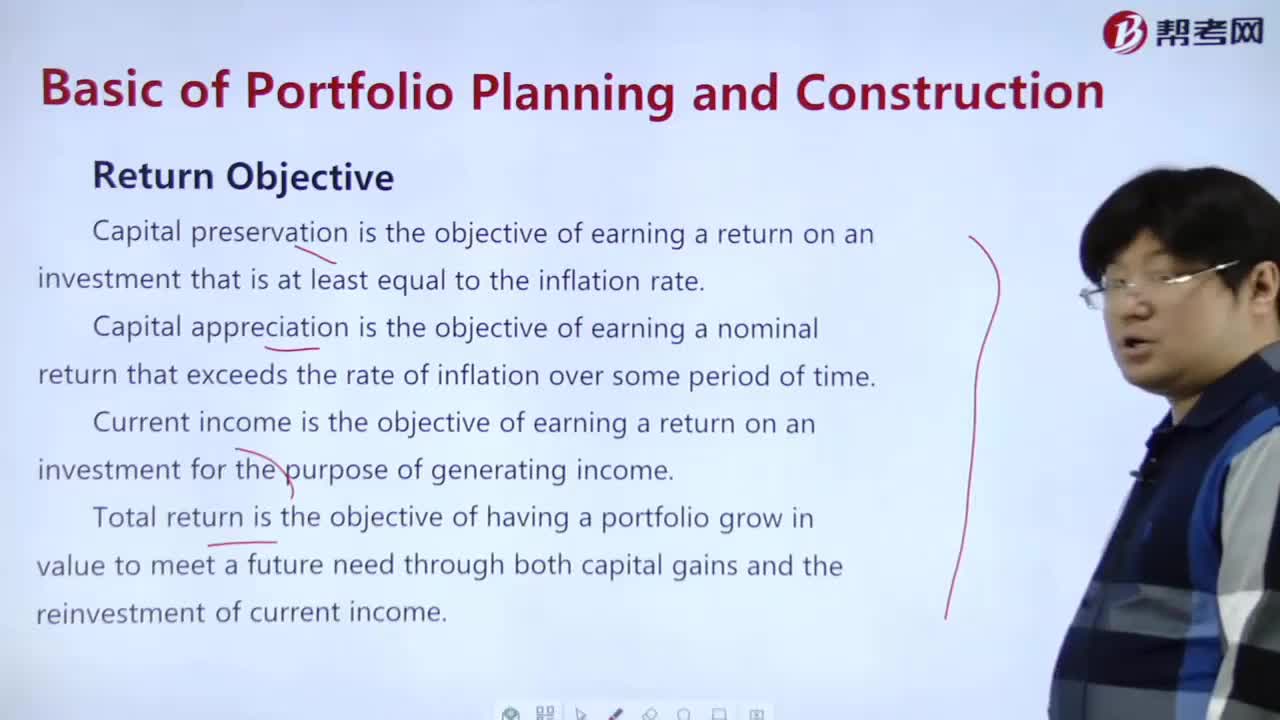

What does it mean Return Objective?

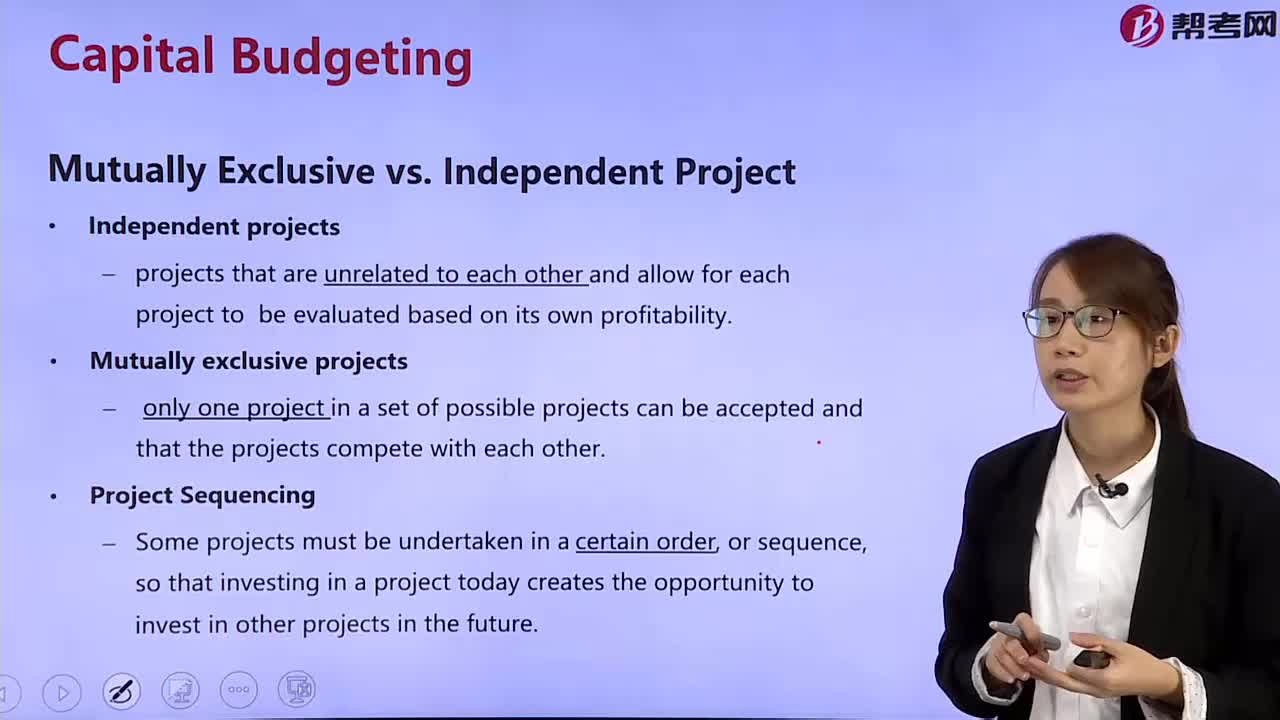

What's the difference between a mutually exclusive project and an independent project?

What is an order driven market?

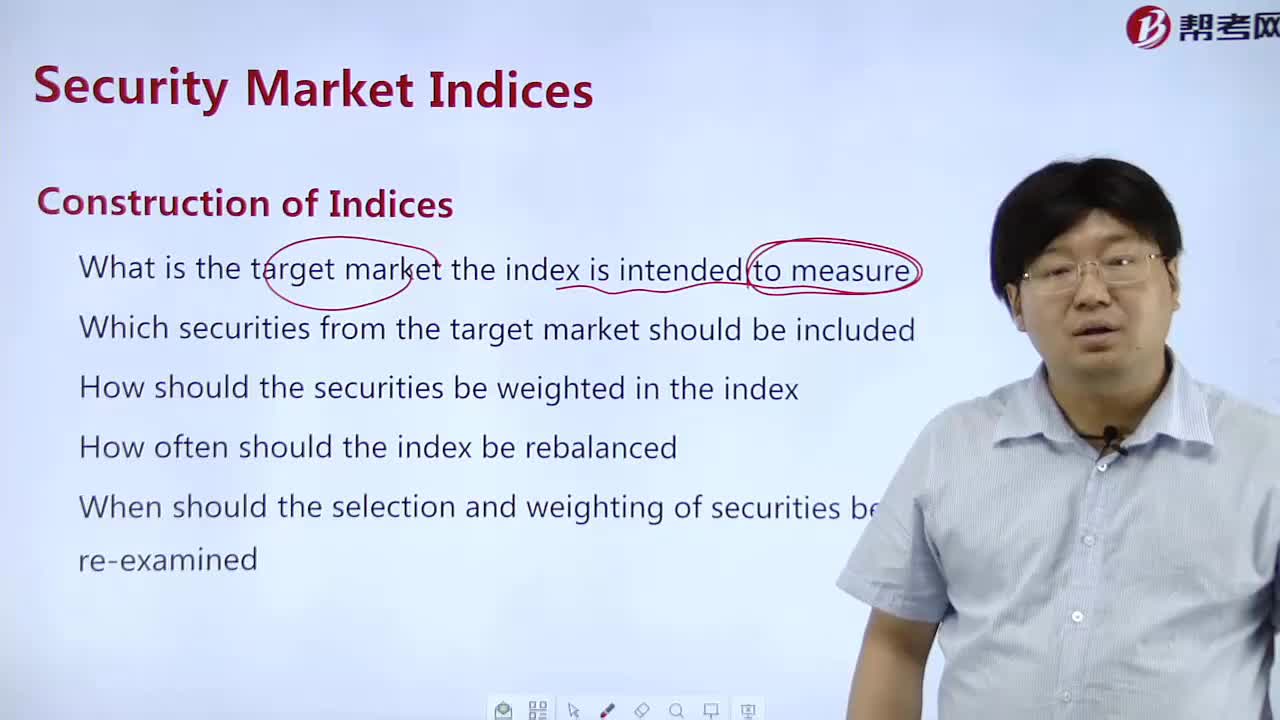

What is the construction of an exponent?

Measures of Dispersion

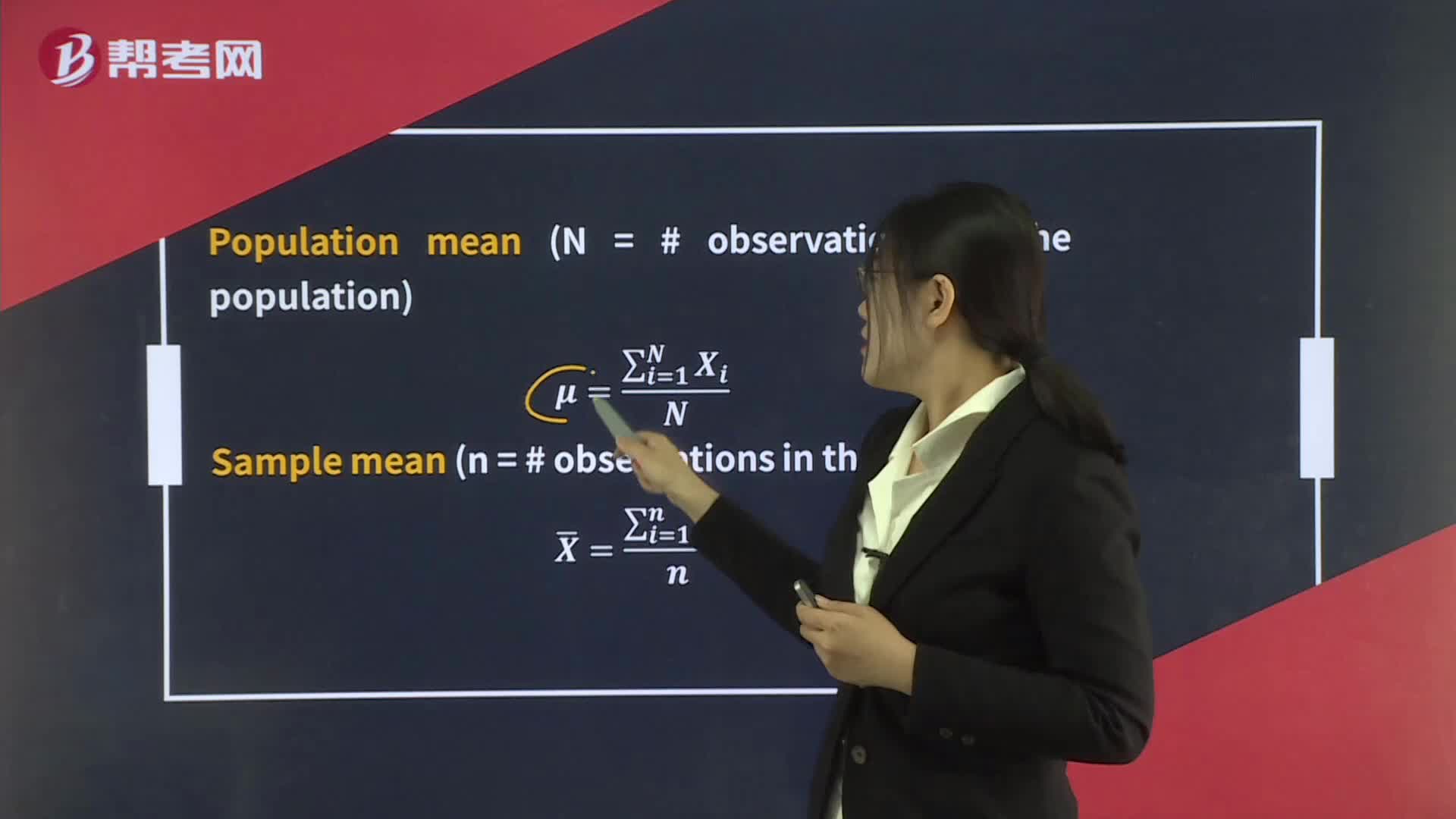

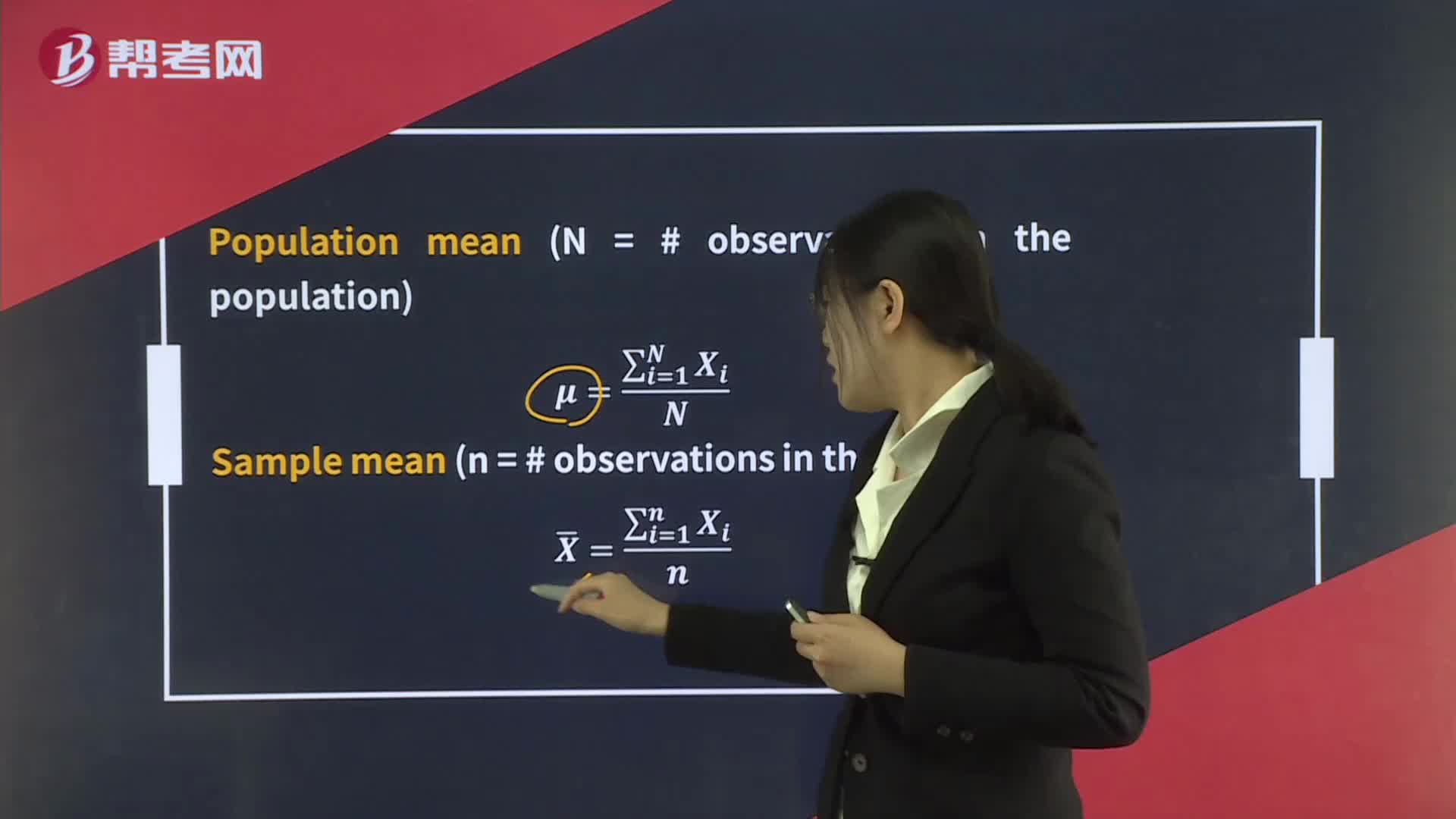

Measures of Central Tendency

下载亿题库APP

联系电话:400-660-1360