下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

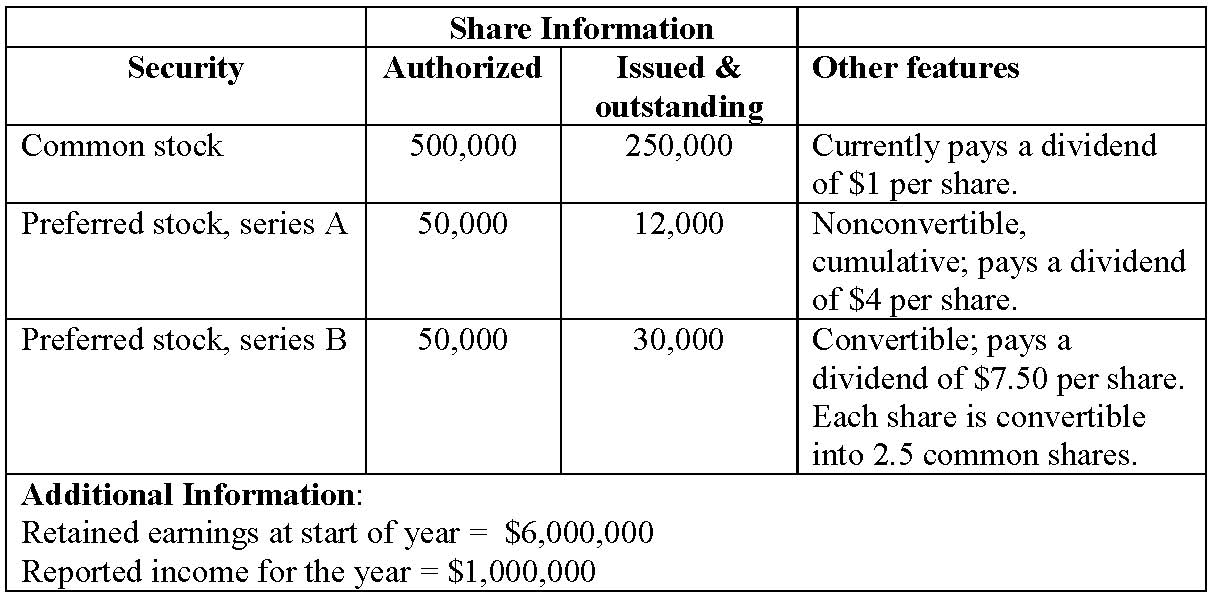

1、The following financial information is available at the end of the year.

The diluted EPS is closest to:【单选题】

A.$2.91.

B.$2.93.

C.$3.08.

正确答案:A

答案解析:“Understanding the Income Statement,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level 1, Vol.3, pp.170-175

Study Session:8-32-g, h

Describe the components of earnings per share and calculate a company’s earnings per share (both basic and diluted earnings per share) for both a simple and complex capital structure.

Differentiate between dilutive and antidilutive securities, and discuss the implications of each for the earnings per share calculation.

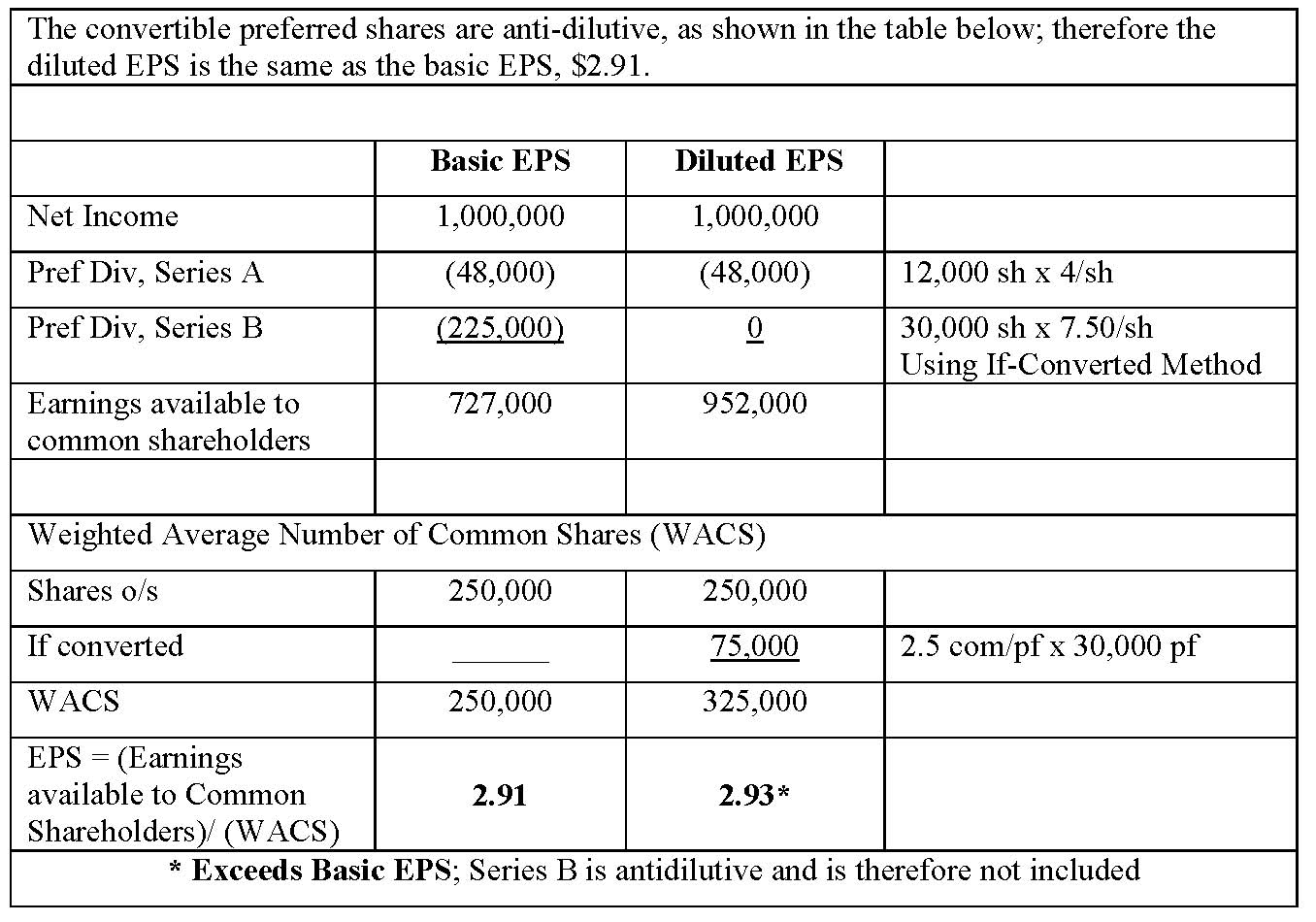

2、The bonds issued by ALS Corp. are currently priced at 108.00 and are option free. Based on a portfolio manager’s valuation model, a 10 basis points rise in interest rates will result in the bond price falling to 106.50 while a 10 basis points fall in interest rates will result in the bond price rising to 110.00. The market value of the portfolio manager’s holdings of ALS bonds is $2 million. The expected change in the market value of this holding for a 100 basis point change in interest rates will be closest to:【单选题】

A.$124,000.

B.$322,600.

C.$645,200.

正确答案:B

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Section 2.5

Study Session 15-53-f

Calculate and interpret the duration and dollar duration of a bond.

B is correct because the bond’s duration is computed using:

The approximate percent change in the value of the holdings (the dollar duration) is:

0.1613 × 2,000,000 = $322,600.

3、An analyst does research about market structures.With respect to traditional oligopolymodel, which of the following is least accurate? The kinked demandcurve model assumes:【单选题】

A.that there is a break in the marginal revenue curve.

B.that the price decreases by one firm is followed by its peers.

C.that the price and quantity are sensitive to small cost changes.

正确答案:C

答案解析:弯曲的需求曲线是在寡头垄断的情况下,造成有两条需求线和两条边际收益线的情形,上面一条需求线弹性比较大,因为该理论假设每个寡头公司认为,如果他提高价格,其他人并不会跟随,所以他的需求量会大幅度下降;下面一条需求线弹性比较小,因为该理论假设每个寡头公司认为,如果他降低价格,其他公司也会跟随着降低价格,所以他的需求量上升幅度比较小。两条需求线所决定的两条边际收益线中间有断开,并不是连续的。两条需求线的交点决定了最优的价格和产量,只有边际成本与两条边际收益线相交的情况下,公司才会改变他们的最优价格和产量,所以价格和产量对于成本较小的变化十分敏感这句话是错误的。

4、A firm’s estimated costs of debt, preferred stock, and common stock are 12%, 17%, and 20%, respectively. Assuming equal funding from each source and a 40% tax rate, the weighted average cost of capital is closest to:【单选题】

A.13.9%.

B.14.7%.

C.16.3%.

正确答案:B

答案解析:“Cost of Capital,” Yves Courtois, Gene C. Lai, and Pamela Peterson Drake

2012 Modular Level I, Vol. 4, pp. 41–42

Study Session 11-37-a, b

Calculate and interpret the weighted average cost of capital (WACC) of a company.

Describe how taxes affect the cost of capital from different capital sources.

B is correct:

5、An analyst has calculated the following ratios for a company:

The company’s return on equity (ROE) is closest to:【单选题】

A.4.8%.

B.15.2%.

C.22.7%.

正确答案:B

答案解析:“Financial Analysis Techniques,” Elaine Henry, Thomas R. Robinson, and Jan Hendrik van Greuning

2012 Modular Level I, Vol. 3, pp. 374–375

Study Session 8-28-d

Demonstrate the application of the DuPont analysis of return on equity, and calculate and interpret the effects of changes in its components.

B is correct. Using DuPont analysis, there are two ways to calculate ROE from the information provided:

ROE = Net profit margin × Asset turnover × Financial leverage 11.7 × 0.89 × 1.46 15.2

ROE = ROA × Financial leverage 10.4 × 1.46 15.2

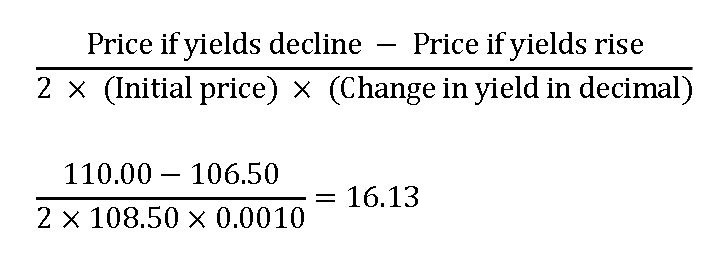

6、An analyst does research about capital budgeting and gathers the following informationabout two independent projects:

If there is no capital rationing and the company' s cost of capital is 10.5% , thecompany should invest in:【单选题】

A.Project 1.

B.Project.

C.both Project 1 and Project 2.

正确答案:C

答案解析:由于是独立项目,项目的决策不相互影响,只要项目的净现值大于零都可以选择。

7、The convergence of global accounting standards has advanced to a degree that the Securities &Exchange Commission in the United States now mandates that foreign private issuers who useIFRS may report under:【单选题】

A.U.S. GAAP or under IFRS with a reconciliation to U.S. GAAP.

B.U.S. GAAP or under IFRS.

C.U.S. GAAP with voluntary supplemental reporting under IFRS.

正确答案:B

答案解析:Historically, the Securities & Exchange Commission required reconciliation for foreign private issuersthat did not prepare financial statements in accordance with U.S. GAAP. However the reconciliationrequirement was eliminated as of 2008 for companies that prepared their financial statements underIFRS.

CFA Level I

"Financial Reporting Standards," Elaine Henry, Jan Hendrik van Greuning and Thomas R. Robinson

Sections 4, 7

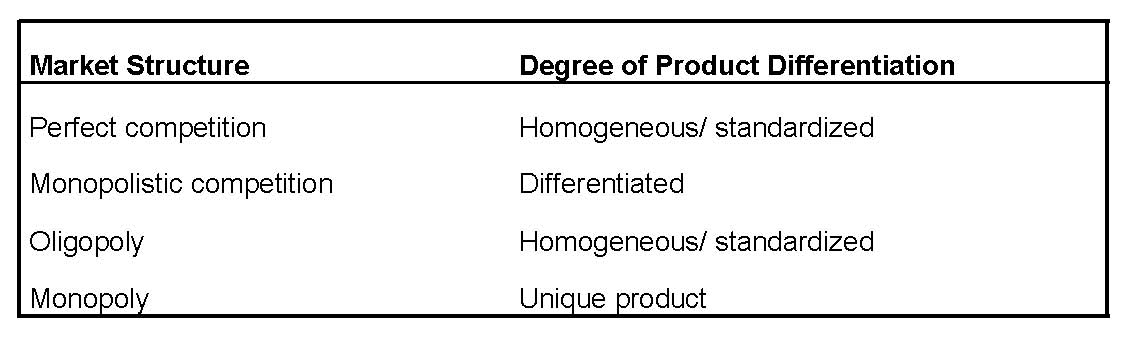

8、A market structure characterized by homogeneous/standardized product differentiation is best described as:【单选题】

A.monopolistic competition.

B.perfect competition and oligopoly.

C.monopoly.

正确答案:B

答案解析:Perfect competition and oligopoly are characterized by homogeneous/standardized product differentiation.

2014 CFA Level I

"The Firm and Market Structures," by Richard G. Fritz and Michele Gambera

Section 2.2

9、An analyst does research about redeemed bonds.A company issues bonds at adiscount, and reports their amortized historical cost.The company redeems thebonds before maturity, when they are trading at a premium.Which of the followingstatements is most accurate?【单选题】

A.Bonds payable is reduced by the amount of the bonds' market value.

B.Bonds payable is increased by the amount of the bonds' face value.

C.Bonds payable is reduced by the amount of the bonds' carrying value.

正确答案:C

答案解析:根据规定:应付债务减少额度与已赎回债务的账面价值(carrying value)有关。

10、An analyst does research about equity swap.An investor enters into a three-monthequity swap on a notional principal of $ 1 000 000 with the followingterms:

·The investor pays the return on an equity index, which is 2 308.55 at inception.

·The investor receives a fixed rate of 8.00% with a 30/360 count convention.

If the ending equity index value is 2 059.15, the net cash flow to the investor isclosest to:【单选题】

A.$ 47 008

B.$ 88 033

C.$ 128 033

正确答案:C

答案解析:收益=[8% ×3/12 - (2 059.15 -2 308.55)/ 2 308.55] × $ 1 000 000≈ $ 128 033。因为股票指数下跌,投资者收到固定的利息外,还可能得到本金乘以股票指数下跌的比例部分。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料