下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、An analyst does research about collateralized mortgage obligation ( CMO).Which of the following statements is least accurate with respect to motivationfor creating a collateralized mortgage obligation?【单选题】

A.A collateralized mortgage obligation appeals to a wider audience and decreaseoverall borrowing costs.

B.A collateralized mortgage obligation creates securities with various maturityranges.

C.A collateralized mortgage obligation redistributes the prepayment risk prorata among investors.

正确答案:C

答案解析:抵押担保债券(CMO)结构的核心在于,根据支持资产未来每期所产生的收入的多寡而分别创设短、中、长期不同级别的证券,从而达到重新分配投资者所面临的提前偿付风险的目的。提前偿付风险并不是按比例在投资项目间进行分配,而是低等级的CMO投资者先行获得偿付,当低等级的CMO投资者本金全部偿还后,再偿还较高等级的CMO投资者,所以C错。CMO满足了不同投资者的需要,并且降低了投资者的总体借贷成本,也创设了不同期限的债券,这些都是创设CMO的动机。

2、Barnes Company issues a bond at a premium to fund a capital project.With respectto the effective interest method, in each subsequent year, the reportedannual interest expense for this bond will most likely:【单选题】

A.decrease.

B.remain the same.

C.increase.

正确答案:A

答案解析:溢价债券(premium bond):在资产负债表中账面价值大于其面值,账面价值会随着溢价的摊销而减少,直到到期时等于其面值,期间利息费用不断减少。

折价债券(discount bond):在资产负债表中账面价值小于其面值,账面价值会随着溢价的摊销而增大,直到到期时等于其面值,其间利息费用不断增加。

3、A trader determines that a stock price formed a pattern with a horizontal trendline that connects the high prices and a trendline with positive slope that connects the low prices. Given the pattern formed by the stock price, the trader will most likely:【单选题】

A.purchase the stock because the pattern indicates a bullish signal.

B.avoid trading the stock because the pattern indicates a sideways trend.

C.sell the stock because the pattern indicates a bearish signal.

正确答案:A

答案解析:

2014 CFA Level I

“Technical Analysis,” by Barry M. Sine and Robert A. Strong

Section 3.3.2.1

4、A trader who owns shares of a stock currently trading at $100 per share places a "GTC, stop $90,limit $85 sell" order (GTC means good till cancelled). Assuming the specified stop condition issatisfied and the order becomes executed, which of the following statements is most accurate?【单选题】

A.The trader faces a maximum realized loss of $15.

B.The order becomes a market order when the price falls below $85 and remains valid forexecution.

C.The order will be executed at either $90 or $85.

正确答案:A

答案解析:The order becomes valid when the price falls to, or below, $90. The "limit $85 sell indicates that thetrader is unwilling to sell below $85. Thus, the trader faces a maximum loss of $15 ($100-$85).

CFA Level I

"Market Organization and Structure, Larry Harris

Section 6.2

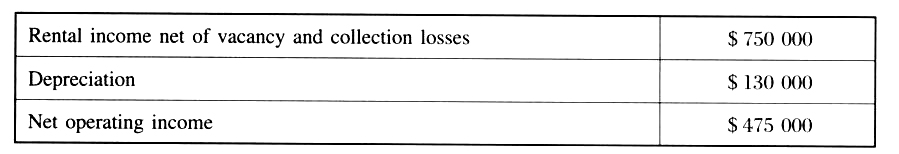

5、An analyst does research about real estate investment and gathered the followingannual information about a real estate investment:

If the property above is valued at $3 925 000 based on the income approach, thecapitalization rate is closest to:【单选题】

A.8.8%

B.12.1%

C.15.8%

正确答案:B

答案解析:在收入法之下,appraisal price = NOI/market cap rate,因而有:

$3 925 000 = $475 000/market cap rate,得出market capitalization rate = 12.1%.

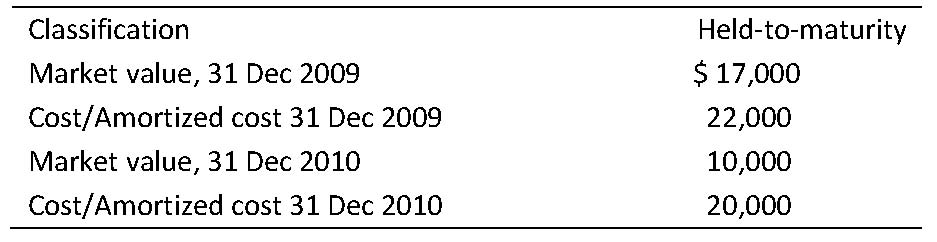

6、The following information is from a company’s investment portfolio:

Investment

If the investment is reclassified as Available-for-sale as of 31 December 2010, the balance sheet carrying value of the company’s investment portfolio would most likely:【单选题】

A.remain the same.

B.decrease by $10,000.

C.decrease by $12,000.

正确答案:B

答案解析:"Understanding The Balance Sheet,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol.3, p. 224

Study Session: 8-33-f

Demonstrate the appropriate classifications and related accounting treatments for marketable and nonmarketable financial instruments held as assets or owed by the company as liabilities.

Held-for-trading and available-for-sale securities are carried at market value, whereas held-to-maturity securities are carried at amortized cost. If the investment is reclassified as available-for-sale in 2010, the carrying amount should be adjusted to its market value, which is $10,000. Compared with the amortized cost of $20,000, it’s a decrease of $10,000.

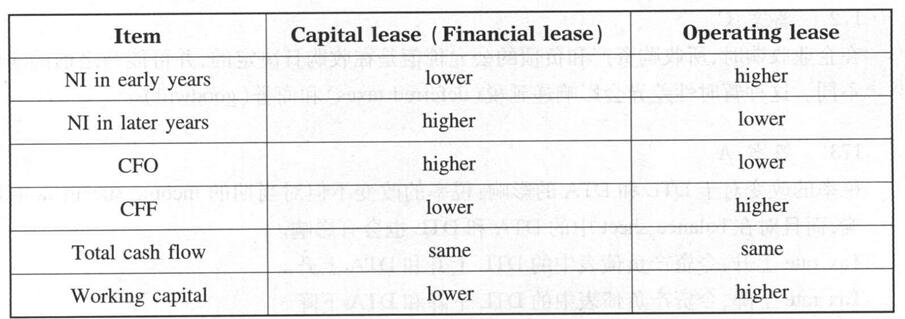

7、An analyst does research about operating lease and financial lease.In the lateryears, reporting a lease as a financial lease rather than an operating lease mostlikely results in :【单选题】

A.higher net income for the lessee.

B.higher total cash flow for the lessee.

C.higher working capital for the lessee.

正确答案:A

答案解析:从lessee的角度看,capital lease(financial lease)和operating lease的对比如下:

8、An analyst determines that 60% of all U.S. pension funds hold hedge funds. In evaluating this probability, a random sample of 10 U.S. pension funds is taken. Using the binomial probability function, the probability that exactly 6 of the 10 firms in the sample hold hedge funds is closest to:【单选题】

A.11.2%.

B.25.1%.

C.60.0%.

正确答案:B

答案解析:The number of trials is 10 (n), the number of successes is 6 (x), and the probability of success is 0.60

2014 CFA Level I

“Common Probability Distributions,” by Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle

Section 2.2

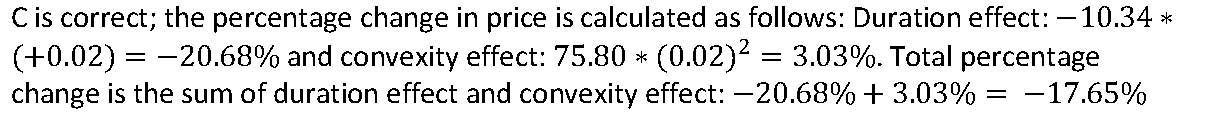

9、The duration and convexity of an option-free bond priced at $90.25 are 10.34 and 75.80, respectively. If yields increase by 200 basis points, the percentage change of the price is closest to:【单选题】

A.–23.71%.

B.–20.68%.

C.–17.65%.

正确答案:C

答案解析:“Introduction to the Measurement of Interest Rate Risk” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 58, Sections 4.2 and 5.1

Study Session 16-58-h

Describe the convexity measure of a bond and estimate a bond’s percentage price change, given the bond’s duration and convexity and a specified change in interest rates.

10、A pharmaceutical company has been very successful for the past several years, increasing its sales many-fold over that of its competition. It has been able to meet or beat analysts’ optimistic quarterly earnings estimates and consistently registers very high sales towards the end of each quarter. Most of the company’s sales are to two of its major wholesalers. The firm covers the carrying costs for these two wholesalers and guarantees them a return on investment until the wholesalers sell the products.

Which of the three risk factors related to fraudulent financial reporting would best explain the behavior of this company?【单选题】

A.Opportunities

B.Incentives/Pressures

C.Attitudes/Rationalizations

正确答案:B

答案解析:“Understanding the Income Statement,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, R. Elaine Henry, CFA and Michael A. Broihahn, CFA

2010 Modular Level 1, Vol. 3, pp. 144-146

“Financial Reporting Quality: Red Flags and Accounting Warning Signs,” Thomas R. Robinson, CFA and Paul Munter

2010 Modular Level 1, Vol. 3, pp. 574-580

Study Session 8-32-b, 10-40-e

Explain the general principles of revenue recognition and accrual accounting, demonstrate specific revenue recognition applications (including accounting for long-term contracts, installment sales, barter transactions, and gross and net reporting of revenue), and discuss the implications of revenue recognition principles for financial analysis.

Describe common accounting warning signs and methods of detecting each.

The company is recognizing revenue for sales on shipment while the risks and rewards of ownership have not yet been transferred to the wholesalers. The motivation behind the activity is most likely the pressure to meet the expectations of investment analysts to meet ever increasing sales growth forecasts.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料