下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、Which of the following transactions is least likely to increase a company’s reported cash from operations?【单选题】

A.Securitizing accounts receivable

B.Delaying payments made to suppliers

C.Using short-term debt to reduce an existing account payable

正确答案:C

答案解析:“Accounting Shenanigans on the Cash Flow Statement,” Marc A. Siegel

2010 Modular Level I, Vol. 3, pp. 592-595

Study Session 10-41

The candidate should be able to analyze and discuss the following ways to manipulate the cash flow statement: ·stretching out payables ·financing of payables ·securitization of receivables ·using stock buybacks to offset dilution of earnings.

Using short-term debt to pay down payables will have no effect on the cash from operations. Payables will decrease which decreases cash from operations, but short-term debt will increase, which is an offsetting increase in cash from operations, resulting in no net effect on cash from operations.

2、An analyst does research about survivorship bias and its impact to measurementratios.Hedge fund data bases and indexes that suffer from survivorship bias becauseof a failure to comply with performance presentation standards are mostlikely to overstate :【单选题】

A.Sharpe ratios.

B.standard deviation of returns.

C.correlations with returns from common stocks.

正确答案:A

答案解析:对冲基金有生存偏差,统计的历史业绩中只包含那些生存下来的基金的业绩,而那些由于业绩不佳而被清盘的基金的业绩不包括在内,这就高估了对冲基金的平均收益率,低估了对冲基金收益率的标准差,所以导致高估了夏普比率。同时,由于对冲基金的业绩看上去很稳定,但并不能反映市场的情况,这就低估了与普通股收益率之间的相关系数。

3、Which of the following is the most appropriate reason for using a free-cash-flow-to-equity (FCFE) model to value equity of a company?【单选题】

A.FCFE is a measure of the firm’s dividend paying capacity.

B.FCFE models provide more accurate valuations than the dividend discount models.

C.A firm’s borrowing activities could influence dividend decisions but they would not impact FCFE.

正确答案:B

答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFA

2013 Modular Level I, Vol. 5, Reading 51, Section 4

Study Session 14-51-c

Explain the rationale for using present-value of cash flow models to value equity and describe the dividend discount and free-cash-flow-to-equity models.

A is correct. FCFE is a measure of the firm’s dividend paying capacity.

4、Carmelo Anthony, CFA, is a mining analyst for East Bank Securities.Anthonyestimates the following information about a mining company he covers:

Using the total probability rule, given the company does not issue new debt,the probability of a rating upgrade is closest to:【单选题】

A.0.24

B.0.34

C.0.36

正确答案:C

答案解析:根据条件概率公式:P(AB) = P(A/B) × P(B),以及下面的关系式:

公司评级上升概率=假定公司发行新债券时使得公司评级上升概率+假定公司不发行新债券时使得公司评级上升概率,可得公司不发行新债券时,评级上升的概率如下:(0.60 - 0.84 × 0.50)/(1 -0.50) =0.36。

5、In the current year, a company increased its deferred tax asset by $500,000. During the year, the company most likely:【单选题】

A.became entitled to a $500,000 tax refund.

B.reported a lower accounting profit than taxable income.

C.had permanent differences between accounting profit and taxable income.

正确答案:B

答案解析:“Income Taxes” Elbie Antonites, CFA and Michael A. Broihahn, CFA

2013 Modular Level I, Vol. 3, Reading 31, Section 2.2

Study Session 9-31-a, b, f

Describe the differences between accounting profit and taxable income, and define key terms, including deferred tax assets, deferred tax liabilities, valuation allowance, taxes payable, and income tax expense

Explain how deferred tax liabilities and assets are created and the factors that determine how a company's deferred tax liabilities and assets should be treated for the purposes of financial analysis.

Distinguish between temporary and permanent differences in pre-tax accounting income and taxable income

B is correct. Deferred tax assets represent taxes that have been paid (because of the higher taxable income) but have not yet been recognized on the income statement (because of the lower accounting profit).

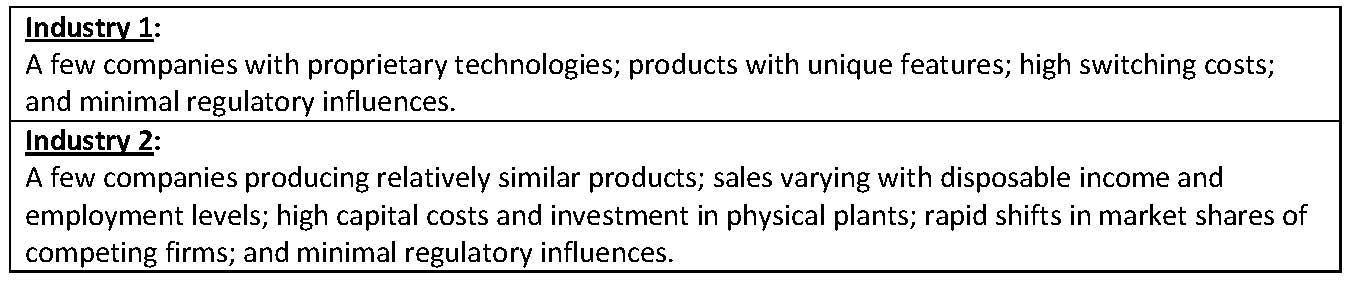

6、An equity analyst follows two industries with the following characteristics.

Based on the above information, the analyst will most appropriately conclude that compared to the firms in Industry 2, those in Industry 1 would potentially have:【单选题】

A.larger economic profits.

B.over-capacity problems.

C.high bargaining power of customers.

正确答案:A

答案解析:“Introduction to Industry and Company Analysis,” Patrick W. Dorsey, Anthony M. Fiore, and Ian Rossa O’Reilly

2012 Modular Level I, Vol. 5, pp. 208, 223–233

Study Session 14-51-e, h, i

Describe the elements that need to be covered in a thorough industry analysis.

Explain effects of industry concentration, ease of entry, and capacity on return on invested capital and pricing power.

Describe the principles of strategic analysis of an industry.

A is correct. The economic profit (the spread between the return on invested capital and the cost of capital) tends to be larger in industries with differentiated products, greater pricing power, and high switching costs to customers. Industry 1 has these features. Firms in Industry 2, on the other hand, have little pricing power (undifferentiated products and rapid shifts in market shares indicating intense rivalry), which is indicative of potentially smaller economic profits.

7、The primary monetary policy goal of most major central banks is best characterized as:【单选题】

A.containing inflation.

B.stimulating economic growth.

C.maintaining low interest rates.

正确答案:A

答案解析:“An Overview of Central Banks,” Anne Dolganos Picker

2011 Modular Level I, Vol. 2, p. 499

Study Session 6-28-a, b

Identify the functions of a central bank.

Discuss monetary policy and the tools utilized by central banks to carry out monetary policy.

Most major central banks’ primary monetary policy goal is to contain inflation.

8、According to the IFRS framework, which of the following is the least likely qualitative characteristic that makes financial information useful?【单选题】

A.Materiality.

B.Comparability.

C.Understandability.

正确答案:A

答案解析:"Financial Reporting Standards," Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Karen O'Connor Rubsam, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol.3, pp.106-108, 113

Study Session: 7-31-d

Describe the International Financial Reporting Standards (IFRS) framework, including the qualitative characteristics of financial statements, the required reporting elements, and the constraints and assumptions in preparing financial statements.

The four principal qualitative characteristics that make financial information useful are understandability, relevance, reliability and comparability. Materiality relates to the level of detail of the information needed to achieve relevance – whether the omission or misstatement of the information would impact the decision maker's decision.

9、An analyst does research aboutembedded options.Which of the following embeddedoptions is least likely to increase in value when interest rates increase?【单选题】

A.The right toput an issue.

B.The cap on a floater.

C.An accelerated sinking fund provision.

正确答案:C

答案解析:由于利率上升,对于浮动利率债券的利率顶的价值上升,因为更有可能超过其所设定的利率顶,而超过利率顶时,购买者就能得到报偿。由于利率上升,可回售债券价格下跌,被回售的可能性增加了,所以回售债券的权利增加价值了。加速沉没资金条款是公司可以选择提前偿还全部或部分本金,在利率下跌的情况下,该条款更有价值,因为可以更低成本进行融资,所以在利率上升的情况下,该权利减少价值。

10、All other things being equal, a decrease in expected yield volatility most likely increases the price of:【单选题】

A.a putable bond.

B.a callable bond.

C.an option-free bond.

正确答案:B

答案解析:“Risks Associated with Investing in Bonds” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 53, Section 10

Study Session 15-53-n

Explain how yield volatility affects the price of a bond with an embedded option and how changes in volatility affect the value of a callable bond and a putable bond.

B is correct because the price of a callable bond is equal to the value of an option-free bond minus the value of the embedded call option. A decrease in yield volatility will decrease the value of the call option and, therefore, increase the value of the callable bond.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料