下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、An analyst does research about margin transaction.An investor purchases a stockpriced at $80 by borrowing the maximum amount under a 65% initial marginrequirement.If the maintenance margin requirement is 30% , the security pricebelow which the investor will first receive a margin call is closest to:【单选题】

A.$37

B.$40

C.$52

正确答案:B

答案解析:需要追加保证金时股价的公式为:margin call price =  × (1 - initial margin)/(1 - maintenancemargin),且

× (1 - initial margin)/(1 - maintenancemargin),且 = initial purchase price。

= initial purchase price。

因此,需要追加保证金时的股价 = $80 × (1 - 65%)/(1 - 30%) = $40。

2、Which of the following bonds is most likely to trade at a lower price relative to an otherwise identicaloption-free bond?【单选题】

A.Convertible bond

B.Callable bond

C.Putable bond

正确答案:B

答案解析:A callable bond benefits the issuer because it gives the issuer the right to redeem all (or part) of thebonds before the maturity date. Thus, the price of a callable bond will typically be lower than the priceof an otherwise identical non-callable bond.

CFA Level I

"Fixed-Income Securities: Defining Elements," Moorad Choudhry and Stephen E. Wilcox

Section 5.1

3、During a period of rising price and stable inventory levels, using the LIFO inventoryaccounting method results in cost of goods sold (COGS) that is:【单选题】

A.less than COGS using the FIFO method.

B.equal to COGS using the FIFO method.

C.greater than COGS using the FIFO method.

正确答案:C

答案解析:当物价上涨并且存货数量稳定时,后进先出法(LIFO)相对于先进先出法(聊)有更高的销货成本,因为后买进来的价格高的存货先作为成本统计。

4、An analyst does research about financial statements.Which of the following bestdescribes the firm's financial performance over a period of time?【单选题】

A.Balance sheet.

B.Income statement.

C.Cash flow statement.

正确答案:B

答案解析:对于一个企业来说,主要的3张财务报表分别是:资产负债表(balance sheet)、利润表(income statement)和现金流量表(cash flow statement)。资产负债表是某个时间点的企业的财务状况(financial position)的反映。利润表反映的则是两个时间点,或者说一个时间段内的企业的盈利/亏损情况和盈利能力。现金流量表反映的是两个时间点,或者说一个时间段内企业的经营性、融资性和投资性的现金流情况。

5、The null hypothesis is most likely to be rejected when the p-value of the test statistic:【单选题】

A.exceeds a specified level of significance.

B.is negative.

C.falls below a specified level of significance.

正确答案:C

答案解析:If the p-value is less than the specified level of significance, the null hypothesis is rejected.

CFA Level I

"Hypothesis Testing," Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E.Runkle

Section 2

6、Which of the following is the most appropriate reason for using a free-cash-flow-to-equity (FCFE) model to value equity of a company?【单选题】

A.FCFE is a measure of the firm’s dividend paying capacity.

B.FCFE models provide more accurate valuations than the dividend discount models.

C.A firm’s borrowing activities could influence dividend decisions but they would not impact FCFE.

正确答案:B

答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFA

2013 Modular Level I, Vol. 5, Reading 51, Section 4

Study Session 14-51-c

Explain the rationale for using present-value of cash flow models to value equity and describe the dividend discount and free-cash-flow-to-equity models.

A is correct. FCFE is a measure of the firm’s dividend paying capacity.

7、An analyst gathered the following information about a company and thatcompany's common stock:

● Weighted average cost of capital is 14%

● Intrinsic value per share is $22

● Market price per share is $28

The company's investment projects for the year are expected to return 16 to 18percent.Which of the following best characterizes the company and thecompany's common stock?【单选题】

A.Growth company and growth stock.

B.Growth company and speculative stock.

C.Speculative company and growth stock.

正确答案:B

答案解析:公司的期望投资收益率大于公司的加权平均资本成本(WACC),所以是成长性股票。公司股票的市场价格大于内在价值,所以是投机性股票。

8、An analyst does research about foreign investments.Which of the following isleast likely to increase estimated required rate of return by foreign investors topurchase domestic securities?【单选题】

A.Exchange rate risk.

B.Real GDP growth rate.

C.Capital liquidity limitation.

正确答案:B

答案解析:汇率风险和资本流动性障碍会增加国外投资者投资于本国的必要回报率,必要回报率等于名义无风险回报率加上风险溢价,而真实的GDP增长率并不会直接反映在必要回报率中。

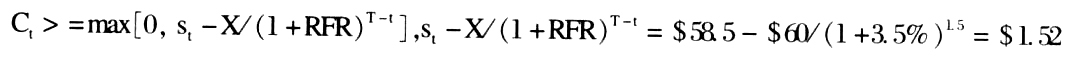

9、An American call has a strike price of $60 and expires in 1.5 years.The currentprice of the underlying is $58.5 and the risk-free rate is 3.5%.The minimumvalue of this call is:【单选题】

A.$0

B.$0.53

C.$1.52

正确答案:C

答案解析:

10、An analyst does research about depreciation and gathers the following informationabout a company.The company sells a price of fixed asset thathas original cost of$9 000 and has accumulated depreciation of $5 000.If there is a loss to thesale of $1 500, the selling price of the fixed asset is closest to:【单选题】

A.$2 500

B.$5 500

C.$6 500

正确答案:A

答案解析:账面价值(book value) = $9 000 - $5 000 = $4 000。

销售价格(selling price) = $4 000 - $1 500 = $2 500。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料