下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、A variation of which real estate valuation approach is most likely to use slope coefficients derived from a statistical analysis to estimate the value of a property?【单选题】

A.Cost approach.

B.Income approach.

C.Sales comparison approach.

正确答案:C

答案解析:“Alternative Investments,” Bruno Solnik and Dennis McLeavey

2010 Modular Level I, Vol. 6, pp. 202-206

Study Session 18-73-e

Describe the various approaches to the valuation of real estate.

One variation of the sales comparison approach (hedonic price estimation) uses recent transactions in the area to derive an equation that weights various property attributes to determine a value for the property.

2、Carolina Ochoa, CFA, is the chief financial officer at Pantagonia Computing. Ochoa is currently thesubject of an inquiry by Pantagonia's corporate investigations department. The inquiry is the result ofan anonymous complaint accusing Ochoa of falsifying travel expenses for senior managementrelated to a government contract. According to the CFA Institute Code of Ethics and Standards ofProfessional Conduct, it is most appropriate for Ochoa to disclose the allegations:【单选题】

A.to CFA Institute when the investigation concludes.

B.on her Professional Conduct Statement.

C.to CFA Institute if the allegations are proven correct.

正确答案:B

答案解析:Members and candidates must self-disclose on the annual Professional Conduct Statement allmatters that question their professional conduct, such as involvement in civil litigation or criminalinvestigations or being the subject of a written complaint.

CFA Level I

"Code of Ethics and Standards of Professional Conduct"

3、An analyst compares different real estate valuation methods.A factor common tothe sales comparison approach and the income approach is that both approachesrequire :【单选题】

A.identification of benchmark properties.

B.knowledge of investor's marginal tax rate.

C.calculation of the property's net operating income.

正确答案:A

答案解析:销售比较法(sales comparison approach)不需要计算房地产项目的经营性净收入(NOI),所以也不需要知道投资者的边际税率(marginal tax rate)。但销售比较法和收入法都需要定义一个标的资产,销售比较法需要寻找基准的房地产用来得到其销售价格,并用以计算该房地产的价格;收入法需要寻找基准的房地产用来得到市场的资本化率(marketcapitalization rate),并用来折现该房地产的经营性净收入,得到房地产的价格。

4、An analyst does research about real estate investing and gathers the following informationfor a real estate investment:

If the estimate vacancy loss is 5% , the net operating income is closest to:【单选题】

A.$182 500

B.$192 500

C.$200 500

正确答案:C

答案解析:NOI = $250 000 - $250 000 × 5% - $15 000 - $9 000 - $13 000 = $200 500,注意在计算经营性净收入时不考虑折旧和利息费用。

5、Consider two countries, A and B. Country A is a closed country with a relative abundance of labor and holds a comparative advantage in the production of textiles. Country B has a relative abundance of capital. When the textile trade is opened between the two countries, Country A will most likely experience a favorable impact on:【单选题】

A.labor.

B.capital.

C.both capital and labor.

正确答案:A

答案解析:“International Trade and Capital Flows,” Usha Nair-Reichert and Daniel Robert Witschi

2012 Modular Level I, Vol. 2, pp. 450–452

Study Session 6-20-b, c, d

Distinguish between comparative advantage and absolute advantage.

Explain the Ricardian and Heckscher–Ohlin models of trade and the source(s) of comparative advantage in each model.

Compare types of trade and capital restrictions and their economic implications.A is correct. As a country opens up to trade, the benefit accrues to the abundant factor, which is labor in Country A.

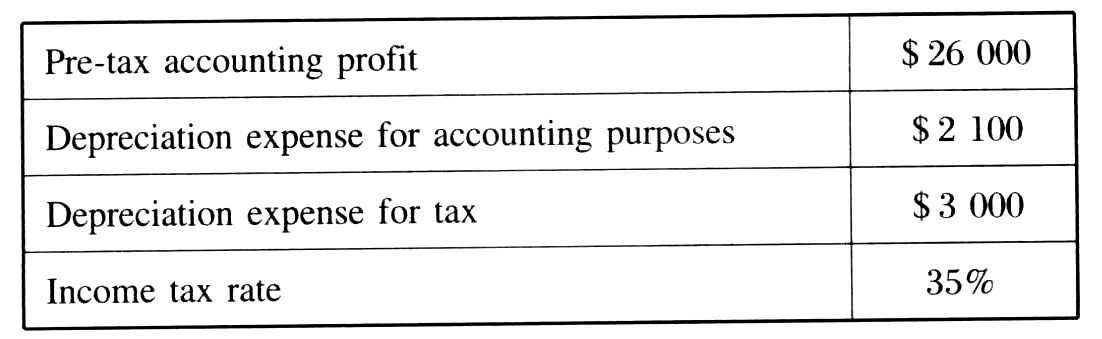

6、An analyst does research about deferred tax asset and liability and gathers thefollowing information about a company:

Assuming there are no other differences between accounting and tax profit, thecompany most likely records:【单选题】

A.A deferred tax asset of $ 315.

B.A deferred tax liability of $ 315.

C.A deferred tax liability of $ 585.

正确答案:B

答案解析:财务报表与税单上的折旧差异造成了递延所得税负债(DTL),DTL在数值上等于折旧之差再乘以税率。DTL = ( $ 3 000 - $ 2 100 ) ×0.35 = $ 315,税单上因为多计了折旧而少计了利润,所以应该增加递延所得税负债。所得税费用(income tax expense)=应纳所得税(taxes payable)+ (△DTL - △DTA)。

7、Brendan Witt, CFA, does research about the Fisher effect.Which of the followingstatements is most accurate about the Fisher effect in the long term?【单选题】

A.Changes in the nominal interest rate are the result of changes in the realinterest rate only.

B.Changes in the nominal interest rate are the result of changes in the expectedrate of inflation only.

C.Changes in the nominal interest rate are the result of changes in both thereal interest rate and the expected rate of inflation.

正确答案:C

答案解析:费希尔效应指出,名义利率等于真实利率加上预期的通货膨胀率。

8、An analyst does research about foreign currency rate.In foreign exchange marketscharacterized by interest rate parity, if the domestic country has a lower risk-freeinterest rate than the foreign country, the currency of the domestic country ismost likely to be trading at a forward:【单选题】

A.discount, and to depreciate.

B.premium, and to appreciate.

C.premium, and to depreciate.

正确答案:B

答案解析:根据利率平价理论,所有国家的真实无风险利率都是一样的,如果本地的名义无风险利率越低,则通货膨胀的预期越低,本地货币会升值,即远期升水。

9、All else being equal, which of the following most likely increase credit quality?A company decreases its:【单选题】

A.margin stability.

B.retained cash flow.

C.dividend payout ratio.

正确答案:C

答案解析:派发给股东的股利越少,在公司里留给债权人的现金就越多,对债权人也越有利,并会增加公司的信用质量;减少利润率的稳定性和留存的现金流,都会降低公司的信用质量。

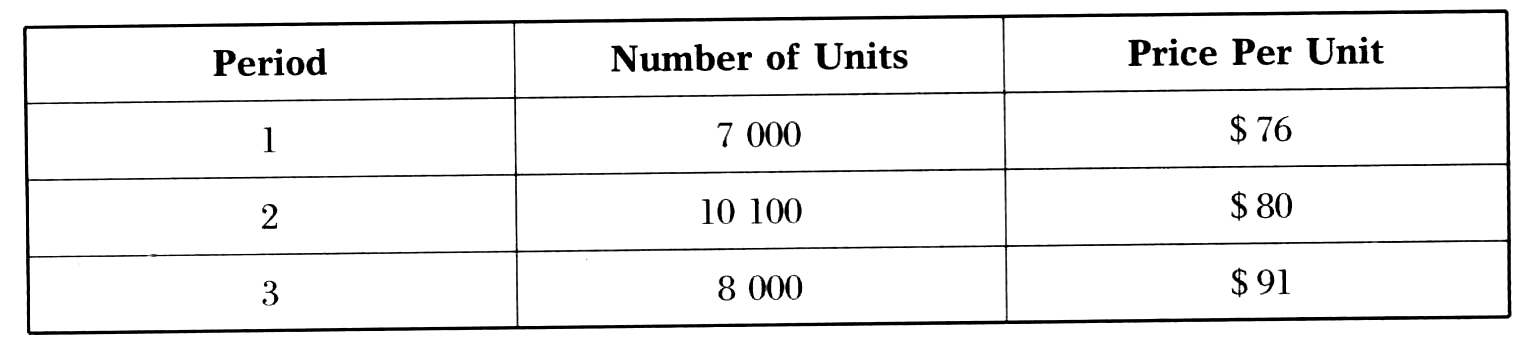

10、An analyst does research about inventory methods.A company with no initialinventory on hand made the following purchases of inventory in 2011:

At the end of 2011, the company had 5 000 units of inventory on hand.Undera periodic inventory system, ending inventory using the weighted average costmethod is closest to:【单选题】

A.$ 43 000 less than using the FIFO method.

B.$ 32 000 more than using the FIFO method.

C.$ 43 000 more than using the FIFO method.

正确答案:A

答案解析:average price of one unit = (7 000 × $ 76 + 10 100 × $ 80 + 8 000 × $ 91)/(7 000 + 10 100+ 8 000) = $ 82.4。

inventory (weighted average cost) =5 000 × $ 82.4 = $ 412 000。

inventory (FIFO) =5 000 × $ 91 = $ 455 000。

inventory ( weighted average cost ) - inventory ( FIFO ) = $ 412 000 - $ 455 000= - $ 43 000。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料