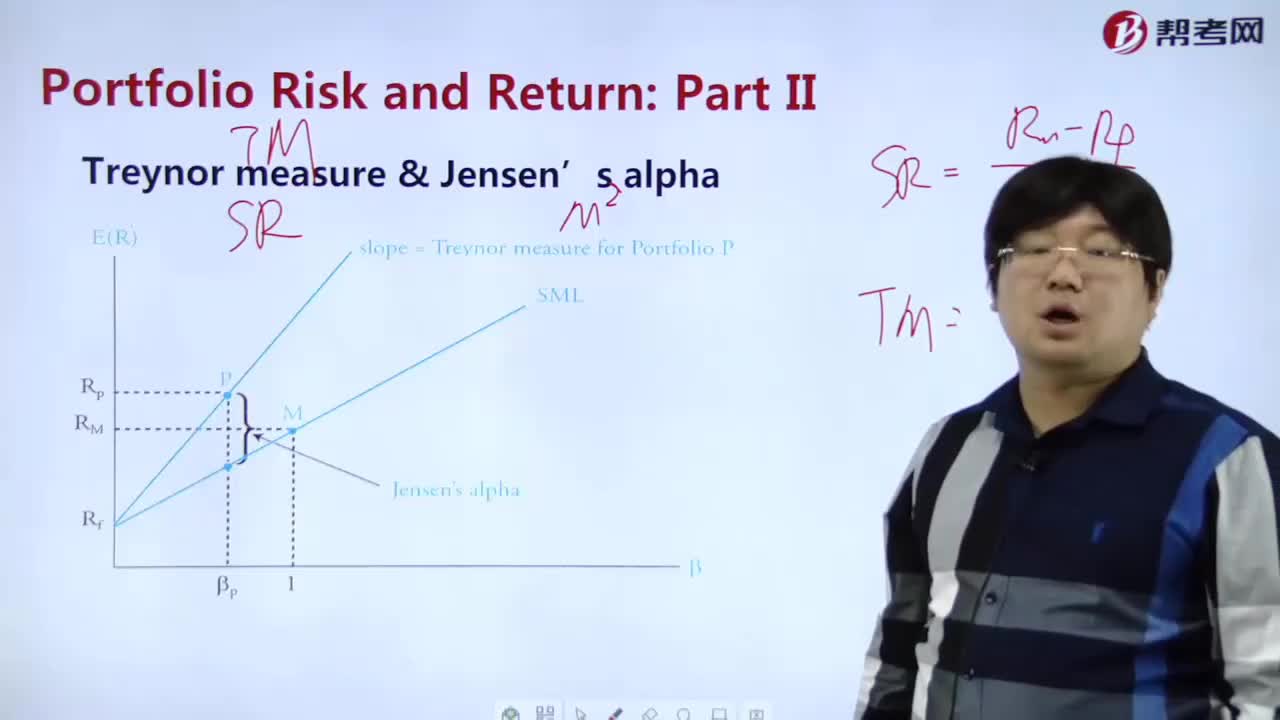

What is Treynor measure & Jensen's alpha?

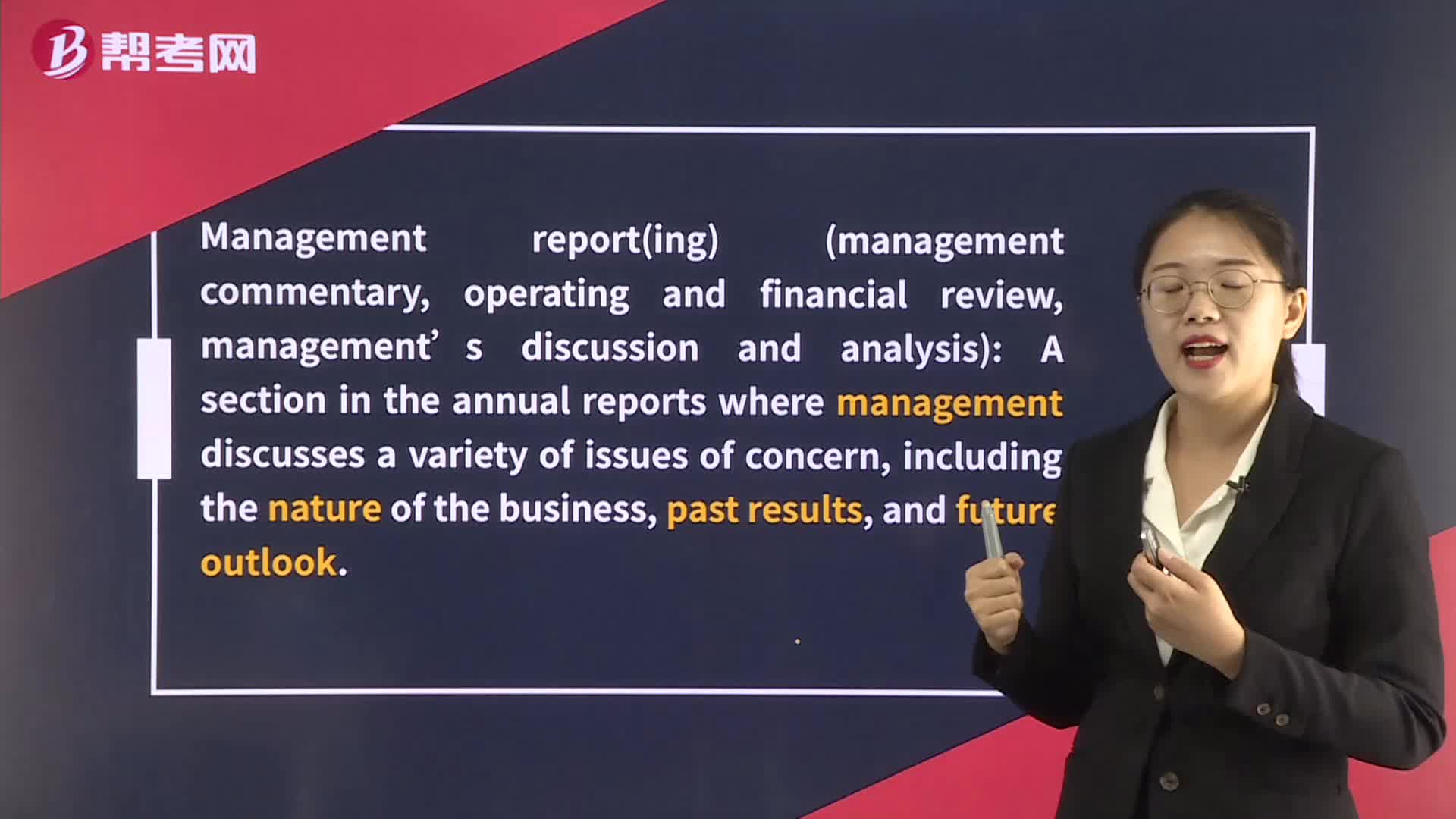

What is cash management?

What is portfolio performance

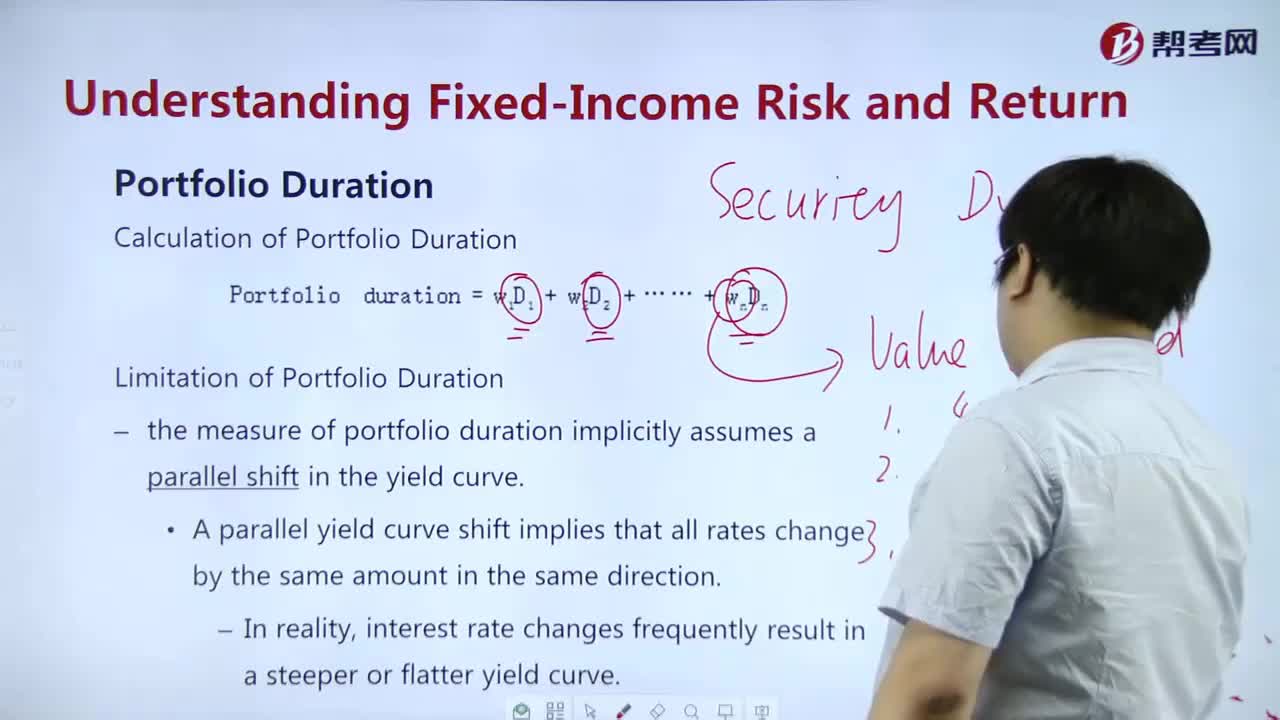

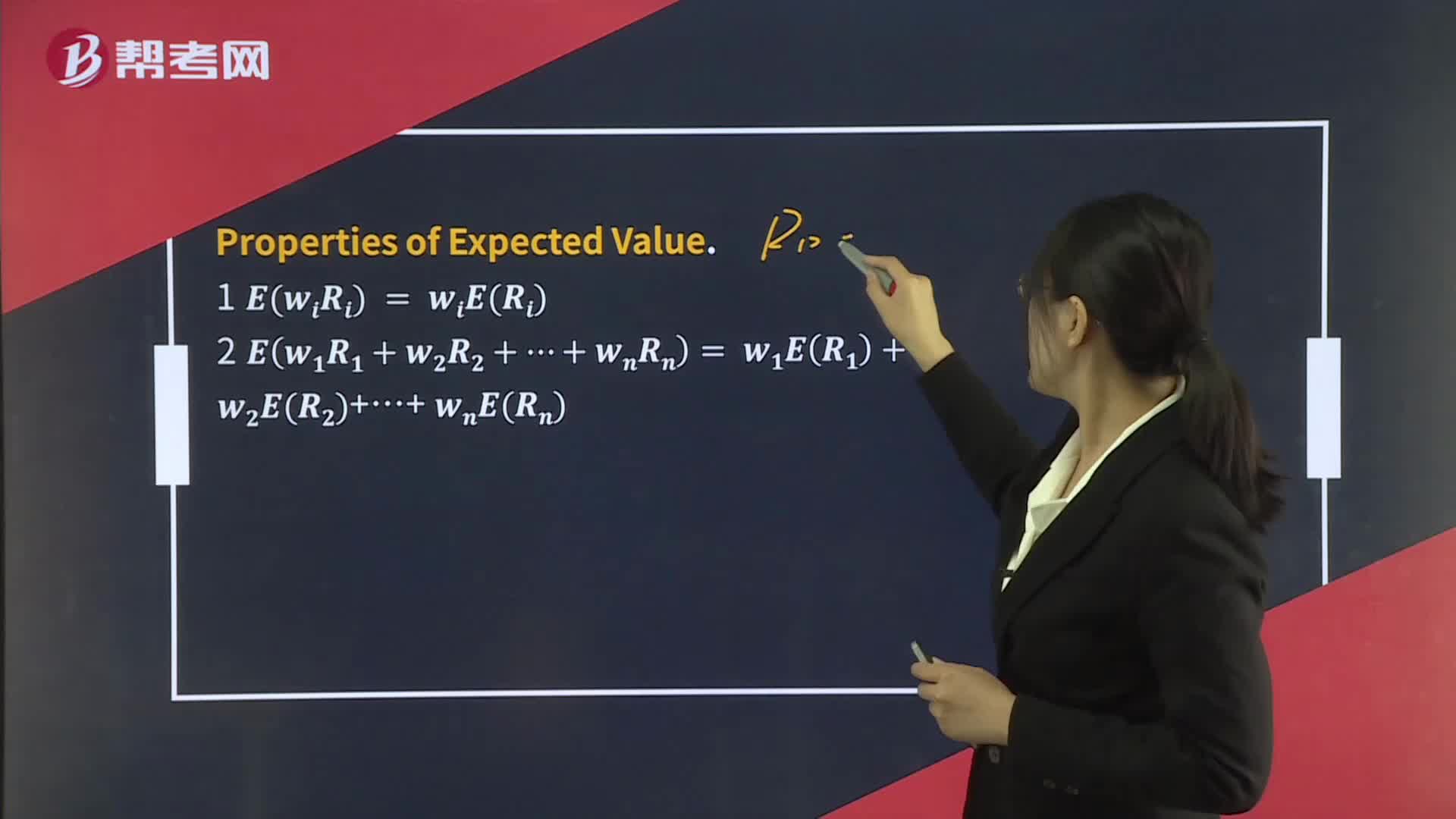

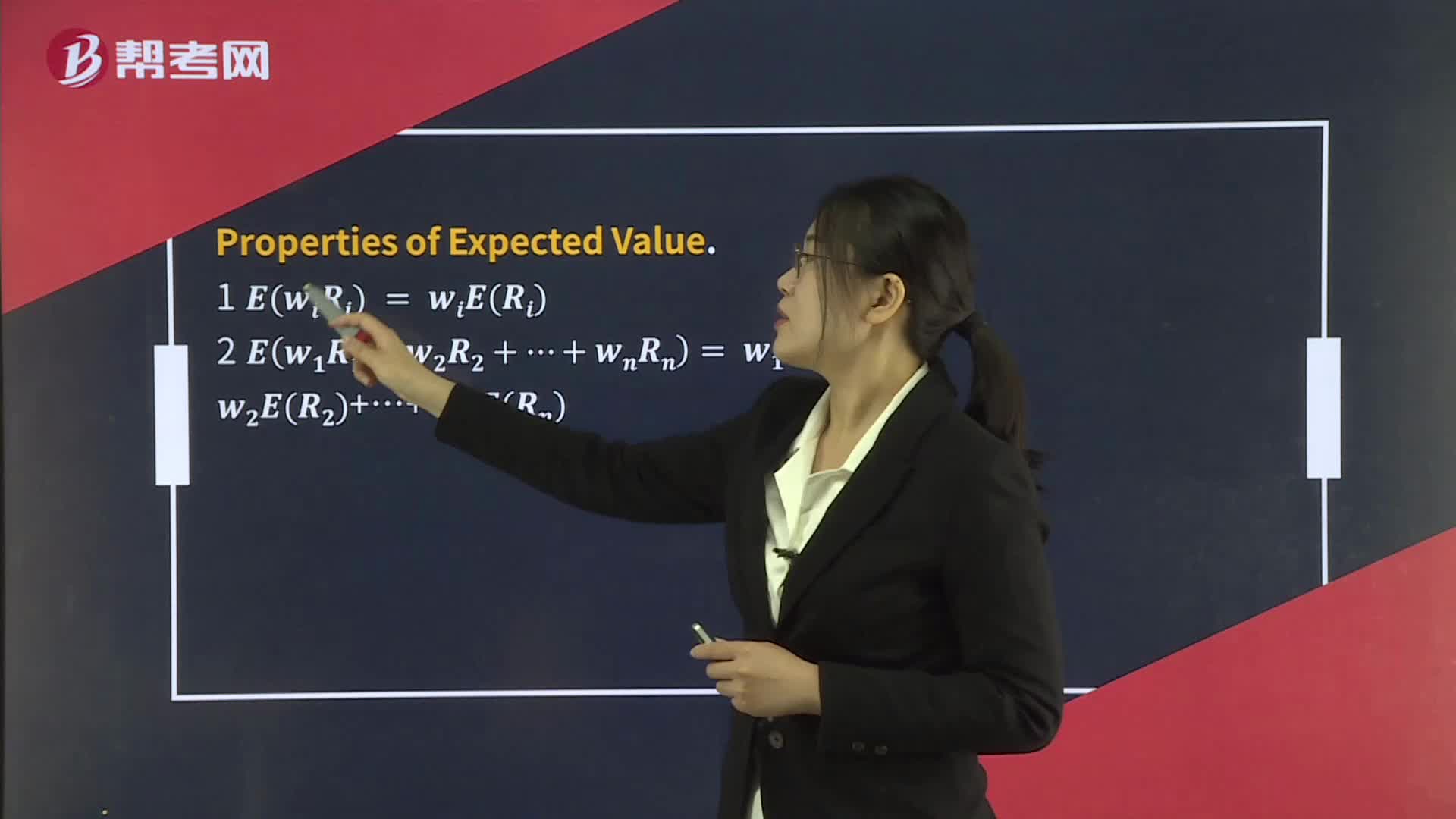

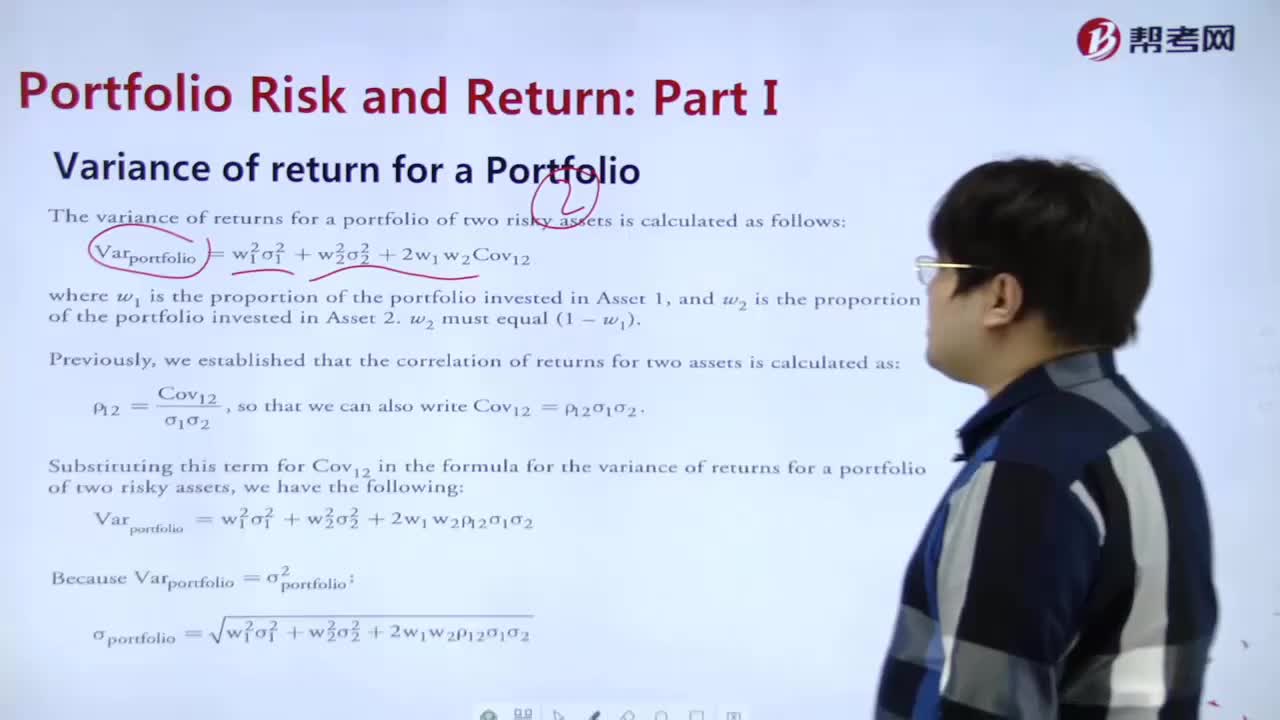

What is variance of return for a portfolio?

What is the purpose of portfolio construction?

What is the assumptions in portfolio risk?

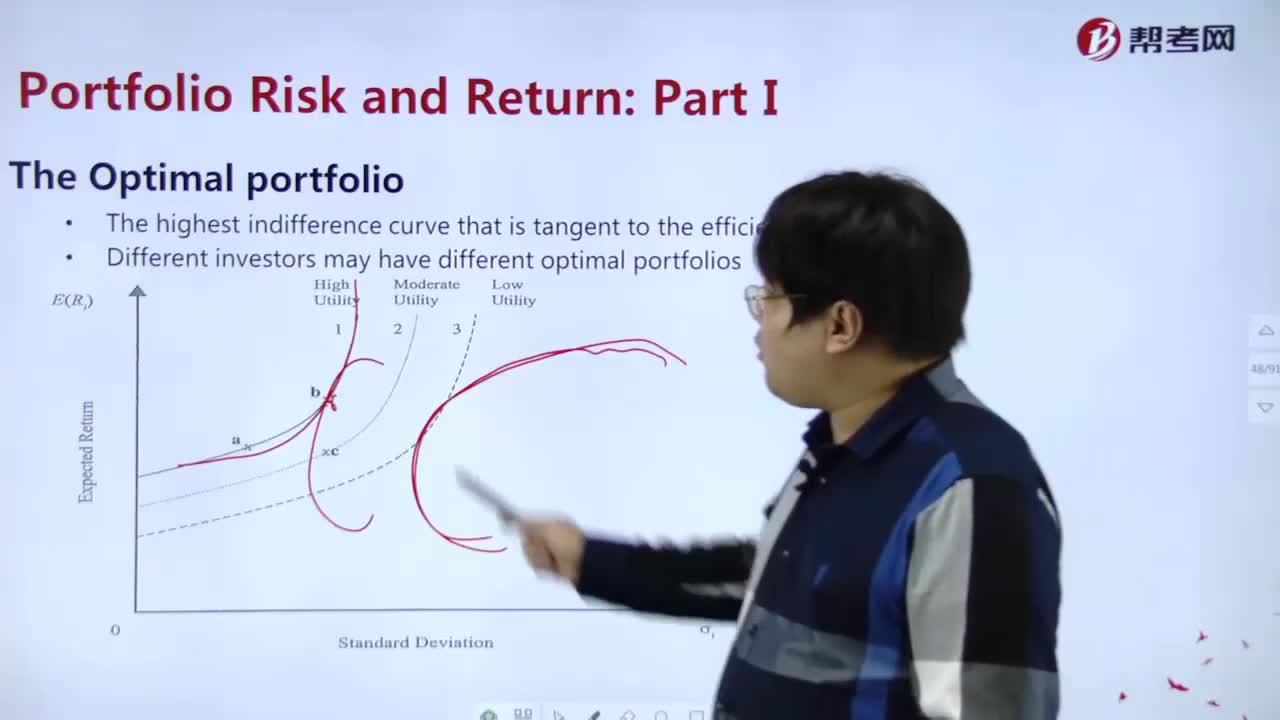

What is the optimal portfolio?

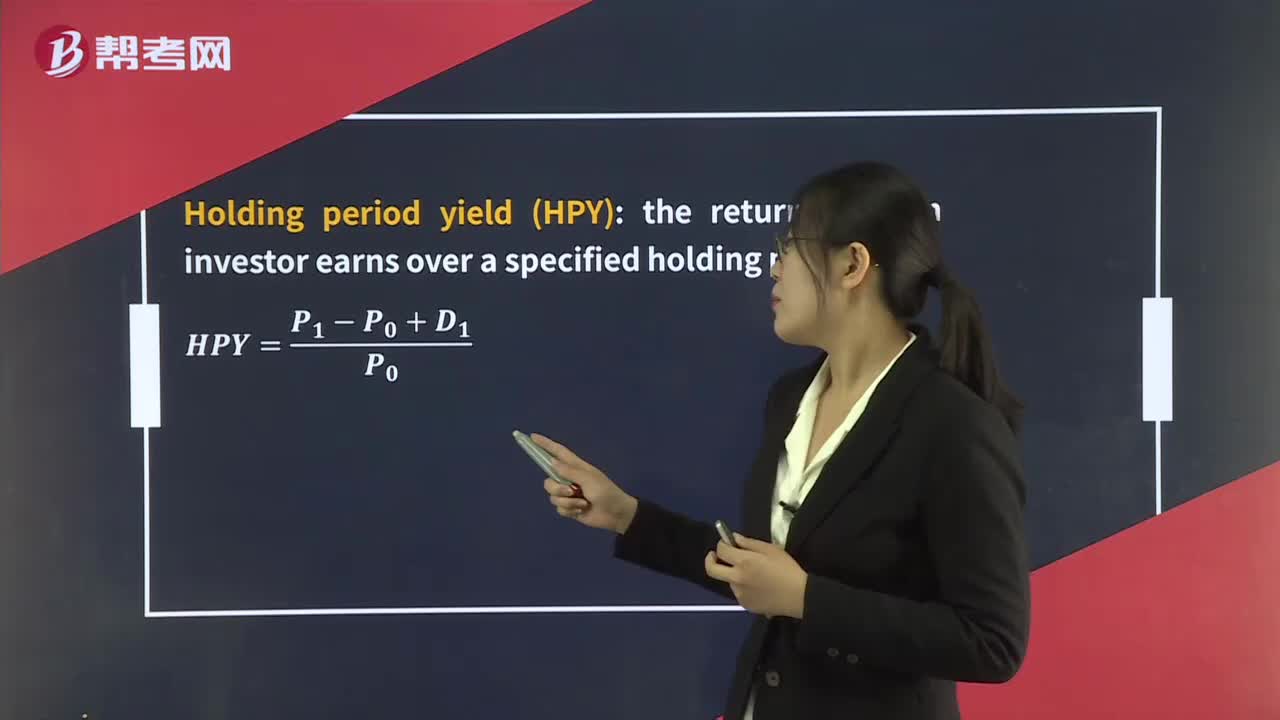

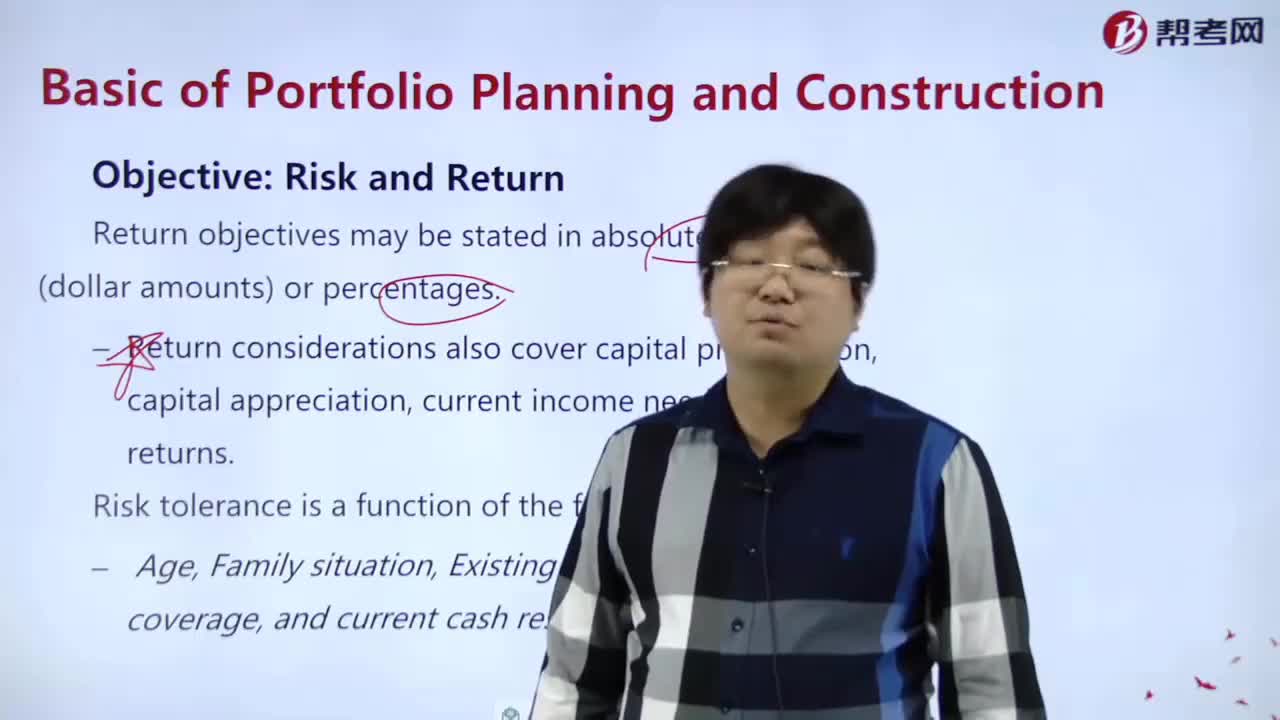

What are the return measures in portfolio management?

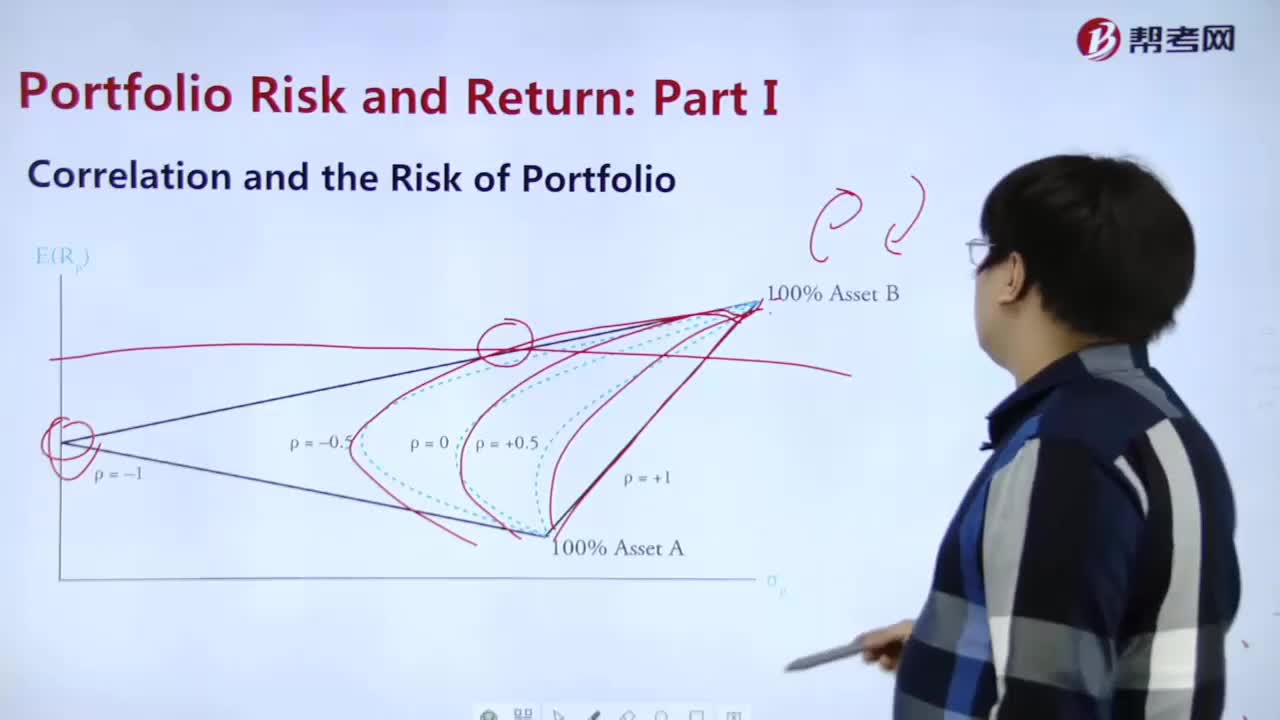

What are the correlations and risks of portfolio?

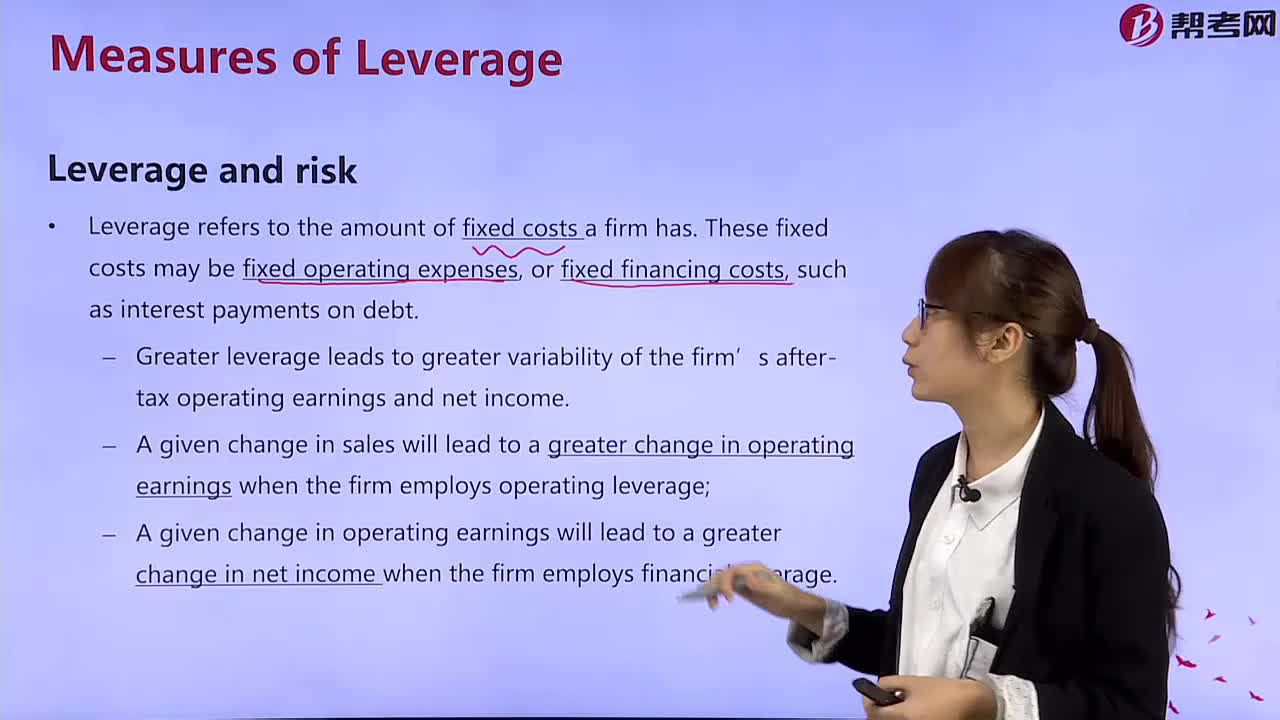

What does leverage and risk mean?

How to control risk and return?

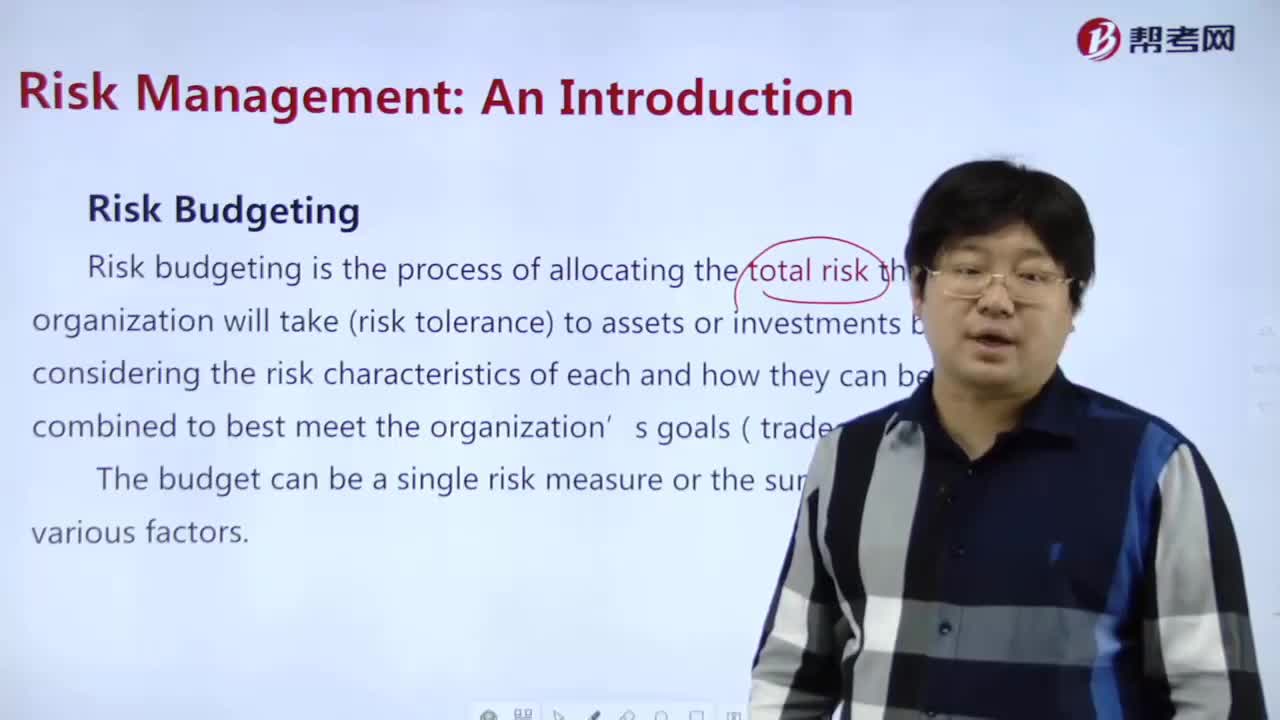

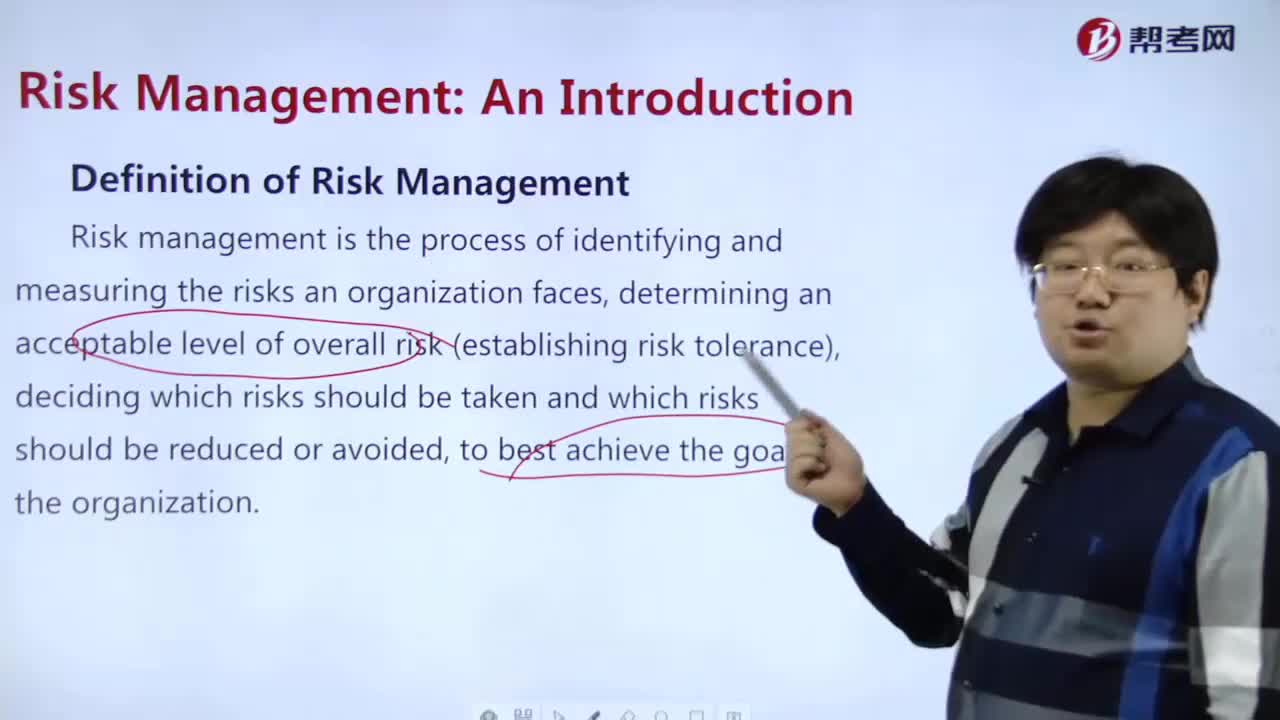

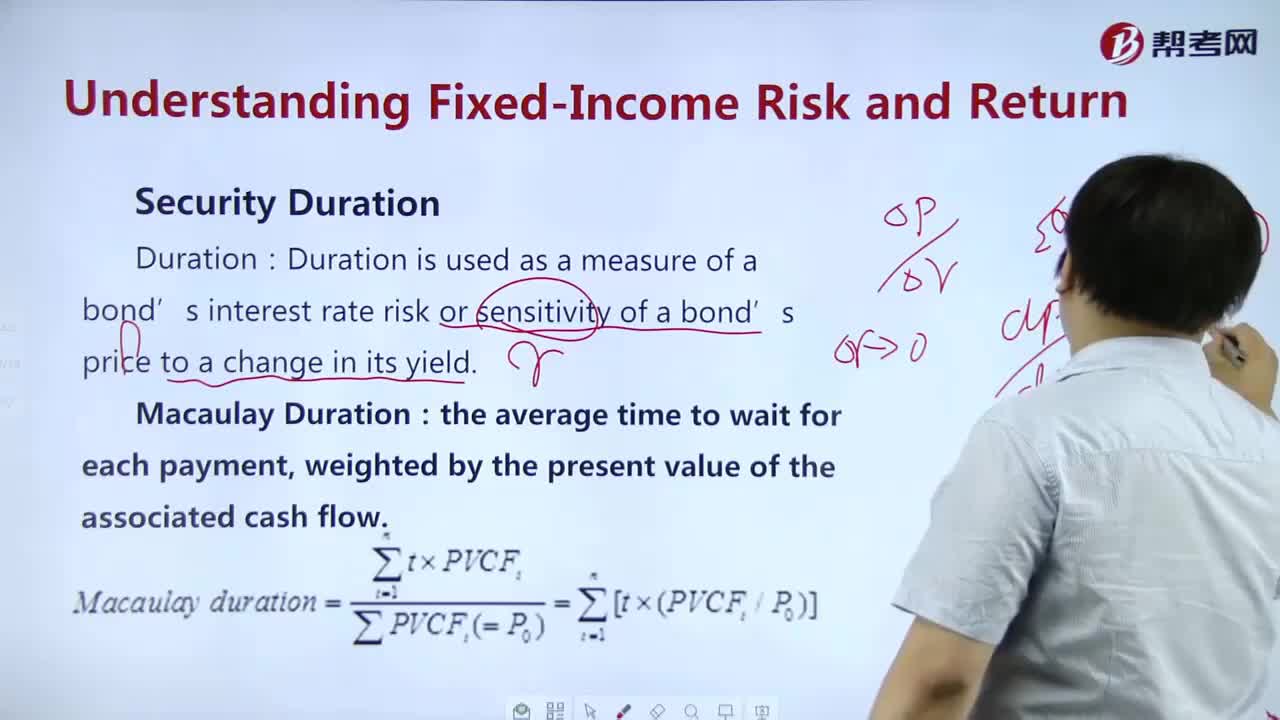

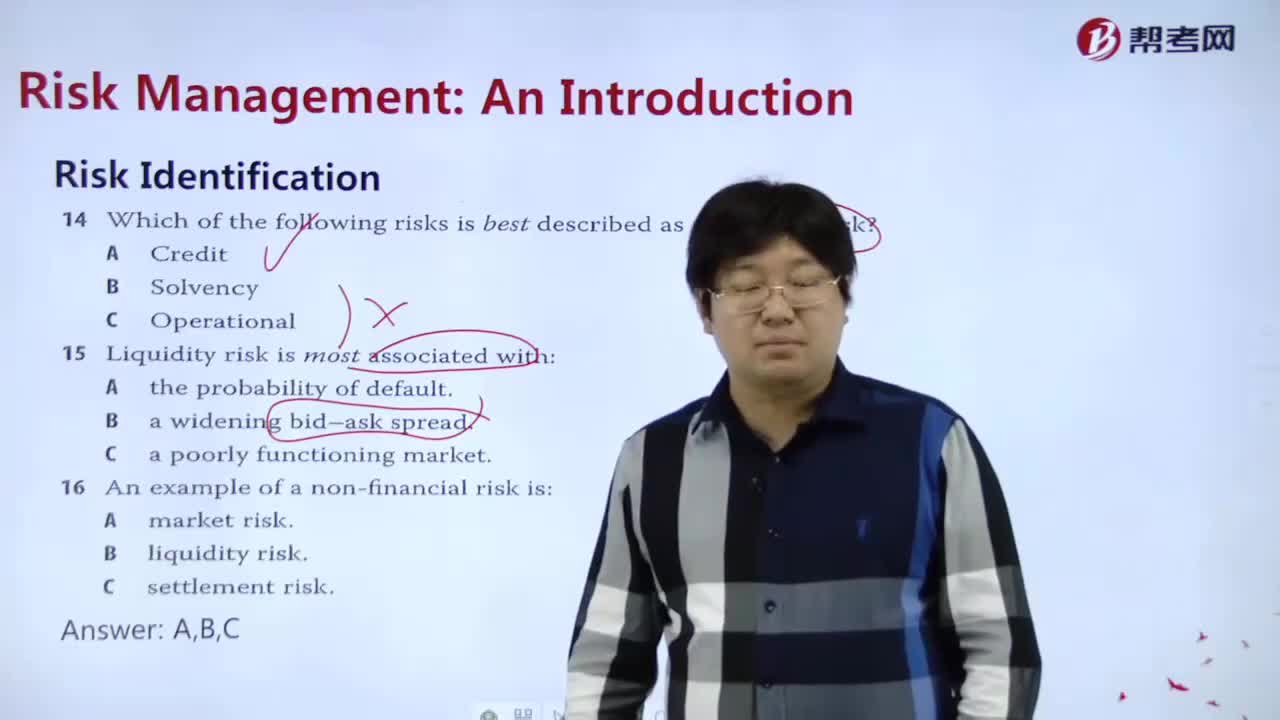

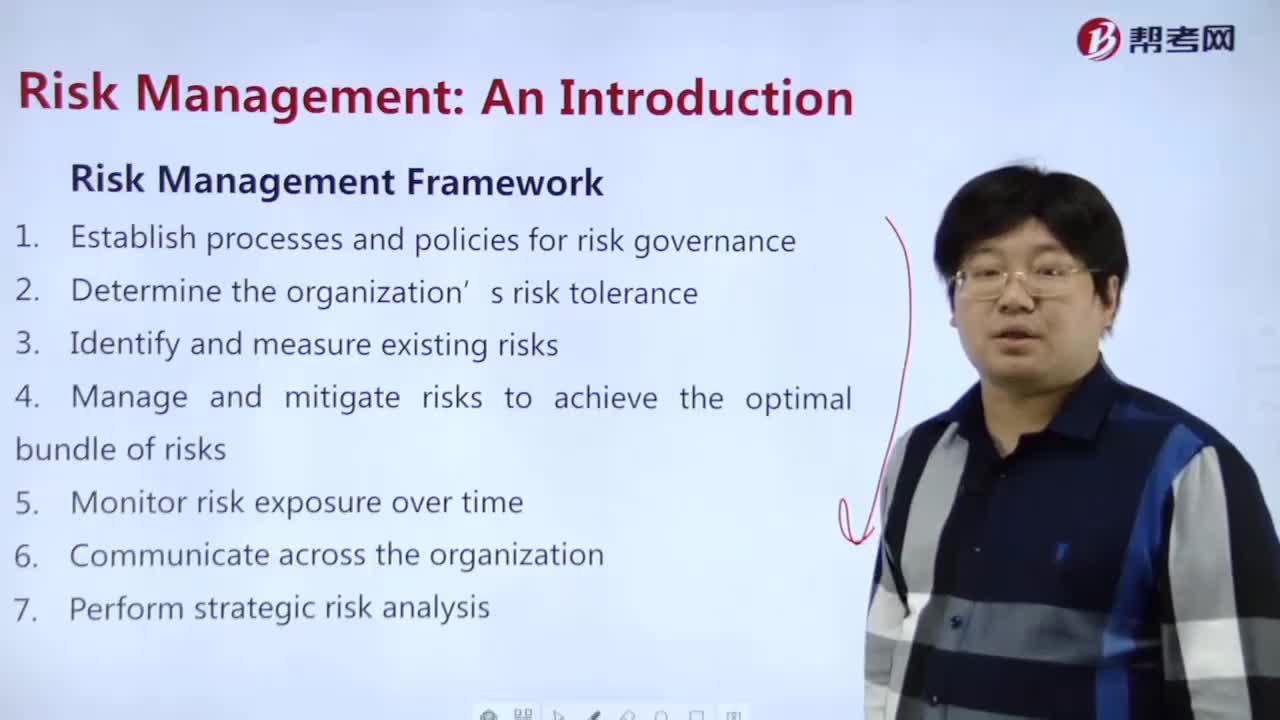

What is risk measurement?

下载亿题库APP

联系电话:400-660-1360