下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、Lee Chu, a CFA candidate, develops a new quantitative security selection model exclusively through back-testing on the Chinese equity market. Chu is asked to review marketing materials that include an overview of the conceptual framework for his model, provide back-tested performance results, and list the top holdings. Chu directs the marketing group to remove the description of his model because of concerns that competitors may attempt to replicate his investment philosophy. He also instructs the marketing group to remove the list of the top holdings because it shows that the top holding represents 30% of the back-tested model. Which of the following actions is least likely to result in a violation of the Code and Standards? Chu's:【单选题】

A.failure to disclose that the top holding represents such a large allocation in the model

B.failure to adequately describe the investment process to prospective clients

C.use of back-tested results in communication with prospective clients

正确答案:C

答案解析:The use of back-tested results is not prohibited, provided it is appropriately disclosed.

2014 CFA Level I

"Guidance for Standards I-VII," CFA Institute

Standard V(B)

2、In setting the confidence interval for the population mean of a normal or approximately normal distribution and given that the sample size is small, Student’s t-distribution is the preferred approach when the variance is:【单选题】

A.large.

B.known.

C.unknown.

正确答案:C

答案解析:“Sampling and Estimation,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 10, Section 4.2, Table 3

Study Session 3-10-i

Describe the properties of Student’s t-distribution and calculate and interpret its degrees of freedom.

C is correct. When the sample size is small, the Student’s t-distribution is preferred if the variance is unknown.

3、An analyst does research about verification.With respect to the verification process,a firm's claim of compliance with the GAPS? must be verified by:【单选题】

A.the investment firm claiming compliance itself.

B.an independent third party firm.

C.the regulatory organization.

正确答案:B

答案解析:如果公司需要核查,一定要由独立的第三方进行核查。同时注意,核查与否是自愿的。

4、With respect to sensitivity to the business cycle, an industry largely independentof the business cycle is least likely classified as:【单选题】

A.defensive.

B.non-cyclical.

C.counter-cyclical.

正确答案:C

答案解析:在防御性(defensive)行业和非周期性(non-cyclical)行业中,企业生产的商品或提供的服务的市场需求在整个经济周期中保持相对稳定,企业收入和盈利也都比较稳定。在反周期性(counter-cyclical)行业中,企业的收入和盈利与经济周期相反。

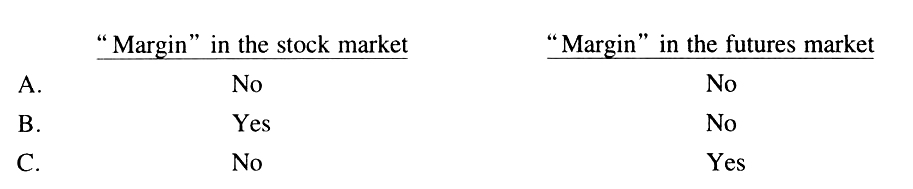

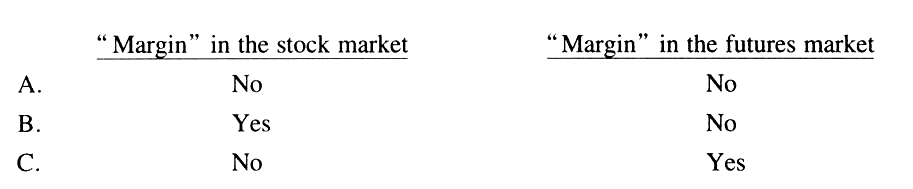

5、Do "margin" in the stock market and "margin" in the futures market, respectively,mean that an investor has received a loan that reduces the amount of hisown money required to complete the transaction?【单选题】

A.

B.

C.

正确答案:B

答案解析:股票市场中的保证金交易是指投资者向券商进行借款,以减少自己使用投资资金的金额,并用购买的证券作为抵押品,到期后归还出借人贷款;而期货市场中的保证金是真正的保证,是将现金或者流动性较好的债券作为抵押品,逐日盯市计算盈亏,并结算保证金账户的余额。

6、The correlation between the historical returns of Stock A and Stock B is 0.75. lf the variance of StockA is 0.16 and the variance of Stock B is 0.09, the covariance of returns of Stock A and Stock B isclosest to:【单选题】

A.0.16.

B.0.09.

C.0.01.

正确答案:B

答案解析:Cov(A,B)= =0.75 × 0.4 × 0.3=0.09.

=0.75 × 0.4 × 0.3=0.09.

CFA Level I

"Portfolio Risk and Return: Part I," Vijay Singal

Section 2.3.3

7、Compared with using the FIFO method to account for inventory, during a period of rising prices, which of the following ratios is most likely higher for a company using LIFO?【单选题】

A.Current ratio

B.Gross margin

C.Inventory turnover

正确答案:C

答案解析:"Inventories,” Michael A. Broihahn, CFA

2011 Modular Level 1, Vol.3, pp. 382-383, 390-391

Study Session: 9-36-e

Compare and contrast cost of sales, ending inventory, and gross profit using different inventory valuation methods.

During a period of rising prices, ending inventory under LIFO will be lower than that of FIFO and cost of goods sold higher; therefore, inventory turnover (CGS/average inventory) will be higher.

8、The following ten observations are a sample drawn from an approximately normal population:

The sample standard deviation is closest to:【单选题】

A.17.56.

B.18.58.

C.19.59.

正确答案:C

答案解析:The sample mean is calculated as follows:

CFA Level I

"Statistical Concepts and Market Returns," Richard A. DeFusco, Dennis W. McLeavey, Jerald E.Pinto, and David E. Runkle

Sections 5.1.2, 7.4.

9、An analyst does research about price value of a basis point (PVBP).With respectto a coupon bond, the duration is 8.61, and the current price of the bondis $ 101.35.The price value of a basis point (PVBP) of the bond is closest to:【单选题】

A.$ 0.0861

B.$ 0.0873

C.$ 0.1014

正确答案:B

答案解析:8.61 × 0.0001 × $ 101.35 = $ 0.0873

10、Which of the following statements is most accurate with respect to rebalancing and reconstitution of security market indices?【单选题】

A.Equal weighted indices require frequent rebalancing.

B.Turnover within an index results from a reconstitution but not from rebalancing.

C.A price-weighted index requires rebalancing more than a market-capitalization-weighted index.

正确答案:A

答案解析:“Security-Market Indices,” Paul D. Kaplan, CFA and Dorothy C. Kelly, CFA

2011 Modular Level I, Vol. 5, pp. 92-93, 99-100

Study Session 13-56-f

Discuss rebalancing and reconstitution.

After an equal weighted index is constructed and the prices of constituent securities change, the index is no longer equally weighted. Therefore, maintaining equal weights requires frequent adjustments (rebalancing) to the index.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料