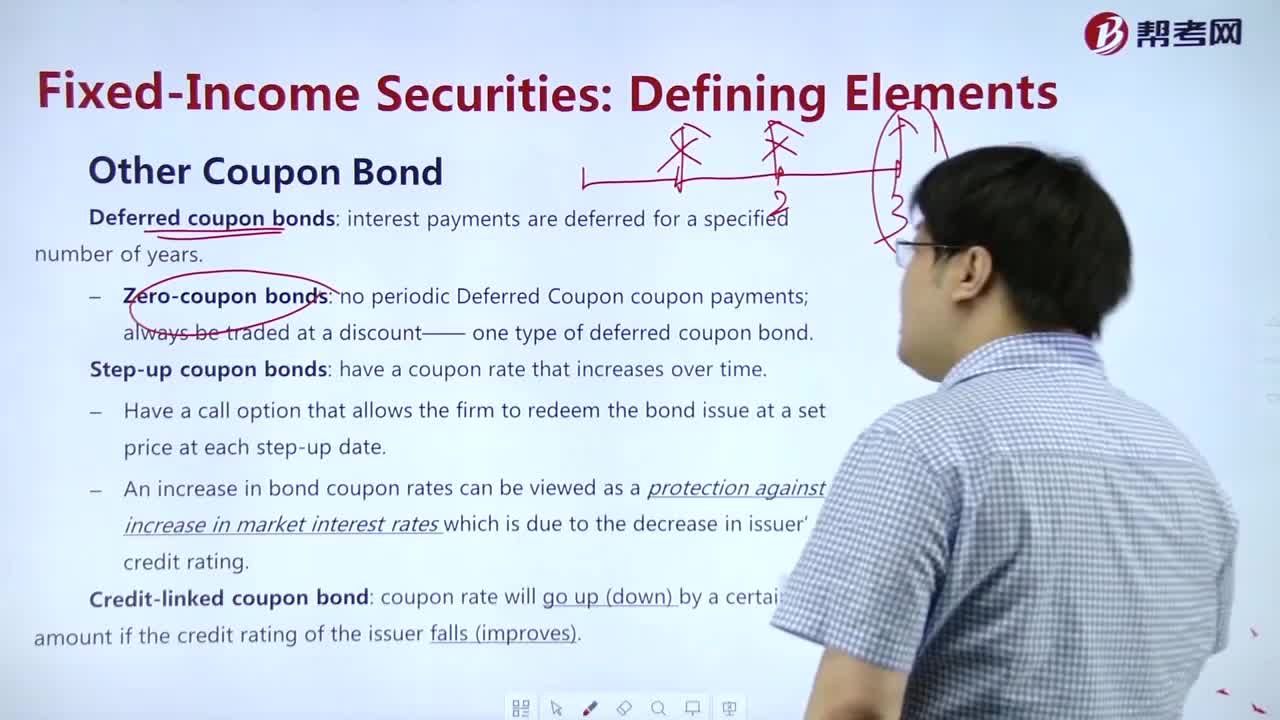

How to understand Ocher Coupon Bond?

Total, Variable, Fixed, and Marginal Cost and Output

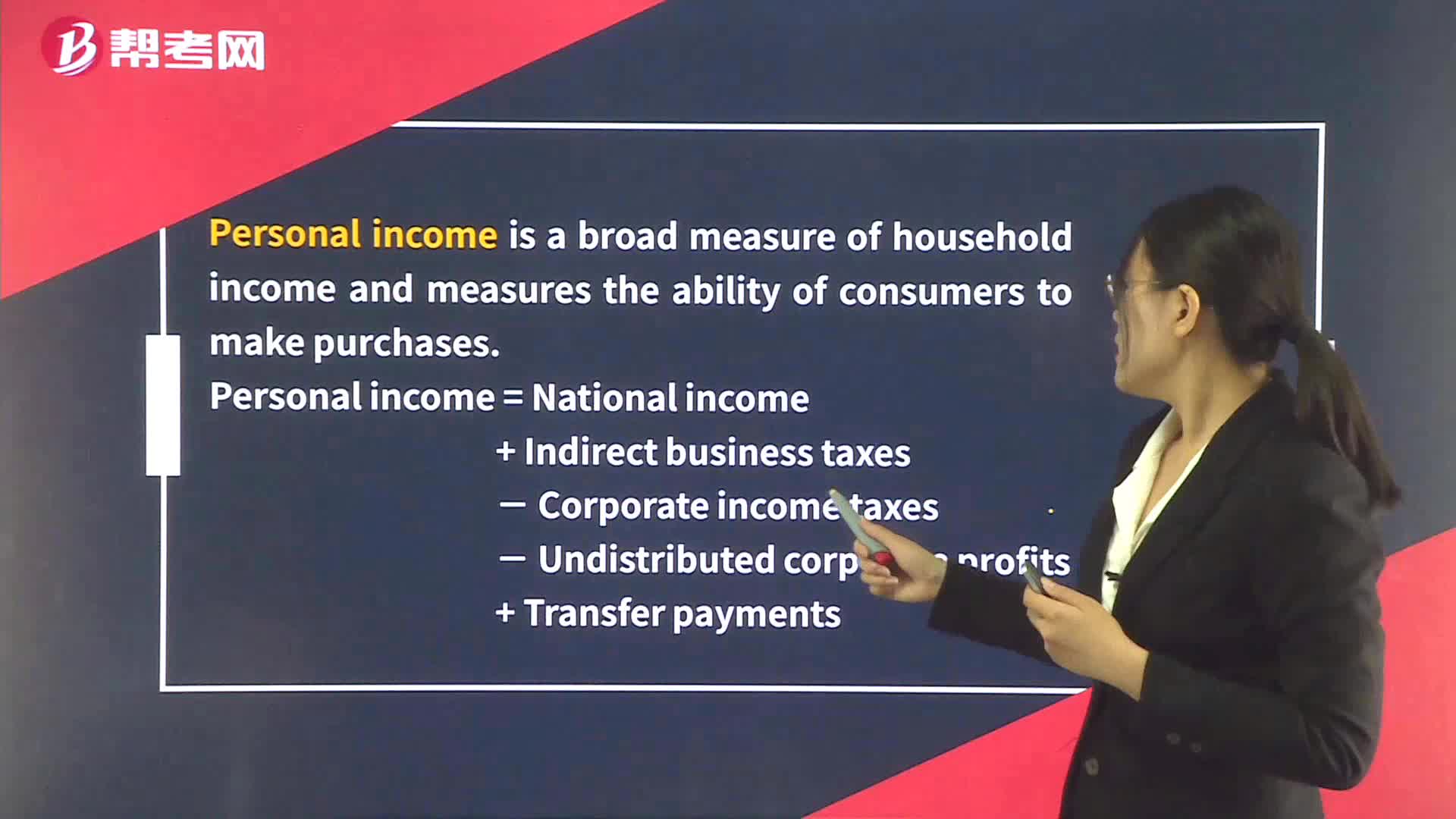

Personal Income & Personal Disposable Income

Substitution and Income Effects

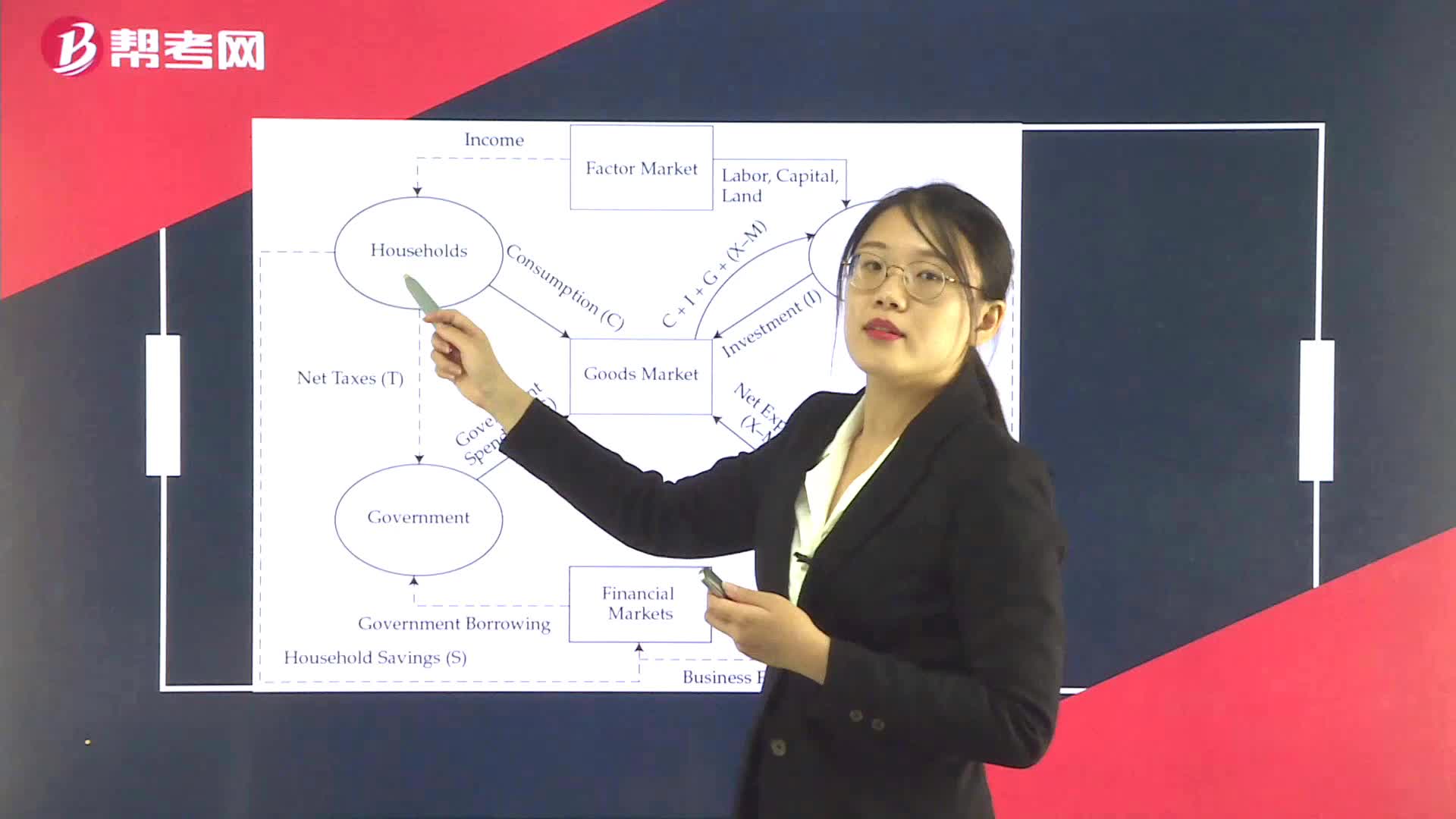

Output, Income, and Expenditure Flows

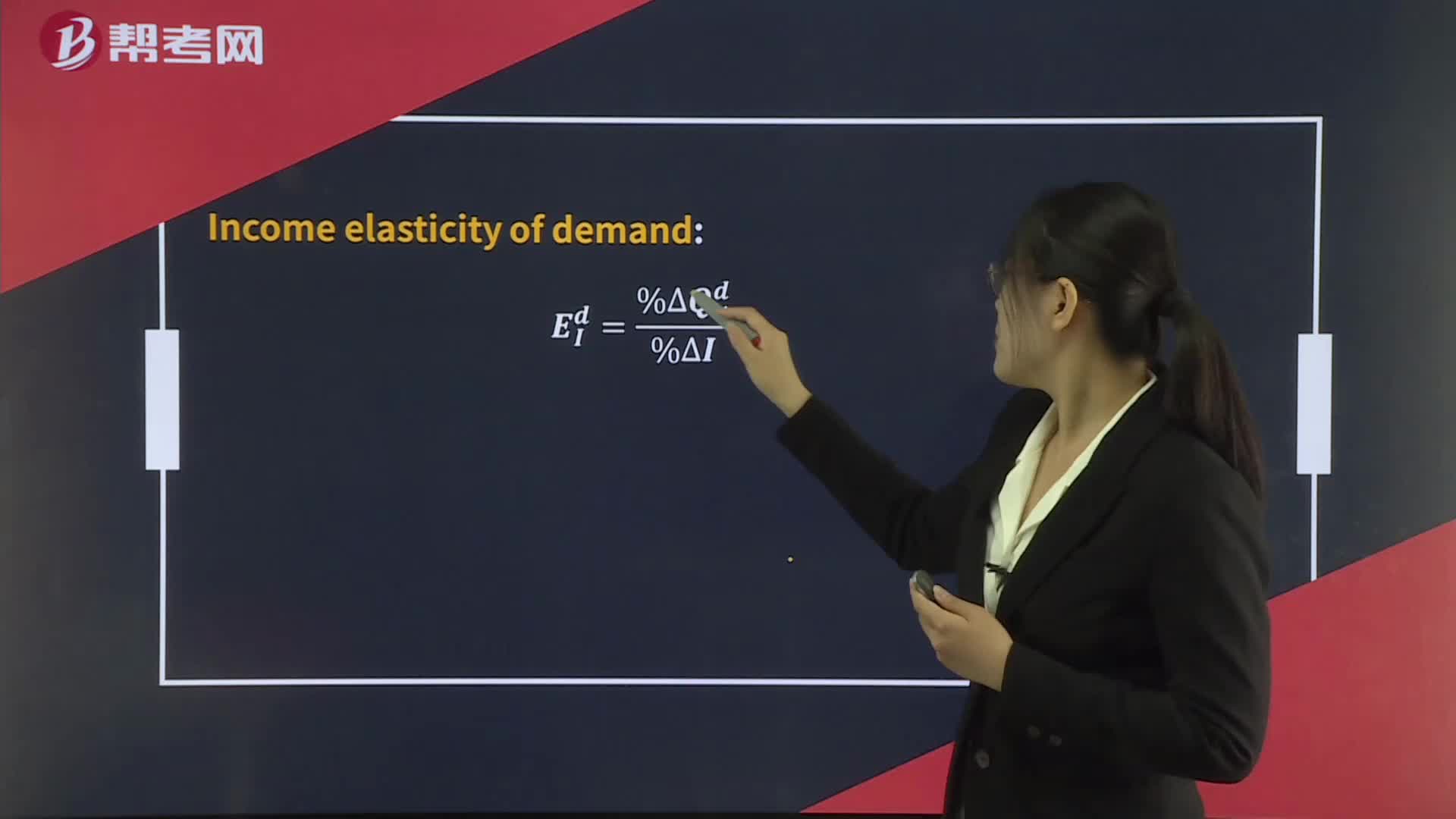

Income Elasticity of Demand

Currency Regimes – Fixed Parity with Crawling Bands

Currency Regimes– Fixed Parity and Target Zone

Statement of Comprehensive Income

Income Statement – Revenue, Other Income, Expenses

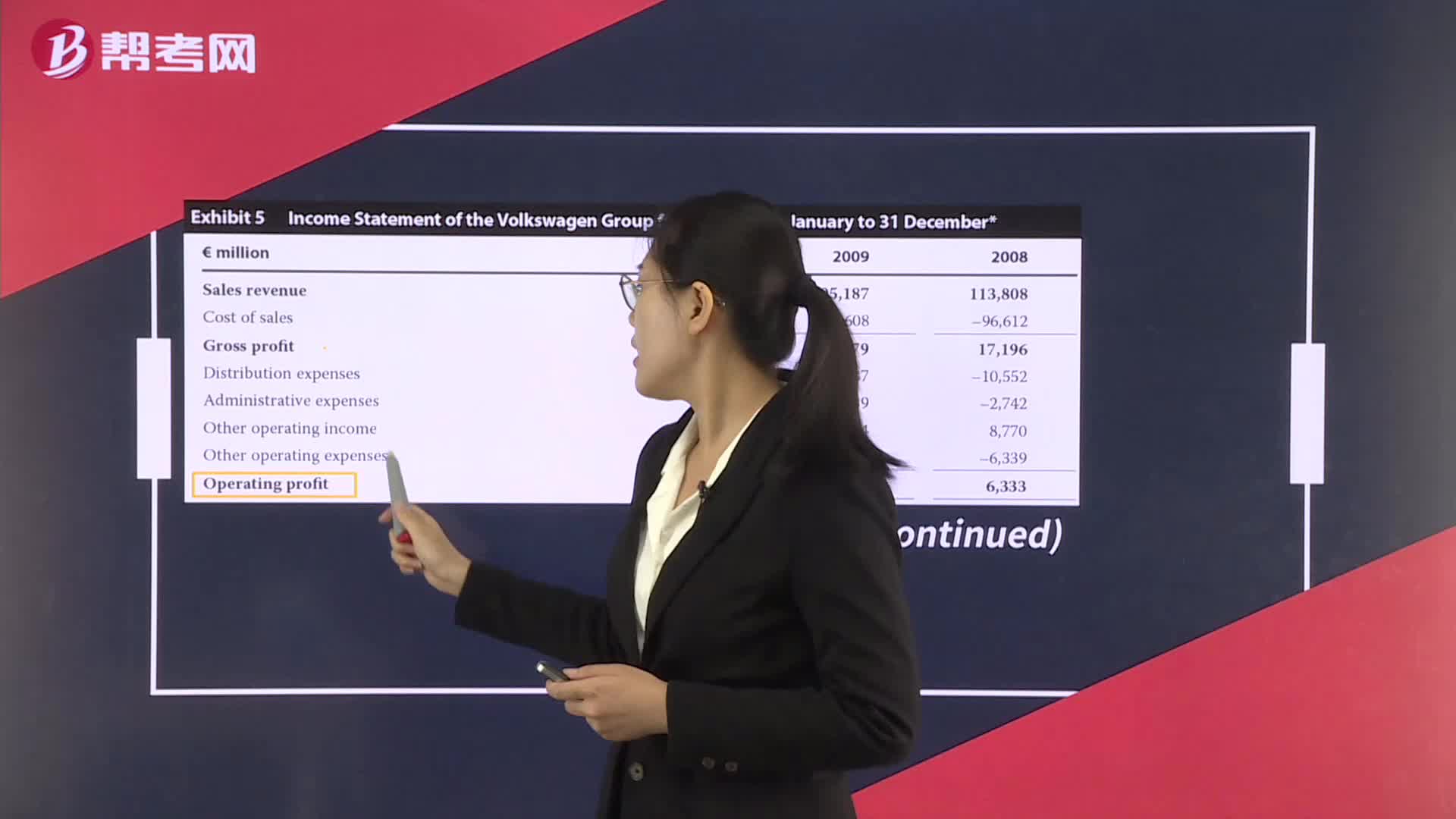

Income Statement– Operating Profit

Income Statement– Earnings Per Share

下载亿题库APP

联系电话:400-660-1360