下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、When comparing investing in exchanged traded funds (ETFs) to investing in open-end mutual funds, which of these is most likely not an advantage of ETFs? ETFs:【单选题】

A.provide lower exposure to taxes related to capital gains distribution.

B.trade throughout the entire trading day at market prices that are continuously updated.

C.are a more cost effective way for large institutional investors to invest in less liquid markets.

正确答案:C

答案解析:“Alternative Investments,” Bruno Solnik and Dennis McLeavey

2010 Modular Level I, Vol. 6, pp. 195-197

Study Session 18-73-b,c

Distinguish among style, sector, index, global, and stable value strategies in equity investment and among exchange traded funds (ETFs), traditional mutual funds, and closed end funds.

Explain the advantages and risks of ETFs.

Some sector and international ETFs have large bid-ask spreads and substantial expense ratios compared to managed portfolios, which may provide a more cost efficient alternative to ETFs, particularly for large institutional investors.

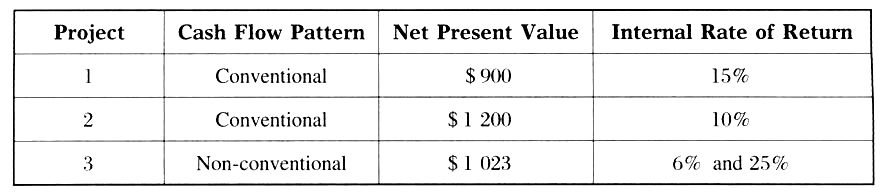

2、Using the following information about three mutually exclusive capital projects tomake an investment decision.

Assumed each project has the same initial outlay and required return, the mostappropriate investment is :【单选题】

A.Project 1.

B.Project 2.

C.Project 3.

正确答案:B

答案解析:当选择互斥项目(mutually exclusive projects)时,如果使用净现值(NPO)与内部收益率作决策有冲突的话,选择有最高的NPV的项目。非传统项目(non-conventional projects)可能会给出不同的内部收益率,如项目开始后,仍然有负的现金流。

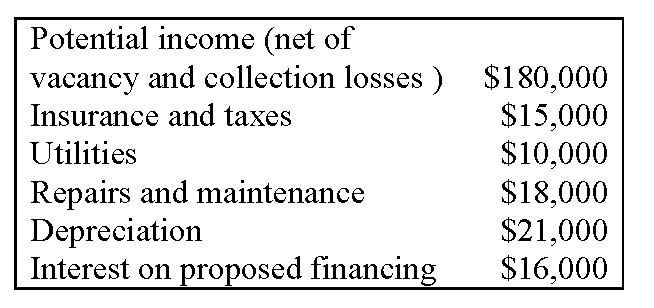

3、An investor has gathered the following data, presented on an annual basis, for an apartment complex that is being considered for purchase:

The annual net operating income (NOI) for the apartment complex is closest to:【单选题】

A.$116,000.

B.$121,000.

C.$137,000.

正确答案:C

答案解析:“Alternative Investments,” Bruno Solnik and Dennis McLeavey

2010 Modular Level I, Vol. 6, pp. 205-207

Study Session 18-73-f

Calculate the net operating income (NOI) from a real estate investment, the value of a property using the sales comparison and income approaches, and the after-tax cash flows, net present value, and yield of a real estate investment

NOI = $180,000 - $15,000 - $10,000 - $18,000 = $137,000.

4、Which of the following is most likely a depreciation method in which the allocationof cost corresponds to the actual use of an asset in a particular period?【单选题】

A.Accelerated method.

B.Weighted average method.

C.Units-of-production method.

正确答案:C

答案解析:折旧(depreciation)费用的3种计算方法如下:

● 直线折旧法[ straight-line(sl) method]:[初始成本(original cost) - 残值(residualvalue)]/应折旧年限(depreciable life)。

● 加速折旧法(accelerated method):例如,双倍余额递减法[double-declining balance(DDB) method],其计算公式中没有残值(salvage value),故在计算最后一年折旧费用时要注意折旧费用不能超过残值,depreciation in year × = (2/ depreciable life) ×book value at the beginning of year × ,如果此公式中2改为1,就是单倍余额递减法。

● 单位产出法(units-of-production method):生产中耗用了多少,就按其比例计算多少折旧费用。

5、The free-rider problem, an obstacle to efficiency, is most likely associated with:【单选题】

A.monopolies.

B.public goods.

C.subsidies and quotas.

正确答案:B

答案解析:“Efficiency and Equity,” Michael Parkin

2010 Modular Level I, Vol. 2, p. 50

Study Session 4-14-e

Explain 1) how efficient markets ensure optimal resource utilization and 2) the obstacles to efficiency and the resulting underproduction or overproduction, including the concept of deadweight loss.

Public goods can be consumed simultaneously by everyone and it is in each person’s interest to free ride on everyone else and avoid paying for her or his share of a public good.

6、An U.S.Treasury bill (T-bill) with a face value of $100 000 matures in 270days.If the T-bill is currently selling for $96 910, the bank discount yield isclosest to :【单选题】

A.2.32%

B.3.09%

C.4.12%

正确答案:C

答案解析:($100 000 - $96 910)/$100 000 × 360/270 = $3 090/$100 000 × 360/270 = 4.12%.

7、Which of the following theories suggests that both aggregate demand and aggregatesupply are primarily driven by changes in technology over time?【单选题】

A.Neoclassical school.

B.Keynesian school.

C.Austrian school.

正确答案:A

答案解析:新古典学派认为,总供给和总需求长期来讲主要由科学水平的变化所主导,而凯恩斯学派认为,总需求的变化是由于市场参与者预期的改变进而引起经济周期,奥地利学派认为,经济周期是由于政府对于经济的干预所引起的。

8、An analyst does research about risk management applications of option strategies.With respect to option strategies, the shape of the graph that illustrates both thevalue at expiration and profit for buying a call is most similar in shape to thegraph for:【单选题】

A.selling a put.

B.a covered call position.

C.a protective put position.

正确答案:C

答案解析:有保护的看跌期权(protective put position)是购买一股股票的同时再买人针对该股票的一个看跌期权,当股票价格上涨时股票可以获利,看跌期权没有价值;而如果股票价格下跌股票损失时,看跌期权则可以获利,所以从图形上来看其收益类似于购买了一个看涨期权。

9、Thomas Turkman recently hired Georgia Viggen, CFA, as a portfolio manager for North South Bank. Although Viggen worked many years for a competitor, West Star Bank, the move was straightforward because she did not have a non-compete agreement with her previous employer. Once Viggen starts working for Turkman, the first thing she does is to bring a trading software package she developed and used at West Star to her new employer. Using public information, Viggen contacts all of her former clients to convince them to move with her to North South. Viggen also convinces one of the analysts she worked with at West Star to join her at her new employer. Viggen most likely violated the CFA Institute Code of Ethics and Standards of Professional Conduct concerning her actions involving:【单选题】

A.clients.

B.the analyst.

C.trading software.

正确答案:C

答案解析:“Guidance for Standards I-VII”, CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard IV (A) Loyalty, Guidance

Study Session 1-2-b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

C is correct because the portfolio manager violated Standard IV (A) Loyalty by taking proprietary trading software from her former employer. Although the manager created the software, it was during a period of time when West Star employed her, so the software is not her property to take with her to her new employer. The member contacted clients using public information, so she did not violate Standard IV (A) Loyalty. Because Viggen was not obligated to abide by a non-compete agreement that would likely restrict recruitment of former colleagues, Viggen is most likely free to recruit the analyst from her former employer.

10、A firm with a marginal tax rate of 40% has a weighted average cost of capital of 7.11%. The before-tax cost of debt is 6%, and the cost of equity is 9%. The weight of equity in the firm's capital structure is closest to:【单选题】

A.79%.

B.37%.

C.65%.

正确答案:C

答案解析:WACC=weight of debt*before-tax cost of debt*(1-tax rate)+weight of equity*cost of equity.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料