下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、An analyst does research about portfolio management.Which of the followingstatements is least accurate when an investor diversifies a portfolio?【单选题】

A.Systematic risk is eliminated.

B.The variance of the portfolio declines.

C.The portfolio will have a higher correlation with the market portfolio.

正确答案:A

答案解析:分散化投资可以减少非系统性风险,但无法减少系统性风险,同时组合的方差会降低,另外投资越分散,该组合与市场组合的表现越接近。

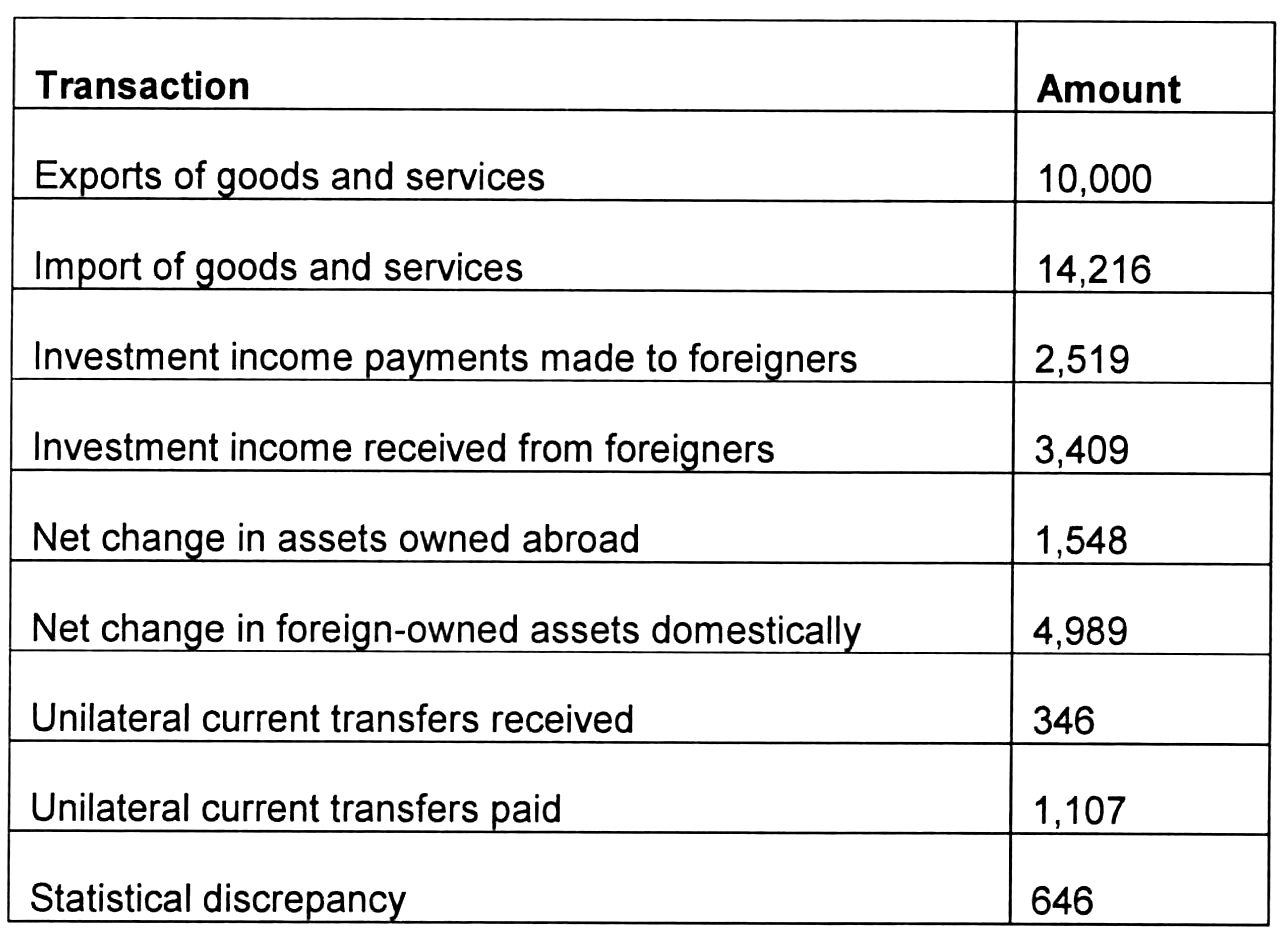

2、A country's international transactions accounts data for last year are presented in its domesticcurrency:

The current account balance is closest to:【单选题】

A.-4,216.

B.-4,345.

C.-4,087.

正确答案:C

答案解析:

CFA Level I

"International Trade and Capital Flows," Usha Nair-Reichert and Daniel Robert

Witschi

Sections 4.1, 4.2

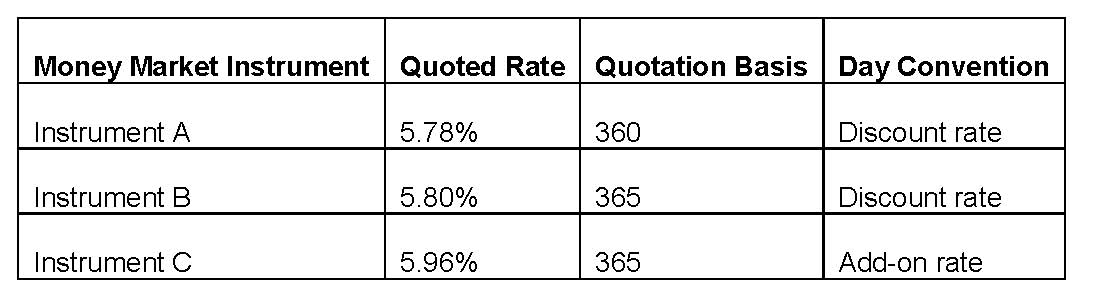

3、Which of the following 90-day money market instruments most likely offers the investor the highest rate of return? 【单选题】

【单选题】

A.Instrument C

B.Instrument B

C.Instrument A

正确答案:A

答案解析:Instrument C provides a bond equivalent yield of 5.96%, compared with 5.946% for Instrument A and 5.883% for Instrument B.

2014 CFA Level I

“Introduction to Fixed-Income Valuation,” by James F. Adams and Donald J. Smith

Section 3.5

4、The crowding-out effect is most likely associated with:【单选题】

A.falling real interest rates.

B.government budget deficits.

C.government budget surpluses.

正确答案:B

答案解析:“Fiscal Policy,” Michael Parkin

2011 Modular Level I, Vol. 2, pp. 440-441

Study Session 6-26-b

Discuss the sources of investment finance and the influence of fiscal policy on capital markets, including the crowding-out effect.

The tendency for a government budget deficit to decrease private investment is called the crowding-out effect.

5、Which of the following investments most likely provides an investor with indirect equity exposure toreal estate?【单选题】

A.Real estate limited partnerships

B.Commercial mortgage-backed securities

C.Real estate investment trusts

正确答案:C

答案解析:Real estate investment trusts (REITs) provide investors with indirect equity real estate exposure. Realestate investment partnerships are a form of direct real estate equity investment. Commercialmortgage-backed securities (CMBSs) provide investors with indirect debt investment opportunities inreal estate.

CFA Level I

"Introduction to Alternative Investments," Terri Duhon, George Spentzos, and Scott D. Stewart

Sections 5.1, 5.2

6、An analyst does research about theories of the business cycle.Which of the followingeconomic views argue that wages are "downward stick"', reducing theability of a decrease in money wages to increase short-run aggregate supply andmove the economy from recession back towards full employment?【单选题】

A.Neoclassical.

B.Keynesian.

C.Monetarist.

正确答案:B

答案解析:新古典学派认为,经济会自动修复,经济周期是由于供给的变化所导致的。凯恩斯主义认为,经济周期是由于人们过度乐观和悲观所导致的,同时由于工资存在向下的刚性,市场自发的力量无法使得经济修复,政府应该采取货币和财政政策来管理经济周期的波动。货币主义认为,不合适的货币政策导致了经济周期。

7、If the price of a key factor of production decreases, real GDP is most likely to:【单选题】

A.decrease.

B.remain unchanged.

C.increase.

正确答案:C

答案解析:如果一种主要生产要素价格降低,则会导致供给增加和真实GDP增加。

8、Relative to an investor with a steeper indifference curve, the optimal portfolio for an investor with a flatter indifference curve will most likely have:【单选题】

A.a lower level of risk and return.

B.a higher level of risk and return.

C.the same level of risk and return.

正确答案:B

答案解析:“Portfolio Risk and Return: Part I”, by Vijay Singal.

2011 Modular Level I, Vol. 4, pp. 343-350.

Study Session 12-52-h

Discuss the selection of an optimal portfolio, given an investor’s utility (or risk aversion) and the capital allocation line.

B is correct because a less risk-averse investor’s highest utility, given the low slope of his indifference curve, is likely to touch the capital allocation line at a point which would represent a portfolio with higher risk and more expected return.

9、An analyst does research about a floating rate securities.All else being equal, theprice of a floating-rate security is most likely to react in the same way to changesin market interest rates as a fixed-rate coupon bond if market rates:【单选题】

A.increase between coupon reset dates.

B.are substantially below the floating rate security's cap rate.

C.are substantially above the floating rate security's cap rate.

正确答案:C

答案解析:浮动利率证券的利率会随着市场利率的变化而进行调整,从而使利率风险减少,但是并不能完全消除。因为存在调整的时间间隔,如果时间间隔变长的话,浮动利率证券的利率风险就会升高。同时,还存在利率顶,限制利率调整的最高幅度,如果市场利率大大超过利率顶的话,该浮动利率证券只能一直提供利率顶的息票率,将使得浮动利率证券就像一个固定利率证券一样。

10、Which of the following statements most accurately describes a valuation allowance for deferred taxes? A valuation allowance is required under:【单选题】

A.IFRS on revaluation of capital assets.

B.U.S. GAAP if there is doubt about recovering a deferred tax asset.

C.both IFRS and U.S. GAAP on tax differences arising from the translation of foreign operations.

正确答案:B

答案解析:“Income Taxes,” Elbie Antonites, CFA and Michael A. Broihahn, CFA

2013 Modular Level 1, Vol. 3, Reading 31, Section 6.1

Study Session, 9-31-g

Describe the valuation allowance for deferred tax assets—when it is required and what impact it has on financial statements.

B is correct. A valuation allowance is required under U.S. GAAP if there is doubt about whether a deferred tax asset will be recovered. Under IFRS the deferred tax asset is written down directly.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料