下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、A portfolio manager decides to temporarily invest more of a portfolio in equities than the investment policy statement prescribes, because he expects equities will generate a higher return than other asset classes. This decision is most likely an example of:【单选题】

A.rebalancing.

B.tactical asset allocation.

C.strategic asset allocation.

正确答案:B

答案解析:Basics of Portfolio Planning and Construction,” Alistair Byrne, CFA, and Frank E. Smudde, CFA

2011 Modular Level I, Vol. 4, pp. 450, 467, 477

Study Session 12-54-g

Discuss the principles of portfolio construction and the role of asset allocation in relation to the IPS.

B is correct. Tactical asset allocation is the decision to deliberately deviate from the policy exposures to systematic risk factors with the intent to add value based on forecasts of the near-term returns of those asset classes.

2、In the audit report, an additional paragraph that explains an exception to an accounting standard is best described as a(n):【单选题】

A.adverse opinion.

B.qualified opinion.

C.disclaimer of opinion.

正确答案:B

答案解析:“Financial Statement Analysis: An Introduction,” Elaine Henry, CFA, and Thomas R. Robinson, CFA

2013 Modular Level I, Vol.3, Reading 22, Section 3.1.7

Study Session 7-22-d

Describe the objective of audits of financial statements, the types of audit reports, and the importance of effective internal controls.

B is correct. A qualified opinion is one in which there is some scope limitation or exception to accounting standards that is described in additional explanatory paragraphs.

3、Accrued expense is most likely recorded by a company if cash is paid:【单选题】

A.before expense has been incurred.

B.at the same time expense has been incurred.

C.after expense has been incurred.

正确答案:C

答案解析:根据权责发生制(accrual accounting)原则,权责发生制的4种情况如下:

预收账款(unearned revenue):已经收到现金,但是没有确认销售收入,因为实现销售收入的过程还没有完成。例如,中国移动预收电话费,会将其记入预收账款。

待摊费用(prepaid expense):现金已经付出,但费用不能马上全部确认,而是应在一定期限内分摊费用。例如,预付了一年的房租,但只能在经过一个月后才能确认当月的租金费用。

应计收入(accrued revenue):企业已经提供产品或服务,但现金还没有收到,最典型的例子就是以“赊销”的方式向下游客户出售商品而形成的应收账款。应计收入的增加会使利润增加,从而使留存收益(retained earnings)上升。

应付费用(accrued expense):企业应支付,但当期尚未支付的费用,例如应付工资(wagespayable)。应付费用的增加会使利润减少,从而使留存收益(retained earnings)减少。

4、For a collateralized mortgage obligation (CMO), the first tranche of bonds most likely has the:【单选题】

A.highest level of prepayment risk and interest rate risk.

B.lowest level of prepayment risk and highest level of interest rate risk.

C.highest level of prepayment risk and lowest level of interest rate risk.

正确答案:C

答案解析:“Overview of Bond Sectors and Instruments,” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 54, Section 4.2.3

Study Session 15-54-f

Explain the motivation for creating a collateralized mortgage obligation.

C is correct. The first tranche of bonds in a CMO receives all monthly principal first until it is paid off; thus, it has the shortest duration of all remaining tranches and, therefore, the lowest interest rate risk. The first tranche also absorbs all prepayments and, therefore, has the highest prepayment risk compared with the remaining tranches.

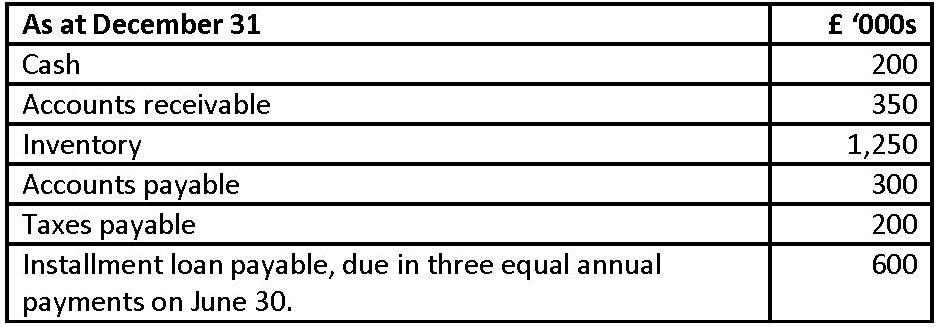

5、The current ratio for an industry is 3.2. Data for a firm in the industry is presented below:

Using the current ratio, when compared with the industry, the firm is best described as being:【单选题】

A.as liquid.

B.less liquid.

C.more liquid.

正确答案:B

答案解析:“Understanding Balance Sheets,” Elaine Henry, CFA and Thomas R. Robinson, CFA

2013 Modular Level I, Vol. 3, Section 7.2, Exhibit 19, Example 8

“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFA 2013 Modular Level I, Vol. 4, Reading 40, Sections 2.2.

Study Session 8-26-i, 11-40-b

Calculate and interpret liquidity and solvency ratios.

Compare a company’s liquidity measures with those of peer companies.

B is correct. Current ratio = Current assets ÷ Current liabilities

The higher the current ratio the more liquid the company. Thus, with a current ratio of 2.6 (1,800 ÷ 700), the company is less liquid than the industry, with a current ratio of 3.2.

6、An equity analyst working for a growth oriented mutual fund has a tendency to misvalue the stocks of popular companies that she has previously recommended and the fund already owns. Her behavior is most likely consistent with which of the following biases?【单选题】

A.Escalation bias

B.Prospect theory

C.Confirmation bias

正确答案:C

答案解析:“Efficient Capital Markets,” Frank K. Reilly, CFA and Keith C. Brown, CFA

2010 Modular Level I, Vol. 5, pp. 89-90

Study Session 13-54-d

Define behavioral finance and describe prospect theory, over-confidence bias, confirmation bias, and escalation bias.

Confirmation bias refers to the bias of looking for information that supports prior

opinions and decisions, which leads to a tendency to misvalue the stocks of

generally popular companies.

7、The supply curve for a particular factor of production with total income consisting solely of economic rent is most likely:【单选题】

A.vertical.

B.horizontal.

C.perfectly elastic.

正确答案:A

答案解析:“Markets for Factors of Production,” Michael Parkin

2011 Modular Level I, Vol. 2, pp. 292-293

Study Session 5-21-h

Differentiate between economic rent and opportunity costs.

When the total income of a factor of production consists solely of economic rent, it indicates that the factor has perfectly inelastic supply. For perfectly inelastic supply, the supply curve is a vertical line.

8、The financial systems that are operationally efficient are most likely characterized by:【单选题】

A.security prices that reflect fundamental values.

B.the use of resources where they are most valuable.

C.liquid markets with low commissions and order price impacts.

正确答案:C

答案解析:“Market Organization and Structure,” Larry Harris

2013 Modular Level I, Vol. 5, Reading 46, Section 9

Study Session 13-46-k

Describe characteristics of a well-functioning financial system.

C is correct. Operationally efficient markets are liquid markets in which the costs of trading-commissions, bid–ask spreads, and order price impacts—are low.

9、Which of the following is least likely to be a warning sign of low quality earnings?【单选题】

A.Greater use of operating leases than peer companies.

B.Use of a higher discount rate in pension plan assumptions.

C.A ratio of operating cash flow to net income greater than 1.0.

正确答案:C

答案解析:“Financial Reporting Quality: Red Flags and Accounting Warning Signs,” Thomas R. Robinson, CFA, and Paul Munter

2011 Modular Level I, Vol. 3, pp. 562-563

Study Session: 10-40-b, e

Describe activities that will result in a low quality of earnings.

Describe common accounting warning signs and methods for detecting each.

A ratio of operating cash flow to net income below 1.0 (not above 1.0) can be a warning sign of low quality earnings.

10、The tools used by the U.S. Federal Reserve system (the Fed) to implement monetary policy most likely include:【单选题】

A.transfer payments.

B.open market operations.

C.raising or lowering income taxes.

正确答案:B

答案解析:“Money, the Price Level, and Inflation,” Michael Parkin

2011 Modular Level I, Vol. 2, p. 371

Study Session 6-24-d

Explain the goals of the U.S. Federal Reserve (Fed) in conducting monetary policy and how the Fed uses its policy tools to control the quantity of money, and describe the assets and liabilities on the Fed’s balance sheet.

The Fed uses three main policy tools to achieve its objectives: required reserve ratios, discount rate, and open market operations.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料